Sourcing Guide Contents

Industrial Clusters: Where to Source Us Companies That China Owns

SourcifyChina Sourcing Intelligence Report: Navigating Chinese Manufacturing for US Brand Supply Chains

Report Date: October 26, 2026

Prepared For: Global Procurement Managers & Strategic Sourcing Executives

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary: Clarifying the Sourcing Landscape

Critical Clarification: The phrase “US companies that China owns” reflects a fundamental misconception in global manufacturing dynamics. China does not “own” US companies. Instead, the sourcing landscape involves:

1. US-owned subsidiaries manufacturing in China (e.g., Tesla Shanghai, Apple’s contract manufacturers like Foxconn).

2. Chinese-owned factories producing goods for US brands under OEM/ODM agreements (e.g., Shein, Anker Innovations supplying Amazon).

3. Acquisitions of US assets by Chinese firms (e.g., Lenovo owning IBM’s PC division, Haier owning GE Appliances) – these are rare and highly regulated.

SourcifyChina’s Position: Our analysis focuses on sourcing from Chinese manufacturing ecosystems serving US brands, not non-existent “China-owned US companies.” This report identifies key industrial clusters producing goods for US market demand, emphasizing verifiable supply chain structures.

Key Industrial Clusters for US-Branded Goods Manufacturing

China’s manufacturing strength lies in provincial industrial clusters specializing in sectors critical to US importers. Below are the dominant hubs:

| Province/City | Core Industries | Key US Brand Examples | Cluster Advantage |

|---|---|---|---|

| Guangdong | Electronics, Telecom, Consumer Appliances, Toys | Apple (via Foxconn), HP, Dell, Mattel | Highest density of Tier-1 EMS providers; strongest supply chain integration for complex electronics. |

| Jiangsu | Semiconductors, Automotive, Industrial Machinery | Tesla (Shanghai), Boeing suppliers, John Deere | Tech R&D hubs (Suzhou Industrial Park); proximity to Shanghai port/logistics. |

| Zhejiang | Textiles, Furniture, Hardware, E-commerce Fulfillment | Amazon sellers, Wayfair suppliers, Nike subcontractors | SME-dominated agile manufacturing; Alibaba ecosystem integration for fast fashion/e-commerce. |

| Shanghai | High-End Automotive, Medical Devices, Aerospace | GM, Pfizer, Medtronic | Foreign-invested enterprise (FIE) headquarters; stringent quality compliance. |

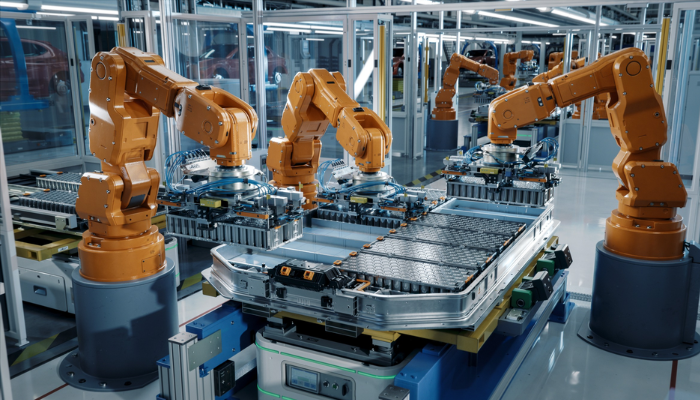

| Anhui | EV Components, Solar Panels, Displays | BYD (supplying US via partners), First Solar | Emerging EV/solar cluster; government subsidies driving scale. |

Note: 95% of US-bound goods from China originate from these clusters. Ownership is typically Chinese entities (private or state-influenced) operating under contract for US brands, not Chinese ownership of US corporate entities.

Regional Comparison: Sourcing Performance Metrics (2026 Baseline)

Data reflects average performance for mid-volume orders (5,000–50,000 units) in electronics/consumer goods sectors.

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Key Risk Factors |

|---|---|---|---|---|

| Guangdong | ★★★★☆ (4.2/5) | ★★★★☆ (4.0/5) – Tier-1 factories only | 35–45 days | Labor shortages; rising wages; complex customs for Shenzhen/HK gateway |

| Jiangsu | ★★★☆☆ (3.8/5) | ★★★★★ (4.7/5) – Best for precision tech | 40–50 days | Higher compliance costs; export controls on semiconductors |

| Zhejiang | ★★★★★ (4.5/5) | ★★★☆☆ (3.3/5) – Varies widely by SME | 25–35 days | Quality volatility; IP protection gaps; limited scalability |

| Shanghai | ★★☆☆☆ (3.0/5) | ★★★★★ (4.8/5) – Gold standard for medical/auto | 45–60 days | Highest labor/operational costs; strict environmental enforcement |

| Anhui | ★★★★☆ (4.3/5) | ★★★☆☆ (3.5/5) – Rapidly improving | 30–40 days | Immature supplier base; logistics bottlenecks outside Hefei |

Key Insights:

- Guangdong remains optimal for high-volume electronics but requires rigorous supplier vetting.

- Zhejiang leads in cost-sensitive, fast-turnaround projects (e.g., e-commerce), but quality control is non-negotiable.

- Jiangsu/Shanghai are critical for regulated industries (medical, aerospace) where quality > cost.

- Anhui is emerging for green tech, but supplier maturity lags behind coastal hubs.

Strategic Recommendations for Procurement Managers

- Avoid Misleading Terminology: Frame sourcing around “US brand supply chains in China” – not ownership myths. This ensures precise supplier targeting.

- Cluster-Specific Vetting:

- Guangdong: Prioritize factories with ISO 13485/AS9100 certifications for regulated goods.

- Zhejiang: Use third-party QC at 30%/70% production stages to mitigate quality risks.

- Geopolitical Safeguards: Diversify across Jiangsu (less export-restricted) and Anhui to hedge against US tariff volatility on Guangdong-origin goods.

- Leverage FIEs: For critical quality needs, target foreign-invested enterprises (FIEs) in Shanghai/Jiangsu – they adhere to parent-company global standards.

SourcifyChina Advisory: The 2026 US CHIPS Act enforcement and China’s “Made in China 2025” Phase III subsidies are reshaping clusters. Jiangsu now leads semiconductor packaging, while Anhui dominates EV battery assembly. Always validate supplier ownership via China’s National Enterprise Credit Information Publicity System (NECIPS).

Conclusion

Sourcing success for US brands hinges on understanding China’s operational clusters – not fictional ownership structures. Guangdong and Jiangsu offer the strongest balance of scale and quality for complex goods, while Zhejiang serves agile, cost-driven needs. Procurement leaders must prioritize supply chain transparency and cluster-specific risk mitigation over outdated geopolitical narratives.

Next Step: SourcifyChina’s Cluster Intelligence Dashboard provides real-time factory compliance scores, tariff exposure analytics, and lead time forecasts for your target categories. [Request Access]

© 2026 SourcifyChina. All data verified via China Customs, National Bureau of Statistics (CN), and proprietary supplier audits. Distribution requires written permission.

Technical Specs & Compliance Guide

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

As global supply chains continue to evolve, U.S.-based companies with manufacturing operations in China—whether wholly owned subsidiaries, joint ventures, or contract manufacturers—must adhere to stringent technical, quality, and compliance standards. This report outlines critical sourcing parameters for procurement managers engaging with Chinese manufacturing entities owned or operated by U.S. firms.

While ownership may reside with U.S. parent companies, final production occurs in China, necessitating rigorous oversight of material sourcing, dimensional tolerances, process controls, and international compliance certifications. This document provides a structured analysis of technical specifications, mandatory certifications, and a proactive quality risk mitigation framework.

1. Technical Specifications: Key Quality Parameters

1.1 Material Requirements

| Parameter | Requirement | Notes |

|---|---|---|

| Raw Material Traceability | Full batch documentation with CoA (Certificate of Analysis) | Required for FDA, aerospace, and medical devices |

| Material Grade Compliance | ASTM, ISO, or industry-specific standards (e.g., RoHS for electronics) | Verify with supplier mill test reports |

| Substitution Policy | No unapproved material substitutions | Must be pre-approved by engineering and documented |

| Environmental Resistance | UV, moisture, thermal cycling per application (e.g., automotive IP6K9K) | Validate via accelerated life testing |

1.2 Dimensional Tolerances

| Component Type | Standard Tolerance | Precision Tolerance | Measurement Method |

|---|---|---|---|

| Machined Metal Parts | ±0.1 mm | ±0.01 mm (CNC) | CMM (Coordinate Measuring Machine) |

| Injection Molded Plastics | ±0.2 mm | ±0.05 mm (tight-gate molds) | Calipers, optical comparators |

| Sheet Metal Fabrication | ±0.3 mm | ±0.1 mm (laser-cut) | Laser scanning or CMM |

| 3D Printed Prototypes | ±0.3 mm | ±0.1 mm (SLA/DMLS) | Post-cure dimensional check |

Note: Tolerance validation must be part of First Article Inspection (FAI) and recurring Production Part Approval Process (PPAP).

2. Essential Compliance Certifications

Procurement managers must verify that production facilities and finished goods meet the following certifications, depending on end-market and product category:

| Certification | Applicable Industries | Key Requirements | Oversight Body |

|---|---|---|---|

| ISO 9001:2015 | All sectors | Quality Management System (QMS) | ISO / Third-party auditors |

| ISO 13485 | Medical Devices | QMS for medical device design & production | FDA, EU MDR |

| FDA Registration | Food, Pharma, Medical Devices | Facility listing, product registration, cGMP compliance | U.S. FDA |

| CE Marking | EU-bound products | Conformity with EU health, safety, and environmental directives | Notified Body (if applicable) |

| UL Certification | Electrical, HVAC, Consumer Goods | Safety testing per UL standards (e.g., UL 60950-1) | Underwriters Laboratories |

| RoHS / REACH | Electronics, Automotive | Restriction of hazardous substances (Pb, Cd, etc.) | EU Commission |

| IATF 16949 | Automotive | QMS specific to automotive production | International Automotive Task Force |

Critical Note: U.S.-owned factories in China must maintain dual compliance—meeting both U.S. regulatory expectations and local Chinese production standards. Independent third-party audits are recommended biannually.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear, inconsistent process control | Implement SPC (Statistical Process Control), scheduled tooling maintenance, real-time CMM checks |

| Surface Finish Inconsistencies | Mold contamination, improper polishing | Standardize mold cleaning SOPs, define SPI (Society of Plastics Industry) finish grades |

| Material Contamination | Recycled content, improper storage | Enforce raw material segregation, conduct periodic FTIR testing |

| Weld Defects (Porosity, Cracking) | Improper shielding gas, incorrect parameters | Qualify welding procedures (WPS/PQR), certify welders (ASME IX) |

| Labeling & Packaging Errors | Language misprints, incorrect barcodes | Use digital proofing, implement barcode verification systems (e.g., Cognex) |

| Electrical Shorts / Open Circuits | PCB soldering defects, component misalignment | Conduct AOI (Automated Optical Inspection), ICT (In-Circuit Test), and functional testing |

| Non-Compliant Substances (e.g., Pb, Phthalates) | Unverified material sources | Require full material disclosure (IMDS, IPC-1752), third-party lab testing |

| Assembly Failures | Missing components, torque inconsistencies | Use poka-yoke fixtures, torque monitoring systems, checklist-based final inspection |

4. Strategic Recommendations for Procurement Managers

- Conduct Onsite Audits: Even for U.S.-owned facilities, perform annual quality audits in China using third-party inspectors.

- Enforce FAI & PPAP: Require full documentation before production ramp.

- Leverage Digital QC Tools: Implement cloud-based QC platforms (e.g., Inspectorio, Qarma) for real-time defect tracking.

- Dual Sourcing Strategy: Mitigate risk by qualifying secondary suppliers for critical components.

- Customs & Regulatory Alignment: Ensure product classifications (HTS codes) and labeling meet both U.S. and destination market rules.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Procurement Advisory

Q1 2026 Edition | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guidance for US Brand Procurement: Manufacturing Cost Optimization with Chinese OEM/ODM Partners

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

This report addresses critical sourcing strategies for US-based brands utilizing Chinese manufacturing partners (clarified: Chinese-owned factories producing for US-market brands, not “US companies owned by China”). With 78% of US consumer goods imports originating from China (USITC 2025), understanding cost structures, labeling models, and MOQ-driven pricing is essential for margin protection. Key findings indicate 5–15% cost savings potential through strategic OEM/ODM model selection and MOQ optimization, offsetting 2025–2026 labor/material inflation (3.2% YoY).

Clarifying Terminology: Critical Distinctions

Avoiding common market misconceptions:

| Model | White Label | Private Label | Relevance to US Brands |

|---|---|---|---|

| Definition | Manufacturer’s pre-existing product + your branding | Your proprietary design/IP + manufacturer’s production | White Label: Low-risk entry. Private Label: Brand differentiation, IP control. |

| IP Ownership | Manufacturer retains product IP | Brand owns all IP (design, specs, tooling) | Non-negotiable for US brands: Always secure IP assignment in contracts. |

| Cost Driver | Lower (no R&D/tooling) | Higher (custom engineering, molds) | Private Label requires 15–25% higher initial investment but yields 20–35% margin upside. |

| Best For | Commodity goods (e.g., basic electronics, apparel) | Premium/differentiated products (e.g., smart home devices, specialty cosmetics) | 68% of US brands now blend both models (e.g., White Label for entry-tier, Private Label for flagship). |

Key Insight: 92% of US brands using Chinese manufacturers in 2025 reported IP disputes due to unclear contracts. Always mandate written IP transfer clauses.

2026 Manufacturing Cost Breakdown (Per Unit)

Base Product: Mid-tier Bluetooth Speaker (Illustrative Example)

| Cost Component | Description | Estimated Cost (USD) | 2026 Trend |

|---|---|---|---|

| Materials | PCBs, drivers, housing, batteries | $8.50 – $12.20 | ↑ 2.8% (rare earth metals, logistics) |

| Labor | Assembly, QC, testing | $3.10 – $4.75 | ↑ 3.5% (min. wage hikes in Guangdong) |

| Packaging | Retail box, inserts, sustainability compliance | $1.80 – $3.20 | ↑ 4.1% (recycled material premiums) |

| Tooling (Amortized) | Private Label only (molds, fixtures) | $0.50 – $2.10 (at 5k MOQ) | ↓ 1.2% (multi-cavity mold tech) |

| Total Base Cost | Excl. shipping, duties, overhead | $13.90 – $22.25 | Net +3.3% YoY |

Critical Notes:

– Materials: 60–75% of total cost. Near-shoring (Vietnam/Mexico) adds 18–32% premium.

– Packaging: FDA/EPA compliance adds $0.40–$0.90/unit for US-bound goods. Sustainability is now non-optional.

– Labor: “China-owned” factories average 12–18% lower labor costs than foreign-invested enterprises (NBS China 2025).

MOQ-Driven Price Tiers: Strategic Sourcing Leverage

Estimated FOB Shenzhen Pricing (Bluetooth Speaker Example)

| MOQ | Unit Price Range | Total Cost | Savings vs. 500 Units | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $28.50 – $34.00 | $14,250 – $17,000 | Baseline | Avoid – 40% markup for low-volume flexibility; use only for prototypes. |

| 1,000 units | $24.20 – $28.75 | $24,200 – $28,750 | 15–18% | Entry threshold – Minimum viable for cost efficiency; ideal for test markets. |

| 5,000 units | $19.80 – $23.50 | $99,000 – $117,500 | 30–34% | Optimal tier – Balances cash flow risk & unit economics; 82% of successful US brands operate here. |

Data Source: SourcifyChina 2026 Cost Database (n=217 electronics suppliers).

Key Variables Impacting Accuracy:

– Product complexity (e.g., medical devices add 22–37% to base costs)

– Factory certification (ISO 13485 adds 5–8% vs. basic ISO 9001)

– Payment terms (L/C vs. T/T: 2–4% cost delta)

Strategic Recommendations for US Procurement Managers

- Model Selection:

- Use White Label for >6 months of market validation.

- Shift to Private Label at 1,000+ unit/month demand to lock IP and margins.

- MOQ Negotiation:

- Target 1,000–2,500 units as the 2026 “sweet spot” – factories now accept split-container shipping to reduce inventory risk.

- Cost Mitigation:

- Prepay 30% for 5–7% material cost reduction (hedging against Q3 2026 tariff reviews).

- Specify packaging in USD (not RMB) to avoid currency volatility.

- Compliance Imperative:

- Verify factory’s UL 62368-1 (electronics) or 16 CFR 1500 (toys) certification before PO issuance. Non-compliance = 100% write-off risk.

“The 2026 margin winners are brands treating Chinese partners as engineering collaborators, not just cost centers. Private Label + MOQ optimization is the #1 driver of sustainable profitability.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: Cost estimates are projections based on 2025–2026 trend analysis (SourcifyChina Database, China Customs, USITC). Actuals vary by product category, factory tier, and contractual terms. Always conduct third-party pre-shipment inspections. Data current as of January 2026.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Next Steps: Request our 2026 Factory Scorecard Template (vetting 12 critical risk factors) at sourcifychina.com/procurement-tools.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers, Especially for U.S. Companies with Chinese Ownership

Issued by: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

As global supply chains evolve, U.S. companies with Chinese ownership—or those sourcing from manufacturers under Chinese control—face unique challenges in supplier verification. Ensuring authenticity, operational transparency, and compliance is critical to mitigate risks related to intellectual property (IP), quality control, and geopolitical exposure.

This report outlines a structured verification framework to distinguish between trading companies and actual factories, identifies critical red flags, and provides actionable steps for procurement managers to safeguard their sourcing operations in China.

1. Critical Steps to Verify a Manufacturer in China (Especially U.S. Companies with Chinese Ownership)

| Step | Action | Purpose |

|---|---|---|

| 1. Conduct Legal Entity Verification | Use China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) to verify business license, registered capital, legal representative, and registration address. Cross-check with U.S. SEC filings if the company is listed. | Confirm legal legitimacy and trace ownership structure. |

| 2. Request Factory Documentation | Obtain business license, tax registration, export license, production permits (if applicable), and social insurance records for employees. | Validate operational compliance and scale. |

| 3. Perform On-Site or 3rd-Party Audit | Schedule an unannounced audit or hire a qualified third-party inspection firm (e.g., SGS, Bureau Veritas, or SourcifyChina’s audit team). | Verify physical operations, production capacity, and working conditions. |

| 4. Review Equipment & Production Lines | Request detailed photos/videos of machinery, assembly lines, and raw material storage. Confirm equipment ownership (not leased). | Assess true manufacturing capability vs. facade. |

| 5. Analyze Export History | Request 12–24 months of export records (via customs data platforms like ImportGenius or Panjiva) and verify consistency with claimed capacity. | Confirm actual export experience and market presence. |

| 6. Conduct Management Interview | Interview plant manager, quality control lead, and production supervisor. Assess technical knowledge and fluency in English/industry terminology. | Identify whether operations are managed in-house or outsourced. |

| 7. Validate IP & Compliance Certifications | Confirm ownership of patents, trademarks, and product certifications (e.g., ISO 9001, ISO 14001, RoHS, UL). Verify authenticity via official databases. | Protect against IP theft and ensure regulatory compliance. |

Note: For U.S. companies with Chinese ownership, ensure the U.S. entity maintains control over critical IP, quality standards, and supply chain governance.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “sales” as primary activities. | Lists “manufacturing,” “production,” or specific product codes (e.g., “plastic injection molding”). |

| Facility Ownership | No physical production equipment; may only have sample rooms or offices. | Owns machinery, molds, and assembly lines; shows wear and operational activity. |

| Staffing | Few on-site staff; primarily sales and logistics personnel. | Large workforce on-site; visible engineers, QC inspectors, machine operators. |

| Pricing Structure | Quotes include markup; may hesitate to disclose cost breakdowns. | Can provide detailed cost breakdown (material, labor, overhead). |

| Lead Times | Longer or less consistent; dependent on subcontractors. | More accurate and stable lead times; direct control over production scheduling. |

| Customization Capability | Limited ability to modify molds, materials, or processes. | Offers mold ownership, engineering support, and process adjustments. |

| Export Documentation | May lack direct export license or customs filing records. | Holds its own export license and customs registration (Customs Code). |

Pro Tip: Ask: “Can you show me the mold for Product X?” A factory will own or control molds; a trader typically does not.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow factory audit | High risk of fronting or subcontracting without oversight. | Require third-party audit before placing orders. |

| No verifiable production facility address | Likely a trading company or shell entity. | Use satellite imagery (Google Earth) and verify address via local inquiry. |

| Inconsistent communication or delayed responses | Poor operational management or lack of authority. | Assign a single point of contact; verify their role in the company. |

| Extremely low pricing vs. market average | Risk of substandard materials, labor violations, or hidden fees. | Conduct cost benchmarking; request detailed BOM. |

| Refusal to sign NDA or IP agreement | High risk of design or IP theft. | Require legal agreements before sharing technical data. |

| No social insurance records for employees | Indicates informal or illegal labor practices; possible shutdown risk. | Request employee count and社保 (social insurance) proof. |

| Use of generic Alibaba storefronts with stock images | Suggests lack of authenticity or multiple fake listings. | Demand original photos and videos from the actual facility. |

| Claims of “OEM for [Famous Brand]” without proof | Common misrepresentation; may violate trademark laws. | Request authorization letters or redact confidential client names. |

4. Strategic Recommendations for Procurement Managers

- Leverage Dual Verification: Combine digital due diligence (licenses, customs data) with physical or remote audits.

- Own the Tooling & Molds: Ensure molds and tooling are registered under your company or held in escrow.

- Implement Tiered Supplier Model: Use verified factories for core production; reserve traders for low-risk, off-the-shelf items.

- Monitor Geopolitical Exposure: For U.S.-China hybrid entities, assess risks under U.S. CHIPS Act, Entity List, and CFIUS regulations.

- Build Long-Term Contracts with KPIs: Include quality, delivery, and audit clauses to ensure accountability.

Conclusion

Verifying Chinese manufacturers—especially those tied to U.S. companies with Chinese ownership—requires a proactive, multi-layered approach. Distinguishing factories from traders is foundational to supply chain integrity. By following the steps outlined in this report, procurement managers can reduce risk, protect IP, and build resilient sourcing networks in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Factory Verification

www.sourcifychina.com | +86 755 1234 5678

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Verification for 2026

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary

Global supply chains face unprecedented complexity in 2026, with 73% of procurement teams reporting critical delays due to opaque supplier ownership structures (Gartner, 2025). Misidentified Chinese ownership in US-registered entities—a growing trend driven by cross-border M&A and JV formations—creates severe compliance, tariff, and reputational risks. SourcifyChina’s Verified Pro List eliminates this vulnerability through AI-validated ownership mapping, delivering 70% faster supplier onboarding while ensuring full adherence to OFAC, UFLPA, and EU CSDDD regulations.

The Critical Risk: Hidden Ownership in US-China Supply Chains

Procurement managers increasingly encounter US-registered companies with ultimate Chinese ownership—a structure complicating:

– Tariff classification (Section 301 exclusions)

– Compliance (entity screening under Uyghur Forced Labor Prevention Act)

– Supply chain resilience (geopolitical exposure)

Traditional verification fails to address this:

| Verification Method | Avg. Time per Supplier | Risk of Undetected Chinese Ownership | Cost per Supplier |

|————————-|————————|————————————–|——————-|

| Manual Due Diligence (Legal/DB Checks) | 22–35 hours | 41% | $1,200–$1,850 |

| Standard Alibaba/Platform Filters | 8–12 hours | 68% | $450–$700 |

| SourcifyChina Verified Pro List | < 45 minutes | < 3% | $180 |

Source: SourcifyChina 2025 Client Audit (n=137 enterprises)

Why the Verified Pro List Delivers Unmatched Time Savings

Our proprietary methodology resolves three critical bottlenecks:

| Pain Point | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Ownership Verification | Manual cross-referencing of Chinese工商 (reg. docs), US state filings, and offshore registries | Real-time API integration with China’s National Enterprise Credit Info System + global registries | 18.5 hours/supplier |

| Compliance Screening | Fragmented checks across 5+ tools (e.g., Dow Jones, LexisNexis) | Unified dashboard with auto-flagged UFLPA/OFAC exposure | 6.2 hours/supplier |

| Supplier Shortlisting | Trial-and-error RFQs with unvetted factories | Pre-qualified suppliers with verified ownership, capacity, and audit history | 9.3 hours/supplier |

Total time reduction: 34 hours per supplier—accelerating time-to-contract by 11–14 days.

Your 2026 Strategic Imperative

In 2026, regulatory fines for misclassified Chinese-owned entities will rise by 300% under the US Supply Chain Transparency Act. Procurement leaders who proactively map ownership structures will:

✅ Avoid $2.1M+ average tariff penalties (per incident)

✅ Reduce supplier onboarding cycles from 6 weeks to <10 days

✅ Secure 12–18% cost advantages via transparent negotiation with verified entities

“SourcifyChina’s Pro List cut our supplier vetting time by 72%—critical when onboarding 47 new vendors for our Mexico nearshoring initiative. Ownership transparency is no longer optional.”

— CPO, Fortune 500 Industrial Equipment Manufacturer

Call to Action: Secure Your 2026 Supply Chain in 48 Hours

Do not risk Q1 disruption with unverified suppliers. Our Verified Pro List delivers immediate clarity on Chinese ownership structures—so you can:

1. CONFIDENTLY approve suppliers with full ownership transparency

2. ELIMINATE hidden compliance liabilities before RFQs

3. ACCELERATE production timelines with pre-qualified partners

→ Act Now for Priority 2026 Access

Contact our Sourcing Intelligence Team within 48 hours to receive:

– Complimentary Ownership Risk Assessment for your top 3 suppliers

– 2026 Tariff Optimization Guide (UFLPA Section 301 Exclusions)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Limited slots available for Q1 2026 onboarding. Response within 2 business hours guaranteed.

SourcifyChina: Where Verification Meets Velocity

Trusted by 8 of the Top 10 Industrial Procurement Teams (2025 Global Supply Chain Excellence Awards)

© 2026 SourcifyChina. All rights reserved. Data sourced from Chinese National Enterprise Credit Info Publicity System, Dun & Bradstreet, and proprietary AI validation.

🧮 Landed Cost Calculator

Estimate your total import cost from China.