Introduction: Navigating the Global Market for Vintage Chairs

Buyers enter the vintage chair market with varied goals—profit, brand differentiation, or authentic period design. Misidentifying style, period, or condition can turn premium inventory into slow-moving stock. Market expectations differ between the USA and Europe, and value hinges on accurate identification, documentation, and pricing discipline.

The following guide provides a B2B framework:

– Market map: demand drivers, buyer segments, regional styles, and valuation differences across the USA and Europe.

– Identification toolkit: key chair styles and eras (e.g., William & Mary, Queen Anne, Chippendale, Victorian), period markers, and authenticity signals that shape perceived value.

– Risk controls: condition grading, verification workflows, and provenance documentation to reduce returns and disputes.

– Pricing and value drivers: wood species, construction quality, craftsmanship markers, and market comparables for defensible pricing.

– Compliance: CITES, import/export, and chain-of-custody essentials to minimize regulatory exposure.

– Operational playbooks: sourcing channels, QC checklists, market timing, and negotiation levers.

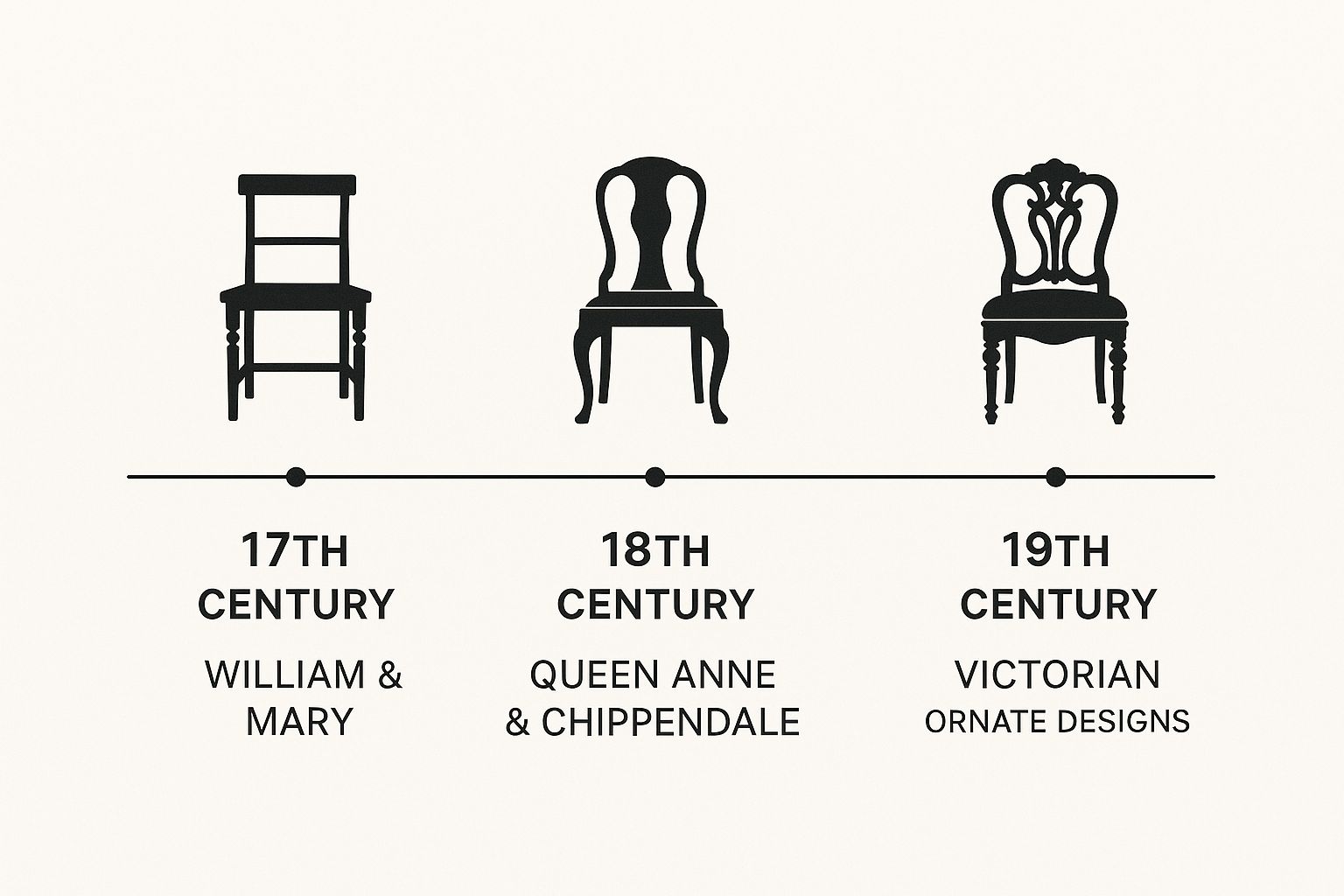

A simple example: a chair with a cabriole leg and Queen Anne proportions will perform differently than a Victorian piece with heavy ornamentation; recognizing these signals determines whether you price for specialist collectors or broader retail appeal.

By combining market intelligence with classic style literacy, you can consistently identify chairs with the highest probability of turning in-region and across borders.

Article Navigation

- Top 10 Vintage Chair Can Help Identify My Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for vintage chair can help identify my

- Understanding vintage chair can help identify my Types and Variations

- Key Industrial Applications of vintage chair can help identify my

- 3 Common User Pain Points for ‘vintage chair can help identify my’ & Their Solutions

- Strategic Material Selection Guide for vintage chair can help identify my

- In-depth Look: Manufacturing Processes and Quality Assurance for vintage chair can help identify my

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘vintage chair can help identify my’

- Comprehensive Cost and Pricing Analysis for vintage chair can help identify my Sourcing

- Alternatives Analysis: Comparing vintage chair can help identify my With Other Solutions

- Essential Technical Properties and Trade Terminology for vintage chair can help identify my

- Navigating Market Dynamics and Sourcing Trends in the vintage chair can help identify my Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of vintage chair can help identify my

- Strategic Sourcing Conclusion and Outlook for vintage chair can help identify my

- Important Disclaimer & Terms of Use

Top 10 Vintage Chair Can Help Identify My Manufacturers & Suppliers List

1. Any help identifying this vintage chair’s maker? – Facebook

Domain: facebook.com

Registered: 1997 (28 years)

Introduction: Please help me identify these chairs. I bought them off marketplace and cannot locate a manufacturer marking and nothing comes up on Google ……

2. How to Identify Furniture Manufacturer-A Comprehensive Guide

Domain: rimehome.com

Registered: 2023 (2 years)

Introduction: Look closely at construction styles, materials, joinery methods, and small details that can provide hints about your furniture’s origins….

3. An In-Depth Guide to Recognizing and Valuing Vintage Furniture

Domain: divineconsign.com

Registered: 2008 (17 years)

Introduction: Identify and price vintage furniture with this guide, featuring tips on recognizing styles, materials, and assessing market value….

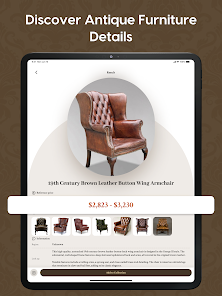

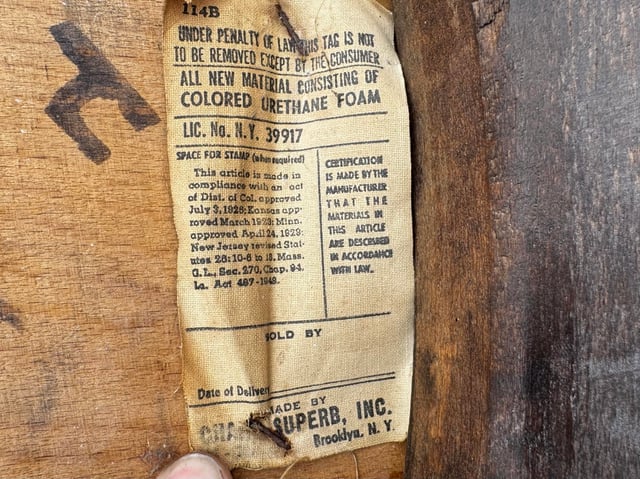

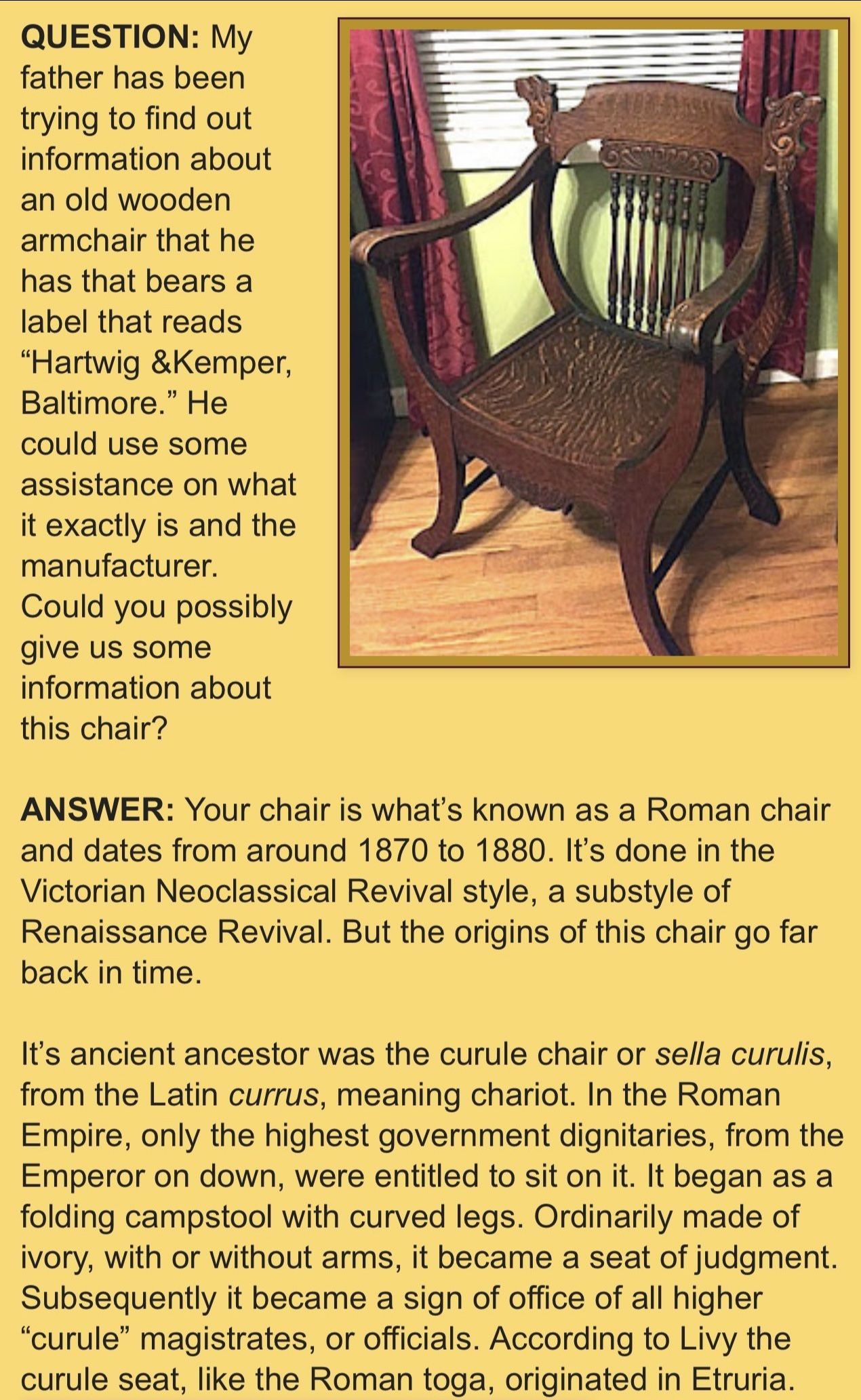

Illustrative Image (Source: Google Search)

4. Antique chair identification help – Reddit

Domain: reddit.com

Registered: 2005 (20 years)

Introduction: Hi all- hoping someone can help, I have a set of two end chairs and 4 side chairs that came with a 2-300 year old refectory table….

5. How to Spot Authentic Vintage Furniture: A Bargain Hunter’s Guide

Domain: coastconsignment.com

Registered: 2021 (4 years)

Introduction: Learning to identify genuine vintage furniture saves you from overpaying and helps you discover valuable treasures others might overlook. The ……

Understanding vintage chair can help identify my Types and Variations

Understanding vintage chair types and variations helps identify your chair

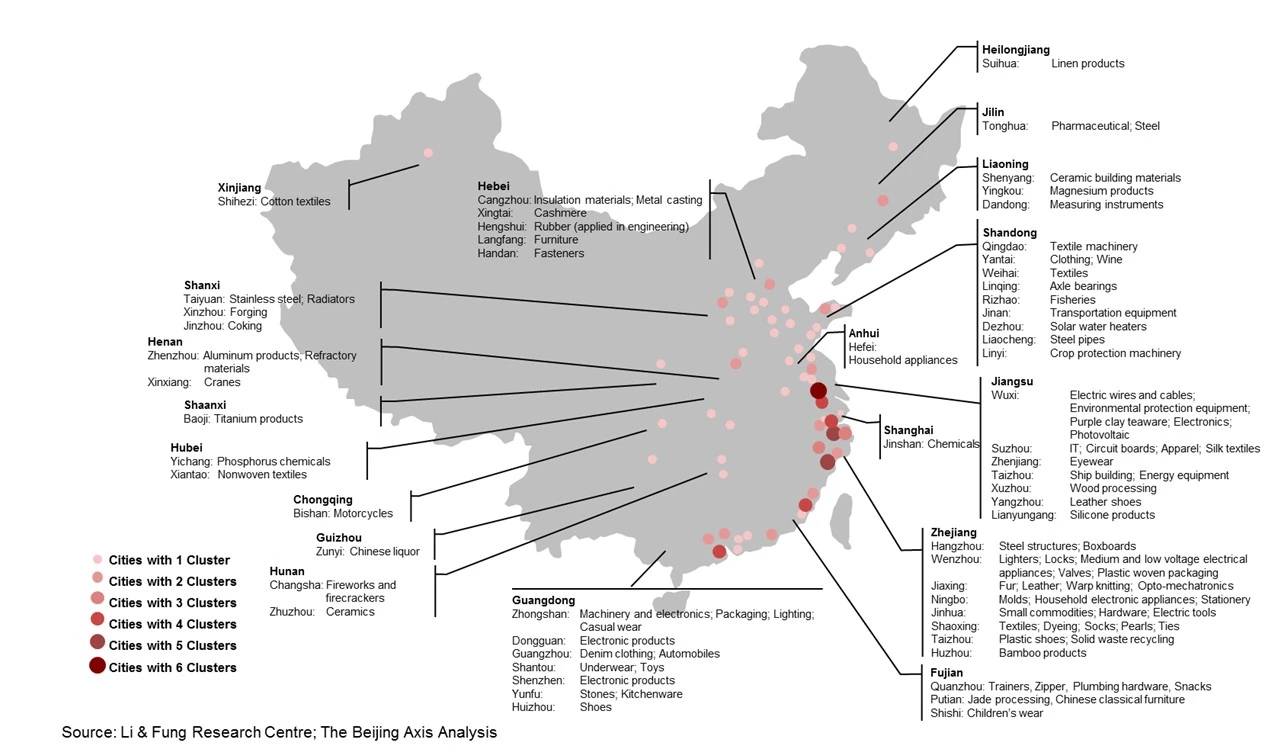

For procurement, design, and refurbishment teams in the USA and Europe, type recognition is the fastest path to accurate dating, sourcing, and pricing. While makers and regional workshops varied widely, the dominant historical styles in Anglo-American and European production cluster into a clear chronology: William & Mary (late 17th–early 18th), Queen Anne (early–mid-18th), Chippendale (mid–late 18th), and Victorian (19th century). Style cues—legs, arms, shells, carving depth, and stretchers—also guide structural assessments and restoration scope.

At-a-glance type comparison

| Type | Features | Applications (USA/EU) | Pros/Cons |

|---|---|---|---|

| William & Mary (late 17th–early 18th c.) | High back, caned seat; straight, turned legs with bulbous or bun feet; stretchers with ball or bulb terminals; yoked crest; walnut or oak; pegged mortise-and-tenon | Contract café, library/lobby, hospitality lobbies; boutique dining; historically accurate residential | Pros: Clear period silhouette; durable turned joints; strong collector interest. Cons: Caning can fail in dry climates; lower seat comfort without modern upholstery; seat sizes smaller by today’s standards. |

| Queen Anne (early–mid-18th c.) | Cabriole legs (often S-curve), pad or trifid feet; shaped seat shells; graceful S-curve arms; walnut predominates; minimized stretchers; mortise-and-tenon | Executive seating (board/side), hotel lounges, private clubs, dining; residential dining | Pros: Iconic elegance; compact footprint; strong style recognition. Cons: Low seat height; delicate pad/trifid feet prone to chipping; upholstery restoration often needed; chair-width variation. |

| Chippendale (mid–late 18th c.) | Deep carving, ball-and-claw feet; ladderback or pierced splats (e.g., pierced ‘comb-back’ arms), heavier proportions; mahogany rising | Hospitality dining (public houses, brasseries), corporate libraries, senior dining | Pros: Visual impact; robust mahogany structure; classic association. Cons: Heavy carving complicates restoration; less refined ergonomics unless re-upholstered; higher freight due to mass. |

| Victorian (19th c.) | Turned, compressed, and carved ornament; pressed wood/varnish; cabriole and turned legs; round-back parlor types; eclectic influences | Hospitality (grand hotels, bars), lounges, retro/retrofit interiors; theatre/cinema seating | Pros: Rich detailing; strong thematic fit for eclectic schemes; often affordable. Cons: Varied quality; can be bulky; wood or laminate wear; may need structural reinforcement. |

Type by type

William & Mary (late 17th–early 18th century)

– Key identifiers: Turned legs with stretchers and bulbous/bun terminals; yoke crest and high back; caned seat; oak or walnut; pegged mortise-and-tenon joinery. The straight, front-to-back leg stance and stretcher network reflect post-medieval pragmatism and stability.

– Applications: Libraries, lobbies, café seating, boutique hotels, and historically themed residential projects across the USA and EU.

– Pros and cons: Offers a distinct silhouette valued by collectors; caning is climate-sensitive and can fail in dry conditions; lower seat comfort and smaller seat sizes may necessitate upholstery upgrades.

Illustrative Image (Source: Google Search)

Queen Anne (early–mid-18th century)

– Key identifiers: Cabriole legs (S-curve) with pad or trifid feet; shaped seat shells; gentle S-curve arms; walnut; reduced reliance on stretchers; mortise-and-tenon construction with wedged tenons on some exports. The cabriole leg is the era-defining element.

– Applications: Executive boardroom sides, hotel lounges, private clubs, dining rooms; high-end residential dining in the USA and EU.

– Pros and cons: Graceful, compact footprint and strong brand of style; low seat heights, delicate feet, and older upholstery are common restoration pain points; seat widths vary historically.

Chippendale (mid–late 18th century)

– Key identifiers: Ball-and-claw feet; deep relief carving; ladderback or pierced splat arms; heavier proportions; increasing use of mahogany. The ornament depth and robust forms signal the late Georgian era’s emphasis on status and presence.

– Applications: Hospitality dining (public houses, brasseries), corporate libraries, and senior dining rooms, both in the USA and Europe.

– Pros and cons: Strong visual impact and durability from mahogany; heavy carving increases finish work; comfort may require modern upholstery; weight raises shipping costs.

Victorian (19th century)

– Key identifiers: Turned, compressed, and carved ornamentation; pressed wood and varnish finishes; round-back parlor forms; varied leg styles (cabriole and turned); eclectic stylistic references that can cross regional traditions.

– Applications: Grand hotels, lounges, bars, retro interiors, and hospitality retrofits; popular in the USA and EU for thematic programs.

– Pros and cons: Rich detailing and thematic flexibility; quality variability and bulk may require structural checks; frequent wear on laminates or veneers; price-friendly compared with Georgian-era pieces.

Practical implications for procurement and restoration

- Confirm leg forms first: straight and turned with stretchers (William & Mary), cabriole with pad/trifid feet (Queen Anne), ball-and-claw with deep carving (Chippendale), or mixed turned/carved Victorian ornament.

- Treat upholstery and finishes as primary unknowns: assume updates in Queen Anne and Chippendale for contemporary comfort; inspect caning on William & Mary; check laminates/varnish on Victorian.

- Price and value hinge on joinery type (mortise-and-tenon), wood species (walnut for Queen Anne; mahogany for Chippendale), original hardware, and condition of carved or turned elements.

This framework—anchored to period leg/arm silhouettes, carving depth, and joinery—enables faster identification, consistent cataloging, and realistic refurbishment plans across vintage chair types in both the USA and Europe.

Illustrative Image (Source: Google Search)

Key Industrial Applications of vintage chair can help identify my

Key Industrial Applications of Vintage Chair Identification

Like a compass in a dense forest, accurate identification guides cross‑functional teams from valuation and restoration to compliance and sales. For USA and Europe operators, vintage chair identification is the linchpin that connects documentation, authentication, risk control, and premium realization.

Table: Industries, Applications, and Benefits

| Industry | Application | Detailed Benefits |

|---|---|---|

| Auction houses and antique dealers | Pre‑sale authentication and provenance assembly; lot description; reserve setting | Reduces returns and disputes; enhances buyer confidence; supports reserve and hammer price realization; simplifies marketing with style‑specific language |

| Appraisers and insurance carriers | Replacement value opinions; condition and risk scoring; policy documentation | Supports accurate coverage and premium pricing; minimizes claim disputes through documented authenticity; aligns valuation with regional markets (USA/EU) |

| Conservation and restoration services | Condition assessment; materials and joinery identification; treatment planning | Preserves authenticity and value; informs material sourcing; avoids non‑appropriate interventions; ensures reversible and compliant restoration |

| Museums and cultural institutions | Exhibition planning; conservation policies; grant proposals | Elevates curatorial narratives; guides environmental controls; aids acquisition reviews; strengthens grant applications with authenticated provenance |

| Interior design and hospitality | Sourcing for concept‑driven projects; compliance with brand standards; space mood setting | Delivers cohesive aesthetics with authentic character; lowers sourcing risk; communicates value stories in client presentations |

| Real estate and commercial staging | Staging for residential and hospitality assets; lifestyle visualization | Speeds sales cycles by signaling quality and taste; supports price negotiations with documented identity and condition notes |

| E‑commerce marketplaces | Category and attribute mapping; search and merchandising; buyer assurance | Improves discoverability and merchandising; reduces buyer uncertainty and return rates; enables transparent cross‑border policies |

| Logistics and fulfillment | Packaging strategy; damage assessment; claims handling | Aligns packaging with structural vulnerabilities; provides objective damage documentation; streamlines cross‑border claims processes |

| Legal and compliance | Dispute resolution; due diligence for authenticity claims; IP/fraud detection | Provides documented evidence and consistent terminology; supports audit trails; aids fraud detection through material/joining pattern mismatches |

| Education and training | Curriculum content for appraisers, designers, and conservators | Standardizes terminology and criteria; builds market‑ready skills; connects technical identification to business outcomes |

| Research and cataloging | Archival projects; public catalogs; comparative studies | Creates searchable datasets; supports comparative analysis; enhances public engagement and scholarly rigor |

In practice, vintage chair identification functions as the keystone in a vaulted arch—without it, the surrounding structure of valuation, compliance, and sales can buckle. Across USA and Europe markets, adopting a shared identification framework turns scattered facts into a single, coherent narrative that buyers, insurers, and curators can trust.

3 Common User Pain Points for ‘vintage chair can help identify my’ & Their Solutions

3 Common User Pain Points for Vintage Chair Identification & Their Solutions

Pain Point 1: Authenticity Verification Challenges

Scenario: A high-end furniture dealer receives a potential client with what they claim is a rare 18th-century Chippendale chair, but lacks proper documentation to authenticate it.

Problem: Without reliable authentication methods, dealers risk purchasing misrepresented pieces or struggling to verify provenance, leading to potential financial losses and credibility damage with clients.

Illustrative Image (Source: Google Search)

Solution: Implement a systematic identification framework using joinery analysis, construction techniques, hardware dating, and wood species identification to establish authentic periods. Cross-reference findings with documented style characteristics and construction methods to verify authenticity before acquisition.

Pain Point 2: Style Classification & Period Dating Difficulties

Scenario: An antique auction house receives multiple chairs requiring style classification and accurate dating for auction cataloging, but staff struggles to distinguish between similar period styles.

Problem: Misclassification of chair styles or incorrect dating undermines auction credibility, affects pricing strategies, and leaves collectors with inaccurate information about their acquisitions.

Solution: Develop comprehensive style reference materials and dating protocols that examine key identifying features including leg construction, back designs, upholstery techniques, and hardware types. Establish clear classification systems based on documented design evolution and regional style variations.

Pain Point 3: Market Valuation Inconsistencies

Scenario: A furniture restoration business needs accurate valuations for insurance claims and estate appraisals but struggles with pricing inconsistencies across different market segments and condition grades.

Problem: Inconsistent valuations lead to client disputes, insurance claim complications, and missed revenue opportunities when chairs are either underpriced or impossible to sell due to unrealistic pricing expectations.

Solution: Create standardized valuation matrices that account for condition factors, style rarity, provenances, and current market demand. Maintain updated pricing databases and establish relationships with specialized dealers and auction houses for comparative market analysis.

Strategic Material Selection Guide for vintage chair can help identify my

Strategic Material Selection Guide for Vintage Chair Identification

Accurate material identification underpins correct style dating, restoration scope, and valuation. For North American and European markets, focus on wood species, joinery, finishes, upholstery systems, and hardware; each component carries strong era and region signals.

Illustrative Image (Source: Google Search)

Why materials matter

- Period-accuracy: Hardwood/softwood choices, hand-cut joinery, and early finish systems align with distinct eras.

- Authentication: Original hardware, hand-riveted webbing, and natural finishes are high-confidence markers; machine-cut hardware or modern finishes are red flags.

- Valuation: Original, period-appropriate materials and finishes add premium; replacements diminish it unless conservator-documented.

Hardwoods and softwoods by period/style

Early 17th century (William & Mary) in North America frequently features oak and maple with period-appropriate hardware and restrained carving; late 17th–early 18th century (Queen Anne) in England and the colonies shifts to walnut for elegance (cabriole legs), often paired with brass or wrought iron mounts. Mid–late 18th century (Georgian/Neoclassical) emphasizes mahogany across UK/EU/North America; regional choices include cherry and maple in American Federal pieces. 19th century (Victorian/Rococo Revival/Renaissance Revival) relies on walnut and mahogany with highly ornamental carving and gilded or brass hardware. Carved or turned “black walnut” was common in late 19th/early 20th American pieces; softwoods (pine/fir) typically appear in utility or country chairs and secondary structural elements (e.g., stretchers).

Joinery and construction signals

- Mortise-and-tenon: Ubiquitous in 17th–early 19th chairs; hand-cut sockets with pegs or wedges are strong indicators of period craftsmanship.

- Draw-bored pegs: Common on hand-built frames before mechanization.

- Dovetail and through tenons: Frequently used for seat frames and back posts.

- Early machine-cut hardware and nails: Indicate late-19th century or later production. Marked or stamped hardware often provides brand/style dating.

Finish systems and patina

- Shellac and spirit varnish: Dominate 17th–19th centuries; visible under UV and repair test swabs in inconspicuous areas.

- French polish: High-end late 19th–early 20th finishing on fine pieces; yields deep gloss with resin-rich surface.

- Oil varnish and wax: Common on country/rustic furniture; offers warm, satin sheen and easy repair.

Upholstery timelines

- Webbing and hog hair: Traditional hand-tied springs; 18th–19th century.

- 8-way hand-tied springs: Became standard by late 19th century; high-quality indicator.

- Coil springs and tarred webbing: Mid–late 19th century; also used in later re-upholstery.

- Modern high-density foam and rubber webbing: Mid–20th century onward; common on restored/reproduced chairs.

- Leather vs. fabric: Leather (hair-on-hide) signals traditional craftsmanship; fabric choices reflect period colorways and weave patterns.

Hardware and mounts

- Brass and bronze: High-end hardware on fine Queen Anne and later styles; often original with aged patina or replaced during period.

- Wrought iron/blackened steel: Early period hardware on country or traditional pieces.

- Gilding: Victorian and Rococo Revival chairs commonly feature gilded metal and carved ornament.

Identification and provenance practices

- Visual grain and color: Walnut (dark brown, chatoyance), mahogany (warm reddish-brown), oak (prominent rays), cherry (warm reddish), maple (fine, pale). Species cross-checking reduces misattribution.

- UV/infra-red and finish tests: Use in non-visible locations; shellac responds differently to solvents than modern polyurethane or waterborne finishes.

- Joinery examination: Prefer non-destructive methods; occasional probing is acceptable in a lab setting for high-value pieces.

- Hardware documentation: Verify patination, mounting methods, and maker’s marks; dated receipts and shop stamps strengthen provenance.

Condition and replacement factors

- Original seat frames: Check mortise-and-tenon integrity and pegs. Modern screws, biscuits, or CNC details suggest recent work.

- Finish refinishing: Hand-planing or sanding to remove patina reduces value; French polishing or in-kind shellac repairs preserve period appearance.

- Upholstery dating: Tacking strips and traditional webbing indicate original work; modern tack strip and rubberized webbing indicate later re-upholstery.

- Restorations: Document all replacements with materials logs; retain original hardware where possible.

B2B market implications (USA/EU)

- Premium factors: Original period wood, authentic finishes, period hardware, and traditional upholstery preserve premium.

- Risk signals: Modern foam, machine-cut joinery (biscuits/CNC), and complete shellac stripping reduce market confidence.

- Documentation: Provide material species lists, finish type, hardware provenance, and joinery method in condition reports for buyer trust and valuation defensibility.

Quick reference: material–era comparison

| Wood species | Typical period | Hardness (approx.) | Joinery fit | Common finishes | Hallmarks | Key risks in the market |

|---|---|---|---|---|---|---|

| Oak | 17th–18th c. | High | Mortise/tenon with pegs; dovetails | Shellac; oil/wax | Ray fleck; heavy grain | Soft-wood substitutions; over-stripping removes patina |

| Walnut | Queen Anne to Victorian (late 17th–19th c.) | Medium | Mortise/tenon; carved forms | Shellac; spirit varnish | Dark brown, chatoyant | “Walnut stain” on inferior species; excessive darkening |

| Mahogany | Georgian to Victorian (mid-18th–19th c.) | Medium–high | Mortise/tenon; refined joinery | Shellac; French polish | Warm reddish-brown; interlocked grain | Modern mahogany substitutes; veneer confusion |

| Cherry | American Federal (late 18th–early 19th c.) | Medium | Mortise/tenon | Shellac; oil/wax | Warm reddish tone | Mislabeling as mahogany; over-refinishing |

| Maple (hard/rock) | Country and 18th c. | High | Mortise/tenon | Shellac; wax | Pale, fine grain | Inconsistent patina; staining to mimic cherry |

| Pine/fir | 17th–19th c. country chairs | Soft | Simple mortise/tenon | Oil/wax | Knots, resin | Over-restoration and modern paint stripping |

| Elm/birch (continental) | EU country pieces | Medium | Mortise/tenon | Oil/wax | Taut grain | Species confusion with ash or beech |

| Beech | EU chairs | High | Mortise/tenon | Shellac; wax | Pale, fine grain | Steam bending misread as later reproduction |

Upholstery and construction system comparison

| System | Era | Materials | Labor | Value impact | Identification cues |

|---|---|---|---|---|---|

| Traditional webbing + hand-tied springs | 18th–19th c. | Jute/hog hair; eight-way tie | High | Preserves premium | Tacks on webbing border; visible tie patterns |

| Tarred webbing + coil springs | Mid–late 19th c. | Tarred jute; steel coils | Medium | Positive if period | Strong tar odor; robust coil geometry |

| 8-way hand-tied (upgraded) | Late 19th c.–early 20th c. | Coir/twine; steel springs | High | Strong positive | Uniform ties; quality felt/padding |

| Modern rubberized webbing + foam | Mid–20th c.–present | Polyester webbing; HD foam | Low–medium | Reduces value | Plastic-like webbing; foam density visible |

| Leather hair-on-hide | Traditional | Hide; heavy dye | High | High value when original | Hide thickness, hand stitching, period hardware |

In-depth Look: Manufacturing Processes and Quality Assurance for vintage chair can help identify my

In‑depth Look: Manufacturing Processes and Quality Assurance for vintage chair can help identify my

Objective

Use the manufacturing signatures and quality outcomes of antique and vintage chairs to strengthen identification, dating, and valuation in B2B contexts. This section translates period craftsmanship into measurable indicators that align with modern QA standards and testing frameworks.

End‑to‑end manufacturing pathway

| Step | Purpose | Key inputs | Signature outputs | ISO‑aligned controls |

|---|---|---|---|---|

| Wood species selection & intake | Authenticate materials, age, and origin | Sapwood vs heartwood, early‑ vs late‑wood ratios, grain, odor, color | Quercus (oak), Fagus (beech), Juglans (walnut), Fraxinus (ash) common; American vs European cuts discernible; early logging yields tighter grain and denser oak | 9001:2015 (Clause 7.5) documented logs; 14001 (timber sourcing traceability); 7.4.1/9.4.2/9.4.3 (inspection) |

| Prep: milling, flattening, cutting | Form dimensions and stability | Moisture content, case hardening avoidance | True surfaces; minimal machine chatter; hand‑planed witness traces; consistent mill checks (8–12% MC target) | 9001:2015; 9000:2015 (measurement consistency); 7.1.5 (CMM/gauge validation) |

| Forming: carving & shaping | Create period character and signature profiles | Toolmarks, relief depth, carved motifs | Cabriole leg contours, ball‑and‑claw vs pad feet; cabochons; carved crest rails with S‑curves; William & Mary/Hepplewhite/Mid‑Century curves | 9001:2015; 9000:2015 (process capability); 7.1.3 (tooling in calibration) |

| Joinery & assembly | Secure structure; reveal era & region | Mortise‑and‑tenon with wedged draw‑pegs; screw/rosehead nail; hand dovetails; machine‑cut pins | Period‑accurate glue lines; pin count/placement; chair‑rail and stretcher integration style | 9001:2015 (process control); 7.5 (work instructions); 9.4 (inspection) |

| Surface preparation | Finish integrity and patina | Stripping, French polish, varnish, shellac, lacquer | Layering; color development; hand‑rubbed uniformity; repaired/replaced veneer panels; no modern aerosol texture | 9001:2015; 9.4.2 |

| Quality assurance & testing | Validate safety, durability, and authenticity | ISO‑related/EN/ASTM programs; in‑house bench checks | 11724 series tests (static/cyclic load, back/foot durability); EN 16121; F1858 seat‑back tests; fit/finish tolerances | 9001:2015; 9000:2015; 11724‑1/2/3; F1858; EN 14757; EN 16121 |

Manufacturing steps by era: joinery and assembly signatures

| Period | Primary materials | Joinery/assembly | Finishes | Carving/dating cues |

|---|---|---|---|---|

| William & Mary (17th century) | Heavy oak; turned stretchers | Heavy mortise‑and‑tenon; pinned joints | Oily wax; early varnish | Turned, bobbin‑turned legs; stretchers; restrained carving |

| Queen Anne (early 18th century) | Walnut, maple; regional variations | Shellac underbody; hand dovetail drawers; minimal stretchers | French polish | Cabriole legs; pad or simple claw feet; S‑curved crest rails |

| Chippendale (mid‑late 18th century) | Walnut/cherry; regional variants | Machine‑cut dovetails (UK) vs hand (US); tenoned aprons | Oil/varnish/Urushi | Rich carving; ball‑and‑claw, cabochons; pierced crest rails |

| Victorian (19th century) | Mahogany; steam‑bent ply | Screw/rosehead nails; machine joinery | Shellac/lacquer | Ornamental splats, tufting; heavier forms |

| Hepplewhite (18th century) | Mahogany/ash; veneer panels | Tenoned aprons; carved details | Hand‑rubbed | Straight legs; shield‑/fiddleback seats; restrained carving |

| Sheraton (late 18th century) | Mahogany; veneer; ply | Machine‑cut joinery; turned legs | Hand‑rubbed | String inlay; crisp lines; straight legs |

| Mid‑20th Modern | Plywood; tubular metal; plastic | Machine/industrial fasteners | Lacquer/anodizing | Sculpted forms; minimal ornamentation |

Assembly methods (eras and identifiers)

| Method | Typical era | Key identifiers |

|---|---|---|

| Mortise‑and‑tenon + wedged draw‑pegs | Early to 19th century | Visible pegs; tight wedge profile; handwork variation |

| Machine‑cut dovetails | Late 18th–19th (UK) | Uniform pin spacing; sharp angles; machine cut |

| Hand‑cut dovetails | 18th century (US) | Variable spacing; slight irregularities; hand‑sawn marks |

| Screw/rosehead nails | 19th century | Round heads; mechanical fastening lines; added rigidity |

| Steam‑bent/formed ply | Mid‑20th | No visible stretchers; continuous curves; modern adhesives |

| Upholstery webbing & tacks | Victorian–Modern | Webbing pattern; tack heads; seat‑back structure |

Forming and finishing: period signatures

| Technique | Indicator | Dating implication |

|---|---|---|

| Hand‑planed surfaces | Continuous planing lines; slight undulation | Pre‑industrial; often 18th century |

| Machine‑sawn/planed | Regular chatter; power tool traces | Post‑1830s; Victorian/industrial |

| French polish | Mirror gloss, soft hand | Queen Anne/Hepplewhite/Sheraton |

| Urushi (lacquer) | Deep gloss, layered build | Regional influence; high‑status pieces |

| Veneer panels with clean miters | Clean edges; modern adhesives | 19th–20th; machine age |

Quality assurance framework

| QA element | What to check | Acceptance | Notes |

|---|---|---|---|

| Material provenance | Species and cut; traceability | Match period expectations | Align with 14001 sourcing; record grain photos |

| Joinery integrity | Mortise fill, dovetail fit, pegs | No gaps; tight fit; glue residue minimal | Rework not permitted on high‑value pieces |

| Surface preparation | Stripping level; no chemical burns | Even substrate; no grain raise under finish | Document pre/post photos |

| Finish integrity | Color, rub lines, blushing | Uniform sheen; no runs/ fisheye | French polish rebuild if historically accurate |

| Patina acceptance | Wear patterns | Consistent with age/use zones | Preserve original patina wherever possible |

| Measurement repeatability (CMM/gauge) | Calibration | In‑tolerance per plan | 9001/9000 compliance |

Testing protocols (select)

| Test | Standard | Intent | Representative pass/fail (qualitative) |

|---|---|---|---|

| Static and cyclic load on seat/back | ISO 11724‑1:2022; ISO 11724‑2:2022; ISO 11724‑3:2022 | Simulate long‑term use without failure | No permanent set; no joint loosening |

| Durability/repeated impact on back | ASTM F1858‑14 | Validate chair‑back strength | No cracks; adequate stiffness retention |

| Chair stability | EN 14757:2013 | Ensure no tipping under load | Stable up to specified angle/load |

| Safety and performance (furniture) | EN 16121:2013+A1:2017 | General furniture safety | Meets dimensional/safety criteria |

| Lead‑containing paint test (US pre‑1978) | EPA 40 CFR Part 745 | Compliance for resale/import | No LBP above regulatory limits |

| Formaldehyde emissions (composite panels) | TSCA Title VI; EN 717‑1 | Indoor air quality compliance | Emission limits met |

| VOC emissions (coatings) | CDPH/E1H (CA); EN 717‑1 (panel) | Health and environment | Emissions within limits |

End‑to‑end QC checklist

- Intake and documentation

- Verify species; record grain and density

- Take baseline photos; measure key dimensions

- Map prior repair footprints (strip, glue, nails)

-

Assign era/style hypothesis aligned with source

-

Production control

- Maintain 8–12% moisture content for wood

- Control plan for joinery tolerances (gap ≤0.3 mm typical)

-

Tool calibration and operator sign‑off

-

Inspection and testing

- Apply ISO 11724 series for load tests on representative chairs

- Conduct ASTM F1858 where relevant

- Evaluate stability per EN 14757 and safety per EN 16121

-

Perform LBP, VOC, and formaldehyde checks as required

-

Final verification and reporting

- Issue certificate with style, era, materials, and restoration scope

- Record test IDs, calibration refs, and acceptance criteria

- Archive photos of signature features (cabriole leg, carving, dovetail pins)

Use manufacturing signatures to sharpen identification

- Joinery profile: hand vs machine dovetails pin an era; machine pins often late 18th–19th UK.

- Leg typology: cabriole leg supports Queen Anne; straight legs point to Hepplewhite/Sheraton.

- Foot forms: ball‑and‑claw suggests high‑status Chippendale; pad feet suit earlier Queen Anne.

- Stretchers: turned stretchers tie to William & Mary; absence implies later minimalism or Mid‑Century.

- Surface and finish: French polish, hand rub, and lacquer indicate specific period finishing.

Documentation and traceability (ISO‑aligned)

| Document | Purpose | Owner |

|---|---|---|

| Material cert (species, sourcing) | Authenticity and compliance | Purchasing/QA |

| Process plan and control plan | Repeatability; measurement consistency | Production/QA |

| Calibration records | Test instrument validity | QA/Lab |

| Test reports and certificates | Customer assurance; audits | QA |

| Traceability log | Item history; re‑entry | Logistics/QA |

Acceptance and rework policy

- High‑value antiques: rework not permitted; reversible restoration required.

- Minor finish repairs: reversible only; no modern coatings over original patina.

- Structural repairs: documented, with materials and method recorded; no irreversible substitutions (e.g., inappropriate modern fasteners).

Minimum inspection levels (example)

| Inspection type | Sample size | Acceptance criteria |

|---|---|---|

| Dimensional verification | 100% critical dims; 10% sample | Within tolerance; no warping |

| Visual finish | 100% | Uniform sheen; no defects |

| Structural tests | Sample per ISO 11724 series | Pass per criteria |

Summary

By tying period craftsmanship markers—materials, joinery, carving, and finish—to a modern QA framework, you create a defensible, standards‑based identification process. ISO 9001/9000 manage process control and measurement consistency; ISO 11724 and EN/ASTM tests demonstrate durability and safety; EN 14757 and EN 16121 address stability and general safety; LBP/VOC and formaldehyde tests ensure regulatory compliance. Together, these controls elevate vintage chair identification from subjective appraisal to a repeatable, auditable practice.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘vintage chair can help identify my’

Practical Sourcing Guide: A Step-by-Step Checklist for Using Vintage Chairs to Identify Your Style

Executive Summary

This sourcing guide provides interior designers, furniture retailers, and styling professionals with a systematic approach to using vintage chairs as style identifiers. By following this checklist, you can accurately assess client preferences and guide authentic design decisions.

Pre-Sourcing Assessment

1. Client Consultation Protocol

- [ ] Conduct detailed style preference interview

- [ ] Request visual references of favorite interior spaces

- [ ] Document color palette preferences

- [ ] Identify budget parameters

- [ ] Assess space dimensions and constraints

2. Research Foundation

- [ ] Study historical design periods relevant to vintage chairs

- [ ] Familiarize with key style identifiers (see style guide below)

- [ ] Establish supplier network in target markets (USA/Europe)

- [ ] Create style comparison reference materials

Style Identification Framework

Primary Vintage Chair Categories

| Period | Style Markers | Best Identification Features | Market Preference |

|---|---|---|---|

| Victorian (1837-1901) | Ornate carvings, dark woods | Tufted upholstery, heavy construction | High in traditional markets |

| Art Deco (1920s-1930s) | Geometric patterns, streamline forms | Chrome accents, lacquer finishes | Strong urban/retro appeal |

| Mid-Century Modern (1940s-1960s) | Clean lines, functional design | Tapered legs, minimalist hardware | Premium contemporary market |

| Scandinavian (1940s-1970s) | Light woods, functional simplicity | Birch/pine construction, light finishes | Growing eco-conscious segment |

Sourcing Checklist

3. Market Research & Supplier Identification

- [ ] USA Markets: Contact established vintage dealers in key cities (NYC, LA, Chicago, San Francisco)

- [ ] Europe Markets: Engage suppliers in Netherlands, Sweden, Germany, UK

- [ ] Verify supplier credentials and inventory reliability

- [ ] Request detailed photos showing construction details

- [ ] Confirm authenticity documentation capabilities

4. Quality Assessment Protocol

- [ ] Examine construction joints and hardware authenticity

- [ ] Check for period-appropriate materials and techniques

- [ ] Assess structural integrity and restoration history

- [ ] Verify original finish vs. modern refinishing

- [ ] Document any modifications or repairs

5. Style Match Validation

- [ ] Compare against style identifier checklist

- [ ] Cross-reference with historical period documentation

- [ ] Confirm marketability in target demographic

- [ ] Assess resale potential and investment value

- [ ] Evaluate compatibility with existing client portfolio

6. Documentation & Client Presentation

- [ ] Create style identification report for each chair

- [ ] Prepare visual portfolio showing style evolution

- [ ] Develop client education materials on chair significance

- [ ] Establish authenticity certificates where applicable

- [ ] Include care and maintenance guidelines

Implementation Timeline

Week 1-2: Foundation Building

- Complete style research and supplier network development

- Create internal style identification protocols

- Establish documentation templates

Week 3-4: Pilot Testing

- Source 2-3 representative pieces per major style category

- Test identification accuracy with client focus groups

- Refine methodology based on results

Ongoing: Quality Control

- Monthly supplier performance reviews

- Quarterly style trend updates

- Annual market preference assessments

Key Success Metrics

- Style identification accuracy rate (target: 95%+)

- Client satisfaction with style guidance (target: 90%+)

- Supplier delivery reliability (target: 85%+)

- Style recommendation implementation success (target: 80%+)

Compliance Notes

- Ensure compliance with EU timber regulations for European sourcing

- Verify US import documentation for international acquisitions

- Maintain detailed provenance records for insurance purposes

Next Steps: Implement this checklist systematically, beginning with internal team training on style identification protocols before engaging with suppliers and clients.

Comprehensive Cost and Pricing Analysis for vintage chair can help identify my Sourcing

Comprehensive Cost and Pricing Analysis for Vintage Chair Sourcing

1) What moves price in antique/vintage chairs

- Provenance and documentation: Maker’s marks, period-correct hardware, paper trail, exhibition/auction history.

- Style and rarity: Verified attribution to periods/styles such as William & Mary (17th c.), Queen Anne (18th c., notable for cabriole legs), Chippendale (18th c., carved ornamentation), and Victorian (19th c., elaborate ornamentation).

- Materials: Species of wood (hardwoods vs. softwoods), original finishes, quality of hardware, and upholstery fabrics.

- Condition and restoration scope: Structural integrity, originality of joinery, extent of losses or prior repairs.

- Market orientation and brand: Auction house/consignment credentials, retailer reputation, current design trends.

2) Cost drivers and total landed cost

- Acquisition (COGS)

- Item-level sourcing price at dealer/auction

- Provenance verification (cataloging, research)

- Restoration and materials

- Materials: lumber (sourcing species to match), veneer/replacement parts, hardware (nails, brackets), finishes (shellac, lacquer, stains), upholstery materials

- Labor: joinery, carving, veneer work, surface preparation, finishing, upholstery

- Logistics and compliance

- Packing and crating, padding, corner protection, palletization

- Freight: LTL or FTL; domestic or cross-border (US ↔ EU)

- Insurance and tracking

- Customs duties/VAT, documentation, HS codes for antique furniture

- Compliance: timber/Harvey/AITES (CITES) and Lacey Act (US/EU)

- Selling and operations

- Photocataloging (style verification, measurements), content production

- Market fees (listing, platform commissions), showroom/storage costs

- Payment processing, returns/claims handling

3) Materials and labor benchmarks (sourcing-calibrated)

- Species and parts: Use matched species for repairs and avoid low-grade substitutions that devalue original design intent.

- Finish: Maintain original finishes where viable; otherwise, use historically appropriate chemistry and finish schedules.

- Hardware: Source period-appropriate reproductions to preserve authenticity without inflating material cost.

- Upholstery: Authenticity to period specifications (webbing, hair stuffing vs. modern foams) impacts perceived value and restoration budget.

4) US vs EU procurement context

- US buyers: Familiarity with US design preferences; US compliance under Lacey Act and CITES; VAT applies only for retail; auction and retail channels well established.

- EU buyers: Strong preference for authenticity and period-correct finishes; EUTR and CITES compliance; intra-EU logistics simplify VAT/re-entry; broader cross-border vendor choices.

- Documentation standards: Clear provenance statements and condition reports accelerate sales in both regions.

5) Value attribution and pricing anchors

- Style-based value tiers (subject to provenance verification)

- William & Mary (17th c.): Scarce; provenance is primary value driver.

- Queen Anne (18th c.): Cabriole legs, turnings, and form quality are key; quality of construction matters.

- Chippendale (18th c.): Carving detail and structural integrity determine premiums.

- Victorian (19th c.): Ornamentation and originality of finish drive perceived value.

- Condition premium uplift

- Expertly restored vs. heavy repairs can differentiate premium tiers.

- Market positioning

- Auction-ready items command higher prices when backed by documented style identification and condition reports.

6) Pricing models and margins (B2B calibration)

- Cost-plus model: Total Landed Cost (TLC) × (1 + Target Margin) + Risk Reserve.

- Market-oriented model: Calibrate to comparable style benchmarks and verified provenance.

- Blended model (recommended): Start with cost-plus for floor; set ceiling by market comparables; target margin bands calibrated to condition and provenance.

7) Logistics and compliance checklist

- Packing: Double-wall crating for arms/backs; protective corner blocks; suspension for loose parts.

- Freight: LTL standard; FTL for multi-item lots; route planning for EU–US transatlantic shipping.

- Insurance: All-risk coverage; declared value per item; tracking and PODs.

- Customs: HS code for antique furniture; commercial invoice detailing provenance, style/period, and materials; VAT/duty handling; CITES and Lacey Act compliance where relevant.

- Documentation: Style verification notes, measurements, hardware counts, and photos for authenticity statements.

8) Practical sourcing strategies to save cost

- Buy lots, not singles: Pack multiple chairs in one crate to reduce per-unit freight and crating costs.

- Pre-verify style and condition: Request detailed photos (back/underside, joints, hardware) and measurements; decline items requiring disproportionate joinery.

- Target “as-found” with clear restoration plans: Minimal structural issues yield lower labor; avoid chairs with extensive veneer loss or major carving damage.

- Coordinate EU–US shipments: Align batches and consolidate freight; plan customs timing to avoid storage fees.

- Leverage verified dealers/auction houses: Reduce misidentification and returns; use their cataloging to strengthen provenance.

- Use period-appropriate materials efficiently: Order small batches of hardware/veneer; reuse original hardware where safe.

- Negotiate with evidence: Present documented style verification and condition reports to support price discussions.

9) Risk and mitigation

- Misattribution: Verify style through period hallmarks, joinery, and known design features (e.g., cabriole legs, carved ornamentation).

- Over-restoration: Track materials and finish decisions; document restoration steps to maintain authenticity.

- Compliance failure: Maintain timber and CITES documentation; verify supplier chain of custody.

- Freight damage: Enforce crating standards; use corner protection and avoid overpacking.

10) Procurement workflow and KPIs

- Step-by-step

- Acquisition screen: Provenance and condition first, style second.

- Due diligence: Document attribution (e.g., Queen Anne cabriole leg evidence); catalog materials and hardware.

- Restoration plan: Budget labor/materials by step; lock scope before production.

- Logistics planning: Consolidate items; select LTL/FTL based on load; secure insurance and customs paperwork.

- Market prep: Produce content with style verification notes and measurements; price via blended model.

- KPIs

- Days to sell, cost of acquisition/TLC ratio, restoration labor variance, freight damage rate, return/claim rate, provenance documentation completeness.

11) Data inputs to collect per item

- Style and period: Attributed styles and feature notes.

- Measurements: Width, depth, height, seat height.

- Materials: Species, finish type, hardware present.

- Condition: Joinery status, veneer condition, upholstery condition.

- Provenance: Maker’s marks, prior sales, any documentation.

- Restoration scope: Labor hours, material costs, compliance notes.

12) Bottom line

Price in vintage chairs is controlled by verified provenance, style rarity, construction quality, and restoration scope. By combining disciplined style identification, tight restoration budgeting, consolidated logistics, and compliance-ready documentation, B2B buyers in the US and EU can confidently source, restore, and price vintage chairs with predictable margins and minimized risk.

Alternatives Analysis: Comparing vintage chair can help identify my With Other Solutions

Alternatives Analysis: Comparing vintage chair can help identify my with other solutions

Vintage chair can help identify my role in a brand and workplace narrative when compared to two viable alternatives: new, brand-labeled contract seating, and modular seating with brand kits. Key differentiators include identity distinctiveness, traceability, risk, and sustainability. Reason: Decision-makers need clear trade-offs to choose a fit-for-purpose solution.

To illustrate the comparison, Table 1 summarizes the critical criteria and practical considerations.

Table 1. Comparative overview

| Criteria | Vintage chair can help identify my | New, brand-labeled contract seating | Modular seating with brand kits |

|---|---|---|---|

| Identity distinctiveness | High—unique silhouette, materials, and provenance create a differentiated brand and narrative. Reason: Distinctiveness signals authenticity and brand voice in interiors. | Medium—brand cues exist but often follow current design norms, leading to visual sameness. Reason: Standardized manufacturing reduces uniqueness. | Medium—strong brand application on modular frames, but form language tends to be system-based. Reason: Configurable kits emphasize consistency over idiosyncrasy. |

| Traceability | High—makers’ marks, construction details, and period design cues enable provenance and dating. Reason: Provenance builds trust and supports authenticity claims. | High—model numbers, SKUs, vendor records, and warranties yield complete traceability. Reason: Formal supply chains provide auditable data. | High—system tracking via configurations, tags, and asset IDs. Reason: Digital configuration records enhance traceability. |

| Risk (authentication, compatibility, maintenance) | Elevated—authenticity requires expert verification; parts may be scarce; compatibility varies. Reason: Older standards (dimensions, upholstery methods) complicate integration. | Low—specs are consistent; warranties and service contracts mitigate downtime. Reason: Contract-grade products align with safety and durability requirements. | Low–Medium—warranty coverage and parts availability support maintenance, but modular variants may complicate sourcing. Reason: System-level parts management reduces, not eliminates, risk. |

| Total cost of ownership | Medium—lower unit cost may be offset by restoration, custom reupholstery, and specialized maintenance. Reason: Historic materials and craft requirements increase lifecycle costs. | Medium–High—higher upfront cost offset by standard maintenance and warranty coverage. Reason: Predictable service pathways lower risk-related expenses. | Medium–High—customization adds cost; systems can be cost-effective at scale but carry premium pricing. Reason: Modular branding drives material and engineering premiums. |

| ESG & sustainability | High—reuse extends product life; lower embodied carbon vs. new manufacturing. Reason: Preserving existing stock reduces resource extraction and emissions. | Medium—new manufacturing adds embodied carbon; durability and recyclability vary by brand. Reason: Production footprint impacts sustainability outcomes. | Medium—modular reuse is feasible; brand overlays may add materials; end-of-life recyclability depends on spec. Reason: System design influences circularity potential. |

| Availability | Low–Medium—finite supply; sourcing requires curation and verification. Reason:库存 depends on market finds and estate sales. | High—predictable stock and lead times via dealers and manufacturers. Reason: Contract channels ensure steady supply. | Medium–High—modular systems are widely available but brand-configured versions may have longer lead times. Reason: Customization drives schedule complexity. |

| Lead time | Long—procurement and restoration extend delivery timelines. Reason: Craft and compliance steps take time. | Short–Medium—standard lead times per brand; rush options available. Reason: Established supply chains expedite delivery. | Medium—lead time depends on brand kit configuration and upholstery. Reason: Custom overlays add process steps. |

| Compliance & safety | Medium—reupholstery must meet current fire and materials standards; structural integrity checks required. Reason: Retrofitting ensures safety and regulatory compliance. | High—designed to meet contract-grade codes and standards with documentation. Reason: Manufacturer certifications reduce compliance risk. | High—system compliance and documentation provided by the vendor. Reason: Contract seating vendors supply compliance data. |

| Fit with interior standards | Medium—may deviate from modern ergonomics and dimensions; requires reconfiguration. Reason: Historical proportions differ from current workplace norms. | High—sizes and ergonomics align with contemporary standards. Reason: Contract seating is purpose-built for workplaces. | High—dimensions and ergonomics align; brand kits overlay on standard forms. Reason: System platforms meet workplace standards. |

| Scalability | Low–Medium—best suited for feature areas, breakout zones, and executive settings. Reason: Provenance-based uniqueness resists repetition. | High—repeatable across sites with consistent brand application. Reason: Contract programs support multi-location rollouts. | High—ideal for open areas and high-traffic zones; scalable configurations. Reason: Modular kits streamline standardization. |

Analysis

- Vintage chair can help identify my when the brand’s differentiators are authenticity, craftsmanship, and a storied narrative, especially in client-facing areas or executive spaces. Reason: Provenance and patina convey personality that modern systems cannot replicate.

- Choose new, brand-labeled seating when documentation, compliance, scalability, and short lead times are paramount. Reason: Contract-grade supply chains deliver predictable outcomes with lower operational risk.

- Select modular systems with brand kits when you need consistency across large footprints plus visible brand presence. Reason: Configurable platforms and overlays balance identity with scale.

- Manage risk with vintage by requiring condition reports, provenance documentation, and post-restoration safety tests. Reason: Verification and compliance convert uniqueness into a safe, reliable asset.

- Blend approaches—deploy vintage anchors with modular uniformity—for balanced identity and performance. Reason: Hybrid strategies leverage strengths while mitigating weaknesses.

Essential Technical Properties and Trade Terminology for vintage chair can help identify my

Essential Technical Properties and Trade Terminology for Vintage Chair Identification

Use this section to standardize descriptions, streamline assessments, and align buyers, sellers, conservators, and e‑commerce teams across the USA and EU. The properties listed below are the minimum technical descriptors you should capture for reliable identification and valuation. The trade terms following these tables support transparent B2B communications.

Core technical properties for vintage chair identification

| Property | What to record | Why it matters (B2B impact) |

|---|---|---|

| Date/Period and Style | Earliest plausible date range, attributed style/maker when known (e.g., William & Mary, Queen Anne, Chippendale, Victorian; or Mid‑Century Modern) | Drives valuation bands; reduces mislabeling risk; enables style/era filters for marketplaces |

| Construction method | Primary joinery: mortise‑and‑tenon, dovetail, dowel, frame‑and‑panel, corner block, glue blocks, double tenon | High signal for authenticity; period‑appropriate construction affects price |

| Structural elements | Seat frame type and materials; stretcher/rail system; leg form (e.g., cabriole leg), turnings | Style and period hallmarks; strength/utility indicators; repair history |

| Material composition | Primary and secondary woods; veneer type (e.g., burl, cross‑banded) and core | Accurate material identification improves assessment and compliance |

| Hardware | Nails/brads types; fasteners (screws, bolts, nuts); joinery hardware (laminated blocks, brackets) | Material and method can date and authenticate; hardware condition affects value |

| Upholstery & webbing | Base construction (slats, webbing, coil springs), materials and period markers | Restorations and modern reupholstery alter perceived age and value |

| Surface & finish | Topcoat type (shellac, lacquer, varnish), patina level, wax, stain layers; evidence of stripping/repainting | Finish authenticity is crucial for condition grading and preservation |

| Patina & wear | Evidence of original tooling, saw marks, glue bleed, reworked parts; wear patterns consistent with age | Supports originality assessment; detects over‑restoration or modern tooling |

| Dimensions & scale | Seat height, seat width/depth, overall height; leg spacing | Fit‑for‑use validation; shipping and logistics planning; comparables |

| Markings & provenance | Labels, stencils, paper fragments, stamps, maker marks, collection stickers; documentation chain | Attribution and provenance improve price; required for insurance and catalogs |

| Condition & conservation | Structural integrity, joint looseness, wood movement, insect damage, prior repairs; cleaning methods | Determines readiness for sale; informs restoration scope and cost |

| Restoration / refinishing | Scope (cosmetic vs. structural), reversibility, materials used | Preserves authenticity; critical for insurance compliance and return policies |

| Compliance & restricted species | CITES listing, Lacey Act (USA), EU Timber Regulation, REACH for finishes | Mandatory documentation for export/import; mitigates legal/financial risk |

Trade terms and B2B vocabulary (used across USA and EU markets)

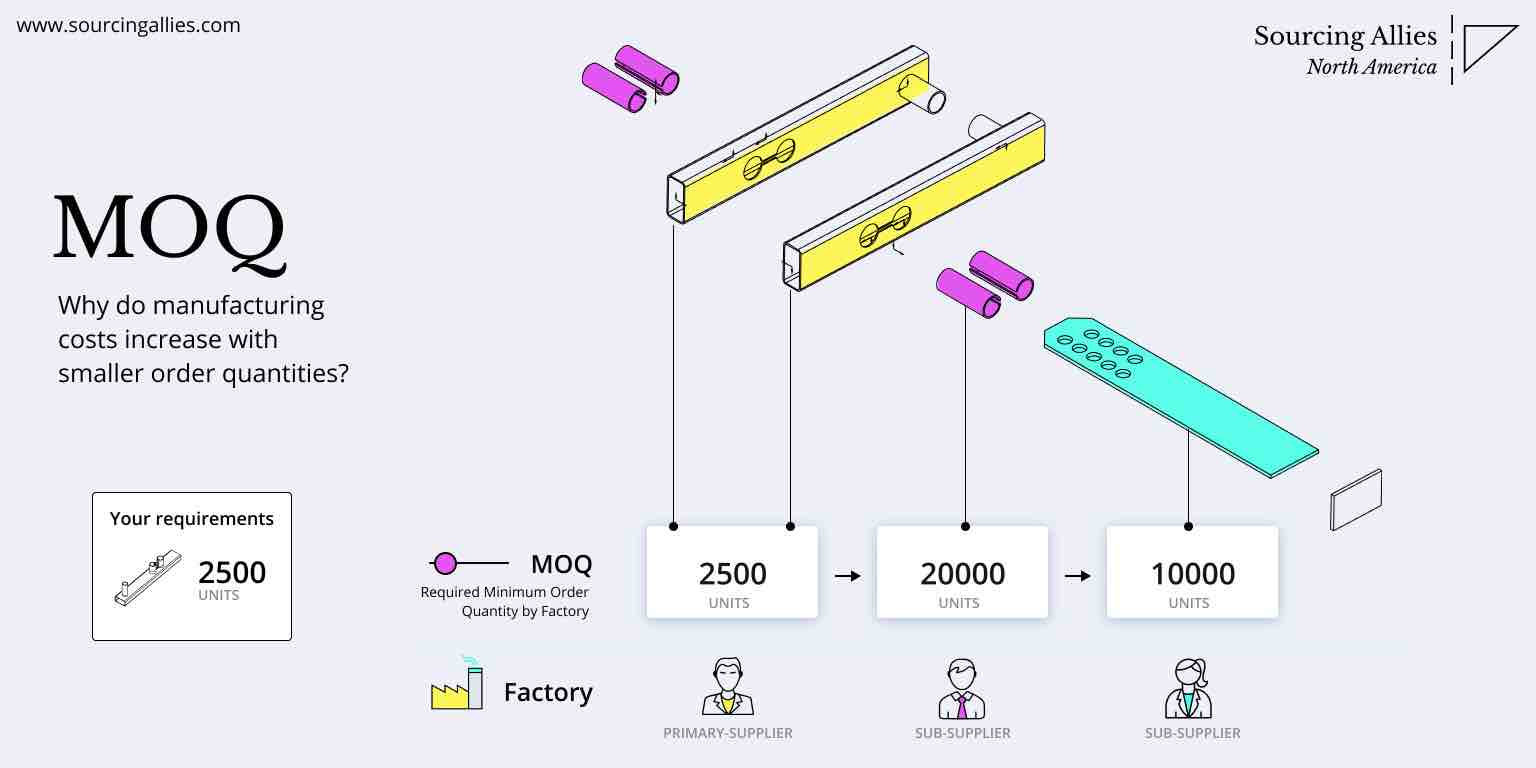

| Term | Definition | Typical use in vintage chair commerce |

|---|---|---|

| MOQ (Minimum Order Quantity) | Smallest batch the seller will deliver | Set for bulk listings, warehouse clearances, or wholesale lots |

| OEM (Original Equipment Manufacturer) | Manufacturer who produced parts for another brand | Used where chairs were made for specific brands; not common for antiques |

| ODM (Original Design Manufacturer) | Manufacturer that designs for the buyer’s brand | Rare for true antiques; relevant for reproductions |

| Lead time | Time from order to shipment | Enables forward planning for retail promotions or exhibitions |

| FOB/CIF/EXW | Incoterms defining responsibility and costs | Clarify who pays for freight, insurance, customs clearance |

| COD (Cash on Delivery) | Payment on delivery | Generally avoided in B2B; occasional in private resales |

| LTL vs. FTL | Less‑than‑Truckload vs. Full Truckload | Determines freight quotes and scheduling for small lots vs. containers |

| Condition grading | Structured description of condition | Aligns expectations and reduces disputes (e.g., “Excellent,” “Good,” “Fair”) |

| SKU (Stock Keeping Unit) | Unique inventory identifier | Enables cataloging, audits, and e‑commerce accuracy |

| Lot vs. single item | Sale type categorization | Important for auction houses, warehouses, multi‑item listings |

| Retail vs. wholesale | Price tiering based on quantity or reseller status | Guides discount structure and inventory allocation |

| Authenticity statement | Formal declaration of originality | Required for insurance/claims; used by galleries and dealers |

| CITES | Convention on International Trade in Endangered Species | Documentation needed for species‑restricted materials |

| Lacey Act (USA) | U.S. law requiring truthful disclosure of wood species | Compliance verification; import/export documentation |

| EUTR/EU Timber Regulation | EU law governing placing timber on market | Due diligence and risk assessment for wooden furniture |

| REACH | EU regulation on chemical substances | Restricts finishes/adhesives; important for restoration materials |

| Restorations & reversibility | Conservator‑grade work aiming to be removable | Signals high‑end handling; affects valuation and insurance |

| Provenance documentation | Chain of ownership/transfer records | Enhances authenticity; required by museums and premium auctions |

Quick verification checklist

- Match construction method to claimed period/style (e.g., mortise‑and‑tenon and carved cabriole legs align with Queen Anne).

- Confirm materials (e.g., solid walnut vs. maple secondary wood) align with style and date range.

- Inspect hardware finish and patina; modern fasteners and shiny plated screws often indicate later work.

- Record finish type (shellac vs. modern lacquer) and preserve patina; heavy stripping reduces value.

- Document markings/labels and provenance; maintain a file for insurance and compliance checks.

- Ensure any restricted species have required CITES documentation and U.S./EU legal records.

Note: Terms like MOQ, OEM, and Incoterms help standardize B2B workflows; for true antiques, authenticity and provenance typically outweigh OEM labels. For modern reproductions, OEM/ODM labels may appear and should be clearly separated from vintage inventory.

Illustrative Image (Source: Google Search)

References:

– Derek Brewster, “Antique Chair Identification Guide: Spot Hidden Treasures” (May 21, 2025), High End Used Furniture.

– “How to Identify, Date & Value Antique Chairs (Updated for 2025)” (March 31, 2025).

Navigating Market Dynamics and Sourcing Trends in the vintage chair can help identify my Sector

Navigating Market Dynamics and Sourcing Trends in the vintage chair sector

What we mean by “vintage chair” and where value is created

In B2B terms, the vintage chair sector spans:

– Authentic antiques (pre-1900, with strong provenance and period construction).

– Mid-century modern (circa 1940s–1960s).

– Retro and late-20th-century (1970s–1990s), often reupholstered or refinished for commercial use.

Value concentrates where style provenance meets condition and function:

– Authentic period styles (e.g., William & Mary, Queen Anne, Chippendale, Victorian) command premium, resale, and collector attention when construction methods (joinery, wood species, hardware) and period finishes are intact.

– Mid-century and retro examples offer scalable supply and robust refurb options for hospitality, workspace, and café programs.

Buyer segments and use cases

- Hospitality and F&B: durability, stackability, reupholstery ease, uniform specification.

- Workspace and corporate fit-outs: ergonomic reupholstery, brand alignment, sustainability credentials.

- Retail and events: high visual impact, quick turnaround, flexible inventory.

- Education and public spaces: hard-wear cycles, robust upholstery cycles, cost-to-use analysis.

- Collectors/resellers: authenticity checks, condition, documentation.

Market dynamics shaping demand and pricing

- Scarcity of high-quality antiques: supply is finite and condition-dependent; provenance can accelerate price.

- Refurb capacity: skills and fabric supply can be the bottleneck, creating lead-time cost.

- Platformization: auctions, specialist marketplaces, estate sales, and regional flea markets enable breadth but add verification effort.

- Regulatory and sustainability: shipping, customs, endangered-wood rules, REACH compliance for finishes/fabrics in EU; FSCs or equivalent for replacements.

- Macro shifts: hospitality reopens, hospitality-grade interiors trend, and workplace design cycles prioritize authentic materials and reduced embodied carbon.

Table: key dynamic, impact, mitigation

| Dynamic | Impact | Mitigation |

|---|---|---|

| Limited antique supply | Higher price volatility, longer search | Diversify sourcing; target style families and regional availability |

| Condition variance | Higher refurb cost; failed auctions | Photo checklists; standardized grading; hold-back budget for restoration |

| Refurb capacity | Lead-time risk | Pre-vendors for upholstery; pre-book finishing slots |

| Shipping/cross-border | Cost and time | Local/regional sourcing for fast-turn items; EU customs prep for antiques |

| Authenticity risk | Returns, brand risk | Style/joinery verification; clear terms; documented photos and marks |

| Sustainability scrutiny | Bids require emissions and material proof | Track refurb vs new; disclose wood species, finishes, and fabric certifications |

| Market cycles | Demand for mid-century vs Victorian fluctuates | Blend categories to balance portfolio and order books |

Consumer demand drivers

- Authentic character and patina over “lookalike new.”

- Restored comfort for long-dwell use (hospitality/workplace).

- Modular or stackable solutions for F&B and events.

- Verified authenticity and condition for resellers/collectors.

Regional differences: USA vs Europe

Table: US vs EU signals

| Dimension | USA | Europe |

|---|---|---|

| Volume vs price | Higher volume trades; strong mid-century; competitive pricing on common patterns | Balanced; strong historic stocks; premium on authenticated antiques |

| Collectibility & style | Mid-century modern dominance in B2B fit-outs | Wider style span including country/pine, Biedermeier, Victorian, Art Nouveau/Deco |

| Sourcing channels | Regional auctions, estate sales, curated marketplaces, local consignors | Antik markets (e.g., Netherlands, Germany, France), dealer fairs, specialist auctions |

| Logistics | FTL/LTL via brokers; state-level regs; customs mainly domestic | Cross-border shipments within EU; customs for non-EU; stricter provenance questions |

| Compliance | Domestic wood species/finishes; local upholstery standards | REACH on finishes; wood trade documentation; CITES attention for listed species |

| Sustainability | USGBC/LEED, WELL alignment; recycled content, refurb credits | EU taxonomy/CSRD; embodied carbon; refurb/second-life procurement |

Use period signals to guide sourcing strategy

Understanding style eras helps de-risk authentication and match stock to demand.

Table: style-to-century guide

| Century | Dominant styles | What to verify | Typical valuation drivers |

|---|---|---|---|

| 17th | William & Mary | Turned legs, early splats, period joinery | Rarity; early features intact; documentation |

| 18th | Queen Anne; early Chippendale | Cabriole legs, curved lines; mortise-and-tenon | Condition of curved elements; period upholstery evidence |

| Late 18th–Early 19th | Georgian, Hepplewhite, Sheraton | Straight tapered legs; inlay; light proportions | Inlay quality; original finish patches; country vs town variants |

| 19th | Victorian | Ornamentation, cast-metal details | Scale of piece; hardware/metalwork integrity; patina |

| Mid-century | Mid-century modern (e.g., Scandinavian, American MCM) | Solid wood joinery; original leather/fabric; labels | Labels/attribution; upholstery condition; production numbers |

| Late 20th | Retro/postmodern | Colorways; iconic forms; newer hardware | Brand authenticity; iconic signatures; condition of newer plastics |

Note: These patterns mirror the style progression identified by chair identification guides—from William & Mary (17th century) to Queen Anne and Chippendale (18th century) through to Victorian (19th century) and beyond.

Illustrative Image (Source: Google Search)

Sourcing channels, pros and cons

Table: channels and trade-offs

| Channel | Pros | Cons | Best for |

|---|---|---|---|

| Estate sales | Authenticity and discovery potential | Time sensitivity; mixed condition | Rare styles; dealer refresh |

| Regional auctions | Price discovery; condition reports | Fees/penalties; limited return windows | Scale lots; curated finds |

| Specialist marketplaces | Convenience; seller vetting | Platform fees; variable stock quality | Fast-turn mid-century |

| Flea markets/antik fairs | Negotiation; local sourcing | Variable authenticity; travel | Small runs; testing styles |

| Direct-to-consignors | Cleaner condition control | Slower acquisition | Programmatic procurement |

| Dealer consignment | Expert authentication; polishing | Margin trade-off | Higher-value antiques and MCM |

Quality, restoration, and cost-to-serve

- Authenticity checklist: joinery type, hardware marks, wood species, screw/finish age, labels/signatures, period upholstery evidence.

- Restoration scope: chair rail/splint repairs, webbing replacement, finish stabilization, re-upholstery (leather vs fabric). Align durability with use case (hospitality vs collectors).

- Cost-to-serve: shipping/drayage, duties, restoration labor, fabric cost, rework, hold days, and returns allowance. Build into the landed cost model.

Sustainability and compliance highlights

- Refurb vs new: prioritize repair and reupholstery cycles to reduce embodied carbon and waste.

- Material diligence: verify wood species; avoid CITES-listed items without documentation; specify REACH-compliant finishes; use recycled or certified fabrics when possible.

- Documentation: retain photos, receipts, and condition reports per item; maintain supplier declarations.

Practical KPIs and signals to monitor

- Inventory mix by era/style and condition grade (A/B/C).

- Landed cost variance by channel and restoration level.

- Sell-through by segment (hospitality vs workspace vs resale).

- Refurb turnaround time and failure rate.

- Cross-border shipment lead time and compliance reject rate.

- Sustainability: proportion of refurbished items, emissions avoided, material certifications on file.

Quick guidance: USA vs Europe sourcing

- Start with style families that match your sales profile (e.g., mid-century for U.S. hospitality projects; a broader antique mix for European retail).

- For U.S., prioritize reliable auctions and estate sales for breadth; in Europe, leverage dealer fairs and regional markets to secure authentic antiques with better documentation.

- Align refurb partners with volume and compliance needs; pre-approve fabrics/finishes to compress lead time.

- Keep cross-border shipments efficient by bundling and pre-clearing; use local warehouses for high-turn SKUs.

By combining period-based identification with disciplined sourcing, quality control, and sustainability compliance, B2B operators can balance authenticity, availability, and margins in the vintage chair sector.

Frequently Asked Questions (FAQs) for B2B Buyers of vintage chair can help identify my

Frequently Asked Questions (FAQs) for B2B Buyers of Vintage Chairs

1) How do I quickly date a chair and confirm it’s period, not a reproduction?

- Use a layered approach:

- Visual style: Identify period design language (e.g., cabriole legs suggest Queen Anne; elaborate turnings can signal Victorian).

- Construction details: Look for hand-cut joinery (dovetails, mortise-and-tenon), handmade nails, and hand-sawn surfaces. Machine-cut elements and uniform machine marks point to later periods or reproductions.

- Finish and upholstery: Shellac and wax older than the 20th century. Machine tacking and synthetic textiles indicate modern re-upholstery or later construction.

- Labels and stamps: Check under-seat and framework for maker’s marks, retail labels, or paper stamps. Verify stamp typography against known period examples.

- Wear patterns: Authentic chairs show natural, consistent wear in contact areas; modern distressing is often uneven or overly “aged.”

- Provenance: Request invoices, gallery receipts, and past sale records.

- Cross-check findings against a period style reference (e.g., William & Mary → Queen Anne → Chippendale → Victorian). A coherent cluster of features supports authenticity.

2) What are the core visual cues to distinguish major styles and periods?

- William & Mary (late 17th–early 18th c.): Turned frames, hooved feet, caned seats, heavy proportions; walnut and oak common.

- Queen Anne (early–mid 18th c.): Cabriole legs, curved crests, shell carving; walnut primary; upholstery transitions from caning to upholstered.

- Chippendale (mid–late 18th c.): Deeply carved, ornate crest rails, ball-and-claw feet; mahogany characteristic.

- Victorian (19th c.): Heavy carved ornament, revival influences (Gothic, Rococo), tufted upholstery; ebonized finishes common.

- Early–mid 20th c. (Neoclassical/Arts & Crafts): Clean lines, turned or square legs, exposed joinery; oak prominent.

3) How do I evaluate condition and structural integrity for resell or hospitality use?

- Framework:

- Joints: Look for cracks at tenon shoulders, glue blocks for reinforcement, and any rocking or wobble.

- Wood: Check for splits, insect damage, and soundness under light rapping.

- Upholstery and finish:

- Springs and webbing: Confirm tautness; avoid sagging and rust stains on metal springs.

- Foam condition: Palpate for crumbly degradation; many historic pieces were re-foamed in the late 20th century—ensure materials are clean and intact.

- Fabric integrity: Inspect seams, stains, and UV fading; note if fabric is period-appropriate for valuation.

- Surface finish:

- Check for thick overpaint, overspray, or masking of defects. Distinguish natural patina from restoration.

- Grade and disclose:

- Assign a transparent condition grade (A–D) and disclose any structural work, replacements, or restored elements. This standardizes valuation and reduces returns.

4) How do I verify authenticity and distinguish antiques from well-made reproductions?

- Indicators of authenticity:

- Hand-cut joinery, handmade nails, and period-appropriate hardware.

- Consistent wood grain and period-correct species for the style and region.

- Natural wear and patina; lack of uniform tooling marks or distressing.

- Red flags:

- Machine-cut joinery where hand-cut is expected.

- Fused metal hardware with modern alloy signatures.

- “Too perfect” surfaces or disproportionate scale for the style.

- Documentation:

- Label/stamp matching the style and era, gallery receipts, and exhibition history improve confidence.

- When in doubt, defer to a furniture conservator or specialist with period furniture experience.

5) What drives price and valuation for vintage chairs in B2B contexts?

- Rarity and demand:

- Brand/designer recognition (e.g., Thonet, Eames, Wright, Baughman) and documented maker’s marks.

- Production volumes and auction comparables.

- Authenticity and period:

- Period correctness, original construction, and intact labels/stamps.

- Condition and completeness:

- Framework soundness, intact hardware, and accurate restoration quality.

- Percentage of original finish and upholstery affects value premiums.

- Market timing:

- Seasonality and trend cycles in hospitality, retail, and staging.

- B2B grading snapshot:

- Use clear grade bands with disclosed work items to align expectations and pricing tiers.

6) What condition and documentation should I expect when sourcing lots or single pieces?

- Documentation:

- Lot sheets with style/period identification, condition grade, restoration notes, and materials used.

- Photo sets: overall views, undercarriages, labels/stamps, joints, hardware, and fabric close-ups.

- Treatment reports for re-glues, finishes, or upholstery.

- Lot composition:

- Mix of grades A/B for high-value stock and C/D for parts/restoration; avoid large undisclosed “mixed lot” purchases without inspection.

- Warranty and returns:

- Define inspection window, acceptable discrepancies, and remedies (credit, repair, or return).

7) How should vintage chairs be packaged and shipped for international B2B delivery?

- Packaging essentials:

- Double-wall cartons, foam-in-place or custom crates for high-value pieces, corner protection, and leg guards.

- Reinforced undercarriage with stiffeners; separate and cushion hardware.

- Upholstery protection: fabric covers and breathable barrier wraps to prevent mildew.

- Transit protection:

- Shock/tilt indicators, desiccant packs in humid climates, and clear labeling (this side up/fragile).

- Delivery expectations:

- White-glove options for hospitality installations; photo documentation on arrival; claim windows aligned to contract terms.

8) Are there export/import requirements for the US and EU?

- US:

- No general CITES permits for mainstream furniture woods; confirm any restricted species.

- Accurate customs descriptions with material composition and HTS codes.

- EU:

- EU Timber Regulation (EUTR) and EU Deforestation Regulation (EUDR) apply to certain woods; ensure documented legality and due diligence.

- CITES may apply to protected species; obtain permits if applicable.

- Provide product documentation (materials, sourcing) for customs checks.

Quick Identification Checklist

- Confirm period style via leg profiles, crest rails, carving motifs, and wood species.

- Inspect under-seat for labels/stamps and maker’s marks; verify stamp typography.

- Assess joinery (hand vs. machine), nail types, and finish layers for authenticity cues.

- Grade and disclose condition; document restoration and material replacements.

- Capture full photo documentation and maintain treatment/provenance records.

Optional Reference: B2B Grading & Pricing Snapshot

| Grade | Condition Summary | Typical Valuation Range (Relative to Base) | Typical Restoration Needs |

|---|---|---|---|

| A | Stable, minor cosmetic wear; original joinery intact | 1.2x–1.8x | Light cleaning only |

| B | Minor structural repairs; good upholstery integrity | 1.0x–1.3x | Spot repair, light refinishing |

| C | Moderate issues; several replaced elements; sound after work | 0.7x–1.0x | Re-glue joints, selective re-upholstery |

| D | Significant restoration required or major replacements | 0.4x–0.7x | Framework restoration, full re-upholstery |

Optional Reference: Packaging & Shipping Matrix

| Element | Requirements | Notes |

|---|---|---|

| Packaging | Double-wall cartons or custom crates; corner protection; leg guards | Use foam-in-place for high-value items |

| Internal Support | Undercarriage stiffeners; hardware separated and cushioned | Prevent contact abrasion and joint stress |