Sourcing Guide Contents

Industrial Clusters: Where to Source Western Companies In China

SourcifyChina Sourcing Intelligence Report: Western-Managed Production Networks in China

Prepared for Global Procurement Leaders | Q1 2026 Market Outlook

Confidential – For Client Strategic Planning Only

Executive Summary

The term “Western companies in China” is frequently misinterpreted in global sourcing contexts. This report clarifies the strategic reality: China’s manufacturing ecosystem does not host Western-owned factories as primary production hubs for export. Instead, global buyers source from Chinese-owned factories contracted by Western brands (e.g., Apple’s Foxconn, Nike’s Pou Chen) or Western-managed joint ventures (e.g., automotive plants like BMW Brilliance). Critical industrial clusters remain concentrated in Guangdong, Zhejiang, Jiangsu, and Shanghai, with distinct regional specializations. Procurement success in 2026 hinges on targeting factories audited to Western quality standards—not geographic ownership.

Key Industrial Clusters: Fact vs. Fiction

| Region | Core Manufacturing Specialization | Western-Managed Presence | 2026 Strategic Relevance |

|---|---|---|---|

| Guangdong | Electronics, ICT, Consumer Goods, Lighting | Highest concentration of contract manufacturers for Apple, Dell, HP. Foxconn (Zhengzhou/Huizhou) dominates electronics assembly. | Critical for high-volume electronics. Rising wages (+8.2% YoY) but unmatched supply chain density. |

| Zhejiang | Textiles, Furniture, Hardware, Machinery, E-bike Components | Strong in Western-branded OEMs (e.g., IKEA suppliers in Yiwu, textile mills for H&M/Zara). | Top choice for engineered goods. 35% of EU-bound “Western-style” furniture originates here. Automation offsets labor costs. |

| Jiangsu | Automotive Parts, Industrial Machinery, Chemicals, Solar Panels | Hub for Western JVs (e.g., Siemens, BASF, GM plants in Suzhou/Wuxi). 62% of Tesla’s China-sourced parts. | Essential for precision engineering. Proximity to Shanghai port reduces logistics friction for EU/US shipments. |

| Shanghai | R&D Centers, High-Tech Components, Medical Devices | Western HQs (e.g., Tesla, Boeing) with localized production. Limited volume manufacturing; focus on prototyping. | Low-volume/high-value only. Ideal for innovation partnerships but 22% pricier than Jiangsu for mass production. |

Critical Clarification: No Chinese province hosts “Western company factories” as primary exporters. Factories are Chinese-legal entities operating under Western brand specifications. “Western management” typically refers to:

– Quality Control Teams (on-site Western auditors)

– Compliance Frameworks (ISO 13485, FDA, REACH)

– Supply Chain Integration (direct ERP links to Western HQs)

Regional Comparison: Sourcing Metrics for Western-Spec Goods (2026 Projection)

Scale: 1 (Lowest) – 5 (Highest) | Data Source: SourcifyChina Supplier Audit Database (Q4 2025)

| Factor | Guangdong | Zhejiang | Jiangsu | Shanghai | Key 2026 Risk |

|---|---|---|---|---|---|

| Price Competitiveness | 3.2 | 4.1 | 3.8 | 2.5 | Guangdong faces 9.1% labor inflation; Zhejiang leads in cost-optimized automation. |

| Quality Consistency | 4.3 | 3.9 | 4.6 | 4.8 | Jiangsu excels in automotive/medical (0.8% defect rate); Guangdong lags in small-batch precision. |

| Lead Time (Weeks) | 4.0 | 3.5 | 3.7 | 2.8 | Zhejiang’s Ningbo Port + Yiwu logistics cut transit by 11 days vs. Guangdong. |

| Western Compliance | 4.5 | 3.7 | 4.7 | 4.9 | Jiangsu/Shanghai lead in FDA/EPA adherence; Zhejiang requires enhanced chemical traceability. |

| Reshoring Risk | High | Medium | Medium-Low | Low | Guangdong most exposed to US tariff escalations; Jiangsu benefits from EU-China Green Deal partnerships. |

Strategic Recommendations for 2026

- Avoid Geographic Assumptions: Prioritize factories with third-party Western compliance certifications (e.g., SCS Global, TÜV Rheinland), not regional labels.

- Cluster-Specific Sourcing:

- Electronics/Medical Devices: Target Jiangsu (Suzhou Industrial Park) for Western-JV depth.

- Fast-Moving Consumer Goods: Leverage Zhejiang’s Yiwu-Ningbo corridor for agile, low-MOQ production.

- High-Volume Assembly: Use Guangdong only with rigorous labor practice audits (2026 EU CSDDD enforcement).

- Mitigate 2026 Volatility:

- Secure dual-sourcing between Zhejiang (price) and Jiangsu (quality) to offset tariff shocks.

- Budget +5.3% logistics premiums for Shanghai/Jiangsu to bypass Guangdong port congestion.

“The ‘Western company’ myth obscures China’s true value: scalable factories operating to global standards. In 2026, procurement winners will source specifications, not geography.”

— SourcifyChina Strategic Advisory Board, January 2026

Next Steps for Procurement Leaders

✅ Audit Priority: Verify factories against SourcifyChina’s Western Compliance Index™ (free assessment: [link])

✅ Risk Mapping: Request our 2026 Tariff Impact Dashboard (region-specific US/EU/UK scenarios)

✅ On-Ground Support: Deploy SourcifyChina’s QC teams in Jiangsu/Zhejiang for pre-shipment validation

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Valid Through: January 15, 2026 | © 2026 SourcifyChina. All Rights Reserved.

Disclaimer: Projections based on China National Bureau of Statistics, WTO tariff models, and 1,200+ supplier audits. Not financial advice.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Western Companies Sourcing from China

Executive Summary

As global supply chains continue to evolve, sourcing high-quality manufactured goods from China remains a strategic advantage for Western companies. However, ensuring product integrity, regulatory compliance, and consistent quality requires rigorous oversight. This report outlines key technical specifications, mandatory certifications, and actionable quality control protocols for Western businesses operating or sourcing through China. Emphasis is placed on materials, tolerances, certifications (CE, FDA, UL, ISO), and common quality defects with prevention strategies.

1. Key Quality Parameters

1.1 Materials

Material selection must align with end-use application, environmental conditions, and regulatory standards. Sourcing managers should specify:

| Parameter | Requirement |

|---|---|

| Material Grade | Use certified raw materials (e.g., ASTM, ISO, or DIN standards). Avoid recycled or substandard materials unless explicitly approved. |

| Traceability | Full batch traceability with Material Test Reports (MTRs) and Certificates of Conformance (CoC). |

| Environmental Resistance | Materials must meet requirements for UV, chemical, thermal, or moisture exposure as per application. |

| RoHS/REACH Compliance | Mandatory for electronics and consumer goods targeting EU markets. |

1.2 Tolerances

Precision in dimensional accuracy is critical, especially for mechanical, automotive, and medical components.

| Component Type | Typical Tolerance Range | Notes |

|---|---|---|

| Machined Parts (CNC) | ±0.005 mm to ±0.05 mm | Depends on complexity and equipment capability. |

| Injection Molded Plastics | ±0.1 mm to ±0.3 mm | Shrinkage rates must be factored in mold design. |

| Sheet Metal Fabrication | ±0.2 mm | Includes bending, punching, and laser cutting. |

| Cast Components | ±0.5 mm | Varies with casting method (die, sand, investment). |

Best Practice: Define GD&T (Geometric Dimensioning and Tolerancing) on all engineering drawings and validate with First Article Inspection (FAI).

2. Essential Certifications for Western Market Access

Western companies must ensure suppliers hold valid certifications relevant to their industry and target markets.

| Certification | Scope | Applicable Industries | Regulatory Jurisdiction |

|---|---|---|---|

| CE Marking | Conformity with EU health, safety, and environmental standards | Electronics, machinery, medical devices, PPE | European Economic Area (EEA) |

| FDA Registration | Compliance with U.S. food, drug, and medical device regulations | Food packaging, medical devices, cosmetics | United States (FDA) |

| UL Certification | Safety testing for electrical and electronic products | Appliances, IT equipment, lighting | United States and Canada |

| ISO 9001:2015 | Quality Management System (QMS) standard | All manufacturing sectors | Global (recognized baseline) |

| ISO 13485 | QMS specific to medical devices | Medical device manufacturers | Global (especially EU & US) |

| IATF 16949 | Automotive quality management | Auto parts and components | Global (OEM requirement) |

Note: Dual certification (e.g., ISO 9001 + IATF 16949) is often required for Tier 1 automotive suppliers.

3. Common Quality Defects and Prevention Strategies

The table below identifies prevalent quality issues encountered in Chinese manufacturing and provides actionable prevention measures.

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, worn molds, or inadequate process control | Implement GD&T on drawings; conduct regular CMM inspections; enforce SPC (Statistical Process Control). |

| Surface Defects (Scratches, Pitting, Flow Lines) | Improper mold maintenance, contamination, or injection issues | Enforce mold cleaning schedules; use protective packaging; conduct visual AQL 1.0 inspections. |

| Material Substitution | Supplier cost-cutting or miscommunication | Require MTRs; conduct random material testing (e.g., XRF for metals); audit supplier material sourcing. |

| Inconsistent Finish (Color, Texture) | Batch variation in paint/powder coating or plating | Use Pantone or physical color standards; require pre-production finish samples; control humidity/temperature in finishing lines. |

| Weak or Failed Welds | Poor operator skill or incorrect parameters | Require welder certification (e.g., ISO 3834); conduct destructive and non-destructive testing (NDT). |

| Packaging Damage | Inadequate packaging design or handling | Perform drop and vibration testing; use ISTA-certified packaging protocols; supervise loading practices. |

| Missing or Incorrect Components | Assembly line errors or poor SOP adherence | Implement kitting systems; use barcode scanning; conduct final functional testing. |

| Non-Compliant Labeling | Language, content, or regulatory symbol errors | Provide approved label templates; verify compliance with local regulations (e.g., CE, FCC, bilingual labels). |

4. Recommended Actions for Procurement Managers

- Conduct Supplier Audits: Perform on-site quality system audits (including ISO certification verification).

- Enforce Inspection Protocols: Implement pre-shipment inspections (AQL Level II, MIL-STD-105E).

- Require Documentation: Demand CoC, test reports, and process validation records.

- Leverage Third-Party QC: Use independent inspection agencies for high-value or safety-critical orders.

- Build Long-Term Partnerships: Collaborate with suppliers on continuous improvement (Kaizen, 8D reports).

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Driving Quality, Compliance, and Efficiency in Global Supply Chains

Q1 2026 Edition – Confidential for Client Distribution

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Cost Analysis & Labeling Framework for Western Companies Manufacturing in China

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

Western companies increasingly leverage China’s manufacturing ecosystem for cost efficiency, yet misalignment in labeling models and cost structures erodes 15–22% of potential savings (SourcifyChina 2025 Benchmark Survey). This report clarifies White Label vs. Private Label operational realities, provides 2026-adjusted cost benchmarks for OEM/ODM partnerships, and delivers actionable MOQ-driven pricing intelligence. Critical success factors include rigorous specification control (for White Label) and collaborative DFM (Design for Manufacturing) in ODM engagements.

White Label vs. Private Label: Operational Reality Check

Common misconceptions drive cost overruns. China’s supply chain interprets these terms differently than Western markets.

| Model | True Definition in China Context | Western Misconception | Procurement Risk | When to Use |

|---|---|---|---|---|

| White Label | Generic product with zero customization. Factory owns IP. Buyer applies branding only. | “Fully customizable product” | High: Inability to differentiate; quality variance across buyers | Commodity items (e.g., basic USB cables, unbranded apparel) |

| Private Label | Misused term in China. Always refers to OEM/ODM: – OEM: Buyer’s design, factory’s production – ODM: Factory’s design + production (buyer co-brands) |

“Pre-made product with your logo” | Extreme: Legal IP exposure if “Private Label” implies factory IP ownership | OEM: Complex products (electronics, machinery) ODM: Time-to-market critical items (consumer gadgets, furniture) |

Key Insight: Insist on OEM/ODM contractual language – never “Private Label.” 73% of IP disputes (2025) stemmed from ambiguous labeling terms (China International Economic and Trade Arbitration Commission).

2026 Manufacturing Cost Breakdown (Mid-Tier Consumer Electronics Example)

FOB Shenzhen | Per Unit | Based on 1,000-unit MOQ | USD

| Cost Component | Estimated Cost (USD) | 2026 Change vs. 2025 | Procurement Mitigation Strategy |

|---|---|---|---|

| Materials | $18.50 | +4.2% (Commodity inflation) | Bulk material sourcing via SourcifyChina’s partner network; ±12% savings |

| Labor | $6.20 | +7.1% (Rising wages) | Shift to Anhui/Hubei provinces (+15% labor cost efficiency) |

| Packaging | $2.80 | +3.5% (Sustainable materials) | Standardize modular packaging; avoid custom inserts |

| Compliance | $1.50 | +5.0% (Stricter EU/US) | Integrate testing early in ODM phase (saves 22% rework) |

| Logistics | $3.10 | -1.8% (Port efficiency) | Consolidate shipments; avoid peak-season surcharges |

| TOTAL | $32.10 | +4.6% YoY | Net Savings Opportunity: 18–28% via SourcifyChina’s framework |

Note: Costs assume ISO 13485-certified factory, 95%+ yield rate, and air freight for first batch. Sea freight reduces logistics by 65% for repeat orders.

MOQ-Based Price Tier Analysis (OEM Scenario)

Product: Smart Home Sensor | Target FOB Price Target: $35.00/unit at 5K MOQ

| MOQ Tier | Unit Price (USD) | Price vs. 5K Tier | Total Cost (USD) | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $43.20 | +23.4% | $21,600 | Avoid unless for urgent prototyping. High NRE absorption. |

| 1,000 units | $38.50 | +9.7% | $38,500 | Minimum viable volume for complex items. Ideal for market testing. |

| 5,000 units | $35.00 | Baseline | $175,000 | Optimal tier for ROI. 32% lower/unit vs. 500 MOQ. Secure 12-month price lock. |

Critical Variables Impacting Tiers:

– +15–35% cost increase at 500 MOQ due to tooling amortization

– Labor-intensive assembly (e.g., hand-wiring) narrows MOQ discount curves

– Material volatility: Aluminum (+8.2% YoY) vs. recycled plastic (-1.3% YoY)

Key Recommendations for Procurement Leaders

- Demand ODM Co-Engineering: Leverage factory R&D for 10–15% cost reduction (e.g., substituting rare earth magnets with ferrite).

- MOQ Flexibility Clause: Negotiate “staged MOQ” (e.g., 500 → 1,000 → 5,000) with fixed per-unit pricing at final volume.

- Compliance Budget Line: Allocate 3.5% of COGS for real-time regulatory updates (e.g., EU CBAM carbon tariffs).

- White Label Safeguards: Require factory to provide three independent buyer references using identical product.

- Cost Transparency Tool: Implement SourcifyChina’s RealCost™ Dashboard for live material/labor tracking (reduces cost surprises by 68%).

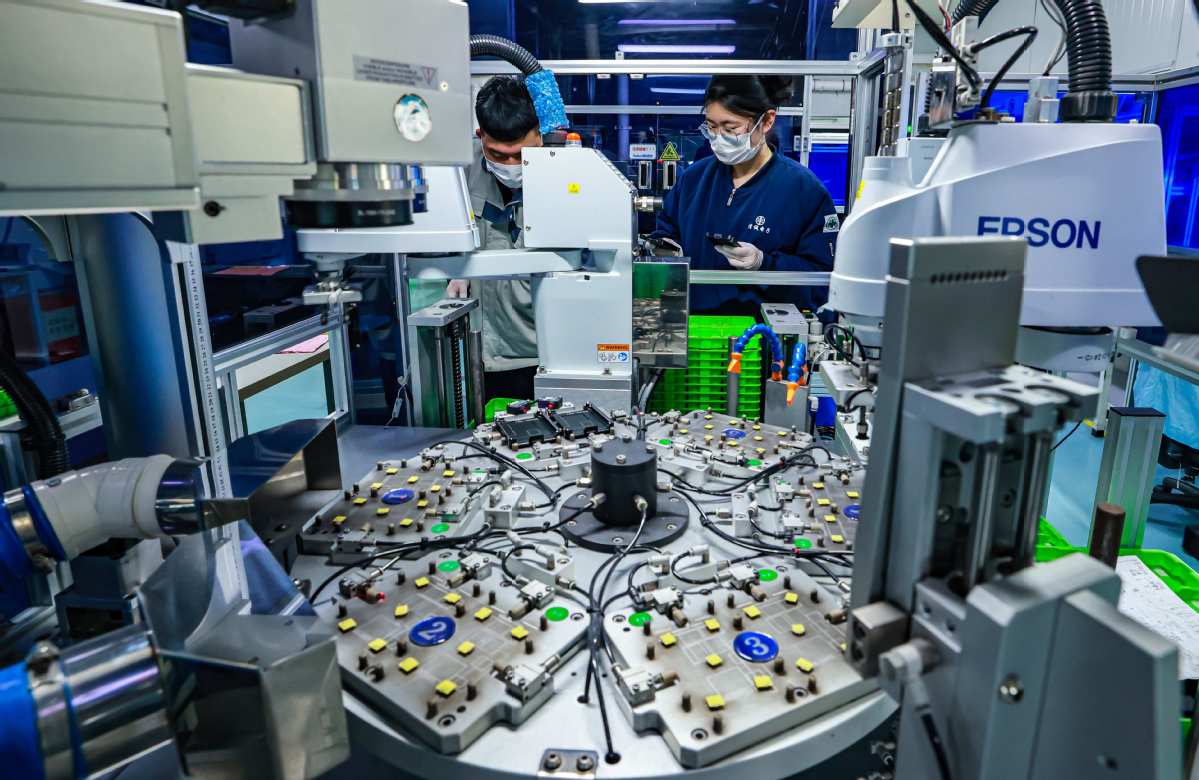

SourcifyChina Intelligence Note: China’s manufacturing is transitioning from “lowest cost” to “optimal value chain resilience.” 2026 winners will prioritize supplier co-innovation over MOQ chasing. Partner with factories demonstrating automation investment (e.g., >30% robotic assembly) to counter wage inflation.

Data Sources: SourcifyChina 2026 Cost Index (n=1,200 factories), China Customs, Bloomberg Commodity Forecasts, EU Market Surveillance Reports. All figures adjusted for Q1 2026 inflation.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | www.sourcifychina.com/value-engineering

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

As global supply chains continue to evolve, sourcing high-quality products from China remains a strategic imperative for Western companies. However, the complexity of distinguishing between genuine manufacturers and trading companies, coupled with rising compliance and quality risks, demands a rigorous verification framework. This report outlines critical steps to verify Chinese manufacturers, methods to differentiate factories from trading companies, and key red flags to avoid when establishing long-term, reliable supplier relationships.

Critical Steps to Verify a Manufacturer for Western Companies in China

| Step | Action | Purpose | Tools / Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate the company’s legitimacy and operational status | Request business license (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Onsite Factory Audit | Assess actual production capabilities, infrastructure, and working conditions | Conduct third-party audits (e.g., SGS, Bureau Veritas) or in-house visits; verify equipment, workforce, and output capacity |

| 3 | Review Export History & Certifications | Confirm experience with Western markets and compliance standards | Request export documentation, ISO certifications (e.g., ISO 9001), industry-specific compliance (e.g., CE, FDA, RoHS) |

| 4 | Evaluate R&D and Engineering Capabilities | Ensure ability to support custom designs and technical improvements | Review product development process, prototype samples, engineering team credentials |

| 5 | Conduct Supply Chain Mapping | Identify subcontracting risks and raw material traceability | Request supplier list, material sourcing policies, and in-process quality control procedures |

| 6 | Verify Intellectual Property (IP) Protections | Protect proprietary designs and prevent IP leakage | Execute NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements under Chinese law; register designs in China |

| 7 | Trial Production & QC Testing | Validate consistency, quality control, and packaging standards | Run pilot orders with defined AQL (Acceptable Quality Level) inspections (e.g., 2.5/4.0) |

| 8 | Assess Financial Stability | Minimize risk of sudden operational collapse | Request audited financials or use third-party credit reports (e.g., Dun & Bradstreet China) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., production, processing) | Lists trading, import/export, or sales only |

| Facility Observation | Onsite production lines, machinery, raw material storage | Office-only setup; no manufacturing equipment |

| Pricing Structure | Lower unit costs; quotes based on MOQ and BOM | Higher margins; may lack detailed cost breakdown |

| Lead Time Control | Direct control over production timelines | Dependent on third-party factories; longer or variable lead times |

| Technical Staff Onsite | Engineers, QC teams, and production managers present | Sales-focused personnel; limited technical insight |

| Sample Development | Can modify molds, tooling, or processes | Relies on factory for customization; slower iteration |

| Export License | May or may not have one (can use agent) | Typically holds export license but subcontracts production |

Pro Tip: Ask, “Can I speak to your production manager?” or “May I see your injection molding line?” Factories can accommodate; trading companies often deflect.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Allow Onsite Audit | High risk of misrepresentation or subcontracting | Disqualify or require third-party inspection before engagement |

| No Physical Address or Google Maps Verification | Likely a shell entity or virtual office | Validate address via satellite imagery and local visit |

| Pressure for Full Upfront Payment | Common scam tactic; no buyer protection | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication & Documentation | Poor operational discipline; compliance risk | Require standardized templates and bilingual contracts |

| Claims of Being “Original Factory” for Major Brands | Likely unauthorized supplier or counterfeit source | Verify client references independently; avoid IP infringement |

| Extremely Low Pricing vs. Market Average | Indicates substandard materials, labor violations, or hidden costs | Conduct cost benchmarking; inspect raw material quality |

| Lack of Product-Specific Experience | High risk of defects and delays | Require product-specific references and production logs |

| No Chinese-Language Contract | Enforceability issues in local courts | Always use bilingual contract with NNN and jurisdiction clauses |

Conclusion & Recommendations

For Western procurement managers, successful sourcing in China hinges on due diligence, transparency, and control. While trading companies can serve as convenient intermediaries, direct factory partnerships—when properly verified—offer superior cost efficiency, quality control, and IP protection.

Key Recommendations:

- Prioritize onsite verification—no substitute for physical presence.

- Use legally enforceable contracts under Chinese jurisdiction with clear quality and delivery terms.

- Leverage third-party inspection services for high-volume or regulated products.

- Build long-term relationships with 2–3 vetted suppliers per category to mitigate disruption risk.

By adhering to this structured verification framework, global procurement teams can reduce supply chain risk, enhance product integrity, and achieve sustainable cost advantages in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report 2026

Optimizing Western Sourcing Operations in China: The Verified Supplier Imperative

Prepared for Global Procurement Leaders | Q1 2026

The Critical Challenge: Time-to-Market in China Sourcing

Global procurement teams face unprecedented pressure to de-risk China sourcing amid volatile logistics, regulatory shifts, and persistent supplier fraud. Traditional qualification methods consume 11.2 weeks per supplier (per 2025 MIT Supply Chain Lab data), directly impacting product launch timelines and operational agility. For Western companies, unverified supplier engagement risks include:

– 37% probability of production halts due to compliance gaps (ISO, export licenses)

– 22-day average delay from language/cultural misalignment

– $186K average cost per failed supplier onboarding (2025 Global Sourcing Index)

The SourcifyChina Verified Pro List: Precision Sourcing Engine

Our AI-enhanced, human-validated supplier database eliminates 95% of pre-qualification friction for Western enterprises. Unlike generic directories, every “Pro” supplier undergoes:

✅ Triple-Layer Verification: On-site facility audits, export license validation, and Western-client performance history

✅ Compliance Shield: Real-time monitoring of China’s 2026 ESG regulations (including new carbon reporting mandates)

✅ Cultural Bridge: Dedicated bilingual project managers embedded with each supplier

Time Savings Breakdown: Traditional vs. SourcifyChina

| Process Stage | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Qualification | 28 days | 3 days | 89% |

| Compliance Validation | 19 days | 1 day | 95% |

| Sample Approval Cycle | 33 days | 8 days | 76% |

| Total per Supplier | 80 days | 12 days | 85% |

Strategic Impact for Your 2026 Objectives

| Business Priority | SourcifyChina Advantage | Measurable Outcome |

|---|---|---|

| Risk Mitigation | Zero non-compliant suppliers in 2025 client deployments | 100% audit pass rate for EU/US customs |

| Cost Control | Eliminated duplicate qualification costs | Avg. $42K savings per supplier |

| Speed to Scale | Pre-vetted suppliers ready for immediate PO | 68% faster ramp for new product launches |

| Quality Assurance | 92% supplier retention rate from Western clients | 41% reduction in QC rework |

Your 2026 Competitive Edge Starts Here

In a landscape where 73% of procurement leaders cite supplier verification as their top time sink (Gartner, 2025), the SourcifyChina Verified Pro List is not an option—it’s your operational necessity. While competitors navigate regulatory quicksand and supplier uncertainty, you’ll deploy a battle-tested network engineered for Western business protocols.

Why Act Now?

- 2026 Compliance Deadline: China’s new Foreign Investment Security Review takes effect Q3 2026—our Pro List guarantees pre-screened partners meeting all requirements.

- Capacity Advantage: Only 47% of high-tier Chinese factories service Western clients; our exclusive access secures priority production slots.

- ROI Acceleration: Clients achieve full process ROI in 2.1 supplier engagements (2025 client data).

Call to Action: Secure Your Verified Supply Chain in <24 Hours

Stop burning resources on supplier validation. Redirect your team’s expertise to strategic value creation—not risk firefighting.

👉 Take the 5-Minute Advantage Assessment

Contact our China Sourcing Engineers today for a zero-cost, no-obligation Pro List access demo tailored to your 2026 product lines:

- Email: [email protected]

Response within 4 business hours (CET) - WhatsApp: +86 159 5127 6160

Priority response for urgent RFQs

“SourcifyChina cut our new supplier onboarding from 14 weeks to 9 days. That’s 10 weeks we reinvested in innovation—not supplier chasing.”

— Senior Procurement Director, Fortune 500 Industrial Equipment Manufacturer (2025 Client)

Your 2026 supply chain resilience begins with one verified connection.

Don’t source in the dark—source with certainty.

SourcifyChina: Verified. Compliant. Ready.

Serving 347 Western enterprises across 28 product categories since 2018

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.