The global water tank float valve market is witnessing steady expansion, driven by increasing urbanization, rising demand for efficient water management systems, and growing infrastructure development. According to Grand View Research, the global water valves market size was valued at USD 9.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. A key segment within this market, float valves are essential components in residential, commercial, and industrial water storage applications, ensuring automated water level control and minimizing wastage. With Asia Pacific dominating demand due to rapid construction activities and government-led water conservation initiatives, manufacturers are focusing on durability, precision engineering, and compliance with international standards. As the need for reliable and leak-proof solutions intensifies, the following nine companies have emerged as leading manufacturers of water tank float valves, combining innovation, scalability, and strong regional or global reach to meet evolving market demands.

Top 9 Water Tank Float Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Float Valves

Domain Est. 1996

Website: ubw.com

Key Highlights: United Brass Works offers dependable float valves for precise liquid level control. These boiler trim valves are reliable in industrial applications….

#2 Float Valves & Agricultural Solutions

Domain Est. 1995

Website: watts.com

Key Highlights: Our float valves & agricultural solutions are used in commercial, industrial, and agricultural applications for controlling high capacity water flow….

#3 Float Valve

Domain Est. 1996

Website: flomatic.com

Key Highlights: A non-modulating Level Control Valve which maintains the level in ground storage tank, basin or reservoir. The valve opens fully when the level falls a preset ( ……

#4 Hudson Valve

Domain Est. 1997 | Founded: 1975

Website: hudsonvalve.com

Key Highlights: Since 1975, Hudson Valve Company has been providing customers with a line of compact, virtually indestructible valves to meet a wide range of water needs….

#5 R400 Series BOB® Float Valves

Domain Est. 1999

Website: cdivalve.com

Key Highlights: These high-capacity float valves with male NPT inlet and outlet connections feature an adjustable short arm for customizing water level….

#6 Float valve

Domain Est. 2001

Website: pamline.com

Key Highlights: The float valve aims at keeping on a determined level the stretch of water in a water tank. It is set up on the supply pipe at the top….

#7 Jobe Valves

Domain Est. 2002 | Founded: 1967

Website: jobevalves.com

Key Highlights: Jobe Valves produce reliable float operated valves for the automatic filling of water storage tanks. Your trusted innovator since 1967….

#8 Float Valves

Domain Est. 2008

Website: philmacinc.com

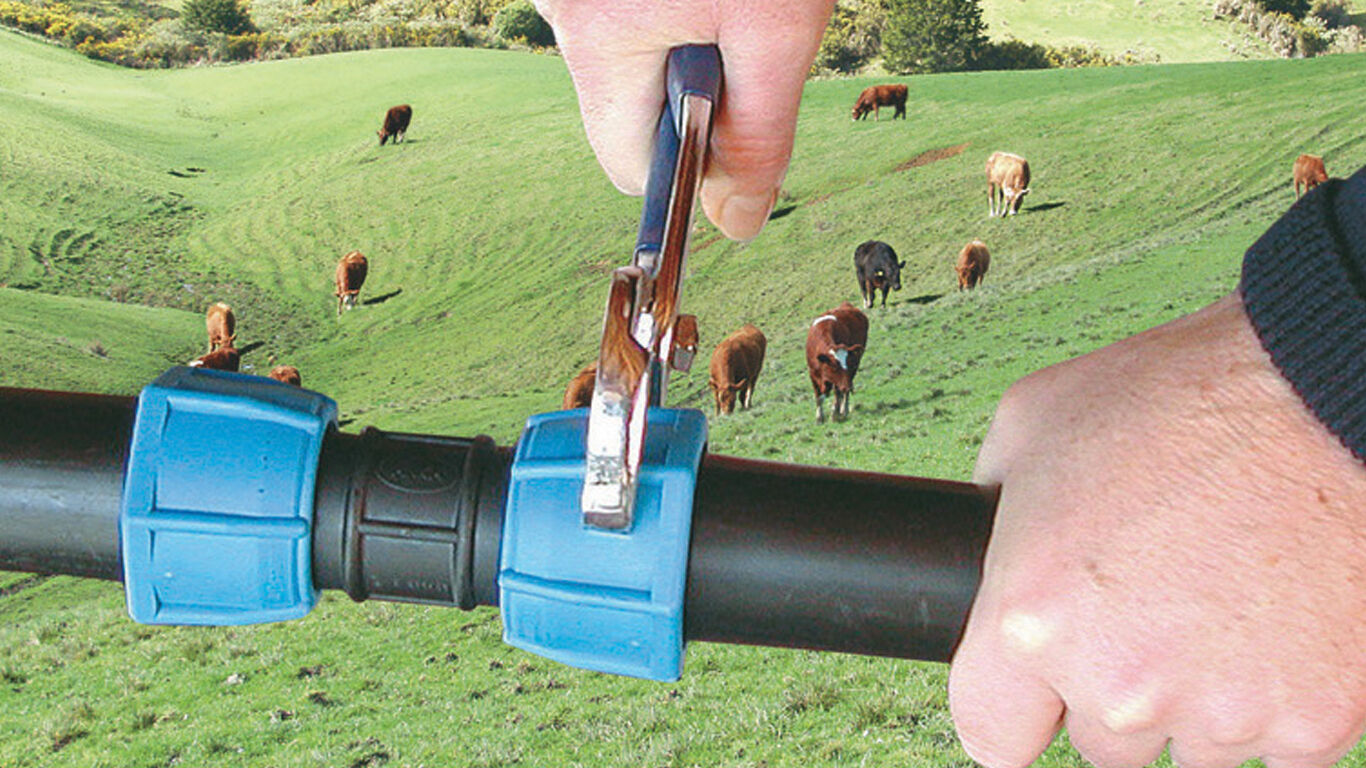

Key Highlights: Philmac’s unique and compact trough valve is essentially a float valve but has been designed specifically for stock troughs….

#9 The YEAR ROUND Float Valves!

Domain Est. 2022

Expert Sourcing Insights for Water Tank Float Valve

H2: 2026 Market Trends for Water Tank Float Valve

The global water tank float valve market is poised for steady growth and transformation by 2026, driven by urbanization, infrastructure development, and increasing emphasis on water conservation. Key trends shaping the market include technological advancements, regulatory standards, regional demand dynamics, and sustainability initiatives.

1. Rising Demand from Residential and Commercial Sectors

Rapid urbanization, particularly in emerging economies across Asia-Pacific, Africa, and Latin America, is fueling construction activities in residential and commercial segments. These developments require reliable water storage and management systems, boosting demand for durable and efficient float valves. By 2026, the expansion of smart homes and green buildings is expected to further integrate advanced float valves with leak-detection and water-saving features.

2. Adoption of Smart and IoT-Enabled Valves

A significant trend by 2026 is the integration of smart technologies into traditional float valves. IoT-enabled valves with remote monitoring, real-time water level alerts, and automated shut-off mechanisms are gaining traction, especially in developed markets. These innovations improve efficiency, reduce water wastage, and support predictive maintenance, appealing to municipal and industrial users focused on water resource optimization.

3. Emphasis on Water Conservation and Regulatory Compliance

With growing water scarcity concerns, governments and regulatory bodies are enforcing stricter water efficiency standards. By 2026, regulations mandating low-leakage and high-durability components in plumbing systems will drive demand for high-performance float valves made from corrosion-resistant materials such as brass, stainless steel, and advanced polymers. Compliance with standards like NSF/ANSI 61 and WRAS will become a key differentiator.

4. Shift Toward Sustainable and Durable Materials

Environmental concerns are prompting manufacturers to adopt recyclable and eco-friendly materials in float valve production. Innovations in engineering plastics and composite materials offer lightweight, rust-free alternatives to traditional metal valves. By 2026, the market will likely see increased preference for long-life, low-maintenance valves that reduce environmental impact and lifecycle costs.

5. Regional Growth Disparities and Opportunities

While North America and Europe focus on retrofitting aging infrastructure and adopting smart water systems, the Asia-Pacific region—led by India, China, and Southeast Asia—will dominate volume growth due to extensive new construction and government water supply programs. Africa and the Middle East also present emerging opportunities, supported by investments in water security and rural electrification.

6. Competitive Landscape and Innovation

By 2026, the market will witness intensified competition among key players such as Watts Water Technologies, Uponor, AVK Group, and local manufacturers. Ongoing R&D will focus on enhancing valve precision, durability, and compatibility with alternative water sources like rainwater harvesting and greywater systems, aligning with circular economy goals.

In summary, the 2026 water tank float valve market will be characterized by technological innovation, regulatory influence, and regional diversification, with a strong emphasis on efficiency, sustainability, and smart integration.

Common Pitfalls When Sourcing Water Tank Float Valve (Quality, IP)

Sourcing water tank float valves involves navigating several potential pitfalls, especially concerning quality and Ingress Protection (IP) ratings. Overlooking these aspects can lead to premature failure, water wastage, contamination, or safety hazards. Below are key pitfalls to avoid:

1. Prioritizing Cost Over Quality

One of the most common mistakes is selecting the cheapest float valve available without assessing build quality. Low-cost valves often use inferior materials like brittle plastics or non-corrosion-resistant metals, leading to:

- Cracking or warping under UV exposure or temperature fluctuations

- Corrosion in hard or chlorinated water

- Premature seal degradation, causing leaks or constant water flow

Always verify material specifications (e.g., brass, stainless steel, UV-stabilized polypropylene) and opt for reputable brands with proven durability.

2. Ignoring Ingress Protection (IP) Rating

Float valves used in outdoor or exposed environments must have an appropriate IP rating to prevent water and dust ingress into mechanical components:

- Pitfall: Using indoor-rated valves (e.g., IP44 or lower) in outdoor tanks leads to water intrusion, corrosion, and mechanical failure.

- Solution: Select valves with a minimum IP65 or IP68 rating for outdoor or submerged applications to ensure dust-tight and water-jet or submersion resistance.

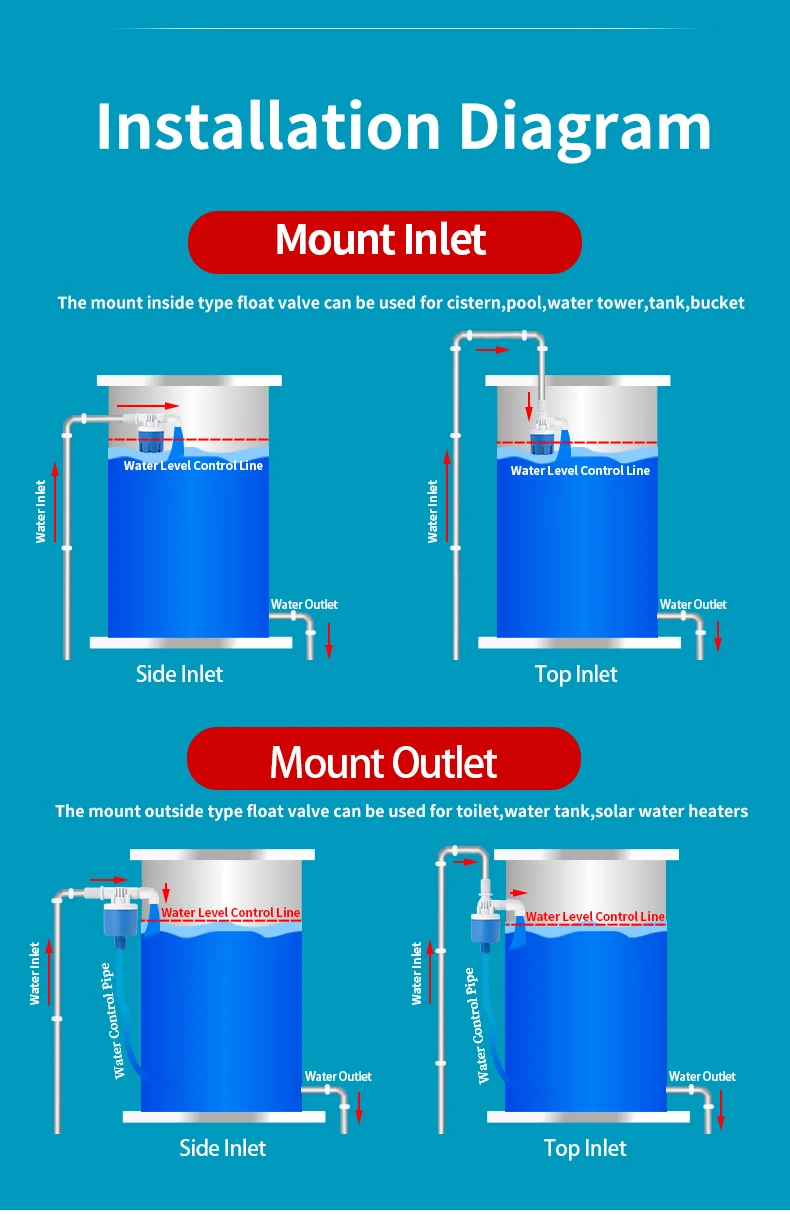

3. Mismatched Valve Type for Application

Using the wrong type of float valve (ballcock vs. diaphragm vs. float switch) for the specific tank or water system can cause inefficiency or failure:

- Pitfall: Installing a gravity-fed ballcock in a high-pressure municipal line can cause hammering and failure.

- Solution: Match the valve to system pressure, water type (potable, greywater), and tank orientation (top, side, or bottom entry).

4. Overlooking Certification and Compliance

Float valves for potable water must comply with health and safety standards:

- Pitfall: Sourcing non-certified valves risks leaching harmful substances (e.g., lead, BPA) into drinking water.

- Solution: Ensure valves meet relevant standards like NSF/ANSI 61, WRAS (UK), or ASSE 1002 for potable water applications.

5. Neglecting Environmental and Operational Conditions

Failure to consider ambient conditions leads to poor performance:

- Pitfall: Using standard valves in areas with extreme temperatures, UV exposure, or chemical presence accelerates degradation.

- Solution: Specify UV-resistant materials for rooftop tanks and chemical-resistant seals for industrial use.

6. Inadequate Supplier Vetting

Sourcing from unreliable suppliers increases the risk of counterfeit or substandard products:

- Pitfall: Receiving valves with inconsistent dimensions, weak floats, or poor sealing mechanisms due to lax quality control.

- Solution: Audit suppliers for certifications (ISO 9001), request product samples, and check customer reviews or third-party testing reports.

7. Assuming All “Stainless Steel” Valves Are Equal

Not all stainless steel is suitable for water applications:

- Pitfall: Using low-grade stainless steel (e.g., 304) in chlorinated or salt-laden environments can still lead to pitting corrosion.

- Solution: For harsh conditions, specify 316 stainless steel, which offers superior corrosion resistance.

By addressing these pitfalls—particularly those related to material quality, IP rating, compliance, and supplier reliability—you can ensure reliable, safe, and long-lasting performance of water tank float valves.

Logistics & Compliance Guide for Water Tank Float Valve

This guide outlines key logistics considerations and compliance requirements for the import, distribution, and use of water tank float valves. Adhering to these guidelines ensures smooth operations, regulatory compliance, and product safety.

Regulatory Compliance Requirements

Ensuring that water tank float valves meet applicable standards and regulations is critical for market access and consumer safety. Key compliance areas include:

Material Safety and Potable Water Standards

Float valves intended for use in drinking water systems must comply with regulations governing materials in contact with potable water. Common standards include:

– NSF/ANSI 61 (USA): Certifies that product components do not leach harmful contaminants into drinking water.

– WRAS Approval (UK): Confirms compliance with the Water Supply (Water Fittings) Regulations.

– ACS Certification (France): Required for materials in contact with drinking water.

– DVGW W270 (Germany): Governs material suitability for drinking water installations.

Manufacturers and importers must ensure the float valve’s materials (e.g., brass, plastic, seals) are certified under the relevant standard for the target market.

Product Safety and Performance Standards

Performance standards ensure valves operate reliably and prevent water wastage or overflow. Key standards include:

– ASSE 1002 (USA): Standard for ballcocks (flush valves) in tanks, often referenced for float valve performance.

– BS EN 817 (Europe): Specifies requirements for sanitary tapware, including float valves.

– AS/NZS 3500.1 (Australia/New Zealand): Plumbing and drainage standards covering water supply systems.

Testing for durability, leak resistance, pressure tolerance, and shut-off accuracy is typically required.

Electrical Safety (if applicable)

If the float valve integrates with electronic sensors or solenoid valves, compliance with electrical safety standards such as:

– IEC 60335 (Household electrical safety)

– UL 1076 (Alarm systems, if used in monitoring)

may be necessary.

Environmental and Chemical Restrictions

Compliance with environmental regulations such as:

– RoHS (Restriction of Hazardous Substances) – EU

– REACH – EU chemical regulation

– Proposition 65 – California, USA (warning requirements for carcinogens and reproductive toxins)

is essential, particularly for metal alloys (e.g., lead content in brass components).

Import and Customs Compliance

Importing float valves requires adherence to customs regulations and accurate documentation to avoid delays.

Harmonized System (HS) Code Classification

Correct HS code classification ensures accurate duty assessment and regulatory tracking. Typical codes include:

– 8481.80 – Tap, cocks, valves, and similar appliances for pipes, boiler shells, tanks, etc.

– 8481.80.90 – Other valves (specific sub-codes vary by country and valve type).

Consult local customs authorities for precise classification.

Required Documentation

Standard import documentation includes:

– Commercial Invoice

– Packing List

– Bill of Lading/Air Waybill

– Certificate of Origin

– Product Compliance Certificates (e.g., NSF, WRAS)

– Test Reports (material and performance)

Import Restrictions and Duties

Some countries impose specific requirements or restrictions on plumbing components. Examples include:

– Mandatory local certification (e.g., INMETRO in Brazil, BIS in India)

– Tariff rates based on material (e.g., brass vs. plastic valves)

– Anti-dumping duties on imports from certain countries

Verify requirements with local regulatory bodies or customs brokers.

Packaging and Labeling Requirements

Proper packaging and labeling ensure product integrity and regulatory compliance.

Packaging Standards

- Use durable packaging to prevent damage during transit.

- Include moisture-resistant materials if shipping to humid environments.

- Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”).

Labeling and Marking

Product labels must include:

– Manufacturer name and address

– Model and part number

– Size (e.g., 1/2″, 3/4″)

– Maximum operating pressure and temperature

– Compliance marks (e.g., NSF, WRAS, CE)

– Country of origin

Labels must be legible, permanent, and in the official language(s) of the destination country.

Transportation and Storage Logistics

Efficient handling and storage are vital for maintaining product quality.

Transport Considerations

- Use palletized shipping for bulk orders to prevent shifting.

- Secure loads to avoid damage during transit.

- Avoid extreme temperatures and moisture exposure.

Storage Conditions

- Store in a dry, climate-controlled environment.

- Keep away from direct sunlight and corrosive chemicals.

- Maintain inventory rotation (FIFO – First In, First Out) to prevent aging.

End-of-Life and Environmental Responsibility

Consider environmental impact throughout the product lifecycle.

Recycling and Disposal

- Inform customers about recyclability of materials (e.g., brass, polypropylene).

- Comply with local WEEE (Waste Electrical and Electronic Equipment) directives if applicable.

- Provide disposal guidelines in product documentation.

Sustainable Sourcing

- Prioritize suppliers with environmental management systems (e.g., ISO 14001).

- Minimize packaging waste and use recyclable materials where possible.

Conclusion

Successfully managing the logistics and compliance of water tank float valves requires attention to material safety, regulatory standards, customs procedures, and responsible handling. By ensuring compliance across all stages—from manufacturing to end-of-life—businesses can mitigate risks, enhance customer trust, and support sustainable operations. Always consult local regulations and obtain certifications relevant to your target markets.

Conclusion for Sourcing a Water Tank Float Valve:

Sourcing the right water tank float valve is a critical decision that directly impacts the efficiency, reliability, and safety of water storage and distribution systems. After evaluating various options based on material quality, durability, compatibility with tank types, ease of installation, and cost-effectiveness, it is evident that selecting a float valve from a reputable supplier ensures long-term performance and minimizes maintenance needs.

Stainless steel or high-grade plastic valves are preferred for their resistance to corrosion and longevity, especially in varying water conditions. Additionally, considering features such as adjustable float arms, leak-proof seals, and compliance with health and safety standards (e.g., NSF, WRAS) enhances system reliability.

In conclusion, a well-sourced float valve not only prevents water wastage and potential overflow but also contributes to sustainable water management. Prioritizing quality over initial cost, verifying supplier credentials, and ensuring compatibility with existing systems are essential steps in making an informed and effective procurement decision.