The global UV light sterilizer market is experiencing robust growth, driven by rising hygiene awareness and increasing demand across healthcare, residential, and commercial sectors. According to Grand View Research, the market was valued at USD 1.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 14.3% from 2023 to 2030. This surge is fueled by technological advancements in UV-C disinfection and growing adoption in response to infectious disease outbreaks. As demand escalates, a wave of manufacturers has emerged, innovating in form factors, safety standards, and application-specific designs. Based on market presence, production volume, technological capability, and global distribution reach, here are the top 10 UV light sterilizer manufacturers shaping the industry’s future.

Top 10 Uv Light Sterilizer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Ultraviolet.com

Domain Est. 1994 | Founded: 1963

Website: ultraviolet.com

Key Highlights: Learn about UV disinfection on Ultraviolet.com by Atlantic Ultraviolet Corporation, engineers and manufacturers of UV-C equipment since 1963….

#2 Light Sources

Domain Est. 1997

Website: light-sources.com

Key Highlights: We develop and manufacture high-quality germicidal lamps found in a multitude of water, air and surface disinfection applications worldwide….

#3 Discover our UV-C LED disinfection solutions

Domain Est. 2014

Website: aquisense.com

Key Highlights: World’s largest supplier of uv-c led disinfection systems · Full Spectrum UV LED Solutions · Providing innovative solutions disrupting multiple industries….

#4 UV-C air disinfection

Domain Est. 1987

Website: lighting.philips.com

Key Highlights: Explore Philips lighting’s range of high-quality UV-C products designed to disinfect air, water, and surfaces. Create a safer and healthier environment ……

#5 Ultraviolet Light Disinfection and Microbial reduction, UV …

Domain Est. 1997

Website: americanultraviolet.com

Key Highlights: Ultraviolet Light Disinfection and Microbial reduction, UV Disinfection and Microbial reduction Lamps for the Medical Industry from American Ultraviolet….

#6 sterilAir AG

Domain Est. 1997 | Founded: 1939

Website: sterilair.com

Key Highlights: With a market presence since 1939, sterilAir AG, based in Switzerland, is one of the world’s oldest and most experienced companies for sterilisation systems….

#7 Lumalier: UV

Domain Est. 1998

Website: lumalier.com

Key Highlights: Lumalier is the recognized leader in advanced UV-C Light Disinfection products designed to benefit commercial and residential markets….

#8 UV Light Sterilizer

Domain Est. 2000

#9 Ultravation

Domain Est. 2002

Website: ultravation.com

Key Highlights: The patented T3™ UV lamp design optimizes UV output of the lamp through thermal stabilization. Available with 18,000-hour or 27,000-hour lamp life. T3 UV lamp ……

#10 Tru-D SmartUVC: UV Light Disinfection

Domain Est. 2011 | Founded: 2007

Website: tru-d.com

Key Highlights: Since 2007, Tru-D SmartUVC has been a leader in the UV space with intelligent, intuitive disinfection solutions for the cleanest spaces possible….

Expert Sourcing Insights for Uv Light Sterilizer

H2: 2026 Market Trends for UV Light Sterilizers

The global UV light sterilizer market is poised for significant transformation by 2026, driven by technological advancements, heightened hygiene awareness, and expanding applications across healthcare, consumer electronics, and public infrastructure. Below are the key trends expected to shape the market landscape:

-

Increased Demand in Healthcare and Public Spaces

By 2026, UV light sterilizers are anticipated to become standard equipment in hospitals, clinics, and public transportation systems. The lingering impact of global health crises has underscored the need for rapid, chemical-free disinfection. Hospitals are increasingly adopting UV-C robots for room sterilization, while airports, schools, and offices are installing fixed or portable UV systems to maintain clean environments. -

Adoption of Far-UVC Technology

A major technological breakthrough influencing the 2026 market is the rise of far-UVC (222 nm) lighting. Unlike traditional UV-C (254 nm), far-UVC is considered safer for human exposure while remaining effective against pathogens. Regulatory approvals and growing scientific validation are expected to accelerate its integration into occupied spaces, such as retail stores and gyms. -

Integration with Smart and IoT-Enabled Devices

UV sterilizers are becoming smarter, with many new models featuring IoT connectivity, motion sensors, and remote monitoring via mobile apps. By 2026, smart UV devices that automatically activate based on occupancy or contamination levels will gain traction, especially in commercial buildings and smart homes. -

Growth in Consumer and Home Applications

The consumer segment is expanding rapidly, with UV sterilizers now available for home use—ranging from phone sanitizers and water purifiers to UV-equipped air purifiers and HVAC systems. Increasing health consciousness among households is fueling demand, particularly in urban areas of North America, Europe, and Asia-Pacific. -

Regulatory and Safety Standards Evolution

As UV sterilization becomes more widespread, governments and international bodies are expected to enforce stricter safety and performance standards by 2026. This includes certification requirements for UV dosage, timer controls, and ozone emissions, which will influence product design and market entry strategies. -

Sustainability and Energy Efficiency Focus

Manufacturers are prioritizing energy-efficient LED-based UV systems over traditional mercury lamps. The shift supports sustainability goals and aligns with global regulations phasing out mercury-containing devices. By 2026, eco-friendly UV sterilizers with longer lifespans and lower power consumption will dominate the market. -

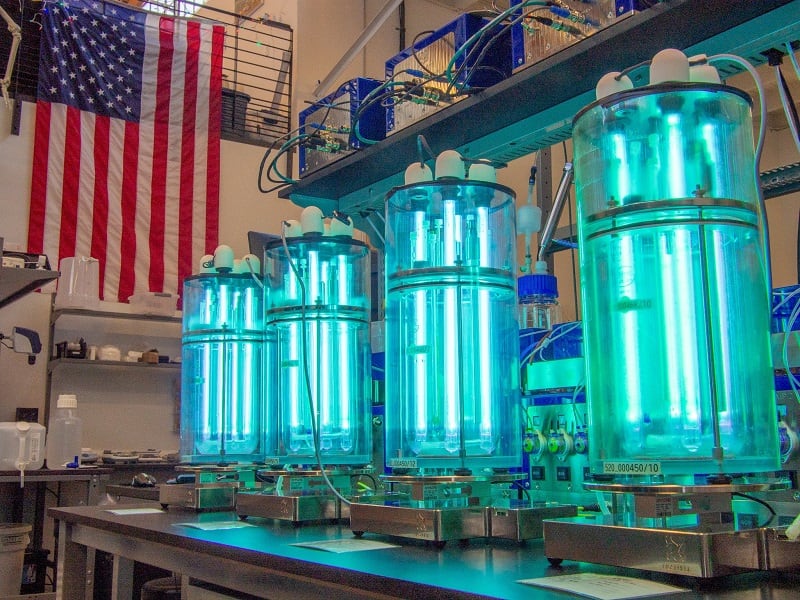

Emerging Applications in Food Safety and Water Treatment

Beyond healthcare and consumer goods, UV sterilization is gaining ground in food processing and municipal water treatment. Compact, scalable UV systems are being adopted to disinfect packaging, surfaces, and drinking water without altering taste or adding chemicals. -

Market Consolidation and Innovation

The competitive landscape is expected to see increased M&A activity and partnerships between UV technology firms and established healthcare or electronics companies. Innovation hubs in the U.S., Germany, South Korea, and China will lead in R&D, particularly in miniaturization and AI-driven sterilization scheduling.

In conclusion, the 2026 UV light sterilizer market will be characterized by technological sophistication, broader application scope, and stronger regulatory oversight. Companies that invest in safe, smart, and sustainable UV solutions are likely to capture significant market share in this evolving industry.

Common Pitfalls When Sourcing UV Light Sterilizers: Quality and Intellectual Property Risks

Sourcing UV light sterilizers—especially from international suppliers—can offer cost advantages, but it also comes with significant risks related to product quality and intellectual property (IP) infringement. Being aware of these common pitfalls helps businesses avoid costly setbacks, regulatory issues, and reputational damage.

Quality-Related Pitfalls

1. Inaccurate or Exaggerated UV-C Output Claims

Many suppliers overstate the intensity or germicidal effectiveness of their UV-C lamps. Some may quote total lamp wattage instead of actual UV-C output, which can be significantly lower. Without third-party testing or radiometric verification, you may receive units that fail to deliver the promised disinfection performance.

2. Poor Construction and Substandard Materials

Low-cost sterilizers often use cheap plastics that degrade under UV exposure, leading to cracking or discoloration. Inferior electronic components (e.g., unstable power supplies or drivers) can result in inconsistent UV output or premature device failure, reducing both safety and efficacy.

3. Inadequate Safety Features

Reputable UV sterilizers include safety mechanisms like motion sensors, timers, and automatic shutoffs to prevent human exposure to harmful UV-C radiation. Many budget models lack these, posing serious health risks and potential liability.

4. Lack of Certification and Compliance

Watch for missing or fake certifications (e.g., CE, RoHS, FCC, or FDA registration where applicable). Some suppliers falsify documentation or use uncertified components. Always verify certification authenticity through official databases.

5. Ineffective Design and Coverage

Poor chamber design or incorrect lamp placement can create shadow zones where pathogens survive. Without proper reflectivity or dwell time, disinfection is incomplete. Always request performance test data (e.g., log reduction against common pathogens like E. coli or SARS-CoV-2).

Intellectual Property (IP) Pitfalls

1. Supply of Counterfeit or Clone Products

Many UV sterilizer designs—especially popular consumer models—are protected by patents, trademarks, or design rights. Suppliers may offer “compatible” or “generic” versions that closely mimic branded products, infringing on IP rights. Importing such goods can lead to seizure by customs or legal action.

2. Unlicensed Use of Proprietary Technology

Some suppliers incorporate patented UV technologies (e.g., pulsed xenon, amalgam lamps, or specific control systems) without proper licensing. Sourcing from such suppliers exposes your business to indirect liability, especially in regulated markets.

3. Weak or Absent IP Verification in Contracts

Failing to include IP indemnity clauses in procurement agreements leaves buyers vulnerable. Ensure contracts require suppliers to guarantee that products do not infringe on third-party IP and to assume responsibility for any claims.

4. Misuse of Branding and Logos

Suppliers may include unauthorized branding on devices or packaging. This not only violates trademark law but can also mislead end users and damage your company’s reputation if discovered.

5. Limited Traceability and Documentation

Opaque supply chains make it hard to verify the origin of components and design. Without proper documentation, proving the legitimacy of a product’s IP status during audits or legal disputes becomes nearly impossible.

Mitigation Strategies

- Demand third-party test reports from accredited labs verifying UV-C output and disinfection efficacy.

- Conduct factory audits or hire third-party inspection services before bulk orders.

- Verify certifications independently through official regulatory portals.

- Perform IP due diligence by consulting legal experts to assess product and supplier risks.

- Include strong IP warranties and indemnification clauses in supplier contracts.

- Work with legally vetted, transparent suppliers who can provide full component traceability.

Avoiding these pitfalls ensures you source UV sterilizers that are both effective and legally compliant, protecting your business and end users.

Logistics & Compliance Guide for UV Light Sterilizer

Product Classification & Regulatory Overview

UV light sterilizers are typically classified as electronic devices and may fall under medical device regulations depending on their intended use. If marketed for sanitizing medical instruments or making health claims (e.g., “kills 99.9% of bacteria and viruses”), they may be subject to oversight by regulatory bodies such as the U.S. Food and Drug Administration (FDA), the European Union’s Medical Device Regulation (MDR), or similar authorities in other regions. Non-medical sterilizers (e.g., for consumer use on phones or household items) are generally regulated as consumer electronics but must still comply with safety and electromagnetic compatibility standards.

International Shipping & Export Compliance

When shipping UV light sterilizers internationally, exporters must comply with export control regulations such as the U.S. Export Administration Regulations (EAR) or the EU Dual-Use Regulation. While most UV sterilizers are not classified as dual-use items, products containing specific electronic components or intended for sensitive applications may require export licenses. Accurate classification under the Harmonized System (HS) code is essential—common codes include 8543.70 (electrical apparatus for ultraviolet radiation) or 8516.79 (other electrical appliances). Proper documentation, including commercial invoices, packing lists, and certificates of origin, must accompany shipments.

Electrical Safety & Certification Requirements

UV light sterilizers must meet electrical safety standards in the destination market. In the United States, compliance with UL 1598 (for luminaires) or UL 61010 (for electrical equipment for measurement, control, and laboratory use) may apply. In the European Union, CE marking is mandatory, requiring conformity with the Low Voltage Directive (LVD), Electromagnetic Compatibility (EMC) Directive, and the RoHS Directive restricting hazardous substances. Other regions may require additional certifications such as CCC (China), PSE (Japan), or KC (South Korea). Testing by accredited laboratories is typically required to obtain these certifications.

Hazardous Materials & Safety Warnings

Although UV light sterilizers do not usually contain hazardous materials, they emit ultraviolet radiation, which poses health risks if misused. Products must include clear safety warnings indicating that direct exposure to UV-C light can harm skin and eyes. Packaging and user manuals should instruct users to avoid direct exposure, use protective features (e.g., safety interlocks), and operate the device only as intended. Battery-powered models must comply with IEC 62133 for safe handling and transportation of secondary cells and batteries.

Import Regulations & Customs Clearance

Importers must ensure that UV sterilizers meet the technical and labeling requirements of the destination country. This includes language-specific user instructions, conformity marks (e.g., CE, UKCA, FCC), and proper voltage compatibility (e.g., 110V vs. 220V). Customs authorities may inspect shipments for compliance, and non-conforming products may be detained or rejected. Pre-shipment verification through a Certificate of Conformity (CoC) or third-party inspection may be required in countries such as Saudi Arabia (SASO) or Russia (EAC certification).

Environmental & Disposal Compliance

UV sterilizers are subject to environmental regulations governing end-of-life disposal. In the EU, compliance with the Waste Electrical and Electronic Equipment (WEEE) Directive requires producers to register and provide take-back options for used devices. In the U.S., state-level regulations such as California’s Electronic Waste Recycling Act may apply. Manufacturers should design products for recyclability and avoid restricted substances listed under RoHS or similar laws.

Labeling & Packaging Requirements

All UV sterilizers must be labeled with essential information, including manufacturer name, model number, electrical ratings (voltage, wattage, frequency), safety certifications, and warning symbols (e.g., UV radiation hazard). Multilingual labeling may be required for export markets. Packaging should protect the device during transit and include user manuals with safety instructions, regulatory compliance statements, and warranty details.

Post-Market Surveillance & Reporting

Manufacturers must establish systems for monitoring product performance and addressing customer complaints or incidents. In regulated markets, adverse events related to device malfunction or safety issues must be reported to relevant authorities (e.g., FDA MedWatch, EU Vigilance system). Maintaining technical documentation and update logs supports ongoing compliance and facilitates audits or inspections.

Conclusion for Sourcing UV Light Sterilizer

Sourcing a UV light sterilizer requires careful evaluation of several key factors, including efficacy, safety, application compatibility, and long-term operational costs. After thorough research and comparison of available options, it is evident that selecting a high-quality UV-C sterilization system from a reputable manufacturer ensures reliable microbial inactivation across various settings—whether for healthcare, laboratories, water treatment, or consumer use.

Prioritizing devices with verified UV-C output, appropriate exposure times, and safety certifications (such as CE, FDA, or NSF) is essential to achieving effective disinfection while protecting users. Additionally, considering ease of integration, maintenance requirements, and energy efficiency contributes to sustainable and cost-effective implementation.

In conclusion, a well-sourced UV light sterilizer not only enhances hygiene and infection control but also provides a chemical-free, environmentally friendly alternative to traditional disinfection methods. By focusing on performance, safety, and supplier reliability, organizations can make informed decisions that support long-term health and operational goals.