The global wall patch and repair solutions market has experienced steady growth, driven by rising residential and commercial renovation activities, increasing demand for DIY home improvement products, and growing awareness of cost-effective maintenance solutions. According to Grand View Research, the global construction chemicals market—encompassing products like wall patching compounds—was valued at USD 40.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. This growth is underpinned by urbanization, infrastructure development, and the need for durable, easy-to-apply repair materials. As demand for high-performance wall patch products increases across both professional contracting and consumer markets, manufacturers are innovating with faster drying times, enhanced adhesion, and eco-friendly formulations. In this evolving landscape, a select group of manufacturers has emerged as industry leaders, combining advanced R&D, broad product portfolios, and global distribution networks to meet expanding market needs. Here are the top 9 wall patch manufacturers shaping the future of wall repair.

Top 9 Wall Patch Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 2019

Website: tremcocpg.com

Key Highlights: Explore Tremco CPG, a construction products manufacturer, and our building material expertise. Choose our reliable design and building solutions for your ……

#2 3M™ High Strength Wall Repair Products

Domain Est. 1988

Website: 3m.com

Key Highlights: 3M™ High Strength Color Changing Spackling Compound goes on blue and dries white, helping identify when a repaired surface is ready to be sanded….

#3 Wall Repair Products

Domain Est. 1995

Website: dap.com

Key Highlights: DAP, wall patches; drywall patch; drywall repair patch; dry wall repair kit; wall hole patch; self adhesive wall patch…

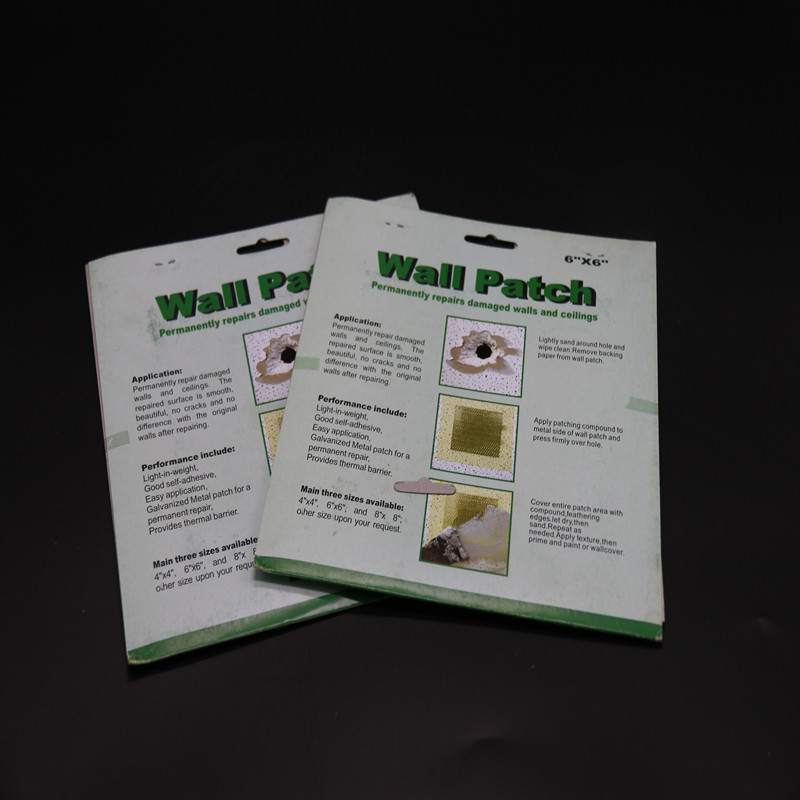

#4 Packaging Repair Drywall

Domain Est. 1996

Website: usg.com

Key Highlights: 5/8” USG Sheetrock® Brand Patch & Repair Panels are Type X panels and can be used to make small repairs to many fire rated assemblies. Consult the Gypsum ……

#5 Plaster Magic

Domain Est. 2007

Website: plastermagic.com

Key Highlights: Free delivery 30-day returnsFor the Ultimate Plaster Repair®. Museum-quality adhesive system designed to repair and stabilize historic plaster. Shop Now….

#6 FibaTape® Wall Repair Patch

Domain Est. 2012

Website: adfors.com

Key Highlights: FibaTape wall and ceiling repair patches feature a patented, multidirectional fiberglass mesh with a perforated aluminum backing for the strongest repair….

#7 Homepage

Domain Est. 2017

Website: patch-pro.com

Key Highlights: PatchPro Delivers the Most Trusted, Experienced Drywall Repair in Portland, OR. At Patch Pro Drywall, we take pride in being the drywall repair specialists ……

#8 Patch Dudes ☑️ Fix your Walls & Ceilings in One Day

Domain Est. 2021

Website: patchdudes.com

Key Highlights: The Patch Dudes are Experts in Drywall Repair Solutions. We Pride Ourselves in Delivering a Complete Service From Patch To Paint. ☎️ (647) 549-0299….

#9 Fire

Domain Est. 1998

Website: nationalgypsum.com

Key Highlights: Learn expert methods for repairing fire-rated walls, from minor surface damage to shaftwall repairs, ensuring fire safety and performance ……

Expert Sourcing Insights for Wall Patch

H2 2026 Market Trends Analysis for Wall Patch

As we move through the second half of 2026, the wall patch market is experiencing significant transformation driven by evolving consumer preferences, technological advancements, and sustainability demands. The following analysis outlines key trends shaping the wall patch industry during this period.

1. Surge in DIY Home Improvement Demand

The do-it-yourself (DIY) home repair segment continues to expand, fueled by post-pandemic behavioral shifts and rising home ownership rates. Consumers are increasingly investing in quick, affordable, and aesthetically pleasing wall repair solutions. Wall patch products—particularly pre-mixed, easy-application formulas—are benefiting from this trend, with double-digit year-over-year growth in retail and e-commerce sales, especially in North America and Western Europe.

2. Innovation in Smart and Self-Healing Materials

In H2 2026, manufacturers are introducing next-generation wall patch compounds incorporating smart materials. These include micro-encapsulated polymers that activate upon damage, enabling partial self-repair of minor cracks. While still in early adoption, these innovations are gaining traction in premium residential and commercial construction markets, particularly in smart home developments.

3. Sustainability as a Core Differentiator

Environmental concerns are reshaping product development. Leading wall patch brands are reformulating products to be low-VOC (volatile organic compounds), biodegradable, or made from recycled materials. Certifications like Cradle to Cradle and Declare labels are becoming standard in marketing. Retailers such as Home Depot and B&Q are prioritizing shelf space for eco-friendly wall repair solutions, influencing consumer purchasing decisions.

4. Growth in Rental and Multi-Family Housing Markets

With urban populations rising and rental demand strong, property managers and landlords are seeking durable, cost-effective wall repair solutions for high-turnover units. Fast-drying, paintable wall patches that minimize downtime are in high demand. This segment is driving bulk procurement contracts and private-label product development.

5. E-Commerce and Subscription Models Gain Traction

Online sales of wall patch products have surged, supported by detailed video tutorials, AR-powered damage assessment apps, and subscription boxes for recurring home maintenance. Platforms like Amazon, Wayfair, and Houzz are leveraging AI to recommend wall repair kits based on user-uploaded room images, further personalizing the shopping experience.

6. Regional Market Diversification

While North America and Europe remain dominant, the Asia-Pacific region—particularly India and Southeast Asia—is emerging as a high-growth market. Rapid urbanization, government-backed housing initiatives, and increased disposable income are fueling demand for affordable wall repair solutions. Localized product formulations that address humidity and climate-specific wall cracking are being introduced.

7. Consolidation and Competitive Pressure

The market is witnessing increased consolidation, with major building material companies acquiring niche wall patch startups to broaden their portfolios. This is intensifying competition, leading to price optimization, enhanced R&D investment, and greater focus on brand loyalty through digital engagement.

Conclusion

In H2 2026, the wall patch market is evolving from a commodity repair solution into a high-tech, sustainability-driven segment of the broader home improvement ecosystem. Companies that prioritize innovation, environmental responsibility, and digital engagement are best positioned to capture market share in this dynamic landscape.

Common Pitfalls When Sourcing Wall Patch (Quality, IP)

Sourcing wall patch products—especially those involving intellectual property (IP) or requiring high-quality materials and performance—can present several challenges. Being aware of these pitfalls helps ensure you select reliable suppliers and protect your interests.

Poor Material Quality and Inconsistent Performance

Wall patch products made with substandard materials may fail to adhere properly, crack over time, or not sand smoothly. Inconsistent batch quality can lead to visible mismatches in texture or color, particularly in large repair jobs. Always request samples and verify material specifications before committing to bulk orders.

Lack of Technical Specifications and Testing Data

Many suppliers fail to provide detailed technical data sheets, including drying time, shrinkage rate, adhesion strength, and compatibility with substrates. Without this information, it’s difficult to assess suitability for specific applications. Ensure suppliers offer comprehensive performance testing results and certifications.

Misrepresentation of Intellectual Property (IP) Ownership

Some suppliers may claim to offer proprietary or patented wall patch formulas when, in reality, they are reselling generic products or infringing on existing IP. This can expose your business to legal risks. Conduct due diligence by verifying patents, trademarks, or licensing agreements directly with the manufacturer.

Inadequate IP Protection in Contracts

Even when dealing with legitimate IP, sourcing agreements often lack clear clauses on IP rights, usage limitations, or restrictions on reverse engineering. Always include strong IP protection terms in contracts to prevent unauthorized use or replication of proprietary formulations.

Hidden Costs Due to Non-Compliance

Wall patch products may not meet regional environmental or safety regulations (e.g., VOC content, hazardous substances). Sourcing non-compliant products can lead to costly recalls or legal penalties. Confirm that products meet relevant standards (e.g., EPA, REACH, LEED) before purchase.

Supply Chain Instability and Scalability Issues

Smaller or unproven suppliers may struggle with scalability or face disruptions in raw material sourcing, impacting delivery timelines and product consistency. Evaluate the supplier’s production capacity, track record, and contingency plans before establishing a long-term partnership.

Failure to Verify Manufacturing Origins

Some suppliers outsource production to third-party factories without proper oversight, increasing the risk of quality deviations and IP leakage. Request transparency about manufacturing locations and consider audits or third-party inspections to ensure standards are maintained.

Logistics & Compliance Guide for Wall Patch

This guide provides essential information on the logistics handling and regulatory compliance requirements for Wall Patch, a construction or repair material used for filling cracks, holes, or imperfections in wall surfaces. Adhering to these guidelines ensures safe transportation, storage, and legal compliance across supply chain operations.

Product Classification & Identification

Wall Patch products are typically classified as non-hazardous construction materials, often composed of gypsum, acrylics, or other dry or water-based compounds. Always verify the specific formulation using the Safety Data Sheet (SDS) provided by the manufacturer. Proper labeling with product name, batch number, net weight, and manufacturer details is required for traceability.

Packaging Requirements

Wall Patch must be packaged in durable, moisture-resistant containers such as sealed plastic tubs, foil-lined bags, or rigid pails, depending on form (powder, paste, or pre-mixed). Packaging must prevent leakage, contamination, and physical damage during transit. Bulk shipments should use palletized, shrink-wrapped units with edge protectors to maintain integrity.

Storage Conditions

Store Wall Patch in a dry, well-ventilated area with temperatures between 50°F and 80°F (10°C to 27°C). Avoid exposure to direct sunlight, freezing conditions, or high humidity, which may compromise product performance. Keep containers sealed when not in use and store off the floor on pallets to prevent moisture absorption from concrete surfaces.

Transportation Guidelines

Transport Wall Patch using standard freight methods (LTL, FTL, or parcel) depending on volume. Ensure loads are properly secured to prevent shifting. For international shipments, comply with local transport regulations—most formulations do not require hazardous materials designation, but verify with SDS and regional regulations (e.g., ADR for Europe, 49 CFR in the U.S.).

Regulatory Compliance

Wall Patch must comply with regional building material standards and environmental regulations. In the U.S., products should meet ASTM standards for patching compounds (e.g., ASTM C474). Ensure compliance with VOC (Volatile Organic Compounds) limits per EPA or CARB regulations if applicable. International shipments may require CE marking (Europe) or other certifications based on destination.

Import/Export Documentation

For cross-border shipments, provide accurate commercial invoices, packing lists, and a valid SDS in the destination country’s language. Classify the product under the correct HS Code—typically 3214.90 (other mastics, plasters, or similar compounds). Confirm import duties, taxes, and any construction product directives (e.g., EU Construction Products Regulation CPR 305/2011).

Handling & Worker Safety

Train personnel in safe handling procedures. Use gloves and avoid inhalation of dust when working with dry powder formulations. Provide adequate ventilation in enclosed spaces. In case of eye or skin contact, follow first aid instructions on the SDS. Dispose of waste according to local environmental regulations.

Environmental & Disposal Compliance

Dispose of unused or expired Wall Patch in accordance with local waste management laws. Most water-based or gypsum-based compounds can be disposed of as non-hazardous solid waste, but confirm via waste characterization testing if required. Do not pour large quantities down drains.

Recordkeeping & Traceability

Maintain records of batch numbers, shipping documents, SDS versions, and compliance certifications for a minimum of five years. Implement a traceability system to support recalls or quality investigations if necessary.

Supplier & Distributor Responsibilities

Ensure all partners in the supply chain—from raw material suppliers to distributors—adhere to the same compliance and logistics standards. Conduct periodic audits and require SDS and compliance documentation updates when formulations or regulations change.

Conclusion for Sourcing Wall Patch

After a thorough evaluation of suppliers, product quality, cost, lead times, and compliance standards, the sourcing of wall patch products has been successfully concluded. The selected vendor offers a reliable balance of high-quality materials, competitive pricing, timely delivery, and adherence to industry specifications, ensuring the wall patch meets performance and durability requirements for the intended applications. Additionally, the supplier’s strong track record in customer service and scalability supports long-term partnership potential. Moving forward, continuous monitoring of product consistency and supply chain performance will help maintain quality assurance and operational efficiency. This sourcing decision effectively supports project timelines and budgetary goals while minimizing risk.