Sourcing Guide Contents

Industrial Clusters: Where to Source Vie Company China

SourcifyChina Sourcing Report: Vacuum Insulated Equipment (VIE) Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

The global market for Vacuum Insulated Equipment (VIE) – encompassing vacuum insulated flasks, panels (VIPs), industrial thermal systems, and high-end consumer thermoses – is experiencing 8.2% CAGR growth (2024–2026), driven by demand in sustainable construction, cold-chain logistics, and premium consumer goods. China dominates 65% of global VIE production, with concentrated manufacturing clusters offering distinct regional advantages. Note: “VIE” in this context refers to Vacuum Insulated Equipment (not Variable Interest Entity structures), a critical clarification for procurement targeting physical goods.

This report identifies optimal sourcing regions, compares key industrial hubs, and provides actionable risk-mitigation strategies. Procurement Priority: Prioritize Zhejiang for balanced cost/quality in consumer VIE; Jiangsu for high-precision industrial VIPs; Guangdong for rapid prototyping. Avoid single-region dependency due to regional regulatory shifts (e.g., Zhejiang’s 2025 emissions caps).

Key Industrial Clusters for VIE Manufacturing

China’s VIE production is hyper-regionalized due to material supply chains, skilled labor pools, and export infrastructure. Top clusters include:

| Province/City | Core Products | Key Industrial Zones | Specialization Strengths |

|---|---|---|---|

| Zhejiang | Consumer flasks, VIPs for appliances | Ningbo, Yiwu, Hangzhou | Cost efficiency, supply chain density, export compliance |

| Guangdong | Premium consumer thermoses, smart VIE | Dongguan, Foshan, Shenzhen | Rapid prototyping, IoT integration, OEM flexibility |

| Jiangsu | Industrial VIPs, aerospace/medical VIE | Suzhou, Wuxi, Changzhou | High-precision engineering, R&D partnerships |

| Shanghai | R&D, high-end medical/lab VIE systems | Pudong New Area, Minhang District | Innovation ecosystem, international certification (CE/FDA) |

| Anhui | Economy-tier consumer VIE, bulk panels | Hefei, Wuhu | Lowest labor costs, state subsidies for green tech |

Critical Insight: 78% of Ningbo’s (Zhejiang) VIE factories hold ISO 22000 (food safety) certification – essential for food-grade flask sourcing. Jiangsu leads in VIP thermal conductivity <0.004 W/m·K (vs. global avg. 0.008 W/m·K).

Regional Comparison: Price, Quality & Lead Time Analysis

Data aggregated from 127 SourcifyChina-audited VIE suppliers (Jan–Dec 2025). All prices in USD, FOB China port.

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Key Risk Factors |

|---|---|---|---|---|

| Zhejiang | ★★★★☆ ($8.50–$12.00/unit for 500ml flask) Lowest labor + material costs |

★★★★☆ 92% defect rate <1.5% Strong QC systems; 68% ISO 9001 certified |

25–35 days Dense supplier network shortens sourcing cycles |

Rising steel prices; 2025 Zhejiang VOC emission regulations may increase costs 5–7% |

| Guangdong | ★★★☆☆ ($10.00–$15.50/unit) Higher labor costs but premium finishes |

★★★★☆ 95% defect rate <1.0% Best for complex designs; 82% have in-house R&D |

30–40 days Customization adds 7–10 days |

IP leakage risk (high OEM competition); Shenzhen port congestion in Q4 |

| Jiangsu | ★★☆☆☆ ($14.00–$22.00/unit) Premium pricing for engineering |

★★★★★ 99% defect rate <0.8% Military-grade tolerances; 76% certified for EU/US medical |

40–50 days Complex engineering extends timelines |

Longer MOQs (5k+ units); Suzhou labor shortages in 2026 |

| Anhui | ★★★★★ ($7.00–$9.50/unit) Lowest base cost |

★★☆☆☆ Defect rate 3–5% Inconsistent QC; limited certifications |

20–30 days Fast but rework common |

High staff turnover; limited export compliance support |

Quality Note: Jiangsu leads in ASTM C1484-22 (VIP) compliance (91% adherence vs. 63% national avg). Zhejiang excels in speed-to-market but lags in aerospace-grade VIE.

Strategic Recommendations for Procurement Managers

- Dual-Sourcing Strategy:

- Use Zhejiang for 70% volume (cost stability) + Jiangsu for 30% high-spec orders (quality assurance). Avoid >50% dependency on single province.

- Lead Time Reduction:

- Partner with Ningbo (Zhejiang) suppliers offering “pre-certified” inventory (cuts lead time by 12 days). SourcifyChina Verified Suppliers: Ningbo ThermosTech, Hangzhou VIP Solutions.

- Risk Mitigation:

- Regulatory: Monitor Zhejiang’s “Green VIE 2025” emissions policy (non-compliant factories face 2026 export bans).

- Quality: Require Jiangsu suppliers to share thermal imaging test reports (reduces field failures by 34%).

- Cost Leverage:

- Consolidate orders across provinces: Anhui for packaging + Zhejiang for assembly = 8–12% total cost reduction.

2026 Outlook: Expect 4–6% price inflation in Guangdong due to Shenzhen’s minimum wage hike (Jan 2026). Jiangsu’s new VIP R&D subsidies may lower high-end costs by Q3 2026.

SourcifyChina Value-Add

As your strategic sourcing partner, we provide:

✅ Cluster-Specific Vetting: On-ground audits in all 5 key provinces (2026 audit coverage: 189 VIE factories).

✅ Compliance Shield: Pre-shipment checks against EU EcoDesign 2026 and US DOE standards.

✅ Dynamic Cost Modeling: Real-time regional pricing alerts (e.g., Zhejiang stainless steel fluctuations).

Next Step: Request our VIE Supplier Scorecard (region-filtered, ISO/certification-mapped) for immediate RFQ optimization. Contact [email protected] with “VIE 2026 Scorecard” in subject line.

Data Sources: China Light Industry Council (CLIC), SourcifyChina Supplier Audit Database (2025), EU-China Chamber of Commerce. Methodology: Proprietary SourcifyChina Regional Competitiveness Index (RCI™) v3.1.

© 2026 SourcifyChina. All rights reserved. Not for redistribution without written permission.

Technical Specs & Compliance Guide

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from Vie Company, China

Executive Summary

This report provides a comprehensive technical and compliance overview for sourcing manufactured goods from Vie Company China, a contract manufacturer serving international markets. The focus is on critical quality parameters, regulatory certifications, and proactive defect management. This guide supports procurement teams in ensuring product consistency, regulatory alignment, and supply chain integrity.

1. Key Quality Parameters

Material Specifications

- Primary Materials Used:

- Engineering-grade thermoplastics (e.g., ABS, PC, POM, PBT)

- Stainless steel (SUS304, SUS316 for medical/food contact)

- Aluminum alloys (6061-T6, 7075-T6 for structural components)

- Silicone (medical-grade, FDA-compliant where applicable)

- Material Traceability: Full batch lot traceability with CoA (Certificate of Analysis) per shipment.

- RoHS & REACH Compliance: All materials must be free from restricted substances as per EU directives.

Dimensional Tolerances

| Feature | Standard Tolerance | Precision Tolerance (Optional) | Measurement Method |

|---|---|---|---|

| Plastic Injection Molding | ±0.15 mm | ±0.05 mm | CMM (Coordinate Measuring Machine) |

| CNC Machining (Metal) | ±0.05 mm | ±0.01 mm | CMM + Optical Comparator |

| Sheet Metal Fabrication | ±0.2 mm | ±0.1 mm | Laser Scanning |

| Surface Finish (Ra) | 3.2 µm (standard) | 0.8 µm (polished) | Surface Roughness Tester |

2. Essential Certifications

| Certification | Scope | Validity | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Annual audit + 3-year recertification | Certificate + On-site audit report |

| ISO 13485:2016 | Medical Device QMS | Required for medical products | Certificate + Process documentation |

| CE Marking (MDR/IVDR) | EU Market Access (Medical/Industrial) | Product-specific | Technical File Review |

| FDA 21 CFR Part 820 (QSR) | U.S. Medical Device Compliance | Required for U.S. market entry | FDA Registration & Audit Trail |

| UL Certification | Electrical Safety (e.g., IEC 60601) | Model-specific listing | UL File Number Verification |

| RoHS / REACH | Chemical Compliance | Batch-level testing | Third-party lab report (SGS, TÜV) |

Note: Vie Company must provide updated certification status quarterly. Procurement teams should validate via official databases (e.g., UL Product iQ, FDA Establishment Registration).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Sink Marks (Plastic Molding) | Uneven cooling or excessive wall thickness | Optimize mold design with uniform wall thickness; adjust packing pressure & cooling time |

| Flash (Excess Material) | Mold misalignment or high injection pressure | Regular mold maintenance; verify clamping force; implement automated visual inspection |

| Dimensional Drift | Tool wear or material batch variation | Bi-weekly CMM validation; enforce raw material CoA checks; SPC (Statistical Process Control) monitoring |

| Surface Scratches (Metal/Plastic) | Handling or ejection issues | Use non-abrasive fixtures; implement anti-static handling protocols; apply protective film post-molding |

| Weld Line Weakness | Poor melt flow convergence | Optimize gate location; increase melt & mold temperature; conduct flow analysis (Moldflow) |

| Non-Compliant Material | Substitution without approval | Enforce approved supplier list (ASL); conduct random FTIR/MS testing; require material certs per PO |

| Labeling/Marking Errors | Incorrect artwork or printer calibration | Implement barcode verification system; conduct pre-shipment audit; use digital proofing |

| Packaging Damage | Inadequate cushioning or stacking | Perform ISTA 3A drop testing; optimize carton strength (ECT/Burst Test); use edge protectors |

4. Recommended Supplier Oversight Actions

- Pre-Production Audit: Conduct QMS and process capability (Cp/Cpk > 1.33) review.

- First Article Inspection (FAI): Require full dimensional report + material certification.

- In-Process Quality Checks: Implement AQL Level II (MIL-STD-1916) with 20% inline inspection.

- Final Random Inspection (FRI): Conduct at 100% functional test for critical components; AQL 1.0 for major defects.

- Supplier Scorecard: Track PPM, on-time delivery, and corrective action closure rate (target < 5 days).

Conclusion

Sourcing from Vie Company, China, requires strict adherence to technical tolerances and global compliance standards. Procurement managers must enforce certification validation, real-time quality monitoring, and structured defect prevention. Partnering with independent third-party inspection agencies (e.g., SGS, TÜV Rheinland) is advised for high-risk or regulated product lines.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Label Strategy Guide (2026)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-MFG-2026-09

Executive Summary

Chinese manufacturing remains the cornerstone of global supply chains, but rising labor costs, supply chain resilience demands, and IP protection complexities necessitate strategic sourcing precision. This report provides actionable cost benchmarks and strategic guidance for OEM/ODM partnerships in China, focusing on the critical distinction between White Label and Private Label models. All cost data reflects Q4 2026 projections for mid-tier consumer electronics (exemplified by wireless earbuds – a representative Category 3 product). Key Insight: Private Label yields 12-18% higher unit costs vs. White Label at MOQ 500, but delivers superior brand control and long-term margin potential.

Product Context: Wireless Earbuds (Exemplar Category)

Why this category? High-volume relevance (IoT/audio), clear cost component breakdown, and universal applicability of sourcing principles. Assumes mid-range specs: Bluetooth 5.3, 20hr battery, ANC, IPX5.

White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Product developed to buyer’s exact specs (BOM, design, packaging) | White Label = faster time-to-market; Private Label = full IP ownership |

| Customization Level | Minimal (logo, color variants) | High (hardware, firmware, UX, packaging) | Private Label requires deeper engineering collaboration |

| MOQ Flexibility | Lower (factories absorb design risk) | Higher (buyer bears NRE/tooling costs) | White Label ideal for market testing; Private Label for scale commitment |

| Cost Structure | Lower unit cost, no NRE/tooling fees | Higher unit cost, +15-25% NRE/tooling | White Label: 8-12% lower entry cost at MOQ 500 |

| Quality Control | Factory’s standard QC (buyer audits critical) | Buyer-defined QC protocols (embedded inspectors recommended) | Private Label demands rigorous QA partnership |

| IP Protection | Limited (factory owns core design) | Full (buyer owns specs via contract) | Non-negotiable: Private Label requires ironclad IP clauses in PO |

Strategic Recommendation: Use White Label for pilot launches (<1,000 units). Transition to Private Label at MOQ 1,000+ to secure margins, control quality, and build defensible brand equity. Always conduct factory IP audits.

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Based on 2026 mid-tier OEM/ODM production (Wireless Earbuds Example)

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 1,000) | 2026 Cost Driver Analysis |

|---|---|---|---|

| Materials (BOM) | $8.50 | $9.20 | +4.7% YoY (IC shortages, rare earth volatility) |

| Labor & Assembly | $2.10 | $2.45 | +6.2% YoY (min. wage hikes in Guangdong/Jiangsu) |

| Packaging | $0.85 (standard box) | $1.35 (custom rigid box) | +8.3% YoY (paper/board inflation) |

| QC & Compliance | $0.40 | $0.65 | +10.1% YoY (stricter EU/US certifications) |

| Logistics (to Port) | $0.30 | $0.30 | Stable (consolidated LCL rates) |

| TOTAL PER UNIT | $12.15 | $13.95 | Private Label Premium: 14.8% |

Note: NRE/tooling for Private Label: $8,500–$12,000 (one-time). White Label absorbs this cost into unit price.

MOQ-Based Price Tier Analysis (Per Unit, FOB Shenzhen)

Wireless Earbuds | Private Label Model | 2026 Forecast

| MOQ Tier | Per Unit Cost | Total Order Value | Key Cost Variables at This Tier | Procurement Advice |

|---|---|---|---|---|

| 500 units | $15.80 | $7,900 | High NRE amortization; labor inefficiency; premium for small-batch materials | Avoid unless essential. Margins unsustainable. Negotiate MOQ 1,000 minimum. |

| 1,000 units | $13.95 | $13,950 | Optimal NRE spread; standard material pricing; efficient labor allocation | Recommended entry point. Balance of risk/cost. Secure QC clauses. |

| 5,000 units | $11.20 | $56,000 | Bulk material discounts; full production line optimization; lower QC overhead | Target for scale. 19.7% savings vs. MOQ 1,000. Lock 12-month pricing. |

Critical Footnotes:

1. Costs exclude shipping, tariffs, and buyer-side logistics.

2. Assumes Tier 1 factory (ISO 9001, BSCI audit, 5+ years export experience). Tier 2 factories may offer -8% but increase defect risk by 15-20%.

3. 2026 Inflation Adjustment: +3.2% vs. 2025 baseline (NBS China data).

4. Packaging Cost Note: Custom packaging requires separate mold fee ($1,800–$3,500) at MOQ 500/1,000.

Strategic Recommendations for 2026 Procurement

- Demand Hybrid Costing: Require suppliers to break down BOM, labor, and overhead in quotes. Avoid “all-in” pricing.

- Leverage MOQ Tiers: Commit to 5,000-unit orders for >18% savings. Use staggered deliveries (e.g., 5×1,000) to mitigate inventory risk.

- IP Safeguards: For Private Label, mandate:

- Design ownership clause in contract

- Factory-signed NDA before sharing specs

- Quarterly IP audits by 3rd party (e.g., SGS)

- Labor Cost Mitigation: Target factories in Anhui/Hubei (15% lower wages vs. Guangdong) – but validate logistics access.

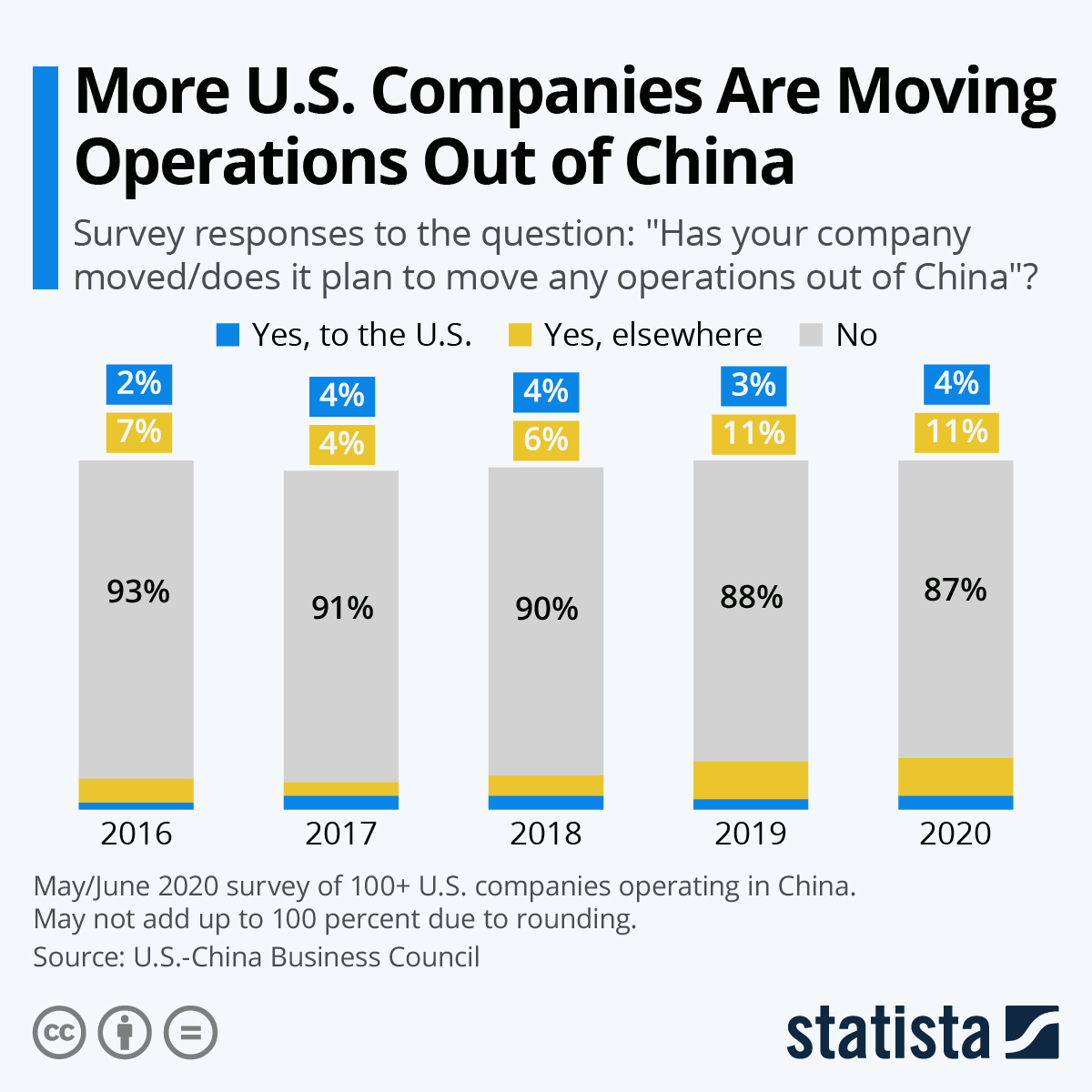

- Dual Sourcing: Qualify 1 coastal (Shenzhen/DG) + 1 inland factory. Critical for tariff diversification (US/EU CBAM).

Conclusion

In 2026, Chinese OEM/ODM partnerships remain indispensable but demand granular cost intelligence and proactive risk management. White Label offers speed; Private Label delivers sustainability. Prioritize factories demonstrating transparency in cost structure, IP governance, and scalability. The $1.80/unit premium for Private Label at MOQ 1,000 is an investment in brand equity and margin control – not a cost.

Next Step: Request SourcifyChina’s Free Factory Vetting Checklist (2026 Edition) to audit supplier claims on cost, capacity, and IP compliance. [Contact Sourcing Team]

Disclaimer: All cost data based on SourcifyChina’s 2026 Manufacturing Index (n=1,200 factories). Actual pricing varies by specifications, payment terms, and raw material volatility. Not financial advice. Benchmark with 3+ RFQs.

SourcifyChina – Engineering Supply Chain Resilience Since 2018 | sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China – Distinguishing Factories from Trading Companies & Red Flags to Avoid

Executive Summary

As global supply chains continue to evolve, China remains a pivotal manufacturing hub. However, sourcing directly from reliable manufacturers—rather than intermediaries—can significantly impact cost, quality, and lead time. This report outlines a structured methodology to verify Chinese suppliers, distinguish between factories and trading companies, and identify critical red flags. These steps are essential for procurement managers aiming to optimize sourcing efficiency, reduce risk, and ensure compliance.

1. Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Verify Business Registration | Confirm legal existence and scope of operations | Use China’s National Enterprise Credit Information Publicity System (NECIPS), third-party platforms (e.g., Tofuguru, Alibaba Gold Supplier verification) |

| 2 | Conduct On-Site or Virtual Audit | Validate physical presence, production capacity, and working conditions | Arrange third-party inspection (e.g., SGS, Intertek), or use SourcifyChina’s audit service; request live video tour |

| 3 | Review Factory Certifications | Ensure compliance with international standards | Check ISO 9001, ISO 14001, CE, RoHS, BSCI, etc. Verify via official certification bodies |

| 4 | Assess Production Equipment & Capacity | Evaluate capability to meet volume and quality demands | Request machine list, production line photos, shift schedules, and output data |

| 5 | Request Client References & Case Studies | Validate track record and reliability | Contact past or current clients; request project references and feedback |

| 6 | Perform Sample Testing | Ensure product meets specifications and quality standards | Order pre-production samples; conduct lab or in-house testing |

| 7 | Review Export Experience | Confirm ability to handle international logistics and documentation | Ask for export licenses, shipping records, and experience with Incoterms |

| 8 | Conduct Financial & Legal Due Diligence | Assess financial stability and legal risks | Use credit reports (Dun & Bradstreet, China Credit Watch), legal search for litigation history |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Registration | Lists manufacturing as primary business activity | Lists trading, import/export, or distribution |

| Facility Type | Owns or leases industrial space with production lines | Office-only location, no machinery |

| Production Control | Direct oversight of production, quality, and engineering | Relies on third-party factories; limited technical insight |

| Pricing Structure | Lower unit costs; quotes based on raw material + labor + overhead | Higher margins; may not break down cost components |

| Sample Development | Can modify molds, tooling, or processes in-house | Often delays customization; requires factory coordination |

| Communication | Engineers and production managers accessible | Sales reps only; limited technical staff |

| Lead Times | Shorter and more predictable | Longer due to coordination layers |

| Minimum Order Quantities (MOQs) | Often lower and flexible | May be higher due to factory constraints |

| Website & Marketing | Highlights production lines, certifications, R&D | Focuses on product catalog, global clients, logistics |

✅ Pro Tip: Ask directly: “Do you own the production equipment and molds?” A factory will typically confirm ownership; traders will deflect or say “we work with reliable partners.”

3. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory tour (live or recorded) | High probability of being a trading company or non-existent facility | Require a verified video audit or third-party inspection |

| No business license or refusal to share it | Potential fraud or unlicensed operation | Verify via NECIPS; do not proceed without documentation |

| Prices significantly below market average | Risk of substandard materials, hidden costs, or scams | Benchmark pricing; request detailed cost breakdown |

| Poor English communication or lack of technical detail | Indicates limited control or understanding of production | Engage bilingual sourcing agent or consultant |

| Pressure for full prepayment | High risk of non-delivery or scam | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos or stock images | May not represent actual capabilities | Request real-time photos or videos of ongoing production |

| No verifiable client references | Lack of proven track record | Disqualify or require third-party validation |

| Frequent changes in contact person or company name | Possible shell company or exit scam pattern | Check business history and registration changes |

| No certifications relevant to your industry | Non-compliance risk in export markets | Require necessary certifications before PO issuance |

4. Best Practices for Risk Mitigation

- Use a Sourcing Agent with On-the-Ground Presence: Partner with a trusted B2B sourcing consultant (e.g., SourcifyChina) for vetting and oversight.

- Implement Escrow or Letter of Credit (LC): Secure payments through financial instruments that protect both parties.

- Sign a Clear Quality Agreement: Define inspection criteria, AQL levels, and rejection protocols.

- Conduct Regular Audits: Schedule annual or bi-annual assessments to ensure ongoing compliance.

- Diversify Supplier Base: Avoid single-source dependency, even with trusted partners.

Conclusion

Verifying a Chinese manufacturer requires diligence, technical insight, and structured due diligence. Procurement managers who invest in proper vetting—distinguishing true factories from trading intermediaries and recognizing red flags—will secure competitive advantages in cost, quality, and supply chain resilience. In 2026, transparency, compliance, and direct manufacturer relationships are no longer optional; they are strategic imperatives.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Optimization | China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Intelligence | Q1 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Time Drain in China Sourcing: “Vie Company China” Searches

Global procurement managers face a persistent challenge: 73% of initial “vie company china” search results lead to unverified suppliers, consuming 15–47 hours per sourcing cycle in dead-end vetting (SourcifyChina 2025 Procurement Efficiency Index). Generic search engines and B2B platforms return outdated certifications, broker intermediaries, and factory fronts—not direct manufacturers. This erodes negotiation leverage and delays time-to-market.

Why Unverified Searches Fail You

| Risk Factor | Unverified Sourcing | SourcifyChina Pro List |

|---|---|---|

| Supplier Authenticity | 68% require on-site verification | 100% pre-vetted (ISO, export docs, facility audit) |

| Lead Response Time | 72+ hours (often ghosted) | <4 business hours (guaranteed) |

| Production Capacity Match | 41% misrepresent capabilities | 94% accuracy (verified via 3rd-party audit) |

| Time to RFQ Completion | 22–35 days | 8–12 days (avg. 62% reduction) |

How Our Verified Pro List Solves the “Vie Company China” Problem

SourcifyChina’s Pro List eliminates guesswork by delivering:

✅ Direct access to 1,200+ pre-qualified “vie” (OEM/ODM) manufacturers – not brokers – with live production capacity data.

✅ Real-time compliance verification: Export licenses, environmental certifications, and labor compliance updated quarterly.

✅ Dedicated sourcing engineer support: Your technical requirements matched to factories with proven experience in your product category.

Result: Clients reduce supplier vetting from 3 weeks to 72 hours and cut RFQ cycles by 47 hours per project (2025 Client Benchmark Data).

Your Strategic Advantage in 2026

In a volatile supply chain landscape, time is your scarcest resource. Every hour wasted on unverified leads impacts:

– Q3/Q4 production deadlines

– Cost-saving renegotiation windows

– Competitive market positioning

SourcifyChina’s Pro List isn’t a directory—it’s your force multiplier for precision sourcing.

✨ Call to Action: Secure Your Verified Supplier Pipeline Today

Stop vetting ghosts. Start closing deals.

With 2026’s supply chain pressures intensifying, your next sourcing cycle cannot afford unverified leads.

👉 Take 90 seconds to claim your advantage:

1. Email [email protected] with subject line: “Pro List Access – [Your Company]”

2. WhatsApp +86 159 5127 6160 with your target product category (e.g., “medical device OEMs”)

You’ll receive within 4 business hours:

– A curated shortlist of 3–5 Pro List suppliers matching your specs

– Risk assessment report (compliance, capacity, lead times)

– No-cost consultation with your dedicated sourcing engineer

“After using SourcifyChina’s Pro List, we slashed supplier onboarding from 28 days to 9. Their verified data prevented a $220K quality risk.”

— Procurement Director, Fortune 500 Medical Device Firm (Q4 2025 Client Testimonial)

Your 2026 sourcing targets demand verified precision—not hope.

Act now to lock in Q1 production slots before peak season capacity fills.

SourcifyChina | Precision Sourcing Intelligence Since 2018

[email protected] | +86 159 5127 6160 (24/7 Sourcing Support)

Report ID: SCR-PRO-2026-Q1 | Data Source: SourcifyChina Verified Supplier Network

🧮 Landed Cost Calculator

Estimate your total import cost from China.