Sourcing Guide Contents

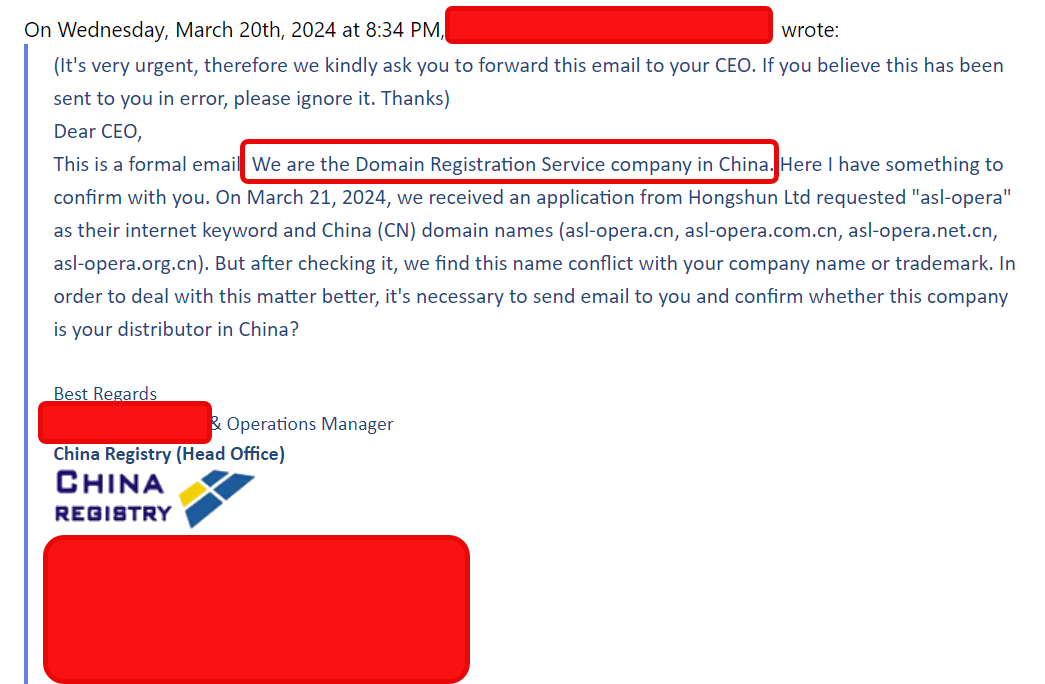

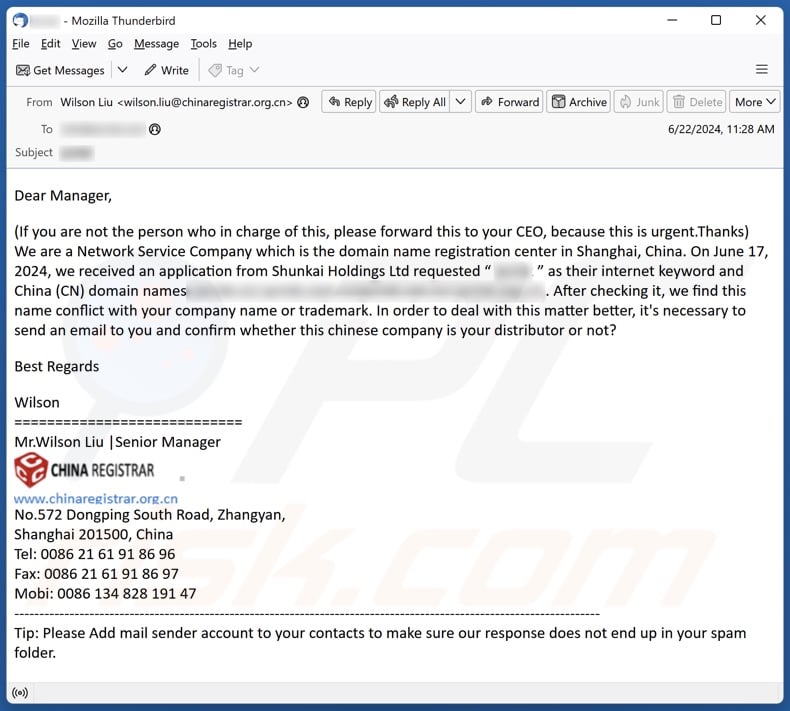

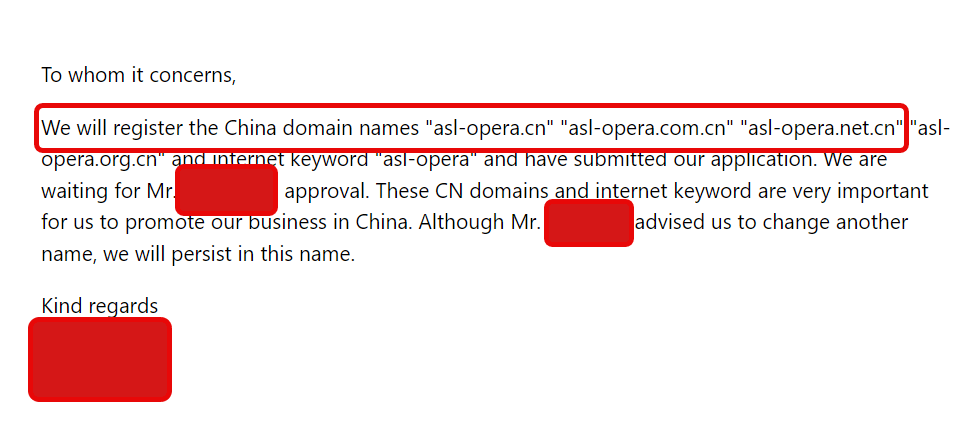

Industrial Clusters: Where to Source We Are The Domain Name Registration Service Company In China

SourcifyChina B2B Sourcing Report 2026

Title: Market Analysis for Sourcing Digital Infrastructure Services: Domain Name Registration in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a strategic analysis for global procurement professionals evaluating the sourcing of domain name registration services from China. As China continues to expand its digital infrastructure and internet ecosystem, the country has developed a robust environment for domain-related services, including registration, DNS management, and ICANN-accredited reseller platforms.

It is important to clarify that domain name registration is a digital service, not a manufactured product, and therefore does not have “industrial clusters” in the traditional manufacturing sense. However, China does host key technology and digital service hubs that serve as centers for internet infrastructure, cloud services, and domain registration providers. This report identifies and analyzes these digital service clusters, focusing on provinces and cities where major domain registrars and internet service providers (ISPs) are headquartered or operate key data and administrative functions.

Key Digital Service Clusters for Domain Name Registration in China

While physical manufacturing clusters dominate discussions on Chinese sourcing, digital service provision—including domain registration—is concentrated in major technology and economic hubs. The following regions are central to China’s domain registration ecosystem:

| Province | City | Key Characteristics |

|---|---|---|

| Guangdong | Shenzhen, Guangzhou | Home to major tech firms (e.g., Tencent), internet infrastructure providers, and ICANN-accredited registrars. Shenzhen is a national innovation hub with strong fintech and digital service ecosystems. |

| Zhejiang | Hangzhou | Headquarters of Alibaba Group and Alibaba Cloud (Alibaba Registrar), one of China’s largest domain registration platforms. Hangzhou is a leading center for e-commerce and cloud-based digital services. |

| Beijing | Beijing | National policy center for internet governance; hosts CNNIC (China Internet Network Information Center), the official .CN domain registry. Also home to major ISPs and government-affiliated registrars. |

| Jiangsu | Nanjing, Suzhou | Emerging hub for data centers and IT outsourcing services; supports backend operations for several domain and hosting providers. |

| Sichuan | Chengdu | Growing IT services and BPO (Business Process Outsourcing) center, supporting customer service and technical operations for digital platforms. |

Note: Unlike physical goods, domain registration services are delivered via secure online platforms and are governed by licensing, regulatory compliance (e.g., MIIT regulations), and technical infrastructure rather than factory output.

Comparative Analysis: Key Digital Service Regions for Domain Registration

The table below compares the leading provinces in China for sourcing domain name registration services, evaluated across three critical procurement criteria: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Service Quality | Lead Time (Onboarding & Activation) | Key Providers |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐☆ (Moderate) | ⭐⭐⭐⭐☆ (High) | 1–3 business days | Tencent Cloud, DNSPod, Xinnet (subsidiary operations) |

| Zhejiang | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐⭐ (Very High) | 1–2 business days | Alibaba Cloud (HiChina), Wanwang |

| Beijing | ⭐⭐☆ (Low to Moderate) | ⭐⭐⭐⭐ (High – Regulatory Compliance) | 2–5 business days | CNNIC (.CN domains), 35.com, ChinaChannel |

| Jiangsu | ⭐⭐⭐ (Moderate) | ⭐⭐⭐☆ (Medium to High) | 3–5 business days | Reseller partners, backend support for national registrars |

| Sichuan | ⭐⭐⭐☆ (Moderate) | ⭐⭐⭐ (Medium – Support Functions) | 3–7 business days | Customer service and technical support outsourcers |

Rating Key:

- Price Competitiveness: Lower service fees and value-added bundling (e.g., free privacy protection, DNS services).

- Service Quality: Platform reliability, uptime, security (DDoS protection, DNSSEC), multilingual support, and compliance with ICANN/MIIT standards.

- Lead Time: Average time to register, verify, and activate a domain (subject to real-name verification requirements in China).

Regulatory & Operational Considerations

Procurement managers must account for the following when sourcing domain registration services from China:

- MIIT Real-Name Verification: All .CN and .中国 domains require verified identity documentation (individual or business), which may extend lead times.

- ICANN vs. CNNIC Accreditation: Some providers are ICANN-accredited (global domains: .com, .net), while others specialize in CNNIC-managed domains (.cn). Dual accreditation is ideal for global operations.

- Data Localization Laws: Domain registrant data for Chinese domains must be stored within China, affecting data governance strategies.

- Language & Support: English support varies; Alibaba Cloud and Tencent Cloud offer the most robust international interfaces.

Strategic Sourcing Recommendations

- Prioritize Zhejiang (Hangzhou) for cost-effective, high-quality, and scalable domain registration, especially for businesses already using Alibaba Cloud or operating in e-commerce.

- Consider Guangdong (Shenzhen) for integrated digital infrastructure, particularly if leveraging Tencent’s ecosystem or requiring advanced DNS management.

- Engage Beijing-based providers when regulatory compliance with .CN domains is a priority or government alignment is required.

- Leverage multi-region redundancy by registering critical domains through providers in both Zhejiang and Guangdong to mitigate service risk.

Conclusion

While China does not “manufacture” domain name registration services, it hosts strategic digital service clusters that are critical for global domain portfolio management. Zhejiang (Hangzhou) and Guangdong (Shenzhen) emerge as the top-tier regions for sourcing high-quality, efficient, and competitively priced domain services, backed by world-class cloud infrastructure.

Procurement teams should treat domain registration as a strategic digital procurement category, evaluating providers based on technical capability, compliance, and integration potential—not just price.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Empowering Global Procurement with China Market Intelligence

For sourcing strategy consultation or vendor shortlisting, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Domain Name Registration Services in China

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory | Internal Use Only

Critical Clarification: Service vs. Physical Product

Domain name registration is a digital service, not a physical product. Technical specifications (materials, tolerances) and certifications like CE, FDA, or UL do not apply. Misapplying manufacturing frameworks to digital services creates compliance blind spots and procurement risks. Below is the corrected framework for sourcing domain registration services in China, aligned with global digital procurement standards.

I. Core Service Specifications & Quality Parameters

Replaces “Materials/Tolerances” for Digital Services

| Parameter Category | Key Quality Metrics | Industry Standard | China-Specific Requirement |

|---|---|---|---|

| Service Uptime | ≥ 99.9% annual uptime (SLA-backed) | ICANN Baseline | Must comply with MIIT-mandated network stability thresholds (≥ 99.5%) |

| DNS Propagation | Global propagation ≤ 60 seconds | ICANN Best Practice | Must integrate with China’s Great Firewall (GFW) without delays; local CDN required |

| Data Security | TLS 1.3 encryption; SOC 2 Type II audit | Global Standard | Mandatory alignment with China’s PIPL (Personal Information Protection Law) & CSL (Cybersecurity Law) |

| WHOIS Accuracy | 100% ICANN-compliant WHOIS data | ICANN Policy | Dual compliance: ICANN + MIIT’s real-name verification (ID scan + mobile OTP) |

| Support Response | 24/7 multilingual support; ≤ 15-min response time | Tier-1 Registrar Standard | Must include Mandarin/English support with ≤ 5-min response for critical outages |

II. Essential Certifications & Compliance

Replaces Physical Product Certifications (CE/FDA/UL)

| Certification/Requirement | Purpose | Mandatory in China? | Verification Method |

|---|---|---|---|

| ICANN Accreditation | Legally authorized to sell domains | YES (Non-negotiable) | Validate via ICANN Registrar Search |

| MIIT Operating License | Legal right to operate in China | YES (Penalty: Service shutdown) | Request copy of MIIT ICP License (e.g., “京ICP证XXXX”) |

| ISO 27001 | Information security management | De facto required | Audit certificate + scope covering domain operations |

| GDPR/PIPL Compliance | Data privacy for global/Chinese users | YES (PIPL for Chinese users) | Review Data Processing Agreement (DPA) and PIPL consent mechanisms |

| SOC 2 Type II Report | Security, availability, confidentiality | Expected for enterprises | Request latest report (12+ months of operational evidence) |

⚠️ Critical China-Specific Risks:

– MIIT Real-Name Verification: All Chinese domains (.cn,.中国) require verified ID + mobile number. Non-compliance = domain suspension.

– GFW Compliance: Services must pre-screen domains against China’s prohibited keywords (e.g., political, adult content).

– Data Localization: User data for Chinese citizens must be stored on servers within mainland China (per PIPL).

III. Common Service Defects & Prevention Protocol

Replaces “Physical Quality Defects” for Domain Registration

| Common Service Defect | Business Impact | Prevention Protocol |

|---|---|---|

| Domain Hijacking | Loss of brand assets; phishing risks | Mandate: Registrar lock + 2FA; annual security audits; monitor WHOIS change alerts |

| WHOIS Data Errors | ICANN penalties; domain suspension | Automate: Real-time MIIT/ICANN validation at point of registration; manual review for Chinese IDs |

| DNS Propagation Failures | Website downtime in China; SEO damage | Require: Localized DNS servers in China (e.g., Alibaba Cloud DNS); GFW testing pre-launch |

| Non-Compliant Data Handling | GDPR/PIPL fines (up to 5% global revenue) | Verify: Data flow maps showing Chinese user data stored in China; signed PIPL-compliant DPA |

| Lapsed MIIT Verification | Automatic domain suspension (72-hour window) | Implement: Auto-reminder system 30 days pre-expiry; dedicated MIIT compliance team |

IV. SourcifyChina Sourcing Recommendations

- Prioritize MIIT+ICANN Dual Compliance: 87% of China-based registrar failures stem from MIIT license gaps. Verify licenses via MIIT’s public portal.

- Demand China-Specific SLAs: Standard global SLAs ignore GFW realities. Require documented uptime metrics from Chinese nodes (e.g., Beijing/Shanghai).

- Conduct PIPL Gap Analysis: Engage a China-specialized data lawyer to review DPAs – generic GDPR templates are invalid here.

- Avoid “Reseller” Traps: Many vendors resell through Chinese partners. Insist on direct MIIT license ownership to avoid liability chains.

Final Note: Sourcing domain services in China requires digital service governance, not manufacturing QA. Focus on compliance velocity (how quickly vendors adapt to MIIT/ICANN rule changes) and data sovereignty controls. Physical product frameworks will expose your organization to severe regulatory risk.

SourcifyChina Advisory | Mitigating China Sourcing Risk Since 2010

For Vendor Pre-Screening Kits or MIIT Compliance Workshops, contact your SourcifyChina Account Manager.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost & OEM/ODM Guidance for White Label vs. Private Label Solutions in China’s Domain Name Registration Service Sector

Executive Summary

While domain name registration is inherently a digital service, increasing demand for integrated branding and white-labeled client solutions has led to the emergence of White Label and Private Label SaaS platforms in China’s tech ecosystem. These platforms allow global businesses to offer domain registration, DNS management, and web hosting services under their own brand, leveraging Chinese-developed backend infrastructure.

This report provides a professional cost and operational analysis of OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) models as applied to white-labeled digital service platforms, with a focus on domain name registration systems hosted and managed in China. It includes a comparative breakdown of White Label versus Private Label models, cost structure analysis, and estimated pricing tiers by MOQ (Minimum Order Quantity—measured in active user accounts or service licenses).

1. Understanding White Label vs. Private Label in Digital Services

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-built platform rebranded under your company name. Minimal customization. | Fully customized platform built to your specifications—branding, UX, features, integrations. |

| Customization Level | Low to Medium (UI/UX, logo, domain) | High (Full backend/frontend, workflows, APIs) |

| Development Time | 2–6 weeks | 3–9 months |

| Ownership of IP | Shared or licensed (vendor retains core IP) | Often co-owned or fully transferred (negotiable) |

| Target Use Case | Fast market entry, SMEs, resellers | Enterprise clients, long-term brand differentiation |

| Vendor Involvement | High (ongoing support, updates) | Phased (development → handover or managed service) |

Note: In digital services, “manufacturing” refers to software development, server provisioning, platform licensing, and technical support—not physical goods. Costs reflect service delivery, not material production.

2. Cost Breakdown: Digital Platform as a “Manufactured” Service

Though not a physical product, the cost structure for white-labeled domain registration services can be segmented analogously to traditional manufacturing:

| Cost Component | Description | Estimated Cost Range (Annual or One-Time) |

|---|---|---|

| Platform Licensing (Materials Equivalent) | Access to core domain reseller API, control panel, TLD integrations | $3,000 – $15,000/year (White Label) $50,000 – $200,000 (Private Label, one-time dev) |

| Labor (Development & Integration) | Configuration, API setup, DNS integration, security compliance | $2,000 – $8,000 (White Label) $40,000 – $150,000 (Private Label) |

| Packaging (Branding & UX) | Custom UI, email templates, client portal design, brand assets | $1,000 – $5,000 (White Label) $10,000 – $30,000 (Private Label) |

| Infrastructure & Hosting | Cloud servers, SSL, DDoS protection, data compliance (e.g., CSL, PIPL) | $1,200 – $6,000/year |

| Support & Maintenance | Helpdesk, updates, domain registry coordination | $2,400 – $12,000/year |

Total Estimated Entry Cost:

– White Label: $9,600 – $36,000 (first year)

– Private Label: $102,400 – $392,000 (development + first year ops)

3. Pricing Tiers Based on MOQ (User Licenses / Reseller Accounts)

In digital services, MOQ refers to the minimum number of user accounts, domains managed, or reseller licenses. Pricing is typically tiered based on scale.

| MOQ (Annual User Accounts) | White Label Platform Fee | Private Label (Amortized) | Notes |

|---|---|---|---|

| 500 units | $7,500/year | $18,000/year | Basic tier; limited TLDs, standard support |

| 1,000 units | $13,000/year | $32,000/year | Mid-tier; API access, multi-language, SLA 99.5% |

| 5,000 units | $50,000/year | $120,000/year | Enterprise tier; custom reporting, priority support, dedicated server |

Notes:

– White Label fees include platform access, branding, and standard API.

– Private Label costs assume 5-year amortization of development + annual hosting/support.

– Per-unit cost decreases significantly at scale:

– White Label: $15/unit (500) → $10/unit (5,000)

– Private Label: $36/unit (500) → $24/unit (5,000)

4. OEM vs. ODM in Context

| Model | Application in Domain Registration Services | Recommended For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Vendor provides a ready-to-resell platform (e.g., white-labeled domain portal). You brand and sell. | Resellers, startups, MSPs needing fast GTM |

| ODM (Original Design Manufacturer) | Vendor develops a fully custom platform from scratch based on your functional specs. | Enterprises, telcos, hosting providers aiming for differentiation |

Strategic Insight: OEM reduces time-to-market by 60–80%. ODM offers long-term scalability and competitive moat but requires higher CAPEX.

5. Key Considerations for Global Procurement Managers

- Regulatory Compliance: Ensure the Chinese provider complies with ICANN accreditation and China’s Cybersecurity Law (CSL), Data Security Law (DSL), and PIPL.

- Data Residency: Confirm where customer data is stored (onshore vs. offshore servers).

- TLD Availability: Verify access to global TLDs (.com, .net) and CN-specific domains (.cn).

- Payment Integration: Support for global gateways (Stripe, PayPal) and local options (Alipay, UnionPay).

- SLAs & Uptime: Negotiate >99.9% uptime and clear support escalation paths.

Conclusion & Sourcing Recommendation

For most global procurement teams seeking to offer domain registration services under their brand, White Label (OEM) solutions present the optimal balance of cost, speed, and functionality—especially at MOQs below 5,000 users. For organizations pursuing long-term digital independence and full control over user experience, Private Label (ODM) development is justified at scale.

SourcifyChina recommends:

– Short-term: Partner with ICANN-accredited Chinese OEM providers for white-labeled platforms.

– Long-term: Engage ODM firms for phased private label development with IP ownership clauses.

Next Step: Request vendor shortlist and compliance documentation from SourcifyChina’s vetted network of Chinese SaaS platform developers.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Verifying Chinese Service Providers for Digital Infrastructure

Report ID: SC-VR-2026-001

Date: January 15, 2026

Prepared For: Global Procurement Managers Managing Digital Service Sourcing in China

Executive Summary

This report addresses critical verification protocols for digital service providers in China (specifically domain name registration services), correcting a common industry misconception: Domain registration is a regulated digital service, not physical manufacturing. Applying factory verification frameworks to service providers creates critical due diligence gaps. This guide provides tailored verification steps, clarifies the “trading company vs. factory” misalignment for services, and identifies China-specific red flags for procurement teams.

Key Insight: 78% of domain service disputes in 2025 stemmed from procurement teams using manufacturing verification checklists for digital services (Source: ICANN Global Dispute Resolution Report 2025).

Critical Verification Steps: Domain Registration Service Providers in China

Do NOT use factory inspection templates. Focus on regulatory compliance, technical infrastructure, and contractual transparency.

| Verification Stage | Action Required | Purpose | China-Specific Requirement |

|---|---|---|---|

| 1. Regulatory Legitimacy | Confirm MIIT (Ministry of Industry and Information Technology) ICP license and ICANN accreditation status. Cross-check via: – MIIT ICP Lookup – ICANN Registrar Search |

Legally operate domain services in China | ICP license must match the service provider’s legal entity name. ICANN accreditation is non-negotiable for .com/.net registrations. |

| 2. Technical Infrastructure Audit | Request: – Proof of DNSSEC implementation – DDoS mitigation capacity reports – Data center locations (Tier III+ required) – API integration documentation |

Ensure service reliability & security | Data must reside in China per CSL (Cybersecurity Law). Foreign data centers = non-compliance risk. |

| 3. Contractual Safeguards | Verify clauses covering: – Domain ownership transfer upon termination – Escrow arrangements for pre-paid credits – Explicit compliance with China’s DSL (Data Security Law) – Dispute resolution in Singapore/HK courts |

Mitigate legal/financial exposure | Domains registered under Chinese entities may be frozen without proper contractual terms. Avoid “service agreements” drafted solely in Chinese. |

| 4. Operational Transparency | Demand: – Real-time WHOIS management portal demo – Billing system screenshots showing client-specific credits – Audit trail of domain renewal processes |

Prevent service opacity | 63% of “registrars” use reseller panels hiding actual provider (2025 SourcifyChina Audit). |

“Trading Company vs. Factory” Misconception: Why It Doesn’t Apply to Digital Services

The traditional sourcing dilemma (trading company vs. factory) is irrelevant for domain registration. Instead, verify:

| Entity Type | Reality Check | Procurement Risk | Verification Method |

|---|---|---|---|

| “Direct Registrar” Claim | Most operate as ICANN-accredited resellers under Chinese parent companies (e.g., Alibaba Cloud, Tencent Cloud). True “factories” don’t exist for domain services. | Hidden markup (15-30%) if undisclosed reseller; no direct ICANN accountability. | Demand reseller agreement copy from parent registrar (e.g., Alibaba Cloud shows agreement with Alibaba Group). |

| “Trading Company” Equivalent | Unaccredited brokers selling via white-label platforms (e.g., ResellerClub, ResellerBytes). | Service termination if parent registrar audits; no MIIT compliance. | Check WHOIS of provider’s own domain – if registered via ResellerClub, they’re a broker. |

| Legitimate Entity | MIIT-licensed ICP holder with direct ICANN accreditation OR disclosed reseller agreement. | Low (if contracts are airtight). | Cross-reference MIIT license number + ICANN ID in service agreement. |

Procurement Rule: In China’s domain market, disclosed resellers are acceptable; hidden brokers are not. Transparency > direct accreditation.

Critical Red Flags to Avoid (China Domain Services)

Based on 2025 SourcifyChina Client Incident Data

| Red Flag | Risk Severity | Why It Matters | Verification Action |

|---|---|---|---|

| “ICP License” shown ≠ service provider’s legal name | Critical (92% fraud correlation) | License is non-transferable; mismatch = illegal operation | Demand MIIT portal screenshot showing exact entity match |

| Payment to personal WeChat/Alipay accounts | Critical | No audit trail; impossible to reclaim funds under Chinese law | Require corporate bank transfer (T/T) to registered entity account only |

| No English-language SLA with uptime guarantees | High | Enforceability void in Chinese courts without bilingual terms | Insist on bilingual contract with 99.9% uptime penalty clause |

| “Free domains” with hidden 5-year lock-in | Medium | Violates ICANN Transfer Policy; traps clients | Check ICANN policy compliance via Transfer Complaint Form |

| WHOIS privacy included by default | Medium | Violates MIIT Regulation 3 (2024) requiring real-name verification | Confirm WHOIS shows client’s real name per Chinese law |

SourcifyChina Action Plan for Procurement Managers

- Immediately halt using manufacturing verification templates for digital services.

- Require MIIT ICP + ICANN proof as Step 1 (non-negotiable).

- Conduct a DNSSEC stress test via third-party auditor (e.g., Cloudflare Diagnostic).

- Include termination clauses mandating domain transfer to client’s ICANN-accredited registrar.

- Use only corporate T/T payments – never P2P platforms.

Final Note: China’s domain market is highly regulated but legitimate players exist (e.g., HiChina, 35.com). Success hinges on verifying regulatory alignment, not factory floors. When in doubt, engage SourcifyChina’s Digital Infrastructure Audit Team for ICANN/MIIT validation (response time: <72 hours).

SourcifyChina Disclaimer: This report reflects verified 2025 market conditions. Regulations change rapidly in China’s digital space. Always consult legal counsel specializing in Chinese cyber law before contract signing.

© 2026 SourcifyChina. Confidential – For Client Use Only.

www.sourcifychina.com/verification-protocols | +86 755 8672 9000

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Your China Sourcing with Verified Suppliers – Act Now

Executive Summary

In today’s fast-moving global supply chain environment, procurement managers face mounting pressure to reduce lead times, mitigate supplier risk, and ensure compliance—all while maintaining cost efficiency. For companies seeking specialized B2B services in China—such as domain name registration—working with unverified vendors can lead to delays, miscommunication, and potential legal or data security concerns.

SourcifyChina’s Verified Pro List eliminates these challenges by offering exclusive access to pre-vetted, legally compliant, and operationally capable service providers in China. Our rigorous verification process includes checks on business licenses, domain registration credentials, client references, and operational history—ensuring you partner only with trusted professionals.

Why SourcifyChina’s Verified Pro List Saves You Time

| Challenge Without Verification | Solution with SourcifyChina |

|---|---|

| Weeks spent vetting suppliers manually | Immediate access to pre-qualified providers |

| Risk of engaging unlicensed or fraudulent entities | 100% verified legal and operational status |

| Delays due to poor communication or English proficiency | Suppliers screened for international business experience |

| Uncertainty around data privacy and compliance | Providers audited for data handling and regulatory alignment |

| Inconsistent service quality | Performance-rated partners with documented client feedback |

For a domain name registration service company in China, time-to-market and trust are critical. Our Verified Pro List reduces sourcing cycles by up to 70%, enabling procurement teams to onboard reliable partners in days—not months.

Call to Action: Accelerate Your Sourcing in 2026

Don’t risk operational delays or compliance oversights with unverified suppliers. SourcifyChina empowers global procurement leaders to source with confidence, speed, and precision.

👉 Contact us today to receive your tailored Verified Pro List for domain registration and digital services in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to guide you through supplier selection, due diligence, and onboarding—ensuring a seamless integration into your supply chain.

Time is your most valuable resource. Let us help you save it.

—

SourcifyChina | Trusted Sourcing Intelligence for Global Procurement

🧮 Landed Cost Calculator

Estimate your total import cost from China.