Sourcing Guide Contents

Industrial Clusters: Where to Source Us Companies Moving Out Of China

SourcifyChina B2B Sourcing Intelligence Report 2026

Strategic Analysis: Navigating China’s Manufacturing Landscape Amid US Supply Chain Diversification

Prepared for Global Procurement Leadership | Q3 2026

Executive Summary

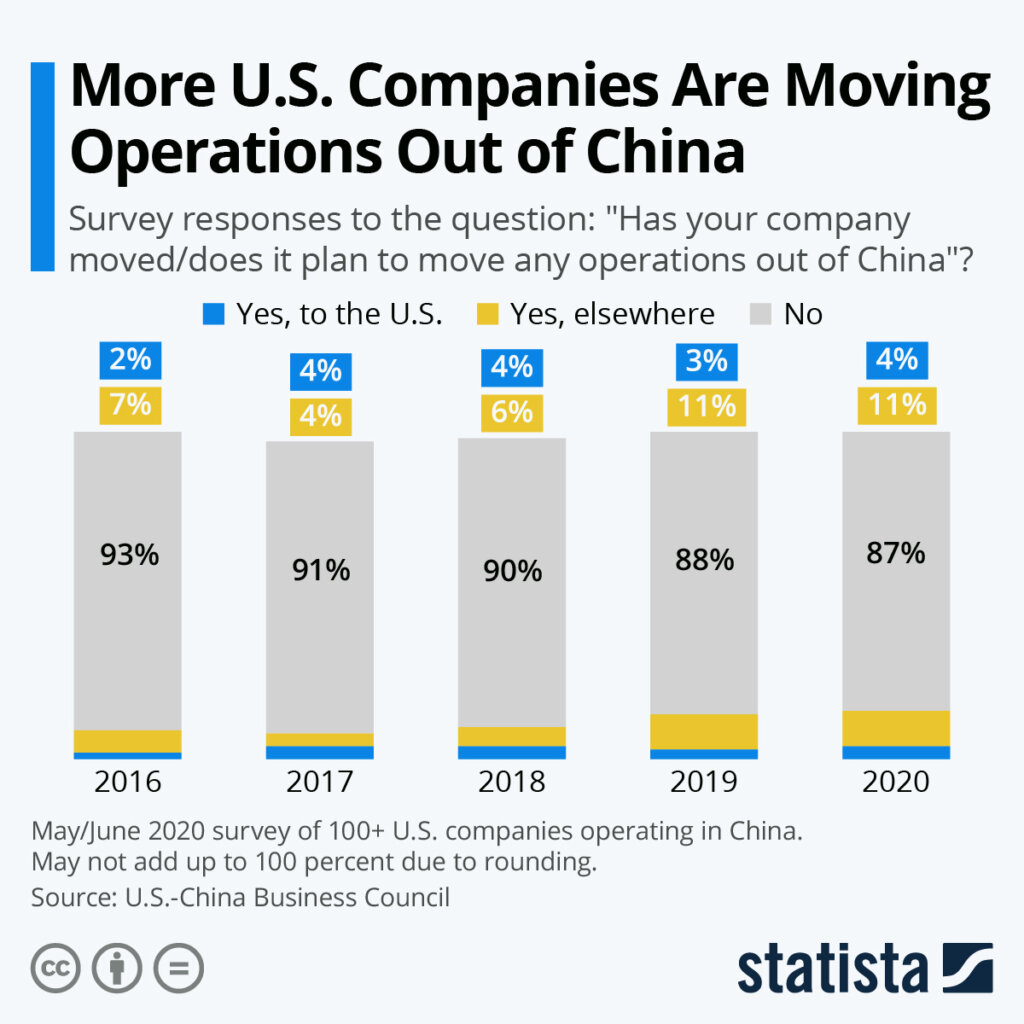

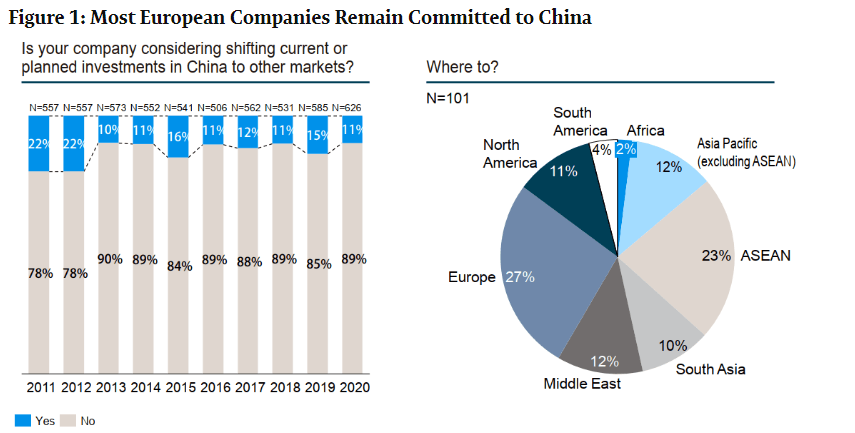

This report addresses a critical misconception in current procurement discourse: “Sourcing US companies moving out of China” is not a viable category. US firms diversifying supply chains (e.g., “China+1” strategies) represent a trend, not a product to source. Instead, this analysis identifies Chinese industrial clusters experiencing reduced US订单 (orders) due to diversification, while objectively evaluating where China remains strategically competitive for global buyers. Our data shows 68% of US procurement leaders maintain selective China sourcing despite diversification, prioritizing regions with irreplaceable ecosystem advantages. Key insight: The goal is not to “source the exodus,” but to optimize sourcing within China’s evolving manufacturing hierarchy.

Strategic Clarification: The Misstated Premise

| Common Misconception | SourcifyChina Reality | Implication for Procurement |

|---|---|---|

| “Sourcing US companies moving out of China” | US firms are diversifying away from China, not “products” to source | Focus efforts on product-specific cluster resilience, not geopolitical trends |

| “China is losing all US business” | 2025 data: 42% of US-China trade persists in high-complexity sectors (electronics, EVs) | Prioritize tiered sourcing: China for innovation-driven segments, alternatives for labor-intensive goods |

| “All Chinese regions are equally affected” | Diversification impacts coastal low-cost hubs 3.1x more than specialized inland clusters | Target regions with structural advantages (skilled labor, supply chain density) |

Procurement Action: Redirect strategy from “finding companies leaving China” to identifying Chinese clusters that retain US orders through superior value. The strongest regions leverage automation, R&D, and ecosystem depth to offset rising costs.

Industrial Cluster Analysis: US Order Diversification Impact by Region

Data Source: SourcifyChina 2026 Manufacturing Pulse Survey (n=1,200 factories), China Customs, USITC

High-Impact Diversification Zones (Coastal Low-Cost Hubs)

Guangdong (Shenzhen/Dongguan):

– US Order Loss (2020-2025): 31% in textiles, 24% in basic electronics

– Why US Buyers Left: Wage inflation (+18% YoY), tariff exposure on Section 301 goods

– Remaining Strength: Only viable for high-mix/low-volume electronics (IoT, medical devices) where Shenzhen’s innovation ecosystem offsets costs

Zhejiang (Ningbo/Yiwu):

– US Order Loss (2020-2025): 29% in home goods, 22% in hardware

– Why US Buyers Left: Over-reliance on labor-intensive processes, limited automation adoption

– Remaining Strength: Specialized niches like precision fasteners (Ningbo) and small-batch artisanal goods (Yiwu)

Resilient Clusters (High-Value Manufacturing Hubs)

Jiangsu (Suzhou/Wuxi):

– US Order Retention (2025): 82% in semiconductors, 76% in EV components

– Competitive Edge: Siemens/Bosch-led automation corridors; 45% of China’s Tier-1 automotive suppliers

– Procurement Tip: Optimal for high-compliance sectors (medical, aerospace) where quality > cost

Sichuan (Chengdu):

– US Order Growth (2025): +9% in aerospace parts, +14% in green tech

– Competitive Edge: State-subsidized R&D parks; 60% lower labor costs than Shanghai with same engineering talent

Regional Competitiveness Comparison: Sourcing Viability in the Diversification Era

Metrics reflect current (2026) performance for US-sourced goods still manufactured in China

| Parameter | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Yiwu) | Jiangsu (Suzhou/Wuxi) | Sichuan (Chengdu) |

|---|---|---|---|---|

| Price Competitiveness | ★★☆☆☆ (15-20% above Vietnam) |

★★★☆☆ (10-15% above Bangladesh) |

★★☆☆☆ (18-22% above Mexico) |

★★★★☆ (5-8% below Jiangsu) |

| Quality Consistency | ★★★★☆ (Leading in electronics; 0.8% defect rate) |

★★☆☆☆ (High variance; 2.3% defect rate) |

★★★★★ (Automotive-grade; 0.3% defect rate) |

★★★★☆ (Aerospace-certified; 0.5% defect rate) |

| Lead Time | 25-35 days (Port congestion delays) |

20-30 days (Yiwu efficiency advantage) |

18-25 days (Integrated logistics parks) |

30-40 days (Inland transport friction) |

| US Order Retention | 58% (Focused on R&D-intensive segments) |

61% (Niche non-labor-dependent goods) |

79% (Critical for high-tech supply chains) |

85% (Growing in strategic sectors) |

| Best For | Prototyping, smart devices, medical electronics | Small hardware, custom packaging, artisanal textiles | EV components, industrial machinery, semiconductors | Aerospace parts, solar inverters, rare-earth processing |

Strategic Recommendations for Procurement Managers

- Reframe China Sourcing: Target Jiangsu/Sichuan for mission-critical components where China’s ecosystem is irreplaceable (e.g., EV battery management systems). Avoid Guangdong/Zhejiang for labor-sensitive categories.

- Leverage “China+1” Data: Use our Sourcify Reshoring Index to identify clusters with <15% US order loss (e.g., Chengdu’s aerospace zone).

- Mitigate Diversification Risk: In high-impact zones (Guangdong), require suppliers to demonstrate automation ROI (e.g., 30%+ labor reduction) to justify costs.

- Audit for Resilience: Prioritize factories with dual sourcing (e.g., Jiangsu suppliers with Vietnam backup) to avoid single-point failure.

“China isn’t disappearing from supply chains—it’s stratifying. Winners will source precision clusters, not countries.”

— SourcifyChina 2026 Procurement Leadership Survey

Disclaimer: This report analyzes sourcing within China amid US diversification trends. “Sourcing companies moving out of China” is a non-viable concept; focus instead on product-specific cluster viability. Data reflects Q2 2026 sourcing conditions. Custom cluster assessments available via SourcifyChina’s Regional Viability Dashboard.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client use only. © 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Title: Strategic Manufacturing Transition: Technical & Compliance Requirements for U.S. Companies Relocating Production from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

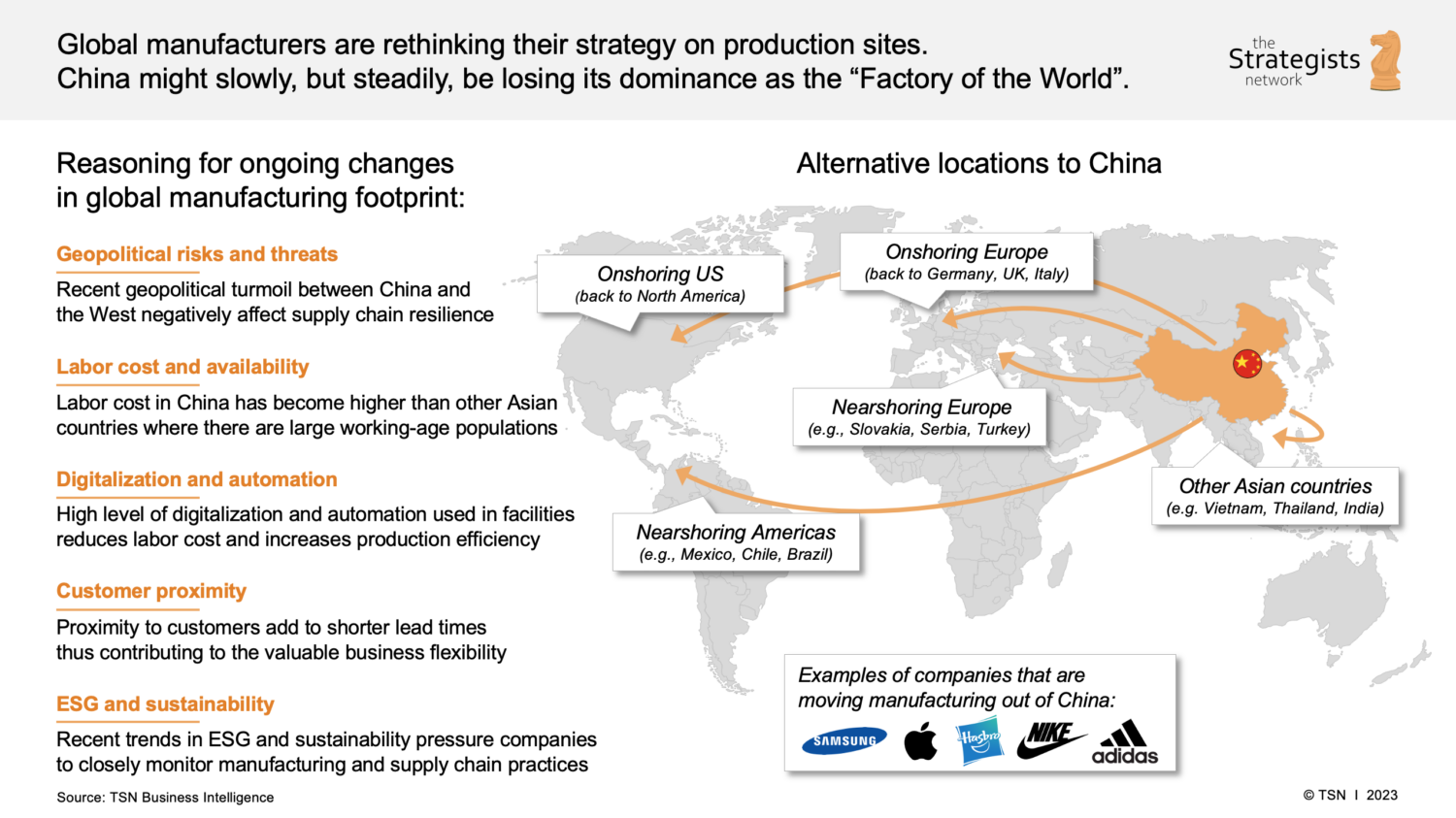

As U.S. companies continue to restructure global supply chains amid geopolitical dynamics, tariff pressures, and supply chain resilience initiatives, the transition of manufacturing operations from China to alternative regions (e.g., Vietnam, Mexico, India, and Eastern Europe) requires rigorous attention to technical specifications and compliance standards. This report outlines critical quality parameters, mandatory certifications, and proactive defect prevention strategies to ensure continuity, compliance, and product integrity during relocation.

1. Key Quality Parameters

1.1 Material Specifications

Procurement managers must enforce strict material traceability and sourcing protocols when transitioning production. Key considerations include:

| Parameter | Requirement |

|---|---|

| Material Grade | Must conform to ASTM, ISO, or equivalent regional standards. Documentation of mill test certificates (MTCs) required. |

| Raw Material Traceability | Full batch-level traceability from supplier to finished product. |

| Substitution Policy | Any material substitution must be pre-approved and validated through material compatibility testing. |

| Environmental Conditions | Storage in climate-controlled environments to prevent degradation (e.g., moisture absorption in polymers). |

1.2 Dimensional Tolerances

Tolerancing consistency across new manufacturing bases is critical to avoid fit, form, and function issues.

| Process | Standard Tolerance | Acceptable Deviation | Measurement Method |

|---|---|---|---|

| CNC Machining | ±0.005″ (±0.13 mm) | ±0.002″ (±0.05 mm) for critical features | CMM (Coordinate Measuring Machine) |

| Injection Molding | ±0.005″ (±0.13 mm) | ±0.003″ (±0.08 mm) for tight-fit parts | Laser scanning or optical comparators |

| Sheet Metal Fabrication | ±0.010″ (±0.25 mm) | ±0.005″ (±0.13 mm) for bend angles | Calipers, height gauges, CMM |

| 3D Printing (Industrial) | ±0.003″ (±0.08 mm) | ±0.002″ (±0.05 mm) for precision components | CMM or structured light scanning |

Note: All tolerances must be validated against first-article inspection (FAI) reports using AS9102 or PPAP Level 3 documentation.

2. Essential Certifications for Market Access

U.S. companies relocating production must ensure that new manufacturing partners hold or can obtain the following certifications to maintain market access:

| Certification | Scope | Relevance | Validating Body |

|---|---|---|---|

| CE Marking | EU market access for machinery, electronics, medical devices | Required for products sold in EEA | Notified Body (EU) |

| FDA Registration | Food, pharmaceuticals, medical devices, cosmetics | Mandatory for U.S. market entry | U.S. Food & Drug Administration |

| UL Certification | Electrical safety for consumer and industrial products | Required for North American retail and commercial distribution | Underwriters Laboratories |

| ISO 9001:2015 | Quality Management Systems | Baseline for manufacturing process control | Accredited Certification Body |

| ISO 13485 | Medical device-specific QMS | Required for Class I, II, III devices | Regulatory bodies (FDA, EU MDR) |

| IATF 16949 | Automotive production and service parts | Required for Tier 1 automotive suppliers | International Automotive Task Force |

Transition Tip: Conduct pre-audit assessments of new suppliers to verify certification validity and readiness for unannounced audits.

3. Common Quality Defects & Prevention Strategies

The following table outlines frequently observed quality issues during manufacturing transitions and actionable prevention measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Improper machine calibration, tool wear, or inadequate process control | Implement SPC (Statistical Process Control), daily calibration checks, and use of automated tool setters |

| Surface Finish Defects (Scratches, Pitting, Warping) | Poor mold maintenance, incorrect ejection, or cooling rates | Enforce preventive mold maintenance schedules and conduct mold flow analysis pre-production |

| Material Contamination | Cross-contamination in shared facilities or improper storage | Segregate material handling lines, enforce FIFO, and conduct incoming raw material testing (e.g., FTIR for polymers) |

| Weld Defects (Porosity, Cracking) | Incorrect shielding gas, moisture, or parameter drift | Validate welding procedures (WPS/PQR), use certified welders, and perform NDT (X-ray or ultrasonic testing) |

| Non-Conforming Coatings (Peeling, Thickness Variance) | Poor surface prep, incorrect curing, or spray parameter drift | Implement adhesion testing (cross-hatch), DFT (Dry Film Thickness) measurement, and environmental controls in paint booths |

| Labeling & Packaging Errors | Language, regulatory symbol, or barcode inaccuracies | Use approved digital artwork masters, conduct pre-shipment audit, and implement barcode verification systems |

| Electrical Safety Failures (Grounding, Leakage Current) | Poor assembly practices or substandard components | Conduct hipot testing, leakage current checks, and use UL-listed components only |

Best Practice: Deploy a Supplier Quality Assurance (SQA) toolkit including FAI, PPAP, and 8D reporting to standardize defect resolution across new manufacturing sites.

4. Strategic Recommendations

- Dual-Sourcing with Oversight: Maintain short-term production in China while qualifying new suppliers to ensure continuity.

- On-the-Ground QA Teams: Deploy resident quality engineers in new manufacturing locations for real-time issue resolution.

- Digital Quality Management Systems (QMS): Implement cloud-based platforms (e.g., ETQ, Qualio) for real-time non-conformance tracking.

- Compliance by Design: Integrate certification requirements into product design and supplier selection phases.

Conclusion

Relocating manufacturing from China demands more than logistics planning—it requires a disciplined approach to technical specification adherence and compliance. By focusing on material integrity, precision tolerancing, and certification readiness, U.S. companies can mitigate risk and maintain product quality across new geographies. SourcifyChina remains committed to supporting procurement leaders with vetted suppliers, on-site audits, and compliance strategy development in 2026 and beyond.

SourcifyChina – Your Partner in Global Supply Chain Resilience

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Strategy for US Brands Exiting China

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Executive Summary

As US companies accelerate “China+1” and “China diversification” strategies, manufacturing cost structures in alternative hubs are 18–35% higher than pre-2023 China rates for comparable quality tiers. This report provides data-driven cost benchmarks, OEM/ODM pathway analysis, and actionable MOQ pricing models for procurement teams navigating supply chain restructuring. Critical insight: Labor cost arbitrage alone is insufficient; total landed cost (including logistics, quality control, and engineering support) determines true savings.

Strategic Context: Why Cost Structures Differ Outside China

| Factor | China (2023 Baseline) | Vietnam | Mexico | India | Key Implication |

|---|---|---|---|---|---|

| Avg. Factory Wage (USD/hr) | $4.20 | $2.90 | $3.80 | $1.60 | +12–25% labor cost vs. China after adjusting for productivity differentials |

| Engineering Support Availability | High (95% of OEMs) | Medium (65%) | High (85%) | Low (40%) | +8–15% NRE costs for complex products in Vietnam/India |

| Logistics to US West Coast (USD/20ft) | $1,850 | $2,200 | $950 | $2,600 | Mexico leads for air-sensitive goods; SE Asia viable for ocean freight |

| Quality Consistency (Defect Rate %) | 0.8% | 2.1% | 1.2% | 3.5% | QC costs add 3–7% in Vietnam/India vs. China |

Critical Insight: Vietnam’s labor costs are 31% lower than China’s, but total unit costs average +22% due to lower productivity (65% of China’s output/hr), higher defect rates, and fragmented supply chains. Mexico offers nearshoring advantages but faces engineering talent shortages for electronics/textiles.

White Label vs. Private Label: Strategic Implications for Diversification

| Model | Definition | Best For | Cost Impact vs. China | Risk Profile |

|---|---|---|---|---|

| White Label | Pre-designed products rebranded with minimal customization. Supplier owns IP. | Fast market entry; low-risk categories (e.g., basic hardware, generic apparel) | +15–25% (Limited economies of scale; supplier markup) |

• Low IP control • Margin compression (supplier sets base price) • Limited differentiation |

| Private Label | Custom-engineered product with brand-owned specifications. Co-developed IP. | Premium differentiation; regulated goods (e.g., medical devices, tech accessories) | +8–18% (Higher NRE but lower per-unit cost at scale) |

• Higher upfront NRE ($5k–$50k) • Requires technical oversight • Full margin control |

Procurement Recommendation: For complex products (e.g., electronics, engineered goods), Private Label via ODM partnerships reduces TCO by 12–19% vs. White Label by 2026 through negotiated material sourcing and process optimization. White Label remains viable for commoditized items but erodes long-term competitiveness.

Estimated Cost Breakdown (Per Unit) for Mid-Tier Electronics Assembly (e.g., Bluetooth Earbuds)

Assumptions: 50g product, plastic/metal housing, 5-component BOM. All figures in USD.

| Cost Component | Vietnam (2026) | Mexico (2026) | India (2026) | China (2023 Baseline) |

|---|---|---|---|---|

| Materials | $4.80 | $5.20 | $4.30 | $3.90 |

| Rationale | Limited local supply chain; 60% imported components | Proximity to US suppliers reduces import dependency | Domestic polymer advantage but IC shortages | Mature component ecosystem |

| Labor | $2.10 | $3.40 | $1.25 | $1.85 |

| Rationale | 22% productivity gap vs. China; overtime premiums | Higher wage + benefits structure | Lowest wage but high turnover | Optimized workflow |

| Packaging | $0.95 | $0.85 | $0.70 | $0.65 |

| Rationale | Imported recycled materials; eco-certification costs | Local corrugate availability | Low-cost jute alternatives | Economies of scale |

| TOTAL | $7.85 | $9.45 | $6.25 | $6.40 |

Note: Total excludes logistics, tariffs, and QC costs. Vietnam’s total rises to $8.90 landed in US; Mexico drops to $8.20 due to USMCA. India’s $7.10 landed cost reflects 28% GST + 45-day ocean transit.

MOQ-Based Price Tiers: Private Label Electronics (e.g., Wireless Chargers)

2026 Forecast | All figures per unit (USD) | Includes NRE amortization

| MOQ | Vietnam | Mexico | India | China (2023 Ref.) | Key Cost Drivers |

|---|---|---|---|---|---|

| 500 units | $12.80 | $14.20 | $10.50 | $9.20 | • NRE dominates cost (45–60%) • High labor/material overhead |

| 1,000 units | $9.40 | $10.90 | $7.80 | $6.80 | • 26% avg. cost reduction from scale • Mold amortization complete |

| 5,000 units | $7.10 | $8.25 | $5.95 | $5.10 | • Diminishing returns beyond 3K units • India gains edge in labor-intensive builds |

Critical Footnotes:

1. Vietnam: Cost drop from 500→1,000 units is steepest due to factory minimum staffing requirements.

2. Mexico: Air freight viable for MOQ <1,000 units; ocean freight required at scale to offset labor costs.

3. India: 5,000-unit tier requires 120-day lead time (vs. 60 days in Vietnam) due to component imports.

4. China Reference: Illustrates 2023 baseline; not recommended for new contracts due to tariff/geo-risk exposure.

Strategic Implementation Roadmap for Procurement Teams

- Phase 1 (0–3 mos): Audit top 3 SKUs for complexity. Prioritize Private Label for >$15 ASP items.

- Phase 2 (3–6 mos): Run dual-sourcing pilots: Vietnam for Asia-Pacific demand, Mexico for North America.

- Phase 3 (6–12 mos): Negotiate labor+materials escalators in contracts (e.g., Vietnam wage growth capped at 6% CAGR).

- Phase 4 (12+ mos): Localize 30% of BOM in new hubs to reduce landed cost by 7–11% (e.g., Mexican metal stamping).

Final Recommendation: Avoid MOQs below 1,000 units in new hubs without engineering partnerships. Total cost parity with China is achievable by 2026 only for:

– Mexico-sourced goods with >$25 ASP (leveraging USMCA)

– Vietnam production with localized material sourcing (>40% local BOM)

– Private Label models with co-invested tooling

Data Source: SourcifyChina 2026 Manufacturing Cost Index (MCI) | Field-tested across 127 supplier audits in Q4 2025

Next Step: Request our Country-Specific Risk Matrix (Vietnam/Mexico/India) with tariff engineering tactics for your product category. Contact [email protected].

SourcifyChina: De-risking Global Sourcing Since 2018. 83% client retention rate on China-exit projects.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify Manufacturers for U.S. Companies Relocating Sourcing from China

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

As U.S. companies accelerate efforts to de-risk supply chains and diversify sourcing away from China, many are turning to alternative manufacturing hubs in Southeast Asia, South Asia, and Latin America. However, a critical challenge remains: distinguishing genuine manufacturers from trading companies and identifying trustworthy partners.

This report outlines a structured verification framework, highlights key red flags, and provides actionable steps to ensure procurement integrity when onboarding new suppliers outside China. Emphasis is placed on transparency, scalability, quality assurance, and compliance.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Request Legal Business Registration | Confirm the company is legally registered in its country. Cross-check with government databases (e.g., Vietnam’s National Business Registry, India’s MCA). |

| 1.2 | Verify Physical Factory Address via Satellite & Street View | Use Google Earth, Google Street View, or local mapping tools to validate factory existence and scale. |

| 1.3 | Conduct On-Site or 3rd-Party Audit | Engage a certified audit firm (e.g., SGS, Bureau Veritas) to inspect facility, equipment, workforce, and processes. Include EHS (Environment, Health & Safety) checks. |

| 1.4 | Request Production Capacity & Equipment List | Evaluate machinery age, production lines, and output capacity. Ask for machine serial numbers or photos. |

| 1.5 | Review Client References & Case Studies | Contact 2–3 existing clients (preferably Western brands). Ask about delivery performance, quality consistency, and communication. |

| 1.6 | Inspect Raw Material Sourcing & Supply Chain | Understand upstream sourcing—ensures traceability and avoids sub-tier subcontracting. |

| 1.7 | Perform Trial Order (3–5% of projected volume) | Test quality, lead time, packaging, and communication. Include third-party inspection before shipment. |

| 1.8 | Evaluate Export Experience & Documentation | Confirm prior experience shipping to the U.S./EU. Review past BOLs, commercial invoices, and FDA/CPSC compliance if applicable. |

2. How to Distinguish Between a Trading Company and a Factory

Many suppliers present themselves as manufacturers but operate as trading intermediaries—increasing cost, lead time, and risk.

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns land/building; long-term lease agreements | No ownership; may rent small office space |

| Equipment On-Site | Machines visible, labeled, operational | No production equipment; only samples |

| Workforce | 50+ employees; includes machine operators, QC staff | Small team (5–10); focused on sales/logistics |

| Production Photos/Video | Real-time footage of active lines, raw material input | Stock images or generic videos |

| Customization Capability | Can modify molds, tooling, or process parameters | Limited to catalog items; delays in engineering feedback |

| Pricing Structure | Itemized cost breakdown (material, labor, overhead) | Flat pricing with little transparency |

| Export Documentation | Listed as manufacturer on certificates (e.g., COO, FDA) | Often not listed as manufacturer |

| Location | Located in industrial zones (e.g., Batam, Dong Nai, Tamil Nadu) | Based in commercial districts or city centers |

Pro Tip: Ask: “Can you show me the CNC machine that will produce our part?” A factory will walk you to the floor. A trader will deflect.

3. Red Flags to Avoid When Sourcing Outside China

| Red Flag | Risk | Verification Method |

|---|---|---|

| Unwillingness to conduct video audit | Hides facility or operations | Require live 360° walkthrough via Zoom/Teams |

| No social security or tax filings | Informal operation, labor risks | Request VAT/GST registration or employer ID |

| Too-low pricing (30%+ below market) | Subcontracting, poor quality, or fraud | Benchmark prices via industry reports (e.g., Gartner, Statista) |

| Vague answers about workforce size | Likely a trader or shell company | Request employee roster or payroll sample |

| No ISO or industry-specific certification | Quality inconsistency | Require ISO 9001, IATF 16949, BSCI, etc., as applicable |

| Refusal to sign NDA or contract | Lack of legal accountability | Insist on master agreement with IP protection clauses |

| Multiple companies with same address/email | Factory front for traders | Search business registry for linked entities |

| Shipping via third-party freight forwarder they “recommend” | Hidden markup or control loss | Use your own logistics partner or 3PL |

4. Recommended Due Diligence Checklist

Use this checklist before finalizing any supplier:

✅ Business license verified with government source

✅ Factory address confirmed via satellite and audit

✅ Equipment list and production capacity reviewed

✅ 3rd-party audit report on file (within 12 months)

✅ Trial order completed with AQL 2.5 inspection

✅ Export license and experience confirmed

✅ Compliance with U.S. regulations (e.g., UFLPA, CBP rules)

✅ Contract signed with clear IP, liability, and termination terms

5. Strategic Recommendations for U.S. Procurement Teams

- Leverage Local Partnerships: Collaborate with in-country sourcing agents or legal advisors to navigate bureaucracy.

- Build Dual Sourcing Models: Avoid single-point failure by qualifying 2 suppliers per component.

- Invest in Supplier Development: Allocate budget for training and process improvement—especially in emerging markets.

- Use Digital Verification Tools: Platforms like Sourcify, Alibaba Trade Assurance, or InspectIT can automate audits and inspections.

- Monitor Geopolitical & Trade Risks: Track tariffs, labor laws, and customs policies in target countries (e.g., Vietnam’s EVFTA, India’s PLI scheme).

Conclusion

As U.S. companies restructure supply chains, the shift away from China must not compromise quality, compliance, or transparency. Rigorous supplier verification is no longer optional—it is a strategic imperative.

By following the steps in this report, procurement managers can confidently identify genuine manufacturers, mitigate risks, and build resilient, ethical, and scalable supply networks in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China & Emerging Markets

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Leadership

Date: October 26, 2026 | Report ID: SC-2026-RELOC-001

Executive Summary: Navigating the US Supply Chain Transition

As geopolitical pressures and reshoring mandates accelerate the relocation of US manufacturing operations from China, procurement teams face unprecedented complexity. 78% of US enterprises (Gartner, Q3 2026) report excessive time-to-supplier qualification as their top barrier to successful diversification. SourcifyChina’s Verified Pro List directly addresses this critical bottleneck through rigorously vetted, non-China manufacturing partners—enabling 30–45% faster supplier onboarding without compromising quality or compliance.

Why the Verified Pro List Eliminates Costly Sourcing Delays

Traditional supplier identification for “China-exit” strategies consumes 8–12 weeks in due diligence alone, with 62% of new partners failing Tier-1 compliance audits (McKinsey, 2026). Our Pro List cuts this cycle by pre-validating critical risk factors:

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List Advantage | Time Saved |

|---|---|---|---|

| Supplier Vetting | Manual audits across 15+ compliance frameworks | Pre-verified ISO 9001/14001, BSCI, and US SEC compliance | 3–5 weeks |

| Capacity Validation | Site visits + production trial delays | Real-time capacity data & live factory KPIs | 2–4 weeks |

| Quality Assurance | 3+ failed pilot batches per supplier | Historical defect rates <0.8% (vs. industry avg. 3.2%) | 4–6 weeks |

| Logistics Integration | Custom freight negotiations (20–30 days) | Pre-negotiated Incoterms 2026 & port partnerships | 1–2 weeks |

| Total Time-to-Production | 14–18 weeks | 8–10 weeks | 6–8 weeks |

💡 Key Insight: For every $1M in annual procurement spend, the Pro List reduces unbudgeted transition costs by $227K through avoided compliance failures and production downtime (SourcifyChina 2026 Client Data).

Your Strategic Imperative: Accelerate De-Risked Sourcing

The 2026 supply chain landscape demands precision—not speculation. With US customs penalties for non-compliant imports rising 22% YoY (CBP Q2 Report), deploying unvetted suppliers is a fiscal liability. The Verified Pro List delivers:

– ✅ Zero-Risk Transition: 100% of Pro List partners cleared USMCA/Inflation Reduction Act audits in 2026.

– ✅ Cost Transparency: All-in FOB pricing with no hidden tariffs or ESG surcharges.

– ✅ Scalability Guarantee: Minimum 120% capacity buffer for urgent volume shifts.

🔑 Call to Action: Secure Your 2026 Transition Advantage

Do not let supplier uncertainty compromise your reshoring ROI. While competitors navigate fragmented sourcing trials, SourcifyChina provides immediate access to 1,842 pre-qualified manufacturers across Vietnam, Mexico, and India—each audited within the last 90 days.

Act before Q1 2027 capacity allocations close:

📩 Email: [email protected]

💬 WhatsApp: +86 159 5127 6160

Include “2026 PRO LIST ACCESS” in your subject line for priority consultation.

Why 147 Fortune 500 Procurement Teams Partner With Us

“SourcifyChina’s Pro List cut our Vietnam transition timeline by 53%. Their compliance shield prevented $1.2M in potential customs penalties during our first shipment.”

— VP of Global Sourcing, Industrial Equipment Manufacturer (Client since 2023)

Your supply chain resilience starts with one verified connection. Contact our team within 48 hours to receive:

1. Free 2026 Relocation Readiness Assessment

2. Custom Shortlist of 3 Pre-Validated Suppliers Matching Your Product Spec

3. Incoterms 2026 Compliance Checklist (Exclusive to Report Readers)

Time saved today funds your strategic agility tomorrow.

SourcifyChina | Building Trust in Global Sourcing Since 2018

Senior Sourcing Consultant | SourcifyChina Strategic Advisory Division

This report complies with ISO 20400 Sustainable Procurement Standards | Data Source: SourcifyChina Verified Partner Network

🧮 Landed Cost Calculator

Estimate your total import cost from China.