The global textile waste market is undergoing a significant transformation as sustainability becomes a core priority in fashion and manufacturing. According to Grand View Research, the global recycled textiles market size was valued at USD 4.8 billion in 2022 and is expected to grow at a CAGR of 7.4% from 2023 to 2030, driven by tightening environmental regulations and rising consumer demand for circular fashion. Parallel insights from Mordor Intelligence highlight that increasing awareness about sustainable production, along with advancements in textile recycling technologies, are accelerating industry shifts—particularly in how waste fabric is collected, processed, and reintegrated into supply chains. As brands aim to reduce landfill dependency and carbon footprints, waste fabric manufacturers are emerging as critical enablers of circularity. The following list highlights the top 10 waste fabric manufacturers leading innovation, scalability, and environmental impact in this rapidly evolving sector.

Top 10 Waste Fabric Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Circ • Threading Together the Future of Circular Fashion

Domain Est. 2020

Website: circ.earth

Key Highlights: We are a textile-to-textile recyclingmaterial innovationfashion technology company on a mission to protect the planet from the cost of clothing….

#2 Unifi.com

Domain Est. 1996

Website: unifi.com

Key Highlights: UNIFI is a leader in performance textiles across the Americas, Asia, and Europe. Known for our flexible solutions and high-quality products….

#3 Hi! We are Reju.

Domain Est. 2001

Website: reju.com

Key Highlights: We’re working with partners across the textile system to redesign it, end to end. Recover textile waste, before it becomes waste….

#4 Infinited Fiber

Domain Est. 2015

Website: infinitedfiber.com

Key Highlights: Meet the textile fiber that is created 100% from textile waste. It delivers the great qualities of cotton with soft and natural look and feel….

#5 FABSCRAP

Domain Est. 2016

Website: fabscrap.org

Key Highlights: FABSCRAP provides a convenient and transparent recycling and reuse service, offers affordable and accessible materials as a valuable resource….

#6 Syre

Domain Est. 2017

Website: syre.com

Key Highlights: Syre is a textile impact company with a mission to decarbonize and dewaste the industry through textile-to-textile recycling at hyperscale….

#7 BlockTexx®

Domain Est. 2018

Website: blocktexx.com

Key Highlights: We are on an urgent mission to stop textiles and clothing going into landfill. At BlockTexx® we re-manufacture textile waste back into the world’s new products….

#8 Recover™ Circular Fashion for all

Domain Est. 2020

Website: recoverfiber.com

Key Highlights: Recover™ transforms textile waste into sustainable recycled fibers and blends, closing the loop on fashion. You might see waste, we see circular solutions….

#9 Circulose

Domain Est. 2021

Website: circulose.com

Key Highlights: CIRCULOSE® is a new material made by recycling cotton from worn-out clothes and production waste. It makes fashion circular….

#10 T

Website: trexproject.eu

Key Highlights: Creating a circular system for post-consumer textile waste. T-REX Project brought together 13 major players from across the entire value chain to create a ……

Expert Sourcing Insights for Waste Fabric

2026 Market Trends for Waste Fabric: Analysis Using the Hydrogen Economy (H2) Framework

The global waste fabric market is undergoing a significant transformation, driven by environmental imperatives, technological advancements, and evolving consumer preferences. Analyzing its 2026 trajectory through the lens of the Hydrogen Economy (H2) framework – focusing on Hydrogen as a symbol for Holistic, High-Impact, and High-Tech transformation – reveals key interconnected trends shaping a more sustainable and innovative future.

H1: Holistic Value Chain Integration & Circularity

By 2026, the waste fabric market will move beyond simple collection and sorting towards a truly holistic, closed-loop system. This shift is fundamental:

- Extended Producer Responsibility (EPR) Maturation: Mandates (e.g., EU Strategy for Sustainable and Circular Textiles) will be fully implemented, forcing brands to take financial and physical responsibility for end-of-life garments. This creates a guaranteed feedstock stream for recyclers and drives design for recyclability.

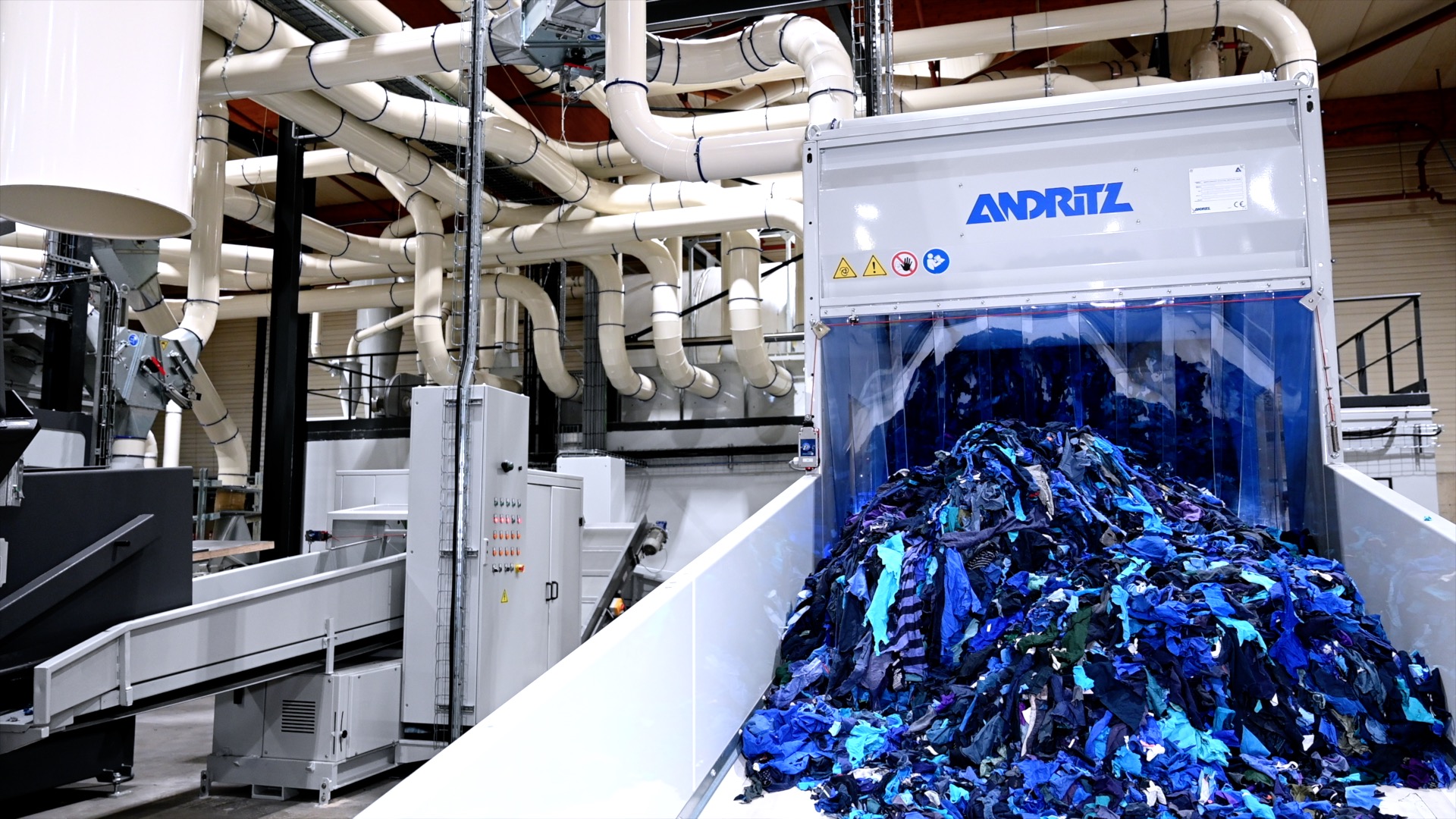

- Advanced Sorting Automation: Near-infrared (NIR) and AI-powered optical sorting will become standard, drastically improving the purity and value of sorted waste streams (e.g., separating cotton/polyester blends, removing contaminants). Robotics will handle delicate or complex items.

- Traceability & Blockchain: Blockchain technology will gain traction, enabling transparent tracking of fabric waste from consumer discard through sorting, recycling, and into new products, verifying recycled content and ensuring ethical practices.

- Consumer Engagement Platforms: Apps and take-back schemes integrated with brands will make disposal easier and incentivize participation, feeding the system with higher-quality post-consumer waste.

H2: High-Impact Sustainable Solutions & Policy Drivers

The high-impact imperative to reduce the textile industry’s massive environmental footprint (water, chemicals, microplastics, landfills) will be the primary engine for change, amplified by stringent regulations:

- Landfill & Incineration Bans: More regions (beyond existing EU leaders) will implement bans on landfilling and limit incineration of textile waste, creating a de facto market for recycling solutions.

- Carbon Pricing & ESG Pressure: Increasing carbon taxes and stringent ESG (Environmental, Social, Governance) reporting requirements will make virgin textile production significantly more expensive, boosting the economic case for recycled fibers.

- Focus on Microplastic Mitigation: Regulations targeting microplastic shedding from synthetic textiles (e.g., washing machine filters) will drive demand for recycled synthetics processed to minimize fiber shedding and for more durable materials.

- Water & Chemical Reduction Targets: Brands will prioritize recycled fibers (e.g., rPET, recycled cotton) that offer dramatic reductions in water consumption and chemical usage compared to virgin production.

H3: High-Tech Recycling & Material Innovation

The “H” also signifies High-Tech breakthroughs essential for handling the complexity of mixed and contaminated waste streams and creating high-value outputs:

- Mechanical Recycling Advancements: Improved processes for downcycling cotton (e.g., higher staple length retention) and complex blends will increase yield and quality. Automated repair and resale platforms for wearable items will grow.

- Chemical Recycling Scaling: This is the critical game-changer for 2026:

- Depolymerization: Technologies breaking down PET (rPET) and potentially emerging for polyamide (nylon) and even cotton (cellulose) into monomers for virgin-quality fiber will see significant scale-up and cost reduction. Partnerships between chemical giants and recyclers (e.g., Infinited Fiber, Renewcell, Circ) will be crucial.

- Solvent-Based Recycling: Processes dissolving cellulose (e.g., from cotton waste) to create new man-made cellulosic fibers (like Lyocell) will become more efficient and widespread.

- AI & Machine Learning Optimization: AI will optimize sorting parameters, predict fiber quality from waste streams, improve chemical process efficiency, and design new recycling pathways for challenging materials.

- Digital Product Passports (DPPs): Mandated in the EU, DPPs will contain material composition data, enabling automated sorting and directing waste to the most appropriate recycling technology (mechanical vs. chemical).

Conclusion: The Converging H2 Landscape in 2026

By 2026, the waste fabric market will be unrecognizable from today’s fragmented landscape. The Holistic integration driven by policy and EPR, the High-Impact push from environmental regulations and carbon costs, and the High-Tech breakthroughs in sorting and (especially) chemical recycling will converge. This H2 framework reveals a market shifting from waste management to a core pillar of a circular textile economy.

Key outcomes will include:

* Significant growth in recycled fiber production, particularly from chemical recycling.

* Increased value and demand for sorted textile waste, creating new revenue streams.

* Emergence of “Recycling Hubs” integrating collection, advanced sorting, and specific recycling technologies.

* Greater transparency and traceability throughout the value chain.

* Reduced environmental impact across the textile lifecycle.

Success will depend on continued investment in technology, supportive policy frameworks, industry collaboration, and consumer participation. The waste fabric market in 2026 won’t just be about managing waste; it will be a high-tech, high-impact engine for sustainable material production.

Common Pitfalls Sourcing Waste Fabric (Quality, IP)

When sourcing waste fabric, businesses must navigate several critical challenges related to both material quality and intellectual property (IP). Overlooking these pitfalls can lead to operational setbacks, reputational damage, and legal risks.

Inconsistent Quality and Contamination

One of the most significant challenges in sourcing waste fabric is ensuring consistent quality. Waste fabric often arrives as mixed post-industrial or post-consumer material, leading to variability in fiber composition, color, and fabric structure. Contaminants such as zippers, buttons, dyes, or non-textile residues can compromise processing efficiency and end-product integrity. Without proper sorting and quality control protocols, buyers risk receiving substandard material that fails to meet manufacturing requirements.

Lack of Traceability and Certification

Many waste fabric suppliers lack transparent supply chains, making it difficult to verify the origin, treatment history, or compliance with sustainability standards. Without certifications (e.g., GRS – Global Recycled Standard), buyers may inadvertently source material that does not meet regulatory or brand sustainability commitments. This lack of traceability also hampers efforts to ensure ethical labor practices and environmental responsibility.

Intellectual Property and Brand Protection Risks

Sourcing waste fabric—especially post-industrial cuttings from fashion brands—poses potential intellectual property concerns. Remnants may contain identifiable brand logos, patented patterns, or copyrighted designs. Reusing or reselling such material without authorization can lead to trademark infringement claims or damage to brand reputation. Buyers must ensure that waste fabric is either stripped of IP elements or sourced under agreements that clearly transfer usage rights.

Unverified Claims and Greenwashing

Suppliers may make inflated or misleading claims about the sustainability or recycled content of waste fabric. Without third-party verification, these assertions can amount to greenwashing, exposing the buyer to consumer backlash and regulatory scrutiny. It is essential to conduct due diligence and request documentation supporting environmental claims.

Logistical and Volume Challenges

Waste fabric is often irregular in form and volume, making logistics and inventory planning difficult. Suppliers may struggle to deliver consistent quantities or meet lead times, especially if relying on unpredictable waste streams. This variability can disrupt production schedules and increase costs.

Mitigating these pitfalls requires thorough vetting of suppliers, clear contractual terms, investment in sorting technology, and adherence to IP and sustainability best practices.

Logistics & Compliance Guide for Waste Fabric

Waste fabric—comprising offcuts, unsold garments, production scraps, and post-consumer textiles—requires careful handling throughout the logistics chain to ensure environmental responsibility and adherence to regulatory requirements. This guide outlines key logistics practices and compliance considerations for the proper management of waste fabric.

Regulatory Classification & Documentation

Waste fabric may be classified differently depending on its origin, composition, and destination. Textiles can fall under municipal solid waste, commercial waste, or recyclable materials, and may be subject to specific regulations such as the Basel Convention if exported internationally.

- Waste Characterization: Accurately classify waste fabric as non-hazardous, recyclable, or contaminated (e.g., mixed with hazardous dyes or chemicals).

- EPA and Local Regulations: Comply with regional waste management laws (e.g., U.S. EPA, EU Waste Framework Directive). In the U.S., generators must follow RCRA guidelines if hazardous substances are present.

- Export Controls: When shipping internationally, determine if waste fabric meets Basel Convention criteria. Untreated post-consumer textiles may require prior informed consent (PIC) from importing countries.

- Documentation: Maintain records of waste manifests, transfer notes, and certificates of recycling or disposal. Documentation must include waste type, quantity, destination, and handling method.

Collection & Segregation

Proper segregation at the source is critical to streamline logistics and ensure compliance.

- Segregate by Type: Separate natural fibers (cotton, wool), synthetics (polyester, nylon), blends, and contaminated materials.

- Prevent Contamination: Keep waste fabric dry and free from food waste, chemicals, or non-textile materials to maintain recyclability.

- Labeling: Clearly label containers with content type, hazard status (if any), and accumulation start date.

Storage & Handling

Safe and compliant storage minimizes fire risks, pest infestations, and environmental contamination.

- Designated Storage Areas: Use covered, dry, and well-ventilated areas away from flammable materials.

- Fire Safety: Follow local fire codes; store combustible waste in approved containers and conduct regular inspections.

- Pest Control: Ensure enclosures are sealed to prevent rodent or insect infestations.

Transportation

Transporting waste fabric requires vehicles and carriers compliant with environmental and safety standards.

- Licensed Haulers: Use transporters with valid waste carrier licenses and environmental permits.

- Containment: Secure loads to prevent spillage; use sealed or covered trucks, especially for loose fiber or shredded material.

- Tracking: Employ GPS or digital tracking systems for transparency and accountability.

Treatment & Disposal Options

Waste fabric should be prioritized for reuse, recycling, or energy recovery—landfilling should be a last resort.

- Reuse & Donation: Channel wearable garments to charities or resale platforms.

- Mechanical Recycling: Shred cotton or wool for use in insulation, cleaning rags, or new yarns.

- Chemical Recycling: For polyester and blends, advanced processes can break down fibers into raw materials.

- Energy Recovery: Non-recyclable textiles may be incinerated in waste-to-energy facilities where permitted.

- Landfill Diversion: Minimize landfill use in accordance with landfill bans on textiles (e.g., in parts of the EU and U.S.).

Compliance with Sustainability Standards

Align operations with industry and international standards to demonstrate responsible practices.

- ISO 14001: Implement an Environmental Management System to monitor waste impacts.

- GSCP (Global Social Compliance Programme): Follow textile industry sustainability benchmarks.

- Extended Producer Responsibility (EPR): In regions with EPR schemes (e.g., France, Sweden), brands may be responsible for end-of-life textile management and must report volumes and recovery rates.

Auditing & Reporting

Regular audits ensure ongoing compliance and continuous improvement.

- Internal Audits: Conduct periodic reviews of waste handling, storage, and disposal practices.

- Third-Party Verification: Obtain certifications from recycling partners or waste processors.

- Annual Reporting: Submit required waste data to regulatory bodies and include textile waste metrics in sustainability reports.

By integrating these logistics and compliance practices, businesses can manage waste fabric responsibly, reduce environmental impact, and maintain legal and ethical standards across the supply chain.

In conclusion, sourcing waste fabric presents a sustainable and innovative opportunity for businesses and designers seeking to reduce environmental impact and promote circularity in the textile industry. By repurposing post-industrial and post-consumer fabric waste, companies can minimize landfill contributions, lower carbon emissions, and conserve valuable resources such as water and energy. Although challenges such as inconsistent supply, sorting complexities, and quality variability exist, advancements in recycling technologies and improved supply chain collaboration are making waste fabric sourcing more viable and scalable. With growing consumer demand for eco-conscious products and supportive regulatory frameworks, integrating waste fabric into production processes not only supports environmental goals but also drives cost efficiency and brand differentiation. Ultimately, responsible sourcing of waste fabric is a critical step toward building a more sustainable, ethical, and resilient fashion and textile industry.