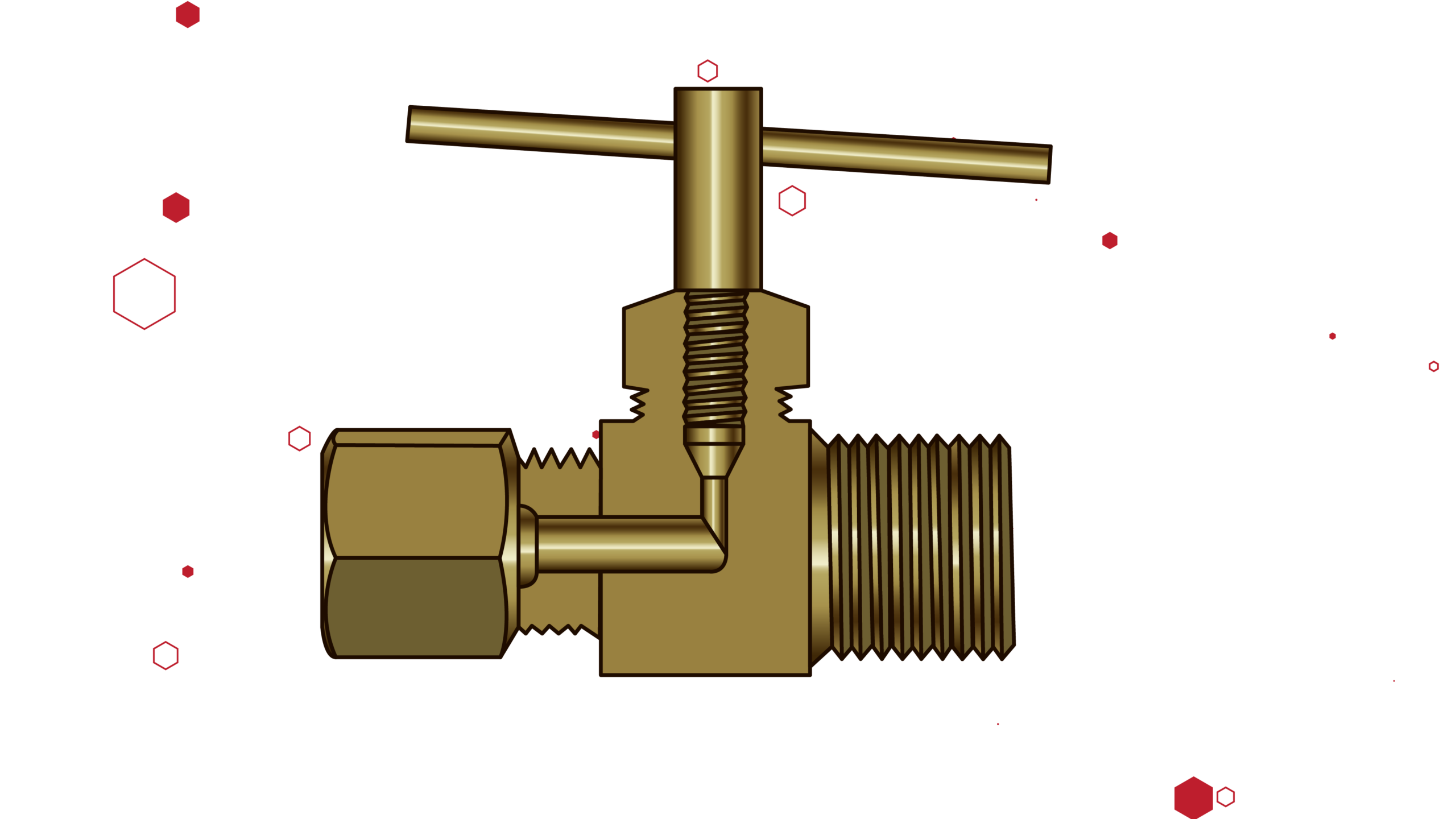

The global industrial valves market, driven by increasing demand across oil & gas, water treatment, power generation, and chemical sectors, is witnessing steady expansion. According to Grand View Research, the market was valued at USD 75.1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. Brass instrument valves—renowned for their corrosion resistance, durability, and precision—are a critical subset within this landscape, particularly in drainage and control applications. With rising infrastructure investments and stricter regulatory standards for fluid control systems, demand for high-performance brass valves continues to climb. Mordor Intelligence supports this trend, highlighting steady growth in the Asia Pacific region due to industrialization and municipal water project expansions. As procurement teams prioritize reliability and compliance, identifying top-tier manufacturers becomes essential. The following list highlights nine leading brass instrument valve manufacturers known for innovation, quality, and global market presence.

Top 9 Valve Drainage Brass Instrument Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Kunkle Valve, Safety and Relief Valves

Website: kunklevalve.company

Key Highlights: Kunkle Valve is a leading manufacturer of quality safety and relief valve products for industrial and commercial applications, including steam, air, ……

#2 Elkhart Brass

Domain Est. 1996 | Founded: 1902

Website: elkhartbrass.com

Key Highlights: Since 1902 Elkhart Brass has earned a reputation for quality, value and customer service in manufacturing firefighting, fire protection, and industrial water ……

#3 Swagelok: High

Domain Est. 1996

Website: swagelok.com

Key Highlights: Swagelok is a privately held manufacturer of fluid system solutions including components, assemblies, and services trusted in critical industries worldwide….

#4 Brass Block and Bleed Valve

Domain Est. 2017

Website: favfittings.com

Key Highlights: Brass Block and Bleed Valve-FAV range of Brass Fitting, Double Ferrule Fittings and Pipe Fittings are widely used with Brass, Copper or Iron pipe and tube….

#5 Buckner Drain Valve Brass 1/2 in. FIPT

Domain Est. 1995

Website: siteone.com

Key Highlights: Automatic ball drain valve has a brass-to-brass seat, preventing sticking in closed position. Long Lasting; Cost efficient. Storm Manufacturing Group is a ……

#6 Quarter Turn Drain Valve

Domain Est. 1996

#7 Crane Fluid Systems

Domain Est. 2000

Website: cranefs.com

Key Highlights: Manufacturing a range of valves and pipe fittings for the Building Services industry, including a full range of commissioning valves for static and variable ……

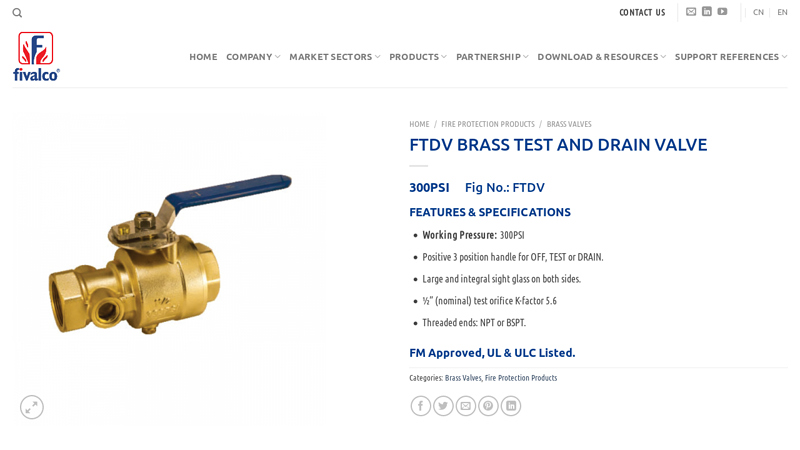

#8 FTDV Brass Test and Drain Valve

Domain Est. 2004

Website: fivalco.com

Key Highlights: FEATURES & SPECIFICATIONS. Working Pressure: 300PSI; Positive 3 position handle for OFF, TEST or DRAIN. Large and integral sight glass on both sides….

#9 Midland Industries

Domain Est. 2011

Website: midlandindustries.com

Key Highlights: Lead-Free Brass Forged Bodies • Full Port 3/4″ Drain Outlets • Ready to ship from Midland. Shop New Tankless Water Heater Valves. [object Object]. CLEARANCE ……

Expert Sourcing Insights for Valve Drainage Brass Instrument

H2: Market Trends for Valve Drainage Brass Instruments in 2026

As the global industrial and infrastructure sectors evolve, the demand for high-performance valve drainage brass instruments is expected to grow steadily by 2026. These instruments—commonly used in plumbing, HVAC systems, irrigation, and industrial fluid control—are experiencing transformation driven by technological innovation, sustainability mandates, and shifting regional market dynamics. Below are key trends shaping the landscape of the valve drainage brass instrument market in 2026:

-

Increased Demand for Corrosion-Resistant and Durable Materials

Brass continues to be a preferred material due to its excellent corrosion resistance, machinability, and longevity. By 2026, manufacturers are increasingly alloying brass with antimicrobial elements (e.g., bismuth or selenium) to meet hygiene standards in potable water systems. This shift is particularly strong in North America and Europe, where regulatory standards (e.g., NSF/ANSI 61) mandate lead-free or low-lead brass components. -

Smart Valve Integration and IoT Connectivity

A major trend in 2026 is the integration of smart technology into traditional brass valves. Valve drainage systems are being equipped with sensors and wireless connectivity for remote monitoring of flow rates, pressure, and leak detection. This is especially prominent in smart building and industrial automation applications, where predictive maintenance and energy efficiency are priorities. -

Growth in Green Building and Sustainable Infrastructure

With the global push toward sustainable construction (e.g., LEED, BREEAM certifications), demand for efficient drainage and water management systems is rising. Brass valve instruments are being optimized for low leakage and high recyclability, aligning with circular economy principles. The construction boom in Asia-Pacific and the Middle East is fueling demand for long-life, low-maintenance brass drainage solutions. -

Regional Market Shifts and Manufacturing Relocation

While Europe and North America remain key markets due to stringent plumbing codes, the Asia-Pacific region—particularly China, India, and Southeast Asia—is expected to show the highest growth rate by 2026. Urbanization, industrial expansion, and government-led water infrastructure projects are driving demand. Concurrently, some manufacturers are relocating production to Vietnam and India to mitigate supply chain risks and reduce costs. -

Regulatory Pressure and Standardization

By 2026, global regulations on lead content in plumbing components will tighten further. The transition to dezincification-resistant (DZR) brass alloys is accelerating, especially in residential and commercial applications. Compliance with international standards such as ISO 4144 and EN 10242 is becoming a competitive necessity. -

Rise of Customization and Modular Design

End users across industries are demanding modular and customizable valve systems that can be easily integrated into complex piping networks. Manufacturers are responding with configurable brass drainage valves that support quick installation and retrofitting, reducing downtime and labor costs.

In summary, the 2026 market for valve drainage brass instruments is characterized by technological advancement, regulatory compliance, and regional diversification. Companies that invest in R&D for smart, sustainable, and compliant products are poised to capture significant market share in this evolving sector.

Common Pitfalls When Sourcing Brass Valve Drainage Instruments (Quality & IP)

Sourcing brass valve drainage instruments—such as drain valves, bleed valves, or sampling valves—requires careful attention to both quality standards and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, compliance issues, or legal risks. Below are key pitfalls to avoid:

Inadequate Material Quality and Certification

One of the most frequent issues is sourcing valves made from substandard brass alloys. Not all brass is equal; compositions like C37700 (forging brass) or DZR (dezincification-resistant) brass are essential in corrosive or potable water environments. Buyers often assume “brass” implies quality, but without proper material certifications (e.g., ISO 9001, ASTM B16, or EN 1254), valves may fail prematurely due to corrosion, leaks, or mechanical weakness.

Pitfall: Accepting valves without mill test certificates (MTCs) or third-party inspection reports. This increases the risk of receiving counterfeit or off-spec materials.

Poor Workmanship and Dimensional Inaccuracy

Low-cost suppliers may cut corners in machining and assembly, leading to dimensional deviations, rough internal finishes, or misaligned threads. These defects compromise sealing performance and can cause leaks or difficulty in installation, especially in high-pressure or sanitary applications.

Pitfall: Failing to conduct pre-shipment inspections or dimensional audits. Without verifying tolerances and surface finishes, end users face field failures and costly downtime.

Non-Compliance with International Standards

Valve specifications often require adherence to standards such as ISO 5211 (for actuator mounting), API 6D, or EN standards for pressure ratings and testing. Sourcing from suppliers who claim compliance without proper documentation or independent verification can result in non-conforming products.

Pitfall: Assuming catalog claims equal compliance. Always request test reports (e.g., pressure tests, helium leak tests) and verify markings on the product (e.g., pressure class, material grade).

Intellectual Property (IP) Infringement Risks

Many reputable valve designs are protected by patents, trademarks, or technical know-how. Sourcing generic copies of branded instruments—especially from regions with lax IP enforcement—can expose buyers to legal liability, shipment seizures, or reputational damage.

Pitfall: Procuring “compatible” or “equivalent” valves that mimic patented designs (e.g., specific actuator interfaces or internal geometries) without proper licensing. This is common with OEM-replacement parts.

Lack of Traceability and Documentation

Traceability is critical in regulated industries (e.g., pharmaceuticals, oil & gas). Valves without proper batch/lot traceability, material test reports, or as-built documentation fail audit requirements and complicate root cause analysis during failures.

Pitfall: Accepting undocumented batches or valves without unique serial numbers. This undermines quality assurance and regulatory compliance.

Supplier Reliability and Long-Term Support

Choosing suppliers based solely on price often leads to inconsistent quality and lack of after-sales support. If the supplier cannot provide replacements, spare parts, or technical assistance, system maintenance becomes problematic.

Pitfall: Not vetting suppliers’ production capabilities, quality management systems, or financial stability. This increases supply chain risk and total cost of ownership.

Conclusion

To mitigate these pitfalls, buyers should:

– Require full material and performance certification.

– Conduct factory audits and third-party inspections.

– Verify IP rights and avoid infringing designs.

– Prioritize suppliers with robust quality systems and traceability.

– Establish long-term partnerships based on transparency and compliance.

Proactive due diligence ensures reliable, compliant, and legally sound sourcing of brass valve drainage instruments.

Logistics & Compliance Guide for Valve Drainage Brass Instrument

Overview

This guide outlines the essential logistics and compliance requirements for the international handling, transportation, storage, and regulatory adherence of Valve Drainage Brass Instruments. These instruments are commonly used in industrial, plumbing, and HVAC applications for controlled fluid drainage via manual or automated valve mechanisms. Proper logistics planning and regulatory compliance are critical to ensure product integrity, legal conformity, and timely delivery.

Classification & Tariff Codes

Valve Drainage Brass Instruments are typically classified under the Harmonized System (HS) code 8481.80 – “Valves for pipes, boiler shells, tanks, vats or the like, other than safety or relief valves, of brass.” Accurate classification is essential for customs declaration, duty calculation, and export control purposes. Confirm the local customs code in the destination country, as sub-classifications may vary.

Packaging & Handling Requirements

- Packaging: Instruments must be packed in moisture-resistant, shock-absorbent materials (e.g., corrugated cardboard with internal foam or plastic inserts). Bulk packaging should prevent abrasion and deformation.

- Labeling: Each package must be clearly labeled with product identification, quantity, net weight, country of origin (“Made in [Country]”), and handling symbols (e.g., “Fragile,” “This Side Up”).

- Palletization: Securely stack packages on wooden or plastic pallets. Use stretch wrap or strapping to prevent shifting during transit.

- Handling: Avoid dropping or stacking heavy loads on top of packaged instruments. Use mechanical handling (forklifts, pallet jacks) for palletized loads.

Transportation Guidelines

- Mode of Transport: Suitable for road, rail, air, and sea freight. Select mode based on urgency, cost, and destination.

- Temperature & Humidity: Store and transport in a dry environment. Avoid prolonged exposure to humidity above 70% to prevent brass tarnishing or internal corrosion.

- Transit Time: Minimize transit duration, especially in high-humidity or saline environments (e.g., maritime routes).

- Documentation: Include commercial invoice, packing list, bill of lading/air waybill, and certificate of origin with all shipments.

Import & Export Compliance

- Export Controls: Verify if the product falls under any dual-use or strategic export control regimes (e.g., EU Dual-Use Regulation, U.S. EAR). Most standard brass drainage valves are not controlled, but automated or high-pressure variants may require review.

- Import Requirements: Confirm destination country’s import regulations, including conformity assessment, product certification (e.g., CE, UKCA, INMETRO), and labeling standards.

- Duty & Taxes: Calculate applicable import duties, VAT, or GST based on HS code and trade agreements. Utilize preferential tariffs where applicable (e.g., under free trade agreements).

Regulatory & Safety Compliance

- RoHS Compliance (EU/UK): Ensure brass components and any electronic actuators (if applicable) comply with RoHS 2 (2011/65/EU) restrictions on hazardous substances (e.g., lead, cadmium). Note: Lead content in brass (<4%) is often exempt under RoHS exemption 6(c).

- REACH (EU): Declare Substances of Very High Concern (SVHC) if present above threshold (0.1% w/w). Brass alloys typically do not require SVHC declaration unless contaminated.

- Pressure Equipment Directive (PED 2014/68/EU): Applies if the valve is used in pressurized systems. Determine category based on fluid group, pressure, and volume. CE marking may be required.

- Water Regulations (e.g., NSF/ANSI 61, WRAS): Required if used in potable water systems. Confirm material compliance with local drinking water standards.

Storage Conditions

- Environment: Store in a clean, dry, indoor area with controlled temperature (10–30°C) and low humidity.

- Shelving: Use non-corrosive shelving. Avoid direct contact with concrete floors to prevent moisture absorption.

- Stock Rotation: Implement FIFO (First In, First Out) inventory management to minimize prolonged storage and potential material degradation.

Documentation & Recordkeeping

Maintain records for a minimum of 5 years, including:

– Certificate of Conformity (CE, etc.)

– Material test reports (MTRs) for brass components

– RoHS/REACH compliance declarations

– Export license (if applicable)

– Test reports for pressure or performance (if required)

– Shipping and customs documentation

End-of-Life & Environmental Considerations

- Recyclability: Brass is 100% recyclable. Encourage proper recycling at end-of-life.

- Waste Handling: Comply with local WEEE or waste metal disposal regulations. No special hazardous waste handling is required for standard brass valves.

Contact & Support

For compliance inquiries or technical documentation, contact:

[Insert Company Compliance Officer Name]

Email: compliance@[company].com

Phone: +[Country Code] [Number]

This guide serves as a general reference. Always verify specific regulatory requirements with local authorities or legal counsel prior to shipment.

Conclusion:

In conclusion, sourcing brass valve drainage instruments requires careful consideration of material quality, manufacturing standards, supplier reliability, and compliance with industry regulations. Brass remains a preferred material due to its corrosion resistance, durability, and antimicrobial properties, making it ideal for drainage applications in plumbing, HVAC, and industrial systems. Ensuring that the valves meet relevant standards (such as ASTM, ISO, or NSF) is critical for performance and safety. Establishing partnerships with reputable suppliers who offer consistent quality, competitive pricing, and timely delivery will ultimately contribute to the efficiency and longevity of the systems in which these components are installed. A strategic sourcing approach—balancing cost, quality, and supply chain resilience—is essential for successful procurement of brass valve drainage instruments.