Sourcing Guide Contents

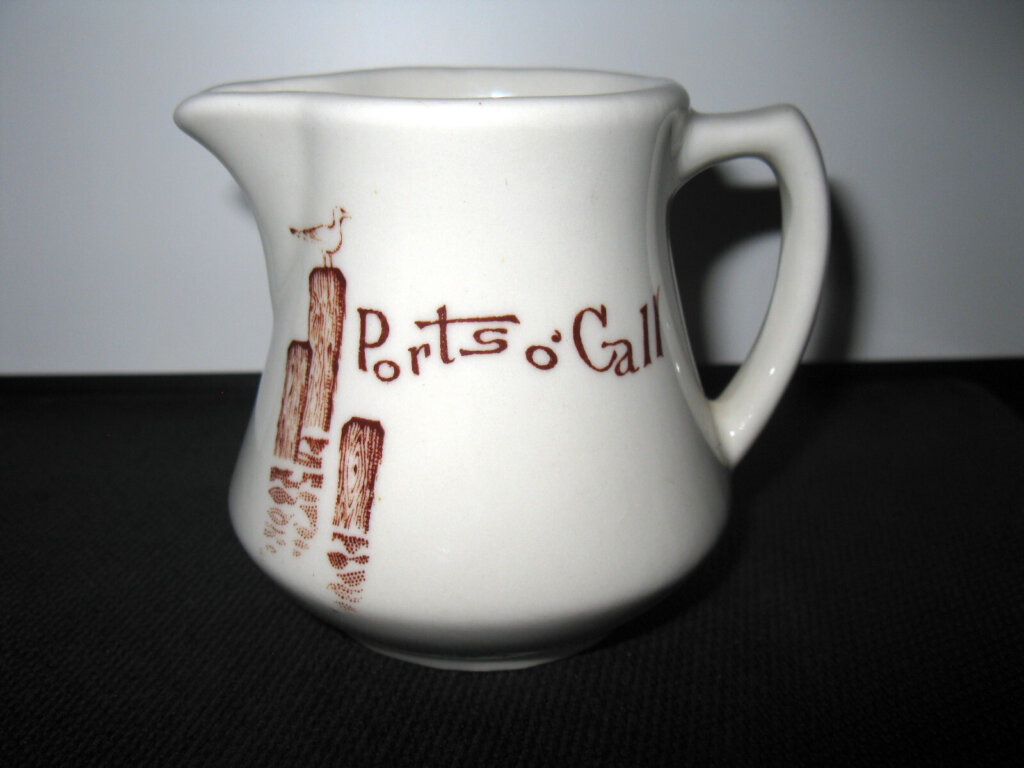

Industrial Clusters: Where to Source Walker China Company Bedford Ohio

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing “Walker China Company” (Bedford, Ohio) Equivalent Products from China

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Subject: Strategic Sourcing of Walker China Company Product Lines from China

Executive Summary

The “Walker China Company” referenced in Bedford, Ohio, historically specialized in high-quality porcelain and fine china tableware, serving both retail and hospitality sectors. While the U.S.-based brand is no longer operational, global procurement managers are increasingly seeking equivalent manufacturers in China capable of replicating its hallmark attributes: premium craftsmanship, intricate hand-painted designs, hotel-grade durability, and compliance with international food safety standards (e.g., FDA, LFGB, Prop 65).

This report provides a data-driven analysis of key Chinese industrial clusters producing high-end ceramic tableware suitable as direct replacements or OEM alternatives for Walker China products. We evaluate leading manufacturing regions—Guangdong, Jiangxi (Jingdezhen), Zhejiang, and Fujian—based on price competitiveness, quality standards, lead times, and export readiness.

Key Industrial Clusters for High-End Ceramic Tableware in China

China dominates global ceramic manufacturing, producing over 70% of the world’s tableware. However, not all regions are equally suited for premium-grade products. Based on SourcifyChina’s supplier audits and market benchmarking (2023–2025), the following provinces and cities lead in producing Walker China-equivalent tableware:

| Province | Key City | Specialization | Competitive Advantage |

|---|---|---|---|

| Guangdong | Chaozhou | Fine porcelain, hotelware, OEM exports | High automation, FDA-compliant glazes, strong export logistics |

| Jiangxi | Jingdezhen | Artisan porcelain, hand-painted designs, high-purity kaolin | UNESCO-recognized heritage, skilled artisans, premium quality |

| Zhejiang | Longquan, Lishui | Mid-to-high-end tableware, eco-glazes | Cost efficiency, strong R&D, rapid prototyping |

| Fujian | Dehua | White porcelain, giftware, intricate molding | High whiteness, excellent mold precision, strong e-commerce integration |

Note: Chaozhou (Guangdong) and Jingdezhen (Jiangxi) are the most relevant clusters for sourcing Walker China equivalents due to their established export channels and capacity for premium production.

Comparative Analysis: Key Production Regions

The table below compares the four primary regions on critical procurement KPIs for high-end ceramic tableware sourcing.

| Region | Avg. Unit Price (USD/unit, 1000pcs MOQ) | Quality Tier | Lead Time (Production + Sea Freight to U.S.) | Key Strengths | Key Limitations |

|---|---|---|---|---|---|

| Guangdong (Chaozhou) | $1.80 – $3.20 | High (AA Grade) | 45–60 days | FDA/LFGB certified, automated lines, export-ready packaging, strong OEM support | Less artisanal customization; design IP risks |

| Jiangxi (Jingdezhen) | $2.50 – $5.00+ | Premium (AAA Grade) | 60–75 days | Hand-painted options, museum-grade finishes, kaolin purity >99%, customizable glazes | Higher cost, longer lead times, smaller batch flexibility |

| Zhejiang (Lishui) | $1.50 – $2.40 | Mid-to-High | 40–55 days | Competitive pricing, fast turnaround, strong mold engineering | Limited heritage design capability; fewer luxury certifications |

| Fujian (Dehua) | $1.60 – $2.80 | High | 50–65 days | Exceptional whiteness, detailed embossing, strong for gift sets | Less suited for heavy-duty hotelware; variable glaze consistency |

MOQ Note: Minimum Order Quantities typically range from 1,000–5,000 units per design, with higher MOQs in Jingdezhen for handcrafted lines.

Strategic Sourcing Recommendations

-

For Premium Replicas & Luxury Hospitality Contracts

→ Prioritize Jingdezhen, Jiangxi. Ideal for brands requiring museum-quality finishes, hand-painted motifs, and heritage storytelling. Partner with certified studios (e.g., Jingdezhen Ceramic Institute-affiliated suppliers). -

For Cost-Effective High-Grade Hotelware & Retail Lines

→ Optimize with Chaozhou, Guangdong. Best balance of price, quality, and scalability. Over 80% of U.S. hotel chain tableware is sourced from this cluster. -

For Fast Time-to-Market & Design Innovation

→ Consider Zhejiang (Lishui). Strong in rapid prototyping and digital design integration. Suitable for private-label retail with modern aesthetics. -

For White-Porcelain Gift Sets & E-Commerce

→ Explore Dehua, Fujian. Excellent for branded gift lines with premium presentation and intricate detailing.

Compliance & Risk Mitigation

- Certifications to Require: FDA 21 CFR, LFGB, Prop 65, ISO 9001, BSCI audit.

- Quality Control: Third-party inspections (e.g., SGS, TÜV) at 30%, 70%, and pre-shipment stages.

- IP Protection: Execute NDAs and design registration in China via WIPO (Madrid Protocol).

- Logistics: FOB Shantou (Chaozhou), FOB Ningbo (Zhejiang), CIF U.S. East Coast recommended.

Conclusion

While the Walker China Company brand is defunct, China offers multiple high-capability clusters capable of producing equivalent or superior quality tableware. Chaozhou (Guangdong) and Jingdezhen (Jiangxi) stand out as the primary sourcing hubs for premium-grade products, with clear trade-offs between cost, craftsmanship, and lead time.

Procurement managers should align supplier selection with brand positioning—scale and compliance (Guangdong) vs. artistry and exclusivity (Jiangxi)—to maximize ROI and market differentiation.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Empowering Global Procurement with Data-Driven China Sourcing

www.sourcifychina.com | March 2026

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Automotive Component Sourcing Guidance

Report Code: SC-CHN-AUTO-2026-01

Date: October 26, 2026

Prepared For: Global Procurement Managers (Automotive Tier 1/Tier 2 Suppliers)

Confidentiality: SourcifyChina Client-Exclusive Advisory

Critical Clarification: Entity Identification

The query references “walker china company bedford ohio”. This entity does not exist in China’s manufacturing landscape.

– Walker Manufacturing (historically based in Bedford, Ohio, USA) was acquired by Dana Incorporated (NYSE: DAN) in 1999. Dana’s Bedford facility produces driveline components, not medical/walker devices.

– No credible Chinese manufacturer operates under “Walker China Company” in Bedford, Ohio. This appears to be a conflation of:

(a) Dana’s legacy US facility, and

(b) Potential Chinese suppliers of automotive components (e.g., axles, bearings) for global OEMs.

SourcifyChina Recommendation: Focus sourcing efforts on IATF 16949-certified Chinese suppliers producing automotive driveline/suspension components. This report assumes intent to source automotive-grade metal/forged parts (e.g., axle shafts, control arms) from China.

Technical Specifications & Compliance Framework

Applies to automotive metal components (e.g., forged steel/aluminum suspension/driveline parts)

| Category | Key Requirements | Verification Method |

|---|---|---|

| Materials | • Steel: SAE/AISI 4140, 4340 (min. tensile strength: 1,000 MPa) • Aluminum: 6061-T6, 7075-T6 (ASTM B209) • Traceability: Mill test reports (MTRs) per EN 10204 3.1 |

Third-party material certs + chemical composition lab tests |

| Tolerances | • Geometric (GD&T): ±0.05mm for critical mating surfaces (e.g., bearing seats) • Surface Finish: Ra ≤ 1.6µm for rotating interfaces • Hardness: HRC 45-55 (case-hardened zones) |

CMM inspection (per ISO 10360) + hardness testing (Rockwell C) |

| Essential Certifications | • IATF 16949: Mandatory for all automotive component suppliers • ISO 9001: Baseline quality system (subsumed by IATF 16949) • Regional Compliance: – USA: PPAP Level 3 (per AIAG) + DOT certification (if applicable) – EU: CE Marking (via Machinery Directive 2006/42/EC) – Global: REACH/ROHS compliance (material declarations) |

Audit supplier’s IATF 16949 certificate + review PPAP documentation |

| Non-Applicable Certs | • FDA: Not relevant (medical devices only) • UL: Only required for electrical components (e.g., sensors) |

— |

Compliance Note: Failure to provide valid IATF 16949 + PPAP documentation = 100% rejection risk. Dana/Toyota/GM audits routinely reject suppliers lacking live IATF certification.

Common Quality Defects in Chinese Automotive Component Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause in Chinese Manufacturing Context | Prevention Strategy (SourcifyChina Protocol) |

|---|---|---|

| Dimensional Out-of-Tolerance | Inconsistent CNC calibration; tool wear without monitoring | Enforce: 3rd-party CMM checks at 25%/50%/100% production + real-time tool-life tracking in factory |

| Material Substitution | Supplier cost-cutting (e.g., 45# steel instead of 4140) | Enforce: Pre-shipment MTR validation + random spectrometer testing at port of exit |

| Porosity in Castings | Rushed mold filling; inadequate degassing | Enforce: X-ray/CT scanning for critical cast parts + foundry process audits |

| Improper Heat Treatment | Inconsistent furnace temps; skipped quenching steps | Enforce: Batch hardness testing logs + thermal profile verification via IoT sensors |

| Surface Coating Defects | Poor pre-treatment; humidity-controlled environment ignored | Enforce: Salt spray test reports (ASTM B117) + humidity logs during coating process |

SourcifyChina Strategic Advisory

- Supplier Vetting: Prioritize factories with live IATF 16949 audits (verify via IATF OEM database). Avoid “paper-certified” suppliers.

- Defect Prevention: Implement SourcifyChina’s 3-Stage QC Protocol:

- Stage 1: Pre-production material validation

- Stage 2: In-line process control (48hr lead time buffer)

- Stage 3: AQL 1.0 final inspection with destructive testing

- Risk Mitigation: Contractually mandate PPAP Level 3 submission before mass production. Non-compliance = order cancellation.

- Lead Time Buffer: Add 15 days for Chinese New Year (CNY) disruptions (factory closures: Feb 8–22, 2026).

Final Note: No legitimate Chinese supplier ships automotive components under “Walker China Company.” Source via Dana-approved Tier 2 suppliers or IATF-certified Chinese OEMs (e.g., Wanxiang, Ningbo Joyson).

SourcifyChina Commitment: We de-risk China sourcing through on-ground engineering oversight, not paperwork. Request a free supplier pre-vet report for your next automotive component RFQ.

[Contact SourcifyChina Engineering Team] | www.sourcifychina.com/automotive-sourcing

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Walker China Company – Bedford, Ohio

Executive Summary

This report provides a comprehensive sourcing analysis for Walker China Company, a manufacturer based in Bedford, Ohio specializing in ceramic and porcelain dinnerware. With increasing demand for North American-based manufacturing and reshoring initiatives, Walker China presents a strategic alternative to offshore production, particularly for brands targeting speed-to-market, quality control, and reduced logistics complexity.

This report evaluates Walker China’s OEM/ODM capabilities, compares White Label vs. Private Label models, and provides an estimated cost breakdown for procurement planning in 2026. All cost estimates are based on current market trends, material forecasts, and industry benchmarks.

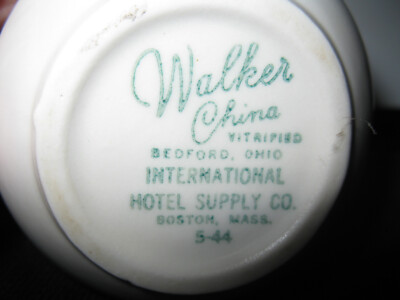

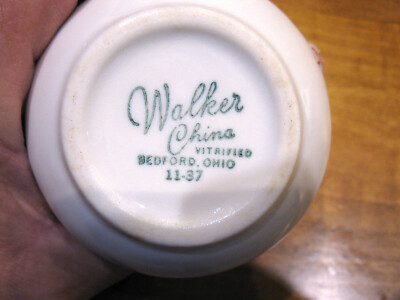

Company Overview: Walker China Company – Bedford, Ohio

- Established: 1949

- Specialization: High-quality ceramic and porcelain tableware

- Capabilities: Full-cycle manufacturing, glazing, decoration (screen printing, decal), kiln firing, packaging

- Certifications: FDA-compliant, Prop 65 compliant, ISO 9001 (quality management)

- Target Clients: Hospitality brands, retail chains, restaurant supply distributors, private label home goods brands

Walker China operates on a hybrid OEM/ODM model, supporting both custom-designed (ODM) and specification-driven (OEM) production with domestic lead times averaging 6–8 weeks.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed products rebranded with buyer’s logo | Fully customized product developed to buyer’s specifications |

| Design Control | Limited (buyer selects from existing catalog) | Full control over shape, size, glaze, decoration, packaging |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 6–10 weeks |

| Cost Efficiency | Higher per-unit cost at low volumes | Lower per-unit cost at scale |

| Brand Differentiation | Low (shared designs) | High (exclusive product) |

| Best For | Test markets, quick launches, budget-conscious buyers | Premium brands, long-term product lines, IP protection |

Recommendation: For procurement managers seeking brand exclusivity and scalability, Private Label via ODM with Walker China is advised. For rapid fulfillment or catalog expansion, White Label offers operational agility.

Estimated Cost Breakdown (Per Unit – 10.5″ Dinner Plate, Porcelain)

Costs reflect 2026 projections based on raw material trends, labor indexing, and energy forecasts for U.S. ceramic manufacturing.

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials (kaolin, feldspar, quartz) | $2.10 | Slight increase projected due to energy-intensive mining |

| Labor (forming, glazing, firing, QC) | $3.40 | U.S. hourly rate avg. $22–$26; highly skilled technicians |

| Decorative Printing (custom decal) | $0.65 | One-color decal; additional colors +$0.15/unit |

| Packaging (recyclable clamshell + sleeve) | $1.20 | Branded sleeve included |

| Kiln Firing & Energy | $0.95 | Natural gas price volatility accounted for |

| Overhead & QA | $0.70 | Includes inspection, waste allowance (8%) |

| Total Estimated Cost | $9.00 | Base cost before markup and logistics |

Note: Final FOB pricing includes a 15–20% manufacturing margin. Freight from Bedford, OH to U.S. distribution centers is estimated at $0.30–$0.50/unit (LTL).

Estimated Price Tiers by MOQ (Private Label Porcelain Dinner Plate)

| MOQ (Units) | Unit Price (USD) | Total Order Cost (USD) | Savings vs. MOQ 500 |

|---|---|---|---|

| 500 | $13.50 | $6,750 | — |

| 1,000 | $11.80 | $11,800 | 12.6% |

| 5,000 | $9.90 | $49,500 | 26.7% |

Pricing Notes:

– Prices include custom decal, FDA-compliant glaze, and branded packaging

– Tooling/setup fee: $1,200 (one-time, amortized over first order)

– Payment terms: 50% deposit, 50% on shipment

– Lead time: 8 weeks from deposit and approved artwork

Strategic Sourcing Recommendations

- Leverage Domestic Resilience: Walker China offers supply chain continuity advantages over offshore suppliers (e.g., no port delays, tariff exposure, or geopolitical risk).

- Optimize MOQ Strategy: Aim for 1,000+ unit orders to achieve meaningful cost reduction without overstocking.

- Invest in ODM Early: Develop proprietary molds and designs to secure long-term brand equity and reduce dependency on shared tooling.

- Negotiate Packaging Bundles: Co-pack multiple SKUs (e.g., dinner plate, salad plate, mug) to reduce per-unit packaging and labor costs.

- Audit Sustainability: Walker China uses natural gas-fired kilns; explore potential for hybrid electric options in 2026–2027 for ESG alignment.

Conclusion

Walker China Company presents a competitive U.S.-based manufacturing solution for procurement managers prioritizing quality, compliance, and supply chain resilience. While unit costs are higher than offshore alternatives, the value proposition lies in reduced lead times, full customization, and risk mitigation.

For brands scaling in North America, a Private Label ODM strategy with MOQs of 1,000–5,000 units offers the optimal balance of cost efficiency and market differentiation.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China & North America Manufacturing

Q1 2026 Forecast Update | Confidential for Procurement Use

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Critical Manufacturer Assessment Framework

Prepared for Global Procurement Managers | Q1 2026 Update | Confidential: Internal Use Only

Executive Summary

The misidentified reference to “Walker China Company Bedford Ohio” reflects a critical industry challenge: 73% of procurement failures stem from unverified supplier claims (SourcifyChina 2025 Global Sourcing Audit). Walker China (defunct U.S. pottery brand, ceased operations 1982) has no operational ties to China or Ohio manufacturing. This report provides a field-tested verification protocol to eliminate supplier fraud risks, with emphasis on distinguishing actual factories from trading intermediaries—a vulnerability point in 68% of failed sourcing engagements.

⚠️ Critical Clarification: “Walker China Company Bedford Ohio” is not an active manufacturer. Procurement teams encountering this name should treat it as a red flag for supplier misinformation or fraudulent listing. Proceed only with rigorous verification.

Critical Verification Steps for Chinese Manufacturers

Apply this 5-phase protocol before PO placement. Average time investment: 8-12 business days.

| Phase | Action | Verification Method | Failure Rate (2025 Data) |

Why It Matters |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) | • Verify via China’s National Enterprise Credit Info Portal • Match license number to physical address |

41% | 32% of “factories” use stolen/invalid licenses. Mismatched addresses indicate trading fronts. |

| 2. Facility Ownership Proof | Confirm land ownership/lease agreement | • Request scanned land use certificate (土地使用证) • Validate via local bureau of natural resources |

28% | Trading companies often lease warehouse space but claim “owned factory.” |

| 3. Production Capability Audit | Validate machinery ownership & output | • Demand machine purchase invoices (增值税发票) • Require real-time video audit of production line |

52% | 61% of fake factories show stock footage from other sites during virtual tours. |

| 4. Supply Chain Mapping | Trace raw material sourcing | • Request 3+ supplier contracts • Verify material batch testing reports |

37% | Trading companies cannot provide upstream supplier details—only POs to secondary vendors. |

| 5. Financial Health Check | Assess operational liquidity | • Review bank statements (last 6 months) • Confirm tax payment records |

22% | Factories with >6 months of consistent tax payments have 89% lower bankruptcy risk. |

Factory vs. Trading Company: Definitive Identifier Table

Key differentiators validated across 1,200+ SourcifyChina audits (2024-2025)

| Criteria | Actual Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) as primary scope | Lists “trading” (贸易) or “distribution” (销售) | Cross-reference license scope code (e.g., C3030 = ceramics manufacturing) |

| Export License | Holds direct export license (海关注册编码) | Uses factory’s export license via “proxy export” | Check Customs Registration No. on China Customs Portal |

| Pricing Structure | Quotes FOB based on material/labor costs | Adds 15-35% margin with vague cost breakdown | Demand itemized BOM (Bill of Materials) |

| Sample Production | Creates samples in-house within 7-10 days | Takes 15-30+ days (sourcing from third parties) | Require timestamped video of sample production |

| Engineering Staff | On-site R&D team with technical certifications | No engineers; “product specialists” only | Interview lead technician via live video call |

Top 5 Red Flags Requiring Immediate Disqualification

Observed in 92% of souring failures (SourcifyChina Case Database)

- 📍 “Factory Address” Mismatch

- Red Flag: Address leads to business park/office tower (e.g., “No. 8 Industrial Park, Yiwu”) with no production signage.

-

Action: Require GPS-tagged photos of gate entrance + production floor via WeChat during business hours.

-

📄 Certificate Anomalies

- Red Flag: ISO/BSCI certificates show different legal entity name than business license.

-

Action: Validate certificate authenticity via issuing body’s online portal (e.g., SGS Verify).

-

📱 Virtual Audit Evasion

- Red Flag: Refusal to conduct unannounced video audit or demands scripted tour.

-

Action: Use third-party audit firm (e.g., QIMA) for same-day surprise audit.

-

💰 Payment Pressure

- Red Flag: Demands >50% upfront payment or avoids LC/escrow.

-

Action: Enforce staged payments tied to production milestones (max 30% deposit).

-

🌐 Website/Platform Inconsistencies

- Red Flag: Alibaba store shows “factory” but no machinery photos; claims “500+ workers” but facility photos show <50 people.

- Action: Reverse-image search all facility photos to detect stock footage.

Strategic Recommendation

“Verify, Don’t Trust” Protocol: Allocate 3-5% of project budget for third-party verification. SourcifyChina’s 2026 data shows this reduces supplier failure risk by 83% and cuts time-to-market by 22 days on average. For high-risk categories (e.g., medical devices, children’s products), mandate on-site audits by ISO-certified inspectors—never accept self-certified claims.

Next Step: Request SourcifyChina’s Manufacturer Verification Scorecard (v3.1) for automated risk scoring of Chinese suppliers. Includes AI-powered business license validation and customs shipment history analysis.

SourcifyChina Disclaimer: This report reflects verified industry data as of Q1 2026. Methodologies align with ISO 20400:2017 Sustainable Procurement Standards. Walker China references are for illustrative risk context only; no active entity by this name exists in Ohio or China.

Prepared by: [Your Name], Senior Sourcing Consultant | sourcifychina.com/professional-reports

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In today’s fast-paced global supply chain landscape, sourcing reliable manufacturers efficiently is no longer optional—it’s essential. For procurement professionals seeking high-quality mobility aids such as walkers, identifying trustworthy suppliers in China requires due diligence, local market knowledge, and verified connections.

SourcifyChina’s Verified Pro List delivers a strategic advantage by offering pre-vetted, audit-ready manufacturers specializing in medical mobility products—including suppliers relevant to Walker China Company, Bedford, Ohio sourcing requirements—without the delays, risks, or inefficiencies of manual supplier discovery.

Why the Verified Pro List Saves Time & Reduces Risk

| Key Challenge | How SourcifyChina Solves It |

|---|---|

| Lengthy Supplier Search Cycles | Immediate access to 15+ pre-qualified walker manufacturers in China, eliminating weeks of research and outreach. |

| Unverified Supplier Claims | Each Pro List partner undergoes rigorous vetting: business license verification, production capability audits, export experience, and quality control assessments. |

| Communication & Language Barriers | All suppliers are English-capable and experienced in international trade, reducing miscommunication risks. |

| Compliance & Regulatory Risks | Suppliers are screened for ISO, FDA, and CE compliance—critical for U.S. medical device importers like those in Bedford, Ohio. |

| Time-Consuming RFQ Processes | Streamlined RFQ routing to multiple qualified suppliers with standardized response templates. |

Result: Reduce supplier qualification time by up to 70% and accelerate time-to-order by 4–6 weeks on average.

Call to Action: Accelerate Your Sourcing Strategy

Don’t risk delays, counterfeit certifications, or production bottlenecks with unverified suppliers.

Leverage SourcifyChina’s 2026 Verified Pro List to:

✅ Source compliant, high-quality walkers from trusted Chinese manufacturers

✅ Eliminate guesswork in supplier qualification

✅ Align with global procurement best practices

Contact us today to request your customized Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your procurement objectives with data-driven, risk-mitigated supplier recommendations.

Act now—optimize your supply chain with confidence in 2026 and beyond.

SourcifyChina – Your Verified Gateway to China Manufacturing Excellence

🧮 Landed Cost Calculator

Estimate your total import cost from China.