The global small engine parts market, which includes critical components for Vanguard engines widely used in lawn and garden equipment, construction machinery, and power generation, is experiencing steady expansion. According to a 2023 report by Mordor Intelligence, the global small engine market was valued at approximately USD 13.5 billion and is projected to grow at a CAGR of 4.8% from 2023 to 2028, driven by rising demand for reliable outdoor power equipment and increased infrastructure development. Similarly, Grand View Research estimates that the broader engine component market will maintain strong momentum, supported by advancements in engine efficiency and durability. As original equipment manufacturers and aftermarket suppliers continue to innovate, a select group of Vanguard engine parts manufacturers have emerged as leaders in quality, performance, and technological integration. These top four manufacturers distinguish themselves through rigorous engineering standards, global distribution networks, and strategic partnerships with equipment builders—making them pivotal players in a growing, data-backed industry landscape.

Top 4 Vanguard Engine Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

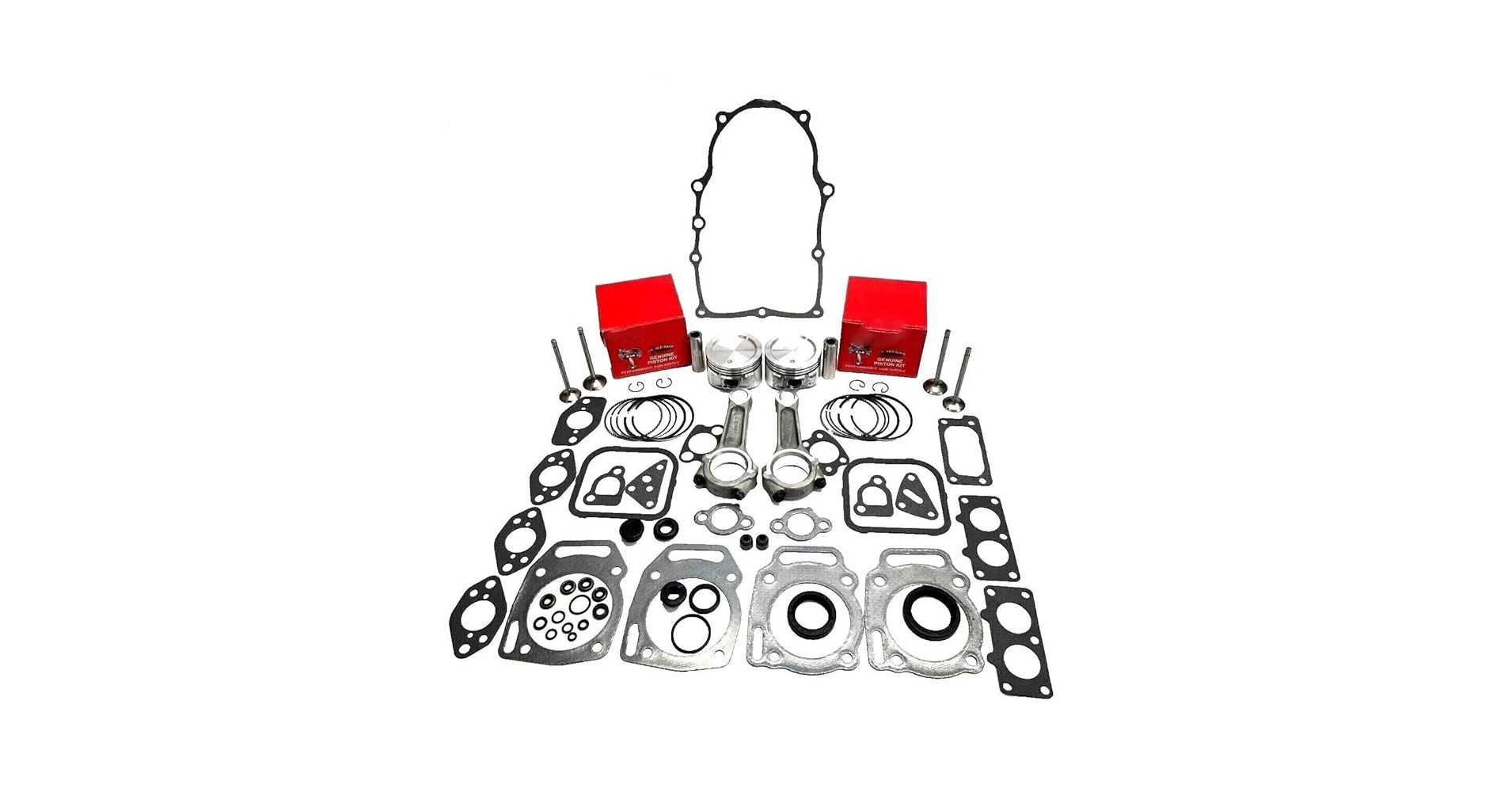

#1 Briggs & Stratton Model Vanguard Genuine Parts

Domain Est. 2015

Website: briggsstrattonstore.com

Key Highlights: 3–5 day delivery 30-day returnsShop Authentic Model Vanguard OEM Parts for Superior Engine Care · Trusted Quality: Genuine OEM parts manufactured to Briggs & Stratton’s exact speci…

#2 VO

Domain Est. 1995

Website: investor.vanguard.com

Key Highlights: Vanguard Mid-Cap ETF (VO) – Find objective, share price, performance, expense ratio, holding, and risk details….

#3 Vanguard Commercial Power

Domain Est. 1996

Website: briggsandstratton.com

Key Highlights: Learn more about our Vanguard commercial engines or battery power solutions – designed to power your application in landscaping, construction, ……

#4 Vanguard® Power

Domain Est. 2001

Website: vanguardpower.com

Key Highlights: High-performance Vanguard® commercial engines and batteries are application-engineered to power equipment that works for a living….

Expert Sourcing Insights for Vanguard Engine Parts

2026 Market Trends for Vanguard Engine Parts

Industry Growth and Demand Drivers

The market for Vanguard engine parts is poised for steady growth through 2026, driven by increasing demand in commercial landscaping, agricultural machinery, and construction equipment. As urbanization expands globally and infrastructure projects accelerate—especially in emerging economies—the need for reliable, durable power equipment continues to rise. Vanguard’s reputation for robust, industrial-grade engines positions its parts segment to benefit from long equipment lifecycles and the necessity for routine maintenance and replacement components.

Shift Toward Fuel Efficiency and Emissions Compliance

Regulatory pressure to reduce emissions and improve fuel efficiency will shape engine design and component demand. By 2026, Tier 5 and equivalent emissions standards in key markets like North America and Europe will necessitate the adoption of cleaner engine technologies. While Vanguard engines already meet current standards, the aftermarket will see increased demand for parts related to emissions control systems, such as advanced carburetors, fuel injection components, and exhaust systems. OEMs and service providers will prioritize parts that ensure compliance and optimal performance within these evolving regulations.

Expansion of E-Commerce and Aftermarket Channels

Digital transformation will continue to reshape how Vanguard engine parts are distributed and sold. By 2026, e-commerce platforms and online marketplaces will dominate aftermarket parts procurement, enabling faster delivery, broader reach, and enhanced customer service through data analytics and inventory tracking. Independent dealers and third-party suppliers leveraging digital tools will compete more effectively, emphasizing authentic parts, warranties, and technical support. Vanguard and its distribution network must invest in digital infrastructure to maintain market share and customer loyalty.

Rising Importance of Sustainability and Circular Economy

Environmental concerns will influence purchasing decisions in the industrial equipment sector. By 2026, there will be growing interest in remanufactured or recycled engine parts as a sustainable alternative to new components. Vanguard can capitalize on this trend by launching or expanding certified remanufactured parts programs, offering cost-effective and eco-friendly solutions. Emphasizing durability, repairability, and end-of-life recyclability in product design will strengthen brand positioning and support sustainability goals.

Technological Integration and Smart Diagnostics

While traditionally mechanical, industrial engines are gradually incorporating digital monitoring features. By 2026, increased integration of IoT-enabled sensors and diagnostic tools in equipment will create new opportunities for data-driven maintenance. This shift may spur demand for compatible engine parts designed to interface with smart systems, as well as software-supported service tools. Vanguard can differentiate its parts by ensuring backward compatibility and offering diagnostic support that enhances uptime and reduces repair costs for end users.

In summary, the 2026 market for Vanguard engine parts will be shaped by regulatory evolution, digital distribution, sustainability imperatives, and technological advancement. Strategic focus on compliance, e-commerce enablement, remanufacturing, and smart service integration will be key to maintaining competitive advantage in a dynamic global landscape.

Common Pitfalls When Sourcing Vanguard Engine Parts (Quality, IP)

Sourcing replacement or aftermarket parts for Vanguard engines—known for their use in industrial, commercial, and outdoor power equipment—can be fraught with challenges, especially concerning part quality and intellectual property (IP) concerns. Being aware of these pitfalls helps ensure reliability, compliance, and long-term equipment performance.

Substandard Quality and Performance Issues

One of the most prevalent risks when sourcing Vanguard engine parts is encountering substandard components that fail to meet original equipment manufacturer (OEM) specifications. Non-OEM or counterfeit parts may use inferior materials, leading to premature wear, reduced engine efficiency, or catastrophic failure. These parts often lack proper heat treatment, precise tolerances, or corrosion resistance, which are critical in high-stress engine environments. Using low-quality parts can void warranties and increase downtime due to frequent replacements.

Counterfeit and Misrepresented Components

The market for engine parts is susceptible to counterfeit products that mimic genuine Vanguard branding. These counterfeit parts may look identical but perform poorly under real-world conditions. They often bypass rigorous testing and certification standards, posing safety risks and reliability concerns. Buyers may unknowingly purchase fake parts from unverified suppliers, especially on online marketplaces or through third-party distributors without proper authorization.

Intellectual Property (IP) Infringement

Many aftermarket parts manufacturers produce components that closely replicate genuine Vanguard designs, potentially infringing on intellectual property rights such as design patents, trademarks, or trade dress. While some “compatible” parts are legally produced under fair-use doctrines, others cross legal boundaries by copying proprietary designs without licensing. Sourcing such parts—even unknowingly—can expose businesses to legal liability, especially in regulated industries or when supplying equipment to government or commercial clients with strict compliance requirements.

Lack of Traceability and Certification

Genuine Vanguard parts come with traceability, including batch numbers, compliance certifications (e.g., ISO standards), and documentation verifying authenticity and performance. Aftermarket or gray-market parts often lack this documentation, making it difficult to verify quality or support warranty claims. This absence of traceability also complicates compliance with industry regulations and safety audits.

Inconsistent Fit and Function

Even if a part appears compatible, dimensional inaccuracies or design differences in non-OEM components can result in improper fit, misalignment, or compromised engine performance. Issues such as incorrect thread sizes, mismatched mounting points, or suboptimal fuel delivery in carburetor replacements can lead to operational inefficiencies or damage to other engine components.

Voided Warranties and Service Denials

Using non-genuine or IP-infringing parts may void the engine’s warranty or disqualify the equipment from manufacturer-supported service programs. Engine manufacturers like Briggs & Stratton (which produces Vanguard engines) often require OEM parts for warranty validation. Sourcing from unauthorized channels increases the risk of future service denials or costly repairs not covered under warranty.

Supply Chain and Supplier Reliability

Unverified suppliers may offer attractive pricing but lack consistent inventory, quality control, or customer support. Delays, incorrect shipments, or inability to replace defective parts can disrupt operations. Relying on such suppliers introduces operational risk, especially for businesses dependent on continuous equipment uptime.

To avoid these pitfalls, always source Vanguard engine parts from authorized distributors, verify part authenticity through official channels, and prioritize certified suppliers with transparent sourcing and quality assurance practices.

Logistics & Compliance Guide for Vanguard Engine Parts

This guide outlines the essential logistics and compliance procedures for handling Vanguard engine parts, ensuring efficient operations and adherence to regulatory standards.

Shipping and Receiving Procedures

All inbound and outbound shipments of Vanguard engine parts must follow standardized protocols. Parts should be received with a verified packing slip and purchase order. Inspect shipments immediately upon arrival for damage or discrepancies and report any issues within 24 hours. Use approved packaging materials for outgoing shipments to prevent transit damage, and ensure all packages are clearly labeled with part numbers, serial numbers (if applicable), shipping addresses, and handling instructions.

Inventory Management

Maintain accurate inventory records using a barcode or RFID tracking system. Conduct regular cycle counts to ensure inventory accuracy and reconcile discrepancies promptly. Store parts in designated, climate-controlled areas to prevent corrosion or degradation. High-value or sensitive components should be secured in restricted-access zones with audit trails.

Transportation and Carrier Requirements

Shipments must use carriers compliant with Department of Transportation (DOT) regulations and experienced in handling automotive and engine components. For international shipments, ensure carriers are authorized under applicable customs frameworks (e.g., C-TPAT for U.S. imports). Temperature-sensitive or hazardous materials (e.g., lubricants, adhesives) must be transported in accordance with IATA, IMDG, or 49 CFR regulations as applicable.

Customs and International Compliance

For cross-border shipments, ensure all export documentation—including commercial invoices, packing lists, and certificates of origin—is complete and accurate. Classify parts using the correct Harmonized System (HS) codes and comply with export control regulations such as the Export Administration Regulations (EAR). Obtain necessary import permits or licenses when required by destination country laws. Retain all customs documentation for a minimum of five years.

Quality and Regulatory Standards

All Vanguard engine parts must meet ISO 9001 quality management standards and relevant OEM specifications. Non-conforming parts must be quarantined and reported through the Corrective Action Preventive Action (CAPA) system. Maintain traceability from supplier to end customer through batch/lot tracking. Comply with environmental regulations such as REACH (EU) and RoHS for restricted substances in materials.

Safety and Handling Compliance

Train staff in proper handling, storage, and emergency response procedures. Provide Material Safety Data Sheets (MSDS/SDS) for all chemical or hazardous components. Use appropriate personal protective equipment (PPE) when handling heavy or sharp parts. Ensure facilities comply with OSHA standards for workplace safety, including proper signage, fire suppression systems, and spill containment.

Recordkeeping and Audits

Maintain comprehensive records of shipments, inventory transactions, compliance certifications, and training logs. These records must be accessible for internal audits and regulatory inspections. Conduct annual compliance audits to verify adherence to logistics protocols and regulatory requirements. Address audit findings with documented corrective actions.

Environmental Responsibility

Dispose of packaging waste and non-reusable parts in accordance with local, state, and federal environmental regulations. Partner with certified recyclers for metal, plastic, and hazardous waste streams. Minimize carbon footprint by optimizing shipping routes and consolidating loads where possible.

By following this guide, all stakeholders involved in the logistics of Vanguard engine parts will ensure reliable operations, regulatory compliance, and sustained customer satisfaction.

Conclusion for Sourcing Vanguard Engine Parts

In summary, sourcing Vanguard engine parts requires a strategic approach that balances authenticity, reliability, cost, and availability. Original Equipment Manufacturer (OEM) parts from authorized distributors or Briggs & Stratton (the manufacturer of Vanguard engines) ensure optimal performance, longevity, and warranty compliance, making them the preferred choice for critical repairs and professional applications. However, high-quality aftermarket alternatives can offer a cost-effective solution for less intensive uses, provided they meet industry standards and are sourced from reputable suppliers.

Key considerations in the sourcing process include verifying part compatibility, evaluating supplier credibility, maintaining proper documentation for traceability, and factoring in lead times and warranty support. Establishing relationships with trusted vendors, utilizing online platforms with verified reviews, and consulting equipment manuals or technical support can further streamline procurement.

Ultimately, a well-informed sourcing strategy ensures minimal downtime, reduces long-term maintenance costs, and supports the efficient operation of equipment powered by Vanguard engines. Prioritizing quality and reliability over upfront savings will yield better performance and greater operational efficiency in the long run.