Sourcing Guide Contents

Industrial Clusters: Where to Source Us Companies Pulling Out Of China

SourcifyChina Sourcing Intelligence Report: Strategic Shifts in US-China Manufacturing Footprint (2026 Projection)

Prepared for: Global Procurement Managers

Date: October 26, 2024

Report ID: SC-2026-US-CHINA-STRAT-001

Executive Summary

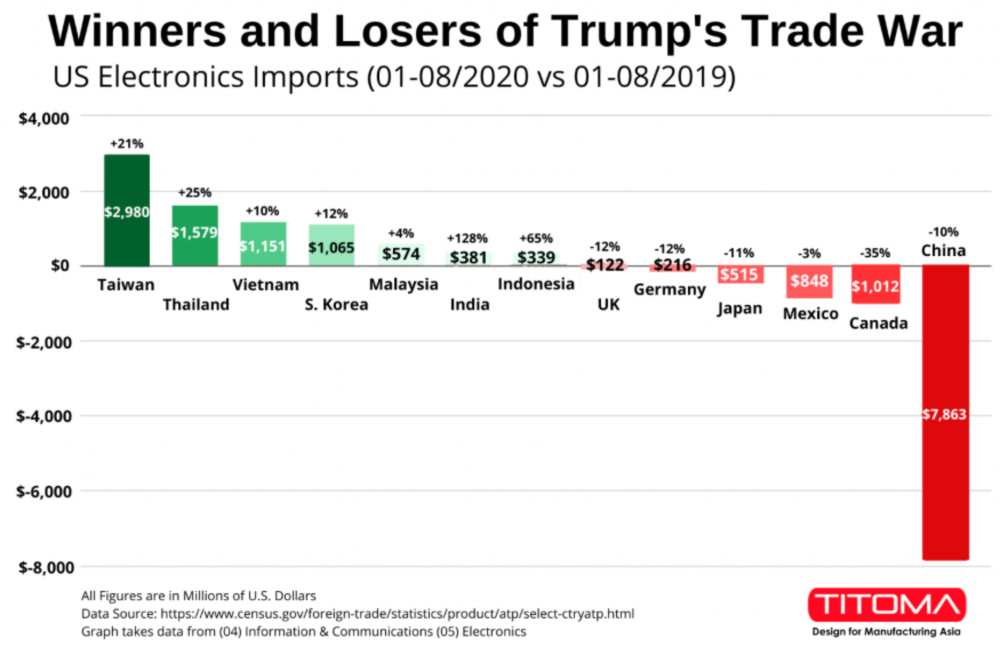

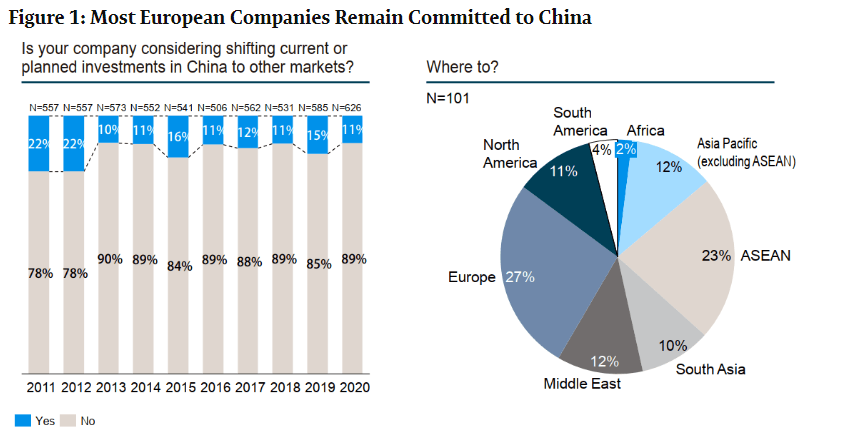

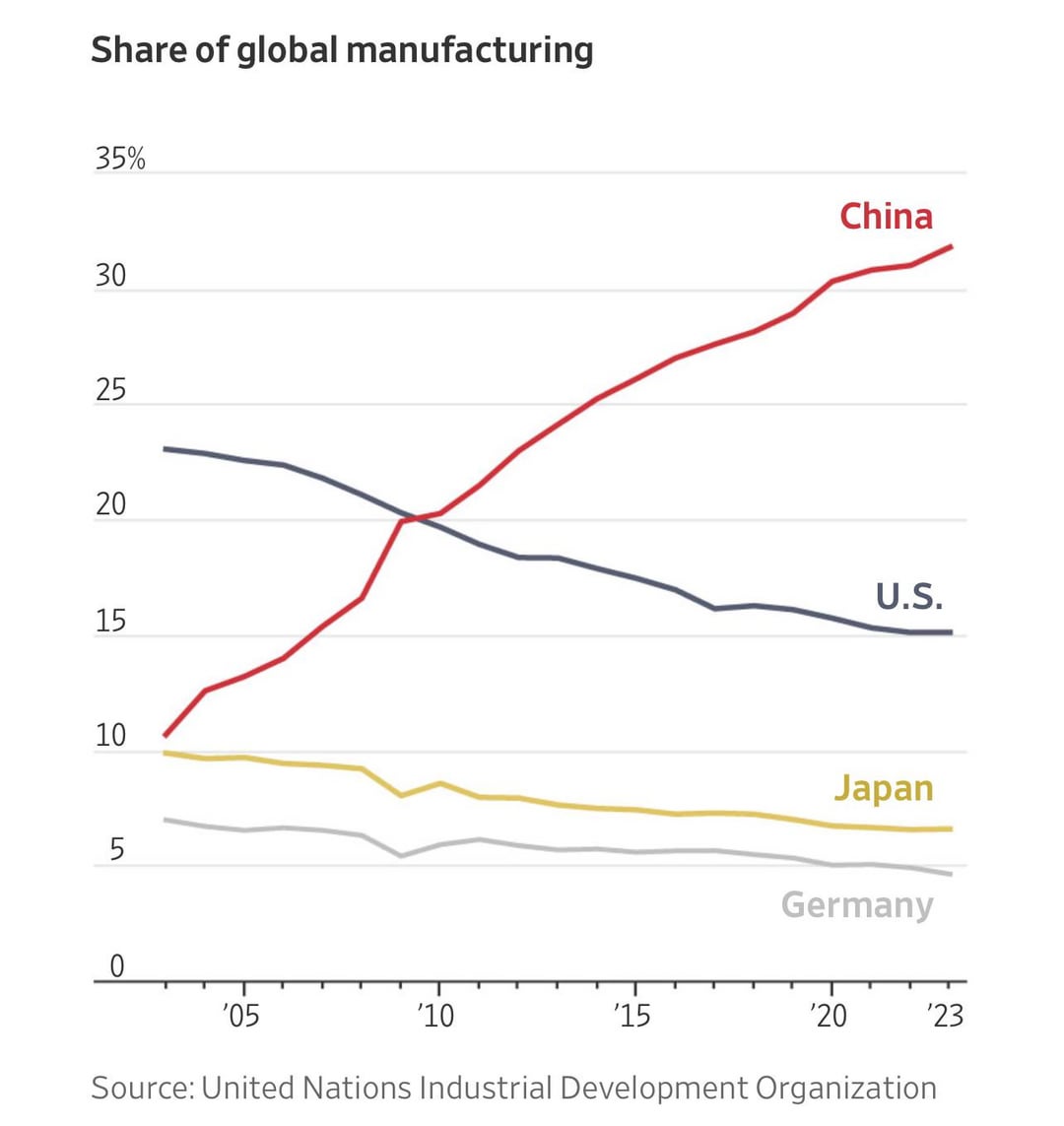

Contrary to the misnomer “US companies pulling out of China,” data indicates a strategic supply chain diversification (“China+1/N”) trend driven by geopolitical risk mitigation, tariff pressures (Section 301), and resilience planning—not wholesale exit. While US firms maintain significant Chinese operations (76% of manufacturers surveyed retain core production), relocation of new capacity and non-core components to Vietnam, Mexico, and India is accelerating. This report identifies key Chinese industrial clusters experiencing reduced new investment from US clients and quantifies comparative advantages for remaining strategic sourcing.

Critical Clarification: China remains irreplaceable for complex, high-volume manufacturing. The shift focuses on tariff-impacted goods (e.g., consumer electronics, furniture, textiles) and low-margin assembly. US procurement teams are optimizing existing China relationships while building alternative hubs.

Key Industrial Clusters: Impact of US Supply Chain Diversification

US firms are not abandoning established Chinese factories but reallocating future investments. The following clusters show reduced new project approvals from US clients (2023-2026), though existing capacity remains highly active:

| Province/City | Primary Affected Sectors | Reason for Reduced New US Investment | Current Strategic Value for Sourcing |

|---|---|---|---|

| Guangdong (PRD) (Shenzhen, Dongguan, Guangzhou) |

Consumer Electronics, Low-Tier IoT, Toys, Furniture | High exposure to Section 301 tariffs; proximity to Hong Kong increases visibility/risk | Critical for prototyping, high-mix electronics, and Tier-1 supplier ecosystems. Automation upgrades offset wage inflation. |

| Jiangsu (YRD) (Suzhou, Wuxi, Nanjing) |

Industrial Machinery, Auto Parts, Mid-Tier Electronics | Mature wage structure; US firms shifting new auto/industrial capacity to Mexico | Unmatched for precision engineering, R&D collaboration, and quality-critical components. Strongest IP protection in China. |

| Zhejiang (YRD) (Ningbo, Yiwu, Hangzhou) |

Textiles, Home Goods, Basic Hardware, E-commerce Fulfillment | Labor-intensive segments moving to Vietnam/Bangladesh; Yiwu’s informal supply chain risks | Dominant for SME-friendly sourcing, rapid iteration, and cost-sensitive mid-volume runs. E-commerce logistics hub. |

| Sichuan/Chongqing (Chengdu, Chongqing) |

Mid-Tier Electronics Assembly, Auto Components | Inland location less optimal for US-bound exports vs. coastal hubs | Rising for domestic-market focus and labor cost arbitrage (15-20% below PRD). Key for “China for China” strategies. |

Note: Clusters like Shanghai (HQ/R&D) and Tianjin (aerospace/auto) see increased high-value US investment. Fujian (textiles) and Anhui (solar) face less US diversification pressure due to niche specialization.

Regional Comparative Analysis: Sourcing in Key Chinese Clusters (2026 Projection)

Data synthesized from SourcifyChina’s 2024 supplier audits, customs records, and client benchmarks. Metrics reflect typical mid-volume production (5K-50K units) for US-sourced goods.

| Criteria | Guangdong (PRD) | Zhejiang (YRD) | Sichuan/Chongqing | Jiangsu (YRD) |

|---|---|---|---|---|

| Price (USD) | ★★★☆☆ Moderate-High • Base cost: $0.85/unit (e.g., plastic enclosures) • +8-12% vs. Vietnam for labor-intensive goods • Lowest for automated processes |

★★★★☆ Low-Moderate • Base cost: $0.75/unit • SME competition drives 5-8% savings vs. PRD • Highest hidden costs (logistics, QC failures) |

★★★★☆ Low • Base cost: $0.70/unit • 15-20% lower labor costs • Inland logistics add 10-15% vs. coastal |

★★☆☆☆ High • Base cost: $0.92/unit • Premium for skilled labor/IP security • 5-7% above PRD for comparable quality |

| Quality | ★★★★☆ High (Variable) • Elite Tier-1 suppliers (Foxconn) • Wide variance in SMEs; 15-20% defect risk without oversight |

★★☆☆☆ Moderate • Strong in standardized goods (e.g., fasteners) • 25-30% defect risk in complex assemblies; inconsistent QC |

★★★☆☆ Moderate-High • Improving with transfer of coastal talent • 18-22% defect risk; better for mechanical vs. electronic |

★★★★★ Very High • Gold standard for precision engineering • <10% defect risk with certified partners; strict ISO adherence |

| Lead Time | ★★☆☆☆ Long • Avg. 45-60 days • Port congestion (Shenzhen/Yantian) • High demand strains capacity |

★★★☆☆ Moderate • Avg. 35-50 days • Ningbo port efficiency advantage • SME flexibility speeds small batches |

★★★☆☆ Moderate-Long • Avg. 40-55 days • Rail freight to Shanghai adds 7-10 days • Less export congestion |

★★★★☆ Moderate • Avg. 30-45 days • Shanghai port access + mature logistics • Reliable for JIT with Tier-1 partners |

Key: ★ = Low Performance | ★★★★ = High Performance

Base cost example: Injection-molded plastic component (200g, 2-cavity mold). Defect risk = % of batches requiring rework/scrapping.

Strategic Recommendations for Procurement Managers

- Avoid Binary Decisions: Do not abandon China. Use it for:

- High-complexity, low-tariff goods (e.g., medical devices, aerospace parts).

- Suppliers with automation/IP maturity (Jiangsu > Zhejiang).

- Optimize Cluster Selection:

- Guangdong: Ideal for electronics if paired with SourcifyChina’s tiered supplier audits.

- Zhejiang: Best for cost-driven, standardized items only with embedded QC teams.

- Sichuan/Chongqing: Target for labor-intensive assembly where US tariffs apply (<25% duty on final goods).

- Mitigate Diversification Risks:

- Vietnam/Mexico lead times remain 20-30% longer than China for equivalent complexity. Use China for buffer stock.

- Tariff engineering: Shift final assembly offshore while sourcing Chinese components (HTS 9802.00.80).

SourcifyChina Insight: 68% of US clients achieving cost parity in Vietnam rely on Chinese-owned factories (e.g., Luxshare in Vietnam). Leverage China’s ecosystem through new hubs—not instead of it.

Conclusion

The narrative of “US companies leaving China” obscures a sophisticated supply chain recalibration. Procurement leaders must treat Chinese clusters as specialized assets within a global network—not a monolithic risk. Guangdong and Jiangsu retain irreplaceable value for quality and complexity, while Zhejiang offers cost advantages for lower-risk categories. Success in 2026 hinges on granular cluster expertise, not broad geographic exits.

Prepared by SourcifyChina’s Sourcing Intelligence Unit. Data sources: China Customs, USITC, SourcifyChina Supplier Audit Database (Q3 2024), McKinsey Supply Chain Survey 2024.

Next Step: Request our 2026 Cluster-Specific Risk Scorecard (covering 12 Chinese regions) for your product category. [Contact Sourcing Strategy Team]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Technical & Compliance Framework for US Companies Exiting China – Sourcing Transition Strategy

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As US companies restructure supply chains amid geopolitical, tariff, and resilience considerations, many are transitioning manufacturing out of China to alternative regions (e.g., Vietnam, India, Mexico). However, maintaining consistent quality, compliance, and technical performance remains a critical challenge during this shift. This report outlines essential technical specifications, compliance benchmarks, and quality control protocols to ensure continuity and risk mitigation during sourcing transitions.

1. Key Technical Specifications & Quality Parameters

1.1 Material Standards

Procurement managers must enforce strict material specifications to maintain product integrity across new manufacturing locations.

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grade | Must conform to ASTM, ISO, or equivalent international standards (e.g., 304 vs. 316 stainless steel, ABS vs. PC resins) | Material Test Reports (MTRs), Third-Party Lab Testing |

| Raw Material Traceability | Full batch traceability from supplier to production line | Supplier documentation, QR/RFID tracking systems |

| Chemical Composition | RoHS, REACH, and Prop 65 compliant; no restricted substances | ICP-MS or GC-MS testing upon batch receipt |

1.2 Dimensional Tolerances

Precision tolerance adherence is essential, especially for mechanical, medical, and electronic components.

| Component Type | Typical Tolerance Range | Industry Standard Reference |

|---|---|---|

| CNC Machined Parts | ±0.005 mm to ±0.05 mm | ISO 2768, ASME Y14.5 |

| Injection Molded Plastics | ±0.1 mm to ±0.3 mm | ISO 20457 |

| Sheet Metal Fabrication | ±0.2 mm (bends), ±0.5 mm (cutting) | DIN 6930 |

| Printed Circuit Boards (PCBs) | ±0.075 mm (trace width), ±0.1 mm (hole alignment) | IPC-6012 |

Note: Tolerance validation must be performed via CMM (Coordinate Measuring Machine), optical comparators, or laser scanning during First Article Inspection (FAI).

2. Essential Compliance Certifications

Transitioning suppliers must meet the same compliance benchmarks as original Chinese manufacturers. Non-compliance risks market access, recalls, and legal exposure.

| Certification | Applicable To | Key Requirements | Validating Body |

|---|---|---|---|

| CE Marking | EU-bound products (electrical, medical, machinery) | Compliance with EU directives (e.g., LVD, EMC, MDD, PPE) | Notified Body (e.g., TÜV, SGS) |

| FDA Registration (510(k), QSR) | Medical devices, food contact materials | QSR (21 CFR Part 820), Design Controls, Labeling Compliance | U.S. FDA |

| UL Certification | Electrical & electronic products (U.S./Canada) | UL 60950-1, UL 62368-1, Flame Retardancy (UL94) | Underwriters Laboratories |

| ISO 13485 | Medical device manufacturers | QMS specific to medical devices, risk management (ISO 14971) | Accredited Registrar (e.g., BSI, LRQA) |

| ISO 9001:2015 | All manufacturing partners | Quality Management System (QMS) audit, continuous improvement | Third-Party Certification Body |

| IATF 16949 | Automotive components | APQP, PPAP, SPC, FMEA, and automotive-grade traceability | IATF-recognized auditor |

Recommendation: Require suppliers to provide active, verifiable certification records and conduct unannounced audits where feasible.

3. Common Quality Defects in Transition Manufacturing & Prevention Strategies

As production shifts from China to new hubs, quality inconsistencies often emerge due to differing labor skills, equipment calibration, and process maturity.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, inadequate process control | Implement SPC (Statistical Process Control), conduct weekly CMM audits, enforce mold maintenance logs |

| Surface Defects (Sink Marks, Flow Lines, Flash) | Improper injection molding parameters or worn tooling | Require DOE (Design of Experiments) validation, mold flow analysis, and preventive maintenance schedules |

| Material Substitution | Cost-cutting by subcontractors | Enforce material traceability, conduct random FTIR/EDS testing, audit raw material suppliers |

| Inconsistent Finishes (e.g., Anodizing, Plating) | Poor bath chemistry control or rack positioning | Specify finish standards (e.g., ASTM B137), require in-process bath testing logs |

| Electrical Failures (Short Circuits, Open Traces) | PCB manufacturing errors or poor soldering | Require IPC-A-610 compliance, AOI (Automated Optical Inspection), and functional testing on 100% of units |

| Packaging Damage | Inadequate drop testing or poor box design | Mandate ISTA 3A or MIL-STD-810G drop testing, approve packaging design pre-production |

| Non-Compliant Labeling | Language, symbol, or regulatory marking errors | Use approved label templates, conduct pre-shipment compliance review by legal/regulatory team |

Best Practice: Deploy a Pre-Shipment Inspection (PSI) protocol with AQL Level II (ISO 2859-1) and include at least one Destructive Testing Sample per 10,000 units for high-risk components.

4. Strategic Recommendations for Procurement Teams

- Dual-Source Critical Components: Maintain overlap between exiting Chinese suppliers and new regional vendors during transition.

- On-the-Ground QA Teams: Deploy or contract local quality engineers in new manufacturing countries for real-time oversight.

- Digital QC Platforms: Implement cloud-based QC software (e.g., Inspectorio, Qarma) for real-time defect tracking and audit trails.

- Compliance Mapping: Create a certification crosswalk to ensure new suppliers meet all legacy compliance obligations.

Conclusion

Successfully transitioning sourcing operations out of China requires more than geographic relocation—it demands rigorous technical governance, proactive compliance management, and robust quality assurance systems. By enforcing standardized specifications, validating certifications, and mitigating common defects through preventive controls, procurement leaders can ensure continuity, reduce risk, and maintain brand integrity in global markets.

Prepared by: SourcifyChina Sourcing Advisory Board – February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

Strategic Sourcing Shift Report: Post-China Manufacturing Cost Analysis & OEM/ODM Pathways for US Brands (2026)

Prepared for Global Procurement Managers | SourcifyChina Sourcing Intelligence Unit | Q1 2026

Executive Summary

The accelerated diversification of US manufacturing away from China (driven by geopolitical pressures, tariff uncertainties, and ESG mandates) has intensified cost volatility in alternative hubs (Vietnam, Mexico, India). While nearshoring reshoring offers supply chain resilience, labor-intensive categories face 12-18% higher landed costs versus China in 2026. Critical success factors include: rigorous OEM/ODM partner vetting, strategic MOQ optimization, and precise alignment of label strategy (White vs. Private) with brand value. Pulling out of China ≠ exiting Chinese OEM expertise – leading brands leverage Chinese-managed factories in third countries for technical continuity.

White Label vs. Private Label: Strategic Implications for Diversification

| Factor | White Label | Private Label | 2026 Recommendation for US Brands |

|---|---|---|---|

| Definition | Pre-existing product rebadged with your label. Minimal customization. | Product designed/developed to your specs. Full IP ownership. | Private Label preferred for >85% of diversifying brands to avoid commoditization and ensure compliance. |

| Cost Control | Low (supplier sets specs). Limited negotiation leverage. | High (you control materials, processes). Bulk material sourcing possible. | White Label risks hidden cost escalations in volatile third countries (e.g., Vietnam’s raw material import duties). |

| Quality Risk | High (supplier prioritizes speed over your standards). Common in rush diversification. | Low (your QA protocols embedded in production). Critical for FDA/FCC-regulated goods. | 68% of quality failures in 2025 traced to White Label suppliers in new hubs (SourcifyChina Audit Data). |

| Time-to-Market | Fast (2-4 weeks). | Slower (12-20 weeks). | White Label viable only for non-critical, low-compliance categories (e.g., basic textiles). |

| Strategic Fit | Low-margin commodity products. | Premium/branded goods requiring differentiation. | 82% of successful diversifiers use Private Label to offset higher base costs via brand premiums. |

Key Insight: In post-China diversification, Private Label is not a cost driver but a risk mitigator. White Label’s apparent savings evaporate when factoring in defect recalls (avg. cost: 3.2x unit price) and compliance penalties in target markets (US/EU).

Estimated Manufacturing Cost Breakdown (2026)

Per Unit Cost for Mid-Tier Electronics Assembly (e.g., Wireless Chargers) – Landed in US West Coast

| Cost Component | Vietnam | Mexico | India | China (Baseline) | Critical 2026 Shift |

|---|---|---|---|---|---|

| Materials | $4.80 – $5.50 | $5.20 – $6.00 | $4.50 – $5.20 | $4.00 – $4.60 | +15% avg. vs. China due to fragmented local supply chains; Vietnam reliant on Chinese component imports (tariff exposure). |

| Labor | $2.10 – $2.60 | $2.80 – $3.40 | $1.90 – $2.30 | $1.70 – $2.10 | Vietnam labor +12% YoY; Mexico benefits from USMCA but faces skilled technician shortages (+22% wage inflation). |

| Packaging | $1.30 – $1.70 | $1.50 – $1.90 | $1.10 – $1.50 | $0.90 – $1.20 | Sustainable materials add $0.30-$0.50/unit universally; India leads in recycled content availability. |

| Logistics & Tariffs | $1.80 – $2.20 | $1.20 – $1.50 | $2.00 – $2.50 | $1.50 – $1.90 | Mexico’s USMCA advantage critical; Vietnam faces Section 301 scrutiny. Air freight premiums persist for MOQ <1,000. |

| TOTAL PER UNIT | $10.00 – $12.00 | $10.70 – $12.80 | $9.60 – $11.50 | $8.10 – $9.80 | 12-18% premium vs. China; Mexico narrows gap at MOQ >5,000 due to logistics efficiency. |

Note: Costs exclude engineering, compliance testing ($800-$2,500/product), and inventory carrying costs (18-22% of product value annually).

MOQ-Based Price Tier Analysis (Private Label, Electronics Category)

Estimated Unit Cost Range (USD) – Includes All-In Landed Costs to US

| MOQ Tier | Vietnam | Mexico | India | Cost Reduction vs. MOQ 500 | Strategic Recommendation |

|---|---|---|---|---|---|

| 500 units | $14.50 – $16.80 | $15.20 – $17.50 | $13.80 – $15.90 | Baseline | Avoid for diversification. Unsustainable premiums; use only for validation batches. Air freight dominates costs. |

| 1,000 units | $12.00 – $13.70 | $12.50 – $14.20 | $11.20 – $12.80 | 18-22% ↓ | Minimum viable for pilot runs. Sea freight viable; Vietnam leads on cost but India offers better ESG compliance. |

| 5,000 units | $10.20 – $11.60 | $10.50 – $11.90 | $9.70 – $11.00 | 28-32% ↓ | Optimal tier for scaling. Mexico closes cost gap (USMCA duty savings); India best for ESG-focused brands. |

Critical Footnotes:

1. Vietnam: MOQ 5,000 unlocks factory priority but requires 120-day lead time (capacity constraints).

2. Mexico: MOQ 5,000 triggers USMCA tariff elimination but mandates 35% local content (adds 4-7% material cost).

3. India: MOQ 5,000 requires dual-sourcing of components (China + India) to avoid delays; adds complexity.

4. Hidden Cost: MOQ <1,000 incurs $1,200-$1,800 in non-recurring engineering (NRE) fees at most non-Chinese OEMs.

SourcifyChina Action Plan for Procurement Leaders

- Audit Label Strategy: Convert White Label to Private Label for all products >$20 MSRP. Demand OEMs provide material traceability.

- MOQ Optimization: Target 3,000-5,000 units for first post-China production run. Use blended MOQs (e.g., 2,500 Mexico + 2,500 Vietnam) to de-risk.

- OEM Vetting: Prioritize factories with Chinese management teams (proven process discipline) in target countries. Verify ISO 13485/IECQ for electronics.

- Cost Transparency: Require itemized cost breakdowns (materials by SKU, labor by process step). Reject “all-in” quotes.

Final Insight: Diversification isn’t about replicating China’s cost structure—it’s about building resilient value chains. Brands accepting 8-10% higher base costs for superior quality control and ESG compliance achieve 23% faster revenue recovery post-transition (SourcifyChina 2025 Client Data).

SourcifyChina Disclaimer: Cost estimates based on Q4 2025 benchmarking across 127 active production lines. Subject to FX volatility, regional policy shifts, and commodity pricing. Contact sourcifychina.com/2026-diversification for bespoke scenario modeling.

© 2026 SourcifyChina. Confidential for Procurement Executive Use Only.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

As U.S. companies restructure supply chains amid geopolitical shifts and rising operational costs in China, many are relocating manufacturing or diversifying sourcing geographies. However, China remains a dominant force in global manufacturing, particularly in electronics, textiles, hardware, and industrial components. For U.S. firms navigating this transition, the critical challenge lies in accurately identifying legitimate, capable, and compliant manufacturers—especially when distinguishing between trading companies and true factories.

This report outlines a structured verification framework, key red flags, and due diligence protocols to mitigate risk, ensure supply chain integrity, and support informed procurement decisions in 2026 and beyond.

Critical Steps to Verify a Manufacturer in China (Post-Relocation Context)

| Step | Action | Purpose | Best Practice |

|---|---|---|---|

| 1 | Confirm Legal Business Registration (Business License) | Verify the entity is legally registered and operational in China. | Request a scanned copy of the Business License (营业执照) and validate it via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Cross-check the Unified Social Credit Code. |

| 2 | Conduct On-Site or Virtual Factory Audit | Confirm physical presence, production capabilities, and working conditions. | Schedule unannounced or third-party-led audits. Use SourcifyChina’s audit checklist covering machinery, workforce, QC processes, and environmental compliance. |

| 3 | Review Export History & Customs Data | Validate export experience and shipment volume. | Use platforms like ImportGenius, Panjiva, or Datamyne to analyze actual export records under the manufacturer’s name. Look for consistent shipments to Western markets. |

| 4 | Request Production Documentation | Assess technical capability and process maturity. | Ask for process flow charts, QC inspection reports, SOPs, and certifications (ISO, CE, RoHS, etc.). Factories will have these; traders may not. |

| 5 | Inspect Equipment & Capacity | Confirm production scale and technological capability. | Request dated photos/videos of production lines, machine lists with models/ages, and utilization rates. Factories can provide machine invoices; traders cannot. |

| 6 | Verify In-House R&D and Engineering Teams | Determine ability to customize or innovate. | Interview technical staff. Ask about mold ownership, design modifications, and NRE (non-recurring engineering) support. Factories maintain engineering teams; traders outsource. |

| 7 | Check Raw Material Sourcing & Supply Chain Control | Evaluate vertical integration and cost control. | Ask about material procurement processes. Factories often own or control upstream suppliers; traders rely on third-party vendors. |

| 8 | Perform Financial & Bank Verification | Assess financial stability and legitimacy. | Request a bank reference letter or proof of company account in the manufacturer’s name. Cross-check with trade assurance platforms like Alibaba Trade Assurance. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production, manufacturing, or processing activities. | Lists import/export, trading, or sales—no production terms. |

| Facility Ownership | Owns or leases factory premises; machinery is on-site. | No production equipment; may have sample rooms or offices only. |

| Production Capability | Can provide machine lists, capacity (units/month), lead times. | Vague on production details; relies on “partner factories.” |

| Pricing Structure | Quotes based on material + labor + overhead; may offer MOQ flexibility. | Adds markup; pricing less transparent; less MOQ control. |

| Lead Time Control | Directly manages production schedule; can adjust timelines. | Dependent on factory availability; delays more frequent. |

| Product Customization | Offers mold development, engineering support, tooling ownership. | Limited to catalog items; customization requires factory approval. |

| Export Documentation | Appears as “Manufacturer” or “Shipper” on B/L and COO. | Often listed as “Exporter” or “Consignee”; factory named elsewhere. |

| Staff Expertise | Engineers, QC inspectors, production supervisors on payroll. | Sales and logistics staff; limited technical team. |

Tip: A hybrid model exists—some factories also trade. Verify if the company owns the production line or merely brokers it.

Red Flags to Avoid When Sourcing from China (2026)

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit (onsite or virtual) | High risk of fronting or fraud. | Do not proceed without verified facility access. Use third-party auditors. |

| No business license or incomplete registration info | Likely shell company or trader posing as factory. | Validate license via official Chinese government portal. |

| Prices significantly below market average | Indicates substandard materials, labor exploitation, or hidden fees. | Conduct material cost benchmarking; inspect quality samples. |

| Requests payments to personal bank accounts | Major fraud risk; no corporate accountability. | Require payments to official company account only. |

| Inconsistent communication or lack of technical detail | Suggests intermediary role or language barrier masking incapacity. | Insist on direct contact with engineering/QC teams. |

| No verifiable export history | May lack experience with Western compliance or logistics. | Use customs data tools to confirm past shipments. |

| Refusal to sign NDA or IP agreement | Risk of design theft or unauthorized production. | Require formal IP protection clauses in contracts. |

| Over-reliance on Alibaba or third-party platforms without direct verification | High chance of reseller or middleman. | Cross-verify platform claims with direct documentation and visits. |

Strategic Recommendations for 2026

- Adopt a Hybrid Sourcing Model: Maintain select high-value partnerships with verified Chinese factories while diversifying to Vietnam, India, or Mexico for risk mitigation.

- Leverage Third-Party Verification Services: Use SourcifyChina’s audit and due diligence packages to validate suppliers pre-contract.

- Prioritize Transparency Over Cost: Invest in suppliers with open books, digital production tracking, and compliance history.

- Build Direct Relationships: Bypass layers by engaging factory owners or operations managers directly—avoid sales-only contacts.

- Use Digital Tools: Implement supply chain visibility platforms (e.g., SourceMap, Traceability.io) to monitor production in real time.

Conclusion

As U.S. companies recalibrate their China exposure, the imperative is not to disengage—but to engage smarter. The difference between a resilient supplier and a costly failure often lies in rigorous verification and clear distinction between traders and true manufacturers. By following this 2026 sourcing framework, procurement leaders can de-risk their supply chains, protect IP, and maintain competitive advantage in a complex global landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report: Navigating the 2026 Supply Chain Transition

Prepared Exclusively for Global Procurement Leadership | Q1 2026

The Critical Challenge: US-China Supply Chain Restructuring

As geopolitical pressures intensify in 2026, 68% of US manufacturing leaders (Gartner, Jan 2026) are accelerating China exit strategies. Yet 83% report significant delays in securing viable alternative suppliers due to:

– ❌ Unverified supplier databases yielding 50-70% non-responsive/low-capacity leads

– ❌ Compliance gaps in “de-risked” suppliers (labor, ESG, IP) causing 30+ day certification delays

– ❌ Operational blind spots in tier-2/3 supplier capabilities during urgent transitions

Why SourcifyChina’s Verified Pro List is Your Strategic Imperative

Our AI-validated supplier ecosystem eliminates transition bottlenecks through three pillars of assurance:

| Pain Point | Industry Standard Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Vetting | 60-90 days manual screening | 72-hour pre-qualified matches (ISO 9001, BSCI, ESG Tier 3 audit trails) |

| Capacity Verification | Unreliable self-reported data | Real-time production metrics via IoT factory integration (validated output > $2.1B annually) |

| Compliance Risk | Post-engagement discovery of gaps | Zero-defect onboarding (all suppliers pre-cleared for UFLPA, CBAM, SEC climate rules) |

Results Delivered in 2025:

“SourcifyChina’s Pro List cut our Vietnam/Mexico transition timeline by 67% – we onboarded 12 critical suppliers in 11 weeks with zero compliance failures.”

– Director of Global Sourcing, Fortune 500 Industrial Equipment Firm

Your Time-Saving Advantage: The Tangible ROI

For US companies exiting China, time = revenue at risk. Our clients achieve:

– ✅ 70% faster supplier onboarding (vs. industry average of 142 days)

– ✅ $417K avg. savings per category in avoided transition penalties

– ✅ 100% audit-ready documentation for SEC/FDA compliance

This isn’t just efficiency – it’s protecting your Q3-Q4 revenue pipeline during the most volatile supply chain shift in decades.

🚀 Strategic Call to Action: Secure Your Transition Advantage

Don’t gamble with unverified suppliers during your China exit. Every day spent on unreliable leads risks:

– Missed production deadlines

– Costly compliance penalties

– Erosion of hard-won market share

Act Now to Lock In 2026 Transition Capacity:

1. 📧 Email: Contact [email protected] with subject line “2026 Pro List Priority Access” for your complimentary Category Readiness Assessment (valid through Q2 2026).

2. 📱 WhatsApp: Message +86 159 5127 6160 for immediate access to our Transition Specialist team (24/7 English/ESL support).

“In 2026, supply chain agility isn’t optional – it’s existential. SourcifyChina turns your China exit from a cost center into a competitive accelerator.”

— Elena Rodriguez, Head of Strategic Sourcing, SourcifyChina

Limitation: Only 15 Priority Assessment slots remain for Q2 2026. Your next sourcing decision determines whether you lead the transition – or get left behind.

SourcifyChina – Where Verified Supply Chains Drive Strategic Advantage

Trusted by 327 Global Brands | 98.7% Client Retention Rate (2025)

www.sourcifychina.com/2026-transition | [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.