The global industrial valves market is experiencing robust growth, driven by increasing demand across oil & gas, chemical processing, water treatment, and power generation sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 75.2 billion in 2022 and is projected to reach USD 108.2 billion by 2028, growing at a CAGR of 6.3% during the forecast period. This expansion is fueled by rising infrastructure investments, stringent safety regulations, and the growing emphasis on energy efficiency—factors that underscore the importance of precision engineering and reliable component documentation. In this context, valves diagram manufacturers play a critical role by providing detailed technical schematics that support design, maintenance, and troubleshooting across complex industrial systems. As demand for transparency and operational clarity increases, leading manufacturers are leveraging digital tools and standardized documentation to enhance interoperability and compliance. Below are the top 9 valves diagram manufacturers at the forefront of innovation, accuracy, and industry integration.

Top 9 Valves Diagram Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Pinch Valves & Check Valves

Domain Est. 1995

Website: redvalve.com

Key Highlights: Red Valve is the largest manufacturer and supplier of pinch and check valves, and is the preferred supplier for municipalities and industrial plants worldwide….

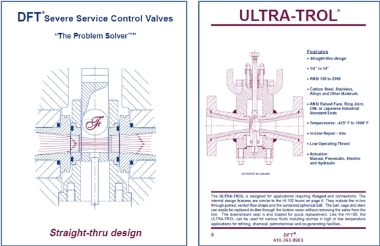

#2 DFT® Valves

Domain Est. 1999 | Founded: 1943

Website: dft-valves.com

Key Highlights: Since 1943 DFT® Inc. has manufactured world class, problem solving, in-line, axial flow, nozzle style silent check valves and severe service control valves….

#3 Valves and Actuation

Domain Est. 1987

Website: slb.com

Key Highlights: SLB provides valves, actuators, gears, and expert services to meet the diverse and demanding requirements of industrial and energy ……

#4 VERSA – Valve Manufacturer

Domain Est. 1996

Website: versa-valves.com

Key Highlights: VERSA Products is a manufacturer of valves, controls and accessories engineered to outperform and outlast all others. Explore our flexible product lines….

#5 Industrial Valves Products

Domain Est. 1997

Website: flowserve.com

Key Highlights: Flowserve offers one of the most comprehensive lines of valves in the industry. Our valves can be custom engineered to perform specific ……

#6 Humphrey Products

Domain Est. 2000

Website: humphrey-products.com

Key Highlights: Specializing in the design and manufacture of pneumatic and fluid control valves, valve systems and customized products for industry….

#7 Valves

Domain Est. 1995

Website: ph.parker.com

Key Highlights: … Valves, Fittings, and Tubing Compiled Catalog – WEB VERSION”,”document-type”:”Static File”,”document-url”:”https://www.parker.com/content/dam/Parker-com ……

#8 Leonard Valve Company

Domain Est. 1996

Website: leonardvalve.com

Key Highlights: We have focused exclusively on designing and manufacturing the highest quality water temperature control valves in America….

#9 Magnatrol

Domain Est. 1996

Website: magnatrol.com

Key Highlights: For more than 75 years, Magnatrol has been manufacturing solenoid valves for process control covering a wide range of air and liquid handling applications….

Expert Sourcing Insights for Valves Diagram

2026 Market Trends for Valve Diagrams

Rising Demand for Smart Valve Integration

By 2026, the global valve diagrams market is expected to evolve significantly due to the increasing integration of smart technologies in industrial systems. As industries adopt Industrial Internet of Things (IIoT) solutions, valve diagrams are no longer static representations but are becoming dynamic, interactive models. These digital twin-enabled diagrams allow real-time monitoring of valve status, pressure differentials, and flow conditions. This shift supports predictive maintenance and improves operational efficiency, especially in oil & gas, water treatment, and chemical processing sectors.

Expansion of Digital Twin and 3D Modeling Tools

Valve diagram design is transitioning from 2D schematics to advanced 3D modeling and digital twin platforms. By 2026, software tools like Autodesk Plant 3D, Siemens NX, and AVEVA are expected to dominate the market, offering integrated valve diagrams that simulate real-world performance. These tools enhance engineering accuracy, reduce installation errors, and streamline maintenance workflows. The demand for interoperable diagrams compatible with Building Information Modeling (BIM) and asset lifecycle management systems is accelerating this trend.

Growth in Sustainability-Driven Design

Environmental regulations and corporate sustainability goals are influencing valve diagram standards. In 2026, valve diagrams are increasingly required to include data on energy efficiency, leakage potential, and material recyclability. This trend is particularly evident in the European Union and North America, where emissions tracking and compliance reporting are mandatory. Diagrams now often include QR codes or embedded metadata linking to environmental product declarations (EPDs), aiding ESG (Environmental, Social, and Governance) reporting.

Increased Standardization and Interoperability

Global standardization efforts by organizations such as ISO, API, and ISA are shaping the future of valve diagrams. By 2026, there is a growing emphasis on uniform symbols, labeling conventions, and data formats across industries. This standardization enables seamless collaboration between engineering firms, OEMs, and operators, especially in multinational projects. Additionally, the adoption of open-data formats like ISO 15926 and OPC UA is improving system interoperability and data exchange in complex process plants.

Surge in AR/VR Applications for Training and Maintenance

Augmented Reality (AR) and Virtual Reality (VR) are transforming how valve diagrams are used in field operations. By 2026, technicians can overlay digital valve diagrams onto physical equipment using AR headsets, enabling faster troubleshooting and reduced downtime. Training programs increasingly rely on interactive valve diagram simulations in VR environments, improving workforce readiness without risking equipment damage. This trend is particularly strong in high-risk industries such as nuclear power and offshore drilling.

Conclusion

The 2026 valve diagrams market reflects broader shifts toward digitalization, sustainability, and operational intelligence. As valve systems become more complex and data-driven, the role of advanced diagrams expands from documentation to active components of industrial automation. Companies investing in smart, standardized, and interactive valve diagram solutions will gain a competitive edge in safety, efficiency, and compliance.

Common Pitfalls Sourcing Valve Diagrams (Quality, IP)

Sourcing accurate and reliable valve diagrams is critical for engineering, maintenance, procurement, and system design. However, several common pitfalls can lead to operational risks, compliance issues, or project delays—particularly concerning diagram quality and intellectual property (IP). Avoiding these pitfalls ensures safety, reliability, and legal compliance.

Poor Diagram Quality

One of the most frequent issues when sourcing valve diagrams is receiving low-quality or inaccurate visuals. This can stem from outdated documentation, unofficial sources, or generic representations that do not reflect the specific valve model or configuration.

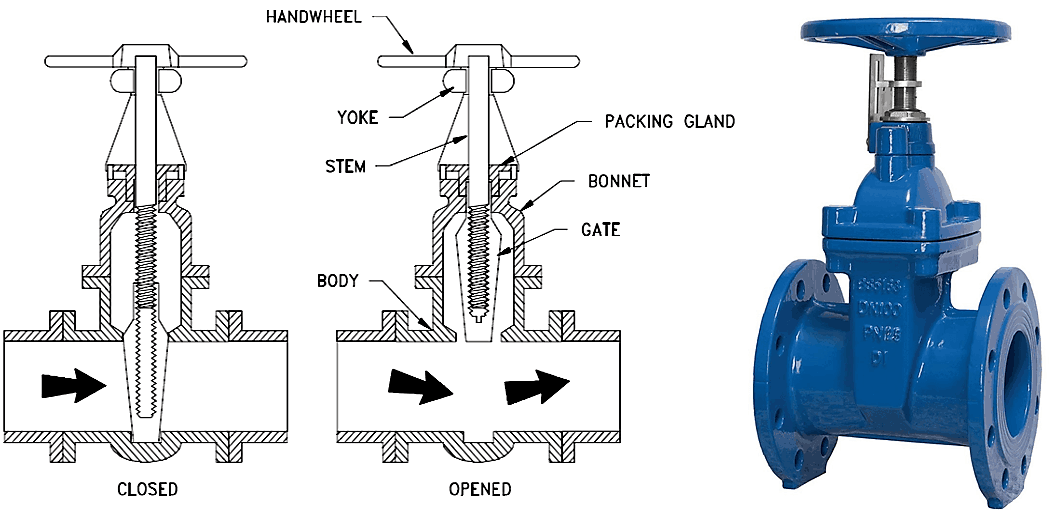

- Inaccurate Dimensions and Specifications: Low-resolution or hastily drawn diagrams often omit critical measurements, flow directions, or connection types, leading to incorrect installations or compatibility issues.

- Lack of Detail for Complex Valves: Multi-port, control, or specialty valves (e.g., cryogenic or high-pressure) require detailed sectional views and operational diagrams. Generic schematics may not convey the necessary information.

- Outdated Versions: Manufacturers update valve designs; using obsolete diagrams can result in mismatched parts or non-compliance with current standards.

To mitigate this, always source diagrams directly from OEM documentation or authorized distributors, and verify revision numbers and dates.

Intellectual Property (IP) Violations

Using valve diagrams without proper authorization can expose organizations to legal risks. Many technical drawings are protected under copyright or design patents, especially when sourced from third-party websites or shared informally.

- Unauthorized Reproduction: Downloading and using manufacturer diagrams from unofficial sources (e.g., forums or file-sharing platforms) often breaches licensing agreements.

- Reverse-Engineered Diagrams: Some suppliers provide diagrams based on reverse engineering, which may infringe on IP rights and lack technical accuracy.

- Unclear Licensing Terms: Even when diagrams are provided, the usage rights (e.g., for internal use vs. commercial projects) may not be clearly defined, risking non-compliance.

Always ensure diagrams are obtained through legitimate channels, with proper licensing for intended use—especially in commercial or public-facing applications.

Failure to Verify Compatibility

Another related pitfall is assuming that a diagram applies universally across valve types or brands. Using a diagram for a ball valve when sourcing a globe valve, for example, can lead to system failures.

- Model-Specific Differences: Valves from the same manufacturer but different series may have internal variations not evident in simplified diagrams.

- Standards and Certifications: Diagrams should reflect compliance with relevant standards (e.g., API, ISO, ASME). Missing certification markings on diagrams can indicate non-compliant or counterfeit products.

Always cross-reference diagrams with product datasheets and certification documentation.

Conclusion

To avoid these pitfalls, prioritize sourcing valve diagrams from official manufacturer portals, authorized distributors, or engineering databases that ensure high quality and IP compliance. Verify document revision status, usage rights, and technical accuracy before implementation. Doing so safeguards system integrity, reduces liability, and supports regulatory adherence.

Logistics & Compliance Guide for Valves Diagram

This guide outlines the essential logistics and compliance considerations when handling, transporting, storing, and using valves diagrams within industrial, engineering, and manufacturing environments. Proper management ensures safety, regulatory adherence, and operational efficiency.

1. Document Classification and Version Control

- Classification: Identify the valves diagram as Controlled Documentation (e.g., Engineering Drawing, Technical Schematic) subject to change management protocols.

- Versioning: Maintain a clear version control system (e.g., Rev 1.0, Rev 2.1) with timestamps and approval signatures.

- Access Control: Restrict access to authorized personnel only, using secure document management systems (DMS) or enterprise content platforms.

2. International and Industry Standards Compliance

Ensure valves diagrams comply with relevant standards:

- ISO Standards:

- ISO 10628: Diagrams for chemical and petrochemical industry.

- ISO 14617: Graphical symbols for diagrams.

- ANSI/ASME Standards:

- ASME B1.20.1: Pipe threads for valves.

- ANSI/ISA-5.1: Instrumentation symbols and identification.

- PED (Pressure Equipment Directive) – EU: Diagrams must support compliance for valves used in pressurized systems.

- API Standards: For oil & gas applications (e.g., API 6D for pipeline valves).

3. Export and Import Regulations

- EAR (Export Administration Regulations): Determine if valves diagrams contain technical data subject to export controls (especially for dual-use technologies).

- ITAR (International Traffic in Arms Regulations): Apply if diagrams relate to defense-related valves or systems.

- Documentation: Maintain records of export licenses, end-user statements, and compliance certifications when sharing diagrams internationally.

4. Data Security and Intellectual Property Protection

- Confidentiality: Label diagrams with appropriate confidentiality levels (e.g., Proprietary, Confidential).

- Digital Security: Use encryption for electronic files and restrict printing or copying via DRM or PDF security settings.

- IP Rights: Ensure proper copyright notices and attribution; register critical diagrams if necessary.

5. Storage and Handling Procedures

- Physical Storage: Store printed diagrams in dry, secure locations with fire-resistant cabinets. Use labeled binders or drawers by project or system.

- Digital Storage: Maintain backups in secure, access-controlled servers with audit trails. Use cloud platforms compliant with ISO 27001 or equivalent.

- Retention Period: Follow corporate document retention policies (typically 7–10 years for engineering records).

6. Transportation Guidelines

- Domestic/International Shipping:

- Use tamper-evident packaging for physical diagrams.

- For digital transfer, use secure FTP, encrypted email, or approved collaboration platforms.

- Chain of Custody: Document all transfers with date, recipient, and purpose.

7. Training and Personnel Compliance

- Training Programs: Provide training on reading and interpreting valve symbols per ISO/ISA standards.

- Compliance Awareness: Educate staff on export controls, data protection, and document handling procedures.

- Audits: Conduct periodic audits to ensure adherence to logistics and compliance protocols.

8. Environmental and Safety Considerations

- Hazardous Environments: Ensure diagrams used in field operations reflect correct valve types for hazardous areas (e.g., ATEX/IECEx compliance).

- Emergency Response: Keep updated diagrams accessible in control rooms or emergency response centers for rapid isolation procedures.

9. Audit and Traceability

- Audit Readiness: Maintain logs of diagram revisions, approvals, distribution, and disposal.

- Traceability: Link valves diagrams to asset tags, equipment numbers, and P&ID systems for lifecycle tracking.

10. Disposal and Decommissioning

- Secure Destruction: Shred physical copies; securely wipe digital files using certified data destruction methods.

- Decommission Records: Archive obsolete diagrams in a “historical” repository with clear labeling to prevent misuse.

Adhering to this guide ensures regulatory compliance, protects intellectual property, and supports safe and efficient operations involving valves systems.

Conclusion for Sourcing Valves Diagram

In conclusion, the process of sourcing valves as illustrated in the diagram highlights a structured and strategic approach to procurement within engineering or industrial systems. The diagram effectively outlines key stages—from identifying valve specifications and requirements, to evaluating suppliers based on quality, cost, and compliance, to finalizing procurement and ensuring proper documentation and traceability.

It emphasizes the importance of aligning valve selection with system demands, such as pressure ratings, material compatibility, and operational environment, to ensure safety, reliability, and efficiency. Furthermore, collaboration between engineering, procurement, and quality assurance teams is essential to make informed decisions and mitigate supply chain risks.

Ultimately, the sourcing valves diagram serves as a valuable tool for standardizing procurement practices, improving transparency, and supporting long-term operational performance. By following this systematic approach, organizations can optimize valve sourcing, reduce downtime, and maintain compliance with industry standards and project specifications.