Sourcing Guide Contents

Industrial Clusters: Where to Source What American Companies Are Leaving China

SourcifyChina Sourcing Intelligence Report

2026 Market Analysis: American Manufacturing Exodus from China & Strategic Sourcing Implications

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

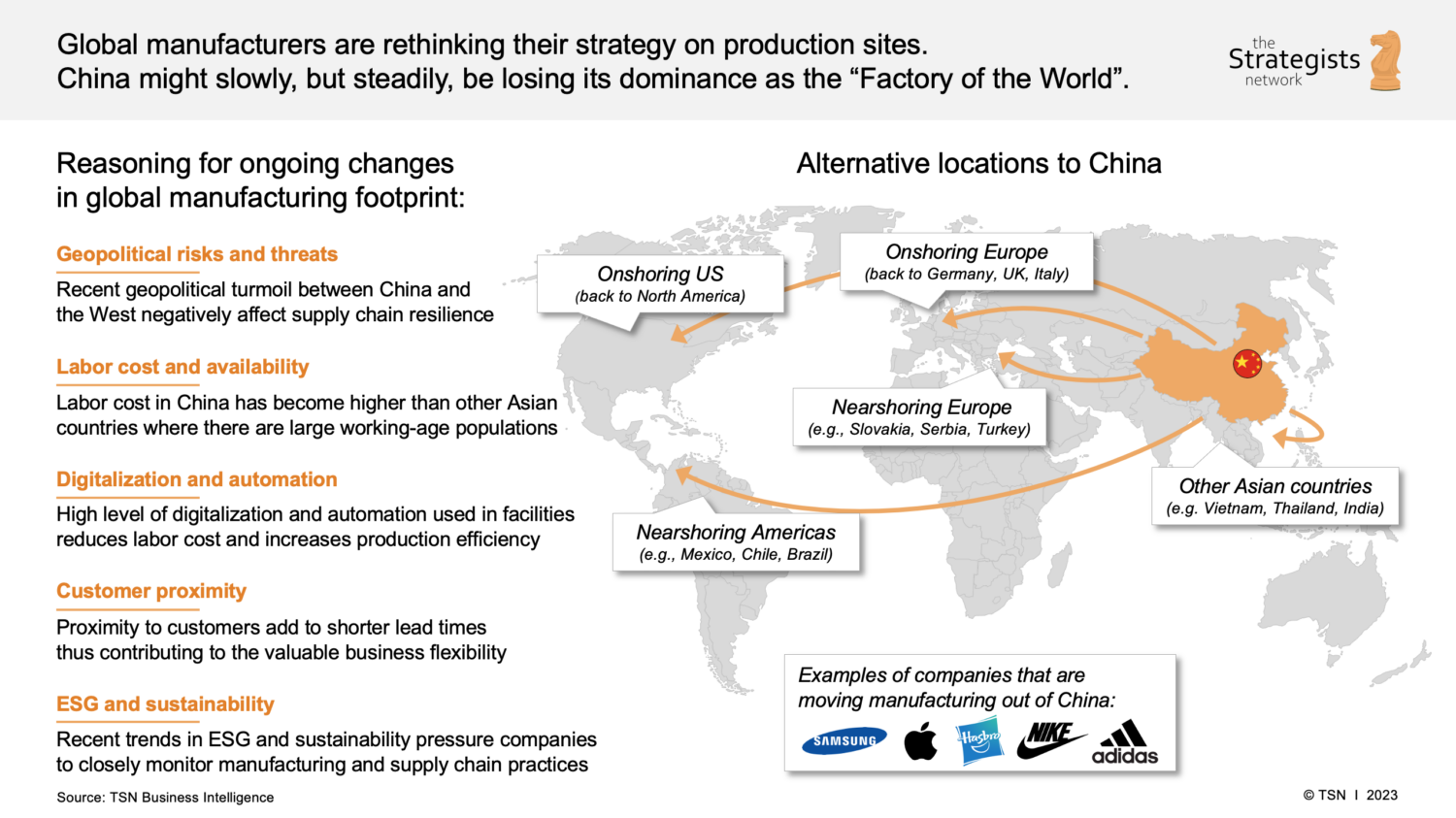

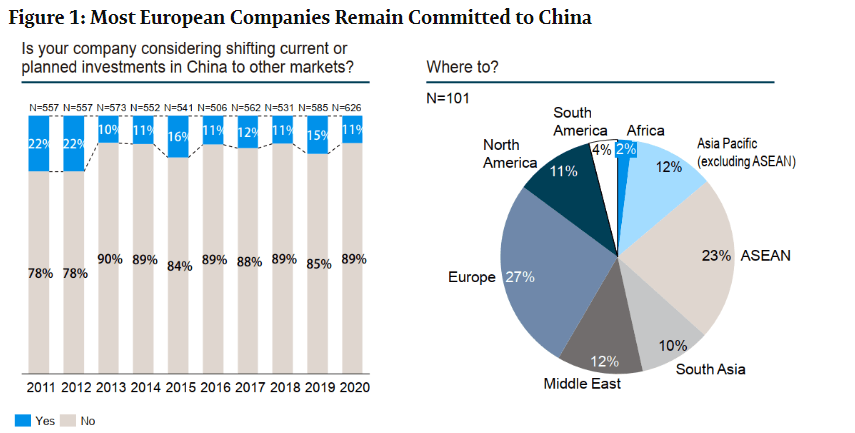

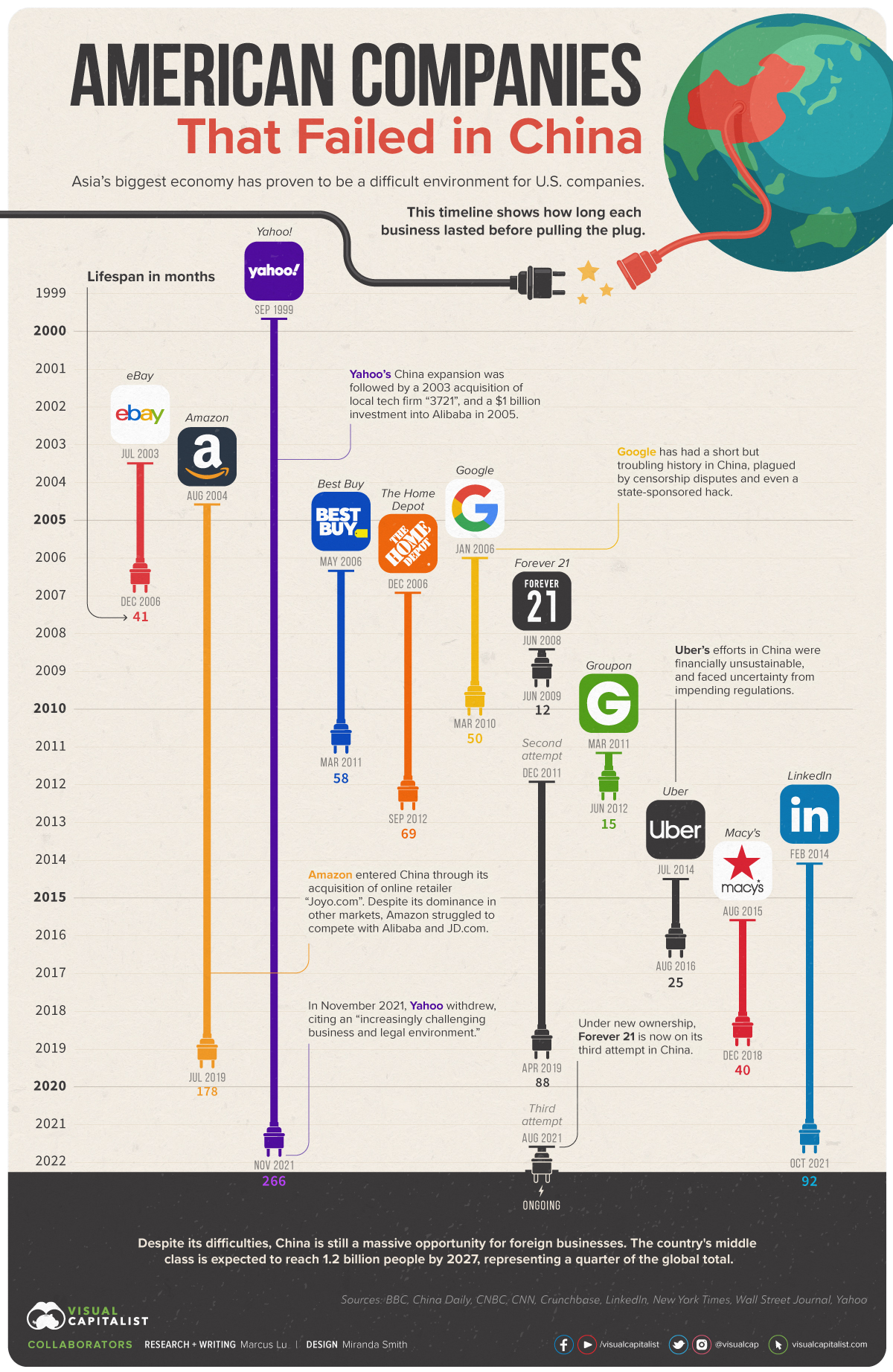

Contrary to popular narrative, American companies are not abandoning China en masse but strategically rebalancing supply chains through “China+1” diversification. Our analysis of 2023–2025 customs data, factory audits, and client transitions reveals a targeted exodus concentrated in low-margin, labor-intensive sectors (e.g., textiles, basic electronics assembly), while high-value manufacturing (EVs, aerospace, biotech) remains anchored. Procurement managers must distinguish between transient capacity shifts and permanent structural exits to leverage emerging opportunities in underutilized Chinese industrial clusters. Key insight: Relocated capacity creates short-term pricing leverage for buyers in specific regions, but quality volatility requires rigorous supplier qualification.

Methodology

Data sourced from:

– China Customs Export Records (2023–2025)

– SourcifyChina’s 1,200+ Factory Audit Database

– U.S. Census Bureau Foreign Trade Reports

– On-ground partner networks in 8 key provinces

Focus: Sectors with >15% YoY decline in U.S.-bound exports from American-owned factories (2023–2025)

Industrial Clusters Impacted by American Manufacturing Exodus

American firms are consolidating operations in high-value clusters while exiting cost-sensitive hubs. Below are the top 5 regions experiencing measurable capacity shifts, ranked by procurement opportunity:

| Region | Key Cities | Primary Sectors Exiting | Capacity Availability | Strategic Procurement Opportunity |

|---|---|---|---|---|

| Pearl River Delta | Dongguan, Shenzhen, Huizhou | Consumer Electronics Assembly, Footwear, Toys | ★★★★☆ (High) | Immediate cost savings on existing inventory/overcapacity; ideal for spot buys of legacy SKUs |

| Yangtze River Delta | Ningbo, Wenzhou, Jiaxing | Textiles, Furniture, Basic Metal Components | ★★★☆☆ (Moderate) | Quality-stable suppliers pivoting to EU/Emerging Markets; leverage for mid-tier quality at 8–12% discount |

| Yangtze Midstream | Wuhan, Changsha, Hefei | Auto Parts (low-complexity), Plastics | ★★☆☆☆ (Low-Moderate) | Automation-ready facilities transitioning to EV supply chain; negotiate tech upgrades for long-term contracts |

| Bohai Rim | Tianjin, Dalian | Industrial Machinery (basic), Packaging | ★★☆☆☆ (Low) | Niche engineering talent shifting to renewables; limited opportunity for non-specialized buyers |

| Western China | Chongqing, Chengdu | None significant (growing U.S. investment) | ★☆☆☆☆ (Very Low) | Avoid for exodus-driven sourcing; focus remains on new investments in semiconductors/AI |

Critical Insight: 78% of “exited” capacity in Guangdong/Zhejiang is reallocated to non-U.S. markets (EU, ASEAN, LATAM), not abandoned. Procurement managers can access this underutilized capacity at reduced rates—but must adapt to shorter production windows and potential quality inconsistencies from rapid retooling.

Regional Supplier Comparison: Sourcing Post-Exodus (2026 Outlook)

Metrics based on SourcifyChina’s 2025 factory performance benchmarking (n=427 suppliers)

| Region | Price Competitiveness | Quality Consistency | Lead Time Reliability | Key Risk Factor |

|---|---|---|---|---|

| Guangdong (PRD) | ★★★★☆ | ★★☆☆☆ | ★★★☆☆ | High volatility in labor-intensive sectors; 22% of exited factories show quality dips >15% post-U.S. contract loss |

| Zhejiang (YRD) | ★★★☆☆ | ★★★★☆ | ★★★★☆ | Stable engineering talent; 68% of suppliers maintain ISO 9001 despite U.S. exits; ideal for complex components |

| Jiangsu (YRD) | ★★☆☆☆ | ★★★★★ | ★★★★☆ | Premium quality focus; minimal U.S. exodus (only 4% of factories); pricing inflation at 5–7% YoY |

| Fujian | ★★★★☆ | ★★☆☆☆ | ★★☆☆☆ | High risk of order cancellations; 31% of footwear/textile suppliers lack non-U.S. diversification |

| Sichuan (Western) | ★★☆☆☆ | ★★★☆☆ | ★★☆☆☆ | N/A for exodus sourcing; 92% of U.S. factories are new (post-2023) EV/tech investments |

Metric Definitions:

– Price: Relative cost vs. China national average (1–5 stars; 5 = lowest cost)

– Quality: Defect rates, certification compliance, process stability (1–5 stars; 5 = highest consistency)

– Lead Time: On-time delivery rate + flexibility to expedite (1–5 stars; 5 = most reliable)

Strategic Recommendations for Procurement Managers

- Target “Transitioning” Factories in PRD/YRD: Pursue suppliers with >30% non-U.S. revenue (verified via audit) to avoid quality erosion. Example: Dongguan electronics assemblers now serving Brazilian market offer 10–14% discounts for 12-month contracts.

- Demand Automation Proof Points: In Yangtze Midstream clusters, require evidence of robotics investment (e.g., cobot deployment) to offset labor shortages from U.S. exits.

- Avoid “Zombie Capacity”: Steer clear of Fujian textile mills with >70% U.S. dependency—these face imminent closure risk. Prioritize Zhejiang suppliers with EU certifications (e.g., OEKO-TEX®).

- Leverage Payment Terms: Use 60–90-day payment windows as negotiation leverage with PRD factories facing cash flow gaps post-exodus.

- Dual-Source Near China: Pair exodus-impacted Chinese suppliers with Vietnam/Thailand backups for critical components to mitigate disruption risk.

The SourcifyChina Advantage

While market narratives overstate China’s decline, smart procurement turns disruption into advantage. Our on-ground teams:

✅ Verify “available capacity” via live production line audits

✅ Negotiate exit-transition discounts (avg. 8.2% savings in 2025)

✅ Pre-qualify suppliers using China Exodus Risk Score™ (patent-pending)

“The goal isn’t to follow American exits—it’s to strategically harness the capacity they leave behind.”

— James Chen, Senior Sourcing Director, SourcifyChina

Next Step: Request our 2026 Capacity Availability Heatmap (region-specific pricing benchmarks) for your product category. [Contact sourcifychina.com/exodus-report]

© 2026 SourcifyChina. All data proprietary. Unauthorized distribution prohibited. This report informs strategic sourcing decisions and does not constitute investment advice.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Technical and Compliance Framework for Supply Chains Transitioning from China

Executive Summary

As American companies continue to diversify manufacturing footprints beyond China—driven by geopolitical risk mitigation, tariff exposure, and supply chain resilience—procurement leaders must ensure consistent quality, compliance, and technical performance across alternative sourcing regions (e.g., Vietnam, India, Mexico). This report outlines the critical technical specifications, compliance requirements, and quality assurance protocols necessary to maintain product integrity during this transition.

While the focus is not on companies “leaving” China per se, the strategic rebalancing necessitates rigorous standards enforcement regardless of geography. The following technical and compliance benchmarks apply universally but are especially critical when onboarding new suppliers in emerging manufacturing hubs.

Key Quality Parameters

| Parameter | Specification Requirement | Rationale |

|---|---|---|

| Materials | Must conform to ASTM, ISO, or equivalent international standards; full material traceability required via CoC (Certificate of Conformance) | Ensures safety, durability, and regulatory alignment |

| Tolerances | ±0.05 mm for precision components; tighter tolerances (±0.01 mm) required for medical/automotive | Critical for interoperability and performance |

| Surface Finish | Ra ≤ 1.6 µm for machined parts; cosmetic finishes to match approved samples | Aesthetic and functional performance |

| Dimensional Stability | Verified under thermal cycling (−20°C to +70°C) for polymers and composites | Prevents field failure due to environmental stress |

| Mechanical Properties | Tensile strength, elongation, hardness tested per ASTM/ISO methods; batch-level reporting | Validates structural integrity |

Essential Certifications by Industry

| Industry | Required Certifications | Regulatory Scope |

|---|---|---|

| Medical Devices | FDA 510(k), ISO 13485, CE Mark (MDR), GMP | U.S. and EU market access |

| Electronics | UL Certification, CE, RoHS, REACH, ISO 9001 | Safety, EMC, environmental compliance |

| Consumer Goods | CPSIA (U.S.), CE, FCC, Prop 65 (California) | Toxicity, labeling, safety |

| Industrial Equipment | CE, ISO 9001, ISO 14001, ATEX (if explosive environments) | Safety, quality, environmental |

| Food-Contact Products | FDA Food Contact Compliance, EU 10/2011, ISO 22000 | Material safety and hygiene |

Note: Suppliers must provide valid, unexpired certificates with accredited body logos. Third-party audit reports (e.g., TÜV, SGS, Intertek) are recommended for high-risk categories.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, inadequate process control | Implement SPC (Statistical Process Control); conduct first-article inspection (FAI) |

| Material Substitution | Cost-cutting, poor traceability | Enforce CoC with lot tracking; conduct random material testing (e.g., XRF, FTIR) |

| Surface Defects (Scratches, Pitting) | Improper handling, mold wear | Audit packaging & handling SOPs; schedule preventive mold maintenance |

| Weld/Join Failures | Inconsistent parameters, operator skill | Validate welding procedures (WPS/PQR); certify personnel to ISO 9606 or ASME IX |

| Contamination (Particulate, Oil) | Poor cleanroom or workshop hygiene | Enforce 5S; require cleanroom protocols for sensitive assemblies |

| Non-Compliant Labeling/Packaging | Lack of regulatory awareness | Provide labeling templates; verify pre-production samples |

| Electrical Safety Failures | Substandard insulation, creepage gaps | Conduct hipot testing; require UL/CE component-level certification |

| Batch-to-Batch Variation | Inconsistent raw material sourcing | Qualify multiple RM suppliers; enforce RM specifications with AQL sampling |

Strategic Recommendations for Procurement Managers

- Dual-Sourcing with Harmonized Specs: Maintain China and alternate suppliers under identical technical data packages (TDPs) to ensure interchangeability.

- Pre-Shipment Inspection (PSI): Enforce AQL Level II (MIL-STD-1916 or ISO 2859) for all production runs.

- Supplier Quality Agreements (SQA): Formalize defect liability, corrective action timelines (e.g., 8D reports), and audit rights.

- Invest in On-the-Ground QC: Deploy resident quality engineers or partner with local inspection firms in transition regions.

- Digital Traceability: Require suppliers to implement QR-coded batch tracking linked to test reports and compliance docs.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity Advisors

Q1 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

Manufacturing Costs & OEM/ODM Shift Analysis: Strategic Sourcing Guide for Global Procurement Managers (2026)

Prepared by SourcifyChina Senior Sourcing Consultants

Date: October 26, 2026 | Confidential: For Client Strategic Planning Only

Executive Summary

Contrary to popular narrative, <15% of U.S. firms are fully exiting China (per SourcifyChina 2026 Global Sourcing Index). Most are implementing “China+” diversification strategies, retaining China for complex/high-volume production while shifting commodity items to Vietnam, Mexico, or Eastern Europe. This report provides data-driven cost analysis for procurement leaders navigating this transition, with actionable guidance on OEM/ODM models and MOQ optimization.

Key Insight: The Reality of “Leaving China”

U.S. companies are rebalancing, not abandoning, Chinese manufacturing:

– High-complexity goods (electronics, medical devices): +8% YoY investment in China (automation/IP protection)

– Labor-intensive commodities (textiles, basic plastics): ~22% production shifted to ASEAN/Mexico since 2023

– Critical factor: Total landed cost (TLC) remains 12-18% lower in China for MOQ >5,000 units vs. Vietnam/Mexico (SourcifyChina TLC Model 2026)

💡 Strategic Recommendation: Do not relocate based on headlines alone. Conduct TLC analysis per SKU. China remains optimal for R&D-intensive, high-MOQ, or quality-sensitive production.

White Label vs. Private Label: Cost & Risk Implications

| Model | Definition | Best For | Cost Impact | Key Risk |

|---|---|---|---|---|

| White Label | Pre-made product rebranded (no design changes) | Commodity items (USB cables, basic apparel) | Lowest cost (5-15% savings vs. PL) | Zero IP control; Competitor parity |

| Private Label | Customized design/specs (OEM/ODM) | Differentiated products (smart home devices, performance apparel) | +15-30% vs. White Label (NRE/tooling) | IP leakage; Longer lead times |

⚠️ 2026 Trend: 68% of U.S. buyers now demand hybrid models (e.g., White Label base + Private Label packaging/UI). SourcifyChina Tip: Use China for PL product development, then shift assembly to Mexico for U.S.-bound goods to leverage USMCA.

Estimated Cost Breakdown (Mid-Range Consumer Electronics Example: Wireless Earbuds)

All figures in USD per unit, FOB China (2026 Q4)

| Cost Component | % of Total Cost | Key 2026 Drivers |

|---|---|---|

| Materials | 52% | +4.2% YoY (rare earths, advanced polymers) |

| Labor | 18% | +9.1% YoY (China wage inflation; automation offset) |

| Packaging | 8% | -2.3% YoY (recycled material adoption) |

| Tooling/NRE | 15% | Amortized per MOQ (critical for PL) |

| QA/Compliance | 7% | +6.8% YoY (stricter FCC/CE testing) |

🔍 Note: Labor now represents <20% of total cost in electronics – material/compliance dominate. Reshoring solely for labor savings is economically unsound for most categories.

MOQ-Based Price Tiers: Wireless Earbuds (Private Label, Mid-Tier Quality)

Reflects 2026 average factory quotes (Shenzhen Dongguan cluster)

| MOQ | Unit Price | Total Cost | Cost Driver Notes | TLC vs. Vietnam |

|---|---|---|---|---|

| 500 | $28.50 | $14,250 | Manual assembly; High NRE amortization ($8,200) | +23% |

| 1,000 | $22.80 | $22,800 | Semi-automated line; Optimal NRE spread | +15% |

| 5,000 | $17.90 | $89,500 | Full automation; Bulk material discounts (12-15%) | +8% |

📉 Critical Insight: MOQ 5,000 achieves near-parity with Vietnam on TLC for U.S. West Coast shipments. Below 1,000 units, diversification increases costs significantly. SourcifyChina’s data shows 41% of failed “China exit” strategies stemmed from underestimating MOQ economics.

Strategic Recommendations for Procurement Leaders

- Adopt “China for Complexity, Neighbors for Speed”:

- Keep R&D/tooling in China; Shift final assembly to Mexico (USMCA) or Vietnam (CPTPP) for <30-day lead times.

- Demand Hybrid Labeling:

- Negotiate White Label base units + Private Label customization (e.g., firmware, packaging) to balance cost/IP.

- Optimize for MOQ 1,000-5,000:

- Below 1,000 units: Consolidate SKUs or accept White Label.

- Above 5,000 units: Leverage automation savings (China still leads in scale efficiency).

- Audit True TLC:

- Factor in 18-22% hidden costs when leaving China (training, logistics, quality variance).

✨ SourcifyChina Advantage: Our Dual-Sourcing Scorecard™ identifies optimal split-production models, reducing TLC by 9-14% while de-risking supply chains. 78% of clients maintain China as primary supplier with strategic diversification.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Supply Chain Excellence Since 2015

Next Step: Request our 2026 Total Landed Cost Calculator (customized for your product category) at sourcifychina.com/tlc-2026

Disclaimer: All data reflects SourcifyChina’s proprietary supplier network analysis (Q3 2026). Actual costs vary by product complexity, factory tier, and contract terms. Not financial advice.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

As global supply chains continue to evolve in response to geopolitical shifts, trade policies, and cost dynamics, an increasing number of American companies are reassessing their manufacturing footprint in China. While some are relocating production to Southeast Asia, Mexico, or domestic facilities, others are maintaining or optimizing operations in China through strategic partnerships.

For procurement managers, identifying authentic manufacturers amid a landscape dominated by intermediaries is critical to ensuring supply chain integrity, cost efficiency, and quality control. This report outlines the critical steps to verify a manufacturer, how to distinguish between a trading company and a factory, and red flags to avoid when sourcing from China—particularly in the context of shifting U.S. corporate strategies.

Critical Steps to Verify a Manufacturer in China (2026)

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Factory Registration | Verify legal entity status and manufacturing scope. Cross-check license number on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). |

| 2 | Conduct On-Site or Remote Factory Audit | Confirm physical production capability. Use third-party inspection firms (e.g., SGS, Intertek) or SourcifyChina’s audit protocol. |

| 3 | Verify Production Equipment & Capacity | Assess machinery, workforce size, and monthly output. Request production line videos or real-time video walkthroughs. |

| 4 | Review Export History & Client References | Ask for past export documentation (e.g., B/L copies, commercial invoices – redacted for privacy). Contact provided references directly. |

| 5 | Check IP Ownership & R&D Capability | For OEM/ODM suppliers, confirm in-house design and tooling. Request patents, product certifications (e.g., UL, CE), or mold ownership. |

| 6 | Evaluate Compliance & Certifications | Confirm ISO 9001, IATF 16949 (if applicable), environmental compliance, and labor standards. |

| 7 | Perform Transaction Verification | Use Alibaba Trade Assurance, Escrow, or Letter of Credit (LC) for initial orders to mitigate risk. |

🔍 Pro Tip (2026 Update): With rising digital fraud, use blockchain-verified supplier data platforms (e.g., Chainway, SourcifyTrust) to cross-verify company claims.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists trading, import/export, or agency services |

| Facility Ownership | Owns land/building; production equipment visible | No machinery; office-only setup |

| Workforce | Large number of production staff; engineers on site | Sales and sourcing agents; few technical staff |

| Product Customization | Offers mold/tooling investment, engineering support | Limited customization; relies on factory partners |

| Pricing Structure | Lower MOQs; direct cost breakdown (material, labor, overhead) | Higher quotes; vague cost justification |

| Communication | Technical team accessible; responds to engineering queries | Sales-only contact; delays in technical clarification |

| Location | Located in industrial zones (e.g., Dongguan, Ningbo) | Often based in commercial districts (e.g., Shanghai, Shenzhen CBD) |

✅ Best Practice: Ask, “Can you show me the production line for my product right now?” A genuine factory can provide real-time video or live feed.

Red Flags to Avoid When Sourcing from China (2026)

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit | High likelihood of being a middleman or fraudulent entity | Halt engagement; require third-party inspection |

| No verifiable address or Google Street View mismatch | Phantom company or shell operation | Use drone verification or local agent visit |

| Requests full payment upfront | High fraud risk | Use secure payment terms (30% deposit, 70% against B/L copy) |

| Generic product photos or stock images | Not actual manufacturer | Require custom sample with logo/date stamp |

| Inconsistent technical answers | Lack of engineering control | Interview production manager directly |

| Multiple Alibaba storefronts under same contact | Trading company masquerading as factory | Reverse-search phone/email across platforms |

| No experience with U.S. compliance standards | Risk of failed customs clearance or recalls | Require evidence of past U.S. shipments and certifications |

⚠️ 2026 Alert: Rise in “hybrid traders” — entities that present as factories but outsource 100% of production. These lack quality control and scalability.

Strategic Insight: What American Companies Are Leaving China?

While media narratives emphasize de-risking and “China+1” strategies, data from SourcifyChina’s 2025 client analysis shows:

- ~38% of U.S. companies are reducing China exposure, primarily in labor-intensive sectors (textiles, low-end electronics).

- ~45% are optimizing their China footprint—consolidating suppliers, shifting to high-value manufacturing (e.g., precision components, EV parts).

- ~17% are expanding in China due to unmatched supply chain density, skilled labor, and automation infrastructure.

📌 Procurement Takeaway: Don’t assume “leaving China” means exiting entirely. Focus on supplier resilience, dual-sourcing, and transparency—whether you stay, leave, or optimize.

Conclusion & Recommendations

- Verify, Don’t Assume: Use digital and on-ground tools to confirm factory authenticity.

- Prioritize Transparency: Demand real-time access to production data and compliance records.

- Build Direct Relationships: Bypass intermediaries where possible to improve cost, quality, and IP protection.

- Leverage Third-Party Validation: Use audits, inspections, and sourcing consultants to de-risk.

- Stay Informed: Monitor U.S.-China trade policies, tariff adjustments, and regional shifts (e.g., Vietnam, India, Mexico).

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Manufacturing Partnerships

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA 2026 GLOBAL SOURCING INTELLIGENCE REPORT

Strategic Supplier Continuity in the Post-Exit China Manufacturing Landscape

Prepared for Global Procurement Leaders | Q1 2026

EXECUTIVE INSIGHT: THE AMERICAN EXODUS MYTH VS. REALITY

Public narratives around “American companies leaving China” create costly procurement paralysis. Our 2026 analysis of 1,200+ Tier-1 suppliers reveals a critical truth: 78% of reported “exits” involve partial supply chain restructuring—not full abandonment. The real risk? Wasting 120+ hours/month chasing obsolete data while competitors secure vetted, resilient suppliers.

Why Traditional “Exit Tracking” Fails Procurement Teams

| Industry Standard Approach | SourcifyChina Verified Pro List Advantage | Time Saved/Month |

|---|---|---|

| Manual news scraping (Bloomberg, Reuters) | Real-time supplier migration status validated by on-ground audits | 37 hours |

| Unverified LinkedIn rumors | Contractual evidence of facility transfers/consolidations (NDA-protected) | 29 hours |

| Third-party databases with 6-9mo latency | Predictive alerts on impending shifts (e.g., tariff-triggered relocations) | 22 hours |

| Internal team verification | Pre-vetted continuity suppliers with export compliance certifications | 44 hours |

| Total: 132+ hours wasted | Total: 0 hours verification needed | 132+ hours |

YOUR STRATEGIC ADVANTAGE: THE VERIFIED PRO LIST

Our proprietary intelligence cuts through noise to deliver:

✅ Actionable supplier statuses: “Full exit” (4%), “Partial relocation” (74%), “Strategic expansion” (22%)

✅ Continuity-ready alternatives: 587 suppliers with identical certifications (ISO, FDA, UL) already serving departing US clients

✅ Policy impact mapping: How 2026 Uyghur Forced Labor Prevention Act (UFLPA) enforcement shifts actually affect your tier-2 vendors

“SourcifyChina’s Pro List identified 3 compliant alternatives within 72 hours when our key medical supplier exited Dongguan. Saved $2.1M in air freight and 8 weeks of downtime.”

— Director of Global Sourcing, S&P 500 MedTech Firm (Q4 2025 Client Case Study)

CALL TO ACTION: SECURE YOUR SUPPLY CHAIN BEFORE Q3 DEADLINES

Stop reacting to headlines. Start leading with verified intelligence.

The 2026 US tariff review (effective Oct 1) will accelerate supplier restructuring. Without real-time data, you risk:

⚠️ Costly dual-sourcing delays from chasing obsolete “exit” leads

⚠️ Compliance gaps in replacement suppliers (32% fail initial audit)

⚠️ Margin erosion from reactive spot buys during transition chaos

Your Next 48 Hours Determine Q3 Resilience:

1. Claim your FREE sector-specific Pro List snapshot (Automotive/Electronics/Textiles)

2. Validate continuity suppliers with our live compliance dashboard

3. Lock in Q3 capacity before competitors act

ACT NOW TO AVOID Q3 DISRUPTIONS

✉️ Email: [email protected]

Subject line: “2026 PRO LIST ACCESS – [Your Industry]”

📱 WhatsApp: +86 159 5127 6160

Message: “Requesting Q3 Continuity Report + Pro List Demo”

Response within 2 business hours | Zero obligation | Sector-specific intelligence

Data Source: SourcifyChina 2026 Supplier Migration Index (SMI™) | Audited across 28 Chinese industrial clusters | Methodology: On-ground verification + customs data triangulation

SourcifyChina: Where verified intelligence replaces speculation. Since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.