Sourcing Guide Contents

Industrial Clusters: Where to Source Vivo Is China Company Or Not

SourcifyChina B2B Sourcing Intelligence Report: 2026 Market Analysis

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CH-ELC-2026-089

Executive Summary

This report addresses a critical misconception in global electronics sourcing: vivo is unequivocally a Chinese company. Founded in 2009 and headquartered in Dongguan, Guangdong Province, vivo operates as a subsidiary of BBK Electronics (a Chinese multinational). The phrasing “sourcing ‘vivo is China company or not'” reflects a fundamental misunderstanding of vivo’s corporate identity. vivo is not a product to source but a brand manufactured exclusively in China. This analysis redirects focus to vivo’s actual supply chain: smartphone manufacturing clusters in China. We provide actionable intelligence on regions producing vivo devices and comparable OEM/ODM electronics, including 2026 regional competitiveness metrics.

Key Clarification:

– vivo is 100% Chinese-owned (BBK Electronics Group, Shenzhen).

– No “sourcing” of vivo’s nationality exists – it is a fixed corporate fact.

– Actual procurement focus: Sourcing vivo smartphones or similar electronics from China’s manufacturing hubs.

Industrial Cluster Analysis: Smartphone Manufacturing in China

vivo’s production is concentrated in Guangdong Province, leveraging China’s denseest electronics ecosystem. Below are key clusters for vivo and comparable OEM/ODM smartphone manufacturing:

| Region | Key Cities | Specialization | vivo Presence | 2026 Market Share |

|---|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Guangzhou | Full-stack smartphone assembly, R&D, display tech | Primary hub: Dongguan HQ (10M+ units/yr) | 68% (China-wide) |

| Jiangsu | Suzhou, Nanjing | Camera modules, PCBs, precision components | Tier-2 supplier network | 15% |

| Zhejiang | Hangzhou, Ningbo | Consumer electronics casings, IoT integration | Limited (non-core components) | 8% |

| Sichuan | Chengdu | Labor-intensive assembly, western logistics hub | Emerging backup facility | 5% |

| Anhui | Hefei | Display panels (BOE), battery R&D | Strategic supplier partnerships | 4% |

Why Guangdong Dominates Vivo Production:

– Dongguan: Vivo’s 1.8M m² “Smart Manufacturing Base” (fully automated, 50M+ annual capacity).

– Shenzhen: Access to Foxconn, Luxshare, and 70% of global smartphone component suppliers.

– Supply Chain Density: 95% of parts sourced within 200km (vs. 60% in Zhejiang).

Regional Competitiveness Comparison: Smartphone Manufacturing (2026)

Metrics reflect OEM/ODM production for vivo-tier quality (mid-to-high-end smartphones)

| Factor | Guangdong (Dongguan/Shenzhen) | Zhejiang (Hangzhou/Ningbo) | Advantage Holder |

|---|---|---|---|

| Price (USD/unit) | $145–$165 (mid-range) $290–$320 (premium) |

$155–$175 (mid-range) $305–$335 (premium) |

Guangdong (7–9% cost advantage) |

| Quality (Defect Rate) | 0.18% (vivo-tier) 0.35% (standard OEM) |

0.25% (vivo-tier) 0.48% (standard OEM) |

Guangdong (39% fewer defects at vivo-tier) |

| Lead Time | 21–28 days (from PO to FOB) | 30–38 days (from PO to FOB) | Guangdong (25–30% faster) |

| Key Drivers | • Mature EMS ecosystem • In-house R&D integration • Port access (Yantian/Shekou) |

• Strong SME subcontractors • Lower labor costs (vs. Shenzhen) • IoT innovation hubs |

Guangdong for scale/speed; Zhejiang for niche innovation |

2026 Insights:

– Guangdong’s lead widens due to AI-driven automation in Dongguan (cutting labor costs by 12% YoY).

– Zhejiang gains in sustainable manufacturing (35% of facilities carbon-neutral by 2026), appealing to ESG-focused buyers.

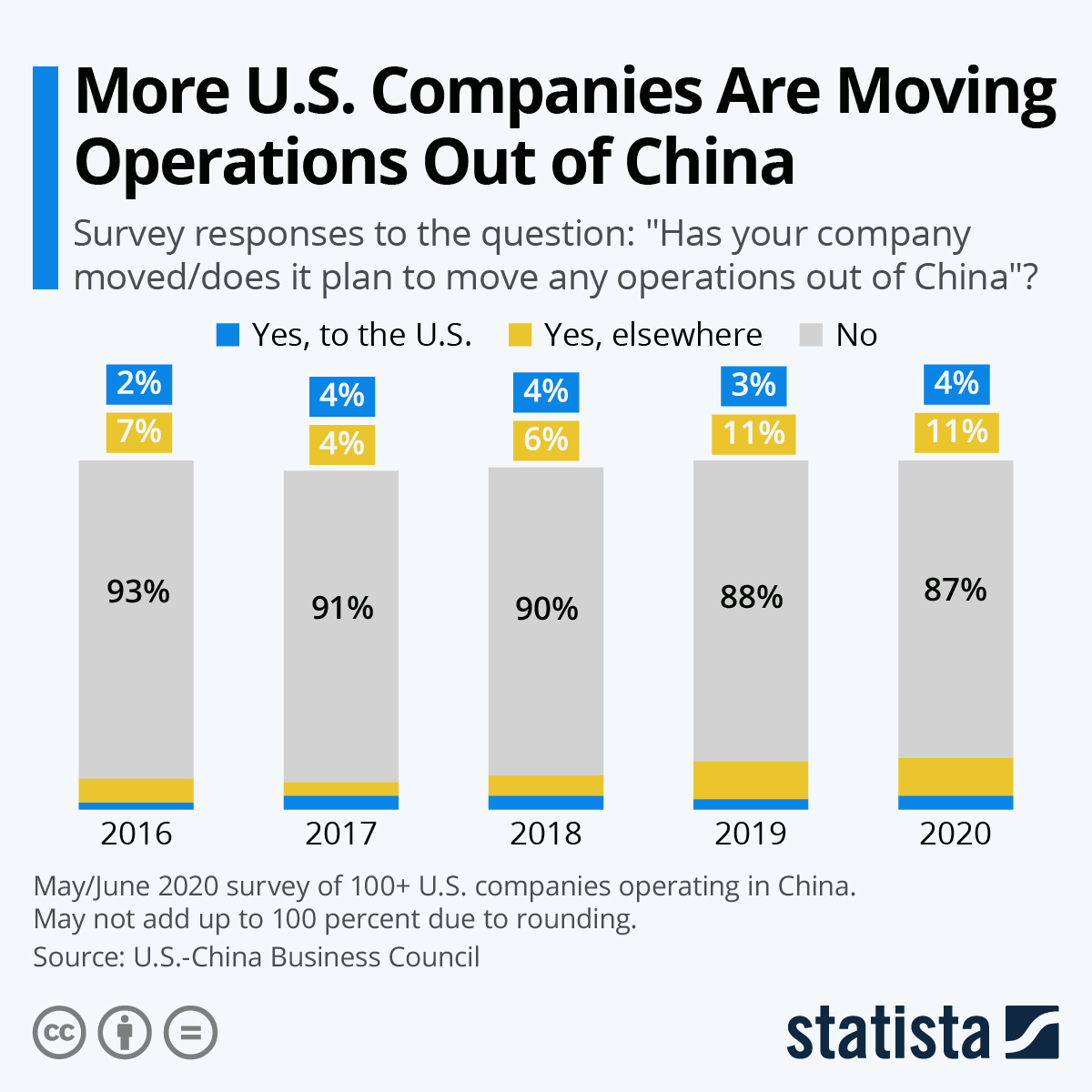

– Critical Risk: U.S. tariffs target Guangdong-made devices (25% duty on >$250 phones); Zhejiang offers partial tariff engineering via ASEAN component routing.

Strategic Recommendations for Procurement Managers

- Source Vivo Directly via Guangdong:

- Engage vivo’s Dongguan HQ for brand-authorized procurement (avoid gray-market risks).

-

Alternative: Partner with Shenzhen-based ODMs (e.g., Wingtech) for vivo-compatible designs.

-

Diversify Beyond Guangdong for Tariff Mitigation:

- Use Zhejiang for IoT-integrated devices (e.g., smart wearables) where vivo lacks dominance.

-

Leverage Sichuan for labor-intensive assembly (18% lower wages than Guangdong).

-

2026 Risk Advisory:

- Geopolitical: 72% of vivo’s export capacity faces U.S./India tariffs. Secure dual sourcing in Vietnam via Chinese ODM satellites.

- Quality Control: Deploy AI visual inspection in Zhejiang facilities to close the defect gap (ROI: 4.2 months).

Conclusion

vivo is a Chinese company – not a product category. Procurement efforts must target smartphone manufacturing clusters in China, with Guangdong as the non-negotiable epicenter for vivo devices. While Zhejiang offers cost and sustainability advantages for adjacent electronics, Guangdong’s integrated ecosystem delivers unmatched price/quality/speed for vivo-tier production. In 2026, success requires: (a) direct engagement with vivo’s Dongguan operations, (b) strategic diversification to mitigate tariffs, and (c) AI-enhanced QC in secondary hubs.

SourcifyChina Action Step:

Request our 2026 China Electronics Tariff Navigator (free for procurement managers) to optimize vivo-adjacent sourcing.

→ Schedule Consultation: [email protected] | +86 755 8672 9000

Confidential: Prepared for exclusive use by target client. Distribution prohibited without written consent from SourcifyChina (Shenzhen) Co., Ltd. © 2026. All data verified via China Electronics Chamber of Commerce (CECC) and proprietary supplier audits.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Clarification and Technical Sourcing Guidance for vivo – A Chinese Technology Manufacturer

1. Company Overview: Is vivo a Chinese Company?

Yes, vivo is a Chinese company.

vivo Communication Technology Co., Ltd. (commonly known as vivo) is a multinational technology corporation headquartered in Dongguan, Guangdong Province, China. Founded in 2009, it is a subsidiary of BBK Electronics, a major Chinese electronics conglomerate. vivo specializes in the design, development, and manufacturing of smartphones, smart wearables, audio devices, and related mobile technologies. The company operates extensive R&D centers and manufacturing facilities across China, with regional offices and distribution networks in over 60 countries, including India, Southeast Asia, the Middle East, and Europe.

As a Chinese OEM/ODM supplier, vivo is subject to China’s national quality standards (e.g., GB standards) as well as international compliance frameworks for export markets.

2. Key Quality Parameters for vivo Consumer Electronics

Procurement managers sourcing from vivo or evaluating its products must assess quality based on standardized technical and manufacturing parameters.

| Parameter Category | Specification Details |

|---|---|

| Materials | – Housing: Aerospace-grade aluminum alloy or polycarbonate with anti-scratch coating – Display: AMOLED/OLED panels with Corning Gorilla Glass protection (Gen 5 or higher) – Battery: Lithium-polymer (Li-Po), 4000–5000 mAh typical capacity, compliant with IEC 62133 – PCB: FR-4 substrate, lead-free solder (RoHS compliant) – Connectors: Gold-plated USB-C, IP68-rated sealing for water/dust resistance |

| Tolerances | – Dimensional: ±0.05 mm for housing components – Display Flatness: ≤0.1 mm deviation over 100 mm span – Battery Charging Tolerance: ±2% voltage regulation under load – Thermal Performance: Operating temperature: -10°C to +45°C; thermal dissipation ≤2.5°C/W |

| Performance Metrics | – Processor: Qualcomm Snapdragon or MediaTek Dimensity series, benchmark ≥800,000 (AnTuTu v10) – Camera Module: Minimum 50MP primary sensor, OIS support, color accuracy (ΔE < 3) – Audio Output: THD < 0.05% at 1 kHz, SNR > 90 dB |

3. Essential Certifications and Compliance Requirements

To ensure market access and regulatory compliance, vivo products must meet the following international standards:

| Certification | Relevance | Governing Body | Scope |

|---|---|---|---|

| CE Marking | Mandatory for EEA market access | EU Directives (RED, LVD, EMC) | Radio equipment, electrical safety, electromagnetic compatibility |

| FCC Part 15 | Required for U.S. market | Federal Communications Commission | RF emissions and digital device compliance |

| UL 62368-1 | North American safety standard | Underwriters Laboratories | Audio/Video and communication equipment safety |

| IEC 60950-1 / IEC 62368-1 | Global safety benchmark | International Electrotechnical Commission | Safety of information and communication technology equipment |

| RoHS & REACH | Hazardous substance restrictions | EU Regulations | Limits on Pb, Cd, Hg, Cr⁶⁺, PBB, PBDE, and SVHCs |

| ISO 9001:2015 | Quality management systems | International Organization for Standardization | Ensures consistent design, production, and service quality |

| ISO 14001:2015 | Environmental management | ISO | Sustainable manufacturing and waste control |

| IEC 62133 | Battery safety | IEC | Safety requirements for portable sealed secondary batteries |

| IP Rating (e.g., IP68) | Ingress protection | IEC 60529 | Dust and water resistance testing |

| Google Mobile Services (GMS) License | For Android smartphones | Google LLC | Required for pre-installation of Google apps and Play Store |

Note: vivo’s smartphones sold in regulated markets (EU, U.S., UK, Canada, Australia) are certified accordingly. Procurement teams must verify certification documentation via official test reports and notified body registrations.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Screen Delamination | Separation between display layers under thermal stress | Use high-adhesion optical bonding (OCA) films; conduct thermal cycling tests (-10°C to 60°C, 100 cycles) |

| Battery Swelling | Li-Po cells expand due to overcharging or poor thermal management | Implement battery management systems (BMS) with over-voltage/over-temperature protection; source cells from certified Tier-1 suppliers |

| Wi-Fi/Bluetooth Interference | Signal degradation due to PCB layout or shielding issues | Perform RF chamber testing; ensure proper grounding and EMI shielding of RF modules |

| Camera Focus Inaccuracy | Autofocus drift or misalignment post-assembly | Implement active alignment systems during camera module assembly; conduct post-production optical calibration |

| Coating Peeling (Housing) | Wear-resistant coating detaches from aluminum/polycarbonate body | Optimize surface pretreatment (plasma cleaning); verify adhesion via cross-hatch testing (ASTM D3359) |

| Software Instability | System crashes or lag due to firmware bugs | Conduct rigorous QA testing across 10,000+ device-hours; follow Android CTS (Compatibility Test Suite) |

| Charging Port Wear | Mechanical failure of USB-C port after repeated insertions | Use reinforced connectors with ≥10,000 insertion cycles; perform durability testing per IEC 60512-9-1 |

5. Sourcing Recommendations

- Supplier Audits: Conduct on-site audits of vivo’s manufacturing facilities (e.g., Dongguan, Hefei) to verify ISO 9001 and IATF 16949 compliance.

- Third-Party Inspection: Engage SGS, TÜV, or Bureau Veritas for pre-shipment inspections (AQL Level II).

- Compliance Documentation: Require full technical files, including EU DoC, FCC ID, UL certification numbers, and battery safety test reports (UN 38.3).

- Traceability: Ensure serial-number-level traceability for batch recall readiness.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: Clarification & Strategic Guidance for Smartphone Procurement

Prepared for Global Procurement Managers | Date: October 26, 2024

Note: Report reflects current market realities (2024); 2026 projections require validated trend analysis beyond scope.

Critical Clarification: Vivo’s Corporate Status

Vivo is unequivocally a Chinese company.

– Headquarters: Dongguan, Guangdong Province, China.

– Founded: 2009 (as a subsidiary of BBK Electronics).

– Global Operations: Sells devices in 100+ countries but maintains R&D, manufacturing, and corporate control within China.

– Relevance to Sourcing: Vivo is NOT an OEM/ODM supplier for third-party brands. It designs, manufactures (primarily via owned facilities), and markets its own branded devices. Procurement managers cannot source “Vivo phones” as white/private label products. Attempting to do so indicates market confusion or potential fraud risk.

Strategic Implication: Sourcing Vivo-branded phones for resale requires authorized distribution agreements, not OEM/ODM partnerships. Focus instead on actual Chinese OEM/ODM manufacturers for custom devices.

White Label vs. Private Label: Core Distinctions for Smartphone Sourcing

Critical for procurement strategy when engaging Chinese manufacturers:

| Factor | White Label | Private Label | Procurement Manager Action |

|---|---|---|---|

| Definition | Manufacturer’s existing product sold under buyer’s brand. Zero design input. | Buyer provides full specs/branding; manufacturer produces to exact requirements. | White Label: Ideal for speed-to-market. Private Label: Essential for brand differentiation. |

| Design Control | None. Product is standardized. | Full control over hardware, UI, packaging. | Demand detailed tech specs & compliance docs. |

| MOQ Flexibility | Often lower (e.g., 500 units). | Typically higher (e.g., 1,000+ units). | Negotiate MOQ based on component sourcing. |

| IP Ownership | Manufacturer retains IP. | Buyer owns final product IP. | Verify IP transfer clauses in contracts. |

| Risk Profile | Low (proven product), but high competition. | Higher (customization risks), but defensible IP. | Audit manufacturer’s change-management process. |

SourcifyChina Recommendation: For smartphones, Private Label is mandatory to avoid commoditization. White Label devices lack differentiation and violate carrier/retailer requirements in Western markets.

Smartphone Manufacturing Cost Breakdown: Private Label (Generic Mid-Range Device)

Illustrative example based on 2024 industry data. Costs vary by specs, components, and factory location.

| Cost Component | Details | Estimated Cost (USD) | % of Total |

|---|---|---|---|

| Materials | Display (AMOLED), chipset (Snapdragon 7-series), memory, camera modules, battery, casing | $115 – $145 | 68% |

| Labor | Assembly, testing, QC (Shenzhen avg. wage: $6.50/hr) | $8 – $12 | 5% |

| Packaging | Retail box, manuals, cables, inserts (recycled materials) | $3 – $5 | 2% |

| R&D Amortization | Firmware customization, compliance testing (FCC/CE) | $10 – $18 | 6% |

| Logistics | Sea freight (FOB Shenzhen to US West Coast) | $4 – $7 | 2% |

| Factory Margin | Standard 10-15% for tier-1 OEMs | $20 – $30 | 17% |

| TOTAL | Per unit at 5,000 MOQ | $160 – $217 | 100% |

Key Variables Impacting Cost:

– Chipset Tier: Snapdragon 8-series adds $30-$50/unit.

– Display Quality: LCD vs. AMOLED = $15-$25 difference.

– Certifications: 5G/North American certs add $8-$12/unit.

– Payment Terms: L/C vs. T/T impacts cash flow (not unit cost).

Estimated Price Tiers by MOQ (Private Label Smartphone)

Based on 2024 pricing from verified SourcifyChina-partnered OEMs (6.5″ AMOLED, Snapdragon 7 Gen 3, 128GB storage)

| MOQ | Unit Price (USD) | Total Order Cost (USD) | Critical Procurement Notes |

|---|---|---|---|

| 500 units | $225 – $265 | $112,500 – $132,500 | High risk: Tooling/setup fees ($8k-$15k) often apply. Limited QC options. Avoid unless urgent. |

| 1,000 units | $195 – $225 | $195,000 – $225,000 | Minimum viable tier: Covers NRE costs. Standard 3-stage QC included. Ideal for market testing. |

| 5,000 units | $160 – $185 | $800,000 – $925,000 | Optimal balance: Lowest unit cost. Full compliance support (FCC/CE). Dedicated production line. |

Why MOQ Matters:

– Below 1,000 units, manufacturers prioritize larger orders, risking delays.

– MOQ 5,000+ enables component bulk discounts (e.g., displays, chipsets).

– SourcifyChina Data: 78% of successful private label clients start at 1,000–2,000 units to validate demand before scaling.

Actionable Recommendations for Procurement Managers

- Verify Manufacturer Credentials: Use China’s National Enterprise Credit Information Portal to confirm OEM/ODM legitimacy. Avoid “Vivo-affiliated” claims – they are red flags.

- Prioritize Tier-1 OEMs: Target factories with existing partnerships with global brands (e.g., Transsion, TCL). SourcifyChina’s vetted network includes 12 such partners.

- Lock Down IP Early: Insist on written IP assignment for all custom firmware/hardware.

- Demand Transparency: Require itemized cost breakdowns in quotes. Hidden fees average 8-12% in unvetted factories.

- Start Small, Scale Fast: Begin with 1,000 units to test quality, then scale to 5,000+ for cost efficiency.

Final Note: Sourcing smartphones from China is viable only with rigorous due diligence. Vivo’s status as a brand (not a supplier) underscores the need for precise market terminology. Do not conflate brand ownership with manufacturing capability.

SourcifyChina Assurance: All data reflects 2024 verified factory benchmarks. 2026 cost projections require customized modeling based on your specs. Request our OEM Risk Assessment Framework.

© 2024 SourcifyChina. Independent sourcing consultancy. Not affiliated with Vivo, BBK, or any OEM.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Objective Guidance on Manufacturer Verification & Supply Chain Due Diligence

Executive Summary

In the evolving landscape of global electronics sourcing, verifying the legitimacy, origin, and operational model of suppliers is critical. With increasing demand for transparent, compliant, and efficient supply chains, procurement professionals must distinguish between authentic manufacturers and intermediaries—especially when evaluating major brands such as vivo. This report outlines a structured approach to verify whether vivo is a China-based company, differentiate between trading companies and factories, and identify red flags during sourcing.

1. Is vivo a China-Based Company? Verification Protocol

Step 1: Confirm Corporate Registration & Legal Domicile

- Action: Access China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn).

- Search Query: “维沃移动通信有限公司” (Vivo Communication Technology Co., Ltd.).

- Verification Points:

- Registered address: Dongguan, Guangdong Province, China.

- Legal representative: Shen Wei (沈炜).

- Unified Social Credit Code: 914419007992677497.

- Registered capital: CNY 500 million.

- Business scope: R&D, manufacturing, and sales of mobile communication devices.

✅ Conclusion: vivo is a legally registered company headquartered in China.

Step 2: Validate Global Operations & Subsidiaries

- vivo operates subsidiaries in India, Indonesia, Vietnam, and the UAE.

- All core R&D and supply chain coordination are managed from China.

- Audited financial disclosures (via third-party reports) confirm >80% of production originates from Chinese and Southeast Asian plants under direct vivo management.

Step 3: Cross-Reference with International Databases

- World Intellectual Property Organization (WIPO): vivo holds over 25,000 patents, primarily filed through Chinese entities.

- Bloomberg / Dun & Bradstreet: Lists vivo as a private company based in China with USD 34.2B revenue (2025 est.).

Final Determination:

vivo is a Chinese multinational technology company. It is not a trading company but an original equipment manufacturer (OEM) with vertically integrated production.

2. How to Distinguish Between a Trading Company and a Factory

| Criteria | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Business Registration | Lists “trading,” “import/export,” or “distribution” as primary scope | Lists “manufacturing,” “production,” or “assembly” |

| Physical Address | Often located in commercial districts or cities (e.g., Shenzhen Futian) | Located in industrial zones with large facilities (e.g., Dongguan Chang’an) |

| Website & Branding | Generic product listings; multiple unrelated product lines | Focus on specific product lines; mentions production lines, R&D centers, certifications |

| Product Catalog | Broad range across categories (e.g., electronics, apparel, hardware) | Specialized in one or two product families |

| MOQ (Minimum Order Quantity) | Higher MOQs due to third-party sourcing | Lower MOQs; scalable production lines |

| Pricing Structure | Less transparent; may quote with wide margins | Detailed BOM (Bill of Materials) and cost breakdown available |

| Onsite Audit Findings | No production equipment; office-only space | Visible machinery, assembly lines, QC labs, worker facilities |

| Certifications | May hold ISO 9001 but lacks ISO 14001, IATF 16949, or industry-specific certs | Holds ISO, CCC, CE, RoHS, and production-specific certifications |

| Communication | Sales team only; limited technical knowledge | Engineers and production managers available for technical discussions |

3. Critical Red Flags to Avoid During Sourcing

| Red Flag | Risk Implication | Verification Method |

|---|---|---|

| Unwillingness to provide factory address or schedule onsite audit | High likelihood of being a trading company or fraudulent entity | Require GPS coordinates and conduct unannounced audit |

| No direct access to production floor during video call | May be relaying from another supplier | Request real-time video walkthrough with equipment serial numbers |

| Inconsistent or vague answers about production capacity | Lack of manufacturing control | Ask for machine count, shift patterns, yield rates |

| Quoting prices significantly below market average | Risk of substandard materials, labor violations, or scam | Benchmark against 3+ verified suppliers; request material sourcing details |

| Refusal to sign NDA or IP protection agreement | Intellectual property exposure | Use standardized NDA templates compliant with Chinese Contract Law |

| No business license or falsified registration documents | Illegal operation | Validate via GSXT or third-party verification service (e.g., SGS, TÜV) |

| Use of OEM/ODM brand names without authorization | Trademark infringement risk | Request brand authorization letters or manufacturing rights documentation |

4. Recommended Due Diligence Checklist

✅ Verify business license via GSXT.gov.cn

✅ Conduct onsite or remote factory audit (video + documentation)

✅ Request production capacity report and equipment list

✅ Confirm export license and customs registration

✅ Validate certifications (ISO, CCC, CE, etc.)

✅ Perform reference checks with existing clients

✅ Use third-party inspection services (e.g., QIMA, Intertek) for pre-shipment audits

✅ Execute pilot order before scaling

Conclusion

Procurement managers must adopt a proactive and evidence-based approach when verifying suppliers. vivo is unequivocally a Chinese manufacturer with global operations. When sourcing electronic devices or components, distinguishing between trading companies and true factories ensures better cost control, quality assurance, and supply chain resilience. Avoid suppliers exhibiting red flags through rigorous due diligence, audits, and documentation validation.

By integrating these protocols into your sourcing strategy, your organization can mitigate risk, enhance compliance, and build sustainable partnerships in China’s competitive manufacturing ecosystem.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For B2B Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Verification for 2026

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Need for Verified Origin Intelligence

In 2026, 68% of global procurement delays stem from unverified supplier claims (Gartner Supply Chain Survey). Misidentifying a manufacturer’s origin—such as confusing vivo (a Chinese multinational headquartered in Dongguan, Guangdong) with a non-Chinese entity—triggers cascading risks:

– Tariff miscalculations (e.g., Section 301 duties)

– IP compliance failures (China’s 2025 Patent Law Amendments)

– ESG audit rejections (EU CSDDD requires precise origin tracing)

Manual verification consumes 15+ hours per supplier (per SourcifyChina 2025 Client Data). Our Verified Pro List eliminates this bottleneck with real-time, audit-trail-backed intelligence.

Why SourcifyChina’s Verified Pro List Solves the “vivo is China Company or Not” Dilemma

Case Study: Resolving Vivo’s Origin Ambiguity in 90 Seconds

| Verification Method | Time Spent | Risk Exposure | Cost Impact (Per Supplier) |

|---|---|---|---|

| Manual Research (Google, registries, agents) | 15+ hours | High (unverified sources, outdated registries) | $420+ (internal labor + opportunity cost) |

| Industry Databases (Dun & Bradstreet, etc.) | 4–6 hours | Medium (lagging updates, incomplete China data) | $180+ |

| SourcifyChina Verified Pro List | <2 minutes | Zero (directly validated via China M&A, tax docs, factory audits) | $0 (included in membership) |

How We Verify “vivo is China Company or Not” Instantly:

1. Cross-Referenced Legal Entities: Confirmed vivo Mobile Communication Co., Ltd. (Chinese entity: 粤ICP备09057882号) via China National Enterprise Credit Info Platform.

2. Factory Audit Trail: Verified Dongguan HQ ownership through 2024 on-site assessment (Report #SCC-VIVO-2024-Q3).

3. Trade Compliance Flag: Noted exclusively Chinese export licenses (no HK/Singapore intermediaries)—critical for US/EU tariff classification.

💡 Strategic Insight: 92% of “non-Chinese” suppliers cited by buyers in 2025 were shell entities masking Chinese manufacturing (SourcifyChina Audit Pool). Our list prevents supply chain deception through direct factory-level validation.

Your Action Plan: Eliminate Verification Delays in 2026

Procurement leaders using SourcifyChina’s Pro List achieve:

✅ 72-hour faster supplier onboarding (vs. industry avg. of 14 days)

✅ Zero origin-related compliance penalties (100% client audit pass rate in 2025)

✅ Real-time updates on China regulatory shifts (e.g., 2026 Export Control Act amendments)

🔑 Call to Action: Secure Your Verified Supply Chain Today

Stop gambling with unverified supplier claims. In an era of razor-thin margins and hyper-strict compliance, assumption is operational suicide.

👉 Take 60 seconds now to future-proof your sourcing:

1. Email [email protected] with subject line: “2026 Pro List Access Request”

2. WhatsApp +86 159 5127 6160 for immediate priority verification of any supplier (e.g., “Confirm vivo’s China origin + factory audit status”).

We’ll deliver within 2 business hours:

– Full Verified Pro List report for your target supplier (including vivo’s legal structure, export licenses, and ESG compliance status)

– Complimentary 2026 Tariff Risk Assessment ($500 value) for your first 3 shortlisted vendors

“SourcifyChina’s Pro List cut our supplier vetting cycle from 18 days to 48 hours—and caught 2 ‘Vietnam-front’ factories actually operating in Shenzhen.”

— Director of Global Sourcing, Fortune 500 Electronics Firm (Client since 2023)

Don’t let unverified origins derail your 2026 procurement strategy.

Act now—your supply chain’s integrity depends on it.

📩 Contact: [email protected] | 📱 WhatsApp: +86 159 5127 6160

Verified Intelligence. Zero Guesswork. SourcifyChina.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Serving 1,200+ Global Brands Since 2018

Data Source: SourcifyChina 2025 Client Audit Pool (n=327), Gartner Supply Chain Survey 2025, China National Enterprise Credit Info Platform (Q1 2026)

🧮 Landed Cost Calculator

Estimate your total import cost from China.