The global water-cooled chiller market is experiencing robust expansion, driven by rising demand for energy-efficient cooling solutions across commercial, industrial, and institutional sectors. According to a report by Mordor Intelligence, the market was valued at USD 15.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2029. This growth is further validated by Grand View Research, which estimates the market will reach USD 23.1 billion by 2030, expanding at a CAGR of 6.4% over the forecast period. Key growth drivers include increasing urbanization, the proliferation of data centers, stringent environmental regulations promoting low-GWP refrigerants, and advancements in chiller efficiency. With these dynamics reshaping the competitive landscape, a select group of manufacturers are leading innovation, scalability, and performance in water-cooled chiller technology. Below are the top 10 water-cooled chiller manufacturers shaping the industry’s future.

Top 10 Water Cooled Chiller Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Thermal Care: Industrial Water Chiller Manufacturer

Domain Est. 1996

Website: thermalcare.com

Key Highlights: Thermal Care is a leading manufacturer of industrial water chillers & process cooling equipment and systems for applications worldwide. ISO 9001 certified….

#2 Cold Shot Chillers

Domain Est. 1999

Website: waterchillers.com

Key Highlights: Cold Shot Chillers manufactures water chillers designed to handle the demands of both industrial and commercial environments. Our units are built to withstand ……

#3 Industrial Chiller Manufacturer for Cooling Systems

Domain Est. 2004

Website: hyfra.com

Key Highlights: The HYFRA product range includes a wide selection of chillers for machines, lubricants, tools, lasers and a variety of other objects to be cooled….

#4 Water-Cooled Chillers

Domain Est. 1995

Website: york.com

Key Highlights: YORK® Water-cooled Chillers meet your building efficiency needs with the widest variety of water-cooled industrial and commercial chillers on the market….

#5 Industrial Process Chiller Cooling Systems

Domain Est. 2001

Website: drakechillers.com

Key Highlights: Drakes industrial chillers pull heat from the equipment, maintaining a temperature to ±1°F to prevent spikes, no matter how many processes are operating….

#6 Quantech: High

Domain Est. 2014

Website: quantech-hvac.com

Key Highlights: Quantech chillers: High-efficiency air-cooled and water-cooled units by Johnson Controls. Save money, reduce costs, and carbon footprint….

#7 Chillers: Air-Cooled, Water-Cooled

Domain Est. 1995

Website: carrier.com

Key Highlights: Carrier leads the way in commercial chillers with a diverse range of air-cooled and water-cooled options, designed for energy efficiency and sustainability….

#8 Water Cooled Chillers

Domain Est. 1996

Website: daikin.com

Key Highlights: Forged under harsh conditions around the world, Daikin water cooled chillers provide high quality, operation efficiency, and energy savings….

#9 Water Cooled Chillers

Domain Est. 1998

Website: filtrine.com

Key Highlights: Filtrine’s self-contained liquid chillers with a water cooled condenser are designed for indoor installation only and for hookup to city, tower or plant ……

#10 Water Cooled Chiller

Domain Est. 2012

Website: topchiller.com

Key Highlights: TopChiller is a professional water-cooled chiller manufacturing company since year of 1999. Mostly, Water cooled chillers are more refrigeration efficient than ……

Expert Sourcing Insights for Water Cooled Chiller

H2: 2026 Market Trends for Water-Cooled Chillers

The global water-cooled chiller market is poised for significant transformation by 2026, driven by technological innovation, regulatory shifts, and evolving end-user demands across key industries. Several interconnected trends are expected to shape the market landscape, positioning water-cooled chillers as a critical component in the transition toward energy-efficient and sustainable cooling solutions.

-

Increased Demand for Energy Efficiency and Sustainability

By 2026, energy efficiency will remain a top priority for industrial, commercial, and institutional building operators. Water-cooled chillers, known for their higher efficiency compared to air-cooled systems—especially in large-scale applications—are set to benefit from stricter energy regulations and green building certifications such as LEED and BREEAM. Governments and municipalities worldwide are likely to enforce tighter HVAC efficiency standards, boosting demand for high-efficiency chillers using advanced compressors (e.g., magnetic bearing and variable speed drive technologies) and low-GWP refrigerants. -

Adoption of Low-Global Warming Potential (GWP) Refrigerants

Environmental regulations, particularly those stemming from the Kigali Amendment to the Montreal Protocol, will accelerate the phase-down of high-GWP refrigerants like R-134a and R-410A. By 2026, manufacturers are expected to increasingly adopt natural refrigerants (e.g., ammonia, CO₂) or next-generation HFOs (Hydrofluoroolefins) in water-cooled chillers. This shift will not only ensure compliance but also enhance the environmental profile of new installations, especially in Europe and North America. -

Growth in Data Center and Commercial Infrastructure

The exponential growth of data centers, cloud computing, and 5G infrastructure will drive demand for reliable, high-capacity cooling systems. Water-cooled chillers offer superior heat rejection performance and scalability, making them ideal for mission-critical data center environments. By 2026, hyperscale data center expansions in North America, Asia-Pacific, and Europe will be a major growth driver, with integrated chiller plants and free-cooling strategies enhancing overall efficiency. -

Integration of Smart Technologies and IoT

The convergence of HVAC systems with Building Management Systems (BMS) and the Internet of Things (IoT) will transform water-cooled chiller operations. By 2026, smart chillers equipped with AI-driven predictive maintenance, remote monitoring, and real-time performance analytics will become standard. These capabilities improve uptime, reduce energy consumption, and lower operational costs, appealing to facility managers seeking operational excellence. -

Expansion in Emerging Markets

Rapid urbanization and industrialization in Asia-Pacific, Latin America, and the Middle East will fuel the demand for large-scale HVAC systems. Countries like India, Indonesia, and Saudi Arabia are investing heavily in smart cities, healthcare infrastructure, and commercial real estate—all of which require efficient cooling. Water-cooled chillers are increasingly favored in these regions for their long-term cost-effectiveness in high-load applications. -

Rise of Modular and Prefabricated Chiller Solutions

To reduce installation time and improve scalability, modular and prefabricated water-cooled chiller plants are expected to gain traction by 2026. These factory-assembled systems offer plug-and-play functionality, quality control, and faster deployment, particularly in fast-track construction projects and retrofits. -

Focus on Water Conservation and Hybrid Cooling

Although water-cooled chillers require water for heat rejection, growing concerns over water scarcity are prompting innovations in water management. Closed-loop systems, water treatment technologies, and hybrid cooling solutions (combining water and air cooling) are being adopted to reduce water consumption. By 2026, water-efficient designs and integration with building water recovery systems will become key differentiators.

In summary, the 2026 water-cooled chiller market will be defined by a convergence of sustainability mandates, digitalization, and infrastructure growth. Manufacturers and service providers who prioritize innovation in efficiency, refrigerant transition, and smart integration will be best positioned to capture market share in this evolving landscape.

Common Pitfalls When Sourcing Water Cooled Chillers: Quality and Intellectual Property (IP) Concerns

Sourcing water cooled chillers, especially from international or less-regulated markets, can expose buyers to significant risks related to quality assurance and intellectual property (IP) rights. Being aware of these pitfalls helps in making informed procurement decisions and mitigating long-term operational and legal risks.

1. Compromised Quality Due to Substandard Components

One of the most prevalent issues is receiving chillers built with low-quality or non-certified components. Some suppliers may cut costs by using inferior compressors, heat exchangers, or control systems that fail prematurely or under load. This leads to:

- Reduced energy efficiency

- Frequent breakdowns and high maintenance costs

- Shortened equipment lifespan

Tip: Always verify compliance with international standards (e.g., AHRI, ISO, CE) and request third-party test reports or factory acceptance tests (FAT).

2. Misrepresentation of OEM vs. Copycat Equipment

Many suppliers falsely claim to be original equipment manufacturers (OEMs) or authorized distributors. In reality, they may be selling rebranded or reverse-engineered units that mimic well-known brands. These replicas often lack proper design integrity and performance validation.

Risks include:

- Lack of genuine technical support and spare parts

- Voided warranties

- Potential safety hazards

Tip: Conduct due diligence on the supplier’s authorization status and verify brand partnerships directly with the original manufacturer.

4. Intellectual Property Infringement

Purchasing a chiller that infringes on patented designs, control algorithms, or proprietary technology can expose the buyer—especially in regulated industries or public projects—to legal liability. Even unintentional use of IP-violating equipment may result in:

- Cease-and-desist orders

- Fines or litigation

- Project delays during equipment replacement

Tip: Request documentation proving the chiller’s design is either licensed or independently developed. Avoid suppliers unwilling to disclose engineering details.

5. Inadequate Documentation and Lack of Traceability

Poor-quality or counterfeit chillers often come with incomplete or falsified technical documentation, including missing test certificates, material traceability reports, or as-built drawings. This can cause problems during commissioning, audits, or compliance inspections.

Tip: Require full documentation packages as part of the contract, including P&IDs, electrical schematics, and component data sheets.

6. Hidden Supply Chain Risks

Some suppliers outsource manufacturing to multiple unvetted subcontractors, leading to inconsistent quality and obscured IP ownership. Without transparency in the supply chain, it’s difficult to ensure that the final product respects IP rights or meets performance claims.

Tip: Audit the supplier’s production facilities and request a clear bill of materials (BOM) with supplier traceability.

Conclusion

To avoid quality and IP pitfalls when sourcing water cooled chillers, prioritize transparency, verify claims independently, and partner with reputable suppliers who adhere to international standards and respect intellectual property. Investing time in supplier qualification ultimately reduces lifecycle costs and protects your organization from legal and operational risks.

Logistics & Compliance Guide for Water Cooled Chillers

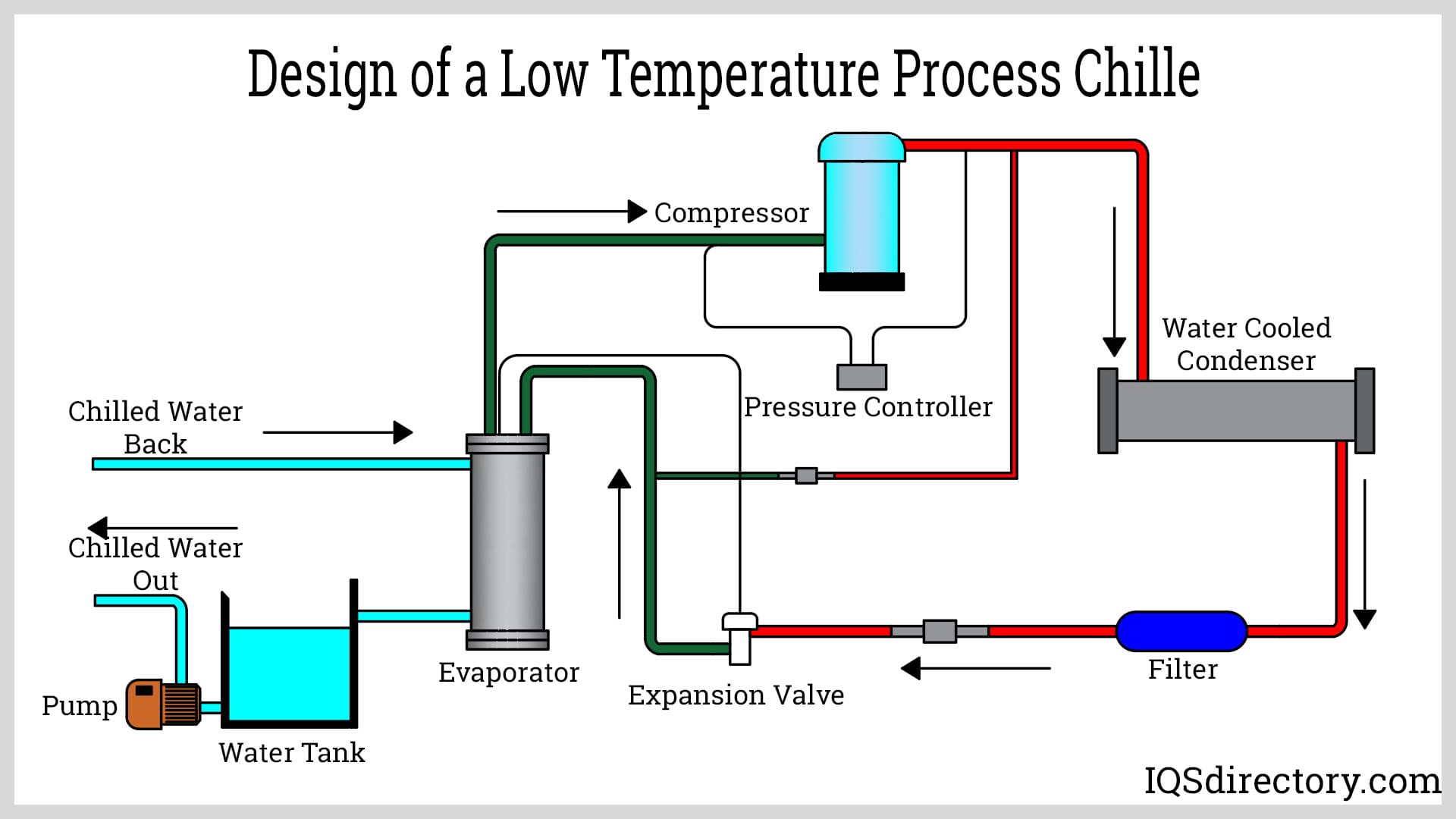

Overview

Water cooled chillers are essential components in heating, ventilation, and air conditioning (HVAC) systems, commonly used in commercial, industrial, and institutional facilities. Due to their size, weight, refrigerant content, and environmental impact, proper logistics planning and compliance with regulatory standards are critical for safe and legal transportation, installation, and operation.

Transportation & Handling Logistics

Size and Weight Considerations

Water cooled chillers are typically large and heavy, often weighing several tons. Pre-planning for transportation routes, crane availability, and site access is essential. Verify road weight limits, bridge restrictions, and clearance requirements (height, width) for delivery vehicles.

Packaging and Protection

Ensure chillers are shipped with factory-installed protective packaging, including weatherproof covers, vibration dampeners, and secured components. Confirm that the chiller’s refrigerant circuit is sealed and under positive nitrogen pressure to prevent moisture ingress during transit.

On-Site Handling

Use appropriate lifting equipment (e.g., forklifts, cranes, rigging gear) rated for the chiller’s weight. Follow manufacturer guidelines for lifting points and avoid tilting beyond specified angles to prevent oil migration or internal damage. Prepare a level and structurally sound foundation prior to delivery.

Delivery Scheduling

Coordinate delivery with site readiness, including crane availability, labor, and weather conditions. Avoid scheduling deliveries during peak traffic hours or inclement weather to prevent delays and safety risks.

Regulatory Compliance

Refrigerant Regulations (F-Gas, EPA, AIM Act)

Water cooled chillers often use high-global warming potential (GWP) refrigerants such as R-134a, R-1234ze, or HFC blends. Compliance with environmental regulations is mandatory:

– U.S. (EPA Section 608): Technicians must be certified to handle refrigerants. Recordkeeping for refrigerant charging, recovery, and leak checks is required.

– EU (F-Gas Regulation 517/2014): Limits on HFC use, mandatory leak checks, refrigerant recovery, and reporting obligations apply based on equipment charge size.

– AIM Act (U.S.): Phasing down HFC production and import; future chillers may require lower-GWP alternatives.

Energy Efficiency Standards

Comply with regional energy performance standards:

– U.S. (DOE): Minimum efficiency levels under 10 CFR Part 431.

– EU (Ecodesign Directive): Seasonal efficiency (SCOP) and part-load performance (IPLV) requirements.

Ensure the chiller model meets or exceeds local energy codes (e.g., ASHRAE 90.1, Title 24).

Electrical and Safety Codes

Installation must adhere to:

– NEC (NFPA 70) in the U.S.

– IEC 60335 or EN 60204 in international markets.

Proper grounding, disconnects, and overcurrent protection must be installed per code and manufacturer specifications.

Environmental Permits and Discharge Regulations

Cooling towers associated with water cooled chillers may require permits for:

– Water discharge (if blowdown is released to sewer or environment).

– Chemical treatment (biocides, corrosion inhibitors) under local water quality regulations (e.g., Clean Water Act in the U.S.).

Documentation and Certification

Required Documentation

Maintain accurate records including:

– Equipment nameplate data (model, serial number, refrigerant type and charge).

– Manufacturer’s installation and operation manuals.

– Refrigerant tracking logs (pre- and post-installation charges).

– Proof of technician certification (EPA 608, F-Gas).

– Energy efficiency certification (e.g., AHRI performance certification).

Compliance Certification

Verify that the chiller meets relevant standards:

– AHRI (Air-Conditioning, Heating, and Refrigeration Institute) certification for performance ratings.

– CE marking (EU), UL listing (U.S.), or other regional safety certifications.

– ISO 5149 (refrigerating systems – safety requirements).

Installation and Commissioning Compliance

Refrigerant Handling Procedures

All refrigerant charging and recovery must be performed by certified technicians using calibrated equipment. Evacuate the system properly before charging to avoid contamination. Record final charge quantity and verify leaks using electronic or soap-bubble methods.

Pressure Testing and Leak Checks

Conduct hydrostatic or pneumatic pressure tests as per ASME B31.5 or local codes. Perform initial and periodic leak checks per regulatory frequency (e.g., quarterly for systems >50 lbs refrigerant in the U.S.).

Water System Integration

Ensure proper water treatment and filtration to prevent scaling, corrosion, and biological growth. Comply with local codes for piping materials, insulation, and expansion tanks.

Commissioning and Reporting

Complete commissioning per ASHRAE Guideline 0 and document all tests. Submit required reports to authorities (e.g., utility rebates, environmental agencies, building inspectors).

End-of-Life & Decommissioning

Refrigerant Recovery

At end-of-life, refrigerant must be recovered by a certified technician using EPA- or F-Gas-compliant equipment. Properly document recovery quantity and submit reports if required.

Recycling and Disposal

Dispose of components in accordance with local waste regulations. Recycle metals, refrigerant oil, and electronic controls where possible. Maintain disposal records for audit purposes.

Summary

Successful logistics and compliance for water cooled chillers require coordinated planning across transportation, installation, operation, and decommissioning phases. Adherence to environmental, safety, and energy regulations ensures legal operation, reduces environmental impact, and supports long-term system reliability. Always consult local authorities and the equipment manufacturer for region-specific requirements.

Conclusion:

After a thorough evaluation of available options, sourcing a water-cooled chiller presents a reliable, energy-efficient, and long-term cost-effective solution for large-scale cooling requirements. Compared to air-cooled alternatives, water-cooled chillers offer superior thermal efficiency, quieter operation, and extended equipment lifespan—particularly when integrated with cooling towers and proper water treatment systems.

The decision to source a water-cooled chiller should be guided by site-specific factors such as available space, ambient climate conditions, water availability, and maintenance capabilities. While the initial installation cost and complexity are higher due to the need for cooling towers, water treatment, and associated piping, the operational savings in energy consumption and improved system performance justify the investment over time.

Procurement should prioritize reputable manufacturers with proven service support, energy-efficient designs (e.g., magnetic bearing compressors, variable speed drives), and compliance with environmental and safety standards. Additionally, incorporating smart controls and preventive maintenance plans will maximize uptime and efficiency.

In conclusion, sourcing a water-cooled chiller is a strategic investment well-suited for commercial, industrial, or institutional facilities requiring stable, high-capacity cooling with long-term operational savings and sustainability benefits.