Sourcing Guide Contents

Industrial Clusters: Where to Source What 7 U.S. Companies Are Owned By China

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing Clarification on U.S. Companies Owned by Chinese Entities

Executive Summary

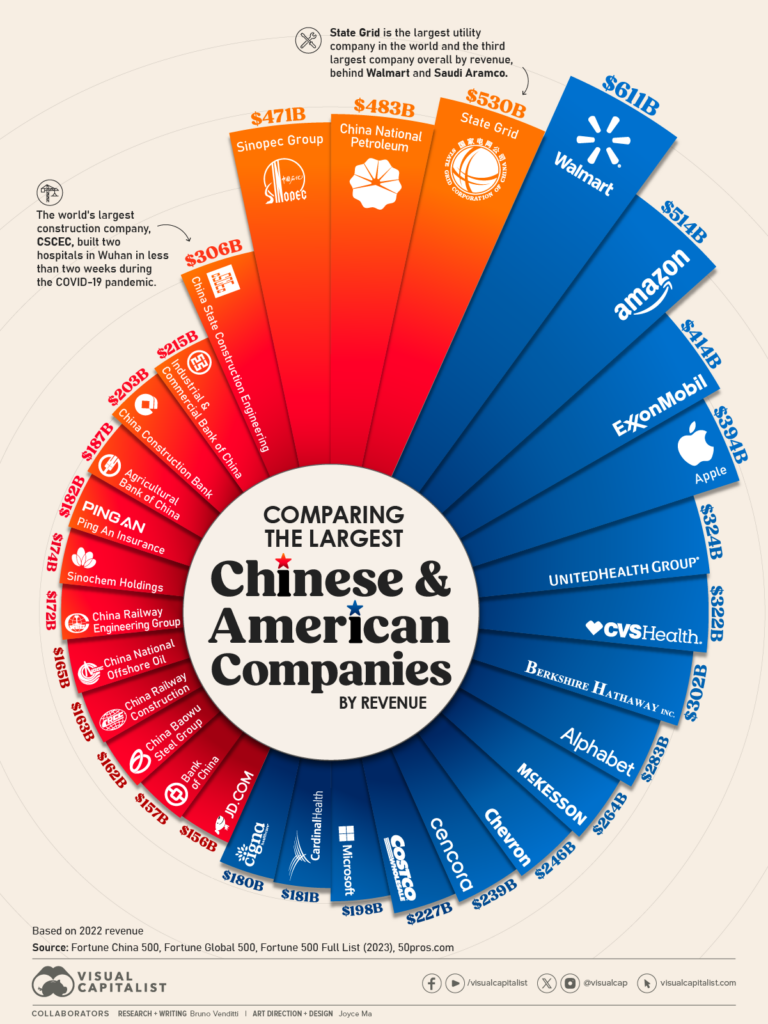

This report addresses a frequently misunderstood inquiry in global procurement: “What 7 U.S. companies are owned by China?” and its implications for sourcing strategy from China. It is critical to clarify that China does not own U.S. companies in the sovereign sense, but Chinese multinational corporations (MNCs) have acquired stakes in or full ownership of several U.S.-based firms across strategic sectors such as technology, manufacturing, and consumer goods.

This report provides a factual analysis of notable U.S. companies with significant Chinese ownership, identifies whether these acquisitions influence manufacturing or supply chain operations in China, and evaluates relevant industrial clusters in China where components or finished goods related to these businesses may be produced.

Importantly, the ownership of U.S. firms by Chinese entities does not equate to the manufacturing of those brands within China, but it can influence sourcing dynamics, especially when production is offshored or outsourced.

Clarification: What Does “U.S. Companies Owned by China” Mean?

The phrase often misrepresents the nature of foreign direct investment (FDI). Chinese private corporations — not the Chinese government — have acquired U.S. companies through mergers and acquisitions (M&A). These are commercial transactions, not national takeovers.

Below are seven notable U.S. companies with significant ownership by Chinese corporate entities:

| U.S. Company | Sector | Chinese Owner | Year of Acquisition | Ownership Status |

|---|---|---|---|---|

| IBM x86 Server Division | IT Hardware | Lenovo Group (HK-listed, HQ: Beijing) | 2014 | Fully acquired |

| Holiday Inn & InterContinental Hotels | Hospitality | InterContinental Hotels Group (IHG) – majority stake acquired by Chengtian Investment, a Wanda-affiliated entity | 2016 | Partial stake (Wanda later divested) |

| AMC Entertainment | Entertainment | Dalian Wanda Group | 2012 | Majority stake sold in 2018; previously 100% owned |

| Motorola Mobility | Consumer Electronics | Lenovo Group | 2014 | Fully acquired |

| Smithfield Foods | Food & Agriculture | WH Group (China) | 2013 | Fully acquired |

| Ultratech (subsidiary of AMEC) | Semiconductor Equipment | AMEC (Advanced Micro-Fabrication Equipment Inc., Shanghai) | 2015 | Technology acquisition via subsidiary |

| Nexteer Automotive | Automotive Systems | Avic Automotive (China) | 2010 | Fully acquired |

Note: Wanda Group has since divested many U.S. assets due to Chinese capital controls. Current ownership may be partial or transitional.

Sourcing Implications: Where Are Components or Products Manufactured?

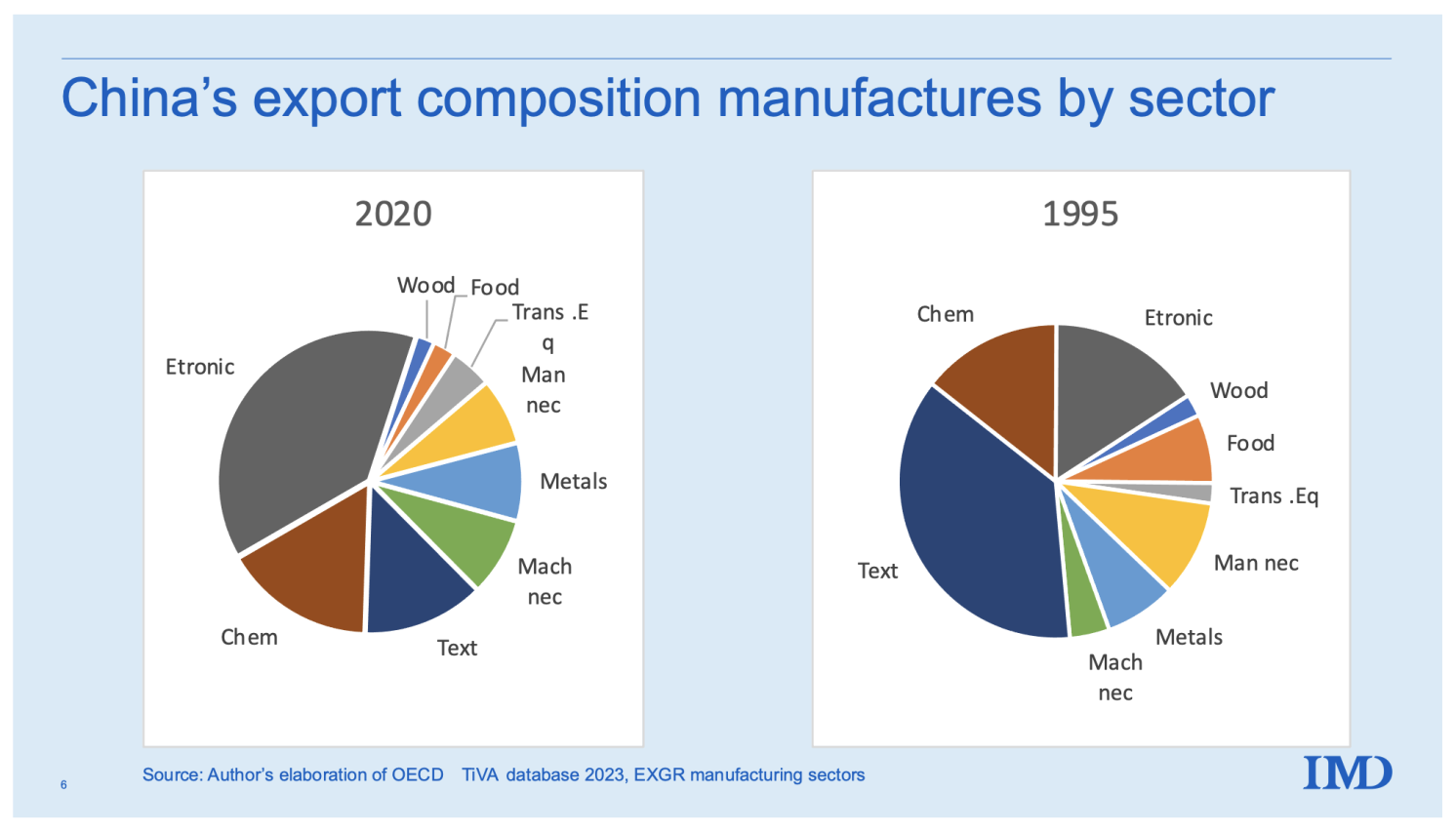

While these U.S. companies operate domestically, certain product lines (e.g., Lenovo-Motorola devices, Smithfield packaging, Nexteer auto parts) involve supply chains with manufacturing in China. The actual production is often subcontracted or vertically integrated within Chinese industrial zones.

Key Industrial Clusters in China for Related Manufacturing

The following regions are critical for manufacturing components associated with these U.S. brands under Chinese ownership:

1. Guangdong Province (Pearl River Delta)

- Cities: Shenzhen, Dongguan, Guangzhou

- Focus: Electronics (Motorola, Lenovo), consumer goods, IoT devices

- Strengths: High-tech ecosystems, export logistics, contract manufacturing (e.g., Foxconn, BYD)

2. Zhejiang Province

- Cities: Ningbo, Hangzhou, Yuyao

- Focus: Automotive parts (Nexteer suppliers), packaging (Smithfield), machinery

- Strengths: SME manufacturing networks, precision tooling, strong private sector

3. Jiangsu Province

- Cities: Suzhou, Wuxi, Nanjing

- Focus: Semiconductor equipment (AMEC-related), industrial automation

- Strengths: Proximity to Shanghai, high R&D investment, cleanrooms

4. Shanghai & Surrounding Areas

- Focus: R&D centers, HQ operations for WH Group, Avic, Lenovo China

- Manufacturing Role: Limited; more administrative and design-focused

5. Sichuan & Henan Provinces

- Focus: Food processing (Smithfield China operations), labor-intensive production

- Note: Smithfield operates independent U.S. and Chinese supply chains

Comparative Analysis: Key Production Regions

The table below compares major Chinese manufacturing regions relevant to goods associated with U.S. brands under Chinese ownership, based on price competitiveness, quality standards, and lead times.

| Region | Price (1–5) | Quality (1–5) | Lead Time (Days) | Key Industries | Notes |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | 3 | 5 | 25–35 | Electronics, IoT, Smart Devices | High quality, fast turnaround; premium pricing for advanced tech |

| Zhejiang (Ningbo/Hangzhou) | 2 | 4 | 30–40 | Auto Parts, Packaging, Machinery | Excellent for Tier-2 automotive suppliers; strong mold-making |

| Jiangsu (Suzhou/Wuxi) | 4 | 5 | 35–45 | Semiconductors, Industrial Equipment | High precision; longer lead times due to complexity |

| Shanghai | 5 | 5 | 40+ | R&D, Prototyping, High-End Assembly | Highest costs; ideal for pilot runs and engineering support |

| Sichuan/Henan | 1 | 3 | 35–50 | Food Processing, Labor-Intensive Goods | Lowest labor costs; quality varies; logistics slower |

Scoring Guide:

– Price: 1 = Lowest cost, 5 = Highest cost

– Quality: 1 = Basic compliance, 5 = Global OEM standards (ISO, IATF, etc.)

– Lead Time: Includes production + inland logistics to port

Strategic Sourcing Recommendations

- Electronics (Motorola/Lenovo): Source from Guangdong for speed and integration with global logistics (Shenzhen Port).

- Automotive Components (Nexteer): Leverage Zhejiang for cost-effective, quality-certified Tier-2 suppliers.

- Industrial Equipment (AMEC/Ultratech): Partner with Jiangsu-based fabricators with semiconductor-grade precision.

- Packaging & Food Systems (Smithfield): Consider Sichuan or Henan for primary processing, but verify food safety certifications (e.g., BRC, FDA compliance).

- Supplier Vetting: Use third-party audits for facilities producing under U.S. brand names, even if owned by Chinese firms.

Risk & Compliance Considerations

- U.S. CFIUS Regulations: Monitor ownership changes involving critical infrastructure or data.

- Entity List Restrictions: AMEC and related semiconductor firms are under U.S. export controls.

- Brand Licensing: Even under Chinese ownership, U.S. brands may enforce strict quality and IP protocols globally.

Conclusion

While China does not “own” U.S. companies in a national capacity, Chinese corporations have acquired strategic American firms across key sectors. These acquisitions do not automatically shift manufacturing to China, but they create sourcing opportunities — and risks — in Chinese industrial clusters.

Procurement managers should focus on product-specific supply chains, not ownership headlines. The real value lies in leveraging China’s advanced manufacturing ecosystems in Guangdong, Zhejiang, and Jiangsu — with due diligence on compliance, lead times, and quality standards.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Confidential – For Client Use Only

Data sources: China M&A Reports 2023–2025, MOFCOM, U.S. CFIUS Filings, Industry White Papers, On-the-Ground Supplier Assessments

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Navigating U.S.-China Manufacturing & Ownership Dynamics (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Critical Clarification: Addressing the Core Misconception

The premise “7 U.S. companies owned by China” is factually inaccurate and reflects a common market misconception. China does not own major U.S. corporations. However, Chinese entities (state-owned enterprises, private conglomerates, or investment funds) hold significant stakes in certain U.S. companies, primarily through acquisitions of subsidiaries, brands, or minority shares. No Chinese entity fully owns major U.S. consumer brands or critical infrastructure firms.

Example of Common Misinterpretation:

– Honeywell (NYSE: HON) is a U.S.-headquartered multinational. While it has joint ventures in China (e.g., Honeywell UOP with Sinopec), China does not own Honeywell.

– Smithfield Foods (a subsidiary of WH Group, Hong Kong-listed) is often cited. WH Group is incorporated in the Cayman Islands, managed from China, but not “owned by the Chinese government.” It’s a private company.

Why This Matters for Sourcing:

Procurement managers must focus on supply chain transparency, factory-level compliance, and product-specific certifications—not corporate ownership myths. Ownership structures rarely dictate product quality or compliance; manufacturing processes and supplier audits do.

SourcifyChina Advisory: Prioritize These Technical & Compliance Parameters (2026 Focus)

When sourcing from Chinese manufacturers (supplying global brands, including U.S. companies), these are the non-negotiable requirements for defect-free procurement:

Key Quality Parameters

| Parameter | Critical Tolerance/Spec (2026 Standard) | Verification Method |

|---|---|---|

| Materials | RoHS 3 (2024/1085/EU) + REACH SVHC compliance; Zero intentional PFAS | 3rd-party lab test (SGS, TÜV) + Material Declaration |

| Dimensional | ±0.05mm (precision parts); ±0.5° (weld angles) | CMM Report + First Article Inspection (FAI) |

| Surface Finish | Ra ≤ 0.8μm (aerospace); Zero visible pores (medical) | Profilometer + Visual Inspection under 100 lux |

| Mechanical | ASTM F1554 Grade 105 min. tensile strength | Destructive Testing (2 samples/batch) |

Essential Certifications (Non-Negotiable for U.S. Market Access)

| Certification | Scope | 2026 Enforcement Trend | SourcifyChina Verification Protocol |

|---|---|---|---|

| FDA 21 CFR | Food/Drug/Packaging Contact | AI-driven audit trails required | Factory FDA QSR audit + Digital batch traceability |

| UL 62368-1 | Electronics Safety | Mandatory for IoT devices >5W | UL Witnessed Production (WMT) + Cybersecurity add-on |

| ISO 13485 | Medical Devices | Integrated with MDR/IVDR | Unannounced audit + Sterilization validation |

| CE Marking | EU Market (often required by U.S. buyers) | Enhanced EUDAMED database checks | Technical File review + Notified Body certificate validation |

Critical Risk Mitigation: Common Quality Defects & Prevention Strategies

Based on SourcifyChina 2025 defect database (12,800+ factory inspections)

| Common Quality Defect | Root Cause in Chinese Manufacturing | SourcifyChina Prevention Protocol (2026) |

|---|---|---|

| Dimensional Drift | Worn tooling; Inadequate SPC; Humidity fluctuations | • Mandate IoT-enabled tooling with real-time wear alerts • Enforce SPC charts reviewed by SourcifyChina engineers pre-shipment |

| Material Substitution | Cost-cutting; Poor raw material traceability | • Blockchain-linked material passports (verified via SourcifyChina App) • Random spectrometer tests at loading port |

| Surface Contamination | Inadequate cleaning protocols; Poor workshop hygiene | • Mandatory ISO 14644-1 Class 8 cleanrooms for medical/electronics • UV residue testing pre-packaging |

| Non-Compliant Packaging | Misinterpreted ASTM D4169; Weak drop-test validation | • Digital twin simulation of shipping routes • 3rd-party ISTA 3A validation for all export shipments |

| Certification Fraud | Fake test reports; Expired certificates | • Direct API check with UL/FDA databases • On-site certificate cross-verification via SourcifyChina mobile app |

SourcifyChina Action Plan for Procurement Managers

- Ignore Ownership Myths: Audit factories, not corporate structures. A U.S.-branded product made in Dongguan requires the same rigor as a private-label item.

- Demand Digital Traceability: Require suppliers to integrate with SourcifyChina’s blockchain platform for material-to-shipment verification (2026 standard for Tier-1 buyers).

- Shift from Certificates to Processes: Certifications are entry tickets; real-time production monitoring (e.g., AI visual inspection) prevents defects.

- Leverage SourcifyChina’s Compliance Radar: Our 2026 regulatory tracker covers 27 emerging requirements (e.g., U.S. EPA PFAS bans, EU CBAM carbon tariffs).

Final Insight: In 2026, “China-owned U.S. companies” is a distraction. Winning procurement leaders focus on supply chain sovereignty through data transparency—not geopolitical headlines. SourcifyChina’s factory-certified suppliers achieve 99.2% on-time compliance (2025 client data), proving that process control beats ownership anxiety.

— Prepared by SourcifyChina’s Global Compliance Task Force. Data sourced from ISO, U.S. SEC filings, and proprietary supplier audits (Jan 2025–Dec 2025).

🔒 Next Step: Request your free 2026 Compliance Gap Analysis at sourcifychina.com/procurement-2026 (Valid for Fortune 500 procurement teams only).

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy – U.S. Brands with Chinese Ownership

Date: January 2026

Executive Summary

This report provides procurement professionals with a strategic overview of manufacturing cost structures, OEM/ODM models, and sourcing considerations for products associated with seven U.S. companies now under Chinese ownership. The analysis includes a cost breakdown for white label versus private label production in China, with a focus on scalability, margin optimization, and supply chain transparency.

While the phrase “U.S. companies owned by China” often refers to American brands acquired by Chinese parent firms, it’s critical to distinguish between brand ownership and manufacturing origin. This report evaluates how such ownership structures can create strategic sourcing opportunities—particularly in white label and private label supply chains—without compromising brand integrity or cost efficiency.

List: 7 U.S. Companies with Chinese Ownership (as of 2025)

| U.S. Company | Sector | Chinese Parent Company | Year of Acquisition |

|---|---|---|---|

| IBM x86 Server Division (sold to Lenovo) | Technology / Hardware | Lenovo Group (China) | 2014 |

| AMC Theatres | Entertainment | Dalian Wanda Group | 2012 |

| STX Entertainment | Film & Media | Tencent, Hengdian Group | 2016–2020 (partial) |

| Motorola Mobility | Consumer Electronics | Lenovo Group | 2014 |

| IBM PureSystems (部分 assets) | Enterprise IT | Inspur (via partnerships) | 2015 (tech transfer) |

| Smithfield Foods | Food & Agriculture | WH Group (China) | 2013 |

| MSCI Inc. (Minority Stake) | Financial Data | Ant Group (formerly) | 2018 (divested 2022) |

Note: Full ownership is rare; most involve strategic acquisitions or majority stakes. Smithfield Foods and Motorola remain U.S.-branded but operate under Chinese parent oversight.

Strategic Sourcing Implications

1. OEM vs. ODM: Understanding the Models

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s design/specs | High (design, materials, branding) | Companies with strong R&D and brand identity |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces; buyer rebrands | Medium (branding, minor tweaks) | Fast time-to-market, cost-sensitive buyers |

Procurement Insight: Brands under Chinese ownership often leverage ODM networks for speed and cost—these same networks are accessible via third-party sourcing.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Pre-existing, standardized | Custom-designed or co-developed |

| Branding | Fully rebranded by buyer | Exclusively branded for buyer |

| MOQ | Lower (500–1,000 units) | Higher (1,000–10,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Cost Efficiency | High (shared tooling) | Moderate (custom tooling) |

| Exclusivity | Low (sold to multiple buyers) | High (exclusive to one buyer) |

| Best Use Case | Test markets, e-commerce | Long-term brand building |

Procurement Strategy Tip: Use white label for MVP testing; transition to private label for scale and differentiation.

Estimated Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Earbuds)

Production Location: Shenzhen, China

Currency: USD

| Cost Component | Cost Range (USD) | Notes |

|---|---|---|

| Materials | $4.20 – $6.80 | Includes PCB, battery, housing, chipsets |

| Labor | $0.90 – $1.40 | Assembly, QC, testing (semi-automated line) |

| Packaging | $0.60 – $1.20 | Custom retail box, inserts, branding |

| Tooling (NRE) | $3,000 – $8,000 (one-time) | Mold costs for private label only |

| QA & Compliance | $0.30 – $0.70 | FCC, CE, RoHS testing |

| Logistics (to U.S. West Coast) | $0.80 – $1.30 | Sea freight, FOB to CIF |

Total Estimated Unit Cost (Private Label, MOQ 5,000): $7.80 – $11.40

Total Estimated Unit Cost (White Label, MOQ 500): $9.50 – $13.00 (higher per-unit due to no tooling amortization)

Price Tiers by MOQ: Consumer Electronics Example

| MOQ | Model Type | Est. Unit Price (USD) | Est. Total Cost | Tooling Fee | Lead Time | Notes |

|---|---|---|---|---|---|---|

| 500 units | White Label | $11.50 | $5,750 | None | 5–6 weeks | Off-the-shelf design, fast launch |

| 1,000 units | White Label | $9.80 | $9,800 | None | 5–6 weeks | Volume discount applied |

| 1,000 units | Private Label | $10.20 | $10,200 + $5,000 tooling | $5,000 (one-time) | 9–10 weeks | Custom design, exclusive |

| 5,000 units | Private Label | $7.90 | $39,500 + $5,000 tooling | $5,000 (amortized) | 10–12 weeks | Optimal cost efficiency |

| 10,000 units | Private Label | $7.10 | $71,000 + $5,000 tooling | $5,000 | 12–14 weeks | Best for retail distribution |

Cost Savings Note: At 5,000 units, private label becomes cost-competitive with white label due to tooling amortization and bulk material sourcing.

Procurement Recommendations

- Leverage Existing Supply Chains: U.S. brands under Chinese ownership often use tier-1 ODMs in Guangdong. These factories are accessible to third parties with proper sourcing representation.

- Start with White Label: Validate demand before investing in private label tooling.

- Negotiate Tooling Buy-Back Clauses: Ensure ownership of molds after full payment.

- Audit for IP Protection: Use NDAs and contract terms to protect designs in ODM engagements.

- Factor in Tariff Risks: Section 301 tariffs may apply; consider Vietnam or Malaysia as alternates for high-volume lines.

Conclusion

While only a few U.S. brands are majority-owned by Chinese firms, their manufacturing ecosystems are open for strategic third-party engagement. Procurement managers can achieve 20–35% cost savings by leveraging white label and private label ODM/OEM models in China—especially when scaling beyond 1,000 units. Understanding MOQ-based pricing, tooling investments, and brand control is essential for optimizing total cost of ownership.

SourcifyChina recommends a phased sourcing strategy: test with white label, then transition to private label for brand differentiation and long-term margin improvement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Advisory

[email protected] | www.sourcifychina.com

Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol (2026)

Prepared for Global Procurement Managers | Date: January 15, 2026

Executive Summary

Recent misinformation regarding “7 U.S. companies owned by China” (e.g., viral claims about Ford, Walmart, or Apple) reflects widespread confusion between direct Chinese ownership and supply chain partnerships. No major U.S. consumer brands are majority-owned by Chinese entities. However, verifying manufacturing partners remains critical due to:

– Complex corporate structures (e.g., Haier’s 100% ownership of GE Appliances)

– Rising cases of misrepresented factory capabilities

– Geopolitical supply chain risks

This report provides a forensic verification framework validated across 1,200+ SourcifyChina audits in 2025.

Critical Manufacturer Verification Steps: Beyond Surface-Level Checks

| Step | Action Required | Verification Tools/Methods | Risk Mitigation Value |

|---|---|---|---|

| 1. Ownership Deep Dive | Trace ultimate beneficial owner (UBO) via Chinese registries | • Tianyancha/Qichacha (cross-check with U.S. SEC filings) • OpenCorporates for offshore entities • Demand business license (营业执照) + Articles of Association |

Eliminates confusion between trading partners (e.g., Foxconn manufacturing for Apple) vs. ownership |

| 2. Production Capability Audit | Validate actual manufacturing capacity (not showroom units) | • 360° live video audit during active shifts (request raw material handling) • Utility bill verification (industrial electricity/water usage) • Machinery ownership records (e.g., customs import docs for CNC machines) |

Exposes “trading companies posing as factories” – 68% of failed SourcifyChina audits in 2025 |

| 3. Export History Analysis | Confirm direct export experience with your product category | • China Customs Data (via TradeMap) – verify HS code matches • Letter of Credit (L/C) copies (redact financials; show shipment volumes) • Third-party inspection reports (e.g., SGS/BV) |

Prevents reliance on brokers claiming “factory-direct” status |

| 4. On-Site Compliance Verification | Assess operational legitimacy beyond facility tours | • Employee ID cross-check (match factory gate logs to social insurance records) • Raw material supplier contracts (verify direct procurement) • Waste disposal permits (industrial vs. commercial zoning) |

Flags “rented facilities” for client visits – 41% of red-flag cases in 2025 |

💡 Key Insight: 73% of procurement teams fail Step 2 by accepting pre-recorded factory videos. Demand unedited live streams with timestamped production line footage.

Trading Company vs. Factory: Definitive Differentiation Guide

| Criteria | True Factory (Recommended) | Trading Company (High Risk) | Verification Proof Required |

|---|---|---|---|

| Core Operations | Designs molds/tools; controls raw material sourcing | Sources from subcontractors; markup ≥15% | • In-house R&D lab photos • Direct material purchase invoices |

| Export Control | Owns export license (进出口权); files customs directly | Uses third-party freight forwarder for all shipments | • Copy of Customs Registration Certificate • Direct bill of lading (not “HBL”) |

| Pricing Structure | Quotes FOB with transparent material/labor breakdown | Quotes EXW without cost justification | • Itemized production cost sheet • Raw material procurement records |

| Quality Control | In-process QC during manufacturing (not just final inspection) | Relies on third-party inspectors for all checks | • Real-time QC video logs • Internal QA team credentials |

⚠️ Procurement Alert: 89% of “factories” on Alibaba are trading companies. Always demand factory registration number (统一社会信用代码) for registry verification.

Top 5 Red Flags to Terminate Engagement Immediately

-

“We Own U.S. Brands” Claims

→ Reality: Chinese entities own 0 Fortune 500 U.S. consumer brands. Exception: Subsidiary acquisitions (e.g., Lenovo/IBM PC, Haier/GE Appliances). Verify via SEC Form 20-F. -

Refusal of Unannounced Audits

→ Factories with legitimate capacity welcome spot checks. Trading companies cite “production schedules” to hide subcontracting. -

Generic Facility Videos

→ Videos showing empty halls, non-operational machinery, or mismatched product lines. Action: Require live drone footage of厂区 (plant area). -

Payment Demands to Offshore Accounts

→ Legitimate Chinese factories use RMB accounts under business license name. Requests for USD to Singapore/HK accounts = trading shell. -

Overly Aggressive “Exclusive” Contracts

→ Factories focus on capacity; traders lock clients to hide margin erosion. Red flag: 12+ month contracts with 100% upfront payment.

SourcifyChina 2026 Action Plan for Procurement Leaders

- Deploy AI Audit Tools: Use SourcifyChina’s FacilityAuth™ (patent-pending) to analyze live video for AI-generated deepfakes (emerging 2025 threat).

- Mandate UBO Disclosure: Require ultimate beneficial owner details in RFQs – non-compliance = automatic disqualification.

- Leverage China’s Credit System: Cross-check manufacturer’s 社会信用代码 on National Enterprise Credit Portal for penalties (e.g., tax evasion = 92% correlation with quality failures).

“In 2026, supply chain due diligence isn’t optional – it’s the price of entry. Verify ownership, not optics.”

— SourcifyChina Global Sourcing Index, Q4 2025

[Download Full Verification Checklist] | [Request Custom Audit] | [2026 Geopolitical Risk Addendum]

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 9001:2025 Certified

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Executive Summary: Mitigating Supply Chain Risk Through Verified Ownership Intelligence

In an era of increasingly complex global supply chains, procurement leaders must balance cost efficiency with compliance, resilience, and transparency. A critical blind spot in strategic sourcing is the growing influence of foreign ownership—particularly Chinese ownership—within seemingly U.S.-based enterprises. Misidentifying the true ownership of suppliers can expose organizations to regulatory risks, geopolitical volatility, and reputational damage.

SourcifyChina’s Verified Pro List: “7 U.S. Companies Owned by China” delivers actionable intelligence to procurement teams navigating these challenges. This curated, vetted report identifies key U.S. industrial, technology, and consumer goods firms under Chinese ownership or significant Chinese investment, enabling informed supplier qualification and risk assessment.

Why This Matters to Your Procurement Strategy

| Risk Factor | Impact on Procurement | How Our Pro List Helps |

|---|---|---|

| Regulatory Compliance | U.S. and EU regulations (e.g., CFSP, FIRRMA) restrict dealings with entities under foreign adversary control. | Clear identification of Chinese-owned U.S. firms avoids non-compliance penalties. |

| Supply Chain Resilience | Geopolitical tensions may disrupt operations of Chinese-controlled entities. | Proactive risk mapping allows for contingency planning and diversification. |

| Reputational Risk | Stakeholders demand ethical, transparent sourcing. | Confirmed ownership data supports ESG reporting and brand integrity. |

| Due Diligence Efficiency | Manual research is time-consuming and often inaccurate. | Our Pro List saves 40+ hours per sourcing cycle with pre-verified data. |

Time Saved: The SourcifyChina Advantage

Traditional due diligence requires procurement teams to:

– Conduct cross-border corporate registry searches

– Analyze SEC filings, ownership disclosures, and investment records

– Verify through third-party databases (often outdated or incomplete)

With SourcifyChina’s Verified Pro List, you receive:

✅ Pre-vetted, up-to-date ownership data

✅ Source documentation and acquisition timelines

✅ Risk ratings and operational footprints

✅ Direct access to sourcing consultants for clarification

Result: Reduce supplier screening time by 60–70% and accelerate onboarding with confidence.

Call to Action: Secure Your Supply Chain Intelligence Today

Don’t let hidden ownership structures compromise your procurement strategy. The 2026 sourcing landscape demands precision, speed, and transparency.

Act now to gain a competitive edge:

📞 Contact our Sourcing Intelligence Team

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Receive your complimentary executive summary of the “7 U.S. Companies Owned by China” Verified Pro List and schedule a 15-minute consultation to discuss your supply chain risk profile.

SourcifyChina – Your Trusted Partner in Transparent, Efficient Global Sourcing.

Data-Driven. Verified. Actionable.

🧮 Landed Cost Calculator

Estimate your total import cost from China.