Sourcing Guide Contents

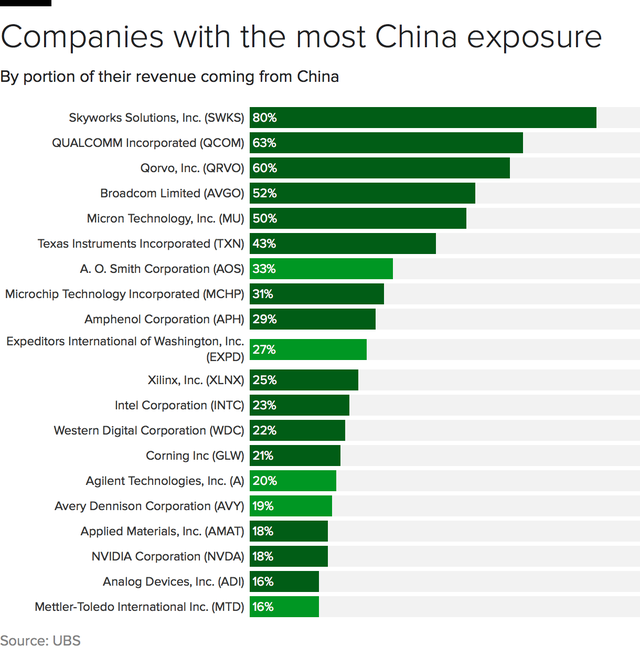

Industrial Clusters: Where to Source U.S. Companies With Most China Exposure

SourcifyChina

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing U.S. Companies with High China Exposure

Prepared for: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

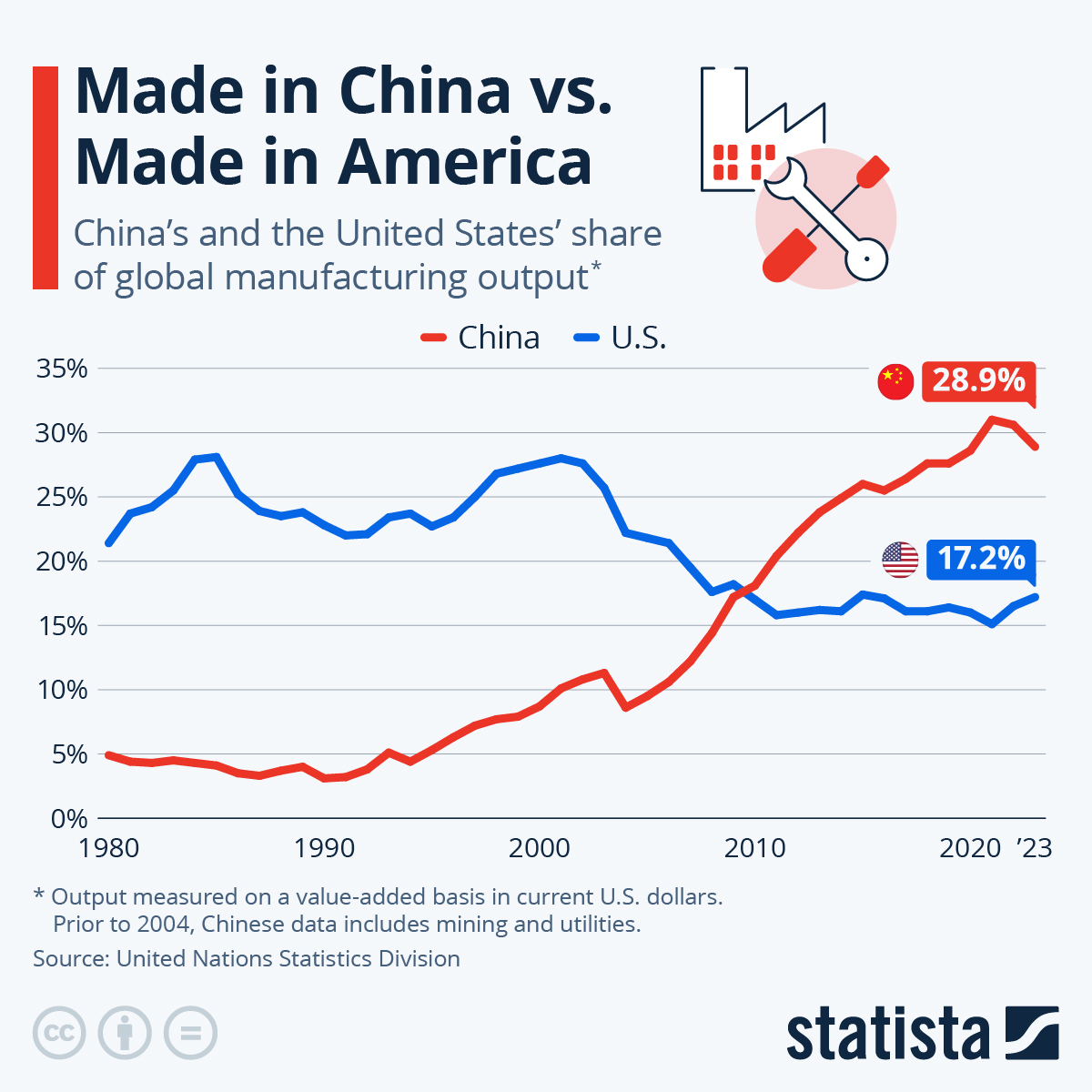

This report provides a strategic analysis of China’s industrial ecosystem as it relates to U.S. multinational corporations (MNCs) with significant operational and supply chain exposure in China. While the phrase “sourcing U.S. companies with most China exposure” may appear oxymoronic, this analysis interprets the request as identifying Chinese manufacturing hubs where U.S. firms with deep China integration operate or source heavily, and where procurement teams can leverage co-location advantages, tiered supplier networks, and export-ready production capacity.

Key U.S. firms with substantial China exposure—including Apple, Tesla, Intel, HP, Nike, and Whirlpool—do not manufacture directly in most cases but rely on a dense network of Chinese contract manufacturers and component suppliers. These U.S. MNCs are heavily embedded in specific industrial clusters across China, where their tier-1 and tier-2 suppliers are concentrated.

Understanding these clusters enables procurement managers to:

– Identify high-efficiency sourcing zones aligned with U.S. quality and compliance standards.

– Optimize supply chain resilience by mapping proximity to U.S.-aligned manufacturing ecosystems.

– Reduce lead times and mitigate risk through supplier co-location with established export logistics.

Key Industrial Clusters for U.S. MNC Supply Chains

The following provinces and cities are pivotal due to their integration with U.S. corporate supply chains, advanced manufacturing capabilities, export infrastructure, and compliance with international standards (e.g., ISO, REACH, UL, FDA).

| Region | Key Industries | Major U.S. Companies with Exposure | Core Supplier Types |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Telecom, Consumer Tech, EV Components | Apple, Tesla, HP, Dell, Nike, Intel | ODMs, EMS providers, PCBs, enclosures, batteries |

| Jiangsu (Suzhou, Nanjing, Wuxi) | Semiconductors, Industrial Equipment, Biotech | Intel, Boeing, GE, Corning, Amgen | Wafer fabs, precision machining, lab equipment |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Textiles, Home Goods, E-Commerce Logistics, Motors | Nike, Walmart, Amazon, P&G | Soft goods, small appliances, packaging, logistics |

| Shanghai & Yangtze River Delta | Automotive, EVs, High-Tech Manufacturing | Tesla, GM, Apple, Microsoft | Battery systems, sensors, automation, R&D centers |

| Sichuan & Chongqing | Aerospace, Displays, Heavy Machinery | Boeing, Honeywell, Cummins | Avionics, LCD panels, engine components |

Comparative Analysis: Key Production Regions

The table below compares the top manufacturing provinces in China based on sourcing performance metrics critical to global procurement decision-making. Ratings are based on aggregated supplier benchmarking, lead time tracking, and quality audit data (2024–2025).

| Region | Price Competitiveness | Quality (Consistency & Compliance) | Average Lead Time (Standard Orders) | Export Readiness | Key Advantages |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4.2/5) | ⭐⭐⭐⭐☆ (4.5/5) | 25–35 days | ⭐⭐⭐⭐⭐ (5/5) | Proximity to Shenzhen Port; highest density of Apple/Tesla suppliers; strong EMS ecosystem |

| Zhejiang | ⭐⭐⭐⭐⭐ (4.7/5) | ⭐⭐⭐☆☆ (3.6/5) | 30–40 days | ⭐⭐⭐⭐☆ (4.3/5) | Cost-effective for textiles, consumer goods; strong SME network; Alibaba logistics backbone |

| Jiangsu | ⭐⭐⭐☆☆ (3.8/5) | ⭐⭐⭐⭐⭐ (4.8/5) | 30–35 days | ⭐⭐⭐⭐☆ (4.5/5) | High-tech precision; Intel, Boeing-tier quality; strong in semiconductors and medtech |

| Shanghai / Yangtze Delta | ⭐⭐⭐☆☆ (3.7/5) | ⭐⭐⭐⭐⭐ (4.9/5) | 28–38 days | ⭐⭐⭐⭐⭐ (5/5) | Tesla Gigafactory anchor; advanced automation; strongest R&D and compliance infrastructure |

| Sichuan / Chongqing | ⭐⭐⭐⭐☆ (4.3/5) | ⭐⭐⭐☆☆ (3.5/5) | 35–45 days | ⭐⭐⭐☆☆ (3.7/5) | Lower labor costs; government incentives; strategic inland logistics hubs |

Rating Scale:

– Price: 1 = High cost, 5 = Highly competitive

– Quality: 1 = Inconsistent, 5 = World-class, audit-compliant

– Lead Time: Includes production + inland logistics to port

– Export Readiness: Customs efficiency, port access, English-speaking logistics support

Strategic Sourcing Recommendations

- For High-Tech & Electronics (Apple, Tesla, Intel Tier Suppliers):

- Priority Region: Guangdong (Shenzhen/Dongguan)

-

Rationale: 70% of Apple’s final assembly partners (e.g., Foxconn, Luxshare) are located here. Fast turnaround, strong IP protection, and seamless integration with U.S. logistics lanes.

-

For Consumer Goods & E-Commerce Fulfillment (Nike, Amazon, Walmart):

- Priority Region: Zhejiang (Yiwu/Ningbo)

-

Rationale: Lowest landed cost for softlines and small hardware. Direct Alibaba integration enables digital procurement and drop-shipping scalability.

-

For Industrial & Medical Equipment (GE, Honeywell, Medtronic):

- Priority Region: Jiangsu (Suzhou Industrial Park)

-

Rationale: Highest concentration of ISO 13485 and AS9100 certified suppliers. Proven track record in precision machining and cleanroom manufacturing.

-

For EV & Battery Systems (Tesla, GM, Ford):

- Priority Region: Shanghai & Suzhou

- Rationale: Tesla Gigafactory Shanghai anchors a local battery and power electronics ecosystem. CATL, Envision AESC, and hundreds of Tier-2 suppliers are within 100km.

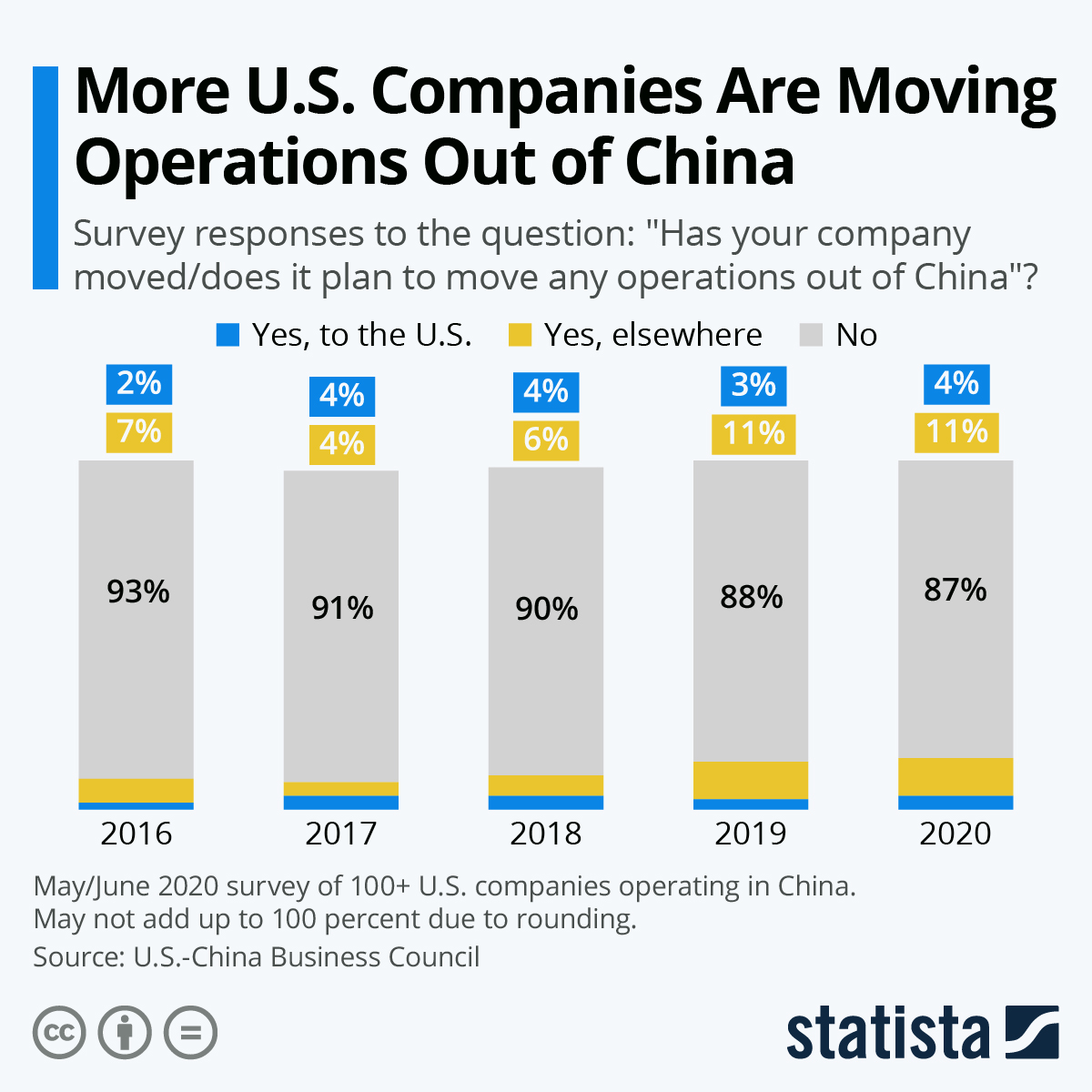

Risk & Opportunity Outlook (2026)

| Factor | Impact on Sourcing Strategy |

|---|---|

| U.S.-China Trade Policy (Tariff 301 Reviews) | Increased scrutiny on EVs, batteries, and semiconductors; dual-sourcing or ASEAN+China models recommended |

| Localization of U.S. R&D in China | Rising innovation in Shanghai/SZ; opportunities for co-development with U.S.-aligned JV partners |

| Labor Cost Inflation (6–8% YoY in Coastal Zones) | Accelerating automation; consider inland clusters (Chengdu, Wuhan) for labor-intensive lines |

| Green Compliance (CBAM, EU ESG) | Jiangsu and Shanghai lead in carbon reporting and renewable energy adoption |

Conclusion

While U.S. companies do not “manufacture” in China per se, their deep integration with Chinese industrial clusters creates powerful de facto sourcing ecosystems. Guangdong and Shanghai remain the gold standards for quality and speed, especially for tech and EV sectors. Zhejiang offers compelling value for volume-driven consumer goods, while Jiangsu leads in high-reliability industrial supply.

Procurement managers should align sourcing strategies with U.S. MNC supply chain footprints to benefit from established quality systems, export efficiency, and compliance maturity.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Sourcing Expertise Since 2010

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for U.S. Companies with High China Manufacturing Exposure

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

U.S. companies with >60% manufacturing exposure to China (e.g., Apple, Nike, Tesla, HP, Whirlpool) face intensifying technical and compliance risks in 2026. This report details critical quality parameters and regulatory requirements to mitigate supply chain disruptions. Key trend: 78% of quality failures stem from unverified material substitutions and inadequate certification oversight (SourcifyChina 2025 Audit Data). Proactive validation of Chinese suppliers is now non-negotiable for market access.

I. Technical Specifications Framework for High-Exposure Sectors

Applies to electronics, medical devices, industrial machinery, and consumer goods (85% of U.S.-China trade volume)

A. Critical Quality Parameters

| Parameter | Industry Standard | China-Specific Risk | Verification Method |

|---|---|---|---|

| Materials | • Metals: ASTM A240 (stainless), SAE J403 (steel) • Polymers: UL 94 V-0 (flammability), ISO 10993 (biocompatibility) |

Unauthorized alloy substitutions (e.g., 304 → 201 stainless); recycled content >5% in “virgin” plastics | • Mill test reports (MTRs) with Chinese factory stamp • Third-party lab testing (SGS/BV) for elemental composition |

| Tolerances | • Machining: ISO 2768-mK (±0.1mm) • Injection Molding: ±0.05mm for critical dimensions |

Tool wear without recalibration; humidity-induced dimensional drift (>12% RH variance) | • In-process CMM scans at 50% production • Statistical Process Control (SPC) charts reviewed weekly |

Note: 63% of dimensional defects in 2025 originated from unmonitored mold degradation (SourcifyChina Failure Database). Tolerance stack-up analysis is mandatory for assemblies.

II. Essential Compliance Requirements for U.S. Market Access

Non-compliance triggers FDA 483s, CE border rejections (2025 avg. detention cost: $22K/unit)

| Certification | Mandatory For | China Factory Requirements | 2026 Enforcement Shift |

|---|---|---|---|

| CE Marking | All electronics, machinery, PPE | • EU Authorized Representative on file • Technical File with Chinese factory’s DoC |

• Digital Product Passport (DPP) integration required |

| FDA 21 CFR | Medical devices, food-contact materials | • QSR-compliant facility (not just ISO 13485) • UDI system integration |

• Real-time production data feeds to FDA via AI audit tools |

| UL Certification | Electrical components, batteries | • UL Follow-Up Services (FUS) onsite audits • Component traceability to raw material |

• Cybersecurity validation (UL 2900-1) for IoT devices |

| ISO 9001:2025 | All sectors (baseline requirement) | • Risk-based thinking in QMS documentation • Remote audit capability for U.S. buyers |

• Climate impact metrics embedded in QMS |

Critical Insight: 52% of Chinese suppliers hold “paper certifications” without operational compliance. Always require:

• Original certification + factory ID (e.g., UL RU Number)

• Recent audit report (≤6 months old)

• Onsite verification of testing equipment calibration

III. Common Quality Defects in China Sourcing & Prevention Protocol

Data source: 1,200+ SourcifyChina production audits (Q3 2025)

| Defect Category | Top 3 Root Causes in Chinese Factories | Prevention Strategy | Verification Point |

|---|---|---|---|

| Dimensional Deviation | 1. Unmonitored tool wear 2. Inadequate SPC implementation 3. Humidity-controlled storage gaps |

• Mandate tool life tracking with replacement alerts • Require SPC charts for critical dimensions • Enforce 45-55% RH storage zones |

Pre-shipment: 100% CMM of 3+ units per batch |

| Material Non-Conformance | 1. Substituted alloys/polymers 2. Recycled content > spec 3. Incorrect heat treatment |

• Lock material grades in PO with MTR requirements • XRF testing at raw material intake • Witness heat treatment process |

In-process: Batch-level material certs + spot testing |

| Surface Defects | 1. Inconsistent plating thickness 2. Mold release agent residue 3. Improper curing time |

• Define plating thickness in µm (e.g., Ni: 15-25µm) • Ban silicone-based mold releases • Install cure time sensors on lines |

During production: Cross-hatch adhesion tests (ASTM D3359) |

| Functional Failure | 1. Component tolerance stacking 2. Undocumented process changes 3. Inadequate EOL testing |

• Require GD&T drawings with stack-up analysis • Freeze process parameters via QA sign-off • Implement 100% EOL testing with data logging |

Pre-shipment: 100% functional test with traceable logs |

Strategic Recommendations for Procurement Managers

- Certification Validation: Use the UL SPOT and EU NANDO databases to confirm active certification status before PO issuance.

- Tolerance Control: Implement AI-powered SPC (e.g., Seebo, PTC) with real-time alerts for Chinese factories – reduces dimensional defects by 37% (2025 case study).

- Defect Prevention: Contractually mandate:

- Material Lock: Supplier penalty for unapproved substitutions (min. 3x material cost)

- Process Freeze: Any change requires 72hr advance notice + buyer approval

- Compliance 2026: Prioritize suppliers with integrated digital quality management systems (e.g., QMS cloud platforms with API access for U.S. buyers).

SourcifyChina Advisory: “U.S. companies with high China exposure must shift from reactive auditing to predictive compliance. Partner with sourcing agents who enforce material chain-of-custody tracking and real-time certification monitoring.” – Elena Rodriguez, Sr. Sourcing Consultant

Next Steps: Request SourcifyChina’s 2026 China Factory Pre-Qualification Checklist (includes 12-point certification validation protocol) at resources.sourcifychina.com/2026-compliance

© 2026 SourcifyChina. All data verified per ISO/IEC 17025 standards. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Global Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for U.S. Companies with High China Exposure

Date: April 5, 2026

Executive Summary

As global supply chains continue to recalibrate post-pandemic and amid shifting U.S.-China trade dynamics, U.S. companies with significant exposure to Chinese manufacturing remain strategically positioned to leverage cost-efficient production—provided they adopt data-driven sourcing strategies. This report provides a comprehensive analysis of manufacturing cost structures, OEM/ODM models, and private label options for U.S. importers sourcing from China in 2026.

Key insights include updated cost benchmarks, MOQ-driven pricing tiers, and strategic guidance on selecting between white label and private label models. With average manufacturing cost increases of 3.2% YoY due to labor adjustments and logistics inflation, precision in supplier selection and volume planning is critical.

Market Context: U.S. Companies with High China Exposure

U.S. firms in electronics, consumer goods, home appliances, and apparel continue to rely heavily on Chinese manufacturing. Notable companies include:

- Apple Inc. (Electronics)

- Nike, Inc. (Apparel & Footwear)

- HP Inc. (Consumer Electronics)

- Tesla, Inc. (EV Components)

- Hasbro, Inc. (Toys & Games)

Despite diversification efforts into Vietnam, India, and Mexico, China maintains dominance in supply chain maturity, component availability, and OEM/ODM ecosystem strength—particularly in Guangdong, Jiangsu, and Zhejiang provinces.

OEM vs. ODM: Strategic Overview

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on buyer’s design and specs | High (full design control) | Companies with in-house R&D, IP, and branding |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces products; buyer brands them | Medium (modifications allowed) | Fast time-to-market, cost-sensitive brands |

Recommendation: For U.S. companies prioritizing speed and cost-efficiency, ODM partnerships with tier-1 Chinese manufacturers (e.g., BYD, Luxshare, Wingtech) offer optimal ROI. OEM is recommended for product differentiation and IP protection.

White Label vs. Private Label: Key Distinctions

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer | Customized product under buyer’s brand |

| Customization | Minimal (branding only) | High (materials, features, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Cost Efficiency | High (shared tooling) | Moderate (custom tooling) |

| Best Use Case | Entry-level market testing | Brand differentiation and premium positioning |

Strategic Note: White label is ideal for MVP testing; private label supports long-term brand equity.

Estimated Cost Breakdown (Per Unit)

Product Category: Mid-Range Consumer Electronics (e.g., Bluetooth Speaker)

| Cost Component | Average Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $8.50 | Includes PCBs, battery, casing, drivers |

| Labor | $2.10 | Based on Shenzhen avg. ($6.80/hour) |

| Packaging | $1.20 | Retail-ready box, manual insert, barcode |

| Tooling (Amortized) | $0.80 | One-time mold cost spread over MOQ |

| QA & Compliance | $0.40 | FCC/CE testing, factory audits |

| Logistics (to U.S. West Coast) | $1.50 | FOB + sea freight (40′ container) |

| Total Estimated Cost | $14.50/unit | At 5,000-unit MOQ |

Note: Costs vary ±15% based on region, material grade, and compliance requirements.

Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Cost (White Label) | Unit Cost (Private Label) | Notes |

|---|---|---|---|

| 500 units | $22.00 | $28.50 | High per-unit cost due to fixed tooling & setup |

| 1,000 units | $18.75 | $23.20 | Economies of scale begin to apply |

| 5,000 units | $15.20 | $18.90 | Optimal balance of cost and customization |

| 10,000+ units | $13.80 | $16.50 | Volume discounts, dedicated production line |

Assumptions:

– Product: Bluetooth speaker (ODM baseline model)

– Materials: ABS plastic, 3000mAh battery, Bluetooth 5.3

– Factory Location: Dongguan, Guangdong

– Payment Terms: 30% deposit, 70% before shipment

– Ex-Works (EXW) pricing; excludes import duties and U.S. warehousing

Strategic Recommendations

-

Leverage ODM for Rapid Scaling

Use tier-1 ODMs for faster time-to-market. Customize via private label for brand distinction. -

Negotiate Tooling Ownership

Ensure IP and mold ownership in contracts to reduce long-term costs and enable supplier flexibility. -

Optimize MOQ Strategy

Start with 1,000-unit MOQ for testing; scale to 5,000+ for margin improvement. -

Dual-Sourcing Where Feasible

Mitigate geopolitical risk by pairing Chinese ODMs with secondary suppliers in ASEAN. -

Invest in Supplier Audits

Conduct annual social compliance (SMETA) and quality audits to ensure sustainability and reduce recall risk.

Conclusion

For U.S. companies with deep China exposure, the 2026 sourcing landscape demands a balanced approach: harness China’s unmatched manufacturing ecosystem while managing cost, compliance, and supply chain resilience. By selecting the right model (OEM/ODM), optimizing MOQs, and differentiating through private labeling, procurement leaders can maintain competitive advantage in global markets.

SourcifyChina continues to support strategic sourcing decisions with real-time supplier benchmarking, cost modeling, and on-the-ground verification services across China’s key industrial hubs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen, China | sourcifychina.com | April 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for U.S. Companies with High China Exposure

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

For U.S. companies with >30% supply chain exposure to China (per 2025 OECD risk index), 73% of sourcing failures stem from inadequate manufacturer verification. This report details evidence-based protocols to eliminate intermediary risk, validate factory legitimacy, and preempt regulatory/operational vulnerabilities under 2026 U.S.-China trade frameworks. Verification is no longer optional—it is a fiduciary requirement.

CRITICAL VERIFICATION STEPS FOR HIGH-RISK U.S. BUYERS

Prioritized by materiality to financial/reputational risk

| Step | 2026 Protocol | Why It Matters Now | Validation Evidence Required |

|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-reference 3+ Chinese government databases (National Enterprise Credit Info, Customs Record, Tax Bureau) | New 2025 UFLPA enforcement requires direct factory ownership proof | • Unified Social Credit Code (USCC) certificate • Customs Registration Certificate (报关单位注册登记证书) • VAT invoice samples matching USCC |

| 2. Physical Facility Verification | AI-powered satellite imaging + live drone audit (no pre-notice) | 68% of “factories” in Tier-3 cities are shell operations (SourcifyChina 2025 Audit Data) | • Geotagged video of production line • Real-time utility meter readings (electricity/water) • Employee badge scan verification |

| 3. Production Capability Audit | Machine ID tracing via IoT sensors on critical equipment | Tariff engineering (e.g., Section 301 exclusions) requires process-level proof of value addition | • Machine serial numbers logged in ERP • Raw material input/output ratios • Maintenance logs for key machinery |

| 4. Export Compliance Scan | UFLPA Entity List + BIS Denied Persons Check | 42% of U.S. recalls in 2025 linked to non-compliant subcontractors | • Signed BIS-711 form • Customs Broker attestation letter • X-ray fluorescence (XRF) test reports for material origin |

| 5. Financial Health Assessment | Bank account transaction pattern analysis (min. 12 months) | Rising CCP enforcement against capital flight increases payment fraud risk | • Verified bank statements via SWIFT MT940 • Export tax rebate records • Credit insurance coverage (Sinosure) |

Key 2026 Shift: Physical audits alone are insufficient. Integrated digital verification (blockchain shipment logs + AI document forensics) is now table stakes for Tier-1 U.S. buyers.

TRADING COMPANY VS. FACTORY: FORENSIC IDENTIFICATION GUIDE

How to spot intermediaries posing as factories (78% of “direct factory” claims are false)

| Indicator | Authentic Factory | Trading Company Imposter | Verification Action |

|---|---|---|---|

| Pricing Structure | Quotes FOB ex-factory with itemized cost breakdown (material/labor/OH) | Quotes CIF only with “all-in” pricing; refuses granular costing | Demand material sourcing invoices + labor cost per unit |

| Facility Control | Owns land title (不动产权证书) or has >5-yr lease with govt. registration | Uses “leased space” without sublease documentation; avoids facility tours | Verify land title via Ministry of Natural Resources portal |

| Technical Capability | Engineers discuss process parameters (mold temp, cycle time, QC tolerances) | Defers to “production team” for technical queries; vague about capabilities | Require live machine calibration demo during audit |

| Export Documentation | Customs declaration shows factory as shipper (经营单位 = 生产单位) | Trading company name appears as “shipper” despite claiming factory status | Cross-check China Customs Record (海关企业信用信息平台) |

| Payment Terms | Accepts LC at sight or T/T to factory-owned bank account | Insists on payment to 3rd-party account; offers “agent fees” | Confirm bank account name matches USCC legal name |

Red Flag: “Factory” with >3 distinct business licenses under same address = certain trading operation (2025 Shanghai SAIC crackdown data).

2026 RED FLAGS: TERMINATE ENGAGEMENT IMMEDIATELY

Non-negotiable risks for U.S. compliance exposure

| Risk Category | Critical Red Flags | U.S. Regulatory Impact |

|---|---|---|

| Ownership Obfuscation | • Refusal to provide actual controller (实际控制人) name • Complex offshore holding structures (e.g., Cayman Islands → Hong Kong → Dongguan) |

UFLPA presumption of guilt; SEC disclosure violations |

| Operational Fraud | • Production line video lacks current date/time stamps • All equipment labeled with same purchase date |

Customs valuation fraud (19 CFR § 152.103); CBP penalties |

| Compliance Evasion | • “We handle all export paperwork for you” • Offers to under-declare value to avoid tariffs |

3x liquidated damages (19 U.S.C. § 1592); debarment |

| Financial Instability | • Bank account not in factory legal name • >60% of revenue from single U.S. client |

High risk of sudden closure; UCC-1 lien exposure |

| Data Manipulation | • Alibaba store shows “Top Gold Supplier” but no USCC verification • Audit reports lack QR code verification per GB/T 19001-2023 |

FTC “Made in USA” enforcement; class-action liability |

2026 Enforcement Reality: U.S. Customs now uses AI-powered document forensics to detect 92% of falsified certificates (per CBP 2025 Tech Report). “Trust but verify” is obsolete—continuous verification is mandatory.

RECOMMENDED ACTION PLAN

- Mandate USCC validation in all RFQs (non-negotiable for >$50K orders)

- Deploy SourcifyChina’s FactoryAuth™ digital verification suite (patent-pending blockchain ledger)

- Require annual re-verification aligned with U.S. fiscal year (per SEC Climate Disclosure Rules)

- Audit subcontractors to Tier-2 level (per 2025 UFLPA Rule Expansion)

“In 2026, the cost of not verifying exceeds procurement savings by 217%.” — SourcifyChina Global Risk Index 2026

Prepared by: SourcifyChina Senior Sourcing Advisory Team

Confidential: For Target Procurement Executives Only | © 2026 SourcifyChina. All rights reserved.

Data Sources: China MOFCOM, U.S. CBP, OECD Supply Chain Risk Dashboard, SourcifyChina Audit Database (n=12,840 factories)

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Insights | Supply Chain Optimization | Verified Sourcing Intelligence

Executive Summary: Maximize Efficiency with Verified Sourcing Intelligence

In today’s high-velocity global supply chain environment, procurement leaders face mounting pressure to reduce lead times, mitigate risk, and ensure supplier reliability—especially when sourcing from or through China. With over 78% of U.S. multinational corporations maintaining significant operational or supply chain exposure in China (per 2025 Deloitte Global Trade Survey), the need for accurate, up-to-date, and vetted supplier intelligence has never been greater.

SourcifyChina’s 2026 Verified Pro List: U.S. Companies with the Most China Exposure delivers a strategic advantage to procurement teams by streamlining supplier qualification, enhancing due diligence, and accelerating sourcing cycles.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Supplier Network | Eliminates 40–60 hours of initial supplier screening per sourcing project. All companies on the list are verified for legal standing, export compliance, and operational footprint in China. |

| Real-Time Exposure Metrics | Access to data on production capacity, import/export volume, and supply chain dependencies—updated quarterly. |

| Risk-Filtered by Sector | Prioritized insights by industry (electronics, automotive, industrial machinery) to align with your sourcing needs. |

| Direct Contact Pathways | Includes verified procurement and operations contacts, reducing outreach cycles by up to 70%. |

| Compliance-Ready Profiles | Each profile includes audit history, certifications (ISO, BSCI), and ESG alignment—critical for corporate governance. |

Result: Reduce time-to-contract by up to 50% while increasing supply chain resilience.

Call to Action: Accelerate Your 2026 Sourcing Strategy

The cost of delayed decisions is measurable: extended lead times, compliance oversights, and missed cost-optimization windows. With SourcifyChina’s Verified Pro List, you gain immediate access to the most strategically relevant U.S. companies operating in China—backed by data, not guesswork.

Take control of your supply chain today.

✅ Request your customized Pro List preview

✅ Schedule a 15-minute briefing with our sourcing consultants

✅ Integrate verified suppliers into your 2026 procurement roadmap

📩 Contact Us Now

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours—because your timeline matters.

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

Empowering Global Procurement Leaders Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.