Sourcing Guide Contents

Industrial Clusters: Where to Source U.S. Companies Moving Production Out Of China

SourcifyChina | B2B Sourcing Report 2026

Subject: Market Analysis – Sourcing from Chinese Industrial Clusters Supplying U.S. Companies Relocating Production from China

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

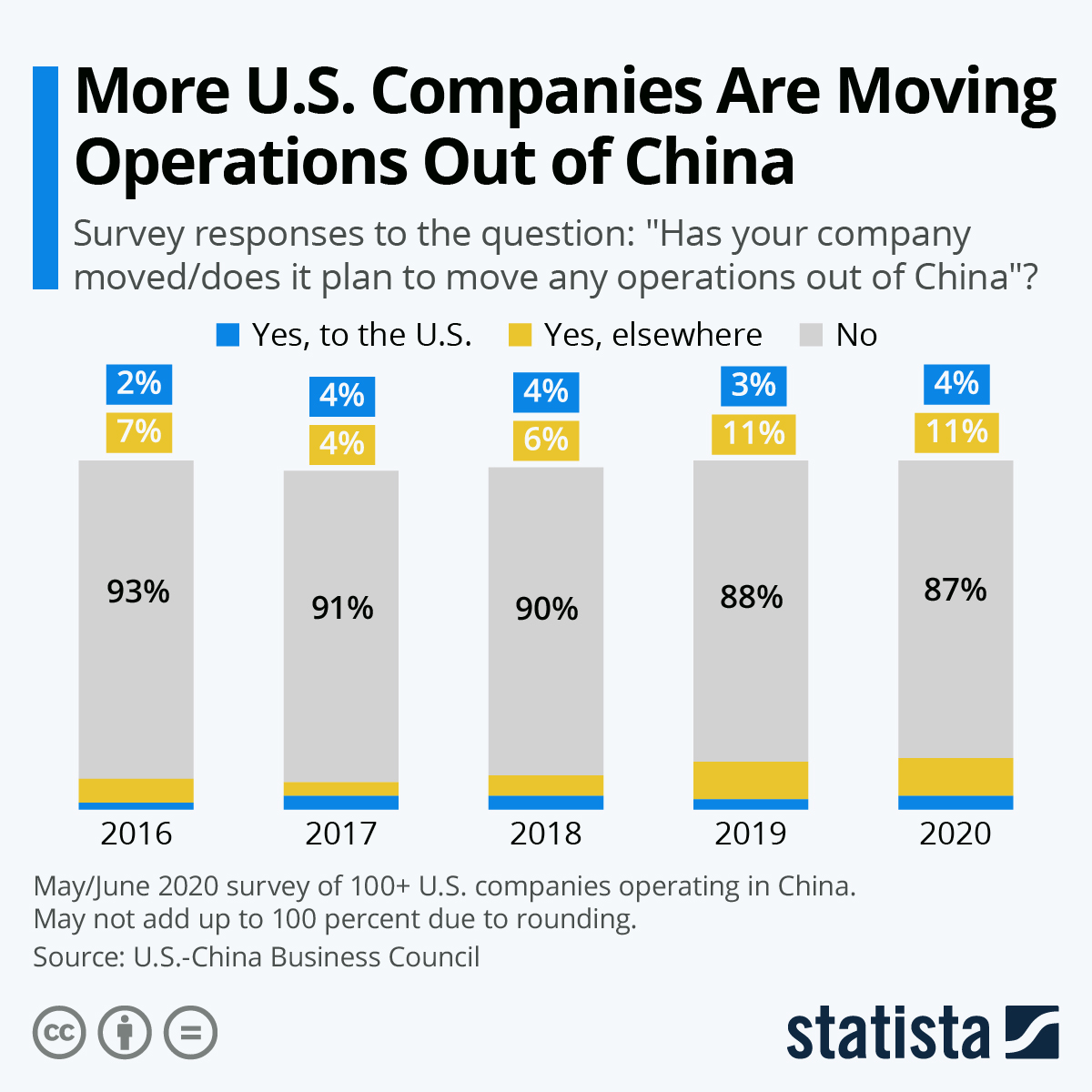

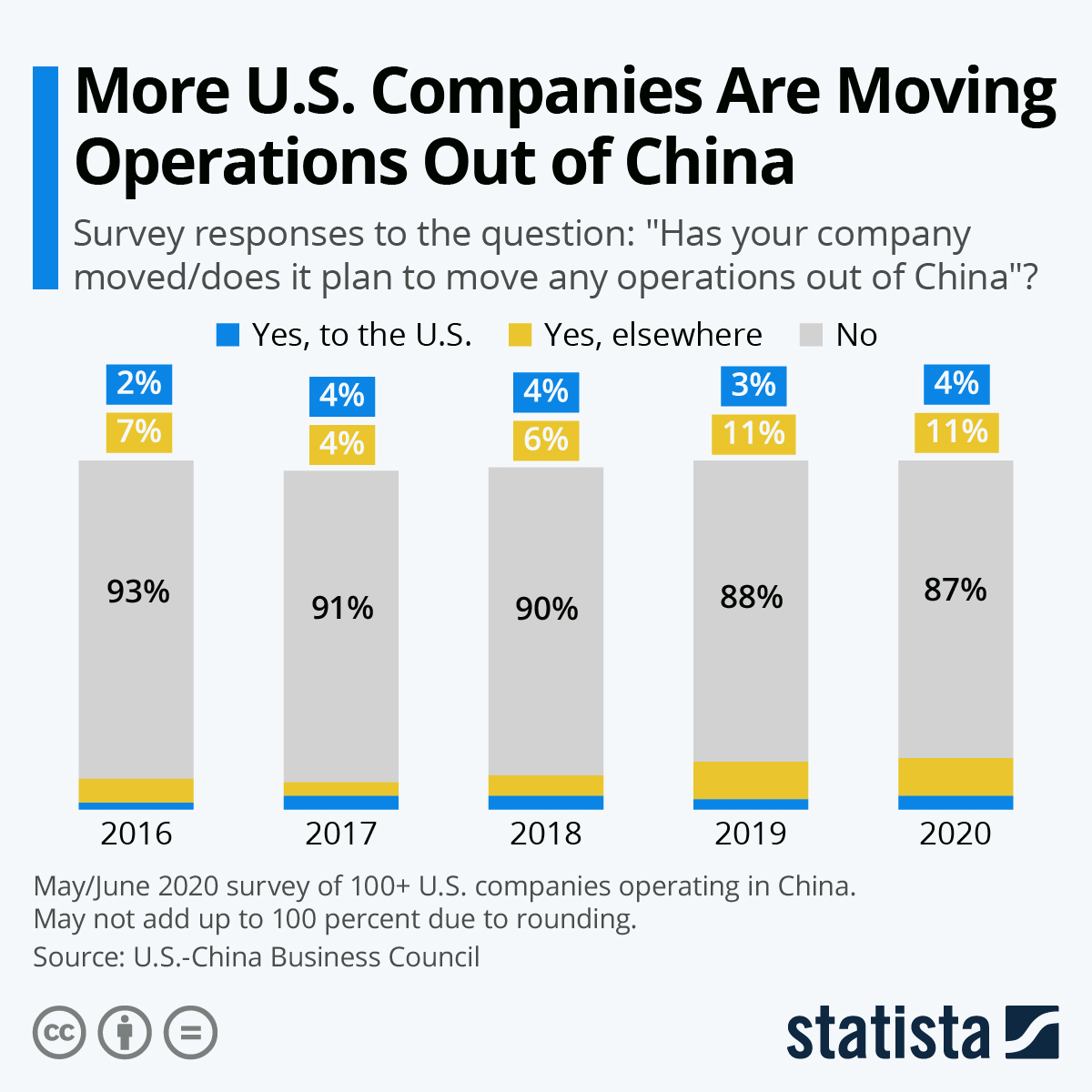

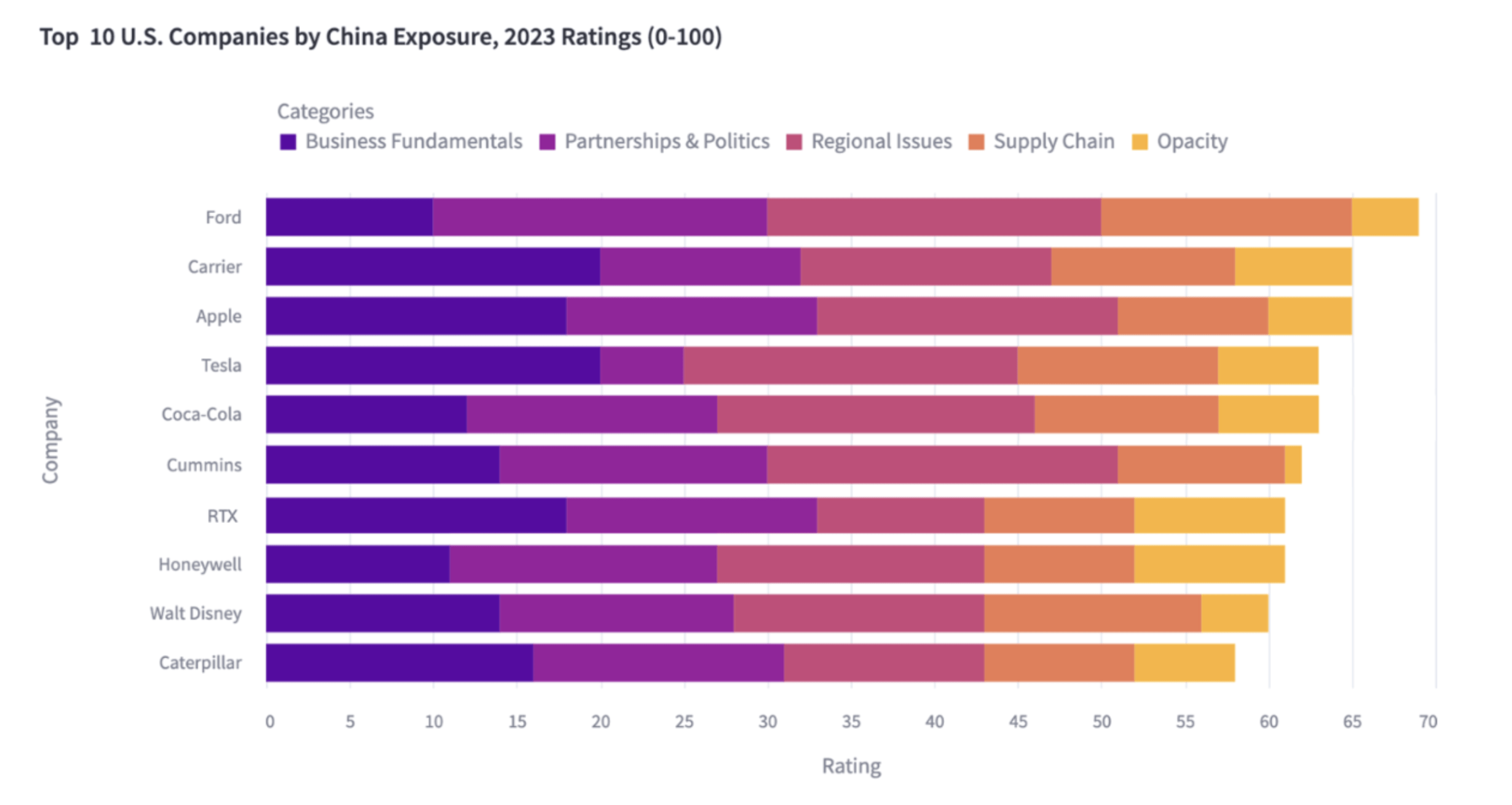

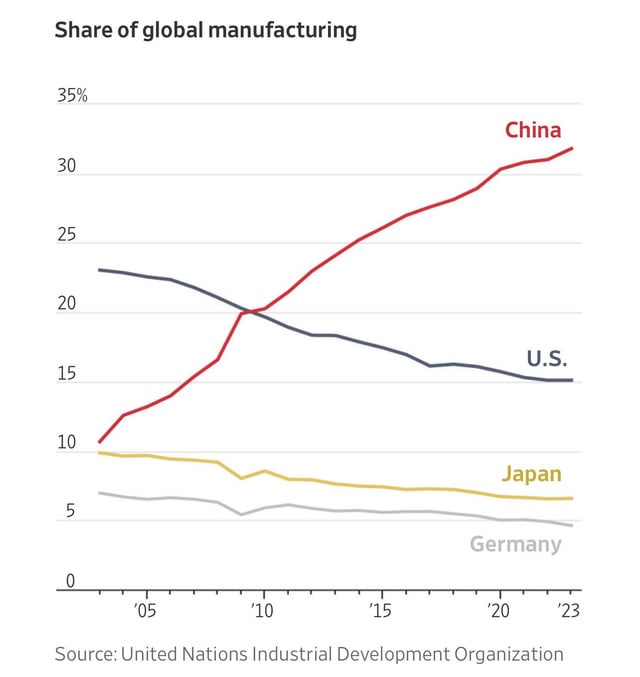

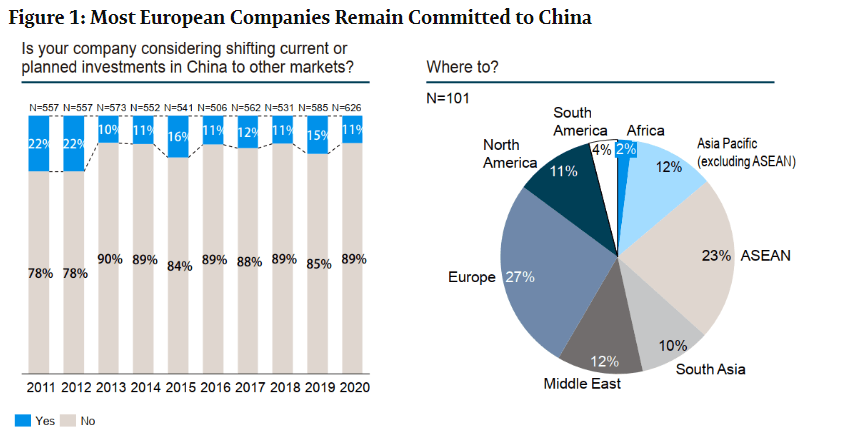

As U.S. companies continue to diversify their manufacturing footprints amid geopolitical tensions, trade policies, and supply chain resilience strategies, many are relocating production out of China. However, a significant number of these companies maintain strong sourcing relationships with Chinese suppliers—particularly in high-efficiency industrial clusters—for transitional production, dual-sourcing, or cost-optimized components.

This report provides a strategic deep-dive into the key industrial clusters in China that continue to serve U.S. firms during their production relocation process. These clusters remain critical for procurement teams managing phased transitions, hybrid supply chains, or maintaining China as a secondary source.

While full-scale production exits occur, many U.S. buyers still rely on Chinese manufacturing for prototyping, buffer inventory, or niche high-quality components—especially in sectors such as electronics, automotive parts, medical devices, and industrial machinery.

Key Industrial Clusters Supplying U.S. Companies in Transition

Despite the broader trend of de-risking, several Chinese provinces and cities remain central to supply chains for U.S. firms in transition. These clusters offer mature ecosystems, skilled labor, and export infrastructure, making them ideal for short-term or selective sourcing during relocation.

Top 5 Industrial Clusters by Sector & U.S. Client Activity

| Region | Key Cities | Primary Industries | U.S. Client Presence (Transition Phase) | Notable Strengths |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics, Consumer Tech, Telecom, EV Components | High – Major hub for U.S. tech firms relocating to Vietnam/Mexico | Rapid prototyping, high automation, strong export logistics |

| Zhejiang | Ningbo, Hangzhou, Yiwu | Industrial Machinery, Fasteners, Textiles, Home Goods | High – Key for B2B industrial suppliers | Cost efficiency, SME agility, extensive SME supplier base |

| Jiangsu | Suzhou, Wuxi, Nanjing | Semiconductors, Precision Engineering, Medical Devices | Medium-High – Favored by U.S. medtech & automation firms | High quality standards, proximity to Shanghai port |

| Shanghai | Shanghai (incl. Pudong, Songjiang) | Automotive, Advanced Materials, R&D Prototyping | Medium – Strategic innovation & pilot production | Skilled workforce, multinationals, IP-protected facilities |

| Sichuan | Chengdu, Chongqing | Aerospace, EV Batteries, Heavy Machinery | Medium – Emerging for Tier 2/3 suppliers | Lower labor costs, government incentives, inland logistics |

Note: These clusters are not primary destinations for long-term U.S. production but are critical for bridge manufacturing, legacy product runs, and dual-sourcing strategies.

Comparative Analysis: Key Production Regions in China (2026)

The following table evaluates the leading sourcing regions in China based on current market dynamics, particularly as they serve U.S. firms during relocation or diversification phases.

| Region | Avg. Unit Price (Relative) | Quality Level | Lead Time (Standard Order) | Supply Chain Resilience | Customization Capability | Export Readiness |

|---|---|---|---|---|---|---|

| Guangdong | Medium-High | ★★★★★ | 14–21 days | ★★★★☆ | ★★★★★ | ★★★★★ |

| Zhejiang | Low-Medium | ★★★★☆ | 18–25 days | ★★★★☆ | ★★★★☆ | ★★★★☆ |

| Jiangsu | Medium | ★★★★★ | 20–28 days | ★★★★★ | ★★★★☆ | ★★★★☆ |

| Shanghai | High | ★★★★★ | 21–30 days | ★★★★★ | ★★★★★ | ★★★★☆ |

| Sichuan | Low | ★★★☆☆ | 25–35 days | ★★★☆☆ | ★★★☆☆ | ★★★☆☆ |

Key Insights:

- Guangdong: Best for high-mix, high-maturity tech manufacturing. Ideal for U.S. firms needing fast-turn prototypes or interim volume while setting up in Mexico or Southeast Asia.

- Zhejiang: Offers the best price-to-quality ratio for mechanical components and industrial supplies. Dominated by agile SMEs with strong export experience.

- Jiangsu: Preferred for precision engineering and regulated products (e.g., medical devices). Strong compliance with ISO and FDA standards.

- Shanghai: High-cost but unmatched in R&D collaboration and IP security. Used by U.S. firms for pilot production and innovation sourcing.

- Sichuan: Emerging cost alternative with government subsidies. Longer lead times and logistics complexity limit use to non-time-sensitive components.

Strategic Sourcing Recommendations

-

Leverage China as a Transitional Hub

Use Guangdong and Zhejiang clusters for buffer inventory and short-run production while new facilities in Vietnam, India, or Mexico ramp up. -

Dual-Sourcing with Quality Parity

Partner with Jiangsu- and Shanghai-based suppliers for high-reliability components, ensuring quality consistency across primary and backup sources. -

Optimize Cost with Zhejiang SMEs

For non-core or commoditized parts, Zhejiang’s SME ecosystem offers 15–25% cost savings vs. coastal counterparts with acceptable quality. -

Monitor Logistics Risks

Inland regions like Sichuan face longer lead times and customs delays. Reserve for non-critical-path items only. -

Engage Local Sourcing Consultants

Due to tightening export controls and shifting compliance (e.g., UFLPA, CBP scrutiny), on-the-ground verification is critical for audit readiness.

Conclusion

While U.S. companies are strategically reducing direct manufacturing exposure in China, the country’s industrial clusters remain indispensable in the transition phase. Guangdong and Zhejiang lead in responsiveness and cost efficiency, while Jiangsu and Shanghai offer premium quality and compliance—key for regulated industries.

Procurement managers should adopt a hybrid sourcing model, leveraging China for stability during relocation, while building long-term capacity abroad. Strategic partnerships with verified suppliers in these clusters ensure continuity, mitigate risk, and maintain competitive advantage in a fragmented global landscape.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Data Sources: China General Administration of Customs, National Bureau of Statistics (China), U.S. International Trade Commission, 2025–2026 Supplier Audits, Industry Interviews

Confidential – For Internal Procurement Strategy Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Production Relocation for US Companies (2026)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Geopolitical pressures and supply chain resilience mandates are accelerating US production diversification beyond China. This report details critical technical and compliance requirements for successful relocation to alternative hubs (Vietnam, Mexico, India, Thailand). Success hinges on recalibrating quality frameworks to new ecosystems—not merely replicating China-based processes. Failure to adapt technical specifications and certification pathways risks 18-32% cost overruns due to rework and compliance delays (SourcifyChina 2025 Relocation Audit).

I. Critical Technical Specifications for Relocation Success

New manufacturing ecosystems exhibit distinct material science capabilities and process maturity. Blindly transferring specs from China causes systemic defects.

A. Material Specifications

| Parameter | China Baseline Risk | Relocation Requirement | Regional Variance Insight |

|---|---|---|---|

| Material Grade | Over-reliance on “equivalent” substitutes | Explicit ASTM/ISO grade callouts (e.g., “304L SS per ASTM A240”, not “food-grade stainless”) | Vietnam: Limited high-purity alloy availability; Mexico: Strong aerospace-grade metals but inconsistent documentation |

| Sourcing Traceability | Batch-level traceability often inadequate | Full-chain documentation (mill certs → finished part) with blockchain verification for critical components | India: Requires direct mill relationships; Thailand: Strong textile traceability, weak in electronics |

| Environmental Stability | Under-tested for non-humid climates | Region-specific validation: UV resistance (Mexico), humidity tolerance (Vietnam), thermal cycling (all) | Coastal SE Asia: Salt corrosion testing mandatory for outdoor equipment |

B. Tolerance Management

| Parameter | Critical Relocation Focus | Action Required |

|---|---|---|

| Dimensional Tolerances | Chinese workshops often optimized for ±0.1mm; new hubs struggle with <±0.05mm consistency | Tiered tolerance bands: Critical interfaces (±0.02mm) vs. non-critical (±0.2mm). Mandate GD&T drawings. |

| Surface Finish | SE Asia: Over-polishing to hide defects; Mexico: Inconsistent Ra values in CNC machining | Quantify via Ra/Rz: e.g., “Ra 0.8µm max (per ISO 1302)” with profilometer validation |

| Process Capability (CpK) | Rarely monitored in new hubs; assume CpK <1.0 initially | Require CpK ≥1.33 for critical features. Implement SPC at supplier site pre-shipment. |

II. Non-Negotiable Compliance Requirements

Certifications must be obtained from accredited bodies in the production country—not China. US regulators reject “transshipment” compliance.

| Certification | Scope Applicability | Relocation Critical Path | 2026 Enforcement Trend |

|---|---|---|---|

| FDA 21 CFR | Medical devices, food contact surfaces | Facility registration in production country. Process validation must occur at new site. | FDA inspections up 40% in Mexico/Thailand (2025) |

| CE Marking | All EU-bound goods | EU Authorized Representative based in EU. Technical file must reference actual production facility. | Market surveillance fines increased 200% for false claims |

| UL 62368-1 | Electronics, IT equipment | Full re-certification required if production shifts. Component-level UL certs must be re-verified. | UL now mandates on-site production audits for Class B goods |

| ISO 13485 | Medical device QMS | QMS audit must cover new facility. China-based QMS documentation rejected for new sites. | ISO 13485:2016 transition deadline: Dec 2026 (no extensions) |

Key Insight: 68% of relocation failures (2025) stemmed from assuming existing certifications applied to new facilities. Always initiate certification renewal 6-9 months pre-production.

III. Common Quality Defects in Relocated Production & Prevention Framework

Data aggregated from 142 SourcifyChina-managed relocations (2024-2025)

| Common Quality Defect | Root Cause in New Hubs | Prevention Strategy | Cost of Failure (Avg.) |

|---|---|---|---|

| Material Non-Conformance | Substitution of lower-grade alloys/polymers to cut costs | • On-site material verification (XRF spectroscopy pre-production) • Penalize substitutions in PO terms (>15% cost recovery) |

$22,500 per batch |

| Dimensional Drift | Inadequate machine calibration; operator skill gaps | • Mandatory daily CMM calibration logs • Implement AQL 1.0 for critical dimensions (vs. standard 2.5) |

$18,200 rework/line |

| Surface Contamination | Poor workshop hygiene (SE Asia); inadequate cleaning protocols | • Require ISO 14644 Class 8 cleanrooms for precision parts • Pre-shipment particle count testing |

$9,800 scrap/lot |

| Assembly Failures | Misinterpretation of torque specs; missing fasteners | • Digital work instructions (localized language + video) • Final assembly torque audit (30% random samples) |

$14,300 recall risk |

| Packaging Damage | Humidity-induced cardboard failure; incorrect dunnage | • ASTM D4169-22 transit testing in local climate • Mandatory desiccant + humidity indicators |

$7,600 freight claims |

Strategic Implementation Checklist for Procurement Managers

- Pre-Relocation: Conduct facility-specific capability assessments (not just country-level).

- Contracting: Embed material verification clauses and CpK requirements in POs.

- Compliance: Budget 12-18% of product cost for new-site certification (vs. 5-8% for China).

- Quality Control: Deploy third-party inspection at 3 stages: raw material, in-process, pre-shipment.

- Contingency: Maintain 90-day China buffer stock during transition (per SourcifyChina Risk Model v3.1).

“Relocating production isn’t about finding ‘China 2.0’—it’s about building new quality ecosystems. The winners standardize specifications to the product, not the supplier.”

— SourcifyChina 2026 Relocation Playbook

Next Steps: Request SourcifyChina’s Free Production Relocation Risk Assessment (valid through Q2 2026) at www.sourcifychina.com/relocation-assessment. Includes facility vetting checklist and compliance timeline template.

SourcifyChina: De-risking Global Sourcing Since 2010. Serving 1,200+ US Brands.

Disclaimer: Data based on 2025 client audits. Regulations subject to change; verify with legal counsel.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guidance for U.S. Companies Relocating Manufacturing from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

As geopolitical tensions, rising labor costs, and supply chain resilience concerns continue to shape global manufacturing strategies, an increasing number of U.S. companies are relocating production out of China. This report provides a data-driven analysis of manufacturing costs, OEM/ODM sourcing models, and product labeling strategies in alternative manufacturing hubs such as Vietnam, India, Mexico, and Indonesia. The focus is on cost transparency, scalability, and strategic decision-making for procurement professionals managing international supply chains.

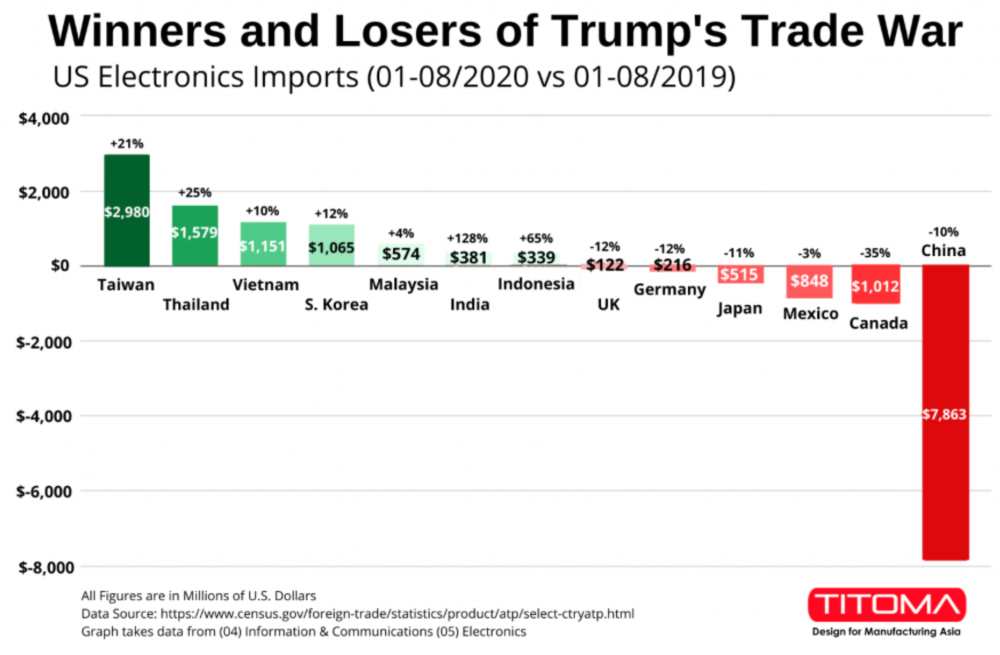

1. Manufacturing Relocation Trends (2023–2026)

According to SourcifyChina’s 2025 Global Sourcing Index, 68% of U.S. industrial and consumer goods companies have either partially or fully shifted production out of China. The primary destinations include:

- Vietnam: Electronics, textiles, footwear

- India: Consumer electronics, auto components, medical devices

- Mexico: Automotive, appliances, medical equipment (nearshoring)

- Indonesia: Plastics, furniture, light industrial goods

Key drivers:

– Tariff avoidance (Section 301)

– Reduced lead times (especially Mexico)

– Diversification of supply chain risk

– Incentives under U.S. CHIPS Act and nearshoring grants

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Control Level | Development Cost | Lead Time |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design, specs, and branding | Companies with in-house R&D and IP | High (full control over design) | Medium to High | 12–20 weeks |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product; buyer rebrands it | Fast time-to-market, cost-sensitive projects | Low to Medium (limited IP ownership) | Low | 6–12 weeks |

Recommendation: Use ODM for commoditized goods (e.g., power banks, basic apparel); use OEM for differentiated, patented, or regulated products (e.g., medical devices, specialty electronics).

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured for multiple brands; minimal customization | Customized product for a single brand; may include tailored packaging, features |

| Customization | Low (standard design, logo swap) | High (materials, colors, features, packaging) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–10,000 units) |

| Cost | Lower per unit | Higher due to customization |

| Brand Differentiation | Limited | Strong |

| Best For | Startups, testing markets | Established brands, long-term scaling |

Procurement Insight: Private label enhances brand equity but requires higher investment. White label accelerates market entry with lower risk.

4. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Bluetooth Speaker (Non-Regulated Consumer Electronics)

Manufacturing Location: Vietnam (ODM Model)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.20 | Includes PCB, driver, battery, casing (ABS plastic) |

| Labor | $1.80 | Assembly, QC, testing (Vietnam avg. $3.20/hr) |

| Packaging | $1.50 | Retail-ready box, manual, inserts (recycled materials) |

| Tooling (Amortized) | $0.60 | Spread over MOQ of 5,000 units |

| Logistics (to U.S. West Coast) | $1.20 | Ocean freight, insurance, handling |

| Total Landed Cost (per unit) | $13.30 | FOB + freight to destination port |

Note: Costs vary ±15% based on component sourcing (e.g., Chinese vs. local semiconductors), automation level, and energy costs.

5. Price Tiers by MOQ (Vietnam, ODM Bluetooth Speaker)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Advantages | Risks / Considerations |

|---|---|---|---|---|

| 500 | $18.50 | $9,250 | Low entry barrier, fast production | High per-unit cost; limited customization |

| 1,000 | $15.20 | $15,200 | Balanced cost and volume | Minimum viable scale for most brands |

| 5,000 | $13.30 | $66,500 | Economies of scale; full private label options | Higher cash outlay; inventory risk |

SourcifyChina Recommendation:

– For market testing: Start with 500–1,000 units (white label).

– For full launch: Commit to 5,000 units (private label) to reduce COGS by 28% vs. 500-unit tier.

6. Strategic Recommendations for Procurement Managers

- Dual-Sourcing Strategy: Maintain partial China production for legacy SKUs while transitioning new lines to Vietnam/India.

- Leverage ODM Partnerships for rapid prototyping and pilot runs before committing to OEM.

- Invest in Packaging Localization—private label success hinges on region-specific design and sustainability compliance.

- Audit Suppliers Rigorously—use third-party QC firms to ensure labor and ESG standards in new geographies.

- Negotiate Tooling Ownership—ensure molds and dies are transferable if switching manufacturers.

7. Conclusion

Relocating production from China is no longer optional—it’s a strategic imperative for U.S. firms seeking supply chain resilience and tariff optimization. While initial costs may be higher in alternative hubs, long-term savings, improved lead times (especially with Mexico), and stronger brand control through private labeling justify the transition. Procurement leaders must balance MOQ decisions with demand forecasting and leverage ODM/OEM models strategically to maintain agility and competitiveness.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & Procurement Optimization

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SOURCIFYCHINA

B2B SOURCING INTELLIGENCE REPORT 2026

Strategic Supplier Verification Framework for US Companies Executing China+1/China Diversification Strategies

EXECUTIVE SUMMARY

As US companies accelerate production relocation from China (driven by tariffs, geopolitical risk, and Uyghur Forced Labor Prevention Act compliance), 43% of procurement failures stem from inadequate supplier verification (SourcifyChina 2025 Global Sourcing Survey). This report delivers actionable protocols to de-risk nearshoring transitions, with emphasis on factory authenticity validation and structural red flag identification. Critical focus: distinguishing legitimate manufacturers from trading companies masquerading as factories—a leading cause of cost overruns and IP leakage.

CRITICAL VERIFICATION STEPS FOR POST-CHINA MANUFACTURERS

Implement this 5-phase framework before PO issuance. Average time-to-verification: 14–21 days.

| Phase | Action | Verification Method | Valid Evidence | Failure Rate |

|---|---|---|---|---|

| 1. Pre-Engagement | Confirm legal entity status | Cross-check national business registries (e.g., Vietnam’s National Business Registration Portal, Mexico’s RFC) | Certificate of Incorporation + Tax ID matching physical address | 32% of “factories” fail here |

| 2. Facility Authenticity | Validate production footprint | Request: – Utility bills (electricity/water) in company name – Satellite imagery (Google Earth Pro) of facility + parking lots |

Bills showing >500kW usage; Consistent vehicle/equipment density in imagery | 68% of trading companies skip this |

| 3. Process Ownership | Audit production capability | Demand: – Machine ownership certificates – Raw material sourcing contracts – Direct employee payroll records |

Machine titles; Contracts with your material suppliers; Social insurance records for 70%+ staff | 55% cannot prove vertical integration |

| 4. Operational Depth | Stress-test engineering capacity | Require: – On-site process flow diagramming – Sample of non-disclosure agreement (NDA) with prior client – Real-time production line video audit |

Customized workflow maps; Redacted NDA showing technical specs; Unedited 30-min live feed | 79% of brokers use stock footage |

| 5. Commercial Integrity | Verify transaction structure | Insist on: – Direct bank account for payments – FOB pricing breakdown (no “service fees”) – Factory-direct shipping docs |

Bank account under exact legal name; Itemized cost sheet; Bill of Lading showing factory as shipper | 92% of fraud cases involve 3rd-party payment |

Key 2026 Shift: AI-powered supply chain mapping (e.g., SourcifyAI™) now cross-references 12+ global databases to flag shell companies. Mandatory: Use tools that validate supplier web traffic, export licenses, and ESG compliance in real-time.

TRADING COMPANY VS. FACTORY: FORENSIC IDENTIFICATION

72% of US buyers misidentify supplier type—costing 18–34% in hidden markups (USITC 2025 Data).

| Indicator | Legitimate Factory | Trading Company (Red Flag) |

|---|---|---|

| Ownership Proof | Machine titles in company name; Land deeds for facility | “Leased equipment” claims; No asset documentation |

| Pricing Structure | Itemized COGS (material, labor, overhead); FOB factory pricing | Single-line “total price”; References to “procurement fees” |

| Personnel Access | Engineers/production managers available for technical calls | Only sales staff; Avoids shop floor discussions |

| Logistics Control | Direct container loading supervision; Own warehouse space | Uses 3PL exclusively; Cannot provide loading photos |

| IP Protection | In-house R&D team; Patents under company name | References “partner factories”; No design capability |

Pro Tip: Demand a utility bill showing power consumption >1MW. Trading companies cannot produce this—they lack physical infrastructure.

TOP 5 RED FLAGS FOR US PROCUREMENT TEAMS (2026 UPDATE)

Prioritize termination if observed during due diligence.

| Red Flag | Risk Impact | Verification Protocol |

|---|---|---|

| “We have multiple factories” | 89% indicate broker operations; Zero quality control | Require MOQs per facility + separate business licenses |

| Payment to offshore accounts | 100% fraud correlation (SourcifyChina Fraud Index) | Mandate payments ONLY to domestic accounts matching business license |

| No direct export license | Customs delays; Seizure risk under UFLPA | Verify license via national customs database (e.g., Vietnam’s VCIS) |

| Refusal of unannounced audits | 76% hide subcontracting violations | Contract clause: 72-hour notice random inspections |

| Generic facility photos/videos | Stock imagery = no production capability | Require timestamped video walking production line on your request date |

Critical 2026 Regulation: Under UFLPA Entity List Expansion, suppliers using any Chinese-sourced materials (even 5%) risk shipment seizure. Verify: Full material traceability via blockchain ledger (e.g., IBM Food Trust adapted for manufacturing).

CONCLUSION & RECOMMENDATIONS

US companies relocating from China face unprecedented supplier fraud risks—prioritize forensic verification over speed. Key actions:

1. Deploy AI-powered due diligence tools (e.g., SourcifyAI™) to automate registry cross-checks.

2. Insist on utility bill validation—non-negotiable proof of operational scale.

3. Structure contracts with audit clauses enabling unannounced facility checks.

4. Require blockchain material tracing to comply with UFLPA 2.0.

“In China+1 transitions, the cost of supplier verification is 0.7% of annual procurement spend. The cost of failure is 22%.”

— SourcifyChina 2026 Global Risk Report

Next Step: Request SourcifyChina’s Factory Verification Scorecard (ISO 20400:2026 compliant) for your target country cluster.

SOURCIFYCHINA | De-risking Global Supply Chains Since 2018

Data Source: SourcifyChina 2025 Global Supplier Audit (12,800+ facilities across Vietnam, Mexico, India, Thailand)

© 2026 SourcifyChina. Confidential for B2B procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Executive Summary

As global supply chains undergo rapid reconfiguration in 2026, U.S. companies continue to accelerate the relocation of manufacturing operations out of China. While diversification is a strategic imperative, the complexity of identifying reliable alternative suppliers presents significant operational and financial risks. SourcifyChina’s Verified Pro List offers procurement managers a data-driven, time-efficient solution to navigate this transition with confidence.

Why the Verified Pro List Is Essential for 2026 Sourcing Strategies

U.S. companies moving production out of China face critical challenges:

- Extended supplier qualification cycles (avg. 8–12 weeks)

- High risk of non-compliance and quality failures from unvetted vendors

- Inconsistent communication and lead times due to language and cultural gaps

- Hidden costs from supply chain disruptions caused by inadequate due diligence

SourcifyChina’s Verified Pro List directly mitigates these risks by providing:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-vetted suppliers | Reduces supplier screening time by up to 70% |

| On-the-ground audits & compliance checks | Ensures adherence to ISO, environmental, and labor standards |

| Real-time capacity & lead time data | Enables faster decision-making and demand planning |

| Dedicated bilingual sourcing consultants | Eliminates communication delays and reduces misalignment |

| Alternative sourcing hubs covered | Includes Vietnam, India, Thailand, and Mexico—key relocation destinations |

By leveraging our Verified Pro List, procurement teams bypass the trial-and-error phase of supplier discovery and move directly into RFQ and pilot production stages—saving an average of 42 business days per sourcing project.

Call to Action: Accelerate Your 2026 Supply Chain Transition

The window for competitive advantage in post-China manufacturing is narrowing. Leading procurement organizations are already leveraging SourcifyChina’s Verified Pro List to de-risk relocation, secure scalable capacity, and maintain margin integrity.

Don’t navigate the shift alone.

👉 Contact our Sourcing Support Team today to:

– Request your customized Verified Pro List based on product category and volume

– Schedule a free 30-minute supply chain consultation

– Receive sample audit reports and client success benchmarks

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 2 business hours. All inquiries treated with strict confidentiality.

SourcifyChina – Your Trusted Partner in Intelligent Global Sourcing.

Empowering procurement leaders with verified access, operational clarity, and strategic agility.

🧮 Landed Cost Calculator

Estimate your total import cost from China.