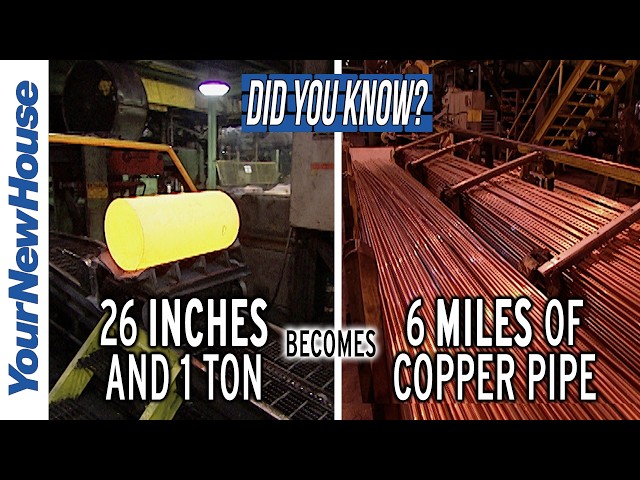

The global water heater market is witnessing steady expansion, driven by rising urbanization, increasing demand for energy-efficient heating solutions, and stringent government regulations promoting sustainable infrastructure. According to Mordor Intelligence, the global water heater market was valued at USD 26.8 billion in 2023 and is projected to grow at a CAGR of 4.9% through 2029. This growth directly fuels demand for high-quality components, particularly copper piping—renowned for its thermal conductivity, corrosion resistance, and durability in hot water systems. As water heater manufacturers prioritize performance and compliance, the reliance on reliable copper pipe suppliers has intensified. In this context, a select group of manufacturers has emerged as leaders in producing copper pipes specifically engineered for water heater applications, combining precision manufacturing, material integrity, and scalability to support the expanding thermal equipment sector.

Top 10 Water Heater Copper Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mueller Industries

Domain Est. 1996

Website: muellerindustries.com

Key Highlights: Mueller Industries, Inc. is an industrial manufacturer that specializes in copper and copper alloy manufacturing while also producing goods made from aluminum, ……

#2 cello_index

Domain Est. 2012

Website: celloproducts.com

Key Highlights: Cello Products Inc. is the premier copper solder fittings manufacturer in North America and is one of the only cast brass fittings producers….

#3 Cerro Flow Products

Domain Est. 1996

Website: cerro.com

Key Highlights: Welcome to Cerro Flow Products LLC®. We manufacture world-class copper tube and supply fittings for the Plumbing, HVAC/Refrigeration, and Industrial markets….

#4 Copper tubes for heating, air

Domain Est. 1997

Website: silmet.com

Key Highlights: Silmet is the world leader in the production of copper tubes for water, heating, air-conditioning and sanitary applications and industrial use in Level Wound ……

#5 Sioux Chief: Rough Plumbing Products

Domain Est. 1997

Website: siouxchief.com

Key Highlights: We are an American manufacturer. Sioux Chief believes in making our products right here in America. American manufacturing is important….

#6 Heat Pipes

Domain Est. 2003

Website: 1-act.com

Key Highlights: ACT, a leading heat pipe manufacturer, makes copper/water heat pipes into two basic geometries: Tubular Heat Pipes and Planar Heat Pipes….

#7 Great Lakes Copper Ltd.

Domain Est. 2010 | Founded: 1958

Website: glcopper.com

Key Highlights: Welcome to Great Lakes Copper Ltd. Manufacturing copper tube for the plumbing, refrigeration and industrial markets since 1958….

#8 VF Copper-Tube Vertical Water Heater

Domain Est. 1995

Website: hotwater.com

Key Highlights: The VF™ Water Heater is capable of firing from 100% to 25% or a 4:1 turndown ratio of rated input based on the current system demand. The VF’s modulating ……

#9 Plumbing/HVAC

Domain Est. 1995

Website: copper.org

Key Highlights: Copper tube, pipe and fittings home page by CDA to provide industry professionals and consumers with information of copper applications in plumbing….

#10 Copper Tube Product

Domain Est. 1996

Website: unitedpipe.com

Key Highlights: We have a full line of copper tube and copper coils for plumbing, heating, air-conditioning, water works, refrigeration, medical, gas and other applications….

Expert Sourcing Insights for Water Heater Copper Pipe

2026 Market Trends for Water Heater Copper Pipe

The global market for copper pipes used specifically in water heater applications is expected to experience steady growth and notable shifts by 2026, driven by evolving construction standards, energy efficiency demands, material innovation, and regional economic dynamics. This analysis explores key trends shaping the water heater copper pipe sector through 2026 under the H2 (hydrogen-ready or hydrogen-compatible) considerations, as the energy transition influences infrastructure materials.

Rising Demand for Hydrogen-Ready Plumbing Infrastructure

With increasing government initiatives to decarbonize energy systems, hydrogen is emerging as a viable alternative to natural gas in residential and commercial heating. By 2026, many countries—especially in Europe, Japan, and South Korea—are advancing hydrogen blending programs and pilot projects for hydrogen-ready homes. Copper pipes are gaining favor in this transition due to their proven resistance to hydrogen embrittlement compared to certain plastics and lower-grade metals. As water heaters adapt to hydrogen-compatible combustion systems, demand for high-purity, thick-walled copper tubing (Types L and K) is expected to rise, particularly in new-build and retrofit applications designed for future hydrogen use.

Regulatory and Building Code Evolution

Building codes are anticipated to evolve by 2026 to accommodate low-carbon heating technologies. In regions adopting H2 blending (up to 20% hydrogen in natural gas), plumbing standards such as ASTM B88 and EN 1057 are expected to include stricter specifications for copper pipe integrity, joint reliability, and leak prevention. These updates will drive demand for certified, high-quality copper pipes in water heater installations, reinforcing copper’s position over alternative materials like PEX or CPVC, which may degrade under hydrogen exposure over time.

Regional Market Divergence

North America and Western Europe will lead in adopting hydrogen-compatible water heating systems, boosting copper pipe demand. In contrast, developing markets in Asia and Africa may continue prioritizing cost-effective materials, though urban infrastructure projects in China and India are beginning to incorporate copper in premium residential and commercial developments aligned with green building standards. The Middle East, leveraging its energy transition strategies, may also increase copper pipe imports for smart city projects integrating H2-ready utilities.

Supply Chain and Sustainability Pressures

Copper supply chains are expected to face volatility due to rising electric vehicle (EV) and renewable energy demands, which also rely heavily on copper. By 2026, manufacturers of water heater copper pipes may face pricing pressures, incentivizing greater recycling and the use of secondary copper. Environmental, Social, and Governance (ESG) standards will likely require greater transparency in sourcing, pushing producers toward certified sustainable copper. This could further differentiate high-grade H2-compatible copper products in the market.

Competitive Landscape and Material Substitution

Despite the advantages of copper in hydrogen environments, material substitution remains a challenge. Cross-linked polyethylene (PEX) continues to dominate in cost-sensitive markets. However, as hydrogen compatibility becomes a regulatory necessity, especially in water heater connections exposed to higher temperatures and potential H2 permeation, copper’s durability will strengthen its market share in critical applications. Innovations such as coated copper pipes to further reduce corrosion and improve thermal efficiency may emerge by 2026, enhancing competitiveness.

Conclusion

By 2026, the water heater copper pipe market will be increasingly influenced by the global shift toward hydrogen-based energy systems. The H2-readiness of copper infrastructure positions it as a preferred material for next-generation water heating solutions, especially in regions advancing clean energy policies. Growth will be driven by regulatory support, material performance advantages, and sustainability imperatives, though supply chain resilience and cost management will remain critical challenges for stakeholders.

Common Pitfalls When Sourcing Water Heater Copper Pipe (Quality, IP)

Sourcing copper pipe for water heater installations requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these factors can lead to system failures, safety hazards, legal issues, and financial losses. Below are key pitfalls to avoid:

Poor Material Quality

Using substandard copper pipe can compromise the integrity, efficiency, and safety of a water heating system. Common quality-related pitfalls include:

- Non-Compliant Alloy Composition: Sourcing pipe that does not meet ASTM B88 or local plumbing code standards (e.g., Type L or Type M copper) may result in premature corrosion, leaks, or bursting under pressure.

- Thin Wall Thickness: Inferior pipes may have walls thinner than specified, reducing durability and pressure tolerance—especially critical near high-temperature water heaters.

- Poor Manufacturing Practices: Pipes with inconsistent diameters, surface pitting, or improper annealing can lead to weak joints, difficulty in installation, and increased risk of failure.

- Counterfeit or Recycled Materials: Some suppliers offer copper pipe made from recycled or non-potable-grade materials that may leach contaminants or fail under thermal stress.

Intellectual Property (IP) Violations

While less obvious, IP issues can arise when sourcing components, particularly with branded or patented products:

- Unauthorized Use of Branding: Using or sourcing copper pipe that falsely bears trademarks (e.g., imitations of well-known brands like Uponor or Viega) can expose contractors and suppliers to legal liability.

- Patented Fitting Systems: Some copper piping systems include proprietary joint or connection technologies protected by patents. Using knock-offs or incompatible fittings may infringe on IP rights and void warranties.

- Misrepresentation in Documentation: Suppliers may provide falsified certifications or test reports that mimic legitimate documentation, misleading buyers about compliance and origin.

Best Practices to Avoid Pitfalls

- Source from Reputable Suppliers: Use certified distributors or manufacturers with verifiable quality control and compliance records.

- Verify Certifications: Confirm that copper pipe meets ASTM B88, NSF/ANSI 61 (for potable water), and local plumbing codes.

- Inspect Material Upon Delivery: Check for proper markings, wall thickness, and surface quality before installation.

- Conduct Supplier Due Diligence: Research supplier legitimacy, review client testimonials, and request proof of IP compliance where applicable.

By proactively addressing both quality and IP concerns, professionals can ensure reliable, code-compliant, and legally sound water heater installations.

Logistics & Compliance Guide for Water Heater Copper Pipe

Overview

This guide outlines the logistics and compliance requirements for handling, transporting, storing, and installing copper piping used in water heater systems. Adherence to industry standards, regulatory codes, and best practices ensures safety, efficiency, and legal compliance throughout the supply chain and installation process.

Regulatory and Industry Standards Compliance

Plumbing Codes

Copper piping for water heaters must comply with national and local plumbing codes. Key standards include:

– International Plumbing Code (IPC) – Governs materials, installation methods, and system design.

– Uniform Plumbing Code (UPC) – Widely adopted in the U.S.; specifies copper tube types (e.g., Type M, L, K) based on application and pressure requirements.

– Local Jurisdiction Requirements – Some municipalities enforce amendments or additional inspections; verify with local authorities before installation.

Material Standards

Copper pipe must meet ASTM (American Society for Testing and Materials) standards:

– ASTM B88 – Standard specification for seamless copper water tubes.

– ASTM B280 – For ac refrigerant copper tubes (not applicable to potable water).

– Ensure pipes are certified for potable water use (lead-free compliance under NSF/ANSI 61 and 372).

Environmental and Safety Regulations

- Lead-Free Compliance: As mandated by the U.S. Safe Drinking Water Act, copper piping and fittings must contain ≤0.25% lead (weighted average).

- OSHA Guidelines: Safe handling practices to prevent injury during transport and installation (e.g., cuts from burrs, exposure to soldering fumes).

- DOT Regulations: For transportation of heavy copper coils or rigid piping (e.g., secure load binding, proper labeling).

Logistics and Supply Chain Management

Sourcing and Procurement

- Purchase from certified suppliers adhering to ASTM B88 and NSF standards.

- Verify mill test reports and material certifications with each shipment.

- Specify required copper type (e.g., Type L for high-pressure domestic hot water systems).

Packaging and Labeling

- Copper pipes should be bundled securely with protective end caps to prevent contamination and damage.

- Labels must include:

- ASTM standard (e.g., ASTM B88)

- Copper type (K, L, M)

- Diameter and wall thickness

- Lead-free certification

- Manufacturer and batch/lot number

Transportation

- Use flatbed or enclosed trucks with adequate support to prevent bending.

- Secure loads with straps to avoid shifting; avoid sharp impacts.

- Protect from moisture and corrosive environments during transit.

- Follow Department of Transportation (DOT) regulations for load securement (49 CFR Part 393).

Storage and Handling

- Store indoors or under cover to prevent oxidation, moisture exposure, and contamination.

- Elevate bundles off the ground using pallets or racks to avoid soil contact.

- Handle with clean gloves to reduce oil and dirt transfer; use lifting slings for heavy coils.

- Keep away from galvanized steel or other dissimilar metals to prevent galvanic corrosion.

Installation and Field Compliance

Proper Sizing and Application

- Match pipe type to system requirements:

- Type K – Thickest wall; suitable for underground or high-pressure applications.

- Type L – Standard for most residential and commercial hot water lines.

- Type M – Thinner wall; acceptable in low-pressure systems, but verify local code acceptance.

- Ensure correct diameter (e.g., ½”, ¾”) based on fixture units and flow requirements.

Joining Methods

- Soldered (Sweat) Joints: Use lead-free solder (≤0.2% lead) per NSF/ANSI 61. Apply flux only to the outside of fittings.

- Press/Push-Fit Systems: Approved for copper; require compatible fittings and tools.

- Flared or Compression Fittings: For specific appliance connections (e.g., water heater inlets).

Inspections and Testing

- Pressure test completed systems per IPC or UPC (typically 1.5x working pressure for 15–30 minutes).

- Document compliance with local building department requirements.

- Final inspection may require third-party verification in some jurisdictions.

Documentation and Recordkeeping

- Retain supplier certifications, material test reports, and compliance declarations.

- Maintain installation records, including pressure test results and inspector sign-offs.

- Provide homeowners or facility managers with system documentation for future maintenance.

Conclusion

Proper logistics and compliance for water heater copper pipe are essential to ensure system longevity, public health, and adherence to legal standards. By following recognized codes, handling materials correctly, and documenting all processes, stakeholders can prevent failures, reduce liability, and deliver safe, reliable plumbing systems.

In conclusion, sourcing copper pipe for water heater installations requires careful consideration of quality, compliance with local plumbing codes, and suitability for the specific application. Copper pipes, particularly Type L or Type M, are widely preferred for their durability, resistance to heat, and long-term reliability in hot water systems. When sourcing materials, it is essential to purchase from reputable suppliers to ensure the copper meets ASTM standards and is certified for potable water use. Additionally, proper sizing, availability, and cost-effectiveness should be evaluated to balance performance and budget. By selecting the right copper pipe and adhering to best installation practices, homeowners and plumbers can ensure a safe, efficient, and long-lasting water heating system.