The global vital sign monitor market is experiencing robust growth, driven by rising demand for continuous patient monitoring, increasing prevalence of chronic diseases, and the expanding adoption of remote healthcare solutions. According to Grand View Research, the global patient monitoring devices market size was valued at USD 30.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of approximately 6.8% during the forecast period of 2023–2028, citing advancements in wearable technology and telehealth infrastructure as key growth catalysts. With hospital networks, home care providers, and emergency services increasingly reliant on accurate, real-time physiological data, the role of high-performance vital sign monitors has become indispensable. This growing demand has fueled innovation and competition among manufacturers, leading to enhanced device accuracy, connectivity, and usability. The following list highlights the top 10 vital sign monitor manufacturers shaping this dynamic landscape through technological leadership, global reach, and strong regulatory compliance.

Top 10 Vital Sign Monitor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Masimo

Domain Est. 1996

Website: masimo.com

Key Highlights: Masimo (NASDAQ: MASI) is a global medical technology company that develops and manufactures innovative noninvasive patient monitoring technologies, ……

#2

Domain Est. 2018

Website: sibelhealth.com

Key Highlights: Sibel Health Snapshot. Through wireless vital signs monitoring and data integration, we transform healthcare delivery and improve patient outcomes worldwide….

#3 Vital signs monitors

Domain Est. 1987

Website: usa.philips.com

Key Highlights: Philips vital signs patient monitors combine reliability with functionality to equip clinicians with information they need exactly when they need it….

#4 Welch Allyn Connex Spot Monitor

Domain Est. 1992

Website: baxter.com

Key Highlights: Connex Spot Monitor provides accurate vital signs measurements with an easy-to-use, vivid touchscreen display and secure EMR connectivity….

#5 Vital Signs Monitors

Domain Est. 1997

Website: hillrom.com

Key Highlights: Shop Vital Signs Monitors from Hillrom or browse all of our Patient Monitoring products….

#6 Patient Monitoring Systems

Domain Est. 1998

Website: us.nihonkohden.com

Key Highlights: Nihon Kohden delivers a comprehensive portfolio of patient monitoring systems. View all of our products today….

#7 Vital Signs and Patient Monitoring

Domain Est. 1998

Website: medline.com

Key Highlights: Vital Signs and Patient Monitoring. Accessories · Patient Monitors · Vital Sign Machines. Category Best Sellers. MEDLINE. Medline Heart Rate and Pedometer ……

#8 RTM Vital Signs

Domain Est. 2014

Website: rtmvitalsigns.com

Key Highlights: A small and powerful wearable device ergonomically designed to address the critical need for complete and continuous respiratory monitoring….

#9 Sempulse

Domain Est. 2015

Website: sempulse.com

Key Highlights: Our patient management platform remotely monitors 100s of patients’ vital signs simultaneously, in real-time, using a compact sensor and user-friendly app….

#10 Patient Vital Signs Monitoring System

Domain Est. 2022

Website: soteradigitalhealth.com

Key Highlights: Sotera’s ViSi Mobile Patient Monitoring System is a platform for comprehensive vital signs monitoring that keeps clinicians connected to their patients….

Expert Sourcing Insights for Vital Sign Monitor

H2: 2026 Market Trends for Vital Sign Monitors

By 2026, the vital sign monitor (VSM) market is poised for significant transformation, driven by technological innovation, evolving healthcare delivery models, and increasing demand for proactive health management. Key trends shaping the market include:

-

Dominance of Remote Patient Monitoring (RPM) & Telehealth Integration: The shift towards value-based care and the need for chronic disease management will solidify RPM as the primary growth driver. VSMs will be seamlessly integrated into telehealth platforms, enabling continuous, real-time data transmission to clinicians. Expect widespread adoption in managing conditions like heart failure, COPD, hypertension, and post-operative care, reducing hospital readmissions and improving patient outcomes.

-

Convergence with Wearables and Consumer Health Tech: The line between medical-grade VSMs and advanced consumer wearables (smartwatches, rings, patches) will blur significantly. Devices will offer validated medical data (ECG, blood pressure trends, SpO2, respiration rate) with consumer-friendly design and long battery life. This convergence will expand the user base beyond clinical settings to preventive health and personal wellness, creating a massive new market segment.

-

AI and Advanced Analytics Integration: Artificial Intelligence (AI) and Machine Learning (ML) will move beyond simple alerts to predictive analytics. VSMs will analyze complex, multi-parameter data streams to identify subtle physiological changes indicating early deterioration (e.g., predicting sepsis or heart failure exacerbation) or assessing overall physiological stress and recovery. AI will personalize baselines and reduce false alarms.

-

Focus on Multi-Parameter Monitoring & Miniaturization: Devices will increasingly monitor a wider array of vital signs simultaneously (e.g., ECG, PPG, temperature, respiration, activity, potentially non-invasive blood pressure and glucose trends) in smaller, less obtrusive form factors. Continuous, non-invasive blood pressure (cNIBP) and advanced respiratory monitoring will see significant advancements and adoption.

-

Enhanced Usability, Interoperability, and Data Security: User experience (UX) will be paramount, especially for elderly and home users. Simplified interfaces, voice control, and automated data sharing will be standard. Strict adherence to interoperability standards (like HL7 FHIR, IEEE 11073) will ensure seamless data flow into Electronic Health Records (EHRs) and care coordination platforms. Robust cybersecurity measures will be non-negotiable for protecting sensitive health data.

-

Expansion into New Settings and Populations: Beyond hospitals and homes, VSMs will be deployed in ambulances (pre-hospital care), skilled nursing facilities, outpatient clinics, and even occupational health settings (e.g., monitoring workers in extreme environments). Focus will grow on monitoring vulnerable populations like the elderly at home and pediatric patients.

-

️ Regulatory Evolution and Reimbursement Clarity: Regulatory bodies (like the FDA) will adapt frameworks to accommodate the rapid pace of software-driven, AI-powered VSMs (potentially as Software as a Medical Device – SaMD). Clearer and more favorable reimbursement policies for RPM services will be crucial for widespread adoption by providers and payers.

-

Sustainability and Cost-Effectiveness: Pressure to reduce healthcare costs will drive demand for cost-effective VSM solutions. Emphasis will be placed on device longevity, reusability (especially in hospitals), energy efficiency, and solutions that demonstrably reduce overall care costs through preventive intervention.

In summary, by 2026, the vital sign monitor market will be characterized by intelligent, connected, and user-centric devices. The focus will shift from isolated measurements to continuous, context-aware health insights delivered seamlessly across the care continuum, fundamentally changing how patient health is monitored and managed. Success will belong to companies offering integrated, data-rich, and clinically validated solutions that improve outcomes while enhancing patient and provider experience.

Common Pitfalls Sourcing Vital Sign Monitors (Quality, IP)

Sourcing vital sign monitors involves critical considerations beyond price and availability. Overlooking quality and intellectual property (IP) aspects can lead to regulatory failures, patient safety risks, and legal liabilities. Below are key pitfalls to avoid:

Poor Manufacturing Quality and Regulatory Non-Compliance

Many suppliers, especially low-cost manufacturers, may lack adherence to medical device standards such as ISO 13485, IEC 60601-1 (electrical safety), or IEC 62304 (medical device software). Purchasing units without valid regulatory certifications (e.g., FDA 510(k), CE Marking with MDR compliance) can result in product recalls, import denials, or use in clinical settings being prohibited. Inconsistent quality control may also lead to inaccurate readings, endangering patient outcomes.

Lack of Traceability and Component Transparency

Some suppliers use substandard or counterfeit components to cut costs, affecting device reliability and longevity. Without full bill-of-materials (BOM) traceability or third-party testing reports (e.g., for EMI/EMC), it can be difficult to verify performance under real-world conditions. This opacity complicates post-market surveillance and fault diagnosis.

Inadequate Software Validation and Cybersecurity Measures

Modern vital sign monitors rely heavily on embedded software for data processing and connectivity. Sourcing devices without documented software validation, secure boot mechanisms, or vulnerability management plans increases the risk of malfunction or cyberattacks. Non-compliance with FDA cybersecurity guidance or EU MDR software requirements is a growing concern.

Intellectual Property Infringement Risks

Purchasing from manufacturers that replicate patented designs, user interfaces, or algorithms without licensing exposes buyers to IP litigation. Cloned devices may incorporate unauthorized firmware or copied software code, violating copyrights or trade secrets. Conducting due diligence on the supplier’s IP ownership—such as registered patents, trademarks, and software licenses—is essential to avoid legal exposure.

Insufficient Post-Sale Support and Firmware Updates

Low-cost suppliers may not provide long-term technical support, calibration services, or critical firmware updates. This lack of support affects device maintainability and can void regulatory compliance if security patches or performance fixes are not delivered promptly.

Ambiguous Warranty and Liability Terms

Contracts that lack clear warranty terms, indemnification clauses, or liability coverage for device failure may leave the buyer financially and legally exposed—especially in cases of patient harm due to faulty monitoring. Ensuring service level agreements (SLAs) and compliance with local medical device liability laws is crucial.

Avoiding these pitfalls requires thorough supplier vetting, independent quality audits, and legal review of IP and contractual terms prior to procurement.

Logistics & Compliance Guide for Vital Sign Monitor

This guide outlines the essential logistics and regulatory compliance considerations for the distribution, handling, and use of Vital Sign Monitors (VSMs) across various healthcare environments. Adherence to these guidelines ensures patient safety, product integrity, and regulatory compliance.

Regulatory Classification & Approvals

Vital Sign Monitors are classified as medical devices and are subject to stringent regulatory oversight. In the United States, the FDA typically classifies VSMs as Class II devices under 21 CFR 870.2775 (Patient monitoring devices), requiring 510(k) premarket notification. In the European Union, they fall under the Medical Device Regulation (MDR) 2017/745, commonly requiring conformity assessment under Class IIa or IIb, depending on features and risk. Ensure the device holds valid CE marking, FDA 510(k) clearance, or equivalent approvals in target markets. Maintain documentation of all regulatory submissions, certificates, and technical files for audits and inspections.

Labeling & Documentation Requirements

All VSMs must be labeled in compliance with regional regulations, including device name, model, serial number, manufacturer details, UDI (Unique Device Identification), and essential warnings. Accompanying documentation must include Instructions for Use (IFU), labeling in local language(s), Declaration of Conformity, and safety information. The IFU must clearly describe intended use, contraindications, setup procedures, maintenance, and troubleshooting. Labels must remain legible throughout the product lifecycle and be included in all packaging levels.

Supply Chain & Distribution Logistics

Implement a temperature-controlled and shock-minimized distribution chain, especially if the device contains sensitive components. Use packaging that meets ISTA 3A or equivalent standards for medical devices to protect against vibration, drops, and environmental exposure. Track shipments via GPS and temperature loggers where necessary. Partner only with authorized distributors who comply with Good Distribution Practices (GDP) and maintain cold chain integrity if applicable. Conduct regular audits of logistics partners to ensure compliance.

Import/Export Compliance

Comply with international trade laws when shipping VSMs across borders. This includes obtaining proper export licenses (e.g., from the U.S. Department of Commerce if applicable), completing accurate Harmonized System (HS) code classifications (e.g., 9018.19 for electro-diagnostic apparatus), and submitting required customs documentation. Be aware of import regulations in destination countries, such as local registration, in-country representation (e.g., Authorized Representative in the EU), and conformity assessment requirements. Maintain records of all export transactions for a minimum of five years.

Installation, Calibration & Maintenance

VSMs must be installed and initially calibrated by trained personnel per manufacturer specifications. Provide service manuals and calibration tools to authorized technicians. Establish a schedule for routine calibration and preventive maintenance based on usage and regulatory requirements (e.g., annually or per manufacturer IFU). Document all service events and retain records for audit purposes. Only use original replacement parts to maintain device integrity and compliance.

Post-Market Surveillance & Incident Reporting

Implement a robust post-market surveillance (PMS) system to monitor device performance and adverse events. Report any serious incidents or field safety corrective actions (FSCAs) to relevant regulatory authorities (e.g., FDA MedWatch, EUDAMED) within mandated timeframes (e.g., 10–15 days for serious events under MDR). Conduct periodic safety update reports (PSURs) for higher-risk devices. Maintain a complaints handling system and trend analysis process to detect potential risks early.

Data Privacy & Cybersecurity Compliance

VSMs that store or transmit patient data must comply with data protection regulations such as HIPAA (U.S.), GDPR (EU), or other local privacy laws. Ensure data encryption (in transit and at rest), secure user authentication, and audit trail functionality. Conduct regular cybersecurity risk assessments and apply firmware updates to address vulnerabilities. Provide users with clear guidance on data handling and network integration to prevent unauthorized access.

Training & User Competency

Healthcare providers using VSMs must receive formal training on device operation, interpretation of readings, and troubleshooting. Offer training programs, either onsite or online, and maintain training records. Ensure users understand limitations of the device and recognize signs of malfunction. Distribute updated training materials with any device modifications or software updates.

End-of-Life & Disposal

Develop an end-of-life plan for VSMs that includes data sanitization (e.g., secure deletion of patient records), safe decommissioning, and environmentally responsible disposal in accordance with WEEE (EU) or EPA (U.S.) regulations. Provide return or take-back programs where required. Document the disposal process to demonstrate regulatory compliance and environmental stewardship.

Audits & Recordkeeping

Conduct regular internal audits of logistics, compliance, and quality management systems (e.g., ISO 13485). Maintain records related to device traceability, distribution, servicing, adverse events, training, and regulatory submissions for a minimum of 10 years post-device discontinuation (as per MDR) or as required by local regulations. Ensure records are secure, accessible, and backed up.

Conclusion for Sourcing a Vital Signs Monitor

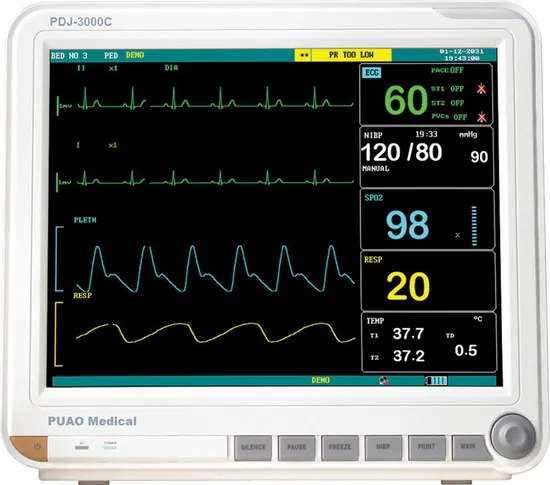

In conclusion, sourcing a vital signs monitor requires a comprehensive evaluation of clinical needs, technical specifications, budget constraints, and long-term service support. The selected device should offer accurate, reliable, and real-time monitoring of essential parameters such as heart rate, blood pressure, oxygen saturation, respiratory rate, and temperature, while being adaptable to various care settings—including emergency departments, intensive care units, and general wards.

Key considerations in the sourcing decision include ease of use, integration with existing hospital systems (e.g., electronic health records), regulatory compliance (such as FDA or CE marking), and robust after-sales service and training. Additionally, opting for energy-efficient, durable, and scalable solutions ensures long-term value and adaptability to future healthcare demands.

After thorough assessment of available options, the recommended vital signs monitor balances performance, cost-effectiveness, and user satisfaction, ultimately supporting improved patient outcomes and clinical efficiency. Strategic sourcing not only enhances patient monitoring capabilities but also contributes to the overall quality and safety of healthcare delivery.