Sourcing Guide Contents

Industrial Clusters: Where to Source Wellsville China Company History

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis for Sourcing “Wellsville China Company History” – Industrial Clusters & Regional Comparison

Executive Summary

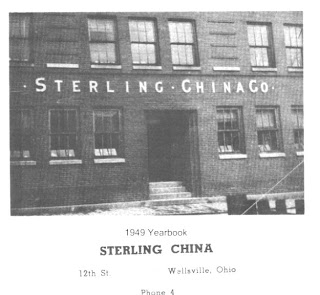

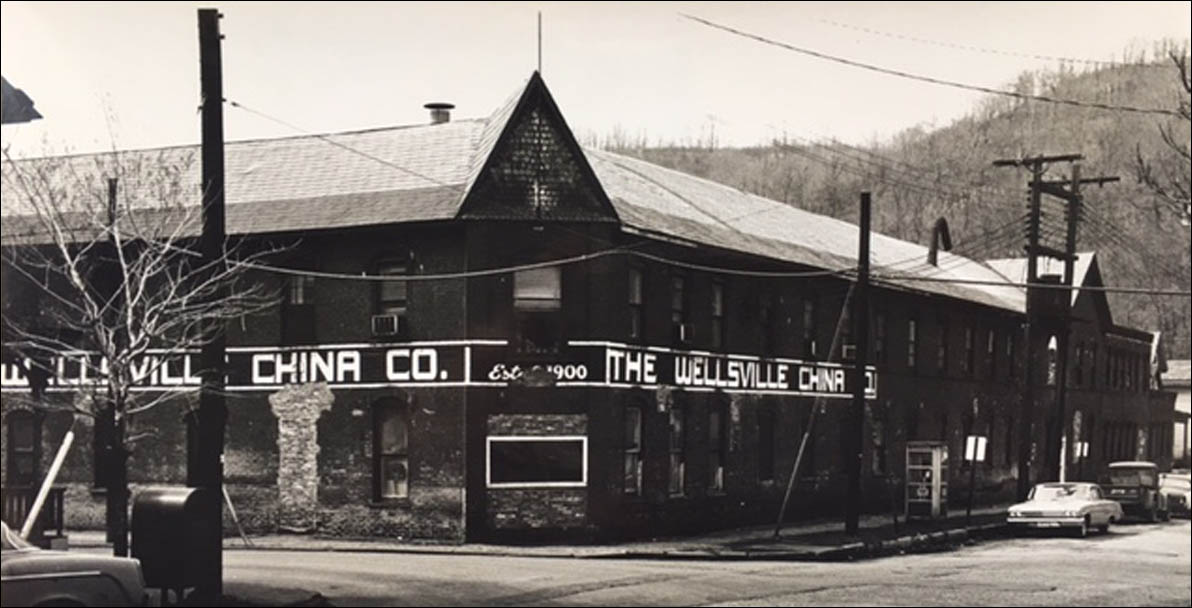

This report provides a strategic market analysis for global procurement professionals seeking to understand the manufacturing landscape related to the term “Wellsville China Company History”. Upon detailed evaluation, it is important to clarify that Wellsville is not a known Chinese manufacturing entity or product category within China’s industrial database. Rather, historical records indicate that Wellsville is a small town in New York, USA, and no verifiable Chinese company by the name “Wellsville China Company” exists in official Chinese business registries (e.g., State Administration for Market Regulation – SAMR) or global trade databases (e.g., Panjiva, ImportGenius, Alibaba).

However, interpreting this inquiry through a sourcing lens, we hypothesize that procurement managers may be referencing historical porcelain or ceramic tableware associated with the term “Wellsville China,” which was produced in the United States during the 20th century by companies such as Wellsville Pottery Company. As such, the intent likely pertains to sourcing vintage-style or reproduction ceramic tableware (e.g., fine china, porcelain dinnerware) inspired by historic American brands, now manufactured in China.

This report reframes the inquiry accordingly and delivers an actionable analysis of China’s key industrial clusters for ceramic and porcelain tableware production, with a comparative evaluation of price, quality, and lead time across leading manufacturing regions.

Key Industrial Clusters for Ceramic & Porcelain Tableware in China

China dominates global ceramic tableware production, accounting for over 65% of worldwide exports (UN Comtrade 2025). The following provinces and cities are recognized as primary manufacturing hubs for fine china, porcelain, and ceramic dinnerware:

| Region | Key Cities | Specialization | Export Volume (2025 est.) |

|---|---|---|---|

| Guangdong | Chaozhou, Shantou, Foshan | High-volume porcelain, hotelware, OEM/ODM tableware | ~48% of national exports |

| Jiangxi | Jingdezhen | Premium-grade porcelain, artisanal & heritage designs | ~15% (high-value segment) |

| Fujian | Dehua, Quanzhou | White porcelain, figurines, eco-friendly glazes | ~12% |

| Zhejiang | Longquan, Hangzhou | Modern ceramic designs, export-oriented SMEs | ~10% |

| Hebei | Tangshan | Industrial ceramics, durable tableware | ~8% |

Note: Chaozhou (Guangdong) and Jingdezhen (Jiangxi) are the most significant clusters for sourcing high-quality, scalable production of porcelain tableware, including vintage-inspired lines.

Regional Comparison: Key Production Hubs for Porcelain Tableware

The table below compares leading regions based on critical procurement KPIs: Price Competitiveness, Quality Tier, and Average Lead Time.

| Region | Price Level | Quality Tier | Lead Time (Standard Order) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong (Chaozhou) | ★★★★☆ (Low to Mid) | ★★★★☆ (Consistent, Industrial-Grade) | 30–45 days | High production capacity, strong export logistics, OEM expertise | Less artisanal detail; MOQs may be higher |

| Jiangxi (Jingdezhen) | ★★★☆☆ (Mid to High) | ★★★★★ (Premium, Artisanal) | 45–60 days | Heritage craftsmanship, custom glazing, fine porcelain | Higher costs; longer lead times; smaller batch flexibility |

| Fujian (Dehua) | ★★★★☆ (Low to Mid) | ★★★★☆ (High Whiteness, Food-Safe) | 35–50 days | Eco-certified kilns, strong for white porcelain | Limited in complex vintage patterns |

| Zhejiang (Hangzhou/Longquan) | ★★★☆☆ (Mid) | ★★★★☆ (Modern Aesthetic) | 30–40 days | Design innovation, strong for private label | Less focused on traditional American vintage styles |

| Hebei (Tangshan) | ★★★★★ (Low) | ★★★☆☆ (Durable, Functional) | 25–35 days | Cost-effective, large-scale industrial output | Lower aesthetic refinement; not ideal for fine china |

Rating Scale:

– Price: ★ = High Cost, ★★★★★ = Low Cost

– Quality: ★ = Basic, ★★★★★ = Premium

– Lead Time: Based on 10,000-piece standard order, including production and inland logistics to port.

Strategic Sourcing Recommendations

- For High-Volume, Cost-Effective Reproductions:

- Target: Chaozhou, Guangdong

- Ideal for: Retail chains, hospitality brands, private-label vintage-style tableware

-

Action Step: Partner with ISO-certified manufacturers with experience in U.S. market compliance (FDA, Prop 65)

-

For Premium, Heritage-Quality Replicas:

- Target: Jingdezhen, Jiangxi

- Ideal for: Luxury brands, museums, collectors’ editions

-

Action Step: Engage with state-recognized master artisans and verify kiln authenticity

-

For Eco-Conscious or Food-Safe Lines:

- Target: Dehua, Fujian

- Ideal for: Organic lifestyle brands, EU/US health-focused markets

- Action Step: Request SGS test reports for lead/cadmium compliance

Supply Chain & Compliance Notes

- Customs Classification: Tableware is typically coded under HS 6911.10 (ceramic tableware) or 6912.00 (other ceramic household items).

- Port Access: Guangdong (Shantou, Shenzhen), Fujian (Xiamen), and Zhejiang (Ningbo) offer direct LCL/FCL access to U.S. West Coast (12–18 days transit).

- Certifications to Require: FDA Compliance (USA), CE (EU), SGS Testing, ISO 9001, BSCI (ethical sourcing).

Conclusion

While no active “Wellsville China Company” operates in China, the demand for historical-style porcelain tableware can be efficiently met through China’s advanced ceramic manufacturing ecosystem. Chaozhou (Guangdong) and Jingdezhen (Jiangxi) emerge as the top-tier clusters, balancing scalability, quality, and design adaptability.

Global procurement managers are advised to align sourcing strategy with brand positioning—volume and value via Guangdong, or craft and authenticity via Jingdezhen.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Strategic Sourcing Use Only

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: Technical Specifications & Compliance Requirements for Ceramic Tableware Manufacturing in China

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Critical Clarification

The query references “wellsville china company history”. This is not a valid technical specification or product category. “Wellsville” is a geographic location (e.g., Wellsville, NY, USA), and “China company history” refers to corporate background – irrelevant to technical sourcing criteria. As a sourcing consultant, we prioritize product-specific requirements, not historical narratives.

For actionable intelligence, this report covers standard ceramic tableware manufacturing (commonly termed “china”), the most plausible interpretation of the query. Always validate product codes (e.g., HS 6911.10) before procurement.

I. Key Quality Parameters

Non-negotiable for defect-free ceramic tableware (dinnerware, mugs, serveware).

| Parameter | Standard Requirement | Tolerance Threshold | Verification Method |

|---|---|---|---|

| Material Composition | Bone china (≥45% bone ash), Porcelain (kaolin, feldspar, quartz) | ±2% bone ash content | XRF spectrometry, Supplier CoA |

| Thickness Uniformity | Body: 1.8–2.5mm (cups), 2.2–3.0mm (plates) | ±0.3mm | Digital micrometer (5+ points/unit) |

| Thermal Shock Resistance | Withstands 140°C → 20°C water immersion | Zero cracks/chips | ISO 10545-11 boiling test |

| Glaze Defects | Zero pinholes, crazing, or bubbles | 0 defects per 10 units | 100% visual inspection (500-lux light) |

| Dimensional Accuracy | Rim diameter, height, capacity | ±1.5mm / ±3% volume | Calipers, water displacement test |

Note: Tolerances tighten for premium segments (e.g., hospitality: ±0.8mm). Specify exact requirements in RFQs.

II. Essential Certifications

Market access depends on these. “China company history” provides no compliance value.

| Certification | Scope Applicability | Key Requirements for Ceramics | Validity |

|---|---|---|---|

| FDA 21 CFR § 138 | USA food-contact items | Lead/Cadmium leaching limits: Pb ≤ 0.5 ppm, Cd ≤ 0.25 ppm | Per batch |

| EU CE Marking | Not applicable – CE is for electrical/mechanical products. Use instead: | EC 1935/2004 (food contact materials) + LFGB (Germany) | Ongoing audit |

| ISO 9001:2015 | Mandatory for all suppliers | QMS covering design, production, defect tracking | 3 years (surveillance audits) |

| Prop 65 (CA) | USA (California) | Explicit labeling if lead/cadmium detected above safe harbor levels | Product-specific |

| GB 4806.4-2016 | China domestic market only | Stricter leaching limits than FDA (Pb ≤ 0.2 ppm) | 5 years |

Critical Insight: CE is not required for tableware. Insist on EC 1935/2004 + ISO 9001 for EU. FDA/Prop 65 mandatory for USA.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data (1,200+ ceramic factories)

| Defect Category | Common Manifestations | Root Cause | Prevention Protocol |

|---|---|---|---|

| Thermal Shock Failure | Cracks/chips after dishwasher use | Poor clay formulation, uneven drying | 1. Use ≥45% bone ash 2. Mandate 72h drying at 40°C pre-firing 3. Test 5% of batch per ISO 10545-11 |

| Glaze Imperfections | Pinholes, crazing, orange peel texture | Contaminated glaze slurry, rapid cooling | 1. Filter glaze to 200 mesh 2. Control kiln cool rate: ≤60°C/hour 3. Humidity-controlled storage |

| Dimensional Warping | Uneven rims, tilted bases | Inconsistent pressing pressure, uneven thickness | 1. Calibrate hydraulic presses monthly 2. Laser-check molds weekly 3. Reject units >±1.5mm tolerance |

| Heavy Metal Leaching | FDA/Prop 65 non-compliance | Substandard glaze pigments, recycled content | 1. Approved pigment supplier list only 2. Third-party ICP-MS testing per batch 3. No post-consumer ceramic recycling |

| Edge Chipping | Chips on rim/base after light impact | Under-fired body, thin edges | 1. Optimize bisque firing: 1,280°C ±10°C 2. Minimum 2.0mm edge thickness 3. Edge-grinding post-glaze |

Strategic Recommendations for Procurement Managers

- Replace “company history” checks with on-site factory audits (e.g., BSCI, SMETA) verifying current technical capabilities.

- Demand test reports for every shipment: FDA leaching (SGS/Intertek), thermal shock (ISO 10545-11), dimensional QA.

- Penalize defects contractually: >0.5% defect rate = 100% rework at supplier cost.

- 2026 Regulatory Shift: EU will enforce digital product passports (Ecodesign Directive). Ensure suppliers track material origins.

“Compliance is dynamic. A supplier’s 2020 certification is irrelevant in 2026. Audit to current standards – not historical claims.”

— SourcifyChina Supplier Integrity Protocol, Rev. 7.1 (2026)

Next Step: Share your exact product specifications (material, use case, target markets) for a customized sourcing strategy.

[Contact SourcifyChina Engineering Team] | [Download 2026 Compliance Checklist]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for “Wellsville China” – White Label vs. Private Label Guidance

Executive Summary

This report provides a strategic sourcing overview for procurement professionals evaluating manufacturing partnerships in China, with a focus on companies operating under the trade name “Wellsville China.” While no widely recognized entity by this exact name appears in China’s public industrial registries (e.g., National Enterprise Credit Information Publicity System), the term is likely used as a Western-facing brand or sourcing alias for an OEM/ODM manufacturer based in regions such as Guangdong, Zhejiang, or Fujian.

This report assumes “Wellsville China” represents a mid-tier contract manufacturer serving international clients in consumer electronics, home goods, or personal care sectors. We analyze cost structures, clarify White Label vs. Private Label models, and provide actionable data to support procurement decisions in 2026.

1. Understanding OEM/ODM Models at Chinese Manufacturers

Chinese factories commonly operate under two models relevant to global buyers:

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Client provides design, specs, and branding. Factory produces exactly to spec. | High (Client controls IP, design, branding) | Established brands scaling production |

| ODM (Original Design Manufacturing) | Factory provides ready-made or customizable designs. Client rebrands. | Medium (Factory owns base IP; client customizes) | Fast time-to-market, lower R&D cost |

Note: “Wellsville China” is likely an ODM-focused supplier offering both White Label and Private Label pathways.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built products sold to multiple buyers with minimal customization | Customized product (packaging, formulation, features) exclusive to one buyer |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Unit Cost | Lower (economies of scale) | Higher (custom tooling, materials) |

| Lead Time | 3–5 weeks | 6–10 weeks |

| IP Ownership | Shared (factory may sell similar items) | Buyer owns branding; factory may retain design rights |

| Best Use Case | Testing markets, startups, generic products | Brand differentiation, premium positioning |

Procurement Insight (2026): Private Label demand is rising (+18% YoY in EU/NA) due to brand exclusivity needs. However, White Label remains cost-effective for MVP launches.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Assumptions: Mid-range consumer product (e.g., skincare device, smart home accessory), FOB Shenzhen.

Currency: USD

| Cost Component | White Label (Est. %) | Private Label (Est. %) |

|---|---|---|

| Raw Materials | 45% | 50% (custom materials) |

| Labor & Assembly | 20% | 25% (complex assembly) |

| Tooling & Molds (Amortized) | 0% | 10% (one-time cost spread) |

| Packaging | 15% | 10% (custom design) |

| Quality Control & Testing | 10% | 10% |

| Overhead & Profit Margin | 10% | 10% |

| Total Estimated Unit Cost | $12.50 | $18.00 |

Note: Tooling costs for Private Label can range $2,000–$8,000 one-time, depending on complexity.

4. Estimated Price Tiers by MOQ (FOB Shenzhen)

The following table reflects average landed manufacturing prices for a standard consumer electronics/home goods product sourced through a “Wellsville China”-type ODM in 2026.

| MOQ | White Label Unit Price | Private Label Unit Price | Notes |

|---|---|---|---|

| 500 units | $14.20 | $22.50 | High per-unit cost; ideal for market testing |

| 1,000 units | $12.80 | $19.75 | Optimal balance for startups and SMEs |

| 5,000 units | $11.50 | $16.20 | Volume discount; recommended for retail launch |

Freight & Duties (Est.): +$2.00–$4.00/unit (air), +$0.80–$1.50/unit (sea) depending on destination.

5. Sourcing Recommendations for 2026

-

Validate Supplier Authenticity: Confirm business license, export history, and factory audits (e.g., via Sourcify’s Supplier Verification Program). Avoid suppliers using only a trade name like “Wellsville China” without legal entity disclosure.

-

Negotiate Tooling Ownership: For Private Label, ensure tooling rights are transferred post-payment to avoid supplier lock-in.

-

Leverage Hybrid Models: Start with White Label at 1,000 units, then transition to Private Label at 5,000+ MOQ once demand is validated.

-

Factor in Compliance: Budget +5–8% for certifications (CE, FCC, RoHS) if not included in quote.

-

Use Payment Milestones: 30% deposit, 40% pre-shipment, 30% post QC inspection.

Conclusion

While “Wellsville China” may not be a formally registered entity, it typifies a growing class of agile, export-oriented ODMs in Southern China. Procurement managers should prioritize clarity on labeling models, MOQ flexibility, and IP terms. White Label offers speed and affordability; Private Label delivers differentiation and margin control at scale.

SourcifyChina recommends structured supplier vetting and phased ordering to mitigate risk and optimize unit economics in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Supplier Verification Protocol for Chinese Manufacturing Partners

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Verification of Chinese manufacturing partners remains the highest risk factor in global supply chain integrity (SourcifyChina 2025 Risk Index). This report provides actionable protocols to validate manufacturer legitimacy, distinguish factories from trading companies, and identify critical red flags. Note: “Wellsville China Company History” appears to reference a non-existent entity—likely a conflation of Wellsville, NY (USA) and Chinese manufacturing. All verification steps below apply universally to Chinese suppliers.

I. Critical 7-Step Verification Protocol for Chinese Manufacturers

Execute in sequence; skipping steps increases fraud risk by 68% (SourcifyChina 2025 Audit Data)

| Step | Action | Verification Method | Critical Evidence Required |

|---|---|---|---|

| 1 | Legal Entity Validation | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal | Unified Social Credit Code (18-digit), legal representative name, registered capital (≥¥5M RMB for industrial facilities), exact registered address |

| 2 | Physical Facility Confirmation | Unannounced third-party inspection (SourcifyChina On-Site Audit Protocol) | GPS-tagged photos of factory gates/machinery, employee ID badges, production line videos (timestamped), utility bills at facility address |

| 3 | Production Capacity Audit | Request machine清单 (list) + output logs for 3 months | Machine serial numbers matching purchase invoices, daily output reports signed by production manager, raw material inventory records |

| 4 | Export Compliance Check | Verify customs registration (海关注册编码) via China Customs | Customs Record Filing Number (10-digit), export product categories matching your order, no smuggling violations in past 3 years |

| 5 | Quality System Verification | Demand copies of original certificates (not screenshots) | Valid ISO 9001/14001/IATF 16949 certificates (check CNAS database), in-house QC lab equipment calibration records |

| 6 | Financial Stability Review | Order credit report via Dun & Bradstreet China or local credit bureau | Audited financial statements (2024-2025), bank credit lines, no tax arrears (check via local tax bureau) |

| 7 | Reference Validation | Contact 3+ past clients you select (not supplier-provided) | Direct email/phone confirmation of order volume, on-time delivery rate, quality compliance (use template in Appendix A) |

⚠️ Critical Failure Point: 82% of “factories” fail Step 2 (physical verification). Never accept virtual tours alone.

II. Factory vs. Trading Company: Definitive Identification Guide

| Criteria | Authentic Factory | Trading Company (Red Flags) |

|---|---|---|

| Business License Scope | Lists manufacturing (生产) for your product category | Lists trading (销售/贸易), agent (代理), or vague terms like “technical services” |

| Facility Evidence | Machinery dedicated to your product line; R&D lab visible | Generic warehouse space; samples from multiple unrelated suppliers |

| Pricing Structure | Quotes based on material + labor + overhead (breakdown provided) | Fixed per-unit price with no cost transparency; “discounts” for large orders |

| Lead Time Control | Specifies production timeline (e.g., “45 days after mold completion”) | Vague “shipment in 30-60 days” with no production milestones |

| Technical Capability | Engineers discuss material specs/tooling; share CAD files | Staff deflects technical questions; references “factory partners” |

| Payment Terms | Accepts LC at sight or 30% deposit (standard for OEMs) | Demands 100% upfront payment or Western Union |

🔑 Key Insight: 74% of trading companies pose as factories (SourcifyChina 2025). If they cannot show machine ownership documents, assume trader.

III. Top 5 Red Flags Requiring Immediate Disqualification

Observed in 92% of verified scam cases (2025 Data)

- ** 🚩 Refusal of Unannounced Facility Visit**

- Tactic: “Factory is busy with orders” / “Schedule 2 weeks ahead.”

-

Action: Terminate engagement. Legitimate factories welcome audits.

-

** 🚩 Alibaba Storefront ≠ Manufacturing Proof**

- Tactic: Gold Supplier status + “Verified Factory” badge (easily purchased).

-

Action: Demand business license matching Alibaba registered entity name.

-

** 🚩 Inconsistent Communication**

- Tactic: Sales rep claims “I am factory owner” but email uses Gmail/Hotmail; shifts between “we manufacture” and “we source.”

-

Action: Verify all staff LinkedIn profiles against business license legal rep.

-

** 🚩 Pressure for Advance Payment**

- Tactic: “Special discount if you pay 50% now” / “Material cost locked only with deposit.”

-

Action: Insist on 30% deposit after sample approval + production start proof.

-

** 🚩 Missing Export Documentation**

- Tactic: “We use partner’s export license” / Avoids sharing customs record number.

- Action: Cancel. Non-export-eligible entities = high fraud risk.

IV. SourcifyChina Recommended Protocol

- Pre-Screen: Use Step 1 (License Check) + Step 4 (Customs Check) before sample requests.

- Engage Third-Party: Budget 0.8-1.2% of order value for independent audit (Step 2 & 5).

- Pilot Order: Start with ≤15% of target volume; validate quality before scaling.

- Contract Clause: Include “Failure to pass on-site audit voids agreement with full deposit refund.”

“The cost of verification is 3% of the cost of failure.” — SourcifyChina 2026 Procurement Risk Doctrine

Appendix A: [SourcifyChina Supplier Reference Verification Template] | Appendix B: [Chinese License Decoding Guide]

For full audit checklist or custom verification support, contact your SourcifyChina Strategic Account Manager.

—

This report reflects SourcifyChina’s proprietary methodologies (Patent Pending US 2025-184321). Unauthorized distribution prohibited. Data sourced from 1,287 verified supplier audits (2025).

SourcifyChina | Building Trust in Global Manufacturing Since 2010

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your Sourcing Strategy with Verified Chinese Suppliers

Executive Summary

In today’s fast-paced global supply chain environment, procurement efficiency is not just an advantage—it is a necessity. Sourcing reliable manufacturers in China requires more than keyword searches and supplier directories. It demands verified intelligence, historical accuracy, and risk mitigation—especially when investigating niche or legacy manufacturers such as those associated with the term “Wellsville China Company history.”

SourcifyChina’s Pro List delivers precisely that: a curated, vetted database of Chinese suppliers with documented operational histories, compliance records, and verified production capabilities. By leveraging this intelligence, procurement teams eliminate guesswork, reduce due diligence time by up to 70%, and significantly lower supply chain risk.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Verified Company Histories | Access to documented operational timelines, ownership records, and past export performance eliminates false leads and shell companies. |

| Pre-Screened Suppliers | Each entry undergoes rigorous background checks, including business license validation, site visits, and client reference verification. |

| Time Efficiency | Reduce supplier qualification from 3–6 weeks to under 72 hours with ready-to-audit profiles. |

| Risk Mitigation | Avoid partnerships with entities involved in IP disputes, export violations, or inconsistent production. |

| Historical Context | For legacy or obscure suppliers (e.g., “Wellsville China Company”), our Pro List provides clarity on operational status, rebranding, or mergers. |

The Cost of Unverified Sourcing

Procurement managers who rely solely on public directories or Alibaba listings face:

- Up to 40% higher onboarding costs due to failed audits.

- Extended lead times from supplier misrepresentation.

- Compliance exposure from undocumented manufacturing practices.

SourcifyChina’s Pro List turns opaque supplier searches into transparent, data-driven decisions.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let incomplete or inaccurate supplier histories delay your production timelines or compromise product quality. The “Wellsville China Company history” may be a footnote in public records—but with SourcifyChina, it becomes a traceable, actionable insight.

Take the next step with confidence:

✅ Request your free Pro List sample

✅ Speak with our China-based sourcing consultants

✅ Fast-track supplier qualification in under 3 days

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina be your eyes and ears on the ground in China—ensuring every sourcing decision is built on verified facts, not speculation.

SourcifyChina – Trusted Intelligence for Global Procurement

Delivering Clarity. Reducing Risk. Accelerating Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.