The global vertical milling machine market is experiencing robust growth, driven by increasing demand for precision machining across industries such as automotive, aerospace, and electronics. According to Grand View Research, the global CNC machine tool market—of which vertical milling machines are a critical component—was valued at USD 70.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 7.5% for the machine tools market during the forecast period 2023–2028, citing rising automation, Industry 4.0 adoption, and expanding manufacturing activities in Asia-Pacific as key growth catalysts. As demand for high-accuracy, efficient milling solutions intensifies, leading manufacturers are innovating to deliver advanced, reliable, and smart machining systems. In this competitive landscape, a select group of vertical milling machine manufacturers stand out for their technological expertise, global reach, and comprehensive product portfolios.

Top 10 Vertical Milling Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Vertical Milling Machines

Domain Est. 1996

Website: haascnc.com

Key Highlights: Get a quick look at the complete vertical mill lineup Haas has to offer. Our vertical mills provide high performance machining for a magnitude of applications….

#2 Makino

Domain Est. 1996

Website: makino.com

Key Highlights: Achieve superior results with Makino’s CNC machining. Makino machines and engineering services provide precision and reliability across applications….

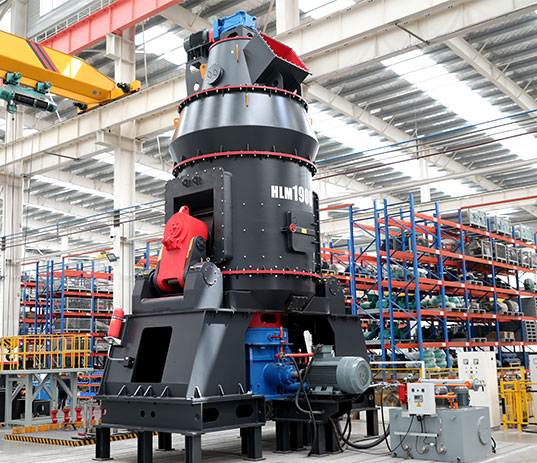

#3 Vertical Mills

Domain Est. 2001

#4 Sherline Vertical Milling Machines

Domain Est. 1995

Website: sherline.com

Key Highlights: Sherline vertical mini milling machines are made in the USA and feature either precision-rolled ball screws or leadscrews….

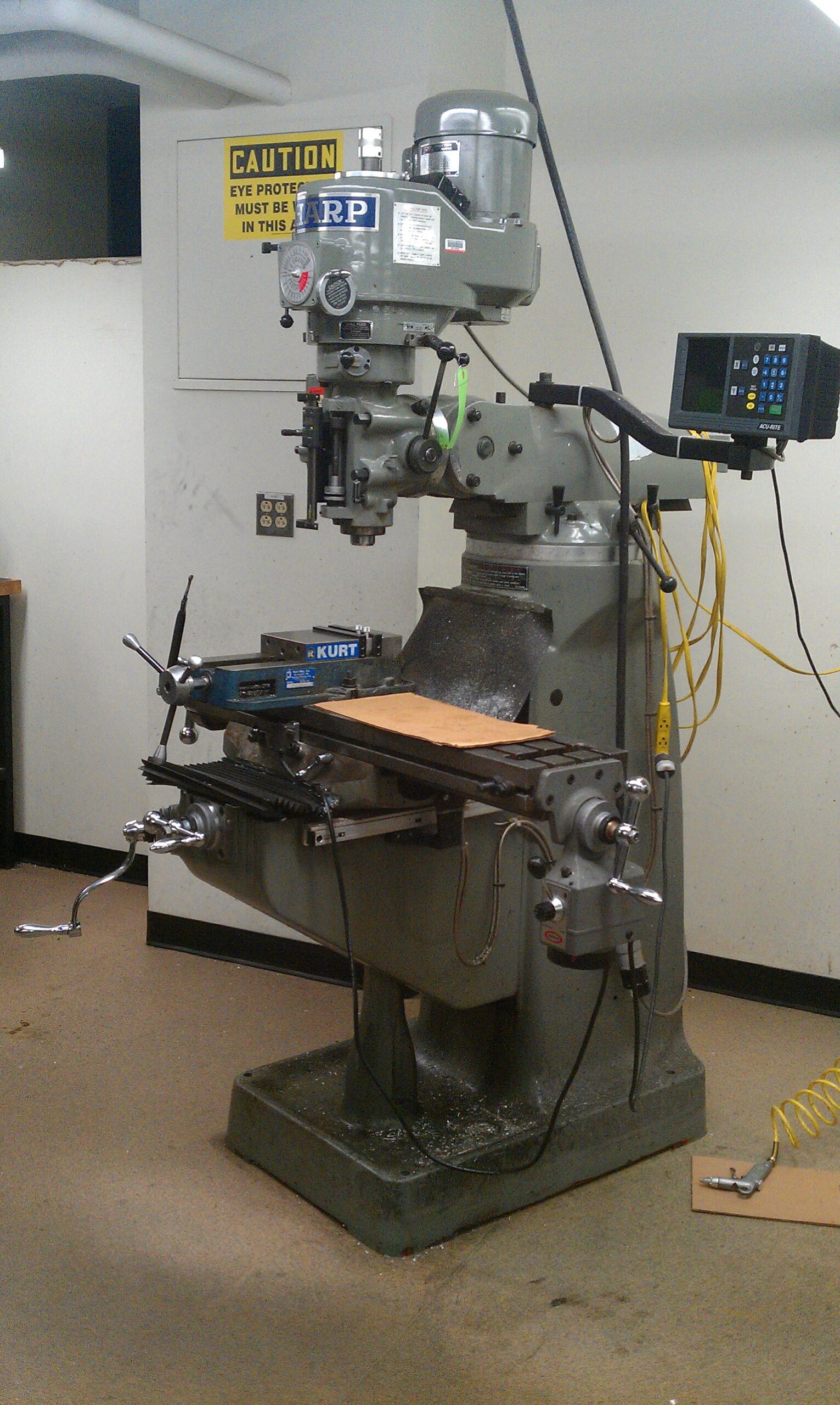

#5 Milling Machines

Domain Est. 1996

Website: summitmt.com

Key Highlights: Summit Machine Tool is one of the metalworking industry’s largest providers of vertical mills and horizontal mills, milling machines, vertical knee mills ……

#6 to Mazak Corporation

Domain Est. 1998

Website: mazak.com

Key Highlights: Mazak provides products and solutions that can support a wide range of parts machining processes, such as high-speed and high-accuracy machines, various ……

#7 High rail vertical mills, gantries and profilers for precision machining

Domain Est. 2007

Website: fivesgroup.com

Key Highlights: Versatile, adaptive vertical milling solutions for large and complex material removal applications: milling, drilling, turning, contouring and more….

#8 Amera

Domain Est. 2011

Website: ameraseikicnc.com

Key Highlights: Amera-Seiki has decades of experience building a large variety of CNC machines. No matter your need, we have the machine….

#9 Vertical Milling

Domain Est. 2013

Website: us.dmgmori.com

Key Highlights: Overview of all Vertical CNC Milling Machines and Vertical CNC Milling Centers by DMG MORI….

#10 Vertical Milling

Domain Est. 2013

Website: wells-index.com

Key Highlights: Wells-Index builds a quality line of knee-type milling machines. With over 80 years of experience behind us, we can assure you that every mill we build is the ……

Expert Sourcing Insights for Vertical Milling

H2: 2026 Market Trends in Vertical Milling

By 2026, the vertical milling market is poised for significant transformation driven by technological innovation, evolving industry demands, and global economic shifts. Key trends shaping the sector include:

1. Accelerated Adoption of Smart Manufacturing and Industry 4.0 Integration

Vertical milling centers are increasingly embedded with IoT sensors, AI-driven predictive maintenance, and real-time data analytics. By 2026, seamless integration with digital twins and centralized manufacturing execution systems (MES) will become standard, enabling higher precision, reduced downtime, and adaptive machining processes. Machine learning algorithms will optimize tool paths and spindle speeds dynamically, boosting efficiency and part consistency.

2. Rise of Multi-Tasking and Hybrid Vertical Machining Centers (VMCs)

Demand for reduced setup times and increased throughput is driving the adoption of multi-axis vertical mills with turning, grinding, or additive capabilities. Hybrid VMCs capable of both subtractive and additive manufacturing will gain traction, particularly in aerospace and medical device sectors, where complex geometries and high material utilization are critical.

3. Focus on Sustainability and Energy Efficiency

Environmental regulations and corporate ESG goals will push manufacturers toward energy-efficient spindles, regenerative braking systems, and coolant recovery technologies. By 2026, eco-conscious design—including recyclable components and reduced fluid consumption—will be a competitive differentiator. Green manufacturing initiatives will influence procurement decisions across the supply chain.

4. Growth in Automation and Lights-Out Machining

Labor shortages and the need for 24/7 production will accelerate integration with robotics and automated pallet changers. Vertical mills equipped for unattended operation—especially in high-mix, low-volume environments—will see increased adoption. Compact, flexible automation cells designed for small to mid-sized job shops will expand market accessibility.

5. Expansion in High-Performance Materials Processing

As industries like aerospace, EVs, and renewable energy adopt advanced composites, titanium alloys, and high-strength steels, vertical mills will require enhanced rigidity, thermal stability, and high-speed spindles. Tooling innovations, including diamond-coated and ceramic inserts, will complement machine upgrades to maintain precision in challenging materials.

6. Regional Market Shifts and Supply Chain Localization

Geopolitical factors and supply chain resilience concerns will drive regionalization of manufacturing. North America and Europe will invest in domestic vertical milling capacity, while Asia-Pacific—led by China and India—will remain a dominant production and consumption hub. Nearshoring trends will support demand for advanced, flexible VMCs adaptable to localized production needs.

7. Software-Centric Machine Control and Cloud Connectivity

CNC platforms will evolve beyond basic control to include cloud-based monitoring, remote diagnostics, and over-the-air updates. Open-architecture software will enable easier integration with CAD/CAM systems, reducing programming time and enhancing interoperability across diverse equipment fleets.

In conclusion, by 2026, the vertical milling market will be defined by intelligent, connected, and adaptable systems focused on maximizing productivity, sustainability, and flexibility. Manufacturers embracing digitalization, automation, and advanced materials will lead the next phase of growth in precision machining.

Common Pitfalls Sourcing Vertical Milling (Quality, IP)

When sourcing vertical milling services or equipment, businesses often encounter critical challenges related to quality assurance and intellectual property (IP) protection. Overlooking these areas can result in defective parts, production delays, legal disputes, and compromised competitive advantage. Below are key pitfalls to avoid:

Poor Quality Control Processes

One of the most frequent issues is partnering with suppliers who lack robust quality management systems. Inconsistent machining tolerances, surface finish defects, or dimensional inaccuracies can arise when vendors do not adhere to standardized inspection protocols (e.g., ISO 9001) or fail to provide comprehensive inspection reports (CMM, first-article inspections). Without clear quality benchmarks and regular audits, the risk of receiving substandard components increases significantly.

Inadequate Documentation and Traceability

Suppliers may provide insufficient documentation for materials, tooling, or process parameters, making it difficult to trace deviations or replicate successful production runs. Missing lot numbers, heat treatments, or machine calibration records can undermine quality assurance and complicate root cause analysis during failure investigations.

Weak Intellectual Property Agreements

Many sourcing engagements fail to establish clear contractual safeguards for IP. Without properly drafted non-disclosure agreements (NDAs) and work-for-hire clauses, companies risk unauthorized use, replication, or disclosure of proprietary designs, toolpaths, or manufacturing know-how. This is especially critical when sharing CAD/CAM files or custom fixtures.

Unsecured Digital Files and CAM Data

Transferring sensitive design and toolpath data to third-party mills without encryption or access controls exposes IP to theft or misuse. Suppliers using outdated or unsecured networks may inadvertently leak critical information, and some may retain copies of files beyond the scope of the project, creating long-term vulnerabilities.

Lack of Supplier Vetting and On-Site Audits

Relying solely on certifications or marketing materials without conducting on-site assessments can lead to overestimating a supplier’s capabilities. Hidden issues such as outdated equipment, untrained operators, or poor maintenance practices may only surface after production begins, impacting both quality and delivery timelines.

Assumption of Industry Standard Compliance

Assuming that all vertical milling providers follow best practices in precision machining—such as proper tooling strategies, coolant management, or thermal compensation—can result in unexpected quality variances. Suppliers may cut corners to reduce costs, especially under tight margins, leading to premature tool wear or part deformation.

Insufficient Change Management Protocols

When design or process changes occur, unclear communication or undocumented revisions can lead to the production of obsolete or non-conforming parts. Without a formal engineering change order (ECO) process tied to the supplier, quality consistency and IP integrity are at risk.

Avoiding these pitfalls requires thorough due diligence, strong contractual protections, continuous monitoring, and clear communication throughout the sourcing lifecycle.

Logistics & Compliance Guide for Vertical Milling

Overview of Vertical Milling Operations

Vertical milling involves machining processes using vertically oriented cutting tools to shape metal or other materials. Proper logistics and compliance are critical to ensure operational efficiency, worker safety, and adherence to regulatory standards across manufacturing environments.

Equipment Transportation and Handling

Ensure milling machines are transported using appropriate lifting and rigging equipment, such as forklifts or overhead cranes with sufficient load capacity. Secure machines during transit to prevent damage. Follow manufacturer guidelines for disassembly, packaging, and reassembly. Use protective covers and padding to safeguard precision components.

Facility Requirements and Installation Logistics

Vertical milling machines require a stable, level foundation with adequate floor loading capacity. Ensure sufficient clearance for operation, maintenance access, and chip removal systems. Coordinate utilities including three-phase power, coolant supply, compressed air, and exhaust ventilation before installation. Conduct site surveys to confirm spatial and infrastructure compatibility.

Regulatory Compliance Standards

Adhere to relevant safety and environmental regulations, including OSHA (Occupational Safety and Health Administration) standards in the U.S., or equivalent local regulations such as the EU Machinery Directive. Ensure all equipment carries appropriate CE, UL, or other required certifications. Maintain documentation for machine conformity and safety inspections.

Operator Training and Safety Protocols

Only trained and authorized personnel should operate vertical milling machines. Provide comprehensive training on machine functions, emergency stops, lockout/tagout (LOTO) procedures, and personal protective equipment (PPE) requirements. Implement routine safety drills and maintain up-to-date training records to comply with workplace safety regulations.

Environmental and Waste Management

Manage metal shavings, coolant, and lubricants according to environmental regulations. Use chip conveyors and coolant filtration systems to minimize waste. Recycle metal scrap through certified vendors and dispose of contaminated fluids as hazardous waste where applicable. Maintain Material Safety Data Sheets (MSDS/SDS) for all consumables.

Maintenance and Documentation Compliance

Follow the manufacturer’s preventive maintenance schedule to ensure machine reliability and safety. Keep detailed logs of inspections, repairs, and component replacements. Retain calibration records for precision tools and measuring instruments to support quality assurance and audit readiness.

Supply Chain and Spare Parts Management

Establish reliable suppliers for cutting tools, fixtures, and replacement parts. Maintain an inventory of critical spares to minimize downtime. Verify compliance of procured components with ISO or other industry standards, particularly for safety-critical parts.

International Shipping and Customs Considerations

For cross-border transport of milling equipment, comply with export controls, including EAR (Export Administration Regulations) or ITAR if applicable. Prepare accurate commercial invoices, packing lists, and certificates of origin. Use proper HS codes to classify machinery and avoid customs delays.

Continuous Improvement and Audit Preparedness

Conduct regular internal audits of logistics workflows and compliance practices. Use findings to refine safety protocols, maintenance schedules, and documentation systems. Stay informed about updates to industry standards and regulatory requirements affecting vertical milling operations.

Conclusion for Sourcing Vertical Milling:

Sourcing vertical milling capabilities—whether through in-house investment or external suppliers—is a strategic decision that directly impacts manufacturing efficiency, product quality, and overall production costs. Vertical milling machines offer precision, versatility, and cost-effectiveness for a wide range of machining applications, particularly for molds, dies, tooling, and complex part geometries. When sourcing externally, it is essential to evaluate suppliers based on technical expertise, equipment capabilities, quality control processes, lead times, and cost competitiveness. Establishing strong partnerships with reliable milling service providers ensures consistent part quality and supports scalability. Ultimately, a well-informed sourcing strategy for vertical milling enhances operational agility, supports innovation, and strengthens the supply chain in precision manufacturing environments.