The global vacuum dust collector market is experiencing robust growth, driven by increasing industrialization, stringent environmental regulations, and growing emphasis on worker health and safety. According to Grand View Research, the market was valued at USD 2.4 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This expansion is further fueled by rising demand across sectors such as pharmaceuticals, food and beverage, woodworking, and metal fabrication, where effective dust management is critical for operational efficiency and regulatory compliance. As industries prioritize air quality and automated cleaning solutions, the role of high-performance vacuum dust collectors has become increasingly vital. In this competitive landscape, a handful of manufacturers have emerged as leaders, combining innovation, reliability, and global reach to dominate market share. Based on technological advancement, production capacity, and market presence, the following list highlights the top 10 vacuum dust collector manufacturers shaping the future of industrial air quality management.

Top 10 Vacuum Dust Collector Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wet/Dry Dust Extraction

Domain Est. 1995

Website: fein.com

Key Highlights: FEIN wet/dry vacuums are made for professional, industrial applications and protect you from possible health risks while working in dusty environments….

#2 Dustcontrol

Domain Est. 2002

Website: dustcontrol.us

Key Highlights: Dustcontrol manufactures mobile dust extractors for industrial and construction use, fixed extraction systems, peripheral equipment and accessories….

#3 Superior Filtration, Industrial Dust and Mist Collector

Domain Est. 1995

Website: parker.com

Key Highlights: Industrial dust collectors, leader in filtration. High quality dust collector and mist collector. Provide clean air solutions to reach your operating goals….

#4 Industrial Dust Collector Systems

Domain Est. 1999

Website: industrialvacuum.com

Key Highlights: We manufacture portable dust collectors, available for rent or purchase. Built for contractors who need a mobile dust collector, to clean multiple job sites ……

#5 Extraction Systems by Keller USA, Inc. for Clean Air Production

Domain Est. 2000

Website: kellerusa.com

Key Highlights: Our custom-engineered extraction systems and dust collectors offer flexible clean air solutions to meet any individual needs and challenges….

#6 Dust Collector Manufacturers

Domain Est. 2012

Website: dustcollectormanufacturers.org

Key Highlights: Instantly connect with the leading dust collector manufacturers and suppliers whose products are high performance and designed to protect people as well as ……

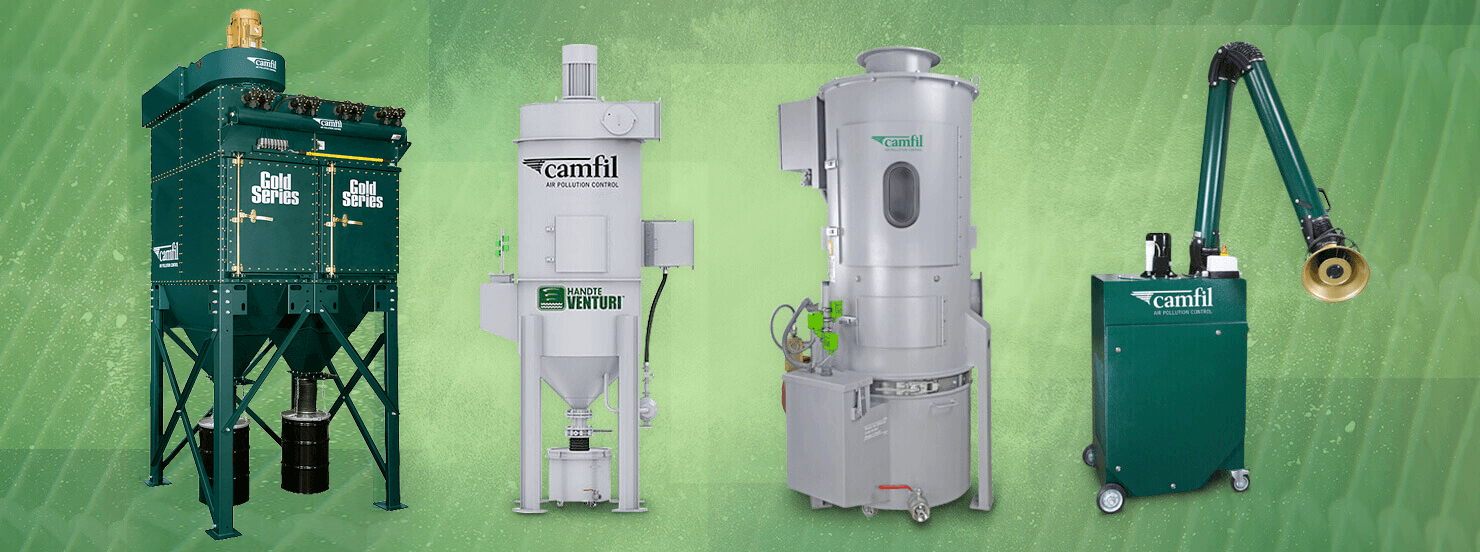

#7 Camfil APC

Domain Est. 2013

Website: camfilapc.com

Key Highlights: Industrial dust collection equipment and replacement filters for manufacturing & industrial processes. We offer a wide range of replacement filters ……

#8 Dust Collectors

Domain Est. 1996

Website: lagunatools.com

Key Highlights: Free deliveryLaguna Tools offers a range of woodworking dust collectors that will minimize shop debris and keep your working space clean. Explore our selection today….

#9 Vacuum Dust Collection Systems

Domain Est. 1997

Website: csunitec.com

Key Highlights: CS Unitec’s portable wet/dry dust extraction vacuums are designed for dust collection with concrete grinders, cut-off saws, wall slotters, sanders and more….

#10 Cyclone Dust Collectors Made in USA

Domain Est. 1998

Website: oneida-air.com

Key Highlights: Free delivery · 30-day returnsWe’ve dedicated ourselves to providing the most innovative and high performance dust control solutions available – proudly made in the USA!…

Expert Sourcing Insights for Vacuum Dust Collector

H2: 2026 Market Trends for Vacuum Dust Collectors

The global vacuum dust collector market is poised for significant transformation by 2026, driven by technological advancements, rising environmental regulations, and growing industrial automation. Several key trends are shaping the trajectory of this sector, influencing product development, demand patterns, and regional market dynamics.

-

Increased Demand from Manufacturing and Industrial Sectors

The expansion of manufacturing activities—particularly in automotive, metal fabrication, woodworking, and pharmaceuticals—is fueling the need for efficient dust collection systems. As industries prioritize worker safety and regulatory compliance, vacuum dust collectors are becoming essential components in production facilities. By 2026, emerging economies in Asia-Pacific and Latin America are expected to lead demand growth due to rapid industrialization. -

Stricter Environmental and Occupational Health Regulations

Governments worldwide are enforcing stringent air quality standards and occupational safety laws. Regulatory bodies such as OSHA (U.S.) and the EU’s REACH and CE directives mandate effective dust control to minimize airborne particulate matter. This regulatory push is compelling industries to upgrade outdated systems, accelerating the adoption of high-efficiency vacuum dust collectors with HEPA filtration and low emission rates. -

Adoption of Smart and Connected Dust Collection Systems

Integration of IoT (Internet of Things) and Industry 4.0 technologies is a defining trend. By 2026, smart vacuum dust collectors equipped with sensors, remote monitoring, predictive maintenance, and performance analytics are gaining traction. These systems enable real-time monitoring of filter status, airflow efficiency, and energy consumption, improving operational efficiency and reducing downtime. -

Shift Toward Energy-Efficient and Sustainable Solutions

Energy efficiency is becoming a key differentiator. Manufacturers are focusing on developing vacuum systems with variable speed drives (VSD), regenerative blowers, and low-power consumption designs. Additionally, reusable filter systems and recyclable components are being prioritized to support sustainability goals and reduce total cost of ownership. -

Growth in Customized and Modular Systems

As industrial applications diversify, there is a rising demand for modular and customizable dust collection solutions. By 2026, OEMs are increasingly offering scalable, plug-and-play systems tailored to specific operational environments—such as explosive atmospheres (ATEX-compliant units) or cleanroom settings—enhancing flexibility and integration with existing workflows. -

Expansion of Aftermarket Services and Filter Replacements

The lifecycle revenue model is gaining prominence. Beyond equipment sales, companies are investing in after-sales services, including filter replacement programs, maintenance contracts, and technical support. This trend is driven by the recurring need for filter upkeep and the increasing complexity of advanced filtration systems. -

Regional Market Shifts

While North America and Europe remain mature markets with steady growth due to regulatory upgrades and retrofits, the Asia-Pacific region—especially China, India, and Southeast Asia—is expected to register the highest compound annual growth rate (CAGR) by 2026. This growth is supported by infrastructure development, foreign direct investment, and government initiatives promoting clean manufacturing.

In conclusion, the 2026 vacuum dust collector market will be characterized by innovation, regulatory influence, and digital integration. Companies that prioritize efficiency, compliance, and smart technology adoption are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Vacuum Dust Collectors (Quality & IP)

Sourcing a Vacuum Dust Collector requires careful evaluation beyond just price and capacity. Overlooking critical quality and Ingress Protection (IP) factors can lead to premature failure, safety hazards, poor performance, and increased operating costs. Below are key pitfalls to avoid:

1. Ignoring IP Rating Suitability for the Environment

- Pitfall: Selecting a vacuum with an IP rating that doesn’t match the operating environment (e.g., using an IP54 unit in a washdown area requiring IP67/IP69K).

- Consequence: Water or dust ingress into motors, controls, or electrical components, leading to short circuits, corrosion, motor burnout, and safety risks.

- Best Practice: Match the IP rating to the environment—IP54 for dry industrial areas, IP65 for washdown zones, and IP67/IP69K for high-pressure cleaning or wet processes.

2. Overlooking Build Material Quality and Corrosion Resistance

- Pitfall: Assuming all stainless steel is equal or selecting collectors made from thin-gauge or non-corrosion-resistant materials.

- Consequence: Rapid deterioration in humid, chemical, or abrasive environments; structural weakness; contamination of collected dust.

- Best Practice: Specify 304 or 316L stainless steel for corrosive or hygienic environments; verify material thickness (gauge) and construction weld quality.

3. Underestimating Filtration Efficiency and Media Quality

- Pitfall: Focusing only on airflow (CFM) while neglecting filter media type, filtration grade (e.g., HEPA vs. standard), and cleaning mechanism.

- Consequence: Poor dust capture, release of fine particulates into the workspace (health hazard), clogged filters, reduced suction, and higher maintenance.

- Best Practice: Match filter efficiency (e.g., MERV, HEPA) to dust type (e.g., wood, metal, chemical); ensure robust cleaning systems (pulse-jet, reverse air) for sustained performance.

4. Neglecting Motor and Component Quality

- Pitfall: Choosing units with unbranded or low-quality motors, bearings, and seals to cut costs.

- Consequence: Shorter lifespan, frequent breakdowns, higher noise levels, and increased downtime.

- Best Practice: Source motors from reputable brands; verify insulation class (e.g., Class F), duty rating, and sealed bearings for durability.

5. Assuming All “Industrial” Vacuums Are Suitable for Hazardous Dust

- Pitfall: Using standard vacuum collectors for combustible dust (e.g., aluminum, wood, flour) without proper safety certifications.

- Consequence: Risk of fire or explosion due to static discharge or internal ignition sources.

- Best Practice: For combustible dust, ensure the unit is ATEX/IECEx certified, has conductive construction, grounding points, and explosion relief or suppression systems.

6. Failing to Verify Real-World Performance Claims

- Pitfall: Relying solely on manufacturer-provided suction power (e.g., water lift, airwatts) without third-party validation or real-world testing.

- Consequence: Underperformance in actual application; inability to handle required dust load or hose length.

- Best Practice: Request performance curves, ask for case studies, or conduct on-site trials with your specific dust type and configuration.

7. Overlooking Serviceability and Spare Parts Availability

- Pitfall: Selecting a vacuum with poor access to filters, motors, or proprietary components.

- Consequence: High maintenance downtime, difficulty replacing parts, reliance on a single supplier, and increased lifecycle cost.

- Best Practice: Choose models with easily accessible components and verify long-term spare parts availability and support from the supplier.

By proactively addressing these quality and IP-related pitfalls, buyers can ensure reliable, safe, and cost-effective dust collection performance over the system’s lifetime. Always conduct thorough due diligence and consider total cost of ownership, not just the initial purchase price.

H2: Logistics & Compliance Guide for Vacuum Dust Collector

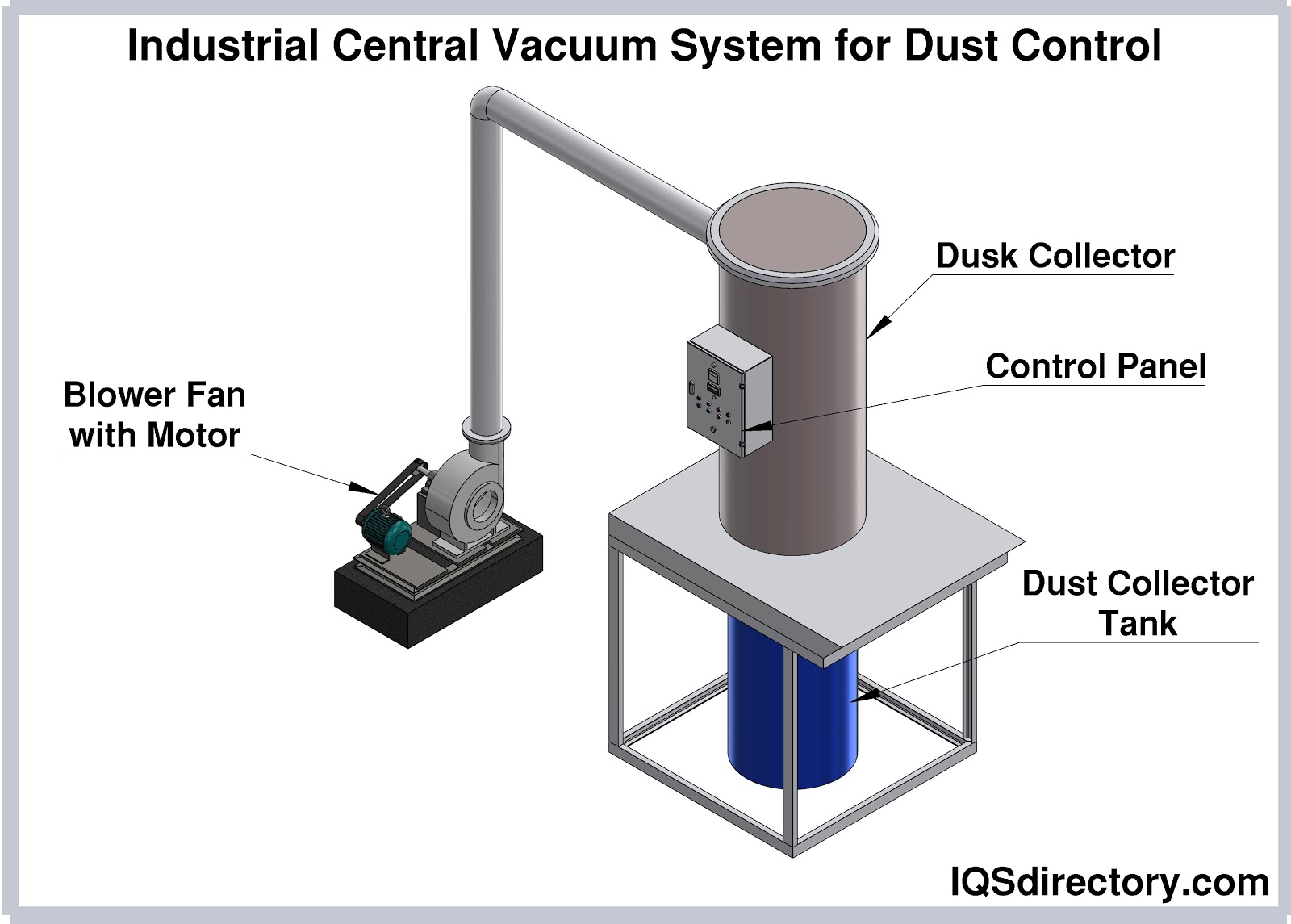

H2: Overview

This guide outlines the key logistics considerations and compliance requirements for the transportation, handling, installation, and operation of Vacuum Dust Collectors. Adhering to these guidelines ensures safety, regulatory compliance, efficient operations, and longevity of the equipment.

H2: International Shipping & Logistics

Packaging and Handling

- Secure Packaging: Vacuum Dust Collectors must be crated or palletized with protective materials to prevent damage during transit.

- Lifting Points: Use only designated lifting points when moving the unit. Never lift by ducts, filters, or electrical enclosures.

- Orientation Labels: Ensure “This Side Up” and “Fragile” labels are visible and respected during handling.

Transportation Modes

- Marine Freight: Use weatherproof containers; secure the unit to prevent shifting. Provide desiccant packs to control moisture.

- Air Freight: Verify weight and dimension restrictions with carriers. Prioritize expedited shipping for time-sensitive installations.

- Overland Transport: Use flatbed or enclosed trucks with tie-downs. Protect from road debris and weather exposure.

Import/Export Documentation

- Commercial Invoice: Includes HS Code (e.g., 8421.39 – Air Filtering/Conditioning Equipment).

- Packing List: Details weight, dimensions, and contents per package.

- Certificate of Origin: Required for tariff determination.

- Bill of Lading / Air Waybill: Legal document of carriage.

H2: Regulatory Compliance

Environmental Regulations

- EPA Standards (U.S.): Comply with National Emission Standards for Hazardous Air Pollutants (NESHAP) Subpart KKKKKK if handling hazardous dust (e.g., wood, metal).

- REACH & RoHS (EU): Ensure materials used in construction (e.g., wiring, coatings) meet chemical safety and restriction standards.

- WEEE Directive: Plan for end-of-life recycling; register as a producer if selling in EEA countries.

Safety Standards

- OSHA (U.S.): Follow 29 CFR 1910.107 and 1910.94 for spray finishing and ventilation systems to control combustible dust.

- ATEX Directive (EU): Required if operating in explosive atmospheres (e.g., grain, coal, metal dust). Equipment must be certified for Zone 21 or 22.

- CE Marking: Mandatory for sale in Europe; includes compliance with Machinery Directive (2006/42/EC) and EMC Directive.

Electrical Compliance

- Voltage & Frequency: Verify compatibility with local power supply (e.g., 230V/50Hz in EU, 120V/60Hz in North America).

- Certifications:

- UL/CSA (North America): Equipment must be listed for industrial use.

- IEC Standards: Ensure compliance with IEC 60204-1 (Safety of Machinery – Electrical Equipment).

H2: Installation & Operational Compliance

Site Requirements

- Ventilation: Install in well-ventilated areas; exhaust must comply with local air quality regulations.

- Clearance: Maintain minimum clearance (typically 30–50 cm) around the unit for maintenance and airflow.

- Foundation: Mount on a level, load-bearing surface to prevent vibration and misalignment.

Dust Type Classification

- Combustible Dust: If handling materials like aluminum, sugar, or flour, comply with NFPA 652 (Standard on the Fundamentals of Combustible Dust).

- Toxic Dust: Implement HEPA filtration and containment systems per OSHA PELs (Permissible Exposure Limits).

Filtration & Emissions

- Filter Efficiency: Filters must capture ≥99.9% of particles ≥0.3 microns (HEPA standard) if required by local regulations.

- Stack Emissions Testing: Periodically test exhaust for particulate matter to ensure compliance with environmental permits.

H2: Maintenance & Documentation

Routine Maintenance

- Filter Cleaning/Replacement: Follow manufacturer schedule; log all maintenance activities.

- Dust Disposal: Dispose of collected dust per local hazardous waste regulations (e.g., EPA 40 CFR Part 261).

- Leak Testing: Conduct annual integrity tests for systems handling toxic or explosive dusts.

Record Keeping

- Maintain logs of:

- Maintenance and filter changes

- Emissions testing results

- Safety inspections

- Operator training

Training & Certification

- Train operators on:

- Safe startup/shutdown procedures

- Emergency response (e.g., fire, filter breach)

- PPE requirements (respirators, gloves)

H2: Conclusion

Proper logistics planning and compliance with international, environmental, and safety regulations are essential for the effective deployment of Vacuum Dust Collectors. By following this guide, organizations can ensure operational safety, avoid regulatory penalties, and support sustainable industrial practices. Always consult local authorities and equipment manufacturers for site-specific requirements.

Conclusion for Sourcing a Vacuum Dust Collector

After a thorough evaluation of available options, it is clear that sourcing the right vacuum dust collector is critical to ensuring a safe, efficient, and compliant working environment—especially in industries such as woodworking, metal fabrication, pharmaceuticals, and food processing. The decision should be based on a combination of factors including airflow capacity (CFM), filtration efficiency, dust type and volume, portability, maintenance requirements, and budget.

By comparing various suppliers, models, and technologies (such as cartridge filters, cyclone separators, or HEPA filtration systems), it becomes evident that investing in a high-quality, properly sized dust collector not only enhances air quality and protects worker health but also improves operational efficiency and reduces long-term maintenance costs. Additionally, compliance with OSHA and other regulatory standards is a key consideration that supports the necessity of reliable dust collection.

Ultimately, sourcing a vacuum dust collector should be a strategic decision guided by technical specifications, lifecycle costs, and supplier reliability. Partnering with reputable manufacturers or vendors offering strong after-sales support, warranty, and service ensures sustained performance and minimal downtime.

In conclusion, a well-sourced vacuum dust collector is not merely a piece of equipment—it is an essential component of workplace safety, regulatory compliance, and operational excellence.