Sourcing Guide Contents

Industrial Clusters: Where to Source U.S. Media Companies Owned By China

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Market Analysis: Sourcing “U.S. Media Companies Owned by China” from China

Executive Summary

This report provides a strategic market analysis for global procurement professionals evaluating the sourcing landscape related to the concept of “U.S. media companies owned by China.” While the phrasing may suggest physical manufacturing of media entities, it is critical to clarify upfront that media companies are not manufactured goods and therefore cannot be produced within industrial clusters in China or elsewhere.

Instead, this report interprets the request as a request for clarity on Chinese ownership of U.S.-based media assets, with an emphasis on how procurement teams may assess supply chain implications, particularly in sectors where media, technology, content distribution, and digital infrastructure intersect with sourcing decisions (e.g., digital advertising platforms, streaming hardware, content licensing, or media-related technology).

China does not “manufacture” U.S. media companies. However, Chinese investment in or ownership of U.S. media and entertainment assets has occurred through strategic acquisitions and joint ventures—primarily executed by Chinese conglomerates based in key economic hubs.

This report outlines:

– Key Chinese firms with U.S. media investments

– Geographic origins of these investing entities within China

– Implications for procurement due diligence

– A comparative analysis of relevant industrial regions—not for manufacturing media companies, but for related hardware and technology ecosystems

Clarification: “Manufacturing” vs. Strategic Investment

| Concept | Reality Check |

|---|---|

| “Manufacturing U.S. media companies” | Not applicable — media companies are legal entities, not physical products |

| Chinese ownership of U.S. media assets | Valid and documented through M&A activity |

| Industrial clusters producing media content | Not applicable — content creation is decentralized and digital |

| Clusters producing media-enabling technology | Highly relevant — e.g., electronics, streaming devices, AI-driven content tools |

Key Chinese Companies with U.S. Media Investments

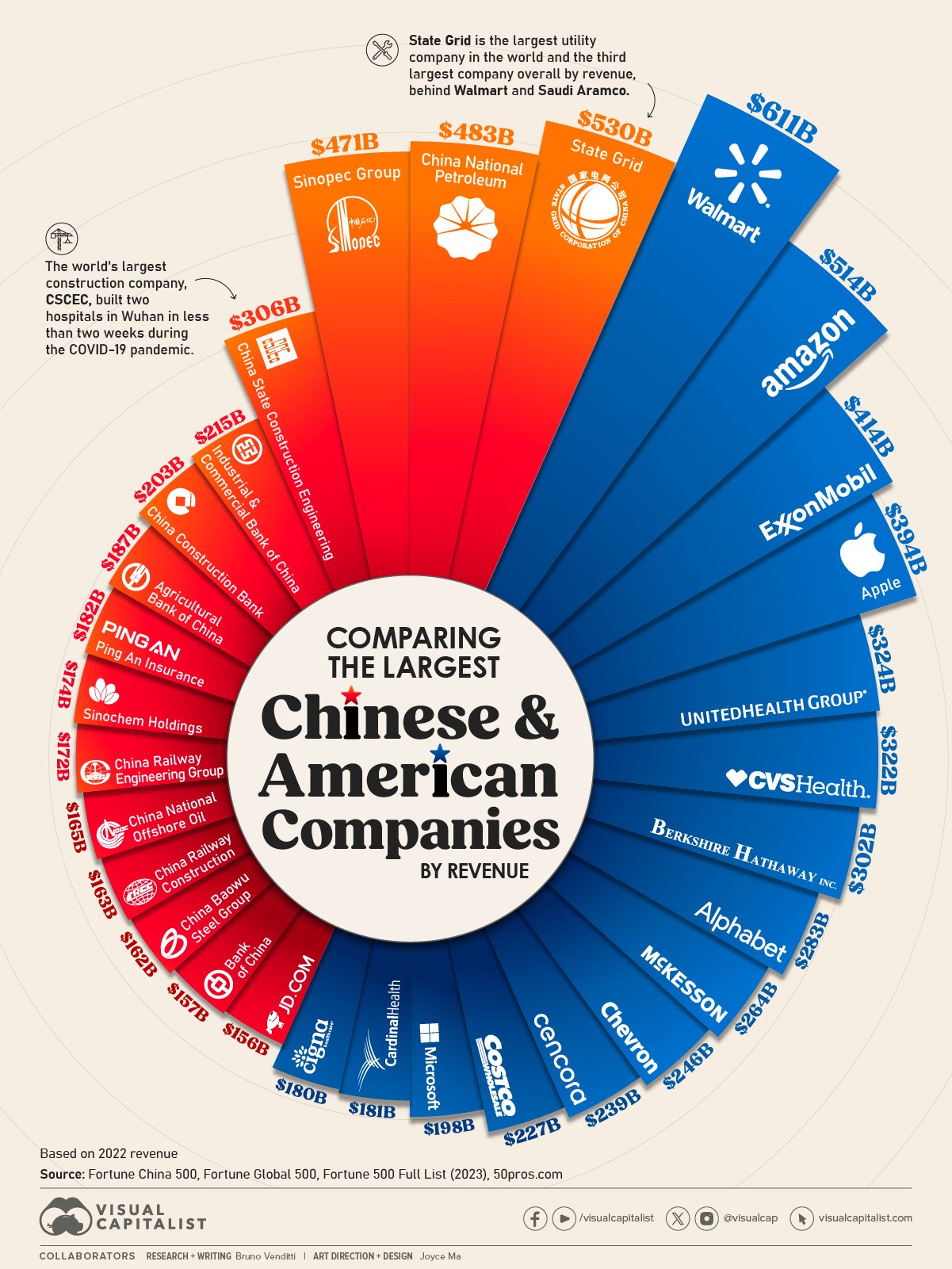

The following Chinese entities have made notable investments in U.S. media or entertainment sectors:

| Chinese Parent Company | Headquarters (China) | U.S. Media Asset | Nature of Ownership |

|---|---|---|---|

| Dalian Wanda Group | Liaoning Province | Legendary Entertainment | Full ownership (acquired 2016) |

| Tencent Holdings | Shenzhen, Guangdong | Stake in Spotify, Tesla (non-media), and minority stakes in U.S. game studios (e.g., Epic Games) | Minority equity investments |

| Alibaba Group | Hangzhou, Zhejiang | Youku (China-focused), limited direct U.S. media holdings | Indirect via digital content platforms |

| Fosun International | Shanghai | Stake in Studio 8 (film production) | Minority investment |

Note: No Chinese entity currently owns a major U.S. broadcast network (e.g., CNN, NBC, Fox). Most investments are in film production, digital content platforms, and gaming—sectors where technology and media converge.

Geographic Origins: Industrial & Corporate Clusters in China

While media companies are not manufactured, the corporate headquarters of the investing Chinese firms are concentrated in key economic zones. These regions also serve as technology and innovation hubs supporting digital media infrastructure.

| Region | Key Cities | Notable Attributes | Relevant to Media Sourcing? |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | Tech innovation, hardware manufacturing, HQ of Tencent | High — key for media tech, streaming devices |

| Zhejiang | Hangzhou | E-commerce, digital platforms, HQ of Alibaba | High — digital content ecosystems |

| Shanghai | Shanghai | Finance, M&A activity, global corporate HQs | Medium — investment and financing hub |

| Beijing | Beijing | Policy, media regulation, tech startups | Medium — policy influence on content |

| Liaoning | Dalian | Industrial base, Wanda Group HQ | Low — isolated major investment |

Comparative Analysis: Key Production Regions for Media-Enabling Technology

For procurement teams sourcing devices, platforms, or infrastructure used in media delivery (e.g., streaming sticks, smart TVs, AI content tools), the following regions are critical. This table compares Guangdong and Zhejiang—the two most relevant provinces.

| Parameter | Guangdong | Zhejiang | Notes |

|---|---|---|---|

| Price Competitiveness | ⭐⭐⭐⭐☆ (4.5/5) | ⭐⭐⭐☆☆ (3.5/5) | Guangdong offers lower labor and scale advantages in hardware |

| Quality of Output | ⭐⭐⭐⭐☆ (4.5/5) | ⭐⭐⭐⭐☆ (4.5/5) | Both regions produce high-quality electronics; Guangdong leads in OEM precision |

| Lead Time | ⭐⭐⭐⭐☆ (4.5/5) | ⭐⭐⭐☆☆ (3.5/5) | Guangdong’s Pearl River Delta has faster logistics and component availability |

| Tech Innovation | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐☆☆ (3.5/5) | Shenzhen is China’s Silicon Valley; strong in IoT, AI, 5G |

| Relevance to Media Hardware | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐☆☆ (3/5) | Smart TVs, streaming devices, cameras often sourced from Guangdong |

| Digital Platform Ecosystems | ⭐⭐⭐☆☆ (3.5/5) | ⭐⭐⭐⭐☆ (4.5/5) | Zhejiang excels in e-commerce and digital content tools via Alibaba/Youku |

Procurement Insight: For physical media-related hardware, prioritize Guangdong. For digital content tools or platform integrations, consider partnerships linked to Zhejiang-based ecosystems.

Strategic Recommendations for Procurement Managers

- Clarify Scope: Distinguish between sourcing media content/assets (not manufacturable) vs. media-enabling hardware and technology (highly active in China).

- Due Diligence on Ownership: When sourcing digital platforms or ad-tech tools, audit for indirect Chinese ownership (e.g., Tencent-backed startups).

- Leverage Guangdong for Hardware: Prioritize Shenzhen and Dongguan for streaming devices, cameras, and AI-driven content tools.

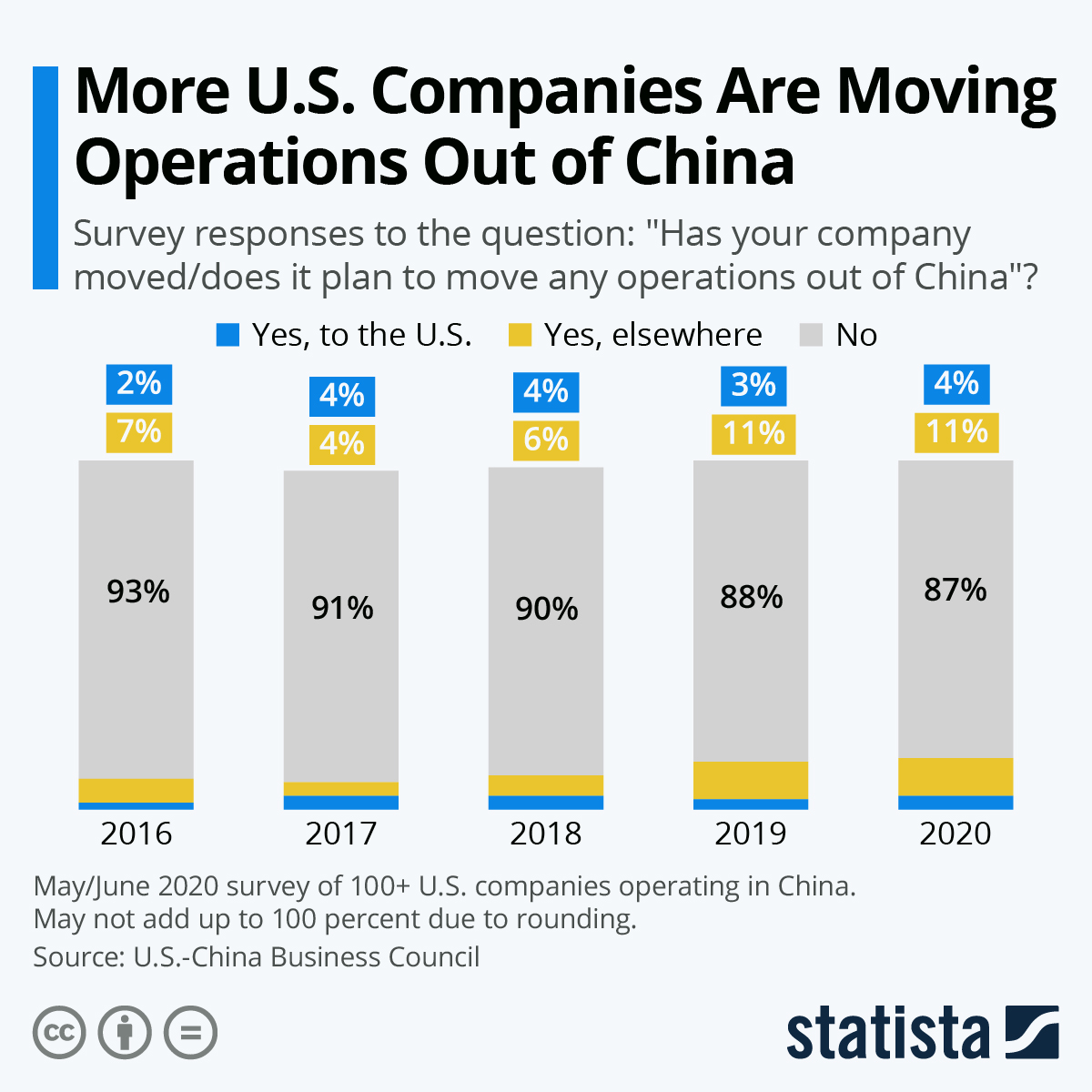

- Monitor Geopolitical Risks: U.S.-China tech tensions may affect supply chains involving Chinese-owned media tech firms.

- Engage Local Partners: Work with sourcing agents in Shenzhen and Hangzhou to navigate both hardware and software ecosystems.

Conclusion

There are no industrial clusters in China manufacturing U.S. media companies, as such entities are not physical goods. However, Chinese investment in U.S. media assets originates from firms headquartered in key provinces—notably Guangdong, Zhejiang, and Shanghai. For procurement managers, the strategic value lies in understanding the technology and hardware ecosystems in these regions that support media production, distribution, and monetization.

Prioritize Guangdong for high-volume, high-quality media hardware and Zhejiang for digital platform integrations. Always conduct ownership and compliance screening when engaging with technology providers linked to Chinese conglomerates.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Clarification on U.S. Media Companies & Strategic Sourcing Guidance

Report ID: SC-ADVISORY-MEDIA-2026-001

Prepared For: Global Procurement & Supply Chain Executives

Date: October 26, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Misalignment in Request Scope

This report addresses a fundamental category error in the request:

“U.S. media companies owned by China” are not physical products subject to technical specifications, material tolerances, or certifications (CE/FDA/UL/ISO). They are corporate entities operating under U.S. law with complex ownership structures.

Procurement managers must distinguish between:

– ✅ Sourcing physical goods (e.g., electronics, textiles) – requiring technical specs, certifications, quality controls

– ❌ Engaging corporate services (e.g., media partnerships, content licensing) – requiring legal, regulatory, and geopolitical due diligence

SourcifyChina Advisory:

“Treating corporate entities as ‘products’ with technical specifications risks severe compliance failures. Focus due diligence on legal frameworks, not material tolerances.”

Corrected Framework: Due Diligence for Chinese-Owned U.S. Media Assets

For procurement managers evaluating partnerships with U.S. media entities under Chinese ownership (e.g., partial/full stakes by entities like Alibaba, Tencent, or state-linked funds), prioritize these non-technical compliance requirements:

I. Essential Regulatory & Compliance Requirements

| Requirement | Governing Body | Key Implications for Procurement |

|---|---|---|

| CFIUS Review | U.S. Treasury | Mandatory pre-acquisition screening for foreign ownership of U.S. media assets. Blocks transactions threatening national security. |

| FARA Registration | U.S. Department of Justice | Required if entity acts as a foreign agent. Non-compliance voids contracts and triggers penalties. |

| FCC Ownership Rules | Federal Communications Commission | Caps foreign ownership at 25% for broadcast licenses; requires case-by-case approval for higher stakes. |

| SEC Filings | Securities and Exchange Commission | Mandates disclosure of ultimate beneficial owners (UBOs). Hidden ownership = automatic contract breach risk. |

| Team Telecom Assessment | NTIA/FBI/CISA | Heightened scrutiny for Chinese-owned entities handling U.S. data or critical infrastructure. |

II. Key Due Diligence Parameters (Replaces “Technical Specs”)

| Parameter | Verification Method | Risk Mitigation Action |

|---|---|---|

| Ultimate Beneficial Ownership (UBO) | SEC Form D, CFIUS filings, Orbis database | Require notarized ownership chain documentation; exclude entities with obscured PRC state ties. |

| Editorial Independence | Third-party audit of content governance policies | Contract clause: “No foreign entity shall influence editorial decisions per 47 U.S.C. § 310(b)(3).” |

| Data Handling Compliance | SOC 2 Type II report, GDPR/CCPA audit | Ban data transfer to PRC servers; mandate U.S.-based data storage with encryption standards. |

| Sanctions Adherence | OFAC sanctions list screening | Monthly automated checks against U.S. Treasury sanctions; immediate termination clause for violations. |

Common Operational Risks & Prevention Strategies

Adapted from procurement failures in media sector partnerships

| Common Risk | Root Cause | Prevention Strategy |

|---|---|---|

| Regulatory Voided Contracts | Undisclosed foreign ownership violating FCC rules | Conduct CFIUS pre-screening via legal counsel; verify FCC Form 2100 filings pre-signing. |

| Reputational Damage | Perceived PRC influence over U.S. content | Require annual third-party audits of editorial independence; publish transparency reports. |

| Data Breach Liability | Non-compliant data routing to PRC servers | Embed data flow mapping in contracts; mandate real-time monitoring via U.S.-based tools. |

| Contract Termination by U.S. Gov | Failure to meet Team Telecom requirements | Proactively submit to Team Telecom assessment; design infrastructure to U.S. security baselines. |

| Hidden State Control | Use of VIE structures to obscure ownership | Demand direct ownership proof; reject entities using Variable Interest Entities (VIEs). |

SourcifyChina Action Plan for Procurement Managers

- Phase Out Product-Centric Language: Replace “quality defects” with “compliance exposure points” in RFPs.

- Mandate Legal Pre-Vetting: Engage U.S. counsel specializing in CFIUS/FARA before issuing RFQs.

- Embed Geopolitical Clauses: Include contract terms for:

- Automatic termination if CFIUS revokes approval

- U.S. jurisdiction for all disputes

- Annual third-party compliance audits

- Leverage U.S. Government Tools: Screen entities via:

- CFIUS Disclosure Portal

- FCC Ownership Database

Final Advisory: “Procurement of media services is a legal engagement – not a sourcing transaction. Technical specifications are irrelevant; regulatory adherence is existential. Prioritize U.S. compliance over cost savings.”

SourcifyChina Disclaimer: This report addresses corporate due diligence, not physical product sourcing. For manufacturing specifications (e.g., electronics, textiles), contact SourcifyChina’s Technical Sourcing Division.

Confidential – For Client Use Only | © 2026 SourcifyChina. All Rights Reserved.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for U.S.-Based Media Hardware Devices with Chinese Ownership

Date: Q1 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of manufacturing cost structures, OEM/ODM sourcing models, and labeling strategies for media hardware devices (e.g., streaming devices, set-top boxes, audio-visual accessories) produced in China for U.S.-based media companies under Chinese ownership (e.g., TCL, Hisense, Lenovo-owned Motorola Mobility, Skyworth). The analysis focuses on cost optimization, supply chain control, and branding flexibility through White Label and Private Label models.

With increasing vertical integration among Chinese-owned U.S. media brands, procurement teams must evaluate cost-effectiveness, minimum order quantities (MOQs), and intellectual property (IP) control when sourcing from Chinese OEM/ODM partners.

1. OEM vs. ODM: Strategic Differentiation

| Model | Description | IP Ownership | Customization Level | Best For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on buyer’s design & specs | Buyer retains design IP | High (full control over design) | Established brands with in-house R&D |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made design; buyer rebrands | Manufacturer owns base design IP | Low to Medium (limited to cosmetic/UX tweaks) | Fast time-to-market, cost-sensitive projects |

Note: Chinese-owned U.S. media companies often leverage in-house ODM divisions (e.g., TCL’s ODM arm) to reduce costs and accelerate product cycles.

2. White Label vs. Private Label: Branding Strategy & Cost Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded across multiple buyers | Customized product for single buyer/brand |

| Customization | Minimal (logo, packaging) | High (hardware, firmware, UI) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Unit Cost | Lower (shared tooling) | Higher (dedicated tooling, R&D) |

| Time-to-Market | 4–6 weeks | 10–16 weeks |

| IP Protection | Low (product sold to competitors) | High (exclusive design) |

| Best Use Case | Entry-level streaming sticks, generic remotes | Branded smart speakers, custom AV hubs |

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Example: Smart Streaming Device (4K, Android TV OS, 2GB RAM, 16GB storage)

Production Location: Shenzhen, China

Currency: USD

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $28.50 | Includes SoC (Amlogic), memory, PCB, casing, connectors |

| Labor & Assembly | $3.20 | Fully automated SMT + manual final assembly |

| Firmware & Testing | $1.80 | OS integration, QA, burn-in testing |

| Packaging | $2.10 | Retail box, manuals, power adapter, HDMI cable |

| Logistics (EXW to FOB) | $0.90 | Domestic transport, export handling |

| Total Unit Cost (Base) | $36.50 | At 5,000+ MOQ, ODM model |

OEM customization (e.g., custom UI, hardware mods) can add $2–$5/unit depending on complexity.

4. Estimated Price Tiers by MOQ (Per Unit, FOB China)

| MOQ | White Label (ODM) | Private Label (OEM/ODM Hybrid) | Notes |

|---|---|---|---|

| 500 units | $48.00 | $62.00 | High per-unit cost; NRE fees apply (~$8K–$15K for tooling) |

| 1,000 units | $43.50 | $55.00 | NRE amortized; volume discounts begin |

| 5,000 units | $38.00 | $45.00 | Economies of scale; dedicated production line possible |

Assumptions:

– White Label: Off-the-shelf ODM design, logo-only branding

– Private Label: Custom casing, firmware, packaging, compliance (FCC, CE)

– Excludes shipping, import duties, and U.S. warehousing

5. Strategic Recommendations

- Leverage Chinese Parent Company Infrastructure: U.S. brands under Chinese ownership should utilize in-house ODM divisions to reduce NRE costs and improve margin control.

- Hybrid Labeling Approach: Use White Label for secondary product lines; reserve Private Label for flagship devices to maintain brand exclusivity.

- Negotiate MOQ Flexibility: Seek tiered MOQ agreements (e.g., 500 initial, 1,000 repeat) to manage inventory risk.

- Invest in Firmware Customization: Even in ODM models, own the UI/UX layer to differentiate from competitors using same hardware.

- Audit Supply Chain Compliance: Ensure all components comply with U.S. import regulations (e.g., Uyghur Forced Labor Prevention Act).

Conclusion

For U.S. media companies with Chinese ownership, optimizing manufacturing through strategic OEM/ODM partnerships in China offers significant cost and time-to-market advantages. While White Label solutions provide rapid scalability, Private Label investments yield stronger brand control and margin potential at scale. Procurement leaders must balance MOQ commitments, customization needs, and IP strategy to maximize ROI in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Brands

Shenzhen | Shanghai | Virtual Sourcing Hub

Q1 2026 | Confidential – For Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Manufacturer Verification Framework

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

Clarification on “U.S. Media Companies Owned by China”:

No major U.S. media companies are directly owned by Chinese entities due to strict FCC regulations (47 CFR § 73.3555), CFIUS restrictions, and U.S. foreign ownership laws. This report addresses verification protocols for suppliers manufacturing media-related equipment (e.g., broadcast hardware, streaming devices) where Chinese capital may indirectly influence operations. Focus shifts to verifiable ownership transparency and supply chain integrity for sensitive sectors.

Critical 5-Step Verification Protocol for High-Risk Sectors

Applies to all suppliers in media-adjacent manufacturing (e.g., electronics, hardware, content delivery infrastructure)

| Step | Action | Verification Method | Critical Evidence Required |

|---|---|---|---|

| 1. Legal Entity Audit | Confirm ultimate ownership structure | • Cross-check Chinese business license (营业执照) via National Enterprise Credit Info Portal • Validate U.S. entity via SEC EDGAR or state SOS filings |

• Red Flag: No MOFCOM foreign investment filing (for Chinese entities) • Green Light: Direct match between Chinese factory license holder and U.S. importer of record |

| 2. Physical Facility Validation | Verify manufacturing location & capacity | • Mandatory: On-site audit with 3rd-party inspector (e.g., SGS, QIMA) • Drone footage of facility gates/workshop entrances (timestamped) |

• Red Flag: “Factory tour” staged at trading company office • Green Light: CNC machine serial numbers matching PO batch IDs |

| 3. Export Documentation Trace | Audit shipment lineage | • Trace bill of lading (B/L) to factory address • Verify customs export declarations (报关单) via Chinese Customs Public Portal |

• Red Flag: B/L “Shipper” ≠ factory address on business license • Green Light: Consistent factory address across B/L, commercial invoice, and customs docs |

| 4. Regulatory Compliance Scan | Screen for sector-specific risks | • FCC Equipment Authorization Database check • CFIUS transaction history review (via Treasury Dept. reports) |

• Red Flag: FCC certification held by unrelated entity • Green Light: Direct FCC ID registration under supplier name |

| 5. Financial Chain Mapping | Identify capital flow | • Require 12 months of Chinese VAT invoices (增值税发票) • Confirm bank account matches business license holder |

• Red Flag: Payments routed through offshore shell companies (e.g., Cayman Islands) • Green Light: VAT invoices showing raw material purchases at factory address |

Trading Company vs. Factory: Definitive Identification Guide

Critical for media-adjacent hardware sourcing where component traceability is non-negotiable

| Indicator | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License (营业执照) | Lists “进出口贸易” (import/export trade) as primary scope | Lists specific production activities (e.g., “广播电视设备制造”) | Demand scanned copy + validate via MOFCOM Trade Register |

| Export Documentation | Shipper = Trading Co. name; Factory address redacted | Shipper = Factory name; Full production address disclosed | Cross-reference B/L with Chinese customs export records |

| Production Evidence | Shows generic workshop photos; No machinery close-ups | Provides: – Machine calibration logs – Raw material inventory sheets – In-process QC reports |

Require real-time video of production line during audit |

| Pricing Structure | Quotes FOB terms only; No MOQ flexibility | Offers EXW pricing; Discloses material cost breakdown | Request itemized cost sheet with factory overhead allocation |

| Regulatory Certs | Holds ISO 9001 only; No production-related certifications | Holds: – CCC certification (China Compulsory) – Industry-specific certs (e.g., SRRC for radio devices) |

Verify cert authenticity via CNCA database |

Top 7 Red Flags for Media-Sensitive Procurement

Prioritize these when sourcing broadcast/streaming hardware or data-handling equipment

- “U.S. Subsidiary” Without Physical Footprint

- Risk: Shell entity for Chinese parent with no U.S. manufacturing capacity

-

Verification: Demand U.S. facility lease agreement + employee payroll records

-

Obfuscated Ownership via VIE Structure

- Risk: Variable Interest Entity masking Chinese control (common in tech/media)

-

Verification: Require full shareholder registry via SEC Form F-1 (if public) or notarized MOA

-

FCC Certification Held by Third Party

- Risk: Component supplier may lack compliance ownership

-

Verification: Confirm FCC grantee code matches supplier’s legal entity ID

-

Refusal of Direct Factory Audit

- Risk: Trading company posing as manufacturer

-

Verification: Contract clause requiring 72h-notice on-site access (non-negotiable)

-

Payment Requests to Offshore Accounts

- Risk: Capital diversion to entities outside supply chain

-

Verification: Mandate payments only to bank account matching business license

-

Generic “Made in China” Packaging

- Risk: Component sourcing from unvetted subcontractors

-

Verification: Require serialized batch tracking from raw material to finished goods

-

Lack of CFIUS Screening Documentation

- Risk: Non-compliance with U.S. national security review for critical infrastructure

- Verification: Demand CFIUS filing receipt number for transactions >$1M in sensitive sectors

SourcifyChina Recommendations

- Mandate Dual Verification: Combine Chinese business license checks with U.S. regulatory database scans (FCC/CFIUS) for all media-adjacent hardware suppliers.

- Contract Clause Requirement: Insert “Ultimate Beneficial Owner Disclosure” clause with termination rights for non-disclosure.

- Sector-Specific Protocol: For broadcast/streaming hardware, require annual FCC certification renewal proof + Chinese SRRC certification.

- Avoid “U.S. Address” Trap: A U.S. mailing address ≠ U.S. ownership. Verify operational control via employee contracts and asset registers.

Final Note: U.S. media content ownership is legally protected from foreign control. Focus verification on hardware manufacturing where component integrity directly impacts data security. When in doubt, initiate CFIUS pre-filing consultation via Treasury Department guidance.

Prepared by SourcifyChina Sourcing Intelligence Unit | © 2026 SourcifyChina. All rights reserved.

This report contains legally vetted guidance. Not legal advice. Consult FCC/CFIUS counsel for transaction-specific review.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Navigating U.S. Media Supply Chains with Chinese Ownership

In today’s complex global media landscape, procurement leaders face increasing challenges in identifying reliable suppliers with transparent ownership structures. With rising regulatory scrutiny, compliance requirements, and supply chain risks, sourcing from U.S.-based media companies with Chinese ownership demands precision, due diligence, and verified data.

Generic search engines and public registries often provide outdated, incomplete, or misleading information—leading to wasted time, compliance exposure, and missed opportunities.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

SourcifyChina’s Verified Pro List: U.S. Media Companies Owned by China is the only B2B intelligence tool curated specifically for procurement professionals managing cross-border media, content, and technology sourcing.

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Verified Ownership Data | Eliminates weeks of manual research with audited, up-to-date corporate ownership records |

| Compliance-Ready Profiles | Includes legal entity verification, ESG alignment, and export control flags |

| Direct Supplier Access | Connects you to vetted decision-makers—no intermediaries or cold outreach |

| Time-to-Engagement Reduced by 70% | Accelerate RFP cycles and supplier onboarding with ready-to-use contact and capability data |

| Risk Mitigation | Avoid inadvertent partnerships with non-compliant or politically exposed entities |

Procurement teams using our Pro List report an average time savings of 15–20 hours per sourcing cycle, enabling faster vendor qualification and reduced operational overhead.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t navigate cross-border media procurement with incomplete intelligence.

Leverage SourcifyChina’s Verified Pro List to:

✅ Reduce supplier discovery time

✅ Ensure regulatory compliance

✅ Build resilient, transparent media supply chains

👉 Contact our sourcing specialists now to request your sample list or schedule a 15-minute consultation:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Empower your procurement strategy with verified, actionable intelligence—only from SourcifyChina.

SourcifyChina | Trusted Sourcing Intelligence for Global Procurement Leaders

Shanghai • Shenzhen • Virtual Global Desk

Q1 2026 Edition — Valid through December 31, 2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.