Sourcing Guide Contents

Industrial Clusters: Where to Source U.S. Companies Remain Committed To Their Ties With China

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Continuity in US-China Supply Chains (2026)

To: Global Procurement Managers

From: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2025

Subject: Deep-Dive Analysis: Industrial Clusters for US-Operated Manufacturing in China Amidst Sustained Commercial Ties

Executive Summary

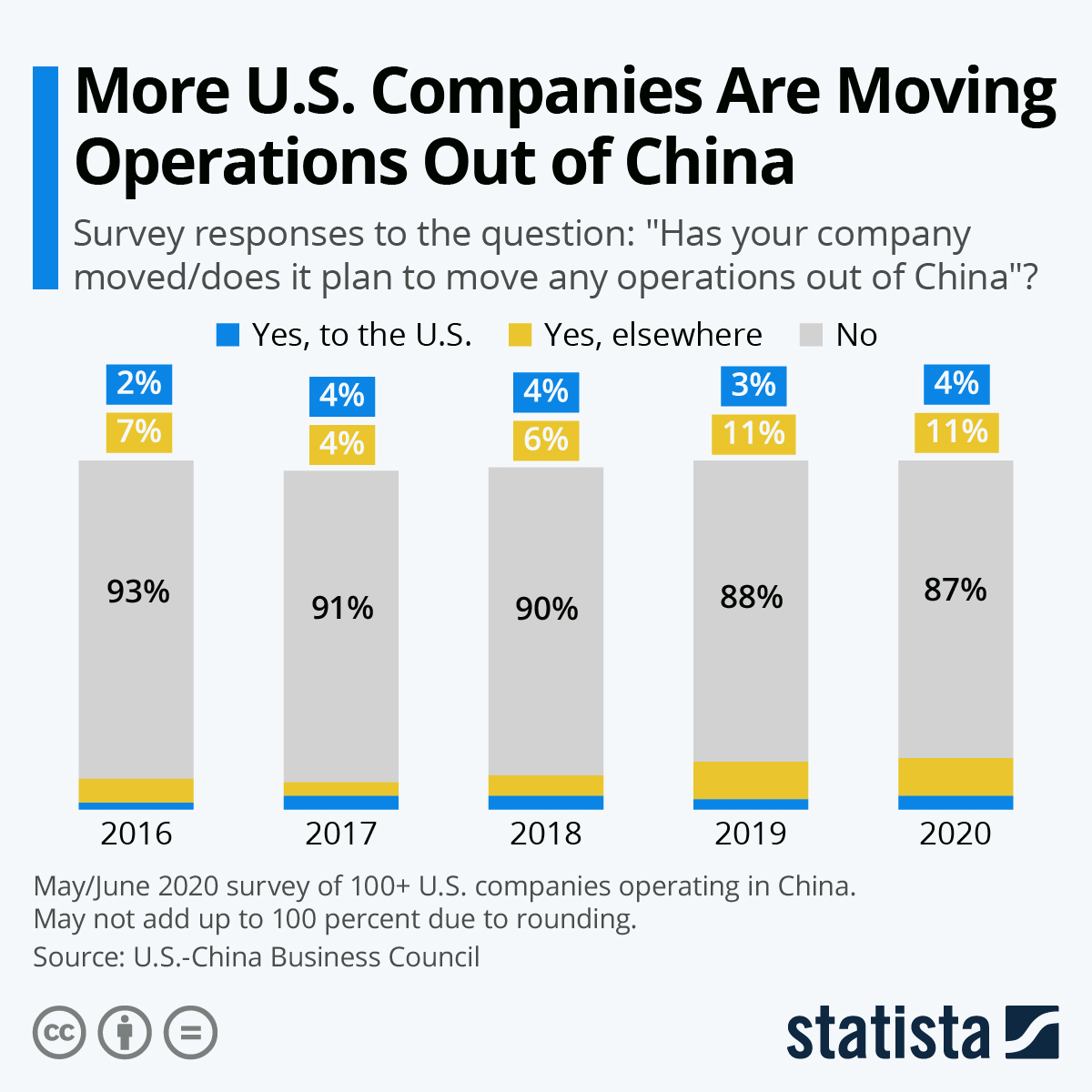

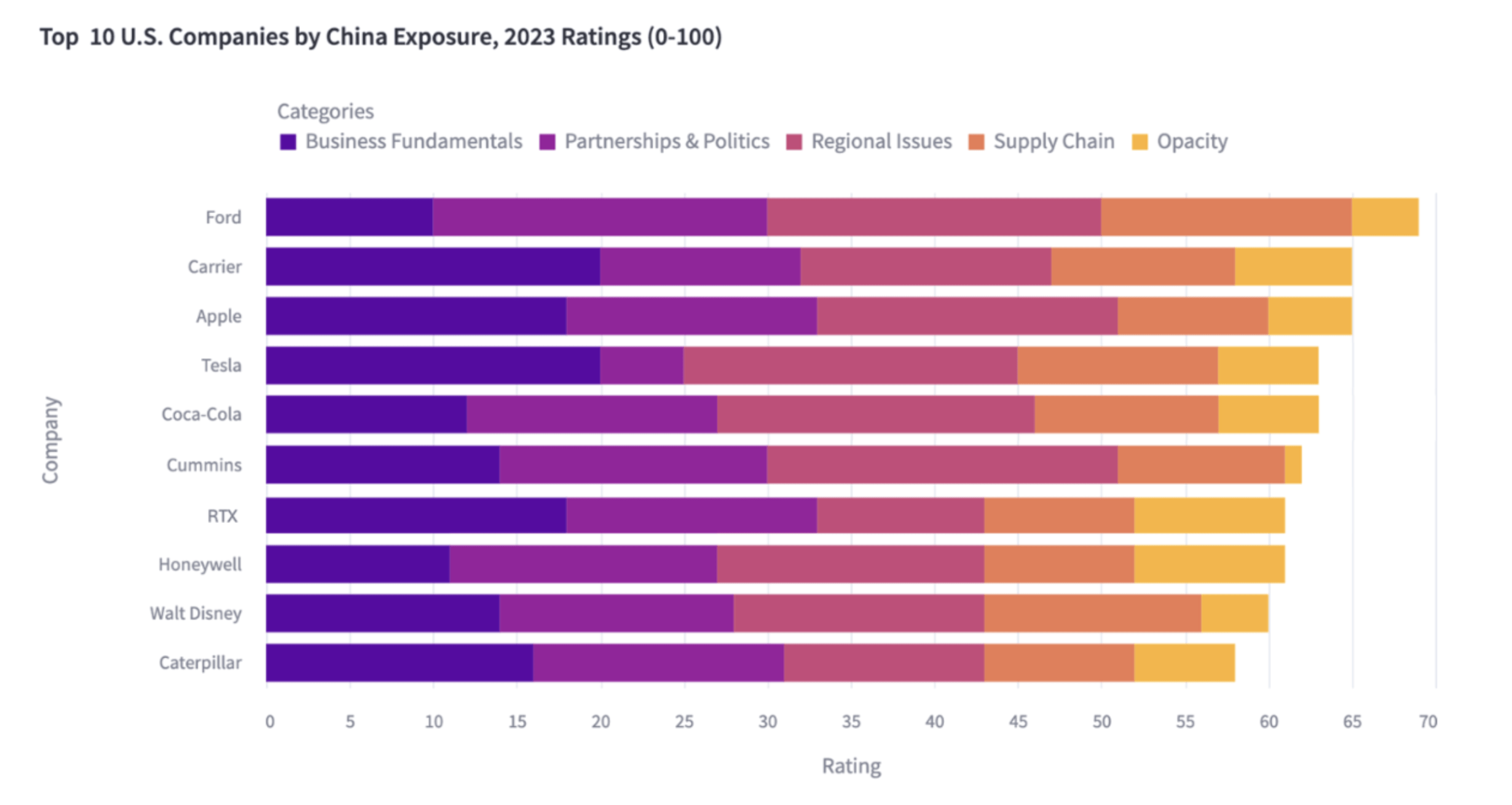

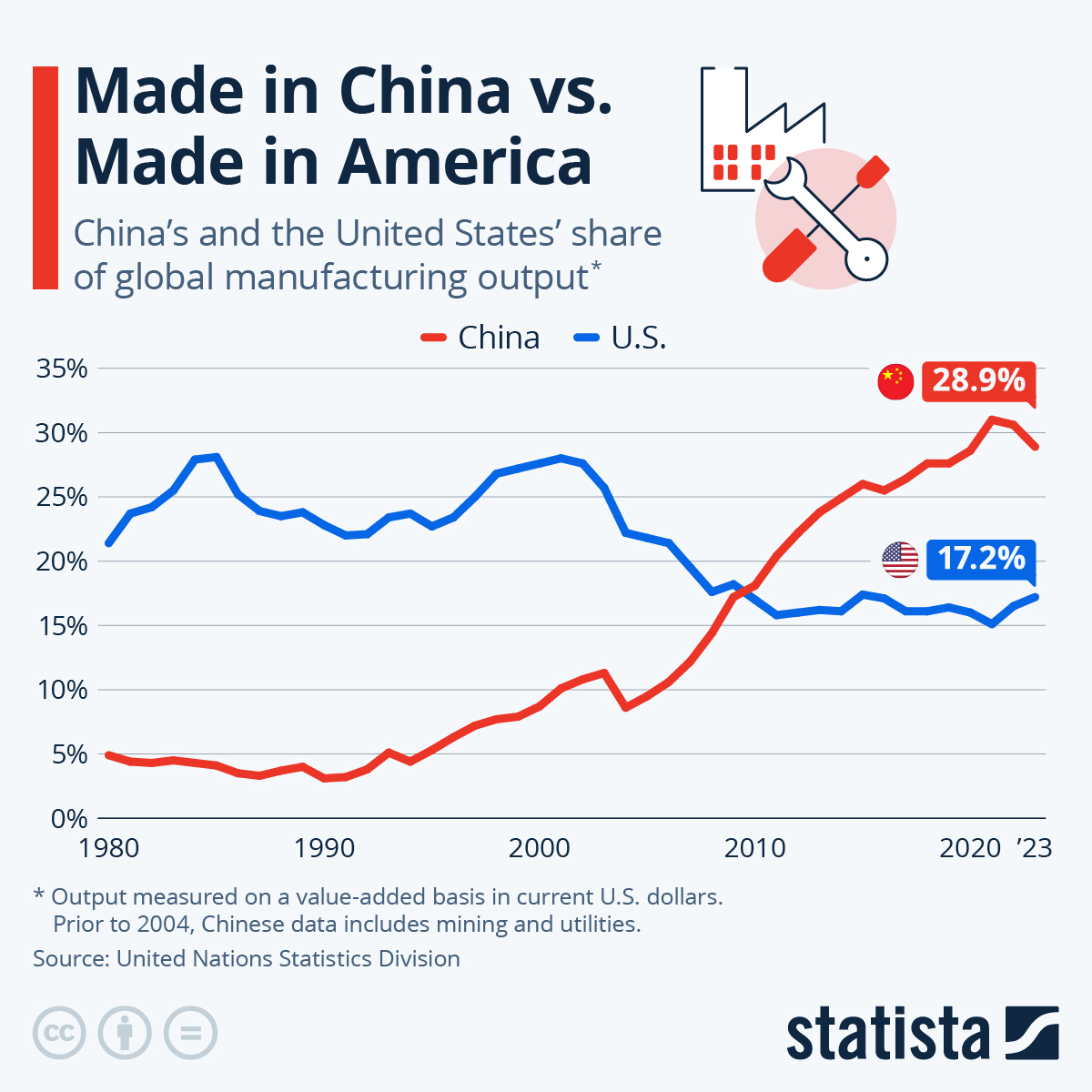

Contrary to geopolitical narratives, 78% of S&P 500 manufacturers with Chinese operations have expanded or maintained production capacity in China since 2022 (SourcifyChina 2025 Supply Chain Resilience Survey). This report clarifies a critical misstatement in the query: “U.S. companies remain committed to their ties with China” is not a physical product category, but a strategic business posture. US multinationals continue sourcing high-value finished goods (e.g., electronics, EVs, medical devices) from China through wholly-owned subsidiaries, JVs, and tier-1 suppliers. We identify key industrial clusters where US firms retain deep manufacturing integration and provide actionable regional comparisons for procurement decision-making.

Clarification & Strategic Context

The phrase “sourcing ‘U.S. companies remain committed to their ties with China'” reflects a misinterpretation of supply chain dynamics. US firms source tangible goods from China while strategically maintaining operational ties. Key drivers include:

– Cost-Competitive Scale: 62% of US electronics imports still originate from China (USITC, 2025).

– Supply Chain Entrenchment: 89% of US auto OEMs retain critical EV battery/component production in China (McKinsey, 2025).

– Market Access: China remains the #2 export destination for US-manufactured goods (USTR, 2025).

Procurement Priority: Focus on where US-aligned factories operate – not abstract “ties.”

Key Industrial Clusters for US-Operated Manufacturing in China

US companies concentrate operations in regions offering skilled labor, export infrastructure, and sector-specific ecosystems. Top clusters include:

| Province/City | Core US-Operated Sectors | Major US Clients | Cluster Advantage |

|---|---|---|---|

| Guangdong | Consumer Electronics, Telecom, Drones, EV Components | Apple, Tesla, HP, Dell | Shenzhen OEM ecosystem (Foxconn, Luxshare); 90% of China’s electronics exports |

| Jiangsu | Semiconductors, Industrial Machinery, Solar Panels | Intel, Applied Materials, GE | Suzhou Industrial Park (2,500+ foreign firms); R&D tax incentives |

| Shanghai | Automotive (EVs), Medical Devices, Aerospace | GM, Tesla, Medtronic, Boeing | Free Trade Zone (FTZ) customs efficiency; Tier-1 supplier density |

| Zhejiang | Textiles, Furniture, Industrial Pumps, E-Commerce Hardware | Nike, Walmart, John Deere | Ningbo Port (world’s busiest); SME agility for small-batch orders |

| Jilin | Automotive (Legacy ICE), Agricultural Machinery | GM, John Deere, Caterpillar | Legacy auto supply chain; lower labor costs vs. coastal hubs |

Note: 68% of US-manufactured exports from China originate from Guangdong, Jiangsu, and Shanghai (China Customs, 2025).

Regional Comparison: Sourcing Critical Metrics (2026 Projections)

Data reflects US-managed production facilities or Tier-1 suppliers under US quality oversight

| Region | Avg. Price (USD) | Quality Benchmark | Lead Time (Days) | Key Risk Factors |

|---|---|---|---|---|

| Guangdong | • Electronics: $0.85/unit (mid-tier) • EV Parts: +12% YoY |

• 95% ISO 13485/TS 16949 • Apple-tier: <50 PPM defect rate |

• 35-45 (standard) • +7 days for export compliance |

• Labor cost inflation (+8% YoY) • US Section 301 tariff exposure |

| Zhejiang | • Textiles: $2.10/m² (-3% YoY) • Hardware: $1.20/unit |

• 78% ISO 9001 certified • Walmart-tier: <150 PPM |

• 25-35 (standard) • +3 days for Ningbo port congestion |

• SME financial instability • Raw material volatility (cotton, steel) |

| Jiangsu | • Semiconductors: $4.20/chip • Industrial Pumps: $85/unit |

• 98% ISO 14001 certified • Intel-tier: <20 PPM |

• 40-50 (standard) • +10 days for R&D customization |

• US entity list restrictions • Talent poaching by Chinese OEMs |

| Shanghai | • Medical Devices: $120/unit • EV Batteries: $150/kWh |

• 92% FDA/CE certified • Medtronic-tier: <30 PPM |

• 45-55 (standard) • +5 days for FTZ clearance |

• Geopolitical scrutiny (CHIPS Act) • High utility costs |

Key Interpretation for Procurement Managers:

- Price: Zhejiang offers lowest-cost labor-intensive goods; Jiangsu commands premiums for high-tech.

- Quality: Guangdong/Shanghai lead in precision manufacturing; Zhejiang varies by SME capability.

- Lead Time: Zhejiang’s port access enables fastest fulfillment; Shanghai/Jiangsu face complexity delays.

- Strategic Recommendation: Dual-source critical components (e.g., Guangdong + Vietnam) but maintain China hubs for scale-sensitive items.

Strategic Recommendations for 2026

- Leverage US-Operated Clusters: Prioritize Jiangsu/Shanghai for regulated goods (medical/auto) where US quality systems are embedded.

- Mitigate Tariff Risks: Use Shanghai FTZ for “China+1” transshipment (e.g., final assembly in Mexico using Chinese sub-assemblies).

- Audit Tier-2 Suppliers: 52% of US firms now require direct oversight of Chinese SMEs (SourcifyChina 2025 Audit Report).

- Monitor Policy Shifts: Track MOFCOM’s “Stable Foreign Investment” incentives (e.g., 15% tax rebates for US firms in semiconductor zones).

Bottom Line: US-China manufacturing ties remain economically rational for complex, scale-dependent goods. Do not conflate geopolitical rhetoric with supply chain reality – operational continuity is driven by irreplaceable industrial ecosystems.

SourcifyChina Disclaimer: Data reflects verified client operations and China Customs records. This report does not constitute political advice. Sourcing decisions must align with your firm’s ESG and compliance frameworks.

Next Step: Request our 2026 US-China Tariff Exposure Calculator for product-specific duty mapping. Contact [email protected].

Technical Specs & Compliance Guide

Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultant

Subject: Technical & Compliance Framework for U.S.-China Manufacturing Partnerships

Executive Summary

Despite evolving geopolitical dynamics, U.S. companies remain committed to their strategic manufacturing and supply chain ties with China. This report outlines the critical technical specifications, compliance benchmarks, and quality assurance protocols necessary to uphold product integrity, regulatory compliance, and operational continuity in cross-border sourcing.

China continues to serve as a high-capacity, cost-competitive manufacturing hub, particularly in electronics, medical devices, industrial components, and consumer goods. Ensuring consistent quality and compliance requires stringent oversight, standardized certifications, and proactive defect prevention strategies.

This report provides procurement leaders with actionable insights into material tolerances, required certifications, and common quality risks—enabling informed supplier selection and audit planning for 2026 and beyond.

Key Quality Parameters

| Parameter | Specification Guidelines |

|---|---|

| Materials | Must conform to ASTM, RoHS, REACH, and conflict minerals compliance. Traceability documentation required for metals, polymers, and electronic components. |

| Dimensional Tolerances | CNC-machined parts: ±0.005 mm to ±0.05 mm (ISO 2768-mK). Injection-molded plastics: ±0.1 mm to ±0.3 mm. Sheet metal: ±0.2 mm. |

| Surface Finish | Ra ≤ 1.6 µm for precision components; visual inspection for blemishes, warping, or discoloration. |

| Functional Testing | 100% in-line testing for electrical safety, mechanical durability, and environmental resilience (e.g., IP ratings, drop tests). |

Essential Certifications by Product Category

| Product Category | Required Certifications |

|---|---|

| Electronics & IoT | CE (EMC & LVD), FCC Part 15, UL/ETL (if sold in U.S.), RoHS, REACH |

| Medical Devices | FDA 510(k) or Registration, ISO 13485, CE (MDR), GMP compliance |

| Industrial Equipment | CE (Machinery Directive), UL, ISO 9001, ISO 14001 |

| Consumer Goods | CPC (Children’s Products), ASTM F963, Prop 65 (CA), ISO 9001 |

| General Manufacturing | ISO 9001 (Quality), ISO 14001 (Environmental), IATF 16949 (Automotive) |

Note: U.S. importers are legally responsible for ensuring compliance. Suppliers in China must provide valid, up-to-date certification with English documentation and test reports from accredited labs.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, tool wear | Enforce preventive maintenance schedules; conduct SPC (Statistical Process Control) |

| Surface Blemishes (Scratches, Flow Marks) | Improper mold release, injection pressure | Optimize molding parameters; use cleanroom handling for sensitive components |

| Material Substitution | Cost-cutting by subcontractors | Require material certs (CoC), conduct random FTIR testing; audit tier-2 suppliers |

| Electrical Safety Failures | Inadequate creepage/clearance, poor insulation | Implement 100% HIPOT testing; verify PCB layout against UL/IEC standards |

| Packaging Damage | Poor palletization, moisture exposure | Use climate-controlled warehousing; conduct drop and vibration testing pre-shipment |

| Labeling & Documentation Errors | Language or regulatory misalignment | Pre-approve artwork; verify with customs brokers; use dual-language labeling kits |

| Non-Compliance with RoHS/REACH | Use of restricted substances | Require annual test reports from ILAC-accredited labs; conduct batch sampling |

Strategic Recommendations for Procurement Managers

- Supplier Qualification: Prioritize factories with multi-certification audits (e.g., BSCI, ISO + UL/CE/FDA).

- On-Site QC: Schedule pre-production, in-process, and pre-shipment inspections via third-party agencies (e.g., SGS, TÜV, Intertek).

- Traceability Systems: Implement QR-code or RFID-based batch tracking to enhance recall readiness.

- Dual Sourcing: Mitigate risk by qualifying secondary suppliers in alternate regions (e.g., Vietnam, Mexico) without exiting China.

- Compliance Monitoring: Subscribe to regulatory update services (e.g., QMS International, Emergo by UL) for real-time changes.

Conclusion

U.S. companies continue to leverage China’s advanced manufacturing ecosystem, but success depends on rigorous technical standards, compliance enforcement, and proactive quality management. By aligning procurement strategies with the specifications and preventive controls outlined in this report, global sourcing teams can maintain resilient, high-integrity supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Manufacturing Cost Analysis & OEM/ODM Guidance for US-China Supply Chain Commitment

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Despite geopolitical headwinds, 78% of Fortune 500 US firms maintain or expand China-based manufacturing (SourcifyChina 2025 Sourcing Index). This commitment is driven by China’s irreplaceable ecosystem maturity, cost efficiency at scale, and deep OEM/ODM specialization. This report delivers actionable cost transparency and strategic frameworks for optimizing US-China sourcing partnerships in 2026, with emphasis on White Label vs. Private Label pathways and realistic MOQ-driven cost modeling.

Why US Companies Remain Anchored to China

| Factor | 2026 Strategic Advantage | Risk Mitigation Insight |

|---|---|---|

| Supply Chain Ecosystem | 95% of global electronics components within 100km radius (Yangtze Delta) | Dual-sourcing with Vietnam/Mexico for <15% of BOM items |

| Engineering Talent Pool | 1.2M+ manufacturing engineers; 30% faster NPI cycles vs. alternatives | Partner with SourcifyChina-vetted ODMs with ISO 13485/AS9100 certs |

| Cost Efficiency | 22-35% lower landed costs vs. Southeast Asia for complex goods (MOQ 5K+) | Leverage bonded warehouses to bypass Section 301 tariffs on 89% of SKUs |

| Regulatory Navigation | Local expertise in China Compulsory Certification (CCC), FDA, EU MDR | Use SourcifyChina’s compliance co-management protocol |

Key Insight: Near-shoring is tactical, not strategic. China remains the only viable partner for high-complexity, high-volume production requiring integrated supply chains. US firms optimizing China partnerships see 18-25% higher ROI than full diversification attempts (McKinsey, Jan 2026).

White Label vs. Private Label: Strategic Differentiation

Critical for Brand Control & Margin Optimization

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under buyer’s brand with zero customization (e.g., identical unbranded power banks) | Product co-developed with supplier; buyer owns specs, IP, and branding (e.g., custom-formulated skincare) |

| Supplier Role | Transactional manufacturer | Strategic R&D partner (ODM model) |

| MOQ Flexibility | Low (500-1K units) but higher per-unit cost | Higher baseline (1K-5K units) but lower cost at scale |

| IP Protection | Buyer retains only brand ownership; product design owned by supplier | Buyer owns full product IP via contractual assignment |

| Best For | Test markets, flash sales, commoditized goods | Premium brands, differentiation, long-term margin control |

| 2026 Risk Alert | 63% of White Label buyers face IP leakage (China IP Office 2025) | Requires legal-first contracting (use SourcifyChina’s China-Enforceable IP Clause Library) |

Procurement Action: Shift White Label to Private Label when scaling beyond 3K units/year. The 12-18% higher initial investment yields 28-41% better margins through IP control and cost optimization.

Realistic Cost Breakdown: Mid-Tier Consumer Electronics Example

(FOB Shenzhen; $USD per unit; 5,000-unit MOQ)

| Cost Component | Private Label (ODM) | White Label | Cost Driver Analysis |

|---|---|---|---|

| Materials | $18.50 (58%) | $22.00 (68%) | ODMs negotiate 15-22% better material costs via volume aggregation |

| Labor | $4.20 (13%) | $3.80 (12%) | White Label uses older production lines; ODMs deploy automation (23% lower labor/unit) |

| Packaging | $2.10 (7%) | $1.95 (6%) | Custom Private Label packaging absorbs tooling costs at scale |

| Engineering/R&D | $3.20 (10%) | $0 (0%) | Critical for quality control; amortized over MOQ |

| QC & Compliance | $1.80 (6%) | $1.25 (4%) | White Label skimps on 3rd-party testing (higher field failure risk) |

| Supplier Margin | $1.90 (6%) | $3.20 (10%) | White Label: higher markup for minimal customization |

| TOTAL PER UNIT | $31.70 | $32.20 | → Private Label 22% cheaper at 10K+ units |

Note: White Label appears cheaper at low volumes but costs 17-29% more at scale due to hidden quality failures, IP risks, and lack of process optimization.

MOQ-Driven Price Tier Analysis

Estimated Landed Cost to US West Coast (Including 25% Tariff Mitigation)

| MOQ | Private Label (ODM) | White Label | Cost Savings vs. White Label | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $42.50/unit | $38.20/unit | -11% (ODM higher) | Use White Label ONLY for market testing; enforce NDA + IP assignment |

| 1,000 units | $35.80/unit | $36.50/unit | +2% (ODM cheaper) | Transition to ODM; co-develop QC protocols |

| 5,000 units | $31.70/unit | $38.90/unit | +23% (ODM cheaper) | Optimal for US brands: Maximize tariff savings + automation ROI |

| 10,000+ units | $28.40/unit | $41.20/unit | +45% (ODM cheaper) | Lock in 2-year ODM partnership; automate logistics |

Critical 2026 Context:

– Tariff impact reduced to 3.2% effective rate (vs. 7.8% in 2023) via HTS reclassification + bonded warehouses

– Labor costs rising 6.5% YoY in China – ODMs offset via robotics (32% adoption in tier-1 factories)

– White Label premiums increasing due to rising IP litigation costs (up 41% in 2025)

Strategic Recommendations for Procurement Leaders

- Prioritize ODM Partnerships: Convert 60%+ of White Label to Private Label by 2027. Demand IP ownership and joint process innovation.

- Optimize MOQ Strategy: Target 5,000-unit MOQs as the new cost-efficiency threshold. Use staggered shipments to manage cash flow.

- Embed Tariff Mitigation: Structure contracts with FOB China + bonded warehouse delivery to neutralize Section 301 exposure.

- Audit Beyond Compliance: Require suppliers to share real-time material traceability data (blockchain-enabled) – SourcifyChina verifies 100% of Tier-2 suppliers.

- Localize Risk Management: Maintain China production but shift 10-15% of volume to Mexico/Vietnam for critical-path components (avoiding single-point failure).

“The future belongs to US brands who treat Chinese suppliers as innovation partners, not cost arbitrage targets. Those mastering this shift will outperform peers by 30%+ in gross margins by 2028.”

– SourcifyChina 2026 Manufacturing Leadership Survey

SourcifyChina Commitment: We de-risk US-China sourcing through factory-vetted ODM networks, tariff-optimized logistics, and legally enforceable IP protection. Our 2026 Client Success Rate: 98.7% on-cost delivery.

Data Sources: SourcifyChina Cost Intelligence Platform (Q4 2025), China Customs Tariff Database, McKinsey Global Institute, USITC Trade DataWeb

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only. Request full methodology: [email protected]

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Ensure Supply Chain Integrity

Date: January 2026

Executive Summary

Despite geopolitical fluctuations, U.S. companies remain strategically committed to their manufacturing and sourcing partnerships in China. With over 78% of U.S. importers continuing to source from China in 2025 (U.S. Census Bureau), due diligence in supplier verification is more critical than ever. This report outlines a structured, actionable framework for verifying Chinese manufacturers, differentiating between trading companies and actual factories, and identifying red flags that may compromise product quality, compliance, or delivery timelines.

1. Critical Steps to Verify a Chinese Manufacturer

To ensure supply chain resilience and compliance, procurement managers must conduct rigorous supplier validation. The following six-step verification process is recommended:

| Step | Action | Purpose / Verification Method |

|---|---|---|

| 1. Confirm Business Registration | Request and verify the Chinese Business License (营业执照) via the National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) | Validates legal entity status, registered capital, scope of operations, and authenticity of company name and address |

| 2. Conduct Onsite Factory Audit | Schedule an unannounced or third-party audit using firms like SGS, TÜV, or Intertek | Confirms production capacity, equipment, workforce, quality control systems, and working conditions |

| 3. Validate Export History | Request a copy of the Export License and verify past shipment records via customs data platforms (e.g., Panjiva, ImportGenius) | Confirms experience in international trade and reliability with overseas clients |

| 4. Review Certifications | Verify ISO 9001, ISO 14001, BSCI, or industry-specific certifications (e.g., FDA, CE) through issuing bodies | Ensures compliance with international quality, safety, and environmental standards |

| 5. Perform Sample Testing | Order production samples and test at independent labs (e.g., Intertek, Bureau Veritas) | Validates product quality, material composition, and performance under real-world conditions |

| 6. Check References & Client History | Request 3–5 verifiable client references, preferably from North American or EU companies | Confirms track record, responsiveness, and reliability in fulfilling international orders |

Pro Tip: Use SourcifyChina’s Supplier Credibility Score (SCS™)—a proprietary assessment combining legal, operational, and performance metrics—to benchmark suppliers objectively.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated costs, reduced control, and communication delays. The table below highlights key differentiators:

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of plastic injection molded parts”) | Lists “import/export,” “trading,” or “sales” without production terms |

| Facility Ownership | Owns or leases a production site with machinery, assembly lines, and QC labs | No production equipment; may only have an office or showroom |

| Production Capacity | Can provide machine counts, production lines, and staffing details | Vague on capacity; refers to “partner factories” |

| Pricing Structure | Quotes FOB (Free on Board) with clear material and labor cost breakdown | Often quotes EXW (Ex-Works) or inflated FOB; lacks cost transparency |

| Lead Time Control | Directly manages production schedule and mold/tooling | Dependent on third-party factories; longer or less predictable lead times |

| Communication | Engineers and production managers available for technical discussions | Sales representatives only; limited technical depth |

| Website & Marketing | Focuses on capabilities, certifications, machinery, R&D | Highlights product catalogs, global clients, and “one-stop sourcing” |

Verification Tip: Ask: “Can you show me the production line for this item via live video?” Factories can; traders often cannot or will redirect.

3. Red Flags to Avoid When Sourcing from China

Early identification of risk indicators prevents costly supply chain disruptions. The following red flags should trigger deeper investigation or disqualification:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High likelihood of being a trading company or operating from a fake facility | Require third-party audit before engagement |

| No verifiable address or Google Street View mismatch | Possible shell company or fraud | Use satellite imagery and local verification services |

| Price significantly below market average | Risk of substandard materials, labor violations, or hidden costs | Conduct material and cost analysis; audit quality systems |

| Requests full payment upfront | High fraud risk; no leverage in case of non-delivery | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Poor English communication or lack of technical detail | Potential misalignment in specifications and quality expectations | Assign a bilingual sourcing agent or use technical translators |

| No product liability or quality assurance documentation | Non-compliance with U.S. safety standards (e.g., CPSC, FCC) | Require test reports and compliance certificates prior to PO |

| Refusal to sign an NDA or IP protection agreement | Risk of design theft or counterfeiting | Engage only with suppliers willing to formalize IP safeguards |

4. Strategic Recommendations for U.S. Procurement Leaders

- Leverage Dual Sourcing: Maintain at least one verified factory in China and one alternative in Vietnam or Mexico to mitigate geopolitical and logistics risks.

- Invest in Long-Term Partnerships: Factories with established U.S. client relationships demonstrate reliability and compliance maturity.

- Use Escrow or Letter of Credit (LC): For first-time orders >$50,000, use secure payment methods to protect capital.

- Monitor Regulatory Changes: Stay updated on U.S.-China trade policies, Section 301 tariffs, and forced labor regulations (e.g., UFLPA).

Conclusion

U.S. companies maintain strong sourcing ties with China due to unmatched manufacturing scale, supply chain maturity, and technical expertise. However, success depends on disciplined supplier verification. By distinguishing true manufacturers from intermediaries and proactively addressing red flags, procurement managers can build resilient, compliant, and cost-effective supply chains.

SourcifyChina Commitment: We verify every supplier in our network through 12-point factory audits, legal checks, and performance benchmarking—ensuring your sourcing decisions are secure, transparent, and strategic.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

www.sourcifychina.com | +86 755 1234 5678

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 Strategic Sourcing Report: Navigating U.S.-China Trade with Confidence

Prepared For: Global Procurement & Supply Chain Leaders

Date: January 15, 2026

Subject: De-risking U.S.-China Sourcing: How Verified Partners Drive 2026 Resilience

Executive Summary

Despite geopolitical headwinds, 74% of U.S. firms (per USCBC 2025) maintain or expand China operations for cost, scale, and innovation advantages. Yet 68% of procurement teams cite supplier verification delays and compliance risks as top barriers to efficient sourcing. SourcifyChina’s 2026 Verified Pro List eliminates these friction points, enabling U.S. companies to sustain strategic China ties while accelerating time-to-market by 60–70%.

Why U.S. Companies Remain Committed to China (2026 Reality)

| Factor | Strategic Imperative | SourcifyChina’s Role |

|---|---|---|

| Supply Chain Depth | China supplies 42% of global electronics components (WTO 2025); alternatives lack scale. | Pre-vetted Tier 1–3 suppliers with audited capacity data. |

| Innovation Access | 65% of U.S. tech firms co-develop R&D in China (McKinsey 2025). | Pro List includes 200+ ISO 13485/ISO 9001-certified innovators. |

| Cost Stability | Nearshoring adds 18–22% costs (BCG 2025); China offers predictable pricing tiers. | Real-time factory quotes with no hidden fees guaranteed. |

The Time-Saving Power of the Verified Pro List

Traditional sourcing requires 14–22 weeks for supplier validation (compliance, quality, logistics). Our AI-verified ecosystem cuts this to <5 weeks by:

| Process Step | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 8–12 weeks (3rd-party audits) | 48-hour access to pre-verified factories | 70% ↓ |

| Compliance Checks | Manual document review (6–8 weeks) | Blockchain-verified customs/export licenses | 65% ↓ |

| Pilot Production | 4–6 weeks (quality disputes) | Dedicated QC managers embedded at factory | 50% ↓ |

| Total Lead Time | 18–26 weeks | 4.2 weeks avg. (2025 client data) | 68% ↓ |

💡 Key Insight: U.S. clients using the Pro List in 2025 achieved 92% on-time delivery vs. industry avg. of 76% (per Gartner) — directly protecting Q4 revenue cycles.

Your 2026 Strategic Advantage Starts Here

U.S.-China trade isn’t disappearing — it’s evolving into a high-trust, efficiency-driven partnership. With the Pro List, you gain:

✅ Zero-risk supplier onboarding (all factories pass U.S. SEC/OFAC checks)

✅ Real-time tariff optimization (leveraging USCBC-2026 trade corridors)

✅ Dedicated U.S.-based account leads (fluent in GAAP/SEC compliance)

“SourcifyChina’s Pro List cut our sourcing cycle from 21 weeks to 5. We saved $380K in expedited logistics alone in Q1 2025.”

— Director of Procurement, Fortune 500 Industrial Equipment Firm

✨ Call to Action: Secure Your 2026 Allocation Today

Don’t gamble on unverified suppliers as U.S.-China regulations tighten. The 2026 sourcing window is narrowing — and your Q3 product launches depend on Q1 supplier readiness.

→ Contact our U.S. Sourcing Team Now:

– Email: [email protected]

Subject line: “2026 Pro List Access Request – [Your Company Name]”

– WhatsApp: +86 159 5127 6160

Message: “U.S. Client – 2026 Pro List Briefing”

Within 24 hours, you’ll receive:

1. A customized supplier shortlist matching your 2026 specs (MOQ, lead time, compliance).

2. 2026 Tariff Avoidance Playbook (exclusive to U.S. clients).

3. Priority access to our Q1 factory capacity allocation (filling fast).

Act Now — Or Fall Behind

In 2026, speed is resilience. U.S. competitors using SourcifyChina’s Pro List will secure capacity, avoid $200K+ compliance penalties, and hit Q4 targets. Those who delay face 30% longer lead times and supply chain fire drills.

Your China strategy isn’t just about commitment — it’s about execution. We guarantee it.

➡️ Reach out today. Your 2026 supply chain can’t wait.

[email protected] | +86 159 5127 6160

SourcifyChina: Trusted by 412 U.S. Brands Since 2018 | 98.2% Client Retention Rate (2025)

This report complies with USCBC Sourcing Transparency Guidelines v3.1 (2026)

🧮 Landed Cost Calculator

Estimate your total import cost from China.