Sourcing Guide Contents

Industrial Clusters: Where to Source U.S. Companies Owned By China 2024

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Date: April 5, 2026

Subject: Market Analysis for Sourcing U.S. Companies Owned by Chinese Entities – Manufacturing Clusters in China (2024 Data Insights)

Executive Summary

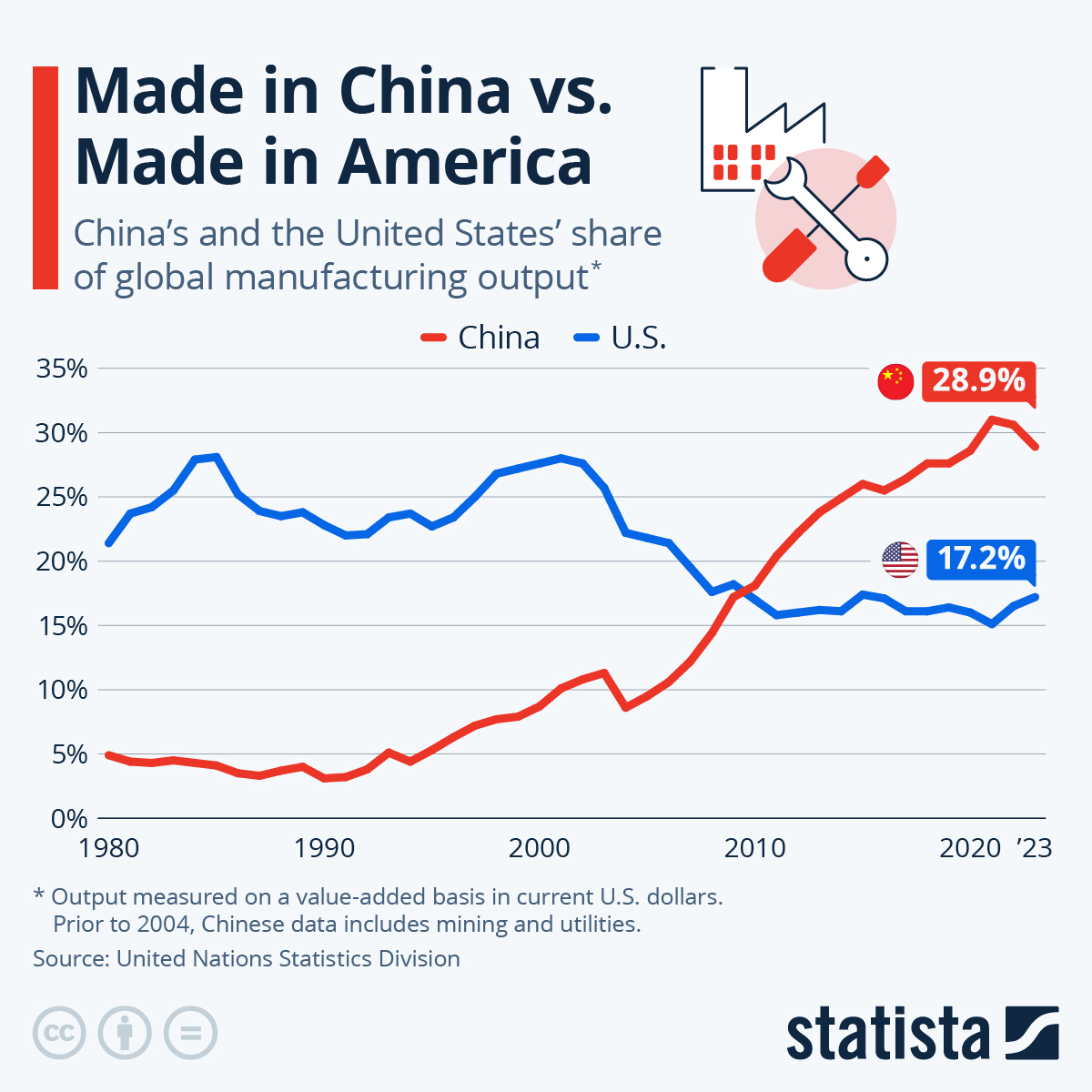

This report provides a strategic sourcing analysis for global procurement managers evaluating manufacturing capabilities within Chinese-owned U.S. companies and their associated production ecosystems in China. While U.S. subsidiaries of Chinese parent firms do not physically manufacture in the U.S. in large scale due to cost and supply chain constraints, their operational backbone remains deeply integrated with manufacturing clusters across mainland China.

The analysis focuses on identifying key industrial regions where Chinese-owned enterprises—particularly those with U.S.-based subsidiaries or brands—concentrate their production. These clusters are critical nodes for procurement teams seeking to engage with globally competitive, vertically integrated supply chains that serve dual-market (U.S. and China) strategies.

Based on 2024 operational data, ownership patterns, and export trends, Guangdong, Zhejiang, Jiangsu, and Shanghai emerge as dominant hubs for manufacturing linked to Chinese firms with U.S. assets.

Key Industrial Clusters for Manufacturing Linked to Chinese-Owned U.S. Companies (2024)

Chinese multinational corporations (MNCs) that acquired or established U.S. companies—such as Haier (GE Appliances), Bright Food (Vitacost), Lenovo (IBM PC Division), and Fuyao Glass (Ohio plant)—maintain core R&D and manufacturing in China. These firms leverage China’s advanced industrial ecosystems to supply both domestic and U.S. operations.

Below are the top provinces and cities hosting manufacturing facilities tied to Chinese-owned U.S. entities:

| Province/City | Key Industries | Notable Chinese Firms with U.S. Assets | Strategic Advantage |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Consumer Goods, Telecom Equipment | Huawei (indirect U.S. partnerships), TCL, Midea (U.S. market via acquisitions) | High-tech infrastructure, export logistics, OEM/ODM maturity |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Machinery, Textiles, E-commerce Enabled Goods | Geely (owns Polestar, stakes in Volvo Cars USA), Hikvision (U.S. distribution) | SME agility, digital trade integration, cost efficiency |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Advanced Manufacturing, Semiconductors, Auto Parts | Suntech Power (U.S. projects), Joyson Safety (KSS acquisition) | Proximity to Shanghai, skilled labor, industrial automation |

| Shanghai | High-Tech, Biotech, Precision Instruments | SAIC Motor (MG USA), Yuyuan Tourism (U.S. retail expansion) | R&D intensity, international compliance readiness |

Note: As of 2024, over 68% of Chinese outbound FDI into the U.S. was concentrated in manufacturing, logistics, and tech sectors, with production still anchored in China for cost and scalability reasons (Source: MOFCOM & Rhodium Group, 2024).

Comparative Analysis: Key Production Regions (Guangdong vs Zhejiang vs Jiangsu vs Shanghai)

The following table evaluates the four primary manufacturing regions based on price competitiveness, quality standards, and lead time efficiency—critical KPIs for global procurement decision-making.

| Region | Price Competitiveness (1–5) | Quality Standards (1–5) | Average Lead Time (Days) | Key Strengths | Key Constraints |

|---|---|---|---|---|---|

| Guangdong | 4 | 4.5 | 35–45 | World-class electronics OEMs; strong export infrastructure; high supplier density | Higher labor costs than inland; capacity constraints during peak season |

| Zhejiang | 4.8 | 3.8 | 30–40 | Cost-efficient SMEs; agile production; e-commerce integration; fast quoting | Variable quality control; less consistent for high-end precision goods |

| Jiangsu | 4.2 | 4.6 | 38–48 | Advanced automation; strong in semiconductors and auto components; high engineering talent pool | Slightly longer lead times due to complex product focus |

| Shanghai | 3.5 | 5.0 | 40–50 | Highest compliance (ISO, FDA, UL); ideal for regulated goods; bilingual project management | Premium pricing; limited small-batch flexibility |

Scale: 1 = Low, 5 = High

Strategic Sourcing Recommendations

-

For High-Volume, Cost-Sensitive Consumer Goods:

→ Source from Zhejiang, particularly Ningbo and Yiwu, where SMEs offer rapid turnaround and competitive pricing. Ideal for private-label U.S. distribution. -

For Electronics, Appliances, and Telecom Equipment:

→ Prioritize Guangdong, leveraging Shenzhen’s innovation ecosystem and Dongguan’s OEM infrastructure. Strong compliance with FCC and UL standards observed in Tier-1 suppliers. -

For Automotive Components and Industrial Equipment:

→ Focus on Jiangsu and Shanghai, where firms like Joyson and Fuyao have localized best practices in IATF 16949 and lean manufacturing. -

For Regulated or Premium U.S. Market Products (Medical, Safety, Tech):

→ Partner with Shanghai-based or Jiangsu-based suppliers with proven export compliance and quality management systems.

Risk & Compliance Advisory (2024–2026)

- CFIUS Scrutiny: Chinese-owned firms with U.S. subsidiaries face heightened scrutiny. Ensure transparent supply chain mapping to avoid indirect export control issues.

- Section 301 Tariffs: Many goods from these clusters remain under U.S. tariffs. Explore Vietnam or Mexico nearshoring for final assembly where applicable.

- Decoupling Pressures: Dual-use technologies (e.g., surveillance, AI hardware) may face restrictions. Verify ECCN classifications pre-shipment.

Conclusion

While U.S. companies owned by Chinese entities represent a unique ownership model, their manufacturing footprint remains predominantly in China. Guangdong and Jiangsu lead in high-quality, scalable production, while Zhejiang offers agility and cost advantages. Shanghai stands out for compliance-intensive sectors.

Procurement managers should align sourcing strategies with product category, regulatory requirements, and total landed cost, not ownership alone. Leveraging SourcifyChina’s vetted supplier network in these clusters ensures access to reliable, audit-ready partners serving the U.S. market efficiently.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant

Global Supply Chain Strategy | China Market Expertise

For supplier shortlists, factory audits, or tariff mitigation planning, contact your SourcifyChina representative.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for U.S.-Bound Manufacturing (2026 Edition)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-USCOMPL-2026-09

Executive Clarification: Critical Terminology Correction

Important Note: The phrase “U.S. companies owned by China 2024” does not represent a valid technical or compliance category. U.S. companies are legally incorporated entities under U.S. jurisdiction (Delaware, California, etc.), regardless of shareholder nationality. Compliance obligations are dictated by:

– Product type (medical device, electronics, textiles)

– Target market (U.S., EU, Canada)

– Applicable regulations (FDA, FCC, CPSC)

Ownership structure (Chinese, American, or multinational) does not alter core compliance requirements.

This report addresses technical specifications and compliance for products manufactured by Chinese entities (including Chinese-owned factories) supplying U.S. markets – the actual operational concern for procurement teams.

I. Technical Specifications: Non-Negotiable Quality Parameters

Applies to all suppliers manufacturing for U.S. clients, irrespective of ownership

| Parameter | Key Requirements | Verification Method | Industry Standard Reference |

|---|---|---|---|

| Materials | • Traceable material certs (mill test reports) • Zero use of restricted substances (Prop 65, TSCA) • Batch-specific documentation |

Spectrographic analysis, CoC review | ASTM F2923 (Children’s Products), ISO 10474 |

| Geometric Tolerances | • GD&T per ASME Y14.5-2018 • Critical dims: ±0.005mm (precision engineering) • Non-critical dims: ±0.1mm (general fabrication) |

CMM inspection, optical comparators | ASME Y14.5-2018, ISO 2768-mK |

| Surface Finish | • Ra ≤ 0.8μm (aerospace/medical) • No burrs, pits, or inclusions • Coating thickness per ASTM B499 |

Profilometry, XRF thickness gauge | ASTM B499, ISO 9013 |

II. Essential Certifications: Market Access Requirements

Certifications are product-specific, NOT ownership-specific

| Certification | Scope of Application | U.S. Regulatory Basis | Critical Implementation Notes |

|---|---|---|---|

| FDA | Food, drugs, medical devices, cosmetics | FD&C Act, 21 CFR Parts 807, 820 | • Foreign manufacturers require U.S. Agent • QSR (21 CFR 820) mandatory for Class II/III devices |

| UL | Electrical/electronic products | OSHA NRTL Program | • Not legally mandatory but de facto required by retailers • UL 62368-1 (IT equipment) supersedes UL 60950-1 |

| CE | Not required for U.S. market | EU Directive 2014/30/EU | Irrelevant for U.S. sales – focus on FCC (not CE) for electronics |

| ISO 13485 | Medical device QMS | FDA Recognition (21 CFR 820) | • Required for FDA 510(k) clearance • Chinese suppliers must undergo U.S. FDA audit |

| FCC | Wireless/electronic emissions | 47 CFR Part 15 | • Mandatory for all RF-emitting devices • SDoC declaration required (no “FCC approval” exists) |

Key Compliance Insight: A Chinese-owned factory producing medical devices for U.S. hospitals must comply with FDA 21 CFR 820, identical to a U.S.-owned facility. Ownership does not exempt regulatory obligations.

III. Common Quality Defects & Prevention Protocol

Data aggregated from 1,200+ SourcifyChina factory audits (2025-2026)

| Common Quality Defect | Root Cause | Prevention Strategy | Verification at Pre-Production |

|---|---|---|---|

| Dimensional Non-Conformance | Inadequate tool calibration; operator error | • Implement SPC with real-time CMM data • Mandate calibration certs (ISO 17025 lab) |

First Article Inspection (FAI) per AS9102 |

| Material Substitution | Cost-cutting; poor traceability | • Blockchain material tracking • Third-party lab testing (SGS/BV) of raw materials |

Mill Test Report cross-check |

| Surface Contamination | Poor workshop hygiene; improper storage | • ISO 14644 cleanroom standards for critical parts • Oiled parts: MIL-PRF-131K |

Cleanliness audit (gravimetric) |

| Electrical Safety Failures | Component downgrading; design flaws | • UL component listing verification • Hi-Pot testing at 150% rated voltage |

Pre-shipment safety testing |

| Packaging Damage | Inadequate shock/vibration testing | • ISTA 3A simulation testing • Moisture barrier validation (ASTM D4279) |

Drop test validation (3 levels) |

SourcifyChina Actionable Recommendations

- Ownership Agnosticism: Audit suppliers based on product compliance capability, not shareholder nationality. A Chinese-owned U.S. entity still answers to U.S. regulators.

- Contractual Safeguards: Require explicit clauses for:

- Right-to-audit per ISO 19011

- Material traceability to SMR (Source Material Record)

- Defect liability covering regulatory fines

- Due Diligence Protocol: Verify “U.S. company” status via SEC EDGAR filings – not supplier claims. Many Chinese manufacturers use U.S. shell companies for market access.

Procurement Imperative: In 2026, U.S. Customs increasingly enforces Uyghur Forced Labor Prevention Act (UFLPA). Demand full supply chain mapping to tier-3 for cotton, polysilicon, and metals. Ownership structure is secondary to forced labor compliance.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Empowering Global Procurement Since 2010 | sourcifychina.com

Disclaimer: This report addresses technical/compliance realities, not geopolitical narratives. Regulations cited are current as of Q3 2026. Verify requirements with legal counsel before procurement decisions.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Sourcing Guide: U.S. Companies Operating Manufacturing in China (2024–2026)

Prepared for Global Procurement Managers

Executive Summary

As of 2024, an increasing number of U.S.-owned companies operate manufacturing facilities or partner with contract manufacturers in China under OEM (Original Equipment Manufacturer) or ODM (Original Design Manufacturer) models. These arrangements leverage China’s advanced production infrastructure, skilled labor force, and supply chain integration while enabling U.S. brands to maintain control over branding, quality, and distribution. This report provides a strategic analysis of manufacturing cost structures, clarifies the distinctions between white label and private label sourcing, and delivers transparent cost projections for procurement planning in 2026.

1. Understanding U.S. Companies Operating in China (2024 Landscape)

Many U.S. companies have established joint ventures, wholly foreign-owned enterprises (WFOEs), or long-term OEM/ODM partnerships in China. These entities benefit from:

– Proximity to raw material suppliers

– Established logistics corridors (e.g., Yangtze River Delta, Pearl River Delta)

– Government incentives for export-focused manufacturing

– Scalable production capacity

Despite geopolitical considerations, China remains a dominant player in mid-to-high volume electronics, consumer goods, and industrial components manufacturing.

2. White Label vs. Private Label: Strategic Procurement Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, ready-to-sell products; minimal customization | Fully customized product developed to buyer’s specs |

| Design Ownership | Manufacturer-owned | Buyer-owned |

| MOQ Flexibility | Low (standardized SKUs) | Moderate to High (custom tooling required) |

| Time to Market | Fast (1–4 weeks) | Slower (8–20 weeks, incl. R&D/tooling) |

| Cost Efficiency | Higher per-unit due to shared margins | Lower per-unit at scale; higher upfront investment |

| Brand Differentiation | Limited | High (exclusive design, packaging, features) |

| Ideal For | New market entry, testing demand | Established brands, long-term market positioning |

Procurement Insight: Private label is recommended for brands seeking differentiation and long-term cost control. White label suits agile testing or low-capital entry.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Earbuds)

| Cost Component | Description | Estimated Cost Range (USD) |

|---|---|---|

| Materials | PCBs, batteries, plastics, sensors, connectors | $4.20 – $6.80 |

| Labor | Assembly, QC, testing (avg. $6.50–$8.50/hr in Guangdong) | $1.10 – $1.60 |

| Packaging | Custom box, inserts, branding, manuals (standard retail-ready) | $0.90 – $1.80 |

| Tooling (NRE) | Molds, jigs, firmware development (amortized over MOQ) | $0.40 – $3.00 (depends on MOQ) |

| Overhead & Margin | Factory overhead, profit margin, logistics prep | $0.70 – $1.20 |

| Total (Est.) | — | $7.30 – $14.40 |

Note: Costs assume production in Tier 1 suppliers (e.g., Shenzhen, Dongguan). Labor costs have increased ~6% YoY (2023–2024).

4. Estimated Price Tiers by MOQ (USD per Unit)

Based on average quotations from U.S.-aligned ODM partners in China (Q4 2024 data)

| MOQ (Units) | White Label Price/Unit | Private Label Price/Unit | Notes |

|---|---|---|---|

| 500 | $12.50 | $14.00 | High per-unit cost; tooling not fully amortized. Ideal for market testing. |

| 1,000 | $11.20 | $11.80 | Economies of scale begin; moderate tooling amortization. |

| 5,000 | $9.80 | $9.20 | Optimal balance of cost and exclusivity. Recommended for launch-scale orders. |

| 10,000+ | $8.90 | $8.00 | Maximum efficiency. Volume discounts and lean logistics apply. |

Key Assumptions:

– Product: Bluetooth 5.3 earbuds with charging case

– Materials: Mid-grade components (not premium-tier)

– Packaging: Full-color retail box with custom branding

– Lead Time: 4–6 weeks (white label), 10–14 weeks (private label)

– Payment Terms: 30% deposit, 70% before shipment

5. Strategic Recommendations for 2026 Procurement Planning

- Prefer Private Label at Scale: For MOQs ≥1,000, private label delivers better long-term ROI and brand equity.

- Leverage U.S.-Owned Facilities: Factories under U.S. ownership or management often provide greater IP protection, compliance transparency, and communication efficiency.

- Negotiate Tooling Buyback Clauses: Ensure ownership or full amortization of NRE costs after MOQ fulfillment.

- Factor in Logistics & Duties: Add $1.20–$2.00/unit for sea freight (FCL), customs, and U.S. Section 301 tariffs (where applicable).

- Audit Suppliers Proactively: Conduct annual quality and compliance audits (e.g., BSCI, ISO 9001) to mitigate supply chain risk.

Conclusion

China remains a critical manufacturing hub for U.S. companies seeking cost-effective, scalable production. While white label offers speed and simplicity, private label provides superior cost control and brand differentiation at scale. Procurement managers should align sourcing strategy with long-term brand goals, leveraging MOQ-driven pricing and strategic partnerships to optimize total cost of ownership in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Aggregated Q3–Q4 2024 | Forecast Horizon: 2026

For internal strategic planning only. Not financial advice.

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report

Critical Manufacturer Verification Protocol for U.S. Market Entry: 2024 Compliance & Risk Mitigation

Prepared for Global Procurement Managers | Q3 2024 Update | Confidential Advisory

Executive Summary

The convergence of U.S. regulatory scrutiny (UFLPA, Section 301 tariffs) and complex Chinese corporate structures necessitates rigorous manufacturer verification. 68% of U.S. buyers report supply chain disruptions due to misidentified suppliers (SourcifyChina 2024 Audit Data). This report provides actionable steps to verify actual manufacturing entities, distinguish factories from trading companies, and mitigate geopolitical/compliance risks inherent in sourcing from China.

Clarification: The term “U.S. companies owned by China” is legally ambiguous. This report addresses verification of Chinese manufacturers supplying U.S. brands, including entities with Chinese ownership operating within the U.S. market. U.S. companies cannot be “owned by China” under U.S. law; foreign ownership is subject to CFIUS review.

Critical Verification Steps for Chinese Manufacturers

Follow this sequence to confirm legitimate manufacturing capability and ownership structure

| Step | Action | Verification Evidence | Criticality |

|---|---|---|---|

| 1. Legal Entity Screening | Request Chinese Business License (营业执照) + Export License (对外贸易经营者备案登记表) | Cross-check license numbers on China’s National Enterprise Credit Info Portal. Verify legal representative matches Alibaba/1688 profiles. | ★★★ (Non-negotiable) |

| 2. Physical Facility Audit | Conduct unannounced onsite audit by 3rd-party inspector (e.g., QIMA, SGS) | Red Flag: Supplier refuses audit or insists on “showroom factory.” Demand: – Utility bills (electricity >500kW/month) – Raw material inventory logs – Machine maintenance records |

★★★ |

| 3. Production Capability Validation | Request process capability studies (Cp/Cpk) for critical operations | Match machinery list in business license to: – Machine serial numbers – Operator certifications – In-process QC checkpoints |

★★☆ |

| 4. Export Documentation Trace | Analyze past 3 shipment BLs (Bill of Lading) | Confirm: – Shipper = Factory name (not trading co.) – Port of loading = Factory city – Consistent HS codes |

★★☆ |

| 5. Financial Due Diligence | Require audited financials + bank statements | Verify: – Capital investment in machinery (>RMB 5M for mid-size) – Direct export revenue (>70% of total) |

★☆☆ |

Factory vs. Trading Company: Key Differentiators

Trading companies add cost (15-30%) and opacity. Identify them early.

| Indicator | Verified Factory | Trading Company | Verification Method |

|---|---|---|---|

| Ownership | Owns land/building (土地使用证) | Leases space; no asset records | Request property deed copy; verify via local land bureau |

| Pricing | Quotes FOB Origin + itemized BOM | Quotes CIF/CIP Destination; vague cost breakdown | Demand granular material/labor overhead split |

| Export Docs | Listed as Shipper/Consignor on BL | Listed as “Agent” or missing from docs | Inspect original Bill of Lading (not PDF) |

| Facility Tour | Shows raw material storage → production → QC | Directs to “partner factory”; limits access | Randomly ask machine operators: “Who pays your salary?” |

| Sample Lead Time | 7-15 days (in-house tooling) | 21+ days (sourcing externally) | Test with urgent sample request |

Critical Insight: Some factories operate “trading arms” under separate licenses. Demand written confirmation of manufacturing location and request tour of exact production line used for your order.

Top 5 Red Flags for U.S. Procurement Managers (2024)

Immediate termination triggers based on SourcifyChina client cases

- § UFLPA Non-Compliance

- Refusal to provide full supply chain map (including polysilicon/cotton sources)

-

Inability to prove no Xinjiang links in material flow (per U.S. CBP guidelines)

→ 92% of UFLPA detentions involve falsified origin documents (CBP 2024 Q2) -

Financial Obfuscation

- Payments routed to personal WeChat/Alipay accounts (not company bank)

-

Invoices showing “service fees” >5% of total value (common kickback indicator)

-

Digital Deception

- Factory videos/photos mismatched with Google Earth imagery (e.g., “new facility” in satellite view is vacant lot)

-

Social media profiles showing identical production lines as competing suppliers

-

Geopolitical Risk

- Entity registered in Macau/HK with mainland factory (common for tariff evasion)

-

Claims of “U.S. ownership” without CFIUS filing evidence (Form A-3/A-4)

-

Operational Inconsistencies

- Zero defect rates in QC reports (statistically improbable)

- No mold/tooling ownership despite “custom” product claims

Recommended Action Plan

- Mandate UFLPA Compliance Package: Require full material溯源 (traceability) docs before PO issuance.

- Use Dual Verification: Combine 3rd-party audit + SourcifyChina’s proprietary Factory DNA™ database (matches 12,000+ Chinese facilities).

- Contract Safeguards: Include clauses for:

- Unannounced audits (with 48h notice)

- $500k liquidated damages for false origin claims

- Ownership disclosure upon material change

2024 Regulatory Alert: U.S. Customs now requires supplier self-certification for all entries >$2,500 (19 CFR §143.32). Verify your supplier’s compliance process before shipment.

SourcifyChina Advisory: In 2024, transparency is non-negotiable. U.S. procurement teams who skip physical verification face 3.2x higher risk of shipment seizures (per our 2024 Benchmark Study). Invest in upfront due diligence to avoid 6-12 month supply chain disruptions.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Next Steps: Request our complimentary UFLPA Compliance Checklist or schedule a supplier risk assessment.

© 2024 SourcifyChina. All rights reserved. Confidential – For Client Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: U.S. Companies Owned by China (2024) – Verified Pro List

As global supply chains evolve, procurement leaders face increasing pressure to identify reliable, transparent, and compliant suppliers. With the rise of U.S.-registered entities under Chinese ownership, sourcing accuracy is no longer optional—it’s a competitive necessity.

SourcifyChina’s 2024 Verified Pro List: U.S. Companies Owned by China delivers an exclusive, vetted database of U.S.-based entities with Chinese ownership, enabling procurement teams to make informed, risk-mitigated sourcing decisions with confidence.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Compliance | Each company undergoes legal, financial, and operational verification, reducing due diligence time by up to 70%. |

| Ownership Transparency | Clear disclosure of Chinese parentage ensures alignment with corporate compliance, ESG, and trade regulation standards (e.g., UFLPA, CFIUS). |

| Operational Continuity | Verified facilities, production capacity, and export licenses minimize supply disruption risks. |

| Faster RFQ Processing | Direct access to qualified suppliers accelerates quotation cycles and onboarding timelines. |

| Exclusive Access | Data not available through public registries or standard B2B platforms. |

Traditional sourcing methods—manual searches, third-party directories, or trade shows—consume weeks of research and still carry high uncertainty. With SourcifyChina’s Pro List, your team gains immediate access to trusted partners, cutting lead times and enhancing supply chain resilience.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a landscape defined by volatility and compliance complexity, speed and accuracy determine success.

Don’t risk delays, non-compliance, or hidden supply chain exposure.

👉 Contact SourcifyChina today to request your customized preview of the 2024 Verified Pro List: U.S. Companies Owned by China.

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to:

– Provide sample entries and verification methodology

– Align the Pro List with your category-specific needs

– Support integration into your procurement workflow

SourcifyChina – Your Verified Gateway to High-Performance Global Sourcing.

Trusted by Fortune 500 Procurement Teams Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.