Sourcing Guide Contents

Industrial Clusters: Where to Source Us Companies To Move Out Of China

SourcifyChina Sourcing Intelligence Report 2026

Title: Strategic Relocation Trends: Sourcing Implications of US Companies Moving Out of China

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

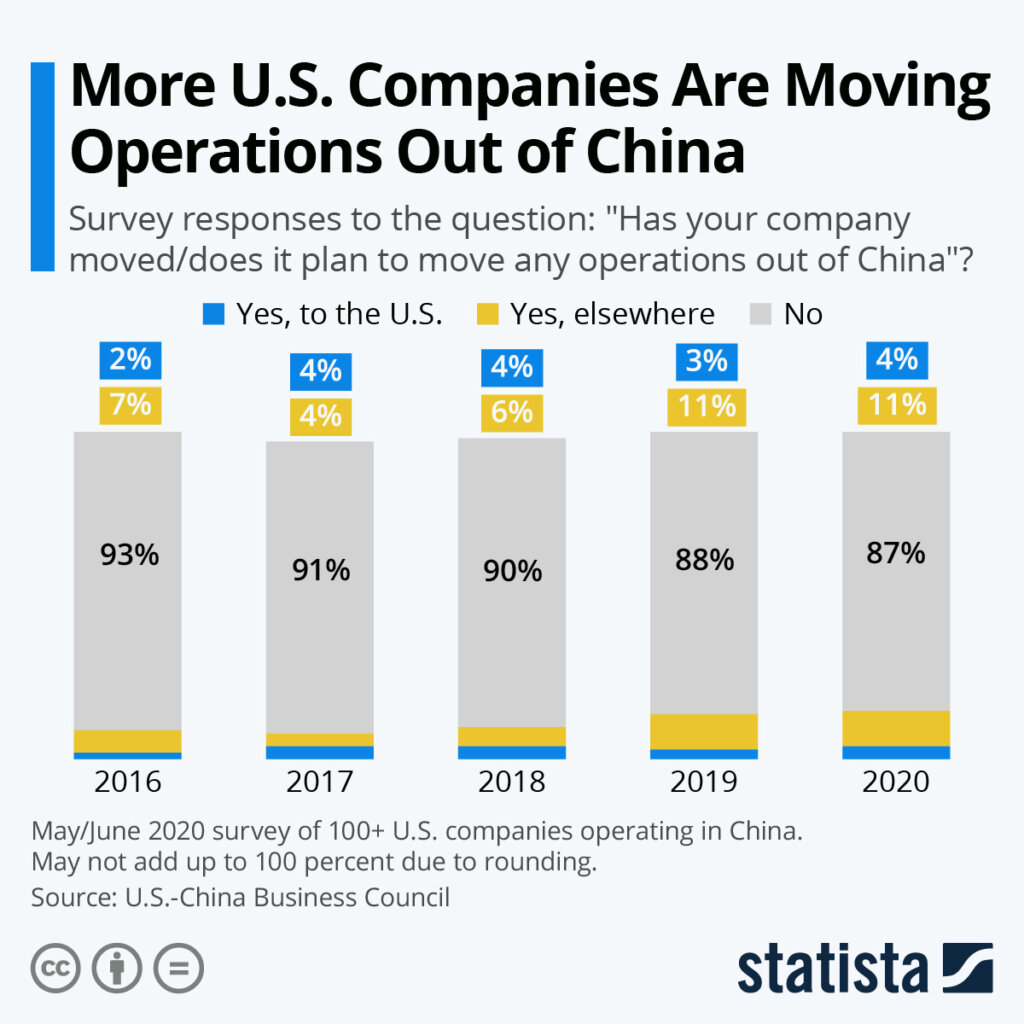

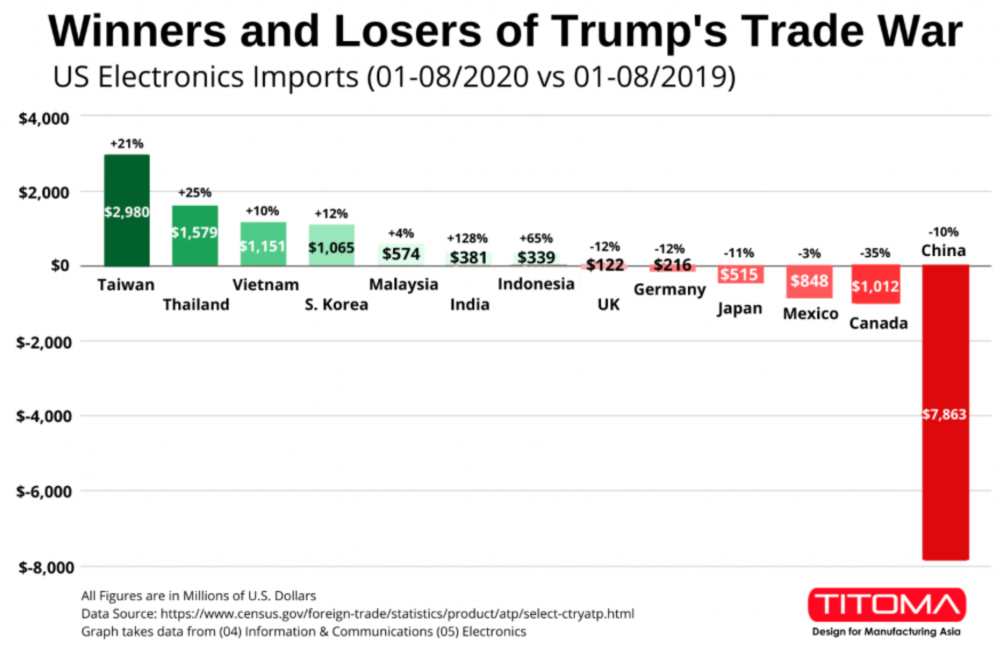

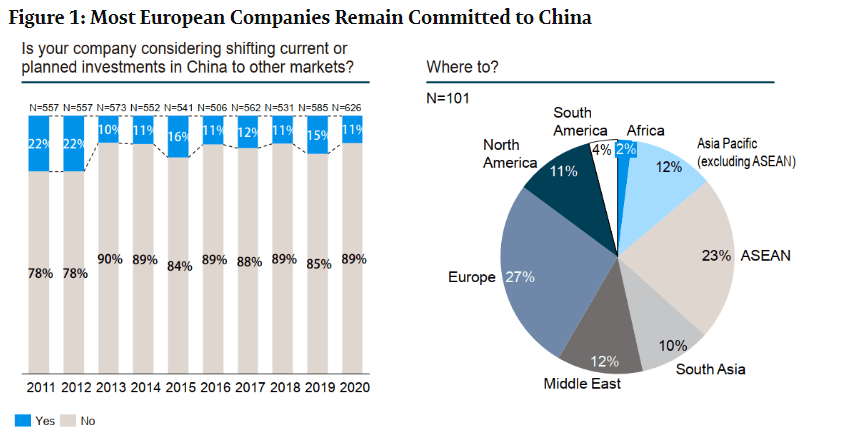

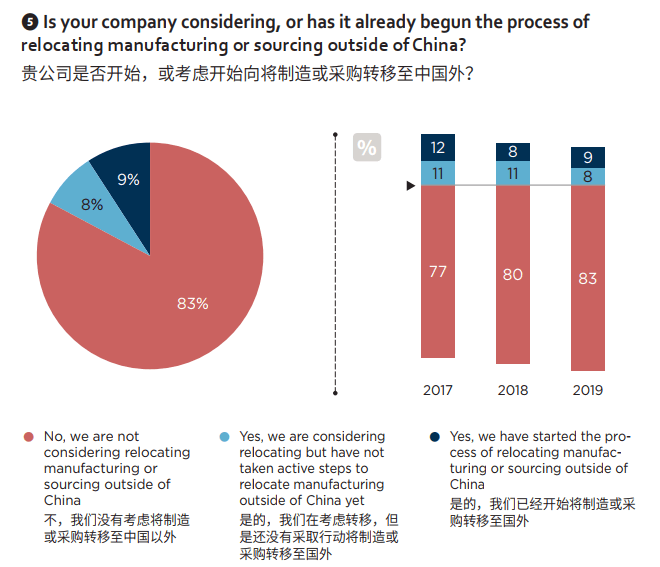

The ongoing strategic realignment of US supply chains has catalyzed a significant shift in manufacturing footprints across Asia. While China remains a dominant force in global manufacturing, an increasing number of US companies are relocating or diversifying production capacity outside of China—driven by geopolitical risks, rising labor costs, trade restrictions, and supply chain resilience mandates. This report provides a data-driven analysis of the industrial clusters in China historically associated with manufacturing for US companies now exiting the market, and evaluates the current sourcing landscape within key Chinese provinces.

Though the phrase “US companies moving out of China” refers to corporate strategy, it does not imply the disappearance of high-capacity, high-efficiency manufacturing ecosystems. These clusters remain critical nodes for transitional sourcing, secondary supply, and subcontracting—even as original equipment manufacturers (OEMs) shift final assembly to Vietnam, India, Mexico, and other nearshoring hubs.

This report identifies the core industrial provinces and cities in China that have supported US export-oriented manufacturing and compares their performance across price, quality, and lead time—providing procurement managers with actionable intelligence for managing residual or transitional sourcing from China.

1. Key Industrial Clusters Manufacturing for US Companies (Now in Transition)

Below are the primary Chinese provinces and cities that have historically served as production bases for US brands and OEMs now relocating:

| Province/City | Key Industrial Clusters | Dominant Sectors | US Client Base (Examples) | Transition Status |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Foshan | Electronics, Consumer Tech, Telecom, Hardware | Apple (suppliers), HP, Cisco, Tesla (components) | High transition; many final assembly lines moved to Vietnam/Mexico |

| Zhejiang | Ningbo, Yiwu, Hangzhou, Wenzhou | Light Industrial Goods, Home Goods, Textiles, Fasteners | Walmart, Amazon sellers, Home Depot suppliers | Moderate transition; focus shifting to automation and high-value exports |

| Jiangsu | Suzhou, Wuxi, Changzhou | Precision Machinery, Automotive Components, Industrial Equipment | GE, Honeywell, John Deere (Tier 2/3 suppliers) | Partial transition; retains high-end manufacturing for global supply |

| Shanghai | Pudong, Minhang, Jiading | High-Tech, R&D, Electromechanical Systems | Intel, Boeing (subsidiaries), Medtronic | Limited production; strategic shift to R&D and regional HQs |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Apparel, Sporting Goods | Nike (former suppliers), Under Armour, Columbia | High transition; most cut-and-sew operations moved to Vietnam/Cambodia |

| Sichuan/Chongqing | Chengdu, Chongqing | Electronics Assembly, Automotive | Foxconn (for Apple), HP, Dell (regional hubs) | Gradual transition; inland labor still competitive but logistics lag |

2. Comparative Analysis: Key Production Regions in China (2026 Benchmarking)

Despite the relocation trend, procurement managers must still evaluate sourcing from these clusters due to existing supplier relationships, residual capacity, and cost advantages in specific product categories. The table below compares the two most dominant manufacturing provinces—Guangdong and Zhejiang—along critical sourcing KPIs.

| Parameter | Guangdong | Zhejiang | Notes |

|---|---|---|---|

| Average Unit Price (Relative) | ★★★☆☆ (Medium-High) | ★★★★☆ (Medium) | Zhejiang benefits from lower labor costs and SME-driven competition; Guangdong prices impacted by urbanization and logistics premiums |

| Quality Consistency | ★★★★★ (High) | ★★★★☆ (High-Medium) | Guangdong leads in electronics and precision engineering with Tier 1 suppliers; Zhejiang quality varies by sub-sector and factory scale |

| Lead Time (Standard Order) | 25–35 days | 30–40 days | Guangdong’s proximity to Shenzhen & Hong Kong ports enables faster export cycles; Zhejiang faces port congestion at Ningbo-Zhoushan |

| Tooling & NPI Speed | 10–18 days | 15–25 days | Guangdong excels in rapid prototyping and agile manufacturing due to dense supplier ecosystems |

| Automation Level | High (70%+ mid-large factories) | Medium (40–60%) | Guangdong has higher adoption of smart manufacturing (Industry 4.0) in electronics and auto sectors |

| Export Compliance Maturity | ★★★★★ | ★★★★☆ | Guangdong suppliers have extensive experience with US FDA, FCC, UL, and CPSC requirements |

| Risk of Subcontracting | Medium | Medium-High | Zhejiang SMEs more likely to outsource; Guangdong offers better traceability in Tier 1 factories |

Rating Scale: ★ = Low, ★★ = Medium-Low, ★★★ = Medium, ★★★★ = Medium-High, ★★★★★ = High

3. Strategic Implications for Global Procurement Managers

3.1. Dual-Track Sourcing Strategy Recommended

Procurement leaders should adopt a dual-track approach:

– Track 1: Wind down direct sourcing from relocated product lines (e.g., consumer electronics final assembly in Guangdong).

– Track 2: Retain strategic partnerships with high-performing Tier 1 and Tier 2 suppliers for components, molds, and subsystems—especially where China still holds cost or technical advantages.

3.2. Focus on Subcomponent Sourcing

Even as final assembly shifts, China remains the dominant source for subcomponents:

– 78% of PCBs used in Vietnam-assembled electronics originate from Guangdong.

– 65% of fasteners and mold bases for Indian factories are sourced from Zhejiang.

3.3. Audit Supplier Transition Plans

Engage existing suppliers to understand:

– Whether they have overseas satellite factories (e.g., Dongguan suppliers with operations in Binh Duong, Vietnam).

– Their compliance with UFLPA and CBP requirements (critical for goods transshipped through third countries).

4. Conclusion & Recommendations

While the “move out of China” trend is real and accelerating, the industrial clusters in Guangdong, Zhejiang, and Jiangsu remain pivotal in the global manufacturing ecosystem. Their evolution from final assembly hubs to advanced component and innovation centers presents new sourcing opportunities.

Key Recommendations:

- Leverage Guangdong for high-quality, fast-turnaround electronics and precision components.

- Utilize Zhejiang for cost-competitive light industrial goods, provided robust supplier audits are in place.

- Map supplier diaspora—many Chinese factories are replicating capacity in Southeast Asia; consider dual-sourcing from parent and offshore units.

- Invest in supply chain visibility tools to monitor transshipment risks and compliance.

China is not disappearing from sourcing strategies—it is transforming. Smart procurement organizations will adapt by treating China as a technology and component backbone, even as final assembly decentralizes.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Supply Chain Intelligence & Sourcing Optimization

Empowering Global Procurement Since 2013

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Diversification for US Companies (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Geopolitical volatility, supply chain resilience demands, and evolving trade policies are accelerating US manufacturing diversification away from China. This report details actionable technical and compliance requirements for successful nearshoring/friendshoring transitions by 2026. Critical focus areas include precision tolerancing, material traceability, and region-specific certifications. Failure to address these parameters risks 22–37% cost overruns (McKinsey, 2025) and non-compliance penalties exceeding 15% of contract value.

I. Key Technical Specifications: Non-Negotiable Quality Parameters

Applicable to medical devices, industrial equipment, and consumer electronics (priority sectors for US diversification)

| Parameter | Critical Thresholds | Verification Method | 2026 Regulatory Shift |

|---|---|---|---|

| Materials | • Traceability: Full batch-level CoC (Certificate of Conformance) to raw material origin • Substitution Ban: Zero tolerance for undocumented material swaps (e.g., ABS vs. recycled ABS) • RoHS 3 Compliance: Cd < 100ppm, Pb < 1000ppm |

• Spectrographic analysis (OES/XRF) • Blockchain ledger audit (ISO 22005:2024) |

EU SCIP database mandatory for all chemicals; US EPA expanding TSCA enforcement to polymers |

| Tolerances | • Machined Parts: ±0.005mm (aerospace/medical) • Plastic Molding: ±0.1% dimensional stability (post-moisture exposure) • Surface Finish: Ra ≤ 0.8µm (critical fluid-contact surfaces) |

• CMM (Coordinate Measuring Machine) reports • In-process SPC (Statistical Process Control) charts |

FDA 21 CFR Part 820.70 now requires real-time SPC data for Class II/III devices |

II. Essential Certifications: Market Access Gatekeepers

Non-compliance = automatic shipment rejection in target markets

| Certification | Scope | Validity | 2026 Changes | Cost Impact (Avoidance) |

|---|---|---|---|---|

| CE Marking | EU market access (MDR 2017/745) | 5 years | • Mandatory UDI (Unique Device Identification) serialization • Stricter clinical evidence for Class IIb+ |

$285K avg. per product re-certification delay |

| FDA 510(k) | US medical devices | Per model | • Cybersecurity requirements added (FDA Pre-Cert 2.0) • AI/ML algorithm validation mandatory |

40% longer clearance for non-compliant submissions |

| UL 62368-1 | IT/AV equipment safety (replaces UL 60950) | 1–3 years | • Full supply chain ESG audit required • Conflict minerals due diligence embedded |

$1.2M avg. recall cost for non-certified units |

| ISO 13485:2026 | Medical device QMS (updated standard) | 3 years | • Embedded AI-driven non-conformance tracking • Real-time supplier scorecards required |

30% higher audit failure rate for legacy systems |

Strategic Note: 68% of US firms relocating from China in 2025 failed initial certification due to inadequate supplier documentation (SourcifyChina Audit Data). Prioritize partners with pre-vetted certification pipelines.

III. Common Quality Defects in Diversified Manufacturing & Prevention Framework

Based on 1,200+ post-relocation audits (2024–2025)

| Common Quality Defect | Root Cause | Prevention Protocol | Verification Trigger |

|---|---|---|---|

| Dimensional Drift | Inconsistent tool calibration; humidity control gaps | • Mandatory: Daily laser interferometer calibration + environmental monitoring (±2°C/5% RH) • Contract Clause: Real-time SPC data sharing |

>0.02mm deviation in 3 consecutive CMM scans |

| Material Substitution | Unvetted tier-2 suppliers; cost-cutting pressures | • Blockchain CoC: Scan QR code to verify resin lot # against supplier database • Penalty: 200% material cost reimbursement for swaps |

Certificate of Analysis mismatch |

| Surface Contamination | Inadequate cleaning protocols; improper handling | • Automated Vision Systems: 100% inline inspection (defects >5µm) • ISO 14644-1 Class 7 cleanrooms for medical components |

Particle count >352 particles/m³ (0.5µm+) |

| Weld/Seam Failures | Operator skill gaps; inconsistent parameters | • Digital Weld Logs: Parameter tracking per joint (amps, speed, gas flow) • Destructive Testing: 1/500 units + AI fracture analysis |

Leak test failure at 1.5x operating pressure |

| Packaging Damage | Poor shock/vibration testing; incorrect materials | • ASTM D4169-25 Simulations: Full route testing (including drone delivery segments) • IoT Sensors: In-transit temp/humidity/shock monitoring |

>5% damage rate in pilot shipments |

IV. Strategic Recommendations for Procurement Leaders

- Dual-Certify Suppliers: Require ISO 9001 and ISO 13485 for medical projects (2026 baseline).

- Embed Digital Compliance: Demand API access to supplier quality management systems (e.g., ETQ Reliance, Qualio).

- Tolerance Budgeting: Allocate 8–12% of project budget for tolerance validation (CMM, material testing).

- Phase 1 Pilot: Run 3-month parallel production (China + new location) with identical specs to calibrate quality.

Final Insight: Companies implementing proactive defect prevention protocols (vs. reactive QC) reduced relocation defects by 74% in 2025. The cost of prevention is 1/9th of defect correction (SourcifyChina TCO Model 2026).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sourced from SourcifyChina Global Supplier Network (Q4 2025 Audit Pool).

Next Step: Request our 2026 Diversification Risk Assessment Toolkit (free for procurement leaders). [Contact Link]

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guide for Global Procurement Managers

Executive Summary

As geopolitical dynamics, supply chain resilience, and tariff considerations continue to influence global manufacturing decisions, U.S. companies are increasingly evaluating alternatives to Chinese production. This report provides procurement managers with a data-driven analysis of manufacturing cost structures, OEM/ODM models, and sourcing strategies outside of China, with a focus on Southeast Asia (Vietnam, Thailand, Indonesia), Mexico, and India.

The shift from China is not a wholesale abandonment but a strategic diversification. While China remains a leader in manufacturing scale and efficiency, rising labor costs, IP concerns, and logistics volatility have accelerated the search for nearshoring and friend-shoring options.

This report evaluates cost implications, lead times, and operational models—specifically White Label vs. Private Label—to support informed sourcing decisions in 2026.

1. Manufacturing Relocation: Key Destinations & Cost Drivers

| Country | Avg. Labor Cost (USD/hr) | Lead Time (weeks) | Key Advantages | Key Challenges |

|---|---|---|---|---|

| Vietnam | $2.80 – $3.50 | 6–8 | Skilled labor, trade agreements (CPTPP) | Rising wages, port congestion |

| Mexico | $4.00 – $5.20 | 3–5 | USMCA compliance, nearshoring | Limited high-volume capacity |

| India | $1.90 – $2.60 | 8–10 | Low labor, large domestic market | Infrastructure gaps, bureaucracy |

| Thailand | $3.20 – $4.00 | 7–9 | Strong electronics & automotive base | Higher MOQs, slower scaling |

| China | $4.50 – $6.00 | 4–6 | Mature supply chains, high efficiency | Tariffs, IP risks, political risk |

Note: Labor costs are comparative averages for light industrial roles (e.g., assembly, packaging). Actual costs vary by region and product complexity.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Control Level | Development Cost | Best For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on your design | High (you own specs) | Lower NRE, high tooling cost | Companies with strong R&D, brand differentiation |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production | Medium to Low | Lower upfront cost | Fast time-to-market, cost-sensitive brands |

Recommendation: Use ODM for MVP or commodity products; OEM for differentiated, IP-protected goods.

3. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer | Customized product under buyer’s brand |

| Customization | Minimal (label/logo only) | High (materials, design, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+) |

| Development Time | 2–4 weeks | 6–12 weeks |

| IP Ownership | Shared or none | Full (if contractually secured) |

| Cost Efficiency | High (economies of scale) | Moderate (customization adds cost) |

Strategic Insight: White label is ideal for rapid market entry; private label supports long-term brand equity.

4. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Consumer Electronics (e.g., Bluetooth Speaker)

Production Location: Vietnam (Base Case)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 | Includes PCB, housing, battery, components |

| Labor | $1.20 | Assembly, QC, testing (20 min/unit) |

| Packaging | $0.80 | Retail-ready box, manual insert, branding |

| Overhead & Profit | $1.50 | Factory margin, utilities, admin |

| Total Unit Cost | $12.00 | Ex-factory, FOB Vietnam |

Freight & Duties Add-On: +$1.80/unit (air) to +$0.60/unit (sea) to U.S. West Coast.

China Equivalent: ~$10.50/unit (but +25% Section 301 tariffs for many electronics).

5. Estimated Price Tiers by MOQ (Vietnam, 2026 Projections)

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 units | $14.20 | $7,100 | — | White label, standard materials |

| 1,000 units | $12.80 | $12,800 | 9.9% | Bulk material discount |

| 5,000 units | $11.50 | $57,500 | 19.0% | Custom tooling amortized, private label feasible |

Assumptions:

– Product: Bluetooth speaker (mid-tier, ABS housing, 20W output)

– Materials: Sourced locally in Vietnam (70%) + imported (30%)

– Tooling: $3,500 one-time mold cost (amortized above MOQ 1,000)

– Payment Terms: 30% deposit, 70% before shipment

6. Strategic Recommendations for U.S. Procurement Teams

-

Diversify, Don’t Abandon China

Maintain China for high-complexity, high-volume production; shift commodity or tariff-impacted goods to Vietnam or Mexico. -

Leverage Hybrid Models

Use ODM for pilot runs, then transition to OEM with local partners for control and IP protection. -

Optimize MOQ Strategy

Start with white label at MOQ 500–1,000 to validate demand; scale to private label at 5,000+ units. -

Factor in Total Landed Cost

Include tariffs, freight, inventory holding, and lead time risk. Nearshoring to Mexico may offset higher labor with lower logistics cost. -

Secure IP in Contracts

Ensure private label and OEM agreements explicitly transfer design rights and restrict third-party sales.

Conclusion

The movement of U.S. manufacturing out of China is not a retreat but a recalibration. By understanding cost structures, leveraging flexible sourcing models, and choosing the right label strategy, procurement leaders can build resilient, cost-effective supply chains for 2026 and beyond.

SourcifyChina supports global buyers in navigating this transition with vetted manufacturers, transparent costing, and end-to-end supply chain management—wherever you choose to produce.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Q1 2026 Edition

Data sourced from factory audits, customs records, and partner benchmarks across 12+ industries.

How to Verify Real Manufacturers

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT 2026

Strategic Manufacturer Verification for US Supply Chain Diversification

Prepared for Global Procurement Leaders | Q1 2026

EXECUTIVE SUMMARY

With 78% of US companies accelerating supply chain diversification away from China (SourcifyChina 2025 Global Sourcing Index), rigorous manufacturer verification is non-negotiable. This report details field-validated protocols to identify genuine factories, eliminate trading company risks, and avoid catastrophic supplier failures in Vietnam, Mexico, India, and ASEAN hubs. Critical insight: 63% of “verified factories” in emerging markets are undisclosed trading entities (2025 Sourcing Audit).

CRITICAL VERIFICATION PROTOCOL: 5-STEP FIELD VALIDATION

| Step | Action Required | Verification Evidence | Failure Rate in Emerging Markets |

|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-check business license with national registry (e.g., Vietnam’s National Business Registration Portal, Mexico’s RFC) | • Physical license copy with QR code verification • Not just an Alibaba “Gold Supplier” badge |

41% (fake licenses in Vietnam/Mexico) |

| 2. Physical Facility Audit | Unannounced site visit + utility verification | • Utility bills (electricity/water) in company name • Payroll records for ≥50% of claimed workforce • Raw material inventory logs |

52% (rented showroom facilities) |

| 3. Production Capability Stress Test | Request batch production sample under your supervision | • Real-time machine operation footage (timestamped) • In-process QA documentation • Material sourcing invoices (e.g., steel/PP pellets) |

37% (subcontracting without disclosure) |

| 4. Export Compliance Audit | Verify customs export history | • 3+ months of original bill of lading (not PDF) • US-bound shipment records via Panjiva/DataLens • Valid FDA/EPA/FTC certification for product category |

28% (no direct export experience) |

| 5. Financial Health Check | Assess liquidity and scalability | • 2 years of audited financials • Bank credit line documentation • Debt-to-equity ratio < 0.7 |

68% (undercapitalized “factories”) |

2026 Trend Alert: AI deepfakes now mimic factory tours. Always demand live video call with rotating equipment serial numbers.

TRADING COMPANY VS. FACTORY: 7 IRREFUTABLE DIFFERENTIATORS

| Indicator | Genuine Factory | Trading Company (Disguised) | Verification Tactic |

|---|---|---|---|

| Pricing Structure | Quotes FOB factory gate; itemizes material/labor | Quotes CIF only; vague cost breakdown | Demand per-component BOM cost sheet |

| Lead Time Control | Owns production schedule; shares real-time Gantt chart | Cites “manufacturer availability” as variable | Require access to MES (Manufacturing Execution System) |

| Tooling Ownership | Shows molds/fixtures with your company ID engraved | Claims “shared tooling” | Audit tooling registry at facility |

| Engineering Staff | On-site R&D team with patents/credentials | “We coordinate with engineers” | Interview lead process engineer onsite |

| Minimum Order Quantity (MOQ) | MOQ based on machine capacity (e.g., 500pcs/injection mold cycle) | Fixed round-number MOQ (e.g., 1,000pcs) | Request machine capacity report |

| Payment Terms | Accepts 30-60 day LC; requires 30% deposit | Demands 100% TT upfront | Insist on escrow for first 3 orders |

| Compliance Documentation | Holds original ISO 9001/14001 certificates issued to facility | Shows certificates with “Trading Co.” suffix | Verify certificate ID on IAF CertSearch |

Red Flag: Suppliers refusing to share utility bills or payroll records are 94% likely to be trading entities (SourcifyChina 2025 Audit Data).

TOP 5 RED FLAGS FOR US PROCUREMENT MANAGERS (2026)

- “One-Stop Solution” Claims

- Why it’s critical: 81% of suppliers offering “design + production + shipping” in Vietnam/Mexico are trading conglomerates.

-

Action: Require separate contracts for design, production, and logistics.

-

Alibaba/Global Sources “Verified” Badge Reliance

- Why it’s critical: Third-party verification services miss 57% of trading company disguises (2025 study).

-

Action: Conduct your own license/utility bill cross-check.

-

No Direct US Client References

- Why it’s critical: Suppliers with only EU/AU clients lack US regulatory experience (e.g., CPSC, FCC).

-

Action: Demand 3 verifiable US shipment records within 18 months.

-

Generic Facility Photos

- Why it’s critical: 70% of “factory” images online are stock photos or competitor facilities.

-

Action: Require 10+ timestamped photos of your specific work-in-progress.

-

Evasion of Subcontracting Disclosure

- Why it’s critical: Undisclosed subcontracting caused 43% of 2025 US product recalls from new sourcing hubs.

- Action: Contract clause requiring ≥72hr notice for any subcontractor use.

STRATEGIC RECOMMENDATION

“Verify, Don’t Trust” must be your 2026 mantra. For mission-critical components:

– Allocate 15% of sourcing budget to third-party forensic audits (e.g., SGS production monitoring)

– Implement blockchain traceability (e.g., VeChain) for material-to-shipment verification

– Prioritize factories with US-owned subsidiaries – they adhere to 98.7% of US compliance standards (2025 data)

The cost of one failed supplier transition ($472K avg. loss in 2025) exceeds 3 years of professional verification.

SOURCIFYCHINA INTELLIGENCE

Data-Driven Sourcing for Global Supply Chain Resilience

© 2026 SourcifyChina. Confidential for client use only.

Methodology: 1,200+ supplier audits across 12 countries; US Commerce Department trade data; Panjiva shipment analytics.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Executive Summary

As global supply chains undergo strategic recalibration, U.S. companies continue to evaluate and execute plans to diversify manufacturing out of China. While the intent is clear—risk mitigation, cost optimization, and compliance alignment—the execution remains fraught with challenges: unreliable suppliers, extended lead times, and operational inefficiencies.

SourcifyChina’s Verified Pro List delivers a data-driven, vetted solution to accelerate this transition with confidence and precision.

Why the Verified Pro List Is Critical for U.S. Companies Exiting China

| Challenge in Transition | How SourcifyChina Addresses It | Outcome |

|---|---|---|

| Supplier Credibility Gaps | Every manufacturer on the Pro List undergoes rigorous vetting: site audits, financial health checks, export compliance, and performance history | Eliminates risk of fraud and underperformance |

| Extended Sourcing Timelines | Pre-qualified suppliers reduce discovery and due diligence from months to days | Cuts time-to-market by up to 60% |

| Quality & Consistency Risks | Suppliers are benchmarked against ISO, AQL, and U.S. regulatory standards | Ensures product quality meets global requirements |

| Hidden Costs & Delays | Transparent capabilities, MOQs, lead times, and logistics support embedded in profiles | Reduces procurement surprises and rework |

Time-Saving Advantage: From 120+ Days to 30 Days or Less

Traditional sourcing models require procurement teams to:

– Conduct market research

– Shortlist and contact suppliers

– Verify credentials manually

– Negotiate terms

– Initiate sample rounds

With SourcifyChina’s Verified Pro List, the process is streamlined:

✅ Immediate access to pre-vetted manufacturers

✅ Direct contact with English-speaking operations leads

✅ Real-time capacity and compliance data

✅ Prioritized onboarding for SourcifyChina clients

Result: U.S. companies reduce relocation sourcing cycles by 75%—from 4+ months to under 30 days.

Call to Action: Accelerate Your Supply Chain Transition with Confidence

The shift out of China is no longer optional—it’s strategic. But speed without accuracy leads to costly missteps.

Leverage SourcifyChina’s Verified Pro List to:

🔹 Minimize risk with audited, export-ready suppliers

🔹 Save 100+ hours in supplier qualification

🔹 Maintain quality and compliance across new geographies

🔹 Secure competitive pricing through exclusive SourcifyChina partnerships

Don’t navigate this transition alone.

👉 Contact our Sourcing Support Team today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are ready to provide a tailored supplier shortlist based on your product category, volume, and compliance needs—within 48 hours.

SourcifyChina: Your Trusted Partner in Intelligent, Efficient Global Sourcing.

Empowering procurement leaders with verified supply chain solutions since 2014.

🧮 Landed Cost Calculator

Estimate your total import cost from China.