The global packaging logistics market is undergoing rapid transformation, driven by increasing demand for efficient supply chain solutions, sustainable materials, and advanced automation. According to Mordor Intelligence, the packaging logistics market was valued at USD 178.6 billion in 2023 and is projected to grow at a CAGR of 5.8% through 2029. This expansion is fueled by surging e-commerce activity, stricter regulatory requirements, and the need for temperature-controlled and tamper-evident packaging across pharmaceuticals and food industries. Within this evolving landscape, Vista, California has emerged as a strategic hub for innovative packaging logistics manufacturers, leveraging its proximity to major West Coast ports, skilled labor force, and strong infrastructure. The following list highlights the top five Vista-based companies that are leading the way in integrating smart technology, sustainability, and scalable distribution models to meet the growing demands of global supply chains.

Top 5 Vista Packaging Logistics Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Asia Archives

Domain Est. 1997

Website: trivista.com

Key Highlights: TriVista Facilitates Closure of a US-Owned Manufacturing Facility in China. A private equity owned sporting goods manufacturer was experiencing declining ……

#2 Vista Packaging & Logistics BizSpotlight

Domain Est. 2000

Website: bizjournals.com

Key Highlights: Vista Packaging & Logistics is a certified woman owned business, celebrating thirty-seven years of helping manufacturers, retailers and distributors across the ……

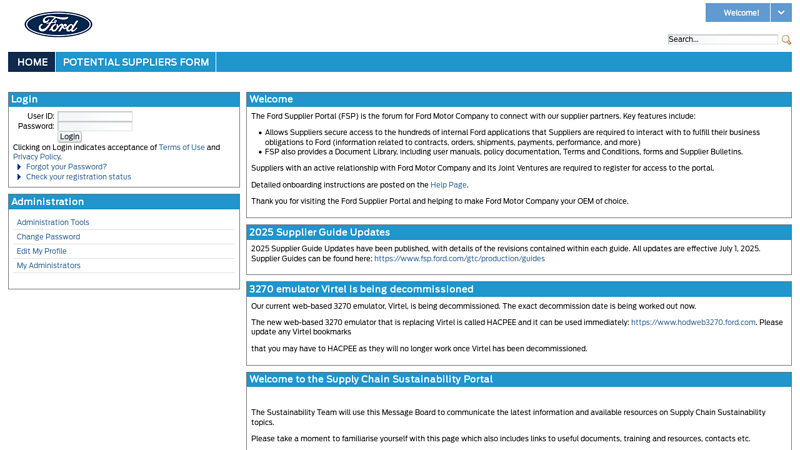

#3 Ford Supplier Portal

Domain Est. 2000

Website: fsp.portal.covisint.com

Key Highlights: The Ford Supplier Portal (FSP) is the forum for Ford Motor Company to connect with our supplier partners….

#4 Contact Us

Domain Est. 2007

Website: vistaindustrialpackaging.com

Key Highlights: Contact Us: Call: 800-454-6117, Fax: 614-851-8889, Email: [email protected], Name(Required) First Last Email(Required) Phone Message(Required)…

#5 GST Number for VISTA PACKAGING PVT LTD is 27AACCV2140D1ZS

Domain Est. 2023

Website: piceapp.com

Key Highlights: GST Number for VISTA PACKAGING PVT LTD is 27AACCV2140D1ZS. GSTIN was registered on 01 Jul 2017 as a PRIVATE LIMITED COMPANY in Palghar….

Expert Sourcing Insights for Vista Packaging Logistics

H2: Analysis of 2026 Market Trends for Vista Packaging Logistics

As Vista Packaging Logistics looks toward 2026, the company is poised to navigate a dynamic and rapidly evolving market landscape shaped by technological innovation, sustainability imperatives, shifting consumer behaviors, and global supply chain transformations. Key trends are expected to influence operational strategies, customer expectations, and competitive positioning across the packaging and logistics sectors. Below is an in-depth analysis of the most impactful market trends anticipated in 2026.

1. Accelerated Adoption of Smart Packaging and IoT Integration

By 2026, smart packaging—embedded with sensors, QR codes, and NFC technology—will become mainstream. Vista Packaging Logistics is likely to experience heightened demand for packaging solutions that offer real-time tracking, temperature monitoring, and tamper detection. These technologies enhance supply chain transparency and improve customer trust, especially in pharmaceuticals, food, and high-value goods. Integration with IoT platforms will enable Vista to provide end-to-end visibility, predictive analytics, and automated inventory management for clients.

2. Sustainability and Regulatory Compliance Drive Innovation

Environmental regulations and consumer demand for eco-friendly solutions will intensify by 2026. Governments worldwide are expected to enforce stricter packaging waste laws, including extended producer responsibility (EPR) and single-use plastic bans. Vista must continue investing in biodegradable materials, recyclable designs, and circular economy models. The trend toward “plastic-neutral” or “zero-waste” packaging will open new service offerings, such as take-back programs and lifecycle assessment consulting, positioning Vista as a sustainability leader.

3. E-Commerce Expansion Demands Agile Logistics Solutions

The e-commerce boom, accelerated by post-pandemic consumer habits, will continue into 2026. This drives demand for faster delivery, durable yet lightweight packaging, and last-mile optimization. Vista will need to scale flexible logistics networks, invest in automated fulfillment centers, and offer customized packaging solutions tailored to direct-to-consumer (DTC) models. Micro-fulfillment centers and urban logistics hubs will be critical to reducing delivery times and carbon footprints.

4. Automation and AI-Driven Supply Chain Optimization

Artificial intelligence and machine learning will play a central role in forecasting demand, optimizing routes, and managing inventory. By 2026, Vista can leverage AI to enhance warehouse automation, reduce operational costs, and minimize errors. Predictive analytics will allow proactive responses to supply chain disruptions, while robotic process automation (RPA) streamlines order processing and customer service. Investments in digital twins and autonomous vehicles may further differentiate Vista’s logistics capabilities.

5. Resilience and Supply Chain Diversification

Geopolitical tensions, climate risks, and ongoing global disruptions will compel companies to prioritize supply chain resilience. In 2026, Vista will benefit from offering nearshoring and regionalization strategies, helping clients reduce dependency on single-source suppliers. Multi-modal logistics networks and digital supply chain platforms will allow Vista to provide agile, responsive services in volatile environments.

6. Customer-Centric Customization and Brand Experience

Brands will increasingly view packaging as a key touchpoint for customer engagement. Vista is likely to see rising demand for personalized packaging—featuring variable printing, augmented reality (AR) labels, and interactive unboxing experiences. By integrating digital printing and on-demand manufacturing technologies, Vista can support short-run, high-impact packaging solutions that enhance brand loyalty and marketing effectiveness.

7. Consolidation and Strategic Partnerships

The packaging and logistics industry is expected to see further consolidation by 2026. To remain competitive, Vista may pursue strategic acquisitions or partnerships with tech providers, material innovators, or last-mile delivery firms. Collaborations with SaaS platforms for supply chain visibility or sustainability reporting could also strengthen its value proposition.

Conclusion: Strategic Outlook for Vista Packaging Logistics in 2026

To thrive in 2026, Vista Packaging Logistics must embrace digital transformation, sustainability leadership, and agile logistics innovation. By aligning with these key market trends—smart packaging, eco-compliance, e-commerce scalability, AI adoption, and customer-centric design—Vista can position itself as a forward-thinking, integrated solutions provider. Proactive investment in technology, talent, and sustainable practices will be critical to capturing market share and delivering long-term value in an increasingly competitive and complex global landscape.

Common Pitfalls When Sourcing Vista Packaging Logistics (Quality, IP)

When sourcing packaging and logistics solutions from Vista or similar providers, businesses often face critical challenges that can compromise product integrity, brand reputation, and intellectual property (IP) security. Being aware of these pitfalls is essential for effective vendor management and risk mitigation.

Quality Inconsistencies Across Production Batches

One of the most prevalent issues is variability in packaging quality between production runs. Differences in materials, printing accuracy, structural integrity, or finishing can occur due to subcontractor use, lack of standardized operating procedures, or inadequate quality control checks. This inconsistency risks damaging brand image and customer satisfaction, especially in regulated industries where compliance is mandatory.

Insufficient Quality Assurance and Testing Protocols

Vista Packaging Logistics may outsource certain functions or use third-party facilities that lack rigorous testing standards. Without clear SLAs (Service Level Agreements) and defined quality benchmarks, clients may receive packaging that fails durability, safety, or regulatory tests—leading to costly recalls or supply chain delays.

Weak Intellectual Property Protection Measures

Sharing proprietary designs, branding, or technical specifications with a logistics and packaging provider creates IP exposure. A key pitfall is the absence of robust contractual safeguards, such as non-disclosure agreements (NDAs), IP ownership clauses, or restrictions on subcontractor access. Without these, there’s a risk of design replication, unauthorized use, or leakage to competitors.

Lack of Transparency in the Supply Chain

Vista may utilize a network of subcontractors or offshore partners, making it difficult to trace where packaging is actually produced. This opacity increases the risk of non-compliant materials, labor violations, or counterfeit components entering the supply chain—posing both quality and reputational risks.

Inadequate Data Security for Digital Assets

When sharing digital artwork, CAD files, or packaging specifications, companies often overlook cybersecurity. If Vista’s systems lack proper encryption, access controls, or audit trails, sensitive IP can be vulnerable to data breaches or unauthorized access.

Poor Change Management and Communication

Changes in materials, design, or logistics processes may be implemented without client approval. This lack of communication can result in non-conforming products, delivery delays, or unintended IP modifications—especially if Vista assumes flexibility in design execution without explicit consent.

Failure to Conduct Onsite Audits and Supplier Vetting

Relying solely on documentation without conducting regular site audits can lead to overestimation of Vista’s capabilities. Unannounced visits or third-party assessments are often necessary to verify compliance with quality standards and IP protection protocols.

To avoid these pitfalls, businesses should implement strong contracts, conduct due diligence, require transparency in operations, and establish continuous monitoring mechanisms throughout the sourcing relationship.

Logistics & Compliance Guide for Vista Packaging Logistics

This guide outlines the key logistics and compliance standards and procedures for Vista Packaging Logistics to ensure efficient operations, regulatory adherence, and customer satisfaction.

Operational Logistics Framework

Vista Packaging Logistics follows a structured logistics framework to manage the end-to-end movement of packaging materials and finished goods. This includes inbound and outbound transportation, warehousing, inventory management, and distribution planning. All operations are coordinated through our integrated Transportation Management System (TMS) and Warehouse Management System (WMS) to provide real-time tracking and reporting.

Regulatory Compliance Requirements

We maintain strict adherence to national and international regulations, including but not limited to:

- DOT (Department of Transportation) standards for safe vehicle operation and hazardous materials (if applicable)

- FMCSA (Federal Motor Carrier Safety Administration) compliance for driver qualifications, hours of service (HOS), and vehicle maintenance

- FDA and USDA guidelines for packaging materials involved in food, pharmaceutical, or medical applications

- EPA regulations concerning packaging waste, recyclability, and environmental impact

- Customs and Border Protection (CBP) requirements for cross-border shipments, including proper documentation and ISF filings

Packaging and Material Handling Standards

All packaging materials handled by Vista Packaging Logistics must meet defined quality and safety specifications. We ensure that:

- Packaging conforms to ISTA and ASTM testing protocols for durability

- Load securement follows OSHA and ANSI standards to prevent shifting or damage during transit

- Reusable and returnable packaging is inspected, cleaned, and tracked per internal SOPs

Documentation and Recordkeeping

Accurate documentation is critical for compliance and traceability. Required records include:

- Bills of Lading (BOL)

- Certificates of Compliance (CoC) for materials

- Chain of custody forms

- Temperature logs (for climate-sensitive goods)

- Driver logs and vehicle inspection reports

All records are retained for a minimum of three years in accordance with federal guidelines.

Safety and Training Protocols

Vista Packaging Logistics enforces a comprehensive safety program. All employees and drivers must complete:

- Annual safety training covering handling procedures, emergency response, and DOT compliance

- Forklift and material handling equipment certification

- Hazard communication (HazCom) training when applicable

Safety audits are conducted quarterly to ensure ongoing compliance.

Sustainability and Environmental Compliance

We are committed to sustainable logistics practices, including:

- Use of fuel-efficient and low-emission vehicles where possible

- Optimization of load planning to reduce empty miles

- Proper disposal and recycling of packaging waste per local and federal regulations

- Participation in industry initiatives to reduce carbon footprint

Incident Response and Corrective Actions

In the event of a compliance breach, safety incident, or shipment discrepancy, Vista Packaging Logistics follows a formal incident response protocol. This includes immediate reporting, root cause analysis, corrective action planning, and follow-up audits to prevent recurrence.

Continuous Improvement and Audits

Internal and third-party audits are conducted annually to evaluate compliance performance. Feedback from customers, carriers, and regulatory bodies is used to drive continuous improvement in logistics operations and compliance practices.

For questions or compliance-related concerns, contact: [email protected]

Conclusion: Sourcing Vista Packaging Logistics

In conclusion, sourcing packaging logistics through Vista Packaging presents a strategic opportunity to enhance supply chain efficiency, reduce operational costs, and ensure consistent product quality. Their comprehensive suite of integrated services—including custom packaging solutions, scalable logistics support, and advanced supply chain visibility—aligns well with the demands of modern distribution networks. By leveraging Vista Packaging’s expertise, industry-specific knowledge, and established infrastructure, businesses can streamline operations from production to delivery, improve time-to-market, and maintain compliance with regulatory standards.

Furthermore, the potential for long-term partnerships with Vista offers opportunities for continuous improvement, innovation, and adaptability in response to changing market conditions. As global supply chains become increasingly complex, aligning with a reliable and technologically enabled partner like Vista Packaging strengthens resilience and competitive advantage.

Ultimately, sourcing packaging logistics from Vista Packaging is a prudent decision for organizations aiming to optimize performance, ensure sustainability, and deliver superior value to customers across diverse markets.