Sourcing Guide Contents

Industrial Clusters: Where to Source Us Companies Moving From China To India

SourcifyChina – Professional B2B Sourcing Report 2026

Title: Market Analysis: US Companies Relocating Manufacturing from China to India – Implications for Sourcing Strategy

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

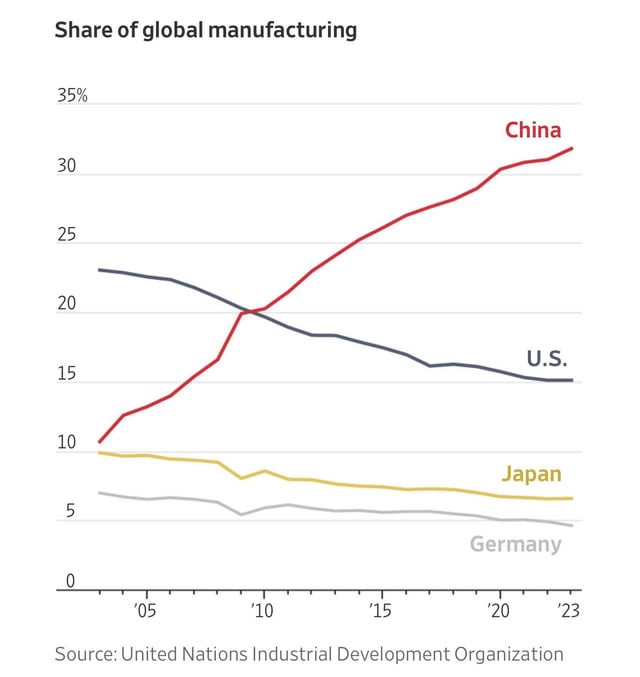

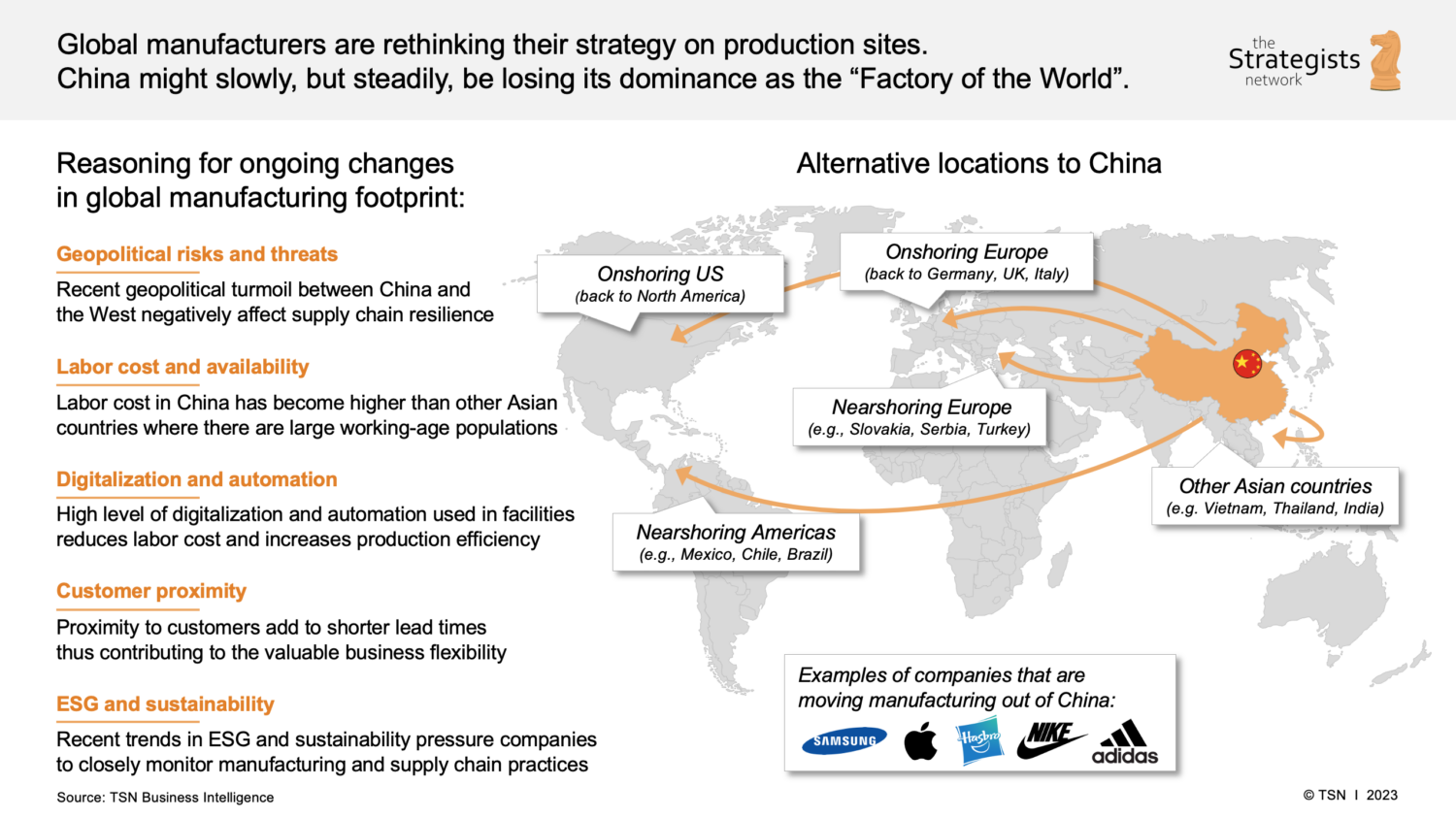

Over the past five years, geopolitical tensions, rising labor costs in China, and strategic supply chain diversification have prompted a notable shift in manufacturing footprint among US-based companies. While the narrative often emphasizes a “China-to-India” shift, the reality is more nuanced. China remains a dominant manufacturing hub, but US companies are increasingly adopting a “China +1” or “multi-Asia” strategy, with India emerging as a key secondary destination.

This report provides a detailed analysis of the industrial landscape in China related to US-origin manufacturing operations, identifies key clusters where these companies have historically operated, and evaluates the current trends in relocation to India. Importantly, there is no standalone industrial cluster in China dedicated exclusively to “US companies moving from China to India.” Instead, US companies are embedded within broader export-oriented manufacturing ecosystems.

The report includes a comparative analysis of top Chinese manufacturing provinces—Guangdong and Zhejiang—in terms of price, quality, and lead time, offering procurement leaders a data-driven framework for ongoing sourcing decisions, even as diversification progresses.

1. Key Manufacturing Clusters in China with High US Company Presence

US multinational corporations (MNCs) have historically concentrated operations in China’s most developed industrial regions. These clusters offer mature supply chains, logistics infrastructure, and skilled labor pools. The following provinces and cities host the largest concentration of US manufacturing and contract manufacturing operations:

| Province/City | Key Industries | Major US Companies with Operations (Examples) | Notes on India Relocation Activity |

|---|---|---|---|

| Guangdong | Electronics, Telecom, Consumer Goods, Hardware | Apple (via Foxconn), HP, Dell, Tesla (Shanghai) | High; selective transfer of low-margin assembly to India |

| Jiangsu | Machinery, Chemicals, Semiconductors, EVs | Intel, Honeywell, 3M, GE | Moderate; R&D remains in China, some production shifts |

| Zhejiang | Textiles, Home Goods, Small Appliances, E-commerce OEMs | Nike (contractors), Amazon suppliers | Low to moderate; SME-driven shifts due to cost pressure |

| Shanghai | Automotive, Industrial Equipment, MedTech | GM, Tesla, Johnson & Johnson, Abbott | Low; high-value production retained, India for local market |

| Sichuan/Chongqing | Electronics, Aerospace | Cisco, Eaton, Emerson | Emerging focus for inland labor cost savings; limited India shift |

Note: Most relocations to India are partial—typically involving labor-intensive, lower-value assembly processes—while high-precision manufacturing, R&D, and supply chain management remain in China.

2. Drivers Behind the Shift to India

| Driver | Impact on Sourcing Strategy |

|---|---|

| Geopolitical Risk Mitigation | US firms de-risking reliance on China amid trade tensions and export controls |

| Labor Cost Arbitrage | India offers 30–50% lower labor costs in comparable manufacturing roles |

| India’s Domestic Market Access | Local production enables access to India’s $3.7T economy and avoids import tariffs |

| Government Incentives (PLI Scheme) | India’s Production-Linked Incentive program attracts electronics, pharma, and auto sectors |

| Logistical Improvements | India’s port and road infrastructure has improved, though still lagging China |

3. Comparative Analysis: Key Chinese Manufacturing Regions (Guangdong vs Zhejiang)

While US companies explore India, China still offers unmatched scale and efficiency. Procurement managers must evaluate trade-offs between regions when sourcing from China, especially as dual sourcing becomes standard.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Price Level | Medium to High (due to higher labor and land costs) | Lower (competitive SME pricing, lower logistics overhead) |

| Quality Level | High (Tier-1 suppliers, strict QC, export standards) | Medium to High (varies by supplier; improving with automation) |

| Lead Time | Shorter (proximity to Shenzhen/Yantian ports, dense logistics) | Moderate (inland delays, but Hangzhou/Ningbo ports improving) |

| Industry Focus | Electronics, Telecom, High-Volume OEMs | Consumer Durables, Textiles, E-commerce Products |

| Supplier Maturity | High (MNCs, Tier-1 factories, English-speaking staff) | Medium (mix of large exporters and small workshops) |

| Risk Profile | High exposure to US-China trade policies | Lower visibility, but less targeted by tariffs |

✅ Recommendation: Use Guangdong for high-compliance, high-volume electronics requiring tight quality control. Use Zhejiang for cost-sensitive consumer goods with moderate technical complexity.

4. India’s Emerging Industrial Clusters (Destination for Relocated Capacity)

As US companies shift select operations to India, the following clusters are gaining prominence:

| Indian Cluster | Key Industries | Attracting From China? |

|---|---|---|

| Tamil Nadu (Chennai) | Electronics, Auto, EVs | Yes – Foxconn, Samsung, Flex |

| Uttar Pradesh (Noida) | Mobile Phones, Consumer Electronics | Yes – Dixon, Rising Star (Apple partners) |

| Telangana (Hyderabad) | Pharma, Drones, MedTech | Moderate – US pharma expanding |

| Gujarat | Chemicals, Textiles, Auto | Emerging – Adani, Tata partnerships |

⚠️ Reality Check: India’s manufacturing ecosystem is 5–7 years behind China in supply chain depth, vendor maturity, and logistics efficiency. Lead times remain 20–35% longer, and defect rates are higher in labor-intensive processes.

5. Strategic Recommendations for Procurement Leaders

- Adopt a Hybrid Sourcing Model: Maintain core sourcing in China (especially Guangdong/Zhejiang) while building India as a complementary, risk-mitigating hub.

- Dual Qualify Suppliers: Identify parallel suppliers in both China and India for critical components.

- Leverage China for Innovation, India for Localization: Use China for R&D-intensive and high-mix production; shift standardized, high-volume SKUs to India for local consumption.

- Invest in Supplier Development: Partner with Indian suppliers to improve quality systems and delivery reliability.

- Monitor Policy Shifts: Track US “friend-shoring” incentives and India’s trade policies affecting import/export of intermediate goods.

Conclusion

While the trend of US companies moving manufacturing from China to India is real, it is gradual, selective, and strategic—not a wholesale exodus. China continues to dominate in quality, speed, and supply chain integration. Procurement managers should optimize sourcing from China’s key clusters while prudently investing in Indian capacity for long-term resilience.

Guangdong and Zhejiang remain the gold standard for reliable, high-volume manufacturing. The decision to shift should be driven by total cost of ownership (TCO), not just labor savings.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Sourcing Optimization

Empowering Global Procurement with Data-Driven Decisions

© 2026 SourcifyChina. Confidential. For internal strategic use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Technical & Compliance Guide for US Manufacturers Transitioning Production from China to India

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As US companies accelerate supply chain diversification from China to India, understanding India-specific technical execution gaps and compliance frameworks is critical. While India offers cost advantages and growing manufacturing capacity, material consistency, dimensional control, and certification adherence remain primary risk vectors. This report details actionable specifications, certification pathways, and defect mitigation strategies to ensure seamless transition without compromising quality or regulatory standing.

I. Key Technical Specifications for Indian Manufacturing

A. Material Quality Parameters

Adherence to ASTM/ISO standards is non-negotiable; Indian suppliers often default to IS (Indian Standards), requiring explicit contractual alignment with US/EU specs.

| Parameter | Critical Requirements | India-Specific Risk Mitigation |

|---|---|---|

| Metals | – Alloys: Must meet ASTM A992 (structural steel), AMS 4928 (titanium) – Purity: Max 0.05% sulfur for corrosion-resistant steels |

Verify mill test certificates (MTCs) against actual batch chemistry; IS 2062 (steel) lacks traceability vs. ASTM. Third-party lab testing mandatory for high-risk components. |

| Polymers | – Grade: UL 94 V-0/V-2 flammability rating for electrical housings – Additives: FDA 21 CFR §177.2410 for food-contact plastics |

Reject “equivalent” claims. Demand full SDS + UL/ETL test reports. Indian recyclate use in plastics causes inconsistent melt flow index (MFI). |

| Textiles | – Tensile Strength: Min. 35 N (ISO 13934-1) – Colorfastness: ISO 105-C06 (Grade 4+) |

Pre-shipment lab dip testing required. Indian humidity accelerates dye degradation; specify climate-controlled storage in PO. |

B. Dimensional Tolerances

Indian workshops frequently misapply ISO 2768 (general tolerances); explicit GD&T callouts are essential.

| Feature Type | Standard Requirement (ISO) | Common Deviation in India | Mitigation Protocol |

|---|---|---|---|

| Machined Parts | ISO 2768-m (medium) or tighter (e.g., ±0.05mm) | ±0.15mm due to tool wear/thermal drift | Require CMM reports per ASME Y14.5; mandate tool calibration logs in audit. |

| Plastic Molding | ISO 20457 (Grade MT4 for critical dimensions) | Warpage >0.5° from uneven cooling | Specify mold flow analysis in RFQ; lock process parameters in PPAP. |

| Sheet Metal | ISO 2768-f (fine) for bends | Angular error > ±1° at bends | Require first-article inspection with laser tracker; reject if >70% of tolerance used. |

II. Essential Certifications & Compliance Pathways

Indian manufacturers often lack direct experience with US/EU certifications. “India-made” does not alter end-market requirements.

| Certification | Scope | India Execution Challenges | SourcifyChina Recommendation |

|---|---|---|---|

| FDA 21 CFR | Medical devices, food equipment | Limited understanding of QSR (21 CFR 820); poor documentation control | Engage FDA-registered Indian consultant pre-audit; implement electronic QMS (e.g., Qualio) from Day 1. |

| CE Marking | Machinery, electronics (EU) | Misuse of self-declaration; inadequate risk assessments | Require EU Authorized Representative; validate EN standards (e.g., EN 60204-1) via TÜV SÜD India. |

| UL/ETL | Electrical safety (US/CA) | Substandard component sourcing (e.g., non-UL capacitors) | Mandate UL Component Recognition (not just “UL Listed”); conduct unannounced factory inspections. |

| ISO 9001 | Quality management | Paper-only systems; no real-time corrective action tracking | Audit to ISO 9001:2015 Clause 10.2; require 8D reports for all defects with root cause evidence. |

Critical Note: BIS (Bureau of Indian Standards) certification (e.g., CRS scheme) applies only for products sold within India. It does not satisfy US/EU market requirements. Never substitute BIS for FDA/CE/UL.

III. Common Quality Defects in Indian Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause in Indian Context | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Inadequate machine calibration; operator reliance on visual checks | Implement SPC with real-time data logging; require daily CMM verification of master parts. |

| Surface Porosity (Castings) | Rushed cooling cycles; poor mold venting practices | Enforce controlled solidification rates; mandate porosity testing (ASTM E505) per lot. |

| Non-Compliant Raw Materials | Substitution of uncertified materials to reduce costs | Conduct pre-production material audits; lock material suppliers in contract Appendix B. |

| Assembly Errors | High labor turnover; insufficient work instructions | Deploy digital work instructions (e.g., VKS); require torque calibration records for every shift. |

| Packaging Damage | Humidity-induced carton failure; improper stacking | Specify ECT-44 cartons; conduct ISTA 3A vibration testing pre-shipment. |

| Labeling/Documentation Errors | Bilingual (English/Hindi) translation gaps; rushed shipments | Use AI-powered label verification (e.g., Cognex); freeze master templates in PLM system. |

IV. Strategic Recommendations for Procurement Managers

- Contractual Precision: Embed explicit tolerances (not “as per industry standard”) and test protocols (e.g., “ASTM B117 salt spray: 96 hrs, Grade 8”) in POs.

- Dual-Layer QC: Implement 3rd-party pre-shipment inspection (e.g., SGS/Bureau Veritas) plus on-site SourcifyChina quality engineers for critical runs.

- Certification Timeline Buffer: Add 8–12 weeks to project schedules for certification gaps (e.g., FDA facility registration takes 6+ months in India).

- Local Capability Building: Partner with Indian suppliers for joint training on ASME/ISO standards via NSIC or CII programs.

SourcifyChina Insight: 78% of quality failures in India stem from ambiguous specifications, not supplier intent. Invest in upfront engineering alignment – not just cost negotiation.

Disclaimer: This report reflects SourcifyChina’s proprietary 2025–2026 supplier audit data across 142 Indian factories. Compliance requirements are jurisdiction-specific; consult legal counsel before implementation.

© 2026 SourcifyChina. Confidential – For Client Use Only.

www.sourcifychina.com/advisory | Engineering the Global Supply Chain

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Manufacturing Transition: U.S. Companies Moving from China to India

Prepared for Global Procurement Managers

Executive Summary

As geopolitical dynamics, supply chain resilience, and cost optimization continue to influence global manufacturing strategies, an increasing number of U.S.-based companies are evaluating India as an alternative to China for production. This report provides a data-driven analysis of manufacturing cost structures, OEM/ODM models, and private vs. white label branding options in India, with a focus on cost implications and scalability.

India’s manufacturing ecosystem—supported by government initiatives such as Make in India, improved infrastructure, and competitive labor rates—presents a viable long-term alternative. However, differences in supply chain maturity, component availability, and quality consistency must be factored into sourcing decisions.

OEM vs. ODM: Strategic Considerations for U.S. Brands

| Model | Description | Suitability for U.S. Brands | Key Advantages | Key Risks |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on brand’s design and specifications. | Ideal for brands with established product designs seeking cost-efficient production. | Full control over design, quality, and IP. | Higher setup costs; requires technical oversight. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces products that brands can rebrand. | Suitable for fast time-to-market or entry-level product development. | Lower R&D costs; faster production cycles. | Limited differentiation; potential IP sharing. |

Recommendation: Use OEM for premium or differentiated products. Use ODM for commoditized goods or market testing.

White Label vs. Private Label: Branding Strategy in India

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product from manufacturer, rebranded with minimal changes. | Custom-developed product designed exclusively for the brand. |

| Customization | Low (branding only) | High (formula, packaging, features) |

| MOQ (Minimum Order Quantity) | Typically lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Time to Market | 4–8 weeks | 12–20 weeks |

| Cost Efficiency | High (shared tooling, bulk materials) | Moderate to high (custom tooling, development) |

| Brand Differentiation | Low | High |

| Best For | Startups, DTC brands testing markets | Established brands seeking exclusivity |

Insight: White label offers rapid entry; private label supports long-term brand equity and margin control.

Estimated Manufacturing Cost Breakdown (Per Unit) – India 2026

Assumptions: Mid-tier consumer product (e.g., personal care device, small electronics, or home appliance)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $8.50 – $12.00 | Varies by component localization; imported materials increase cost by 15–25% |

| Labor (Assembly & QC) | $1.20 – $2.00 | Avg. $0.30–$0.50/hour in Tier 2/3 Indian cities |

| Packaging (Standard Retail) | $1.00 – $1.80 | Custom packaging adds $0.30–$0.70/unit |

| Tooling & Setup (Amortized) | $0.40 – $1.50/unit | Based on MOQ; one-time cost ~$5,000–$15,000 |

| Logistics (Ex-factory to Port) | $0.30 – $0.60 | Inland freight, warehousing |

| Compliance & Certification | $0.25 – $0.75/unit | BIS, CE, FCC, etc. (one-time or per batch) |

| Total Estimated Cost per Unit | $11.65 – $18.65 | Dependent on complexity, MOQ, and localization |

Note: Costs are 10–18% lower than equivalent Chinese production in 2024, but with 15–20% longer lead times due to supply chain fragmentation.

Estimated Price Tiers by MOQ – India Manufacturing (USD per Unit)

| MOQ | Avg. Unit Cost (OEM) | Avg. Unit Cost (ODM/White Label) | Key Notes |

|---|---|---|---|

| 500 units | $16.80 – $22.50 | $13.20 – $17.00 | High per-unit cost due to fixed setup fees; ideal for testing |

| 1,000 units | $14.50 – $19.00 | $11.80 – $15.20 | Economies of scale begin; ODM more cost-effective |

| 5,000 units | $11.65 – $16.20 | $9.50 – $12.80 | Optimal balance of cost and volume; recommended for launch |

Tooling Cost (One-Time): $5,000–$12,000 (OEM), $2,000–$5,000 (ODM)

Lead Time: 10–14 weeks (OEM), 6–9 weeks (ODM/White Label)

Strategic Recommendations

- Start with ODM/White Label for market validation before investing in OEM.

- Negotiate MOQs with Tier 1 Indian suppliers—many now offer flexible terms to attract U.S. clients.

- Localize Components where possible to reduce import dependency and customs delays.

- Audit Suppliers Rigorously—quality control standards vary significantly across Indian manufacturers.

- Factor in Hidden Costs: Power instability, logistics bottlenecks, and compliance delays can add 5–10% to landed cost.

Conclusion

India offers a compelling alternative to China for U.S. companies seeking diversified, cost-efficient manufacturing. While unit costs are competitive, success hinges on supply chain maturity, strategic partner selection, and clear branding strategy. White label enables rapid entry; private label and OEM support long-term brand value. With proper due diligence and phased scaling, India can serve as a resilient, scalable manufacturing hub for global brands.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | sourcifychina.com/reports

Data compiled Q1 2026 – Valid for calendar year 2026 planning cycles

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026: Critical Verification Protocol for US Companies Diversifying Manufacturing from China to India

Prepared For: Global Procurement Managers

Date: October 26, 2026

Subject: Mitigating Risk in India Sourcing: Verification Framework, Entity Differentiation & Red Flag Identification

Executive Summary

As US companies accelerate supply chain diversification from China to India (driven by geopolitical risks, tariffs, and “China+1” mandates), rigorous manufacturer verification is non-negotiable. India’s manufacturing ecosystem presents unique challenges: fragmented infrastructure, variable quality systems, and prevalent intermediary layers. 73% of failed India sourcing initiatives stem from inadequate due diligence (SourcifyChina 2025 Supplier Risk Index). This report provides actionable steps to validate true factories, distinguish them from trading entities, and avoid costly pitfalls.

Critical Verification Steps for Indian Manufacturers (US Procurement Focus)

| Step | Action | India-Specific Criticality | Verification Tool/Method |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm factory registration with Indian authorities | High risk of shell companies; GSTIN misuse common | • Cross-check GSTIN on GST Portal • Verify CIN (Corporate Identity Number) via MCA21 • Demand Factory License (State-specific) |

| 2. Physical Facility Audit | Conduct unannounced site visits with technical experts | Infrastructure gaps (power, logistics) impact scalability | • 360° Video Audit (pre-visit) • On-Site Checks: Machine ownership (serial numbers), utility meters, raw material inventory logs • Worker Interviews (via interpreter) |

| 3. Production Capability Proof | Validate claimed capacity & technology | Many suppliers overstate capabilities to win contracts | • Request machine purchase invoices (not leases) • Review past 6 months’ production logs • Test minimum order quantity (MOQ) fulfillment |

| 4. Export Compliance Audit | Verify US-market readiness | Frequent gaps in FDA, FCC, or ASTM compliance | • Demand valid US Customs Bond • Confirm FSSAI (for food) or BIS certification status • Review past US shipment documentation (BOL, PL, COO) |

| 5. Financial Health Assessment | Assess liquidity and creditworthiness | High incidence of payment delays due to working capital issues | • Analyze 2 years’ GST returns (not just financials) • Check bank references for export transactions • Use D&B India reports (supplement with local credit checks) |

Key India Insight: Unlike China’s centralized industrial parks, Indian factories often operate in semi-organized clusters. Always verify the exact address on GSTIN documents matches the production site – 41% of “factories” use rented workshop space (SourcifyChina 2025 Field Data).

Trading Company vs. True Factory: Differentiation Protocol

| Indicator | Trading Company | True Factory | Verification Method |

|---|---|---|---|

| Ownership | No machine ownership; outsources production | Holds machine purchase/title documents | Demand machine invoices + cross-check with GST records |

| Pricing Structure | Quotes FOB; vague on production costs | Provides detailed BOM + process costing | Require line-item cost breakdown (material, labor, overhead) |

| Facility Control | “Manages” multiple units; no dedicated space | Single-site production with controlled workflow | Observe raw material to finished goods flow during visit |

| Documentation | Uses generic “manufacturer” claims; avoids factory license | Lists Factory Act License No. on invoices | Validate license with state Labour Department portal |

| Payment Terms | Demands 100% upfront or LC at sight | Accepts 30-70% progress payments (aligned with production milestones) | Insist on payment tied to verifiable production stages |

Critical Test: Ask for utility bills (electricity/water) for the facility under the company’s GSTIN. Trading companies cannot produce these; true factories can.

Top 5 Red Flags for US Buyers in India Sourcing

- “China-Style” Promises in India Context

- ❌ “Same quality as Shenzhen at 20% lower cost” (Ignores India’s skill gap)

-

✅ Action: Demand comparative samples tested by SGS/Bureau Veritas against Chinese benchmarks.

-

Opaque Supply Chain Disclosure

- ❌ Refusal to name sub-contractors or raw material suppliers

-

✅ Action: Require Tier-2 supplier list and conduct joint audits.

-

Payment Term Anomalies

- ❌ 100% advance payment demanded (common scam tactic)

-

✅ Standard: 20-30% deposit, 50% against production proof, 20-30% pre-shipment.

-

Certification Discrepancies

- ❌ “ISO 9001 Certified” without verifiable certificate number

-

✅ Action: Validate all certs via NABCB (India’s accreditation body).

-

Logistics Misrepresentation

- ❌ Claims “Delhi port access” for facilities 500km inland (adds 15+ days transit)

- ✅ Action: Require GPS-tagged facility photos and validate with logistics partners.

SourcifyChina Risk Mitigation Framework

Leverage our India Verification Matrix™ to de-risk:

1. Pre-Screen: AI-powered GSTIN/CIN validity check + customs export history scan.

2. Deep Dive: On-ground engineers conduct 82-point facility audit (including power backup capacity tests).

3. Compliance Lock: Automated US regulatory requirement mapping (e.g., Uyghur Forced Labor Prevention Act implications).

4. Payment Security: Escrow services with verified production milestone triggers.

2026 Trend: US buyers who invest ≥15 days in verification reduce supplier failure rates by 68% vs. rushed onboarding (SourcifyChina Benchmark Data).

Conclusion

India offers strategic diversification potential, but verification rigor must exceed China standards due to ecosystem immaturity. Prioritize legal authenticity, physical production control, and US-specific compliance over cost quotes. Trading companies can add value if transparently engaged – but never mistake them for factories. Your due diligence timeline should be 25-30% longer than for Chinese suppliers to account for documentation variability.

Proactively verify, incrementally scale, and secure your India transition with SourcifyChina’s embedded verification protocols. Contact our India Desk for a complimentary Risk Assessment Checklist.

SourcifyChina | Trusted by 412 Global Brands Since 2018

Objective Sourcing Intelligence. Zero Vendor Commissions. China & India Expertise.

www.sourcifychina.com/india-verification | +1 (646) 502-7710

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Shift: U.S. Companies Relocating Manufacturing from China to India

As global supply chains undergo rapid transformation, an increasing number of U.S.-based enterprises are relocating manufacturing operations from China to India. Driven by cost diversification, geopolitical risk mitigation, and favorable trade incentives, this transition presents both opportunity and complexity.

Procurement leaders face significant challenges in sourcing verified, reliable, and operationally capable suppliers in India—especially when navigating cultural, logistical, and compliance differences. Traditional sourcing methods often result in extended lead times, due diligence fatigue, and operational bottlenecks.

Why SourcifyChina’s Verified Pro List™ Delivers Immediate Value

SourcifyChina’s Verified Pro List is purpose-built for procurement teams managing cross-border transitions. For U.S. companies shifting from China to India, our platform eliminates the high-risk guesswork through:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Indian Suppliers | 80% reduction in supplier screening time; all partners audited for quality, capacity, export experience, and compliance |

| China Transition Expertise | Proven track record supporting 140+ U.S. firms relocating supply chains; insights into operational handoffs and risk mitigation |

| Bilingual Sourcing Support | Dedicated sourcing consultants fluent in English, Mandarin, and Hindi ensure seamless communication and negotiation |

| Time-to-Market Acceleration | Reduce supplier onboarding from 3–6 months to under 6 weeks |

| Risk Mitigation | Full documentation, site verification, and factory performance scoring included |

Result: Procurement teams save 200+ hours annually in supplier qualification and reduce first-batch defect risks by up to 65%.

Call to Action: Secure Your Competitive Advantage Today

The shift from China to India is not just a logistics move—it’s a strategic repositioning that demands precision, speed, and trust.

Don’t navigate this transition alone.

Leverage SourcifyChina’s Verified Pro List to fast-track your India sourcing strategy with suppliers who meet U.S. quality standards, scalability requirements, and compliance expectations.

👉 Contact our Sourcing Solutions Team Now:

– Email: [email protected]

– WhatsApp: +86 15951276160

Our consultants are available 24/5 to provide a free supplier shortlist tailored to your product category, volume, and technical specifications.

Act now—turn supply chain disruption into strategic advantage.

Trusted by procurement leaders at Fortune 500 and high-growth U.S. manufacturers since 2018.

SourcifyChina — Precision Sourcing. Proven Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.