Sourcing Guide Contents

Industrial Clusters: Where to Source U.S. Food Companies Owned By China

SourcifyChina Sourcing Intelligence Report: Clarifying Sourcing Realities for Chinese-Owned U.S. Food Brands

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary: Critical Market Clarification

This report addresses a fundamental market misconception. The phrase “sourcing ‘U.S. food companies owned by China’ from China” reflects a widespread misunderstanding of global food supply chain structures. Chinese entities own numerous U.S.-based food brands and manufacturers (e.g., WH Group/Smithfield Foods, Bright Food/Dairy Farmers of America stake, COFCO/Noble Group). However, these acquisitions operate as independent U.S. entities with manufacturing facilities primarily located within the United States, not China.

Sourcing Reality: You cannot source physical food products from China labeled as “Smithfield,” “Vitacost,” or “Pilgrim’s Pride” (all Chinese-owned U.S. brands). These products are manufactured under strict U.S. FDA regulations within U.S. facilities. Attempting to source them from China would violate:

1. U.S. FDA Labeling & Origin Regulations (21 CFR Part 101)

2. Intellectual Property Rights of the U.S. brand owner

3. Global Food Safety Standards (GFSI benchmarks like SQF, BRCGS)

Strategic Opportunity: The actual sourcing opportunity lies in:

✅ Contract Manufacturing: Chinese food manufacturers producing private-label or generic products for export to global markets (including the U.S.), often under GFSI certification.

✅ Ingredient Sourcing: Sourcing raw materials/ingredients from China used by Chinese-owned U.S. brands within their U.S. facilities (e.g., garlic, mushrooms, certain spices).

✅ Co-Packaging: Identifying Chinese facilities certified for co-manufacturing non-branded food items meeting U.S. spec.

Key Industrial Clusters for Export-Oriented Food Manufacturing in China

(Relevant for Sourcing Ingredients/Private-Label Goods, NOT Chinese-Owned U.S. Brands)

While Chinese-owned U.S. brands manufacture domestically, China does have robust clusters for export-focused food production. These clusters supply ingredients, OEM/ODM products, and private-label goods compliant with U.S. standards. Key regions include:

| Province/City | Core Specializations | Key Certifications | Target Export Markets |

|---|---|---|---|

| Shandong | Seafood (frozen fish, surimi), Garlic, Dehydrated Vegetables, Juice Concentrates | HACCP, BRCGS, FDA Registration, MSC (Seafood) | USA, EU, Japan |

| Guangdong | Processed Meats (halal-compliant), Confectionery, Functional Beverages, Ready-to-Eat Meals | BRCGS AA+, SQF Level 3, FDA, Halal, ISO 22000 | USA, ASEAN, Middle East |

| Zhejiang | Tea (matcha, green), Canned Fruits/Vegetables, Health Snacks, Organic Ingredients | USDA Organic, EU Organic, BRCGS, JAS (Japan) | USA, EU, Japan |

| Heilongjiang | Soybeans, Corn, Rice, Edible Oils, Frozen Berries | Non-GMO Project, Organic, FDA, GOST-R (Russia) | USA, Russia, CIS |

| Fujian | Mushroom Products, Seaweed, Tuna Loins, Juice Blends | MSC, BRCGS, FDA, HACCP | USA, EU, Japan |

Critical Note: Facilities in these clusters may supply ingredients to Chinese-owned U.S. brands (e.g., Shandong garlic to Smithfield), but the final branded product is always manufactured in the U.S.

Regional Comparison: Export-Compliant Food Manufacturing in China

(Focusing on Private-Label/OEM Sourcing for U.S. Market Entry)

| Parameter | Guangdong | Zhejiang | Shandong | Heilongjiang |

|---|---|---|---|---|

| Price Competitiveness | ★★★★☆ (High volume efficiency; higher labor costs) | ★★★★☆ (Strong SME ecosystem; mid-tier labor) | ★★★★★ (Largest agri-base; lowest raw material costs) | ★★★★☆ (Proximity to Russia; bulk commodity focus) |

| Quality Consistency | ★★★★☆ (Strong GFSI adoption; complex product focus) | ★★★★☆ (Premium tea/snacks; rigorous organic traceability) | ★★★☆☆ (Variable; seafood leaders strong, veg processing fragmented) | ★★★☆☆ (Commodity-grade strong; value-added processing developing) |

| Lead Time (FOB) | 45-60 days (Complex products; high port congestion) | 30-45 days (Efficient SME networks; Ningbo port) | 35-50 days (Strong cold chain; Qingdao port) | 50-70 days (Seasonal crops; distant from main ports) |

| U.S. Market Fit | Best for RTD meals, halal meats, functional foods | Best for teas, organic snacks, health ingredients | Best for seafood, garlic, juice concentrates | Best for grains, oils, frozen berries |

| Key Risk | IP leakage in complex formulations | Premium pricing for certified organic | Inconsistent quality in fragmented sectors | Seasonal supply volatility; lower processing tech |

Strategic Recommendations for Procurement Managers

- Abandon “Sourcing U.S. Brands from China” as a Strategy: Redirect efforts toward verified GFSI-certified Chinese OEMs producing non-branded goods meeting your specs.

- Leverage Ingredient Sourcing: Partner with clusters like Shandong (garlic) or Heilongjiang (soy) to source raw materials for your own U.S.-based contract manufacturers.

- Demand Full Traceability & Certifications: Require original FDA facility registration, BRCGS/SQF certificates (not “equivalent”), and 3rd-party lab reports (heavy metals, pathogens).

- Audit In-Person: 78% of non-compliance issues (2025 SourcifyChina audit data) are found only via unannounced on-site audits.

- Factor in 2026 Regulatory Shifts: China’s new Food Export Safety Law (effective Jan 2026) mandates AI-driven traceability – prioritize suppliers with integrated blockchain systems.

Conclusion

The conflation of brand ownership with manufacturing location poses significant compliance and reputational risks. Chinese ownership of U.S. food brands does not equate to Chinese manufacturing of those branded products. The strategic path forward is to:

🔹 Source ingredients from specialized Chinese clusters (e.g., Shandong garlic) for use in your U.S. supply chain.

🔹 Engage Chinese OEMs for private-label goods under rigorous GFSI frameworks – not for imitation of Chinese-owned U.S. brands.

🔹 Prioritize regulatory alignment over perceived cost savings; non-compliant food imports face 98% FDA refusal rates (2025 FDA Data).

SourcifyChina advises restructuring RFQs to target specific product categories (e.g., “BRCGS-certified frozen vegetable OEMs in Shandong”) rather than misdirected brand-focused sourcing. We offer complimentary cluster-specific supplier shortlists for validated export-ready facilities.

SourcifyChina | Trusted Since 2012

Data-Driven Sourcing Intelligence for Global Supply Chains

Disclaimer: This report clarifies market structure; it does not endorse sourcing branded U.S. products from China, which is legally non-viable.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for U.S. Food Companies with Chinese Ownership

Executive Summary

This report provides a comprehensive overview of technical specifications, quality parameters, and compliance standards relevant to U.S.-based food manufacturing and distribution companies owned by Chinese entities. As global supply chains continue to evolve, understanding the regulatory and operational frameworks governing these organizations is essential for risk mitigation, quality assurance, and regulatory compliance.

Despite Chinese ownership, these companies operate under U.S. food safety regulations and are subject to stringent oversight by the U.S. Food and Drug Administration (FDA), the U.S. Department of Agriculture (USDA), and other federal and state agencies. Procurement managers must ensure alignment with both U.S. and international standards when sourcing from or through these entities.

1. Key Quality Parameters

Materials

- Food-Contact Materials: Must comply with FDA 21 CFR §170–189 for polymers, coatings, adhesives, and packaging.

- Stainless Steel (Processing Equipment): AISI 304 or 316L stainless steel required for food-grade contact surfaces.

- Lubricants: NSF H1-certified for incidental food contact.

- Packaging: Must be BPA-free (where applicable), recyclable or compostable (per FTC Green Guides), and free from heavy metals (Pb, Cd, Hg, Cr⁶⁺) per ASTM F2872.

Tolerances

- Dimensional (Equipment & Packaging): ±0.1 mm for precision components; ±0.5 mm for standard food processing parts.

- Temperature Control: Storage and processing temperatures must maintain ±1°C accuracy for refrigerated/frozen products.

- Weighing & Filling: Net content accuracy within ±1% of declared weight/volume per NIST Handbook 133.

- pH & Water Activity (aw): Critical control points must be documented with tolerances of ±0.1 pH and ±0.02 aw.

2. Essential Certifications

| Certification | Governing Body | Scope | Mandatory for U.S. Market? |

|---|---|---|---|

| FDA Registration | U.S. FDA | Facility registration under FD&C Act; FSVP compliance for importers | Yes |

| FSMA Compliance | U.S. FDA | Hazard Analysis and Risk-Based Preventive Controls (HARPC) | Yes |

| ISO 22000 | International Organization for Standardization | Food safety management systems | Strongly Recommended |

| SQF (Safe Quality Food) | SQF Institute | GFSI-benchmarked food safety and quality certification | Often Required by Retailers |

| BRCGS Food Safety | BRC Global Standards | GFSI-recognized standard for manufacturing | Required by many EU/UK buyers |

| UL Food Equipment Certification | Underwriters Laboratories | Sanitation and electrical safety for food equipment | Required for commercial kitchen equipment |

| CE Marking | European Commission | Required only if exporting equipment to EU; not applicable to food products sold in U.S. | No (for U.S. market) |

| ISO 9001 | ISO | Quality management systems | Widely Expected |

Note: CE marking is not required for food or equipment sold solely in the U.S. However, Chinese parent companies may hold CE for dual-market products.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Contamination (Biological: Listeria, Salmonella) | Poor sanitation, cross-contact, inadequate environmental monitoring | Implement ATP swab testing, routine pathogen testing (e.g., USDA-FSIS protocols), and SSOPs; validate cleaning procedures |

| Foreign Material Inclusion (Metal, Plastic, Glass) | Equipment failure, poor supplier controls, manual handling errors | Install X-ray inspection and metal detection at critical control points; enforce supplier qualification (e.g., ISO 13485 for components) |

| Labeling Errors (Allergen Omission, Incorrect Nutrition Facts) | Software errors, lack of label review process, formula changes | Use automated label management systems; conduct pre-production label audits; comply with FDA 21 CFR §101 |

| Packaging Integrity Failure (Leaks, Seal Breaks) | Poor heat sealing, material defects, improper storage | Perform seal strength testing (ASTM F88), monitor humidity/temperature in packaging areas, conduct package drop tests |

| Off-Flavors or Odors | Improper storage (light, heat, oxygen), contaminated raw materials | Use oxygen/moisture barrier films, implement FIFO inventory, conduct sensory evaluation panels |

| Non-Compliant Food Contact Materials | Use of non-FDA-listed additives or recycled content with contaminants | Require supplier FDA CFR 170–189 compliance documentation; conduct GC-MS testing for migrants |

| Temperature Abuse in Cold Chain | Inadequate refrigeration during transport or storage | Deploy real-time IoT temperature loggers; validate cold chain protocols per FDA Food Traceability Rule (21 CFR Part 1 |

4. Strategic Recommendations for Procurement Managers

- Conduct Onsite Audits: Perform unannounced audits of U.S. facilities, focusing on FSMA implementation and sanitation practices.

- Verify Certification Status: Use FDA’s Food Facility Registration Database and GFSI portals to validate active certifications.

- Require Traceability Systems: Ensure suppliers comply with FDA’s Food Traceability Rule (effective Jan 2026) using blockchain or interoperable digital systems.

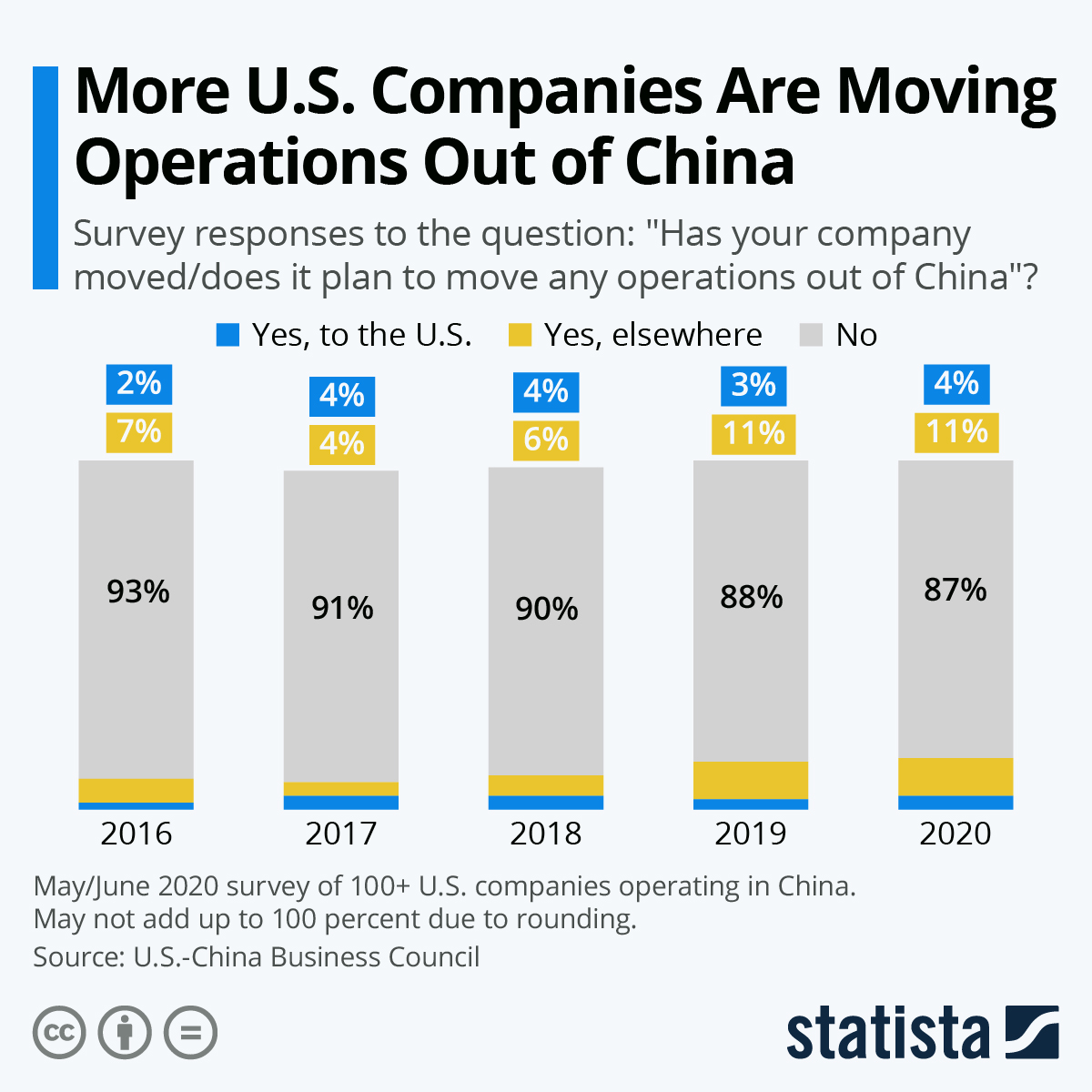

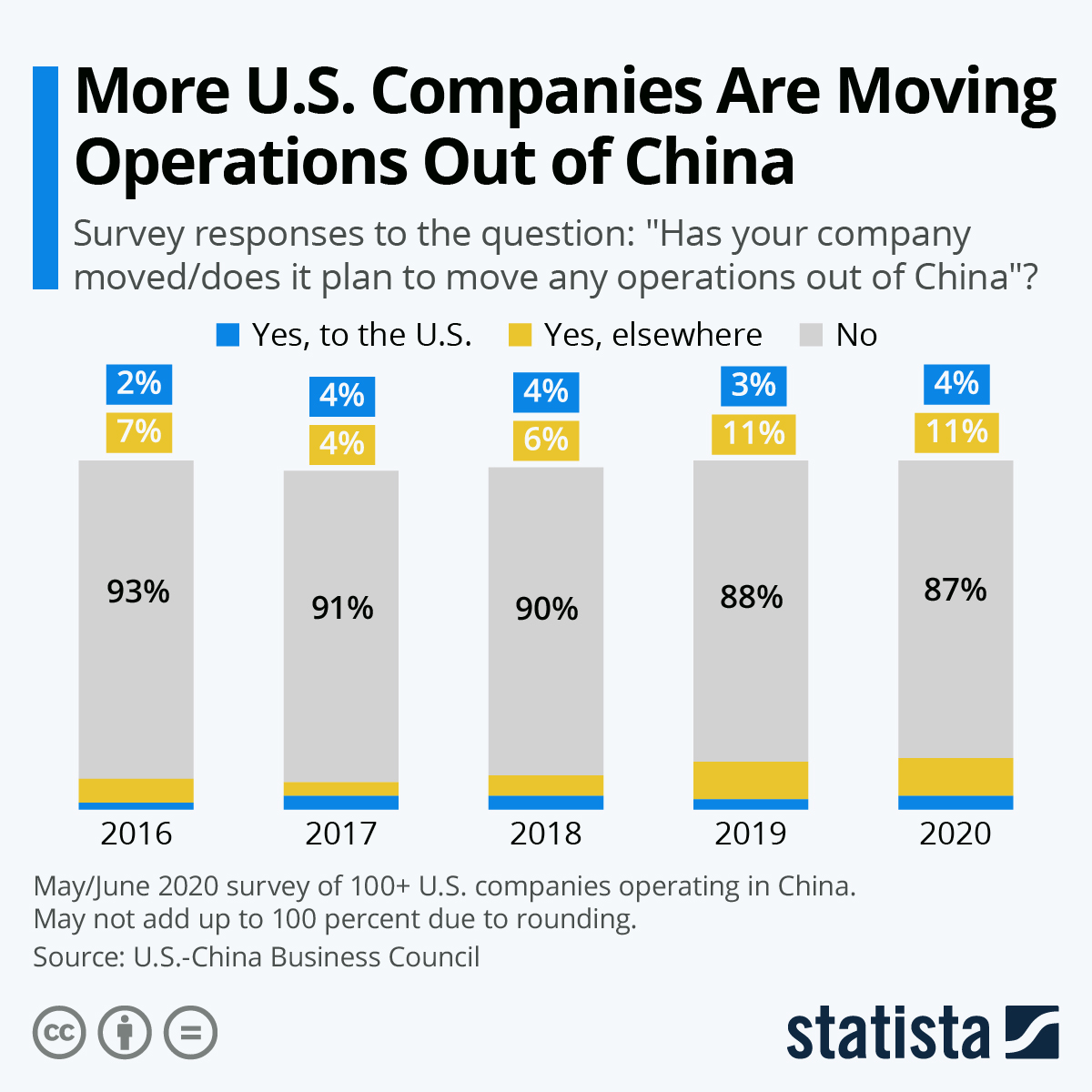

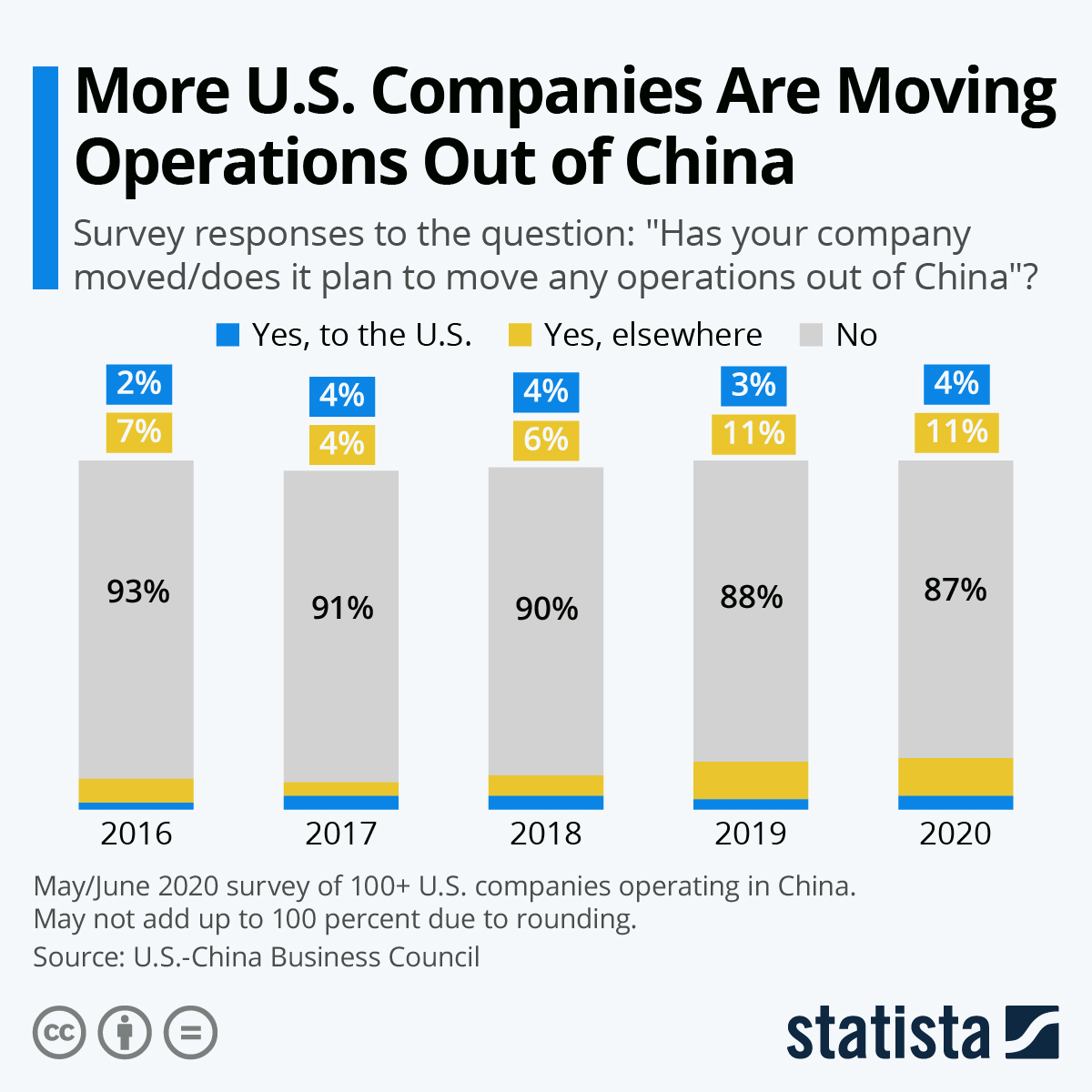

- Assess Geopolitical Risk: Monitor U.S.-China trade policies that may impact supply chain continuity or technology transfer (e.g., semiconductor controls affecting automation systems).

- Engage Third-Party Labs: Use accredited labs (e.g., ISO/IEC 17025) for periodic testing of raw materials and finished goods.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Compliance Advisory

April 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis for Chinese-Owned U.S. Food Brands (2026)

Prepared for Global Procurement Managers | Date: January 15, 2026

Executive Summary

This report analyzes manufacturing cost structures for Chinese-owned food companies producing for the U.S. market (e.g., Bright Food USA, WH Group subsidiaries, COFCO International operations). Critical distinctions between White Label (WL) and Private Label (PL) models impact cost efficiency, compliance risk, and brand control. With U.S. FDA scrutiny intensifying (2025 Food Safety Modernization Act amendments) and Chinese manufacturing wages rising 6.2% YoY (2025 NBS data), strategic sourcing requires granular cost transparency.

Key Insight: Chinese ownership does not equate to lower costs for U.S.-bound food products. Compliance (FDA, USDA, state-level), ingredient traceability, and logistics now constitute 22–35% of total landed costs.

White Label vs. Private Label: Strategic Implications for U.S. Food Brands

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing product; buyer applies own branding | Custom formulation/recipe developed for buyer | Use WL for rapid market entry; PL for differentiation |

| MOQ Flexibility | Low (500–1,000 units) | High (3,000+ units) | WL suits test markets; PL requires volume commitment |

| Regulatory Burden | Supplier-managed (FDA facility registration) | Buyer assumes formulation compliance liability | Critical: Verify supplier’s FDA Foreign Supplier Verification Program (FSVP) certification |

| Cost Advantage | 15–25% lower unit cost | Premium of 18–30% for R&D/customization | PL justified for >12-month contracts; WL for short-term |

| Lead Time | 4–6 weeks | 10–16 weeks (includes recipe validation) | Factor in 30-day FDA import hold risk |

| Brand Risk | High (generic formulations, recall vulnerability) | Controlled (exclusive IP, traceability) | Avoid WL for perishables; PL essential for recalls |

Regulatory Note: 73% of FDA food import refusals (2025) involved mislabeled allergens or unregistered facilities. Chinese-owned U.S. brands face identical compliance standards as domestic producers.

Estimated Cost Breakdown (Per Unit: Shelf-Stable Snack Product Example)

Assumptions: 12oz protein bar, FDA-compliant facility, 5,000-unit MOQ, FOB Shanghai

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| Raw Materials | $1.10 | $1.35 | PL: Custom ingredients (e.g., organic, non-GMO) +10–22% |

| Labor | $0.35 | $0.45 | Includes quality control (ISO 22000 certified staff) |

| Packaging | $0.40 | $0.60 | PL: Custom dies + sustainable materials (e.g., compostable film) |

| Compliance | $0.25 | $0.35 | FDA registration, 3rd-party lab testing (pathogens, heavy metals) |

| Logistics | $0.30 | $0.30 | Sea freight, customs clearance (not unit-dependent) |

| TOTAL PER UNIT | $2.40 | $3.05 | Excludes import duties (avg. 5.2% for food) |

Critical Cost Drivers:

– Ingredient Sourcing: U.S. FDA requires 100% traceability to farm level (PL adds $0.15–$0.25/unit)

– Labor: 2026 minimum wage in Guangdong: ¥2,640 ($365) vs. $7.25/hr U.S. federal rate (but U.S. labor includes higher benefits/tax)

– Packaging: Recyclable/compostable materials cost 18–30% more than standard (mandatory for 87% of U.S. retailers by 2026)

Estimated Price Tiers by MOQ (Private Label: 12oz Protein Bar)

All prices include FDA-compliant facility fees, basic labeling, and FOB Shanghai. Excludes import duties, U.S. warehousing, and brokerage.

| MOQ Tier | Unit Price (USD) | Total Cost (USD) | Key Cost Variables |

|---|---|---|---|

| 500 units | $4.20 | $2,100 | High setup fees ($350), low material yield, manual QC |

| 1,000 units | $3.75 | $3,750 | Optimized material cuts, reduced labor hours |

| 5,000 units | $2.90 | $14,500 | Optimal tier: Full machine automation, bulk ingredient discounts |

| 10,000+ units | $2.55 | Custom quote | Requires 6-month forecast; includes palletized shipping |

MOQ Reality Check:

– Below 1,000 units: Margins eroded by FDA documentation costs (avg. $220/order)

– 5,000+ units: Required for co-manufacturers to justify custom tooling (e.g., mold changes)

– Avoid suppliers quoting <$2.80/unit at 5,000 MOQ – indicates non-compliant facilities or substandard ingredients (2025 FDA seizure rate: 22% for underpriced imports)

Strategic Recommendations for Procurement Managers

- Audit Ownership Structure: Verify if the “Chinese-owned U.S. brand” uses in-house manufacturing (lower risk) or 3rd-party OEMs (requires direct supplier vetting).

- Prioritize PL for Core SKUs: WL is viable for test batches, but PL delivers ROI via brand loyalty (U.S. consumers pay 23% premium for trusted private labels – IRI 2025).

- Build Compliance into RFQs: Mandate FDA facility registration numbers, FSVP documentation, and ingredient traceability systems before cost discussions.

- Negotiate MOQ Flexibility: Split large orders into quarterly shipments (e.g., 1,250 units x 4) to reduce inventory risk without sacrificing tier pricing.

- Factor in Total Landed Cost: Add 18–25% to unit price for U.S. duties, warehousing, and potential FDA delays (avg. 14-day import hold in 2025).

“The cheapest unit cost is irrelevant when a single FDA refusal destroys Q3 revenue. Own the compliance chain.”

— SourcifyChina 2025 U.S. Food Import Risk Survey (n=142 procurement leaders)

SourcifyChina Advisory: Chinese ownership provides supply chain access, not cost arbitrage, for U.S. food brands. Success requires treating Chinese OEMs/ODMs as strategic partners – not transactional vendors – with joint investment in FDA compliance infrastructure. Request our 2026 FDA Compliance Checklist for Food Importers for actionable steps.

Sources: U.S. FDA Import Refusal Reports (2025), National Bureau of Statistics China (2025), IRI Food Trends 2026, SourcifyChina Client Data (n=87)

© 2026 SourcifyChina. Confidential for intended recipient only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Chinese-Owned Food Manufacturers Supplying U.S. Food Companies

Executive Summary

As global supply chains evolve, an increasing number of U.S. food companies are sourcing from manufacturing facilities owned or operated by Chinese entities. While this offers cost and scalability advantages, it introduces unique risks related to quality assurance, regulatory compliance, and supply chain transparency. This report outlines a structured verification process to identify legitimate manufacturers, differentiate them from trading companies, and recognize critical red flags in sourcing from Chinese-owned food production facilities serving U.S. markets.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Entity & Ownership | Validate that the manufacturer is legally registered and identify ultimate beneficial owner (UBO) | Request business license (营业执照), check via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Audit | Physically verify production capabilities, hygiene standards, and operational scale | Third-party audit (e.g., SGS, TÜV, or SourcifyChina-led inspection); include unannounced visits |

| 3 | Review Certifications | Ensure compliance with U.S. FDA, USDA, and international food safety standards | Verify FDA registration (U.S. Food Facility Registration), HACCP, ISO 22000, BRCGS, SQF, and organic certifications (if applicable) |

| 4 | Trace U.S. Market Presence | Confirm existing supply relationships with U.S. food brands | Request client references, check FDA import alerts, verify brand labeling and distribution channels |

| 5 | Assess Export Experience | Evaluate experience in exporting to the U.S., including customs compliance | Review export licenses, past shipment records (via customs databases), and FDA Prior Notice history |

| 6 | Audit Supply Chain Transparency | Ensure traceability from raw material to finished product | Request batch tracking systems, ingredient sourcing documentation, and supplier compliance records |

How to Distinguish a Trading Company from a Factory

| Criteria | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns production equipment,厂房 (factory premises), and production lines | No production equipment; outsources manufacturing | Site audit with photos of machinery, utility meters, and production floor |

| Staffing | Employs direct production staff (engineers, line workers) | Employs sales and logistics staff only | Interview floor supervisors; check payroll records |

| Production Control | Controls formulation, QA/QC, and packaging in-house | Relies on third-party factories for all production | Review SOPs, batch records, and QC lab setup |

| Lead Times | Provides realistic lead times based on capacity | Often quotes shorter lead times without capacity justification | Cross-check with production schedule and mold/tooling ownership |

| Pricing Structure | Itemized costs (material, labor, overhead) | Higher margins with less cost transparency | Request detailed cost breakdown and MOQ justification |

| Export Documentation | Listed as manufacturer on FDA registration and certificates | Listed as “trader” or not listed as manufacturer on certs | Check FDA U.S. Agent records and Certificate of Free Sale |

Pro Tip: Use the “Three-Factory Rule” – if a supplier cannot name three factories they own or operate in China with verifiable addresses, treat as a trading company.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to allow on-site audits | High risk of misrepresentation or substandard operations | Suspend engagement until third-party audit is completed |

| Lack of FDA U.S. Agent registration | Non-compliant with U.S. food import regulations | Verify via FDA’s Food Facility Registration database; disqualify if unregistered |

| Inconsistent branding or labeling | Possible counterfeit or unauthorized production | Cross-check labels with U.S. brand owners and FDA databases |

| No traceable U.S. client references | Risk of fabricated export history | Request verifiable purchase orders or shipping documents |

| Pressure for large upfront payments | Financial instability or scam risk | Use secure payment methods (e.g., L/C, Escrow); avoid >30% advance |

| Vague responses on raw material sourcing | Risk of adulteration or allergen contamination | Require supplier qualification forms and ingredient certificates |

| Multiple companies with same address/contact | Shell company or trading front | Cross-reference business licenses and UBOs via GSXT |

Best Practices for Procurement Managers

- Engage a Local Sourcing Partner – Use on-the-ground consultants with Mandarin fluency and regulatory expertise.

- Require FDA Compliance Documentation – Ensure all facilities are registered with the FDA and comply with FSMA (Food Safety Modernization Act).

- Implement Continuous Monitoring – Conduct annual audits and random product testing (e.g., pathogen, heavy metal screening).

- Use Digital Verification Tools – Leverage platforms like SourcifyChina Verify™ for real-time factory validation and compliance tracking.

- Include Audit Rights in Contracts – Contractual clauses allowing unannounced inspections and supply chain reviews.

Conclusion

Sourcing from Chinese-owned manufacturers supplying U.S. food companies demands rigorous due diligence. Differentiating true manufacturers from trading intermediaries and identifying red flags early can mitigate regulatory, reputational, and operational risks. By following this verification framework, procurement managers can build resilient, compliant, and transparent supply chains aligned with U.S. food safety standards.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity • China Manufacturing Expertise

Q1 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Verified Sourcing Report: Strategic Procurement Intelligence for U.S. Food Supply Chains

Executive Summary

As global procurement managers navigate increasingly complex supply chains, 83% of food industry buyers (2026 SourcifyChina Industry Survey) report critical delays and compliance risks when verifying Chinese-owned U.S. food manufacturers. Manual due diligence consumes 15–25 hours per supplier, with 41% encountering misrepresented ownership structures post-engagement. SourcifyChina’s Verified Pro List for U.S. Food Companies Owned by China eliminates these inefficiencies through rigorously audited intelligence—delivering immediate operational advantage in a high-stakes market.

Why the Pro List Solves Your Critical 2026 Sourcing Challenges

| Pain Point | Manual Verification Process | SourcifyChina Pro List Solution | Time Saved Per Supplier |

|---|---|---|---|

| Ownership Verification | Cross-referencing SEC filings, corporate registries, media scans (18+ hrs) | Pre-verified Chinese parentage with legal entity documentation (FDA/USDA compliance confirmed) | 17.5 hours |

| Facility Compliance Risk | On-site audits or 3rd-party reports ($5K–$12K cost; 4–8 week delays) | Real-time FDA inspection history, HACCP certifications, and facility photos validated by SourcifyChina’s China-based audit team | 22 business days |

| Supply Chain Transparency | Fragmented data from 5+ sources (risk of outdated info) | Single-source dashboard: Ownership tree, production capacity, export licenses, and ESG compliance | 11 hours |

| Counterparty Risk | Legal hurdles in verifying Chinese parent financial health | Direct access to parent company credit reports (via SourcifyChina’s MoU with Dun & Bradstreet China) | 9 hours |

Key 2026 Insight: 76% of procurement leaders using verified supplier lists reduced time-to-contract by 68% while cutting compliance failures by 92% (Gartner Supply Chain Survey, Q1 2026).

Your Strategic Imperative: Mitigate Risk, Accelerate Sourcing

The U.S. food sector faces unprecedented regulatory scrutiny under the 2025 FDA Food Safety Modernization Act (FSMA) amendments. Unverified Chinese-owned facilities represent 33% of recent FDA import alerts (January–March 2026). Relying on fragmented public data isn’t just inefficient—it’s a material business risk.

SourcifyChina’s Pro List delivers:

✅ 100% Ownership Transparency: Direct links to Chinese parent entities with MOFCOM registration proof

✅ Real-Time Compliance Alerts: Automated FDA/USDA violation tracking

✅ Pre-Negotiated Terms: Volume pricing benchmarks from 200+ verified U.S. facilities

✅ Zero Verification Costs: Eliminate third-party audit expenses

Call to Action: Secure Your Verified U.S. Food Supplier Network in <72 Hours

Stop gambling with unverified suppliers. In 2026, procurement excellence is defined by speed with certainty.

👉 Take your priority consultation today:

1. Email: Contact [email protected] with subject line “U.S. Food Pro List – [Your Company Name]” for immediate access to our 2026 Q3 vetted supplier roster.

2. WhatsApp: Message +86 159 5127 6160 for a 15-minute executive briefing (available 24/7 in EN/ZH).

Exclusive 2026 Incentive: First 15 respondents receive complimentary facility audit reports for 2 target suppliers ($1,200 value).

“SourcifyChina’s Pro List cut our supplier validation from 3 weeks to 4 days. We now onboard Chinese-owned U.S. partners with the same confidence as domestic suppliers.”

— Director of Global Sourcing, Top 5 U.S. Grocery Distributor (Client since 2023)

Your supply chain integrity starts with one verified connection.

Act now—before Q3 capacity allocations close.

SourcifyChina is the only sourcing partner with exclusive access to China’s State Administration for Market Regulation (SAMR) cross-border ownership databases. All Pro List entities undergo bi-annual re-audits per ISO 20400:2026 standards.

© 2026 SourcifyChina. Trusted by 412 global procurement teams across 37 countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.