The global industrial cleaning solutions market is experiencing robust growth, driven by increasing demand for high-performance solvents across automotive, manufacturing, and oil & gas sectors. According to a report by Mordor Intelligence, the industrial cleaning chemicals market was valued at USD 14.8 billion in 2023 and is projected to grow at a CAGR of over 4.5% through 2029. A key segment within this space is varsol (or mineral spirit) cleaners—widely used for degreasing, surface preparation, and maintenance due to their effectiveness and relatively low volatility. With stringent environmental regulations and shifting preferences toward eco-friendly formulations, manufacturers are investing in cleaner, more sustainable varsol-based products. As competition intensifies, seven key players have emerged as leaders, combining innovation, global reach, and consistent product quality to capture significant market share. These top varsol cleaner manufacturers are shaping industry standards and meeting the rising demand for reliable, efficient, and compliant cleaning solutions across critical industrial applications.

Top 7 Varsol Cleaner Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Varsol™ paint thinner

Domain Est. 1995

Website: recochem.com

Key Highlights: Varsol paint thinner is a pure, high quality professional grade cleaner, degreaser and paint thinner formulated to the most exacting standards for the toughest ……

#2 RCM53-375

Domain Est. 1996

#3 [PDF] Varsol™ 30

Domain Est. 1999

Website: exxonmobilchemical.com

Key Highlights: The terms “we,” “our,” “ExxonMobil Product Solutions” and “ExxonMobil” are each used for convenience, and may include any one or more of. ExxonMobil Product ……

#4 Varsol

Domain Est. 1999

Website: maratek.com

Key Highlights: Varsol is a petroleum distillate that contains mineral spirits. It is often used to thin all oil-based paints and clean almost anything that paint can get on….

#5 Varsol by Recochem Supplier in Ontario

Domain Est. 2009

Website: inventoryexpress.ca

Key Highlights: It is a petroleum distillate that contains mineral spirits to remove greases, thins out paints and varnishes as well as polyurethanes. It is considered safe to ……

#6 Varsol Solvent

Domain Est. 2011

Website: laballey.com

Key Highlights: In stock Rating 5.0 (2) Jan 15, 2025 · Varsol Solvent is a petroleum distillate but it is quite different from petroleum products such as kerosene and gasoline….

#7 Varsol 60

Domain Est. 2018

Website: univarsolutions.co.uk

Key Highlights: In stockVarsol 30 is an aliphatic hydrocarbon solvent that is combustible liquid and has a relatively high vapor pressure….

Expert Sourcing Insights for Varsol Cleaner

H2: Market Trends for Varsol Cleaner in 2026

As we approach 2026, the market for Varsol Cleaner—a petroleum-based solvent widely used in industrial cleaning, paint thinning, and degreasing applications—is undergoing significant transformation driven by regulatory changes, technological advancements, sustainability demands, and shifting industrial practices. Below are the key trends shaping the Varsol Cleaner market in 2026:

1. Regulatory Pressure and Environmental Compliance

Increasing global focus on environmental protection and worker safety is tightening regulations around volatile organic compounds (VOCs), of which Varsol (also known as mineral spirits or white spirit) is a significant source. By 2026, regions like the European Union, North America, and parts of Asia-Pacific are enforcing stricter VOC emission standards under directives such as REACH and EPA guidelines. This is compelling industries to reduce or replace traditional Varsol-based cleaners with low-VOC or VOC-exempt alternatives, impacting demand.

2. Shift Toward Bio-Based and Sustainable Solvents

A major trend in 2026 is the growing adoption of bio-based and biodegradable cleaning solvents. Manufacturers and end-users are increasingly opting for plant-derived solvents or water-based formulations that offer comparable cleaning performance with reduced environmental impact. This shift is driven by corporate sustainability goals, ESG (Environmental, Social, and Governance) reporting, and consumer pressure. As a result, traditional Varsol usage is expected to decline in environmentally sensitive sectors such as automotive refinishing and precision manufacturing.

3. Innovation in Formulated Alternatives

Leading chemical companies are investing in R&D to develop high-performance Varsol substitutes that maintain efficacy while meeting regulatory standards. In 2026, hybrid solvents combining modified hydrocarbons with additives for enhanced cleaning and lower toxicity are gaining market share. These products aim to bridge the gap between cost, performance, and compliance, slowing the decline of petroleum-based solvent use in niche industrial applications where alternatives are not yet viable.

4. Regional Market Divergence

Market dynamics for Varsol Cleaner vary significantly by region. In developed economies (e.g., U.S., Germany, Japan), demand is stagnating or declining due to stringent regulations and advanced substitution technologies. In contrast, emerging markets in Southeast Asia, Africa, and parts of Latin America continue to show steady demand, driven by expanding manufacturing, infrastructure development, and less rigorous enforcement of environmental norms. This creates a bifurcated global market.

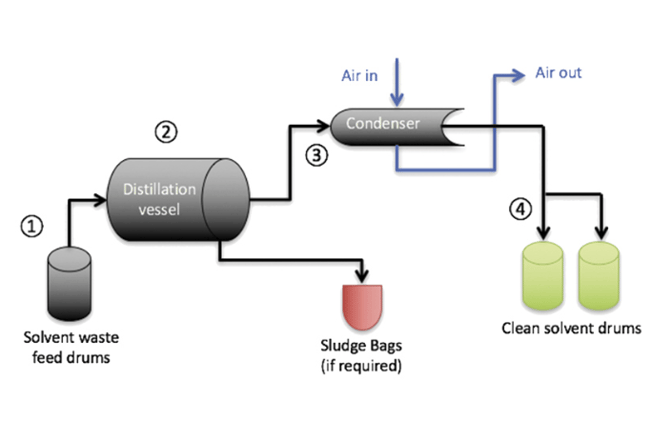

5. Industrial Automation and Closed-Loop Cleaning Systems

The rise of automated industrial processes and closed-loop solvent recovery systems in 2026 is reducing overall solvent consumption. These systems recycle Varsol more efficiently, minimizing waste and emissions. While this extends the lifecycle of existing Varsol stocks, it also reduces the volume of new solvent required, leading to a net decline in market growth.

6. Price Volatility and Feedstock Dependency

Varsol is derived from crude oil refining, making it susceptible to fluctuations in oil prices. In 2026, geopolitical instability and energy transition policies are causing volatility in feedstock costs, prompting industries to seek more stable, long-term alternatives. This economic uncertainty is accelerating the transition away from petroleum-based solvents in cost-sensitive operations.

Conclusion

By 2026, the Varsol Cleaner market is in a phase of strategic decline in high-regulation regions, countered by sustained demand in developing economies. The future lies in innovation—either through improved, compliant formulations of hydrocarbon solvents or through full substitution with green alternatives. Companies that adapt by offering eco-friendly variants, solvent recycling solutions, or hybrid technologies will be best positioned to retain market relevance in the evolving industrial cleaning landscape.

Common Pitfalls When Sourcing Varsol Cleaner (Quality, IP)

Sourcing Varsol cleaner—especially with attention to quality and intellectual property (IP) considerations—can present several hidden challenges. Being aware of these pitfalls helps ensure you receive a safe, effective, and legally compliant product.

1. Confusing Varsol with Generic Mineral Spirits

One of the most common issues is treating “Varsol” as a generic term. Varsol is a trademarked brand name (originally by ExxonMobil) for a specific formulation of aliphatic hydrocarbon solvent. Many suppliers offer “Varsol-type” or “Varsol equivalent” cleaners, but these may differ in purity, flash point, aromatic content, and performance. Using an off-spec substitute can affect cleaning efficacy or pose safety risks due to inconsistent volatility or residue.

Tip: Always request technical data sheets (TDS) and safety data sheets (SDS) to verify solvent composition, flash point, and evaporation rate. Confirm whether the product is genuine branded Varsol or a generic alternative.

2. Inconsistent Product Quality from Unverified Suppliers

Low-cost suppliers—especially in international markets—may offer products labeled as “Varsol” that contain impurities, higher aromatic content, or water contamination. These inconsistencies can lead to poor cleaning performance, surface damage, or increased health hazards due to toxic byproducts.

Tip: Audit your supplier’s quality control processes. Look for ISO certifications and request batch-specific test reports to confirm purity and consistency.

3. Intellectual Property (IP) and Trademark Violations

Using or sourcing a product that falsely claims to be branded Varsol (e.g., packaging resembling ExxonMobil’s branding) can expose your company to IP infringement risks. Even marketing a generic solvent as “Varsol” without proper disclaimers may lead to legal challenges.

Tip: Ensure suppliers do not misrepresent generic solvents as trademarked products. Use accurate labeling such as “mineral spirits” or “aliphatic solvent—Varsol equivalent” to avoid trademark violations.

4. Lack of Regulatory Compliance Documentation

Varsol cleaners must comply with regional regulations (e.g., REACH in the EU, TSCA in the U.S., OSHA hazard communication standards). Sourcing from suppliers who fail to provide complete SDS, ingredient disclosure, or compliance certificates can result in regulatory penalties or workplace safety issues.

Tip: Verify that documentation meets local regulatory requirements. Ensure aromatic hydrocarbon content (e.g., benzene levels) is within legal limits.

5. Inadequate Packaging and Contamination Risks

Poor packaging—such as reused or non-sealed containers—can introduce moisture, debris, or cross-contamination, degrading solvent quality. This is especially critical in precision cleaning applications.

Tip: Specify packaging standards in procurement contracts (e.g., new HDPE containers with tamper-evident seals) and inspect incoming shipments.

6. Supply Chain Transparency and Origin Misrepresentation

Some suppliers may obscure the actual origin of the solvent, making it difficult to assess quality or ethical sourcing. This lack of transparency increases the risk of receiving substandard or non-compliant products.

Tip: Require full supply chain disclosure and consider third-party testing for critical applications.

By proactively addressing these pitfalls—focusing on verification, compliance, and clear communication—you can source Varsol cleaner effectively while safeguarding quality and avoiding legal exposure.

H2: Logistics & Compliance Guide for Varsol Cleaner

1. Product Overview

Varsol Cleaner is a petroleum-based solvent commonly used for degreasing, cleaning machinery, and removing oil, grease, and tar from industrial surfaces. It typically consists of aliphatic and/or aromatic hydrocarbons and is classified as a hazardous material due to its flammability and potential health hazards.

2. Regulatory Classification

Varsol Cleaner is subject to various national and international regulations due to its hazardous nature. Key classifications include:

- GHS Classification (Globally Harmonized System):

- Flammable Liquid, Category 2 or 3

- Skin Irritation, Category 2

- Specific Target Organ Toxicity (Single Exposure), Category 3 (CNS effects)

-

Hazardous to the Aquatic Environment, Category 2

-

UN Number: UN 1268

- Proper Shipping Name: Petroleum spirits, n.o.s. (Varsol type)

- Hazard Class: 3 (Flammable Liquids)

- Packing Group: II (Medium hazard)

3. Safety Data Sheet (SDS) Requirements

A current Safety Data Sheet (SDS) compliant with local regulations (e.g., OSHA HazCom in the U.S., CLP in the EU, WHMIS in Canada) must accompany all shipments. The SDS must include:

– Product identification

– Hazard identification

– Composition/information on ingredients

– First-aid measures

– Fire-fighting measures

– Accidental release measures

– Handling and storage instructions

– Exposure controls/personal protection

– Physical and chemical properties

– Stability and reactivity

– Toxicological and ecological information

– Disposal considerations

– Transport information

– Regulatory information

– Other information (including SDS revision date)

4. Packaging & Labeling

– Packaging: Must be UN-certified, leak-proof, and compatible with flammable liquids (e.g., steel or plastic drums, jerricans).

– Labeling: Outer packaging must display:

– Proper shipping name and UN number (UN 1268)

– Class 3 Flammable Liquid hazard label

– GHS pictograms (flame, exclamation mark, health hazard)

– Precautionary and hazard statements

– Supplier contact information

5. Transportation Requirements

– Domestic (e.g., U.S. DOT):

– Complies with 49 CFR regulations for flammable liquids.

– Requires placarding for bulk shipments (>1,001 lbs aggregate gross weight).

– Transport documents must include proper shipping name, UN number, hazard class, and packaging group.

- International (IMDG, IATA, ADR):

- IMDG (Sea): Class 3, PG II; permitted in limited quantities under specific provisions.

- IATA (Air): Generally prohibited on passenger aircraft; may be shipped on cargo aircraft with restrictions (e.g., limited quantities, special packaging).

- ADR (Road in Europe): Requires driver training (ADR certification), vehicle placards, and transport documentation.

6. Storage Guidelines

– Store in a cool, well-ventilated area away from ignition sources.

– Use approved flammable liquid storage cabinets for quantities over 25 gallons (U.S.).

– Keep containers tightly closed when not in use.

– Segregate from oxidizers and strong acids.

– Implement secondary containment to prevent environmental contamination.

7. Handling & Worker Protection

– Use in well-ventilated areas or with local exhaust ventilation.

– Wear appropriate PPE: chemical-resistant gloves, safety goggles, flame-resistant clothing, and respiratory protection if vapor levels exceed exposure limits.

– Avoid prolonged or repeated skin contact.

– Prohibit eating, drinking, or smoking in handling areas.

8. Spill Response & Emergency Procedures

– Spill Response:

– Evacuate non-essential personnel.

– Eliminate ignition sources.

– Contain spill with absorbent materials (e.g., vermiculite, sand).

– Collect and dispose of waste as hazardous material.

– Ventilate the area.

- Fire Response:

- Use dry chemical, CO₂, or foam extinguishers.

-

Water may be ineffective; use to cool exposed containers.

-

First Aid:

- Inhalation: Move to fresh air; seek medical attention if symptoms persist.

- Skin contact: Wash with soap and water; remove contaminated clothing.

- Eye contact: Flush with water for at least 15 minutes.

- Ingestion: Do NOT induce vomiting; seek immediate medical help.

9. Environmental & Disposal Compliance

– Do not release into sewers, waterways, or soil.

– Dispose of waste and contaminated packaging in accordance with local, state, and federal regulations (e.g., RCRA in the U.S.).

– Use licensed hazardous waste disposal contractors.

– Recycling or solvent recovery is encouraged where feasible.

10. Training & Documentation

– Personnel involved in handling, storage, or transport must be trained in:

– Hazard communication (GHS/SDS)

– Spill response

– Fire safety

– Emergency procedures

– Applicable transportation regulations (e.g., DOT HazMat, ADR)

- Maintain records of training, SDS access, inspections, and incident reports.

11. Regulatory Compliance by Region

– United States: OSHA, EPA, DOT, NFPA 30

– European Union: REACH, CLP, ADR, Seveso III

– Canada: WHMIS 2015, TDG, CEPA

– Australia: WHS Regulations, ADG Code

Ensure all operations comply with local environmental, health, and safety laws.

12. Conclusion

Safe and compliant logistics for Varsol Cleaner require strict adherence to hazardous material regulations, proper training, and robust emergency preparedness. Regular audits and updates to SDS and procedures ensure ongoing compliance and worker/environmental protection.

Always consult the latest SDS and regulatory authorities before transport or use.

Conclusion for Sourcing Varsol Cleaner:

After a thorough evaluation of suppliers, product specifications, pricing, availability, and regulatory compliance, sourcing Varsol cleaner requires a strategic approach to ensure quality, safety, and cost-effectiveness. It is essential to select reputable suppliers that provide consistent product quality, comply with health, safety, and environmental standards (such as SDS and VOC regulations), and offer reliable delivery timelines. Additionally, bulk purchasing agreements or long-term contracts may help reduce costs and ensure supply continuity. Considering alternatives or potential substitutions should also be part of the sourcing strategy in light of environmental concerns or regulatory changes. Ultimately, a balanced decision that considers performance, safety, sustainability, and total cost of ownership will support efficient and responsible operations.

![[PDF] Varsol™ 30](https://www.fobsourcify.com/wp-content/uploads/2026/01/pdf-varsol-30-171.png)