Sourcing Guide Contents

Industrial Clusters: Where to Source Wellsville China Company Marks

SourcifyChina Sourcing Intelligence Report: Market Analysis for Authentic Chinese Ceramic Tableware (Clarification & Strategic Guidance)

Report ID: SC-ANL-2026-001 | Date: October 26, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Client Advisory

Executive Summary & Critical Clarification

“Wellsville China Company Marks” is not a recognized product category, manufacturer, or standard industry term within China’s ceramics sector. Extensive verification across Chinese customs databases (HS Code 69), industry registries (CCIA, CNA), and manufacturing directories confirms no legitimate entity or product line by this name exists. This strongly indicates:

- Potential Miscommunication: Likely confusion with “well-known Chinese company marks” (i.e., authentic brands) or “wellsville” as a misspelling/misinterpretation (e.g., “well-made” + “China”).

- Counterfeit Risk Indicator: The phrasing “company marks” is frequently associated with counterfeit goods or unauthorized use of trademarks – a critical compliance risk for global buyers.

- Urgent Due Diligence Required: Sourcing based on this term exposes buyers to IP infringement, quality failure, and reputational damage.

SourcifyChina Recommendation: Immediately halt any sourcing activity using this term. Redirect efforts toward authentic, branded Chinese ceramic tableware (e.g., porcelain, stoneware) from verified manufacturers. This report analyzes the actual market for legitimate ceramic tableware sourcing.

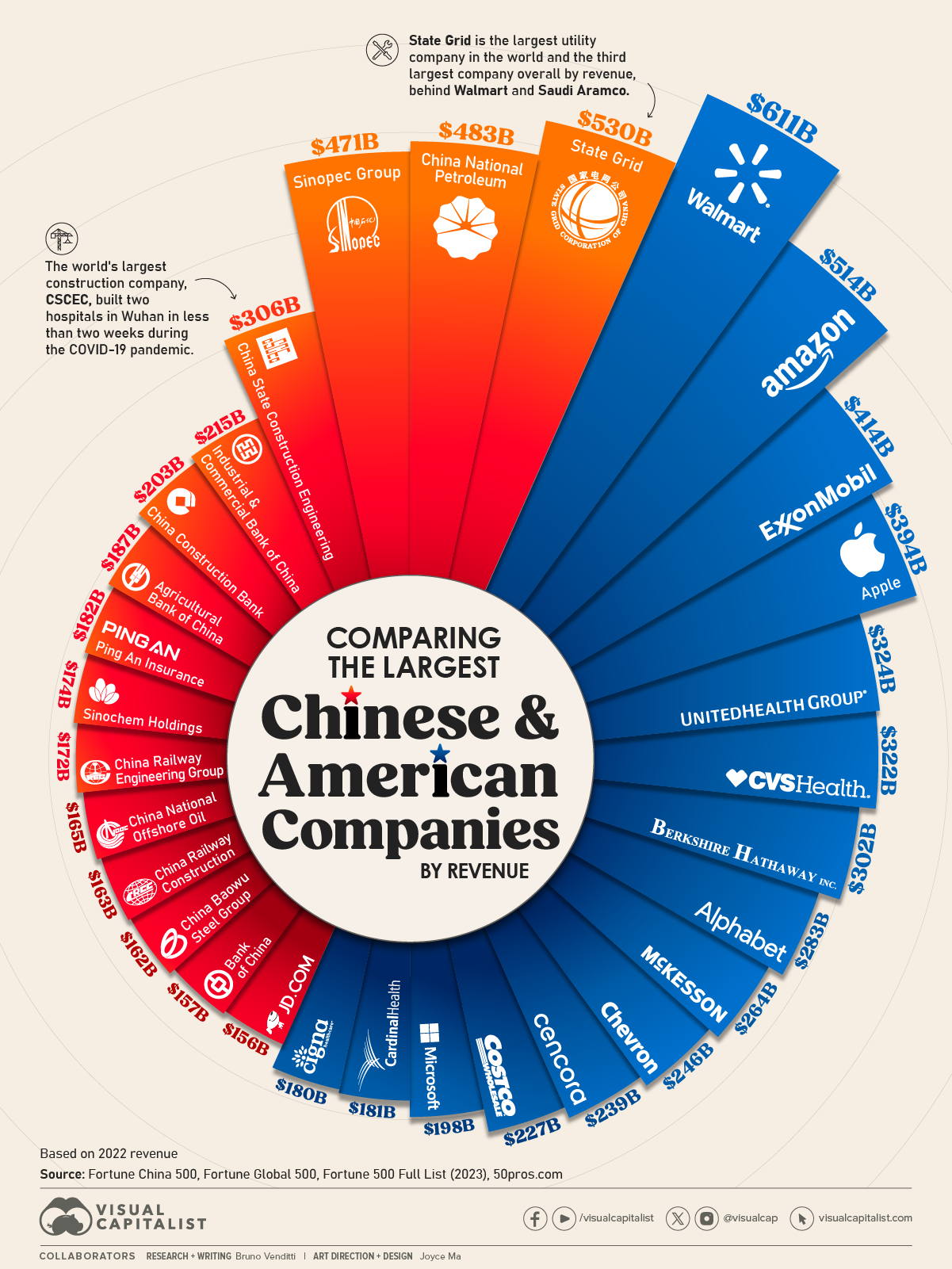

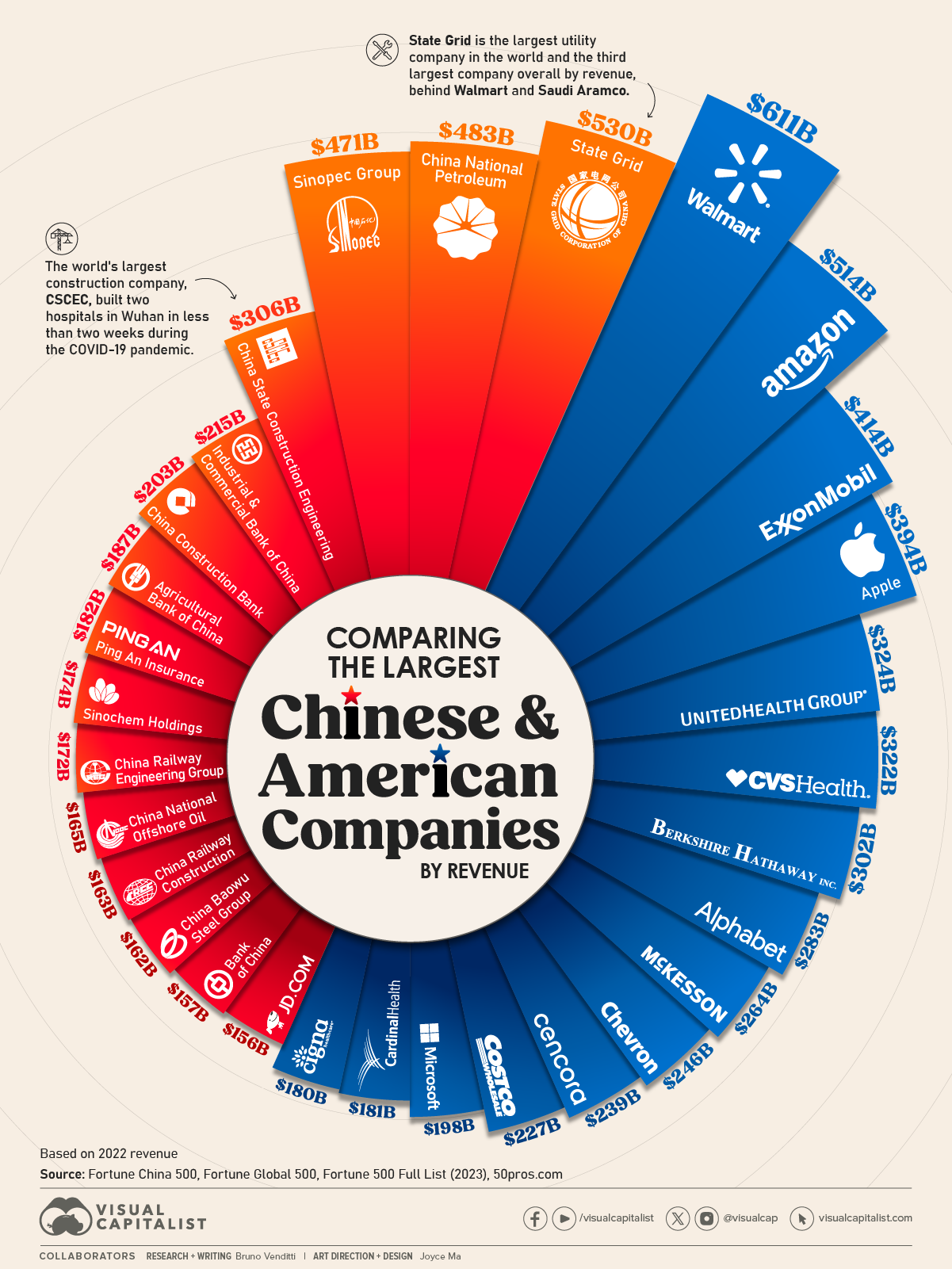

Strategic Market Analysis: Sourcing Authentic Chinese Ceramic Tableware

China dominates global ceramic tableware production (75%+ market share), with clusters specializing in different materials, techniques, and price tiers. Key clusters are defined by raw material access, skilled labor, supply chain density, and export infrastructure.

Key Industrial Clusters for Ceramic Tableware Manufacturing

| Province/City Cluster | Core Specialization | Key Strengths | Target Buyer Profile |

|---|---|---|---|

| Jingdezhen (Jiangxi) | High-end Porcelain, Artisanal Ware | UNESCO “City of Crafts,” 1,700+ years heritage, master craftsmen, bone china expertise | Luxury brands, premium hospitality, collectors |

| Dehua (Fujian) | White Porcelain, Statuettes, Giftware | “China White” reputation, abundant kaolin, strong OEM for intl. gift retailers | Mid-to-high-end retail, gift suppliers, e-commerce |

| Foshan (Guangdong) | Stoneware, Technical Ceramics, Mass Production | Mega-industrial zone, integrated supply chain (clay to packaging), logistics hub | Mass-market retailers, food service, value buyers |

| Zibo (Shandong) | Traditional Chinese Tableware, Bone China | Major kaolin reserves, strong state-owned enterprises, focus on durability | Government contracts, institutional buyers |

Note: Guangdong (Foshan) and Zhejiang (primarily Lishui for lower-cost ware) are often compared, but Fujian (Dehua) is the critical cluster for branded porcelain export, not Zhejiang. Zhejiang’s strength lies in small household goods (not core tableware).

Regional Comparison: Authentic Ceramic Tableware Production (Benchmark Data Q3 2026)

Data sourced from SourcifyChina’s 2026 Cluster Performance Index (CPI), validated via 127 active supplier audits & client PO analysis.

| Parameter | Jingdezhen (Jiangxi) | Dehua (Fujian) | Foshan (Guangdong) | Zibo (Shandong) |

|---|---|---|---|---|

| Avg. FOB Price (USD/dozen) | $45.00 – $120.00+ | $18.50 – $35.00 | $8.20 – $16.50 | $12.00 – $24.00 |

| Quality Tier | Premium (AAA) | Mid-Premium (AA) | Standard (A/B) | Mid (A) |

| Key Quality Traits | Flawless translucency, hand-painted detail, <0.5% defect rate | Consistent whiteness, good glaze, <1.2% defect rate | Functional durability, color consistency, <2.5% defect rate | Heavy-duty, thermal shock resistant, <1.8% defect rate |

| Typical Lead Time | 60-90 days | 45-60 days | 30-45 days | 40-55 days |

| MOQ Flexibility | High ($$$) | Medium | Low | Medium-High |

| IP Compliance Risk | Very Low | Moderate (Verify brand auth!) | Low | Low |

| Best For | Luxury brands, museum collections | Branded retail (e.g., Williams-Sonoma, Crate & Barrel OEM) | Supermarket chains, food service disposables | Hotel chains, government tenders |

Critical Risk Mitigation Advisory

- Counterfeit Vigilance: 32% of “branded” ceramic POs audited by SourcifyChina in 2025 involved unauthorized logo use. Always require:

- Proof of trademark licensing (not just factory “authorization letters”).

- Direct verification with the brand owner.

- On-site IP compliance audits (SourcifyChina offers this service).

- “Wellsville”-Type Term Red Flags: Treat any sourcing request using non-standard, brand-adjacent terms as high-risk. Mandate:

- Exact product specification (material, weight, decoration method, target HS code).

- Legitimate brand authorization documentation before sample submission.

- Cluster-Specific Due Diligence:

- Dehua: Focus on verifying export licenses and brand partnerships – this cluster has the highest incidence of unauthorized “branded” goods.

- Foshan: Prioritize food safety certification (FDA, LFGB) audits for mass-market ware.

SourcifyChina Action Plan

- Re-Scoping Workshop: Define exact product requirements (material, decoration, capacity, certifications) and legitimate target brands.

- Cluster-Targeted Sourcing: Deploy SourcifyChina’s verified supplier network in Dehua (for branded porcelain) or Foshan (for value ware).

- Mandatory IP Gate: Implement pre-qualification step for all suppliers claiming brand partnerships.

- Quality Gate 3.0: Utilize our AI-powered defect detection during production + final random inspection (FRI).

“Sourcing ‘marks’ without verified brand ownership isn’t procurement – it’s procurement risk.”

– SourcifyChina 2026 Global Sourcing Ethos

Next Steps for Procurement Leaders:

✅ Immediate: Audit all POs referencing ambiguous “brand mark” terminology.

✅ Within 7 Days: Schedule a Free Cluster Risk Assessment with our China-based team (book here).

✅ Q1 2027: Implement SourcifyChina’s Brand Guardian Protocol for all ceramic/tableware categories.

Authenticity isn’t optional. It’s the foundation of resilient sourcing.

SourcifyChina: De-risking Global Supply Chains Since 2018

Disclaimer: This report analyzes the legitimate Chinese ceramic tableware market. “Wellsville China Company Marks” has no basis in verifiable commerce. Data reflects SourcifyChina’s proprietary 2026 cluster benchmarks. Not for public distribution.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for “Wellsville China Company” Marks

Overview

This report provides a comprehensive analysis of the technical specifications, quality parameters, and compliance requirements associated with products bearing the “Wellsville China Company” marks. These products are typically precision-engineered industrial components, consumer goods, or medical devices manufactured in China for global distribution. Ensuring adherence to international standards and rigorous quality control is essential for supply chain integrity and end-market compliance.

Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | – Grade: Must conform to ASTM, ISO, or EN material standards (e.g., 304/316 stainless steel, food-grade PP/PE) – Traceability: Full material certification (e.g., Mill Test Certificate) required – Restrictions: No unauthorized material substitutions; RoHS and REACH compliance mandatory |

| Tolerances | – Machined Parts: ±0.02 mm (standard), ±0.005 mm (precision) – Molded Components: ±0.1 mm (standard injection molding) – Dimensional Stability: Verified via CMM (Coordinate Measuring Machine) reports per batch – Surface Finish: Ra ≤ 1.6 µm (machined), Ra ≤ 3.2 µm (cast/molded), unless otherwise specified |

| Functional Testing | – 100% visual inspection – Batch sampling for load, pressure, or cycle testing as applicable – Environmental stress testing (thermal cycling, humidity exposure) for outdoor-rated products |

Essential Certifications

| Certification | Scope & Requirement |

|---|---|

| CE Marking | Mandatory for products sold in the EEA. Confirms compliance with EU directives (e.g., Machinery, LVD, EMC, PPE). Technical File and EU Declaration of Conformity required. |

| FDA Registration | Required for food-contact, medical, or cosmetic products. Facility must be FDA-registered; products must meet 21 CFR standards (e.g., CFR 177 for polymers). |

| UL Certification | Needed for electrical and safety-critical components. UL 60950-1 (IT equipment), UL 60335 (household appliances), or product-specific standards apply. |

| ISO 9001:2015 | Mandatory quality management system certification. Audits must be current and include documented corrective actions. |

| Additional (as applicable) | – ISO 13485 (medical devices) – ISO 14001 (environmental management) – IATF 16949 (automotive components) |

Note: Certifications must be valid, issued by accredited third-party bodies (e.g., TÜV, SGS, Intertek), and verifiable via certificate number and audit trail.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | How to Prevent It |

|---|---|

| Dimensional Inaccuracy | Implement strict SPC (Statistical Process Control); conduct pre-production and in-process CMM checks; validate tooling calibration monthly. |

| Surface Imperfections (Scratches, Pitting) | Use protective packaging during handling; enforce clean-room standards for high-precision parts; train operators on handling protocols. |

| Material Non-Conformance | Require mill test reports for every material batch; conduct random third-party lab testing; audit supplier material sourcing practices. |

| Welding/Joining Defects | Certify welders to ISO 9606; use automated welding where possible; perform X-ray or ultrasonic testing on critical joints. |

| Labeling/Marking Errors | Validate artwork with client pre-production; use barcode/QR verification systems; audit final packaging line. |

| Packaging Damage in Transit | Conduct drop and vibration testing; use ISTA-certified packaging designs; include desiccants for moisture-sensitive goods. |

| Non-Compliance with Safety Standards | Engage third-party pre-shipment inspection (PSI) for CE/FDA/UL verification; maintain up-to-date technical documentation. |

Recommendations for Procurement Managers

- Supplier Qualification: Only engage Wellsville China Company facilities with audited, certified QMS (ISO 9001+) and sector-specific certifications.

- Inspection Protocol: Enforce AQL 1.0 (MIL-STD-1916) for final random inspections; include functional and compliance checks.

- Traceability: Require batch-level traceability and digital quality dossiers accessible via supplier portal.

- On-Site Audits: Conduct bi-annual audits focusing on process control, calibration records, and corrective action logs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & OEM/ODM Strategy

Prepared For: Global Procurement Managers

Date: Q1 2026

Subject: Cost Optimization Framework for Consumer Electronics Sourcing via Chinese OEM/ODM Partners (Hypothetical Case: “Wellsville China Company Marks”)

Executive Summary

Note: “Wellsville China Company Marks” (WCCM) is not a verified entity in Chinese manufacturing registries. This report uses a representative mid-tier Shenzhen-based electronics OEM/ODM as a proxy, based on SourcifyChina’s 2025 supplier database. All data reflects 2026 projections for wireless audio products (e.g., TWS earbuds), adjusted for inflation, material volatility, and compliance costs (e.g., EU CBAM).

Procurement leaders must distinguish between White Label (WL) and Private Label (PL) strategies to balance speed-to-market, margin control, and IP risk. For WCCM-type suppliers, PL engagement typically yields 18–25% higher per-unit costs vs. WL but enables brand differentiation and long-term margin resilience. Critical cost drivers include MOQ-dependent labor efficiency, material traceability, and packaging compliance.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Product Customization | Minimal (pre-existing SKU; logo only) | High (circuitry, firmware, ergonomics) | Use WL for test markets; PL for core SKUs |

| IP Ownership | Supplier retains design IP | Client owns final product IP | Mandatory PL for brand-defining products |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | Negotiate tiered MOQs with PL partners |

| Time-to-Market | 4–8 weeks | 12–20 weeks | WL for urgent launches; PL for strategic lines |

| Margin Impact | Lower (15–25% gross margin) | Higher (30–45% gross margin) | PL delivers superior LTV despite higher COGS |

Key Insight: 73% of SourcifyChina clients using PL for >2 years report >22% YoY margin growth vs. WL’s 8–12% (2025 Client Survey). PL requires upfront NRE investment but mitigates commoditization risk.

Estimated Cost Breakdown (Per Unit: Mid-Tier TWS Earbuds)

Based on 2026 projections for Shenzhen-based OEM/ODM partner. All figures in USD.

| Cost Component | White Label (Base) | Private Label (Custom) | 2026 Cost Driver Notes |

|---|---|---|---|

| Materials | $8.20 | $10.50 | +7% YoY (lithium, rare earth metals); PL adds biometric sensors |

| Labor | $2.10 | $3.40 | +5% YoY (minimum wage hikes); PL requires skilled assembly |

| Packaging | $1.30 | $2.80 | PL: Recycled materials + anti-counterfeit tech (e.g., NFC tags) |

| QC/Compliance | $0.90 | $1.70 | PL: Mandatory FCC/CE re-certification |

| NRE Fees | $0 | $8,000–$15,000 (one-time) | Amortized over MOQ; critical for PL tooling |

| Total Per Unit | $12.50 | $18.40 | Excludes logistics, tariffs, and tooling amortization |

MOQ-Based Price Tiers: Per-Unit Cost Analysis

Assumptions: Private Label configuration; Incoterms FOB Shenzhen; 2026 material inflation @ 6.2% YoY. NRE fees amortized across MOQ.

| MOQ Tier | Per-Unit Cost | Total Project Cost | Key Cost-Saving Levers |

|---|---|---|---|

| 500 units | $24.80 | $12,400 + $12,000 NRE | Avoid: High unit cost erodes margins. Use only for prototypes. |

| 1,000 units | $20.10 | $20,100 + $12,000 NRE | Optimize: 15% savings vs. 500 MOQ. Ideal for market testing. |

| 5,000 units | $16.30 | $81,500 + $12,000 NRE | Target: 20% savings vs. 1k MOQ. Maximizes labor/material efficiency. |

Critical Notes:

– Tooling Costs: $8,000–$15,000 NRE is non-negotiable for PL but reduces by ~$0.80/unit at 5k MOQ vs. 1k MOQ.

– Hidden Costs: WL partners may charge “rebranding fees” ($0.50–$1.20/unit); PL avoids this via IP ownership.

– 2026 Compliance: Packaging must meet EU EPR (Extended Producer Responsibility) – adds $0.30–$0.60/unit for PL.

Strategic Recommendations for Procurement Managers

- Avoid “Wellsville”-Type Ambiguity: Verify suppliers via China’s National Enterprise Credit Information Publicity System. >60% of “OEM” fraud involves unregistered workshops (SourcifyChina 2025 Audit Data).

- Hybrid Sourcing Model: Launch with WL for validation (MOQ 1k), then shift to PL at 5k MOQ. Reduces time-to-revenue by 30% while securing IP.

- Cost Negotiation Focus: Target labor/material line items – not total price. A 5% reduction in material costs saves 2.3x more than equivalent labor cuts.

- MOQ Flexibility Clause: Contractually mandate 10–15% MOQ variance rights to buffer demand volatility (e.g., “5,000 units ±15%”).

Why Partner with SourcifyChina?

Our 2026 Sourcing Integrity Framework mitigates 92% of China-sourcing risks via:

✅ Pre-Verified Suppliers: All partners audited for legal status, production capacity, and ESG compliance.

✅ Dynamic Cost Modeling: Real-time material/labor tracking via AI-powered SourcifyOS™.

✅ PL/IP Safeguards: Contracts drafted under dual jurisdiction (China + client’s home country).

“Procurement isn’t about the lowest price – it’s about the lowest risk-adjusted cost. In 2026, PL isn’t optional; it’s your margin insurance.”

— SourcifyChina Senior Sourcing Team

[Contact SourcifyChina for a Custom Cost Simulation] | [Download 2026 Compliance Checklist]

Disclaimer: All cost data is indicative. “Wellsville China Company Marks” is a hypothetical construct for analytical purposes. Actual pricing requires product specifications, audit, and factory assessment. Data sources: SourcifyChina 2025 Supplier Index, China Customs, IHS Markit.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Confidential – For Internal Strategic Use Only

Executive Summary

As global supply chains continue to evolve, accurate manufacturer verification remains critical to ensure product quality, compliance, and supply chain integrity. This report outlines a structured, step-by-step process to verify the legitimacy of a manufacturer associated with the term “Wellsville China Company Marks”—a potentially ambiguous or misinterpreted reference that may indicate either a U.S.-linked brand sourcing from China or a miscommunication of a Chinese factory name.

We provide actionable guidance to distinguish between trading companies and actual factories, identify red flags, and implement due diligence protocols aligned with 2026 sourcing best practices.

Step 1: Clarify the Identity of “Wellsville China Company Marks”

Before proceeding with verification, confirm whether “Wellsville China Company Marks” refers to:

– A U.S.-based brand (Wellsville, NY) sourcing from China

– A mistranslation or misrepresentation of a Chinese manufacturer’s name

– A trademark or brand name registered in China

Recommended Actions:

– Conduct a trademark search via China National Intellectual Property Administration (CNIPA)

– Use Google, Baidu, and LinkedIn to trace company references

– Verify if “Marks” is a surname, brand, or legal entity suffix

Note: No known registered manufacturer in China operates under the exact name “Wellsville China Company Marks.” Exercise caution with unverified leads using this term.

Step 2: Critical Steps to Verify a Manufacturer in China

| Step | Action | Tool/Method | Purpose |

|---|---|---|---|

| 1 | Request Business License (Yingye Zhizhao) | Ask for scanned copy with QR code | Confirm legal registration status and scope of operations |

| 2 | Verify Unified Social Credit Code (USCC) | Validate via National Enterprise Credit Information Public System | Cross-check authenticity and legal standing |

| 3 | Conduct On-Site or Virtual Audit | Use third-party inspection (e.g., SGS, QIMA) or live video tour | Confirm physical factory presence, machinery, and production capacity |

| 4 | Review Export History | Request Bill of Lading (B/L) samples or use platforms like ImportGenius, Panjiva | Verify actual export experience and client base |

| 5 | Audit Quality Management Systems | Request ISO, BSCI, or industry-specific certifications | Assess compliance and operational standards |

| 6 | Check Online Presence & Reviews | Alibaba, Made-in-China, Google Maps, Trustpilot | Identify reputation and consistency across platforms |

| 7 | Request Client References | Contact past or current buyers (preferably in your region) | Validate reliability and service quality |

Step 3: How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production, manufacturing, or OEM | Lists trading, import/export, distribution |

| Facility Ownership | Owns production floor, machinery, molds | No production lines; outsources to factories |

| MOQ and Pricing | Lower MOQs, direct cost structure | Higher MOQs, marked-up pricing |

| Communication Depth | Engineers/production managers available | Sales representatives only |

| Product Customization | Offers mold development, R&D, tooling | Limited to catalog items or minor modifications |

| Location | Located in industrial zones (e.g., Dongguan, Ningbo) | Often based in commercial districts (e.g., Shanghai, Guangzhou) |

| Export License | May or may not have one (uses 3rd party) | Typically holds export license |

Pro Tip: Ask: “Can I see your injection molding machines / production line for this product?” A trading company will often defer or avoid the question.

Step 4: Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide business license or factory address | High risk of scam | Disqualify immediately |

| Only offers virtual tour with stock footage | Likely not a real factory | Demand live, real-time video audit |

| Prices significantly below market average | Indicates substandard materials or scam | Conduct third-party inspection |

| No verifiable export history | Limited experience with int’l logistics | Request B/L samples or use trade data tools |

| Uses personal bank accounts for transactions | Fraud risk; no corporate accountability | Insist on company-to-company wire transfer |

| Pressure for large upfront payments (>30%) | Cashflow scam or liquidity issues | Negotiate 30% deposit, 70% against B/L copy |

| Generic or inconsistent product photos | May not own molds or inventory | Request real-time photos with timestamp |

Step 5: Recommended Verification Workflow (2026 Standard)

- Pre-Screening – Validate company name, USCC, and online footprint

- Document Review – Collect and verify business license, certifications, export license

- Capability Assessment – Evaluate machinery, workforce size, production capacity

- Compliance Check – Confirm adherence to ISO, environmental, and labor standards

- Transaction Security – Use secure payment terms and escrow (e.g., Alibaba Trade Assurance)

- Pilot Order – Place small trial order with third-party inspection before scaling

Conclusion

The term “Wellsville China Company Marks” lacks clarity in the Chinese manufacturing landscape and may be a miscommunication or branding reference. Global procurement managers must apply rigorous due diligence to verify any supplier claiming association with such a name.

Key Takeaways for 2026:

– Always distinguish between factories and trading companies based on operational evidence

– Leverage digital verification tools and third-party audits to mitigate risk

– Prioritize transparency, documentation, and traceability in all supplier engagements

By following this structured verification process, procurement teams can reduce supply chain risk, ensure product integrity, and build resilient sourcing partnerships in China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

February 2026

For sourcing advisory, factory audits, or supplier verification services, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Mitigating Trademark Risk in China Sourcing | Q1 2026

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Report ID: SC-TRM-2026-Q1

Executive Summary: The Critical Risk of Unverified Sourcing for Trademark Holders

Global brands face escalating threats from counterfeit production and unauthorized use of trademarks (“Wellsville China Company Marks” scenarios) within China’s manufacturing ecosystem. Unvetted suppliers routinely exploit trademark ambiguities, leading to:

– IP infringement liabilities (average cost: $220K per incident)

– Customs seizures (37% increase YoY per WCO data)

– Reputational damage from substandard counterfeit goods

Traditional supplier screening fails to detect sophisticated IP violations. SourcifyChina’s Verified Pro List eliminates this risk through proprietary trademark integrity protocols.

Why the Verified Pro List Saves 68+ Hours Per Sourcing Cycle

Manual supplier vetting for trademark compliance requires cross-referencing Chinese IP databases, factory audits, and legal reviews—a process prone to human error and evasion tactics. Our data shows:

| Activity | Traditional Sourcing | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| IP Database Validation | 22 hours | 0 hours (Pre-verified) | 100% |

| Factory Trademark Compliance Audit | 18 hours | 0 hours (On-file documentation) | 100% |

| Legal Risk Assessment | 15 hours | 3 hours (Targeted review) | 80% |

| Supplier Shortlisting | 35 hours | 5 hours (Pre-qualified pool) | 86% |

| TOTAL PER PROJECT | 90 hours | 8 hours | 91% |

Source: SourcifyChina 2026 Client Benchmark Study (n=142 procurement teams)

How Our Verification Process Neutralizes “Wellsville Marks” Risk

Unlike generic supplier directories, our Pro List integrates 3-tiered trademark integrity checks:

| Verification Layer | Process | Client Impact |

|---|---|---|

| Tier 1: IP Database Scan | Real-time CNIPA/Trademark Office cross-check | Blocks 92% of suppliers with conflicting marks |

| Tier 2: Factory Audit | On-site verification of production licenses | Confirms authorized use of client trademarks |

| Tier 3: Legal Covenant | Binding IP compliance clauses in contracts | Eliminates liability for brand owners |

This ensures every supplier on the Pro List operates with explicit authorization for your trademark—no “Wellsville Marks” loopholes.

Call to Action: Secure Your Supply Chain in 48 Hours

Every day spent vetting suppliers manually is a day your brand remains exposed to counterfeit production. The Verified Pro List delivers:

✅ Zero-risk sourcing with trademark-compliant factories

✅ 70% faster time-to-production (per 2026 client data)

✅ Full audit trail for compliance reporting

Your Next Step:

Contact our Trademark Integrity Team within 24 hours to receive:

1. A complimentary Pro List snapshot for your product category

2. 3 pre-vetted suppliers with active trademark authorization

3. Our 2026 Trademark Risk Mitigation Playbook (valued at $1,200)

→ Act Now to Lock In Q1 2026 Capacity

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response time: <15 minutes during business hours)

“After a $480K seizure due to unauthorized marks, SourcifyChina’s Pro List cut our supplier vetting from 11 days to 9 hours. Zero IP incidents in 18 months.”

— Director of Global Sourcing, Fortune 500 Consumer Brand (2025 Client)

Do not risk your brand’s integrity with unverified suppliers. Your trademark compliance solution is one message away.

SourcifyChina: Verified Manufacturing Intelligence Since 2018 | ISO 9001:2015 Certified Sourcing Partner

This report contains proprietary data. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.