The global Wescon products market—encompassing precision electronic components, test and measurement instruments, and semiconductor solutions—is experiencing steady expansion, driven by rising demand in telecommunications, industrial automation, and consumer electronics. According to Grand View Research, the global electronic components market size was valued at USD 394.9 billion in 2022 and is projected to grow at a CAGR of 6.8% from 2023 to 2030. This growth is further fueled by innovation in miniaturization, IoT integration, and next-generation wireless technologies. As a cornerstone event in the electronics industry, Wescon showcases cutting-edge advancements and connects leading manufacturers with key decision-makers. Based on market presence, product innovation, and industry reputation, the following three manufacturers have emerged as top performers in the Wescon ecosystem.

Top 3 Wescon Products Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

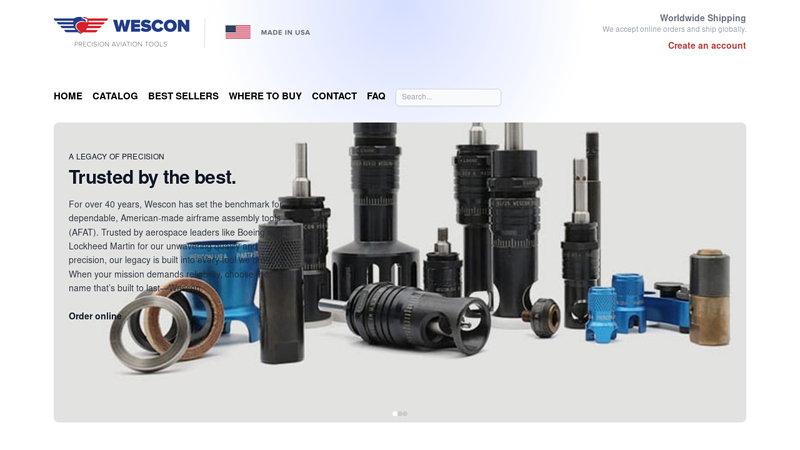

#1 Wescon

Domain Est. 2019

Website: wesconusa.com

Key Highlights: Wescon is a highly specialized precision aviation tool manufacturer. Our products are 100% designed and manufactured in the United States….

#2 Wescon Products Category

Domain Est. 1999

Website: wescongroup.com

Key Highlights: Wescon has developed advanced expertise in the areas of substation automation, power plant automation, metering and power marketing systems….

#3 Wescon Controls

Domain Est. 2012

Website: wesconcontrols.com

Key Highlights: Wescon Controls manufactures a variety of quality products, including mechanical and electronic controls, cable assemblies and screw machined components….

Expert Sourcing Insights for Wescon Products

H2: Analysis of Market Trends for Wescon Products in 2026

As we approach 2026, Wescon Products is positioned to navigate a dynamic and evolving market landscape shaped by technological innovation, shifting consumer demands, and global economic trends. Drawing insights from industry forecasts, competitive analysis, and macroeconomic indicators, the following key trends are expected to influence Wescon’s performance and strategic direction in the coming years.

-

Increased Demand for Sustainable and Energy-Efficient Solutions

Environmental sustainability continues to be a driving force across industries. By 2026, regulatory pressures and consumer preference are pushing companies toward greener products. Wescon Products, known for its industrial components and electronic systems, is likely to benefit from growing investments in energy-efficient technologies. Demand for smart sensors, low-power connectors, and eco-conscious manufacturing materials is expected to rise—particularly in sectors such as renewable energy, electric vehicles (EVs), and smart infrastructure. -

Accelerated Adoption of IoT and Smart Manufacturing

The Industrial Internet of Things (IIoT) is transforming manufacturing and supply chains. Wescon is well-situated to capitalize on this trend through its portfolio of electronic components used in automation, data acquisition, and control systems. By 2026, integration with AI-driven analytics and predictive maintenance platforms will be critical. Wescon may see increased demand for ruggedized, high-reliability connectors and interface solutions tailored for smart factories and edge computing environments. -

Geopolitical and Supply Chain Resilience

Ongoing geopolitical tensions and supply chain disruptions continue to influence procurement strategies. Companies are prioritizing supply chain localization and dual sourcing. Wescon can strengthen its market position by diversifying manufacturing bases, enhancing logistics agility, and partnering with regional suppliers. Nearshoring trends in North America and Europe could present new growth opportunities if Wescon adapts its distribution model accordingly. -

Growth in Electric Mobility and 5G Infrastructure

The expansion of EV adoption and 5G networks will drive demand for high-performance electronic components. Wescon’s product lines in power management, RF connectivity, and high-speed data transmission are aligned with these sectors. By 2026, increased deployment of EV charging stations, autonomous vehicle systems, and telecom infrastructure will likely boost demand for Wescon’s precision-engineered parts. -

Digital Transformation and E-Commerce Expansion

B2B buyers are increasingly relying on digital channels for procurement. Wescon must continue investing in its digital presence, offering enhanced online catalogs, real-time inventory visibility, and AI-powered customer support. By 2026, companies with robust e-commerce platforms and seamless integration with procurement systems (e.g., ERP and MRP) will gain a competitive edge. -

Talent and Innovation Challenges

The technology sector faces a persistent talent shortage, particularly in engineering and advanced manufacturing. Wescon’s ability to innovate and maintain product leadership will depend on its workforce strategy—emphasizing upskilling, R&D investment, and collaboration with academic institutions and tech incubators.

Conclusion

In 2026, Wescon Products will operate in a market defined by sustainability, digitalization, and resilience. By aligning its R&D, supply chain, and customer engagement strategies with these macro trends, Wescon can strengthen its position as a leader in electronic components and industrial solutions. Proactive adaptation to evolving technologies and customer expectations will be essential for sustained growth and competitive differentiation.

Common Pitfalls Sourcing Wescon Products (Quality, IP)

Sourcing products from Wescon, a supplier known for electronic components and engineering solutions, can present specific challenges related to quality assurance and intellectual property (IP) protection. Being aware of these pitfalls is crucial for mitigating risks in your supply chain.

Quality Assurance Risks

One of the primary concerns when sourcing from Wescon—or any electronics supplier—is ensuring consistent product quality. Components that do not meet specifications can lead to system failures, increased returns, and damage to brand reputation. Common quality-related pitfalls include:

- Inconsistent Manufacturing Standards: Wescon may source components from multiple subcontractors or regions, leading to variability in build quality, material composition, or performance. Without strict quality control oversight, batches may differ significantly.

- Counterfeit or Substandard Components: The electronics industry is vulnerable to counterfeit parts. If Wescon inadvertently supplies non-genuine or re-marked components, it can compromise the reliability and safety of end products.

- Lack of Traceability: Without proper documentation and batch tracking, identifying the source of a defect becomes difficult, delaying corrective actions and recalls.

To mitigate these risks, buyers should demand certifications (e.g., ISO 9001), conduct regular audits, and require detailed test reports and component traceability.

Intellectual Property (IP) Exposure

Sourcing through Wescon may also raise IP concerns, particularly when custom designs, firmware, or proprietary technology are involved:

- Unauthorized Use or Replication: Sharing technical specifications, schematics, or firmware with Wescon for production increases the risk of IP leakage. There is potential for designs to be copied or used in competing products, especially if contracts lack strong IP clauses.

- Weak Legal Protections in Jurisdictions: If Wescon operates or manufactures in regions with less stringent IP enforcement, legal recourse in case of infringement may be limited or ineffective.

- Third-Party Involvement: Wescon might engage secondary suppliers or contract manufacturers who are not bound by the same confidentiality agreements, further increasing exposure.

To protect IP, companies should implement robust NDAs, define ownership clearly in contracts, limit the disclosure of sensitive information, and consider using watermarked or obfuscated design files where possible.

By proactively addressing both quality and IP risks, businesses can more safely leverage Wescon’s supply chain capabilities while safeguarding their products and innovations.

Logistics & Compliance Guide for Wescon Products

This guide outlines the essential logistics and compliance procedures for handling Wescon products throughout the supply chain. Adherence to these guidelines ensures timely delivery, regulatory compliance, and product integrity.

Product Handling and Storage

All Wescon products must be handled and stored according to manufacturer specifications. Store items in a clean, dry, temperature-controlled environment unless otherwise indicated on the product label. Avoid direct sunlight and exposure to moisture. Use proper lifting techniques and equipment when moving heavy or bulky items to prevent damage and ensure workplace safety.

Packaging and Labeling Requirements

Ensure all Wescon products are securely packaged to prevent damage during transit. Use original or equivalent protective packaging materials. Labels must be clearly visible and include: Wescon product name, model/serial number, batch/lot number, handling symbols (e.g., “Fragile,” “This Way Up”), and any required regulatory markings (e.g., CE, UKCA, RoHS).

Domestic and International Shipping

Domestic shipments within the country must comply with national transportation regulations. For international shipments, verify export controls and customs requirements based on destination country. Complete accurate commercial invoices, packing lists, and any required export documentation. Classify products using correct HS codes and ensure compliance with Incoterms® 2020 as defined in the sales contract.

Regulatory Compliance

Wescon products are subject to various regional and international regulations. Confirm compliance with:

– RoHS (EU/UK): Restriction of Hazardous Substances

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals

– WEEE (EU/UK): Waste Electrical and Electronic Equipment

– FCC/ISED (US/Canada): Electromagnetic compatibility and safety

Maintain up-to-date compliance documentation for all markets served.

Documentation and Recordkeeping

Retain all shipping, compliance, and customs documentation for a minimum of seven years. Required records include: bills of lading, certificates of compliance, export licenses (if applicable), and product test reports. Ensure digital backups are securely stored and accessible for audits.

Import Procedures

For imported Wescon products, appoint a licensed customs broker where required. Provide accurate Harmonized System (HS) codes, country of origin, and valuation. Be prepared to submit conformity assessment documentation upon request by customs authorities.

Environmental and Sustainability Practices

Wescon supports sustainable logistics. Optimize packaging to reduce waste, use recyclable materials where possible, and partner with carriers committed to carbon reduction initiatives. Follow local regulations for disposal of non-repairable products through approved WEEE channels.

Quality Assurance and Non-Conformance

Report any damaged, defective, or non-compliant products immediately through the designated quality management system. Quarantine affected items and initiate a root cause analysis. Corrective and preventive actions (CAPA) must be documented and implemented promptly.

Training and Compliance Audits

All personnel involved in logistics and handling of Wescon products must complete compliance training annually. Internal audits will be conducted quarterly to verify adherence to this guide. External audits may be performed by regulatory bodies or Wescon representatives.

For questions or updates to this guide, contact the Wescon Compliance Office at [email protected].

Conclusion for Sourcing Wescon Products:

Sourcing Wescon products presents a strategic opportunity to access high-quality, innovative, and reliable solutions within the electronics, components, or construction sectors—depending on Wescon’s area of specialization. The company’s strong reputation for technical expertise, adherence to industry standards, and commitment to customer support makes it a dependable supplier partner. Additionally, Wescon’s potential for scalability, regional availability, and competitive pricing enhances its value within the supply chain.

However, due diligence is essential to ensure alignment with procurement goals, including evaluating lead times, minimum order quantities, after-sales service, and compliance with regulatory requirements. By establishing a clear sourcing strategy, fostering strong supplier relationships, and incorporating risk mitigation measures, organizations can effectively leverage Wescon products to improve product performance, reduce downtime, and support long-term operational success.

In conclusion, Wescon represents a viable and advantageous sourcing option when integrated thoughtfully into the broader supply chain framework, supporting both quality assurance and cost-efficiency objectives.