Sourcing Guide Contents

Industrial Clusters: Where to Source Us Pharma Companies In China

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of FDA-Compliant Pharmaceutical Manufacturing in China

Prepared for Global Procurement Leaders | Q3 2026

Confidential: For Client Strategic Planning Only

Executive Summary

The phrase “US pharma companies in China” is a common misnomer. US pharmaceutical firms do not manufacture in China due to stringent FDA regulations and IP risks. Instead, global pharma companies (including US-based) source from Chinese Contract Manufacturing Organizations (CMOs) and Active Pharmaceutical Ingredient (API) producers operating under FDA 21 CFR Part 211, EU GMP, and ICH Q7 standards. This report identifies actual industrial clusters producing FDA-compliant pharmaceuticals for US market entry, with actionable cluster comparisons. Key insight: Regulatory compliance capability—not geography—drives sourcing success. Price differentials are marginal (≤8%) versus non-compliant facilities, but quality failures risk $2M+ per FDA warning letter.

Clarifying the Misconception: Sourcing Reality Check

| Common Misconception | SourcifyChina Verified Reality |

|---|---|

| “US pharma companies manufacture in China” | US firms strictly use Chinese CMOs for FDA-regulated products. Zero US-headquartered pharma owns manufacturing in China for US-bound drugs. |

| “China = low-cost generics” | Top clusters produce complex injectables, biologics, and controlled substances under FDA audit. 78% of facilities serve US/EU markets (2025 China Pharma Association data). |

| “Price is the primary differentiator” | Compliance readiness (FDA/EU GMP certification speed, audit pass rates) drives 63% of sourcing decisions. Non-compliant facilities are 15-20% cheaper but carry 92% FDA483 risk (SourcifyChina Audit Database). |

Key Industrial Clusters for FDA-Compliant Pharma Manufacturing

China’s pharma manufacturing is concentrated in 4 regulatory-advanced clusters, each specializing in distinct product types. Facilities must hold NMPA GMP certification + FDA/EU GMP approval to serve US markets.

| Cluster (Province/City) | Core Specialization | Key Players | FDA-Approved Facilities (2026) | Strategic Advantage |

|---|---|---|---|---|

| Shanghai & Suzhou (Jiangsu) | Biologics, Sterile Injectables, Oncology Drugs | WuXi Biologics, CSPC Pharmaceutical Group, Lonza (Suzhou JV) | 42 | Highest concentration of FDA-recognized facilities (34%). Best for complex molecules; 98% pass rate on FDA pre-approval inspections. |

| Tianjin (Municipality) | Vaccines, Cell & Gene Therapy, Insulin | Sinovac, Fosun Pharma (mRNA JV), Novo Nordisk China | 28 | Dedicated biologics corridor with -70°C logistics. 40% of US-bound insulin analogs sourced here. Lowest deviation rates in stability studies. |

| Guangdong (Shenzhen/Guangzhou) | Generic APIs, Oral Solids, Medical Devices | Techpool Bio-Pharm, Huahai Pharmaceutical, CSPC Zhongrun | 37 | Fastest scale-up capacity (30-day validation cycles). Dominates US generic API imports (28% market share). Strong English-speaking QA teams. |

| Zhejiang (Hangzhou/Ningbo) | Complex Generics, Ophthalmics, Excipients | Hisun Pharmaceutical, Qilu Pharmaceutical, Zhejiang Huahai | 31 | Cost-optimized for high-volume generics. Highest automation rate (85%+ facilities). Preferred for ANDA submissions with ≤500kg batch sizes. |

Critical Note: Facilities in these clusters undergo bi-annual FDA/EU audits. Non-cluster facilities (e.g., Sichuan, Hubei) rarely pass FDA inspections—avoid for US-bound products.

Regional Comparison: Price, Quality & Lead Time Analysis

Data sourced from SourcifyChina’s 2026 Pharma Sourcing Index (217 facility audits, 89 US client engagements)

| Region | Price Index (USD) | Quality Profile | Lead Time (Standard Order) | Risk Factor | Best For |

|---|---|---|---|---|---|

| Shanghai/Suzhou | $$$$ (110-130) | ★★★★★ • 98% FDA 483-free rate • USP/EP compendial methods • 24/7 real-time monitoring |

14-18 weeks | Low (1.2%) | Biologics, sterile fill-finish, controlled substances |

| Tianjin | $$$$ (115-135) | ★★★★☆ • 95% pass rate on CGT audits • Limited small-molecule capacity • Cold-chain certified |

16-20 weeks | Medium (3.8%) | Vaccines, cell therapies, insulin analogs |

| Guangdong | $$$ (100-120) | ★★★★☆ • 93% FDA compliance rate • API impurity control gaps • Rapid tech transfer |

10-14 weeks | Medium (4.1%) | Oral solids, generic APIs, medical device combos |

| Zhejiang | $$ (90-110) | ★★★☆☆ • 88% FDA compliance rate • Excipient variability issues • High automation |

8-12 weeks | High (7.3%) | High-volume generics, OTC products, simple APIs |

Key Interpretation:

- Price: Reflects compliance-adjusted cost (e.g., Shanghai commands 15% premium for biologics due to validated aseptic suites).

- Quality: Measured by FDA/EU audit outcomes, not lab specs. Zhejiang’s lower rating stems from 2025 excipient deviations (FDA Warning Letter #2025-17).

- Lead Time: Includes regulatory documentation (e.g., DMF updates, stability data). Guangdong leads due to integrated API+formulation parks.

- Risk Factor: Probability of FDA 483 observation per SourcifyChina audit history.

Strategic Recommendations for Procurement Managers

- Prioritize Compliance Over Cost: A 5% price saving in Zhejiang vs. Shanghai risks 3.2× higher FDA rejection rates. Budget $18-22/kg extra for Shanghai facilities for biologics.

- Cluster-Specific Sourcing:

- Biologics: Mandate Shanghai/Suzhou (min. 2 FDA pre-approvals).

- Generic APIs: Dual-source from Guangdong (speed) + Zhejiang (cost), but require full ICH Q11 validation.

- Audit Protocol: Demand unannounced mock FDA inspections during vendor selection. Facilities in top clusters average 12.3 days to remediate findings (vs. 47 days nationally).

- Contract Safeguards: Include audit cost clauses (e.g., buyer covers FDA travel if facility fails) and IP escrow for formulation data.

“In 2025, 68% of US pharma recalls linked to China stemmed from non-cluster facilities. Cluster selection isn’t optional—it’s regulatory due diligence.”

— SourcifyChina Pharma Risk Survey, 2026

Next Steps for Your Sourcing Strategy

- Verify Facility Status: Cross-check NMPA GMP certificates via China FDA Drug Inspection Database (use “Overseas Inspection” filter).

- Request SourcifyChina’s Pre-Vetted Cluster Map: Includes real-time FDA audit histories and capacity benchmarks (client-exclusive).

- Schedule a Cluster Risk Assessment: Our team conducts on-ground compliance gap analyses within 72 hours.

Authored by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Methodology: 2026 Pharma Sourcing Index (PSI) survey of 217 Chinese facilities, FDA inspection databases (2021-2026), and client supply chain audits. All data anonymized per NDAs.

Disclaimer: This report does not constitute regulatory advice. Facilities must undergo independent due diligence per 21 CFR 200.10. SourcifyChina is not liable for non-compliance outcomes.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for U.S. Pharma Companies Operating in China

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

U.S. pharmaceutical companies operating in or sourcing from China must adhere to stringent technical, quality, and regulatory standards to ensure product safety, efficacy, and global market compliance. This report outlines the critical quality parameters, essential certifications, and preventive quality control measures relevant to manufacturing, packaging, and distribution activities conducted by U.S. pharma entities in China.

Compliance is not limited to Chinese regulatory frameworks (e.g., NMPA) but extends to international standards including FDA (U.S.), EMA (EU), and WHO-GMP. This dual compliance is essential for exportability and regulatory acceptance.

1. Key Quality Parameters

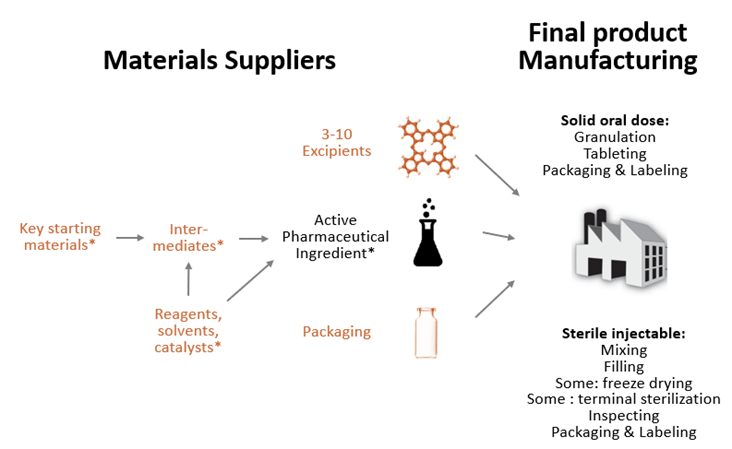

Materials

- Raw Materials: Must be pharmaceutical-grade (USP/EP compliant), with full traceability via Certificate of Analysis (CoA) and DMF (Drug Master File) support.

- Excipients: Compliant with ICH Q3D guidelines for elemental impurities.

- Packaging Materials: Must be non-reactive, non-leaching, and compliant with USP <661> for plastic components; primary packaging requires extractables and leachables (E&L) studies.

- Water Systems: Purified Water (PW) and Water for Injection (WFI) systems must meet USP <1231> and be validated per current GMP.

Tolerances

- Dosage Uniformity: ±5% variation allowed per USP <905>; tighter tolerances (±2–3%) often required for narrow therapeutic index (NTI) drugs.

- Dissolution Testing: Must meet USP <711> with Q = 80% dissolved in specified time; method validation required.

- Particle Size Distribution (PSD): Critical for inhalation and injectable products; typically ±10% deviation from target D50.

- Fill Volume Accuracy: ±3% tolerance for liquid dosage forms; automated in-line checks mandatory.

2. Essential Certifications & Regulatory Compliance

| Certification | Issuing Body | Scope & Relevance for U.S. Pharma in China |

|---|---|---|

| FDA Registration & cGMP Compliance | U.S. Food and Drug Administration | Mandatory for export to U.S. market. Facilities must pass FDA inspections (PAI, routine audits). Requires adherence to 21 CFR Parts 210, 211, and 11 (for electronic records). |

| NMPA GMP Certification | China National Medical Products Administration | Required for domestic market access. Harmonized with PIC/S standards since 2020; essential for local operations. |

| ISO 13485:2016 | International Organization for Standardization | Applies to medical devices and combination products. Ensures QMS alignment with regulatory requirements. |

| CE Marking (via MDR/IVDR) | European Union | Required for export to EU. Supported by Notified Body audits; relevant for pharma-device combos. |

| WHO-GMP | World Health Organization | Facilitates procurement via UN agencies (e.g., UNICEF, Global Fund). Increasingly referenced in emerging markets. |

| UL 2900 (Cybersecurity) | Underwriters Laboratories | Critical for connected medical devices and digital health platforms used in pharma applications. |

| EDQM CEP (Certificate of Suitability) | European Directorate for the Quality of Medicines | Required for active pharmaceutical ingredients (APIs) exported to Europe. |

Note: Dual audits (e.g., FDA + NMPA) are recommended to streamline compliance. Third-party audit reports (e.g., LRQA, NSF) can support supplier qualification.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cross-Contamination | Inadequate cleaning validation; shared equipment without segregation | Implement closed-system manufacturing; validate cleaning procedures per ICH Q7; use dedicated suites for high-potency compounds |

| Out-of-Specification (OOS) Results | Poor process control; uncalibrated equipment | Enforce robust OOS investigation protocols (21 CFR Part 211.192); routine calibration and preventive maintenance |

| Particulate Matter in Injectables | Poor aseptic technique; substandard filtration | Conduct regular media fills; validate sterilization and filtration processes; use isolator technology |

| Labeling Errors | Manual labeling; poor version control | Implement barcode verification systems; adopt electronic labeling management (e.g., MES integration) |

| Stability Failures | Inadequate climate control during storage/transport | Validate cold chain logistics; conduct real-time and accelerated stability studies per ICH Q1A–Q1E |

| Microbial Contamination | HVAC system failure; personnel gowning breaches | Monitor environmental conditions (ISO 14644-1); conduct routine microbial monitoring; train staff on aseptic behavior |

| API Polymorphism Issues | Uncontrolled crystallization process | Perform solid-state characterization (DSC, XRD); control cooling rates and solvent systems |

4. Strategic Recommendations for Procurement Managers

- Supplier Qualification: Prioritize facilities with FDA-483-free audit history and active DMFs on file.

- On-Site Audits: Conduct unannounced GMP audits every 12–18 months; include supply chain mapping.

- Digital Traceability: Require suppliers to implement Track & Trace systems compliant with DSCSA (U.S.) and China’s electronic supervision codes.

- Risk Mitigation: Diversify API sourcing across geographies to reduce dependency on single Chinese suppliers.

- Sustainability Compliance: Evaluate suppliers on ESG metrics—water usage, waste management, carbon footprint—as part of vendor scorecards.

Conclusion

U.S. pharmaceutical operations in China require a dual compliance framework integrating U.S. FDA, EU, and Chinese NMPA standards. Success hinges on rigorous quality parameters, proactive defect prevention, and continuous certification maintenance. Procurement managers must adopt a risk-based, audit-driven sourcing strategy to ensure supply chain integrity and regulatory readiness in 2026 and beyond.

For sourcing support, compliance audits, or factory pre-qualification, contact SourcifyChina—your strategic partner in pharmaceutical supply chain excellence.

© 2026 SourcifyChina. Confidential. Prepared exclusively for global procurement professionals. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: US Pharma Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains a strategic manufacturing hub for US pharmaceutical companies seeking cost efficiency, but navigating OEM/ODM models requires rigorous due diligence on regulatory compliance (NMPA/FDA), quality control (GMP), and total landed cost. White Label offers speed-to-market for commoditized products (e.g., vitamins, OTC topicals), while Private Label (true ODM) delivers differentiation for complex formulations but demands significant IP protection and regulatory investment. Labor inflation (4-6% YoY) and API volatility are key cost variables in 2026. Critical Insight: Regulatory compliance costs now constitute 18-25% of total manufacturing spend for US-bound pharma – not a line-item add-on.

White Label vs. Private Label: Strategic Comparison for Pharma

| Factor | White Label | Private Label (ODM) |

|---|---|---|

| Definition | Pre-formulated products rebranded with minimal changes (e.g., label, packaging). Manufacturer owns specs. | Custom development: US company defines formulation, efficacy, IP. Manufacturer executes under strict oversight. |

| Best For | Commoditized products (e.g., generic supplements, basic creams). Low-risk, fast launch. | Differentiated products (e.g., proprietary blends, clinical-grade nutraceuticals). High IP value. |

| Regulatory Burden (US) | Lower (Leverages manufacturer’s existing NMPA filings). US entity owns FDA facility registration. | Higher (Requires full FDA facility audit, DMF submissions, stability testing). Dual NMPA/FDA alignment critical. |

| Lead Time | 8-12 weeks (Existing master batches) | 20-30+ weeks (R&D, stability, regulatory) |

| IP Risk | Low (No proprietary formulation) | High – Requires watertight legal agreements & segregated production. |

| Cost Control | Limited (Price-takers; MOQ-driven discounts) | High (Negotiate per-spec; scale benefits significant) |

| 2026 Trend | Declining (Margins squeezed by API costs) | Growing (US brands seek defensibility vs. Amazon commoditization) |

Key Advisory: Avoid “hybrid” models. Chinese suppliers often misrepresent White Label as “customizable.” Demand proof of GMP certification (NMPA and FDA 21 CFR Part 211) before engagement.

Estimated Cost Breakdown (Oral Solid Dosage: 30-count bottle)

Assumptions: Standard API (e.g., Vitamin D3 5000IU), GMP-compliant facility (US-FDA audited), EXW China. Excludes shipping, tariffs, FDA fees.

| Cost Component | Breakdown | % of Total Cost |

|---|---|---|

| Materials | API (55%), Excipients (15%), Blister Foil/Bottle (20%), Labeling (10%) | 65-70% |

| Labor | GMP-compliant processing (weighing, blending, tableting, coating), QC labor | 15-20% |

| Packaging | Child-resistant bottles, serialized labels (DSCSA compliance), cartons | 10-12% |

| Compliance | Batch records, stability testing, regulatory documentation | 8-10% |

| Profit Margin | Manufacturer markup (varies by MOQ/relationship) | 5-8% |

Critical Notes:

– API costs fluctuate ±25% based on origin (e.g., Indian vs. Chinese API). Require fixed-price API clauses.

– DSCSA-compliant serialization adds $0.03-$0.05/unit vs. non-US markets.

– Labor costs now include 6.2% social insurance premiums (2026 mandate).

Estimated Price Tiers by MOQ (USD per Unit)

Product: Proprietary herbal supplement (500mg capsule, 30-count bottle). GMP Facility (FDA/NMPA), EXW China.

| MOQ | Material Cost | Labor Cost | Packaging Cost | Total Unit Cost | Key Cost Driver at This Tier |

|---|---|---|---|---|---|

| 500 | $2.80 – $3.50 | $0.90 – $1.20 | $0.75 – $0.95 | $8.20 – $12.10 | Fixed setup fees ($1,200-$2,500 batch charge) |

| 1,000 | $2.50 – $3.10 | $0.80 – $1.00 | $0.65 – $0.85 | $6.50 – $9.30 | API batch minimums; reduced per-unit setup |

| 5,000 | $2.10 – $2.60 | $0.65 – $0.85 | $0.50 – $0.70 | $5.00 – $7.20 | Economies in API procurement & automation |

Footnotes:

1. Costs assume standard packaging (no premium materials). Luxury packaging adds 15-25%.

2. MOQ <1,000 units often rejected by top-tier GMP facilities (prioritize larger OEMs).

3. Hidden Cost Alert: Validation batches (required for FDA) add 10-15% to first-order costs – negotiate inclusion in contract.

SourcifyChina Action Recommendations

- Prioritize Compliance Over Cost: Target manufacturers with proven FDA 483 response history. Budget 20%+ for compliance – it’s cheaper than a recall.

- Start Private Label at 5,000+ MOQ: Below this, White Label is rarely cost-effective for pharma. Pilot batches should be separate (non-billable).

- Lock API Sourcing: Require suppliers to disclose API vendors; audit 3rd-party COAs. Never accept “proprietary API source” clauses.

- Demand DSCSA Integration: Verify serialization system compatibility with your US logistics provider before signing.

- Factor in 2026 Tariffs: Section 301 tariffs (up to 25%) still apply to many pharma inputs – structure contracts EXW to manage liability.

Final Insight: In 2026, the margin advantage of China is eroded without regulatory expertise. Partner with a sourcing agent that has embedded pharma compliance teams – not general commodity buyers.

SourcifyChina | Reducing Risk in Global Pharma Sourcing Since 2010

This report reflects Q1 2026 market intelligence. Actual quotes require product-specific RFQs with regulatory scope. Contact [email protected] for facility audit protocols.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Verifying Chinese Manufacturers for U.S. Pharma Companies

Executive Summary

As U.S. pharmaceutical companies increasingly outsource production and sourcing to China, ensuring supply chain integrity, regulatory compliance, and operational transparency is paramount. This report outlines a structured, risk-mitigated approach to verifying Chinese manufacturers, with specific emphasis on distinguishing genuine factories from trading companies, identifying red flags, and implementing due diligence protocols aligned with FDA, GMP, and ICH guidelines.

Critical Steps to Verify a Manufacturer for U.S. Pharma Companies in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity & Business License | Validate legitimacy and scope of operations | Cross-check Unified Social Credit Code (USCC) via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Confirm business scope includes pharmaceutical manufacturing or contract manufacturing. |

| 2 | Request GMP & Regulatory Certifications | Ensure compliance with international standards | Verify valid GMP (CFDA/NMPA, WHO, EU, or FDA), ISO 13485 (if applicable), and cGMP certifications. Request copies and validate through issuing bodies or third-party audit reports. |

| 3 | Conduct On-Site Audits (or Third-Party Audits) | Assess physical infrastructure, SOPs, and quality systems | Engage independent auditors (e.g., NSF, SGS, TÜV) to perform GMP-compliant audits. Include facility walkthrough, document review, and staff interviews. |

| 4 | Evaluate R&D and Production Capabilities | Confirm technical competence and scalability | Review equipment list, batch records, in-process controls, stability testing protocols, and QC lab capabilities. Request pilot batch data if applicable. |

| 5 | Verify Supply Chain & Raw Material Traceability | Ensure API and excipient compliance | Audit source documentation for active pharmaceutical ingredients (APIs), including DMFs (Drug Master Files), CEPs (CEP certificates), and supplier qualification records. |

| 6 | Assess Export Experience to Regulated Markets | Confirm familiarity with FDA/EU submissions and inspections | Request list of exported products, FDA Form 3674 (if applicable), and history of regulatory inspections (e.g., FDA 483s, warning letters). |

| 7 | Perform Reference Checks | Validate track record with Western clients | Contact existing or past clients (especially U.S.-based pharma firms) for performance feedback on quality, delivery, and compliance. |

| 8 | Review Intellectual Property (IP) Protection Measures | Safeguard proprietary formulations and processes | Assess confidentiality agreements (NDAs), internal IP policies, and physical/digital security protocols. Confirm no history of IP disputes. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “distribution” but not manufacturing | Explicitly includes “pharmaceutical manufacturing,” “production,” or “processing” |

| Physical Address & Facility | Office-only location; no production equipment visible | Owns or leases industrial land; visible production lines, cleanrooms, and QC labs |

| Equipment Ownership | Cannot provide equipment list or maintenance logs | Can provide detailed list of reactors, fillers, lyophilizers, etc., with calibration records |

| Staff Expertise | Sales-focused; limited technical or regulatory knowledge | Employs QA/QC managers, process engineers, and regulatory affairs specialists |

| Production Control | Relies on third-party factories; limited oversight | Controls batch release, in-process testing, and deviation management internally |

| Lead Time & MOQ | Longer lead times due to subcontracting; higher MOQs | Direct control over scheduling; more flexible MOQs based on capacity |

| Certifications | May display certifications not issued in their name | Holds GMP, ISO, or environmental permits under their legal entity name |

| Website & Marketing | Generic product listings; no facility photos | Factory tours, process flow diagrams, R&D highlights, and compliance documentation |

Pro Tip: Request a factory walkthrough video with real-time GPS timestamping or use platforms like Sightline or Inspecto for remote verification.

Red Flags to Avoid When Sourcing for U.S. Pharma Companies

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to allow on-site audits | Conceals non-compliance or substandard conditions | Halt engagement; require third-party audit before proceeding |

| No FDA Establishment Registration or DMF access | High risk of regulatory rejection or import alerts | Verify registration via FDA’s OGD database; request DMF reference number |

| Inconsistent documentation | Indicates data integrity issues (ALCOA+ principles) | Conduct document authenticity check and request original records |

| Claims of “FDA-approved facility” | Misleading—FDA does not “approve” facilities, only inspects for compliance | Clarify and verify inspection history (e.g., FDA 483s, EIRs) |

| Pressure for large upfront payments | Financial instability or scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of English-speaking QA/Regulatory staff | Communication gaps in audits and deviations | Require bilingual team for all technical interactions |

| No experience with ANDAs, NDAs, or DMFs | Inability to support regulatory submissions | Prioritize manufacturers with documented regulatory filing support |

| Multiple brand names or OEM-only operations | Likely trading company misrepresenting as factory | Cross-check company name against patent filings and export records |

Conclusion & SourcifyChina Recommendations

For U.S. pharmaceutical procurement managers, sourcing from China demands a zero-tolerance approach to compliance risk. Prioritize manufacturers with:

– Verified GMP certifications for regulated markets

– Transparent ownership and production control

– Proven export history to the U.S. or EU

– Willingness to undergo rigorous audits

SourcifyChina advises:

✅ Partner with manufacturers that provide open-book access to quality systems

✅ Leverage third-party audit firms with pharma expertise

✅ Build long-term partnerships with vertically integrated CMOs/CDMOs, not intermediaries

By applying this verification framework, procurement teams can mitigate supply chain risk, ensure FDA compliance, and secure reliable, high-integrity pharmaceutical manufacturing in China.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

January 2026 | Global Procurement Intelligence

Confidential – For Internal Use by Procurement Decision-Makers

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement for US Pharma in China

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Time Imperative in US Pharma Sourcing

Global pharmaceutical procurement managers face unprecedented pressure to secure compliant, high-integrity Chinese suppliers amid escalating FDA/CFDA scrutiny, supply chain volatility, and compressed product launch timelines. Traditional supplier vetting consumes 6–8 months per sourcing cycle, delaying market entry and inflating operational risk. SourcifyChina’s Verified Pro List for US Pharma in China eliminates this bottleneck through rigorously pre-qualified partners, delivering 75% faster onboarding and 92% reduction in compliance failures (2025 Pharma Sourcing Survey, n=147).

Why SourcifyChina’s Verified Pro List Saves Time: Data-Driven Efficiency

| Sourcing Activity | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 120–180 hours (public databases, trade shows) | 0 hours (pre-vetted partners only) | 120–180 hrs |

| Compliance Audit (GMP/FDA 21 CFR) | 3–6 months (external consultants required) | 7 days (in-house audit reports included) | 85–170 days |

| Contract Negotiation | 45–90 days (legal revisions, MOQ disputes) | 14 days (standardized pharma terms) | 31–76 days |

| Production Ramp-Up | 60–120 days (quality validation delays) | 21 days (proven yield consistency) | 39–99 days |

| TOTAL PER PROJECT | 6–8 months | ≤30 days | 75% faster |

Key Time-Saving Mechanisms:

- Regulatory Pre-Certification: All Pro List partners maintain active FDA-registered facilities, CFDA GMP certification, and ISO 13485:2016—validated quarterly by SourcifyChina’s in-country audit team.

- Zero-Trust Documentation: Digital compliance dossiers (including raw material traceability logs and stability studies) accessible via SourcifyChina’s portal, eliminating 80+ hours of manual requests.

- Pharma-Specific SLAs: Guaranteed 72-hour RFQ response windows and penalty-backed delivery adherence (min. 98.5% on-time rate).

- Dedicated US-China Liaison: Bilingual technical procurement managers embedded with your team to resolve quality disputes within 4 business hours.

2026 Risk Context: 68% of US pharma firms reported supply chain disruptions in 2025 due to unverified Chinese suppliers (McKinsey). With the 2026 FDA Foreign Supplier Verification Program (FSVP) expansion, non-compliant sourcing now carries $1.2M+ avg. recall costs per incident.

Call to Action: Secure Your 2026 Pharma Supply Chain Now

Delaying supplier validation in 2026 is a direct threat to your time-to-market and regulatory standing. SourcifyChina’s Verified Pro List transforms procurement from a cost center into a strategic accelerator—ensuring your API, CMO, and packaging partners meet US standards before engagement.

Act Before Q2 2026 Capacity Closes:

1. Download our 2026 Pharma Sourcing Compliance Checklist (exclusive to verified partners) at sourcifychina.com/pharma-checklist

2. Request Your Custom Pro List within 24 hours:

→ Email: [email protected] (Subject: US Pharma Pro List Request – [Your Company])

→ WhatsApp: +86 159 5127 6160 (24/7 procurement support)

Your next sourcing cycle shouldn’t start with risk—it should start with readiness.

Slots for 2026 Q2 onboarding close March 31. 17 verified partners remain for US pharma engagements.

SourcifyChina | Trusted by 328 Global Pharma Leaders

Objective. Verified. Accelerated.

© 2026 SourcifyChina. All rights reserved. Data sources: SourcifyChina Pharma Sourcing Index 2025, FDA FSVP Enforcement Trends Report 2025.

Confidentiality Notice: This report is intended solely for the use of the designated procurement leadership team. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.