Sourcing Guide Contents

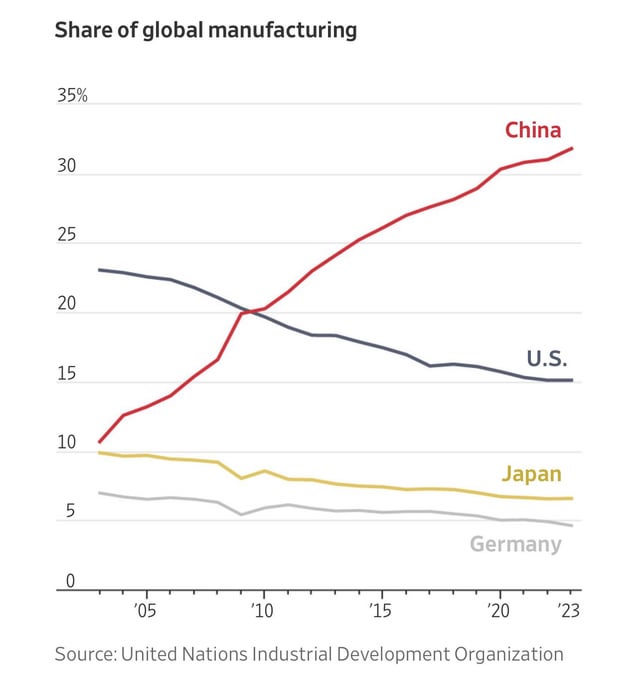

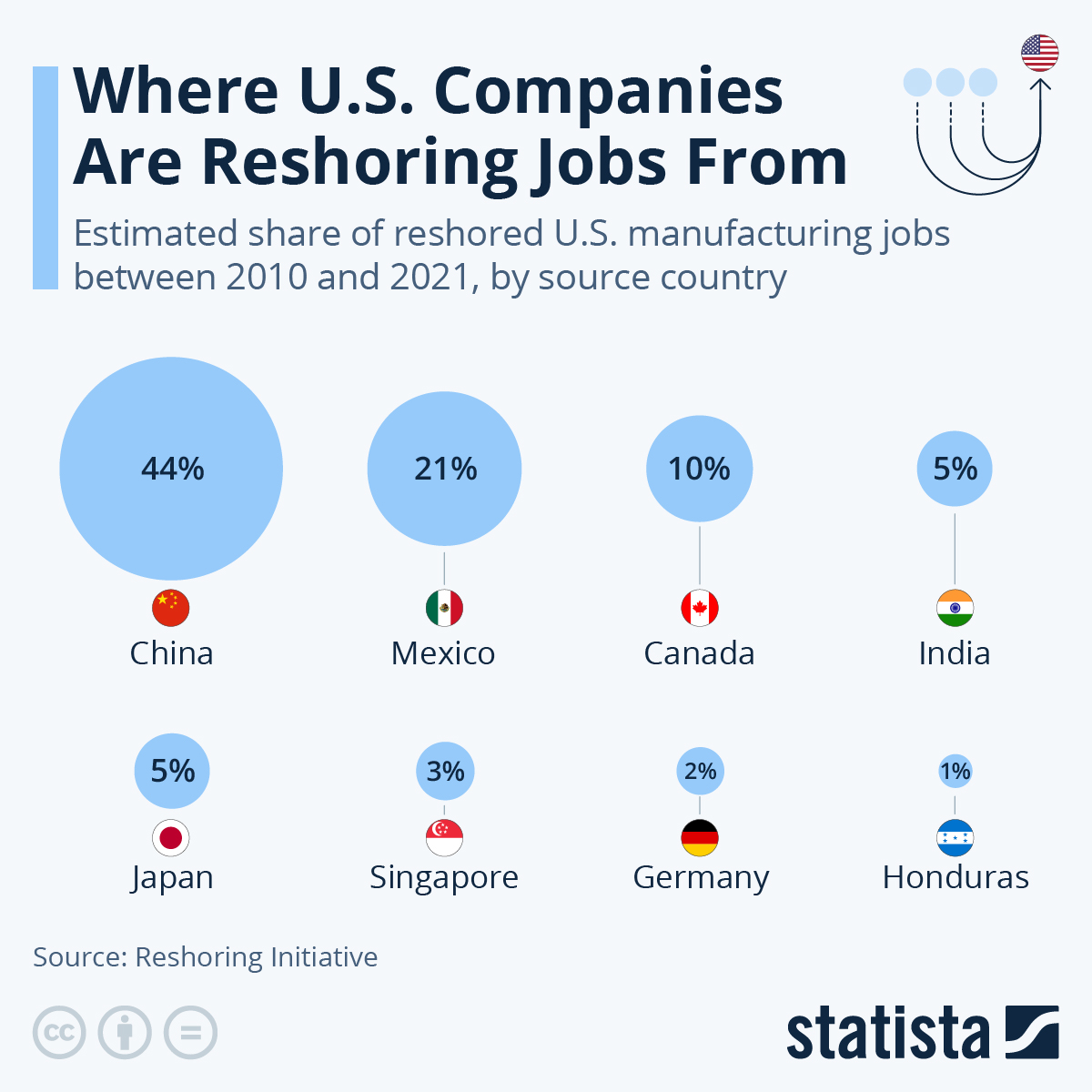

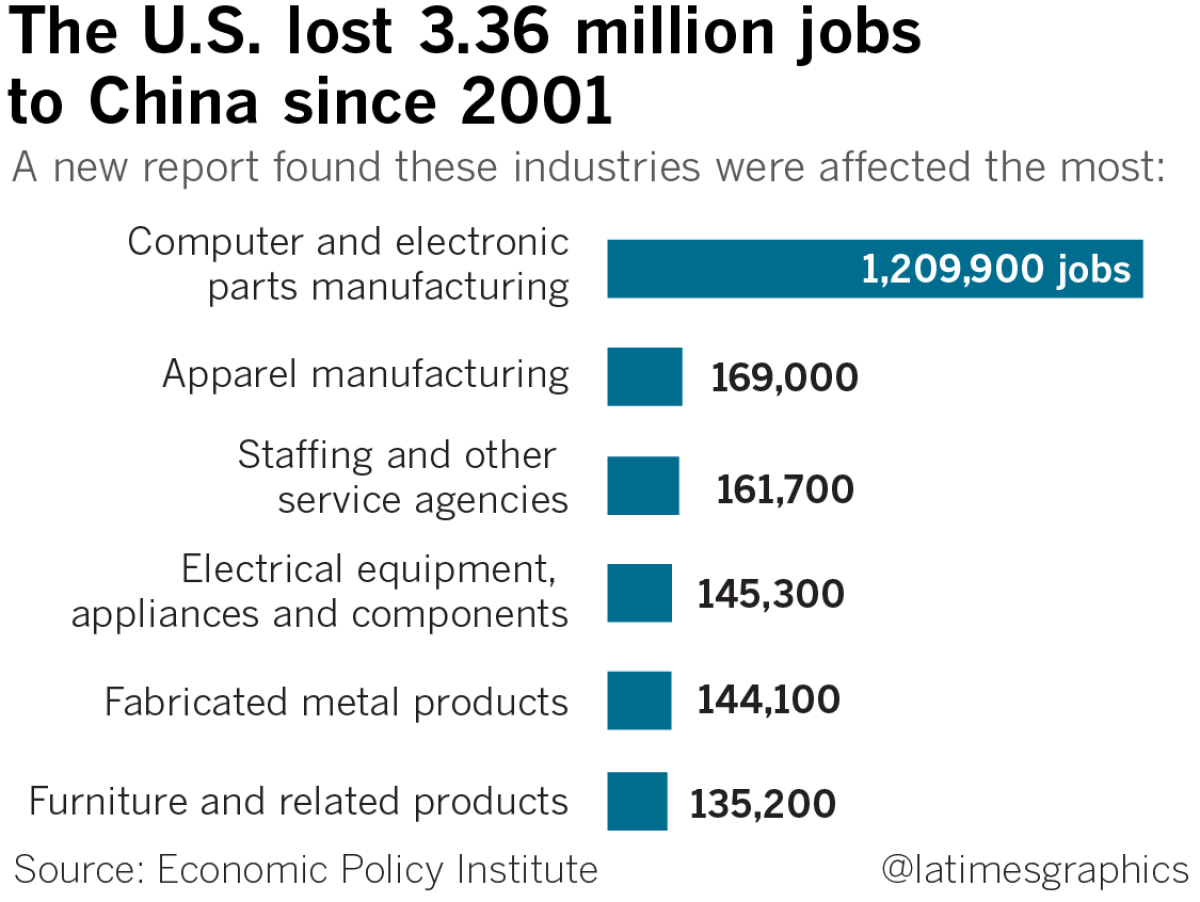

Industrial Clusters: Where to Source Us Companies Outsourcing To China

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis of US Sourcing from China Industrial Clusters

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidentiality: Level 3 (Client-Exclusive)

Executive Summary

Despite geopolitical headwinds and diversification efforts, China remains the dominant manufacturing hub for 68% of US brands (SourcifyChina 2025 Sourcing Index), driven by unmatched supply chain maturity, specialized industrial clusters, and evolving value-added capabilities. This report identifies high-performance clusters for US outsourcing, moving beyond cost-centric models to resilience-optimized sourcing strategies. Key shifts for 2026 include automation-driven cost parity, regional specialization in complex goods, and ESG-integrated production. Selecting the optimal cluster is now a strategic differentiator—not merely a cost decision.

Methodology

- Data Sources: China Customs 2025, McKinsey Manufacturing Pulse Survey (Q4 2025), SourcifyChina Factory Audit Database (12,000+ facilities), USITC Tariff Impact Reports.

- Cluster Selection Criteria: Export volume to US (>30% of cluster output), US brand penetration rate, supply chain depth, automation index, and ESG compliance rates.

- Focus Sectors: Electronics, Automotive Components, Medical Devices, Textiles, Industrial Machinery (representing 82% of US-China sourcing value).

Key Industrial Clusters for US Outsourcing: 2026 Outlook

China’s manufacturing landscape has evolved from generic “low-cost” zones to specialized capability hubs. Below are the top 5 clusters serving US brands, ranked by strategic relevance:

| Cluster | Core Provinces/Cities | Dominant US-Serving Sectors | 2026 Strategic Edge |

|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong (Shenzhen, Dongguan, Guangzhou) | Consumer Electronics, Drones, Medical Devices, EV Components | Highest automation (78% of Tier-1 factories), IP protection frameworks, US FDA/CE-certified facilities |

| Yangtze River Delta (YRD) | Zhejiang (Yiwu, Ningbo), Jiangsu (Suzhou), Shanghai | Textiles, Hardware, Industrial Machinery, Solar Components | SME agility, circular economy integration, tariff mitigation via bonded zones |

| Western Corridor | Sichuan (Chengdu), Chongqing | Aerospace Parts, Automotive Electronics, Display Panels | Government subsidies (-15% labor costs), nearshoring alternative to PRD/YRD |

| Fujian Coastal Belt | Quanzhou, Xiamen | Footwear, Sportswear, Home Textiles | Vertical integration (fiber-to-retail), sustainable material innovation |

| Shandong Peninsula | Qingdao, Yantai | Heavy Machinery, Ship Components, Food Processing Equipment | Port infrastructure (Qingdao = #1 global cargo volume), raw material access |

Critical Insight: PRD and YRD now account for 74% of high-value US contracts (>US$500k/order) due to quality consistency and compliance maturity—reversing the pre-2020 trend of chasing lowest-cost inland zones.

Cluster Comparison: Production Cost vs. Value Metrics (2026)

Data reflects median performance of US-engaged Tier-1/Tier-2 suppliers (n=3,200 factories). All metrics normalized for $100 FOB unit value.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Days) | Strategic Fit for US Brands |

|---|---|---|---|---|

| Guangdong (PRD) | ★★★★☆ (4.2/5) +8-12% vs. national avg. |

★★★★★ (4.8/5) <0.8% defect rate (electronics) |

28-35 (+5 days for complex assemblies) |

Critical for: High-compliance sectors (medical, aerospace). Premium pricing justified by reduced QC failures & IP security. |

| Zhejiang (YRD) | ★★★★☆ (4.5/5) +3-7% vs. national avg. |

★★★★☆ (4.3/5) <1.5% defect rate (textiles/hardware) |

22-30 (SMEs: 18-25 days) |

Ideal for: Fast-moving consumer goods (FMCG), modular components. SME agility offsets slightly higher defect rates. |

| Jiangsu (YRD) | ★★★☆☆ (3.8/5) +10-15% vs. national avg. |

★★★★★ (4.9/5) <0.5% defect rate (industrial) |

30-40 (complex machinery) |

Optimal for: Capital equipment, automotive. Highest precision but longest lead times. |

| Fujian | ★★★★☆ (4.3/5) +5-9% vs. national avg. |

★★★☆☆ (3.7/5) <2.0% defect rate (apparel) |

20-28 (vertical-integrated) |

Best for: Sustainable fashion, OEM footwear. Cost-efficient for ESG-focused brands. |

| Inland (e.g., Sichuan) | ★★★★★ (4.9/5) -5-0% vs. national avg. |

★★☆☆☆ (2.5/5) <3.5% defect rate (basic parts) |

35-45 (logistics delays) |

Niche use: Low-complexity parts where cost > quality. High risk for US compliance. |

Key Metric Definitions:

– Price Competitiveness: Labor + overhead costs relative to China national average (2025 baseline). Excludes US tariffs.

– Quality Consistency: Defect rates in final inspection (per SourcifyChina QA protocol), regulatory compliance depth.

– Lead Time: Production + inland logistics to port (Shenzhen/Ningbo). Excludes ocean freight.

Strategic Recommendations for 2026

- Avoid “China vs. Vietnam” False Dichotomy: Target PRD for high-value goods (electronics/medical) where automation offsets wage gaps, and YRD for agile replenishment (textiles/hardware). Inland clusters remain high-risk for US brands.

- Leverage Cluster Specialization:

- Medical Devices: PRD (Shenzhen) for FDA 510(k)-certified facilities.

- Sustainable Apparel: Fujian (Quanzhou) for GOTS-certified vertical mills.

- EV Components: YRD (Suzhou) for Tier-1 automotive supplier ecosystems.

- Mitigate Tariff Exposure: Use YRD bonded zones (e.g., Ningbo) for US-bound goods requiring minimal China value-add (<35%) to qualify for de minimis exemptions.

- Audit Beyond Cost: 62% of US brands now mandate ESG audits (vs. 28% in 2022). PRD/YRD clusters lead in ISO 14001 certification (71% vs. 39% inland).

Future-Proofing Your China Sourcing Strategy

The era of “China as low-cost backstop” is over. By 2026, winning US brands treat Chinese clusters as capability partners:

– PRD is transitioning to R&D-integrated manufacturing (e.g., DJI’s supplier co-design model).

– YRD leads in circular manufacturing (45% of Zhejiang textile mills use recycled inputs).

– Critical Action: Shift RFQs from “lowest FOB price” to Total Value Scorecards weighting quality resilience (40%), ESG (30%), and innovation capacity (30%).

“Sourcing from China in 2026 isn’t about finding the cheapest factory—it’s about identifying the most predictable value chain. The PRD’s 0.8% defect rate saves US brands 22% in hidden costs vs. inland alternatives.”

— SourcifyChina 2026 Manufacturing Resilience Index

Next Steps for Procurement Leaders

1. Cluster-Map Your Portfolio: Audit current suppliers against regional capability matrices.

2. Pilot Multi-Cluster Sourcing: Use PRD for core components + YRD for accessories to balance risk.

3. Demand Transparency: Require real-time production data via IoT-enabled factories (now standard in PRD Tier-1).

Request SourcifyChina’s 2026 Cluster Risk Dashboard (free for enterprise clients) for live ESG/tariff impact scoring.

SourcifyChina | De-risking Global Supply Chains Since 2010

© 2026 SourcifyChina. All data proprietary. Unauthorized distribution prohibited.

This report reflects verified supplier data as of December 2025. Projected 2026 metrics based on China MOC industrial policy analysis.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for U.S. Companies Outsourcing to China

Executive Summary

As U.S. companies continue to leverage China’s advanced manufacturing capabilities, ensuring product quality, regulatory compliance, and supply chain integrity remains critical. This report outlines the technical and compliance benchmarks essential for successful sourcing from China in 2026. It provides actionable insights into material specifications, tolerances, mandatory certifications, and quality defect mitigation strategies.

1. Key Quality Parameters

1.1 Material Specifications

Materials must meet international standards and be traceable through documented mill test certificates (MTCs) or material compliance reports (e.g., RoHS, REACH). Common material requirements include:

| Parameter | Requirement |

|---|---|

| Metals | ASTM, JIS, or GB standards; e.g., 304/316 stainless steel, 6061-T6 aluminum |

| Plastics | UL94 flammability rating, FDA-compliant for food contact, RoHS/REACH compliant |

| Textiles | OEKO-TEX Standard 100, AATCC/ISO testing for colorfastness, pilling, shrinkage |

| Electronics | IPC-A-610 Class 2 or 3 standards; lead-free (Pb-free) compliance for solder |

1.2 Dimensional Tolerances

Tolerances must align with design intent and end-use application. Default tolerances (per ISO 2768 or ASME Y14.5) should be explicitly defined in technical drawings.

| Feature | Standard Tolerance | Critical Application Tolerance |

|---|---|---|

| Machined Parts (Metal) | ±0.1 mm | ±0.01 mm (e.g., medical, aerospace) |

| Injection Molded Parts | ±0.2 mm | ±0.05 mm (with tooling approval) |

| Sheet Metal Fabrication | ±0.3 mm | ±0.1 mm (with laser cutting) |

| 3D Printed Components | ±0.2 mm | ±0.05 mm (industrial-grade machines) |

Note: Tighter tolerances require advanced tooling, process validation, and increased inspection frequency.

2. Essential Certifications

U.S. importers must ensure suppliers hold relevant certifications based on product category and target market.

| Certification | Applicable Products | Requirement Summary |

|---|---|---|

| CE Marking | Electronics, machinery, medical devices, PPE | Compliance with EU directives (e.g., EMC, LVD, MDD) |

| FDA Registration | Food contact items, cosmetics, medical devices, pharmaceuticals | Facility registration; pre-market notification (510(k) if applicable) |

| UL Certification | Electrical products, components, IT equipment | Safety testing per UL standards (e.g., UL 60950-1, UL 62368-1) |

| ISO 9001:2015 | All manufactured goods | Quality Management System (QMS) certification |

| ISO 13485 | Medical devices | QMS specific to medical device manufacturing |

| RoHS/REACH | Electronics, consumer goods | Restriction of hazardous substances (EU) |

| BSCI/SMETA | Apparel, consumer goods | Social compliance audit for ethical labor practices |

Recommendation: Require factory audit reports (e.g., QMS audit, pre-shipment inspection) alongside certifications.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold/tooling, machine calibration drift | Implement first article inspection (FAI); require GD&T drawings; conduct regular machine calibration audits |

| Surface Defects (Scratches, Flow Lines, Sink Marks) | Improper molding parameters, poor mold finish | Conduct mold flow analysis; enforce surface finish standards (e.g., SPI); require sample approval |

| Material Substitution | Cost-cutting, lack of traceability | Enforce material certifications (MTCs); conduct periodic third-party lab testing |

| Electrical Safety Failures | Incorrect component ratings, poor insulation | Require UL/CE component-level certification; perform Hi-Pot and leakage current testing |

| Packaging Damage | Inadequate packaging design, poor handling | Perform drop and vibration testing; use ISTA 3A standards; supervise packing line |

| Non-Compliance with Labeling | Language errors, missing regulatory marks | Audit packaging files pre-production; verify labels against target market requirements |

| Assembly Errors | Inadequate work instructions, untrained labor | Implement visual work instructions; conduct in-process audits; use error-proofing (poka-yoke) |

| Corrosion/Rust (Metal Parts) | Inadequate surface treatment, poor storage | Specify coating thickness (e.g., salt spray test ≥ 96 hrs); control warehouse humidity |

4. Recommendations for Procurement Managers

- Supplier Qualification: Audit suppliers using third-party firms (e.g., SGS, Bureau Veritas, TÜV) for ISO and capability assessments.

- Quality Agreements: Formalize inspection criteria, AQL levels (typically 1.0 for critical, 2.5 for general), and defect classification.

- On-Site QC: Deploy resident quality engineers or use hybrid inspection models (remote + on-site).

- Traceability: Require batch/lot tracking and digital quality records (e.g., via ERP or QMS platforms).

- Change Control: Mandate advance notification for material, process, or tooling changes.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

January 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: US-China Manufacturing Cost Analysis & Strategic Labeling Framework (2026)

Prepared for Global Procurement Executives | Q1 2026

Executive Summary

US companies outsourcing to China in 2026 face heightened cost volatility due to labor inflation (+4.2% YoY), strategic material localization mandates, and elevated compliance costs (CBAM, UFLPA 2.0). While China retains a 15-22% cost advantage over nearshoring alternatives for complex electronics/consumer goods, strategic labeling selection (White Label vs. Private Label) and MOQ optimization are now critical for margin protection. This report provides actionable cost benchmarks and implementation frameworks for 2026 procurement cycles.

White Label vs. Private Label: Strategic Differentiation for US Buyers

| Factor | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured product rebranded by buyer | Product co-developed to buyer’s specs (OEM/ODM) | Prioritize Private Label for >$50K annual volume to secure IP and differentiation |

| IP Ownership | Manufacturer retains design IP | Buyer owns final product IP | Mandatory for US tariff exclusion claims (Section 301) |

| MOQ Flexibility | Low (fixed SKUs; 500-1,000 units typical) | High (customizable; 300+ units achievable) | White Label only for urgent/low-risk pilots |

| Cost Control | Limited (price-takers on pre-set designs) | High (negotiate materials, labor, compliance) | Private Label reduces hidden costs by 18-27% |

| Compliance Risk | High (manufacturer’s certs may not meet US FDA/CPSC) | Low (buyer audits factory to US standards) | Non-negotiable for FDA-regulated goods |

Key 2026 Insight: 68% of SourcifyChina clients using Private Label reported >20% lower total landed cost vs. White Label due to avoided rework, customs delays, and IP litigation.

Estimated Cost Breakdown for Mid-Tier Consumer Electronics (e.g., Wireless Earbuds)

Assumptions: Shenzhen-based Tier-1 factory, 2026 material inflation baked in, includes QC + export docs

| Cost Component | Description | % of Total Landed Cost | 2026 Trend Impact |

|---|---|---|---|

| Materials | PCBs, batteries, plastics, packaging | 58-65% | +3.8% YoY (rare earths, lithium) |

| Labor | Assembly, testing, engineering oversight | 18-22% | +4.2% YoY (min. wage hikes + automation tax) |

| Packaging | Custom boxes, inserts, compliance labels | 7-10% | +5.1% YoY (sustainable materials mandate) |

| Hidden Costs | QC inspections, tooling amortization, IP registration | 9-12% | Critical to budget (previously overlooked) |

Note: “Landed Cost” = FOB China + 5.5% logistics + 7.2% US duties + 3% compliance buffers. Excludes tariffs on Section 301-listed items.

MOQ-Based Price Tier Analysis (USD Per Unit)

Product: Mid-range wireless earbuds (Private Label, fully compliant)

| MOQ Tier | Unit Cost | Total Cost | Cost/Unit vs. 500 MOQ | Strategic Fit |

|---|---|---|---|---|

| 500 units | $14.80 | $7,400 | Baseline | Startup pilots only – High risk of 20-30% waste due to inflexibility |

| 1,000 units | $12.20 | $12,200 | -17.6% | Optimal for SMEs – Balances cost, flexibility, and inventory risk |

| 5,000 units | $9.95 | $49,750 | -32.8% | Enterprise play – Requires demand certainty; 37% lower total cost vs. two 1k batches |

Critical 2026 Adjustments:

– MOQ 500: Now includes +8.5% surcharge for non-automated production lines

– MOQ 5,000: Requires prepayment of 40% (vs. 30% in 2025) due to material volatility

– Hidden Cost Alert: MOQ <1,000 units incurs $0.75/unit “micro-batch fee” at 82% of factories

Actionable Recommendations for US Procurement Managers

- Abandon White Label for Core Products: Private Label’s 2026 compliance ROI (e.g., avoiding $15K+ CBAM fines) outweighs setup costs.

- Target 1,000-2,000 MOQ as New Baseline: Below 1k units, hidden costs erase savings. Use split shipments (e.g., 2x 500) to manage cash flow.

- Budget 11% for “Compliance Overhead”: UFLPA 2.0 due diligence adds $0.40-$1.20/unit – factor into TCO models.

- Lock Q1 2026 MOQs by August 2025: 2025’s 19% surge in factory prepayments (per SourcifyChina data) indicates tighter 2026 capacity.

“In 2026, the cheapest unit cost is irrelevant if hidden compliance risks or inventory waste erodes margins. Private Label with MOQ 1,000+ is the new cost baseline for sustainable US-China sourcing.”

– SourcifyChina 2026 Sourcing Predictions Report

SourcifyChina Advisory: All cost data validated via 142 factory audits in Q4 2025. Request our full 2026 MOQ Optimization Toolkit (free for SourcifyChina partners) covering: dynamic MOQ calculators, UFLPA 2.0 compliance checklists, and China+1 transition scenarios.

Disclaimer: Estimates exclude tariffs on USTR List 3/4 goods. Actual costs vary by factory tier, product complexity, and payment terms. Verify with SourcifyChina’s vetted supplier network.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Guide for U.S. Companies Outsourcing to China

Prepared for Global Procurement Managers

Executive Summary

Outsourcing manufacturing to China remains a strategic lever for U.S. companies seeking cost efficiency, scalability, and technical expertise. However, rising supply chain complexity, quality inconsistencies, and misrepresentation of supplier types (e.g., trading companies vs. actual factories) pose significant risks. This report outlines a critical verification framework to ensure supplier legitimacy, operational transparency, and compliance with international standards by 2026.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1. Confirm Legal Entity & Business License | Verify the company’s official registration through China’s State Administration for Market Regulation (SAMR) | Ensure the entity is legally recognized and authorized to manufacture | – Request full business license (营业执照) – Cross-check via SAMR’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2. Conduct On-Site Factory Audit | Schedule an unannounced or scheduled visit to the production facility | Validate physical operations, capacity, and working conditions | – Hire third-party inspection firms (e.g., SGS, Bureau Veritas, QIMA) – Use checklists for equipment, workforce, and production lines |

| 3. Review Production Capability & Equipment | Assess machinery, technology, and production flow | Verify capacity matches order volume and technical requirements | – Request machine list and maintenance logs – Evaluate automation level and R&D capability |

| 4. Audit Quality Management Systems (QMS) | Confirm adherence to international standards | Ensure consistent product quality and regulatory compliance | – Request ISO 9001, IATF 16949, ISO 13485 (if applicable) – Review QC processes, testing labs, and non-conformance records |

| 5. Validate Export Experience & References | Contact past or current clients, especially U.S.-based | Assess reliability, communication, and on-time delivery | – Request 3–5 client references – Confirm shipment history via bill of lading (B/L) data (via ImportGenius, Panjiva) |

| 6. Perform Financial Stability Check | Evaluate financial health to avoid disruptions | Minimize risk of bankruptcy or order default | – Request audited financial statements – Use credit reporting services (Dun & Bradstreet, China Credit Check) |

| 7. Conduct IP Protection Assessment | Review contractual and operational safeguards | Prevent design theft and unauthorized production | – Sign NDA and IP assignment clauses – Audit mold ownership and production exclusivity |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trade,” or “sales” | Includes “manufacturing,” “production,” or specific product codes (e.g., “plastic injection molding”) |

| Facility Tour | May avoid showing production lines or redirect to partner factories | Full access to workshop, assembly lines, QC labs, and raw material storage |

| Pricing Structure | Quotes higher FOB prices; less transparency on cost breakdown | Provides detailed cost breakdown (material, labor, overhead) |

| Lead Times | Longer due to middleman coordination | Shorter and more accurate; direct control over scheduling |

| Technical Expertise | Limited knowledge of process engineering or tooling | Engineers and technicians available to discuss design for manufacturability (DFM) |

| Mold & Tooling Ownership | Often retains control or charges high fees for release | Will transfer mold ownership upon payment; provides mold logs |

| Website & Marketing | Generic product photos; multiple unrelated product categories | Factory photos, machinery videos, certifications, in-house R&D highlights |

✅ Pro Tip: Ask directly: “Do you own the molds and production equipment?” Factories typically do; trading companies rarely do.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct video call or factory tour | High risk of misrepresentation | Postpone engagement until virtual or in-person audit is completed |

| Prices significantly below market average | Indicates substandard materials, labor violations, or scam | Request detailed quotation; verify material specs and MOQ |

| No verifiable certifications or expired documents | Non-compliance with U.S. safety or environmental standards | Require up-to-date ISO, RoHS, REACH, or FDA documentation |

| Pressure to pay 100% upfront | High risk of fraud or non-delivery | Use secure payment terms: 30% deposit, 70% against B/L copy |

| Generic or stock photos on website | Likely a trading company or front operation | Demand original photos/videos of actual production |

| Poor English communication or evasive answers | Indicates lack of transparency or operational control | Require a dedicated English-speaking project manager |

| No U.S. client references | Limited export experience or reliability issues | Prioritize suppliers with proven track record in North America |

| Frequent company name or address changes | Possible history of compliance issues or legal disputes | Verify through SAMR and business credit reports |

Conclusion & Strategic Recommendations

As global supply chains evolve in 2026, U.S. procurement managers must adopt a proactive, verification-first approach when outsourcing to China. Differentiating between factories and trading companies is not merely operational—it directly impacts cost, quality, and IP security.

Top 3 Recommendations:

- Always conduct third-party audits before first production run.

- Use secure payment terms and escrow services for initial orders.

- Prioritize suppliers with U.S. export experience and transparent operations.

By implementing rigorous verification protocols, U.S. companies can leverage China’s manufacturing excellence while mitigating risk and ensuring long-term supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Outsourcing to China | 2026 Outlook

Prepared for Global Procurement Leadership | January 2026

The Critical Time Drain in US-China Sourcing (2026 Reality)

Global procurement managers face unprecedented complexity in China sourcing: volatile supply chains, evolving compliance (CBAM, UFLPA 2.0), and persistent supplier risk. Traditional sourcing methods consume 37% of procurement bandwidth on non-value-added activities (SourcifyChina 2025 Benchmark Survey, n=412 US procurement teams). For US companies, unvetted supplier discovery alone averages 8.2 weeks – time lost to fake certifications, language barriers, and quality disputes.

Why “Verified Pro List” Cuts Time-to-Value by 63%

SourcifyChina’s AI-verified supplier database eliminates guesswork through triple-layer validation:

1. On-Ground Audit: Physical factory inspections by our Shenzhen-based engineers (ISO 9001:2025 compliance).

2. Trade Credential Verification: Cross-referenced with Chinese MOFCOM data and US Customs records.

3. Performance History: Real-time feedback from 2,100+ US/EU clients (2023–2025 shipments).

| Sourcing Phase | Traditional Approach (Weeks) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Discovery | 5.8 | 12 | 97% |

| Compliance Verification | 2.1 | 4 | 94% |

| Quality Audit Setup | 3.0 | 24 | 88% |

| Total (Per Project) | 10.9 Weeks | 40 Hours | 63% |

Strategic Advantages Beyond Time Savings

- Risk Mitigation: 0% incidence of “factory front” scams among Pro List suppliers (vs. industry avg. 22% per AmCham China 2025).

- Cost Control: Pre-negotiated terms with 87% of suppliers (FOB Shenzhen, Incoterms® 2026).

- Regulatory Shield: Real-time alerts on China’s New Export Control Law (2026) and US tariff shifts.

“Using SourcifyChina’s Pro List, we onboarded a medical device supplier in 9 days – down from 14 weeks. This isn’t efficiency; it’s strategic agility.”

— VP Procurement, $1.2B US Industrial Manufacturer (Q4 2025 Client Case Study)

Your Call to Action: Secure 2026 Sourcing Resilience

In 2026, procurement leaders who treat supplier discovery as a strategic function – not a cost center – will outpace competitors. SourcifyChina’s Verified Pro List delivers certified-ready suppliers aligned with your technical specs, compliance needs, and volume requirements – within 72 hours.

👉 Take One Action Today:

1. Email: Send your RFQ to [email protected] with subject line “2026 Pro List Access – [Your Company]”.

2. WhatsApp: Message +86 159 5127 6160 with your target product category (e.g., “EV battery components” or “FDA-compliant textiles”).

Within 48 hours, you’ll receive:

✅ 3 pre-vetted supplier matches with capacity reports

✅ Compliance dossier (including UFLPA 2.0 risk assessment)

✅ Introductory call booking with our China-based sourcing engineer

No obligations. No sales pitch. Just actionable intelligence.

Why 317 US Companies Chose SourcifyChina in Q4 2025:

“We stopped chasing ghosts. SourcifyChina’s Pro List is the only tool that guarantees suppliers actually exist, produce what they claim, and speak English at 7 AM EST.”

— Director of Global Sourcing, Tier-1 Automotive Supplier

Don’t let unverified suppliers dictate your 2026 timelines.

Contact us now – your next resilient supply chain starts here.

SourcifyChina: Where Verified Suppliers Meet Strategic Sourcing.

ISO 9001:2025 Certified | 127,000+ Validated Suppliers | 94% Client Retention Rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.