The global hydrographics (water transfer printing) market is experiencing robust growth, driven by increasing demand for customized surface finishes across automotive, consumer electronics, and home décor industries. According to Grand View Research, the global hydrographic printing market was valued at USD 487.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. This surge is fueled by advancements in printing technologies, rising consumer preference for aesthetically enhanced products, and the versatility of water transfer printing in applying complex patterns to 3D surfaces. As demand escalates, a select group of manufacturers has emerged as leaders in producing high-quality water transfer printing sheets, combining innovation, consistency, and scalable production. Based on market presence, product breadth, and technological capability, here are the top 7 water transfer printing sheets manufacturers shaping the industry’s future.

Top 7 Water Transfer Printing Sheets Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Water Transfer Printing Solutions & Hydro Dip Films

Domain Est. 2000

Website: yht.com.tw

Key Highlights: YHT is a leading Water Transfer Printing manufacturer offering complete solutions: 1000+ hydro dip films, dipping machines, and global support….

#2 Hydro Dip and Hydrographic Printing Films

Domain Est. 2007

Website: hydrodip.com

Key Highlights: Click on the link to browse our collection of hydro dipping films. We have a wide-variety of hydrographic printing film and patterns for you to choose from.Missing: sheets manufac…

#3 Professional Water Transfer Printing Film Manufacturer

Domain Est. 2018

Website: sage1988.com

Key Highlights: CHENG FENG is a professional water transfer printing film manufacturer with over 35 years’ experience, providing versatile hydrographic film patterns and ……

#4 IKONICS

Domain Est. 2000

Website: ikonics.com

Key Highlights: This film is the ONLY blank hydrographic film that is both customizable and made in the USA, adhering to stringent quality standards to ensure consistent, ……

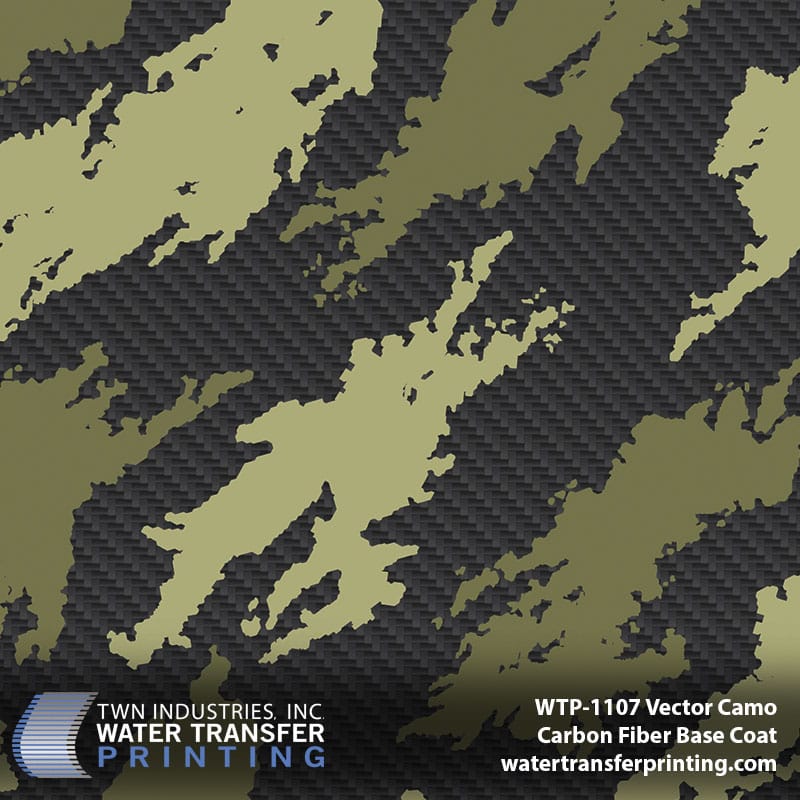

#5 TWN Industries: Water Transfer Printing

Domain Est. 2002

Website: watertransferprinting.com

Key Highlights: Largest supplier of Water Transfer Printing film, training, and equipment. We’ll help you decorate your products so you can beat the competition….

#6 Liquid Print: Hydrographic film

Domain Est. 2008

Website: liquidprintone.com

Key Highlights: Liquid Print provides hydrographic films and activators for manual, semi-automatic and fully automatic water transfer printing systems….

#7 Hydrographic Film Supplies

Domain Est. 2016

Website: hydrographicfilmsupplies.com

Key Highlights: $7.99 delivery 30-day returns…

Expert Sourcing Insights for Water Transfer Printing Sheets

2026 Market Trends for Water Transfer Printing Sheets

The global market for water transfer printing (WTP) sheets is poised for significant transformation by 2026, driven by technological advancements, expanding applications, and shifting consumer preferences. As industries increasingly prioritize customization, sustainability, and cost-effective decoration methods, water transfer printing sheets are emerging as a preferred solution across automotive, consumer electronics, home décor, and niche hobbyist markets.

Rising Demand Across Key Industries

One of the most prominent trends shaping the 2026 outlook is the expanding adoption of water transfer printing sheets in the automotive and motorcycle sectors. Manufacturers and aftermarket customization providers are leveraging WTP to apply complex patterns—such as carbon fiber, wood grain, and camouflage—to dashboards, trim, and accessories. The ability to achieve high-end aesthetics at a fraction of the cost of real materials makes WTP sheets highly attractive. By 2026, growing demand for personalized vehicles is expected to drive steady market growth, particularly in emerging economies with rising disposable incomes.

Similarly, the consumer electronics industry is adopting WTP sheets for customizing phone cases, headphones, laptops, and gaming peripherals. With consumers seeking unique, expressive designs, manufacturers are integrating WTP into mass customization strategies. This trend is amplified by the rise of e-commerce platforms that facilitate direct-to-consumer customization, enabling rapid scaling of personalized product offerings.

Technological Innovation and Material Advancements

By 2026, advancements in film formulation and printing technology are expected to enhance the durability, resolution, and environmental compatibility of water transfer printing sheets. Innovations such as UV-resistant and scratch-resistant coatings will improve product longevity, making WTP suitable for outdoor and high-wear applications. Additionally, the development of biodegradable and solvent-free film carriers is gaining momentum in response to stricter environmental regulations, particularly in Europe and North America.

Digital printing integration is also streamlining the production of custom WTP films. On-demand printing capabilities allow for shorter lead times and lower minimum order quantities, benefiting small businesses and DIY markets. This shift toward agile manufacturing supports a broader democratization of customization tools.

Growth in DIY and Hobbyist Markets

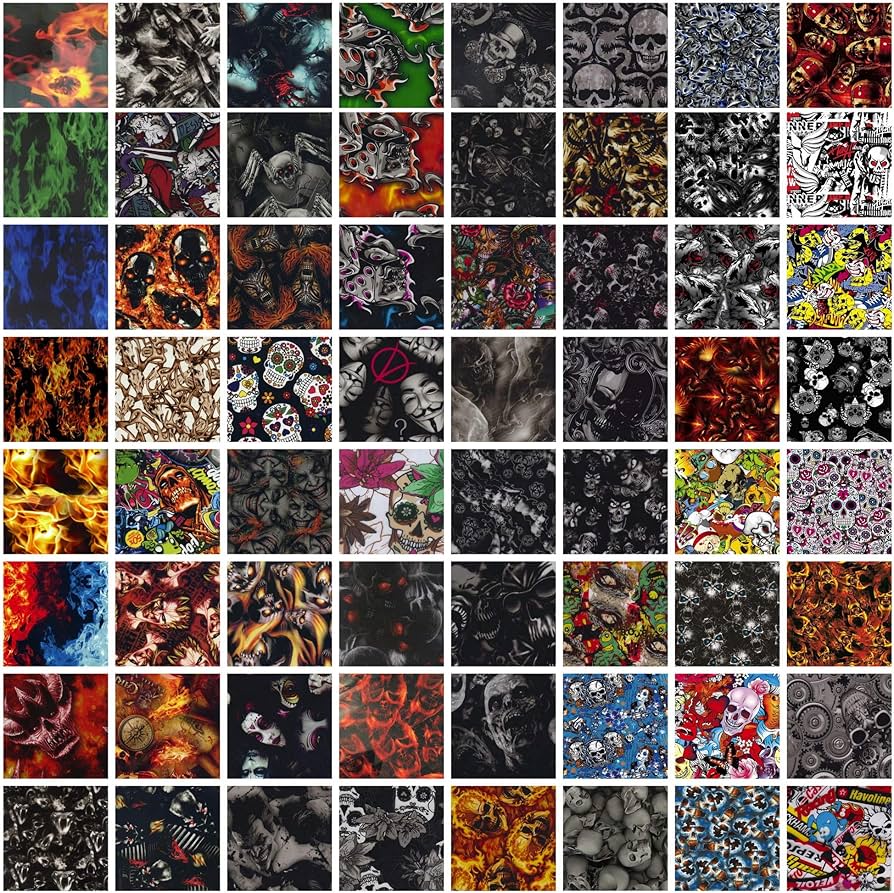

The do-it-yourself (DIY) and hobbyist segment is a key driver of market expansion. Online tutorials, affordable WTP kits, and global e-commerce platforms have made water transfer printing accessible to home users. By 2026, this segment is expected to grow significantly, fueled by social media influencers and niche communities sharing customized projects—from furniture to firearms to cosplay props. The availability of diverse pattern libraries, including anime, geometric, and nature-inspired designs, further fuels consumer engagement.

Regional Market Dynamics

Asia-Pacific is anticipated to lead global market growth by 2026, driven by robust manufacturing activity in China, India, and Southeast Asia. These regions serve as both production hubs and growing consumer markets for customized goods. Meanwhile, North America and Europe will maintain strong demand, particularly in premium and eco-conscious sectors. Regulatory pressures in these regions are likely to accelerate the adoption of low-VOC and recyclable WTP materials.

Challenges and Opportunities

Despite positive momentum, the market faces challenges, including inconsistent quality among low-cost suppliers and the need for skilled labor in application processes. However, automation of the dipping process and standardized training programs are emerging as solutions. Moreover, partnerships between WTP sheet producers and industrial designers are opening new avenues for innovation in product finishes.

In conclusion, the 2026 water transfer printing sheets market will be defined by increased customization, technological refinement, and sustainability efforts. As industries and consumers alike embrace personalization, WTP sheets are set to become a cornerstone of decorative surface technology—offering versatility, affordability, and creative freedom on a global scale.

Common Pitfalls When Sourcing Water Transfer Printing Sheets

Poor Print Quality and Resolution

One of the most frequent issues when sourcing water transfer printing sheets is receiving designs with subpar print quality. Low-resolution images can result in blurry or pixelated patterns once applied to the final product. Additionally, inconsistent ink density, misaligned colors, or poor registration during printing can compromise the overall appearance. Always request physical samples before bulk ordering and verify the DPI (dots per inch) of the designs—ideally 300 DPI or higher for professional results.

Inaccurate Color Matching

Color discrepancies between the digital design and the final printed sheet are common, especially with budget suppliers. Variations in printer calibration, ink quality, and substrate material can lead to colors appearing dull, washed out, or off-tone. To avoid this, ask for Pantone color references or printed color proofs and compare them under consistent lighting conditions.

Use of Infringing or Unlicensed Intellectual Property (IP)

A major legal risk in sourcing water transfer printing sheets is the unauthorized use of copyrighted or trademarked designs—such as branded logos, character art, or patented patterns. Many suppliers, especially on open marketplaces, offer sheets featuring popular IPs without proper licensing. Using such sheets can lead to legal action, product recalls, or seizure by customs. Always verify that the supplier holds appropriate rights to the designs or opt for original, royalty-free patterns with documented usage rights.

Inconsistent Sheet Material or Sizing

Low-quality sheets may use inconsistent paper thickness or poor chemical treatment, which affects how the film dissolves and adheres during the water transfer process. This can lead to tearing, wrinkling, or incomplete transfer. Additionally, incorrect sheet dimensions can cause waste and production delays. Ensure the material is specifically designed for hydro dipping and confirm precise measurements and weight (e.g., 50gsm or 80gsm) with the supplier.

Lack of Technical Support or Application Guidance

Some suppliers provide little to no guidance on soaking time, water temperature, activator usage, or post-processing steps. Without proper instructions, achieving consistent results becomes difficult, especially for beginners. Choose suppliers who offer detailed application guides, technical data sheets, or customer support to troubleshoot common issues.

Hidden Costs and Minimum Order Requirements

While some sheets appear inexpensive upfront, hidden costs can arise from shipping, import duties, or mandatory minimum order quantities (MOQs). Suppliers may also charge extra for custom designs or small-batch production. Clarify all costs, MOQs, and return policies before placing an order to avoid budget overruns.

Logistics & Compliance Guide for Water Transfer Printing Sheets

Product Classification and HS Code

Water Transfer Printing Sheets, also known as hydrographic film or immersion printing film, are typically classified under Harmonized System (HS) Code 3919.10 or 3919.90, which covers self-adhesive plates, sheets, film, foil, tape, and strip of plastics, non-cellular, whether or not in rolls. Accurate classification is essential for customs clearance and determining import duties. Importers should verify the exact HS code with their local customs authority, as classification may vary slightly by country based on composition (e.g., polyvinyl alcohol or PVA-based films).

Packaging and Shipping Requirements

Water Transfer Printing Sheets must be packed in moisture-resistant, durable packaging to prevent damage during transit. Rolls or sheets should be wrapped in protective plastic and placed in rigid cardboard tubes or boxes to avoid creasing, tearing, or warping. Packaging must clearly indicate handling instructions such as “Fragile,” “Do Not Bend,” and “Protect from Moisture.” For international shipping, use standard export packaging compliant with ISPM 15 regulations if wooden components are involved. Air and sea freight must follow IATA and IMDG regulations, respectively, although these films are generally non-hazardous.

Import/Export Documentation

Essential documentation includes a commercial invoice, packing list, bill of lading (or air waybill), and certificate of origin. Depending on the destination country, additional documents such as a conformity certificate or product specification sheet may be required. Exporters must ensure the invoice accurately describes the product (e.g., “Water Transfer Printing Film, Polyvinyl Alcohol-Based, for Decorative Surface Application”) and includes the correct HS code, value, and country of origin to avoid customs delays.

Regulatory Compliance

Water Transfer Printing Sheets must comply with regional chemical and safety regulations. In the European Union, compliance with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) is mandatory, ensuring no restricted substances are present. In the United States, products should meet CPSIA (Consumer Product Safety Improvement Act) guidelines if used on consumer goods. Additionally, RoHS compliance may be required for electronic or automotive applications. Suppliers should provide a Safety Data Sheet (SDS) upon request, even if the product is non-hazardous, to support regulatory audits.

Environmental and Disposal Considerations

While the films themselves are generally non-toxic, waste generated during the water transfer process (e.g., film residue, activator chemicals) may require special handling. Dispose of used films and chemical byproducts according to local environmental regulations. Some regions classify activator residues as hazardous waste, so proper storage, labeling, and disposal methods are essential. Encourage recycling of packaging materials and consider eco-friendly film options (e.g., biodegradable PVA films) to meet sustainability goals.

Labeling and Language Requirements

All packaging must include product identification, batch/lot number, manufacturing date, shelf life, and handling instructions. For international markets, labeling should be in the official language(s) of the destination country. Critical safety warnings (e.g., “Keep Away from Children,” “Use in Well-Ventilated Area”) must be clearly displayed if applicable. Ensure barcode compliance with GS1 standards if required by distributors or retailers.

Storage and Shelf Life Management

Store Water Transfer Printing Sheets in a cool, dry place away from direct sunlight, heat sources, and high humidity. Ideal storage conditions are between 15°C and 25°C (59°F–77°F) with relative humidity below 60%. Most films have a shelf life of 12 to 24 months from the manufacturing date. Implement a first-expiry, first-out (FEFO) inventory system to minimize spoilage and ensure product quality. Regularly inspect stock for signs of degradation such as brittleness or discoloration.

Customs Clearance Best Practices

To expedite customs clearance, provide accurate product descriptions, full material composition, and supporting compliance documentation. Pre-clear shipments when possible and work with a licensed customs broker familiar with printing and specialty film imports. Be prepared for potential inspections, especially if shipping large volumes or to highly regulated markets such as the EU or North America.

In conclusion, sourcing water transfer printing sheets requires careful consideration of several key factors to ensure quality, consistency, and value. It is essential to evaluate suppliers based on material quality, pattern variety, adhesion performance, and customer support. Whether sourcing locally or internationally, establishing reliable communication and verifying product samples beforehand can greatly reduce risks and enhance print outcomes. Additionally, staying informed about market trends and technological advancements in hydrographic films helps in making informed procurement decisions. Ultimately, selecting the right supplier and film type contributes significantly to achieving professional, durable, and visually appealing water transfer prints across various applications.