The global water-based enamel paint market is experiencing robust growth, driven by increasing environmental regulations and a shift toward sustainable building materials. According to Mordor Intelligence, the global water-based paints market was valued at USD 57.8 billion in 2023 and is projected to grow at a CAGR of over 6.2% through 2029. This expansion is fueled by rising demand from the construction and automotive sectors, as well as growing consumer preference for low-VOC, eco-friendly coatings. Water-based enamels, known for their durability, quick drying times, and reduced environmental impact, are gaining traction across residential and industrial applications. As regulatory standards tighten—particularly in North America and Europe—manufacturers are investing in innovative formulations to meet performance and sustainability benchmarks. Against this backdrop, leading players are intensifying R&D efforts and expanding production capacities to capture growing market share. The following analysis highlights the top 8 water-based enamel manufacturers shaping this dynamic industry landscape.

Top 8 Water Based Enamel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

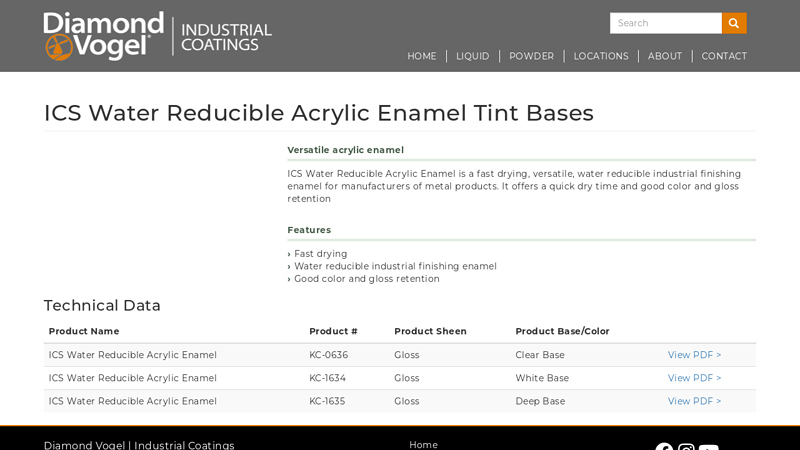

#1 ICS Water Reducible Acrylic Enamel Tint Bases

Domain Est. 1997

Website: diamondvogel.com

Key Highlights: ICS Water Reducible Acrylic Enamel is a fast drying, versatile, water reducible industrial finishing enamel for manufacturers of metal products….

#2 Waterborne Acrylic Enamel

Domain Est. 1997

Website: krylon.com

Key Highlights: Our Krylon® Waterborne Acrylic Enamel offers superior chemical resistance, often used for new construction or maintenance work….

#3 Enamel Coatings and Paints

Domain Est. 1997

Website: wurdack.com

Key Highlights: Specializing in the manufacturing of air-dry & baking enamel paints & coatings which are thermosets based on oils & fatty acids….

#4 Testors Enamel Paints

Domain Est. 1996

Website: testors.com

Key Highlights: Find Testors enamel paints, markers, primers and more….

#5 Water Based Pigmented Top Coats, Paints, Glazes & Enamel

Domain Est. 1997

Website: generalfinishes.com

Key Highlights: Environment friendly water based poly, top coats, paint glazes, & enamel are easy to apply, durable, simple to repair & deliver great depth and vibrant ……

#6 Decorative enamels and paints for flat and hollow glass

Domain Est. 2000

Website: fenzigroup.com

Key Highlights: The Decover range includes Glassolux, Sandolux, and Pearlux organic solvent paints, as well as Aquaglass water-based paints, catering to a wide variety of ……

#7 Water Based Enamel

Domain Est. 2019

Website: robertsonspaints.com

Key Highlights: This is an advanced low VOC, non-yellowing, self levelling acrylic enamel. Ideal for trim work such as doors, window frames and skirting boards….

#8 Durable Enamel Paints for Interior and Exterior Use

Domain Est. 2023

Website: birlaopus.com

Key Highlights: Available in various finishes, including gloss enamel paint, our water-based enamel solutions ensure you achieve a professional look with minimal effort….

Expert Sourcing Insights for Water Based Enamel

H2: 2026 Market Trends for Water-Based Enamel

The global water-based enamel market is poised for significant transformation by 2026, driven by tightening environmental regulations, evolving consumer preferences, and technological advancements. Here’s a breakdown of the key trends shaping the industry:

1. Regulatory Pressure as the Primary Growth Catalyst

- H2: VOC Compliance Driving Adoption: Stringent global regulations (e.g., EU Paints Directive, US EPA NESHAP, China’s VOC limits) are the dominant force pushing formulators and users toward water-based alternatives. By 2026, compliance will be non-negotiable in major markets, making water-based enamels the default choice in architectural, industrial maintenance, and DIY sectors, particularly for interior applications.

2. Performance Parity Closing the Gap

- H2: Enhanced Durability and Application: Historically perceived as inferior to solvent-based counterparts in hardness, chemical resistance, and drying time, water-based enamels are rapidly closing the gap. Advancements in acrylic, hybrid (acrylic-polyurethane), and PUD (Polyurethane Dispersions) technologies will deliver significantly improved:

- Scratch and abrasion resistance.

- Faster recoat and dry times.

- Better flow, leveling, and gloss retention.

- Improved adhesion to challenging substrates (plastics, metals).

Expect widespread adoption in demanding industrial and automotive refinishing applications by 2026.

3. Sustainability Beyond VOC: A Holistic Focus

- H2: Lifecycle Assessment and Bio-Based Content: The definition of “sustainable” is expanding. Beyond low VOC, the market will demand:

- Increased use of bio-based raw materials (e.g., plant-derived resins, solvents).

- Improved recyclability of packaging.

- Transparency in supply chains and lower carbon footprint calculations.

Brands emphasizing comprehensive Environmental Product Declarations (EPDs) and circular economy principles will gain a competitive edge.

4. Consolidation and Strategic Partnerships

- H2: Innovation Through Collaboration: The complexity of developing high-performance, sustainable formulations is driving consolidation among raw material suppliers (resin, additive manufacturers) and partnerships between chemical companies and paint manufacturers. These alliances will accelerate R&D, share risks, and bring next-generation products to market faster to meet 2026 regulatory and performance targets.

5. Emerging Market Growth and Infrastructure Investment

- H2: Asia-Pacific as the Growth Engine: Rapid urbanization, infrastructure development (especially in India, Southeast Asia), and rising middle-class demand for housing and durable goods will make the Asia-Pacific region the fastest-growing market for water-based enamels by 2026. Government initiatives promoting green building standards will further fuel this growth.

6. Digitalization and Customer-Centric Solutions

- H2: Smart Tools and Customization: Expect increased use of:

- Digital color matching apps and online configurators.

- Augmented Reality (AR) for visualizing finishes.

- Personalized tinting systems for DIY and professional users.

This enhances user experience and drives sales in the consumer segment.

In Summary for 2026: The water-based enamel market will be characterized by regulatory-driven dominance, performance parity with solvent-based products, a deepened focus on holistic sustainability, strategic industry consolidation, explosive growth in Asia-Pacific, and enhanced digital customer engagement. Success will belong to companies that innovate relentlessly in performance and sustainability while navigating the complex global regulatory landscape.

Common Pitfalls Sourcing Water-Based Enamel (Quality, IP)

Sourcing water-based enamel paints requires careful attention to both performance specifications and intellectual property (IP) considerations. Overlooking these aspects can lead to product failures, compliance issues, and legal risks. Below are key pitfalls to avoid:

Poor Adhesion and Substrate Compatibility

Water-based enamels may not adhere well to all surfaces (e.g., oily metals, non-porous substrates) without proper surface preparation or primers. Selecting a product without verifying compatibility with the intended substrate can result in peeling, blistering, or premature failure.

Inadequate Durability and Chemical Resistance

Some lower-quality water-based enamels lack sufficient resistance to abrasion, UV exposure, or common chemicals. This leads to chalking, fading, or degradation in demanding environments, especially in industrial or outdoor applications.

Extended Dry and Cure Times

Unlike solvent-based counterparts, water-based enamels can have longer drying and curing cycles, particularly in high-humidity or low-temperature conditions. Failing to account for this in production or application planning can delay project timelines.

Poor Film Formation and Gloss Retention

Improper formulation or storage (e.g., freezing) can disrupt film formation, leading to uneven finishes, poor gloss uniformity, or hazing. This compromises both aesthetics and protective performance.

Inconsistent Batch-to-Batch Quality

Suppliers with inadequate quality control may deliver formulations with variations in viscosity, color, or performance. This inconsistency can disrupt manufacturing processes and affect final product quality.

Misrepresentation of VOC and Environmental Claims

Some suppliers exaggerate low-VOC or eco-friendly credentials. Sourcing without validating certifications (e.g., Green Seal, EPA compliance) can result in non-compliance with environmental regulations and damage brand reputation.

Intellectual Property (IP) Infringement Risks

Using or sourcing formulations protected by patents without authorization exposes companies to litigation. Reverse engineering or copying proprietary chemistries—even unintentionally—can lead to significant legal and financial consequences.

Lack of Technical Support and Documentation

Suppliers may fail to provide adequate technical data sheets (TDS), safety data sheets (SDS), or application guidance. This complicates integration into existing processes and increases the risk of improper use.

Supply Chain and Regulatory Non-Compliance

Water-based enamels may contain restricted substances or fail to meet regional regulations (e.g., REACH, TSCA). Sourcing from non-compliant suppliers can result in shipment delays, recalls, or fines.

Overlooking Long-Term Stability and Shelf Life

Some formulations degrade over time, leading to viscosity changes or microbial growth. Sourcing without confirming shelf life and storage requirements risks material waste and performance issues.

To mitigate these pitfalls, conduct thorough due diligence on suppliers, request samples for testing under real-world conditions, verify regulatory compliance, and consult legal experts when IP concerns arise.

H2: Logistics & Compliance Guide for Water-Based Enamel

1. Introduction

Water-based enamel paints offer a lower-VOC (Volatile Organic Compound) alternative to solvent-based enamels, improving environmental and worker safety profiles. However, proper logistics and compliance management remain critical throughout the supply chain. This guide outlines key considerations for the safe and compliant handling, storage, transportation, and regulatory compliance of water-based enamel products.

2. Regulatory Compliance Overview

Water-based enamels are subject to various national and international regulations due to their chemical composition, including pigments, resins, and additives.

- GHS/CLP Classification:

Most water-based enamels are classified under the Globally Harmonized System (GHS) or EU CLP Regulation. Typical hazard classifications may include: - H319: Causes serious eye irritation

- H412: Harmful to aquatic life with long-lasting effects

-

May also contain substances of very high concern (SVHC) depending on formulation.

-

Safety Data Sheet (SDS):

- An up-to-date SDS (in compliance with GHS Rev. 9 or local equivalent) is mandatory.

- The SDS must include Section 14 (Transport Information) and Section 15 (Regulatory Information).

-

Ensure SDS is available to all handlers and emergency responders.

-

REACH (EU):

- Registration, Evaluation, Authorisation and Restriction of Chemicals applies to all chemical substances in the EU.

-

Confirm supplier compliance and check for SVHCs above 0.1% w/w in the product.

-

TSCA (USA):

- Toxic Substances Control Act requires that all chemical substances are listed or pre-manufactured notified.

-

Verify TSCA compliance with the supplier.

-

VOC Regulations:

- Water-based enamels must comply with regional VOC limits (e.g., EPA Method 24, SCAQMD Rule 1113, EU Paints Directive 2004/42/EC).

- Maintain documentation proving VOC content is within allowable thresholds.

3. Packaging & Labeling Requirements

Proper packaging and labeling ensure safe handling and regulatory compliance.

- Primary Packaging:

- Use containers made of chemically compatible materials (e.g., HDPE plastic or steel).

-

Ensure tight, leak-proof seals to prevent evaporation and contamination.

-

Labeling (GHS-Compliant):

- Labels must include:

- Product identifier

- Supplier information

- GHS pictograms

- Signal word (e.g., “Warning”)

- Hazard statements (e.g., H319, H412)

- Precautionary statements

- SDS reference

- Labels must be durable and legible under transport and storage conditions.

4. Storage Guidelines

Improper storage can lead to product degradation, safety risks, and regulatory violations.

- Temperature Control:

- Store between 5°C and 35°C (41°F–95°F).

-

Avoid freezing (can cause irreversible damage to emulsion) and excessive heat (risk of pressure buildup).

-

Ventilation:

-

Store in a well-ventilated, dry area to prevent moisture accumulation and minimize vapor concentration.

-

Segregation:

- Store away from strong oxidizers, acids, and flammable materials.

-

Use secondary containment (e.g., spill pallets) to contain leaks.

-

Shelf Life:

- Typically 12–24 months from manufacture date.

- Rotate stock using FIFO (First In, First Out) method.

- Check for signs of spoilage (e.g., skinning, separation, odor changes) before use.

5. Transportation & Logistics

Water-based enamels are generally non-flammable but still subject to transport regulations.

- Classification for Transport:

- Most water-based enamels are not classified as dangerous goods under ADR (road), IMDG (sea), or IATA (air) due to low flash points and water-based formulation.

- Exception: If additives or pigments introduce hazards (e.g., heavy metals, flammable solvents), re-evaluation is required.

-

Always verify classification using Section 14 of the SDS.

-

Packaging for Transport:

- Use UN-certified packaging if classified as hazardous.

- For non-hazardous shipments: ensure containers are secured, upright, and protected from physical damage.

-

Use dunnage to prevent movement in transit.

-

Documentation:

- Include commercial invoice, packing list, and SDS with every shipment.

-

For international shipments, ensure compliance with customs requirements (e.g., HS code: 3208.20 for water-based paints).

-

Cold Weather Transport:

- In freezing conditions, use insulated vehicles or add thermal protection to prevent product damage.

6. Spill Response & Waste Management

Prepare for emergencies and ensure environmentally responsible disposal.

- Spill Response Kit:

- Equip storage and handling areas with spill kits containing absorbents (e.g., clay, poly pads), gloves, goggles, and containment booms.

-

Do not use combustible absorbents near ignition sources.

-

Spill Procedure:

- Evacuate non-essential personnel.

- Contain spill using absorbent materials.

- Collect waste and place in labeled, sealed containers.

- Dispose of as hazardous or non-hazardous waste per local regulations.

-

Report significant spills to authorities if required.

-

Waste Disposal:

- Leftover paint and contaminated materials may be regulated as hazardous waste depending on metal content (e.g., lead, chromium).

- Use licensed waste disposal contractors and maintain disposal records.

7. Worker Safety & Training

Ensure personnel are trained and protected.

- PPE Requirements:

- Gloves (nitrile recommended)

- Safety goggles or face shield

- Protective clothing to prevent skin contact

-

Respiratory protection if spraying (NIOSH-approved N95 or equivalent)

-

Training:

- Conduct regular training on SDS review, spill response, and safe handling procedures.

- Maintain training records.

8. International Considerations

– Customs & Import Restrictions:

– Some countries restrict paints containing heavy metals or specific biocides.

– Verify destination country’s chemical regulations (e.g., China REACH, K-REACH in Korea).

– Language Requirements:

– SDS and labels may need to be in the local language (e.g., French in Canada, Spanish in Mexico).

9. Conclusion

While water-based enamels reduce fire risk and VOC emissions, they still require careful attention to regulatory compliance, safe handling, and logistics planning. Always consult the product-specific SDS, work with compliant suppliers, and maintain robust documentation to ensure legal and operational integrity.

References

– GHS Purple Book (Rev. 9)

– ADR, IMDG Code, IATA DGR

– OSHA Hazard Communication Standard (29 CFR 1910.1200)

– REACH Regulation (EC) No 1907/2006

– EPA Method 24

– EU Directive 2004/42/EC

Note: This guide is general in nature. Always verify requirements with local authorities and your product’s Safety Data Sheet.

Conclusion for Sourcing Water-Based Enamel

Sourcing water-based enamel paint is a strategic and sustainable decision that aligns with environmental regulations, health and safety standards, and evolving market demands. As industries and consumers increasingly prioritize eco-friendly products, water-based enamels offer a low-VOC, low-odor, and easy-to-clean alternative to traditional solvent-based coatings without compromising on durability, finish quality, or performance.

Careful supplier evaluation—focusing on product consistency, technical support, compliance certifications, and cost-efficiency—is essential to ensure reliable supply and long-term satisfaction. Additionally, establishing strong relationships with reputable manufacturers or distributors can facilitate innovation, customization, and scalability.

In conclusion, transitioning to and sourcing water-based enamel not only supports corporate sustainability goals but also enhances workplace safety and end-product appeal. With the right sourcing strategy, organizations can achieve a balance between performance, compliance, and environmental responsibility, positioning themselves competitively in a greener marketplace.