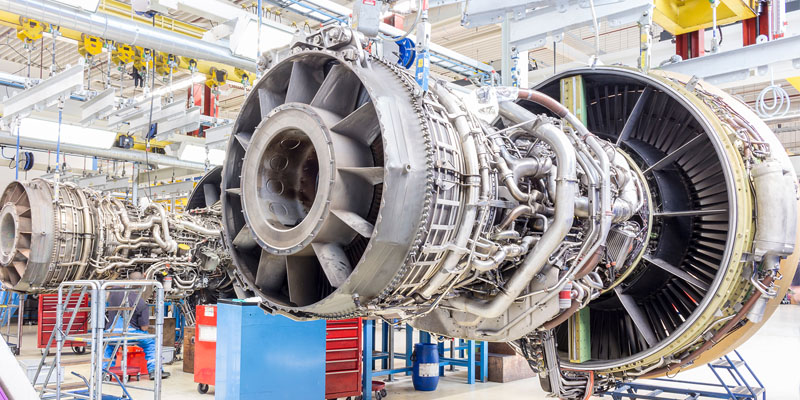

The global water jet cutting machine market is experiencing robust growth, driven by increasing demand for precision cutting solutions across industries such as automotive, aerospace, and manufacturing. According to Grand View Research, the market was valued at USD 967.2 million in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. This growth is fueled by the technology’s ability to cut a wide range of materials—metals, composites, stone, and glass—without generating heat-affected zones, making it ideal for high-precision applications. As industries continue to prioritize efficiency, sustainability, and accuracy, the adoption of advanced water jet cutting systems is on the rise. In this evolving landscape, a select group of manufacturers are leading innovation, offering scalable, high-performance solutions that meet the demands of modern fabrication. Here are the top 10 water jet cutter manufacturers shaping the future of industrial cutting.

Top 10 Water Jet Cutters Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High

Domain Est. 2002

Website: mecanumeric.com

Key Highlights: MECANUMERIC is a French manufacturer of very high pressure water jet cutting machines, with or without abrasives, for cutting all materials, even complex ……

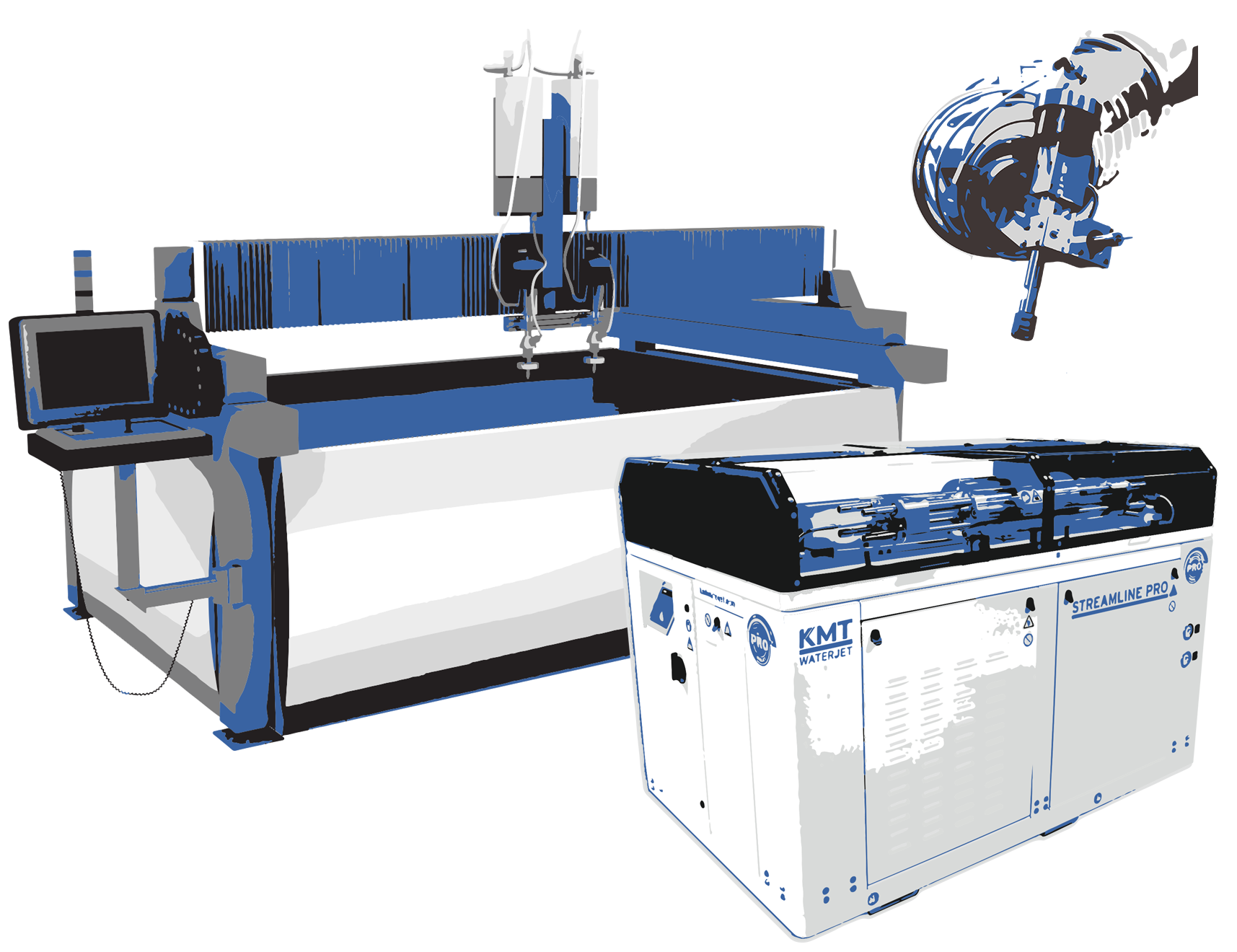

#2 KMT Waterjet

Domain Est. 2003

Website: kmtwaterjet.com

Key Highlights: KMT Waterjet: Pioneers in waterjet cutting technology. Discover pumps, parts, and complete systems for precision solutions….

#3 Jet Edge Waterjet Systems

Domain Est. 2018

Website: jetedgewaterjets.com

Key Highlights: Jet Edge Waterjet Systems is a leading manufacturer of waterjet and abrasive waterjet Cutters, ultra high pressure pumps, and accessories….

#4 – Flow International

Domain Est. 1995

Website: flowcorp.com

Key Highlights: A global leader in advanced cutting and forming solutions, including ultrahigh-pressure waterjet, fiber laser, and press brake technologies….

#5 Tailored Waterjet Solutions

Domain Est. 2000

Website: wardjet.com

Key Highlights: We’ve built and installed thousands of waterjet machines across a diverse industry portfolio to suit specific manufacturing and material cutting needs….

#6 Waterjet Cutting

Domain Est. 2002

Website: waterjet-cutting.com

Key Highlights: Discover top water jet cutting companies in the US offering premium services and competitive prices for high-quality products, saving you time….

#7 Flow Waterjet

Domain Est. 2003

Website: flowwaterjet.com

Key Highlights: Flow is the inventor and world leader in waterjet cutting solutions. With waterjet, you’ve got the versatility to cut any material, any shape, and any size….

#8 TCI Cutting

Domain Est. 2010

Website: tcicutting.com

Key Highlights: We manufacture laser, water and plasma cutting machines. We develop machines focused on obtaining the maximum productive performance….

#9 Finepart: Micro Waterjet Cutting Machines

Domain Est. 2015

Website: finepart.com

Key Highlights: Discover our new generation of high-precision micro waterjet machines, which cut cold with no heat effect, meaning no material distortions….

#10 Waterjet Corporation

Domain Est. 2003

Website: waterjetcorp.com

Key Highlights: Waterjet Corporation is specialised in the production of high-performance, innovative machinery for cutting and hydrofinishing with water jets. Find out more ……

Expert Sourcing Insights for Water Jet Cutters

H2: 2026 Market Trends for Water Jet Cutters

The water jet cutting market is poised for significant transformation by 2026, driven by technological innovation, expanding industrial applications, and a growing emphasis on sustainability. Key trends shaping the industry include:

1. Rising Demand for Precision and Multi-Material Capabilities

Industries such as aerospace, automotive, and medical devices are increasingly adopting water jet cutting for its ability to cut complex geometries in materials ranging from titanium and composites to glass and stone—without heat-affected zones. By 2026, manufacturers will continue prioritizing ultra-high-pressure systems (often exceeding 90,000 psi) and enhanced motion control systems to meet tighter tolerances and intricate design requirements.

2. Integration of Automation and Industry 4.0 Technologies

Smart manufacturing is a dominant trend, with water jet systems incorporating IoT connectivity, real-time monitoring, predictive maintenance, and AI-driven optimization. By 2026, expect wider adoption of automated loading/unloading systems, robotic arms, and seamless integration with CAD/CAM and enterprise resource planning (ERP) software, improving throughput and reducing labor costs.

3. Sustainability and Environmental Advantages Driving Adoption

As environmental regulations tighten, manufacturers are shifting toward cold-cutting technologies to reduce emissions, energy use, and hazardous byproducts. Water jet cutting—using only water and abrasive (or pure water for soft materials)—aligns with green manufacturing goals. Enhanced water recycling systems and closed-loop filtration will become standard, minimizing waste and operational costs.

4. Growth in Emerging Markets and Diversified Applications

Beyond traditional industrial sectors, water jet technology is expanding into architecture, art, food processing, and renewable energy (e.g., solar panel and battery component fabrication). Emerging economies in Asia-Pacific and Latin America are investing in advanced manufacturing, fueling demand for affordable, versatile cutting solutions.

5. Advancements in Abrasive Efficiency and Nozzle Technology

Ongoing R&D is focused on extending nozzle lifespan, improving abrasive mixing efficiency, and reducing consumable costs. By 2026, expect wider commercialization of hybrid nozzles, smart abrasive delivery systems, and proprietary materials that enhance cutting speed and precision.

6. Competitive Landscape and Strategic Consolidation

Major players like OMAX, Flow International, and KMT Waterjet are investing heavily in R&D and global distribution. Increased competition is likely to spur partnerships, mergers, and product diversification, particularly in mid-range and compact systems tailored for small and medium enterprises (SMEs).

In summary, the 2026 water jet cutter market will be defined by smarter, greener, and more accessible technology, positioning it as a cornerstone of modern precision manufacturing across a broadening spectrum of industries.

Common Pitfalls When Sourcing Water Jet Cutters (Quality, IP)

Sourcing water jet cutters can offer significant advantages in precision cutting across diverse materials. However, overlooking key quality and intellectual property (IP) considerations can lead to costly setbacks, operational inefficiencies, and legal risks. Below are critical pitfalls to avoid:

Poor Machine Build Quality and Component Selection

One of the most frequent issues is underestimating the importance of robust construction and high-grade components. Low-cost water jet cutters often use substandard pumps, seals, and motion systems that degrade quickly under high pressure (typically 55,000–90,000 psi). This results in frequent breakdowns, inconsistent cutting performance, and increased downtime. Buyers should verify the manufacturer’s use of industrial-grade materials, precision linear guides, and reputable pump brands (e.g., intensifier or direct-drive pumps from known suppliers) to ensure longevity and reliability.

Inadequate or Misrepresented Cutting Precision and Tolerance

Some suppliers exaggerate specifications such as cutting accuracy, kerf width, or taper control. Without third-party validation or performance testing data, buyers may receive machines that fail to meet required tolerances—especially critical in aerospace, medical, or automotive applications. Always request live demonstrations or reference customer case studies using materials relevant to your needs, and verify stated tolerances under real-world conditions.

Lack of IP Protection in Custom or Integrated Systems

When sourcing customized water jet systems (e.g., automated loading, specialized software, or unique nozzle designs), there’s a risk of unclear IP ownership. Suppliers may incorporate proprietary technologies without proper licensing or may retain rights to improvements developed during integration. This can restrict your ability to modify, maintain, or scale the system later. Ensure contracts explicitly define IP ownership, software licensing terms, and rights to future modifications.

Use of Counterfeit or Unlicensed Software and Control Systems

Some manufacturers use cloned or pirated CNC control software, which can lead to system instability, lack of updates, and legal liability for the end-user. Using unlicensed software also voids warranties and support. Verify that the control system (e.g., OEM versions of Hypertherm, Siemens, or Fanuc) is genuine and comes with valid licenses. Request documentation and proof of software authenticity before purchase.

Insufficient After-Sales Support and Technical Documentation

Low-cost suppliers, particularly from regions with weak regulatory oversight, may provide inadequate technical documentation, training, or spare parts support. This becomes problematic when troubleshooting or maintaining the system. Poor documentation can also hinder compliance with safety or quality standards (e.g., ISO, CE). Confirm that comprehensive manuals, schematics, and training are included, and assess the supplier’s service network and response times.

Hidden IP Risks in Consumables and Nozzle Technology

Advanced nozzle designs and abrasive delivery systems often contain patented technologies. Sourcing machines that use proprietary consumables without proper licensing exposes buyers to infringement claims. Additionally, some suppliers lock customers into overpriced consumables by designing non-standard interfaces. Ensure that consumable components are either licensed or use open-standard designs to avoid dependency and legal exposure.

Failure to Audit Supplier IP Compliance

Before finalizing a purchase, conduct due diligence on the supplier’s IP practices. This includes checking for existing patents related to their technology, verifying compliance with international IP laws, and ensuring they do not infringe on third-party designs. A supplier operating in a jurisdiction with lax IP enforcement may unknowingly (or knowingly) offer infringing products, putting your operations at risk.

By proactively addressing these quality and IP-related pitfalls, businesses can secure reliable, legally sound water jet cutting solutions that support long-term operational success.

Logistics & Compliance Guide for Water Jet Cutters

Overview of Water Jet Cutting Technology

Water jet cutters utilize high-pressure streams of water, often mixed with abrasives, to cut a wide range of materials including metal, stone, glass, and composites. Due to their precision and versatility, they are widely used in manufacturing, aerospace, automotive, and construction industries. However, shipping, handling, and operating these systems involve specific logistical and regulatory considerations.

Regulatory Compliance

Environmental Regulations

Water jet cutting operations generate wastewater containing fine particulate matter, metal sludge, and potentially hazardous additives. Compliance with environmental protection laws is essential:

- EPA Regulations (USA): Facilities must comply with the Clean Water Act and Resource Conservation and Recovery Act (RCRA). Wastewater discharge requires proper filtration and treatment. Sludge disposal must follow hazardous waste guidelines if contaminants exceed thresholds.

- REACH & RoHS (EU): Ensure all materials and components used in the cutting process meet EU chemical safety standards.

- Local Permits: Many jurisdictions require permits for water discharge or industrial wastewater treatment. Check with local environmental agencies before installation.

Occupational Health and Safety

Water jet systems operate at extremely high pressures (up to 90,000 psi), posing significant safety risks:

- OSHA Standards (USA): Adhere to machine guarding, lockout/tagout (LOTO), and personal protective equipment (PPE) requirements.

- Pressure Safety: High-pressure plumbing and fittings must be regularly inspected. All personnel should be trained in high-pressure hazard awareness.

- Noise Control: Water jet systems generate significant noise; hearing protection and sound-dampening enclosures may be required.

- Abrasive Handling: Silica sand and other abrasives can cause respiratory issues. Use proper ventilation and respirators where needed. Consider low-silica or non-silica abrasives to reduce health risks.

Electrical and Equipment Standards

- CE Marking (EU): Equipment must comply with Machinery Directive, Low Voltage Directive, and Electromagnetic Compatibility (EMC) Directive.

- UL/CSA Certification (North America): Electrical components must meet regional safety standards.

- NFPA 70 (NEC): Proper electrical installation in compliance with National Electrical Code is required.

Logistics and Transportation

Packaging and Shipping

Water jet cutters are large, heavy, and contain sensitive components. Proper packaging is essential:

- Crate and Secure: Use wooden crates with internal bracing to protect pumps, nozzles, control panels, and motion systems.

- Moisture Protection: Include desiccants and moisture barriers to prevent internal condensation during transit.

- Labeling: Clearly label units as “Fragile,” “This Side Up,” and “Do Not Stack.” Include handling instructions and weight specifications.

Import/Export Considerations

- Customs Documentation: Prepare commercial invoices, packing lists, and certificates of origin. Include HS codes specific to industrial cutting machinery (e.g., 8460.2.00 for machine tools for planing, shaping, or cutting).

- Export Controls: Verify if components (e.g., high-pressure pumps or CNC controllers) are subject to export restrictions under ITAR or EAR regulations, especially for dual-use technology.

- Duties and Tariffs: Research applicable tariffs based on destination country. Some regions offer exemptions for industrial machinery used in manufacturing.

Installation and Site Preparation

- Floor Load Capacity: Confirm that the facility floor can support the system’s weight (often 5,000–10,000 lbs or more).

- Utilities: Ensure access to sufficient water supply, proper drainage, high-capacity electrical service (typically 480V 3-phase), and compressed air if used for dry cutting or automation.

- Ventilation and Space: Allow adequate space for operation, maintenance, and material handling. Install fume or mist extraction if cutting materials emit harmful particles.

Maintenance and Operational Compliance

Routine Maintenance

- Filter Changes: Replace water filters regularly to maintain cutting efficiency and protect pumps.

- Nozzle Inspection: Inspect and replace focusing tubes and abrasive delivery systems as wear occurs.

- Pump Servicing: Follow manufacturer guidelines for oil changes, seal replacements, and high-pressure seal maintenance.

Record Keeping

- Maintain logs for:

- Equipment maintenance and repairs

- Wastewater treatment and disposal

- Employee safety training

- Regulatory inspections and certifications

Disposal and End-of-Life

- Hazardous Waste Disposal: Used abrasives and contaminated water filters may be classified as hazardous. Dispose through licensed waste management services.

- Equipment Recycling: Metal components, electronics, and high-pressure parts should be recycled in accordance with local e-waste and scrap metal regulations.

- Data Security: If the system includes CNC controllers with stored data, ensure secure data wipe before decommissioning.

Conclusion

Compliance and logistics for water jet cutters involve multi-faceted coordination between environmental, safety, transportation, and operational standards. Proactive planning, adherence to local and international regulations, and regular maintenance ensure safe, efficient, and legally compliant operations throughout the equipment lifecycle.

Conclusion for Sourcing Water Jet Cutters

In conclusion, sourcing water jet cutting machines requires a comprehensive evaluation of several key factors, including cutting precision, material compatibility, production volume, operational costs, and long-term maintenance requirements. Water jet technology offers significant advantages over traditional cutting methods—such as minimal heat-affected zones, versatility across a wide range of materials (from metals to composites and stone), and environmentally friendly operation—making it an ideal solution for industries demanding high precision and flexibility.

When sourcing, it is essential to choose reputable suppliers with proven track records, strong after-sales support, and the capability to provide customized solutions tailored to specific operational needs. Additionally, considerations such as pump type (intensifier vs. direct-drive), cutting speed, nozzle technology, and software integration play a crucial role in maximizing efficiency and return on investment.

Ultimately, investing in the right water jet cutter—aligned with your production goals and budget—can significantly enhance manufacturing capabilities, improve product quality, and reduce waste. With careful planning and due diligence in the sourcing process, businesses can leverage water jet cutting technology to gain a competitive edge in today’s evolving industrial landscape.