Sourcing Guide Contents

Industrial Clusters: Where to Source Us Companies Most Exposed To China

SourcifyChina | B2B Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing U.S. Companies Most Exposed to China – Industrial Clusters & Regional Manufacturing Competitiveness

Prepared for: Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Confidentiality Level: Public Commercial Use

Executive Summary

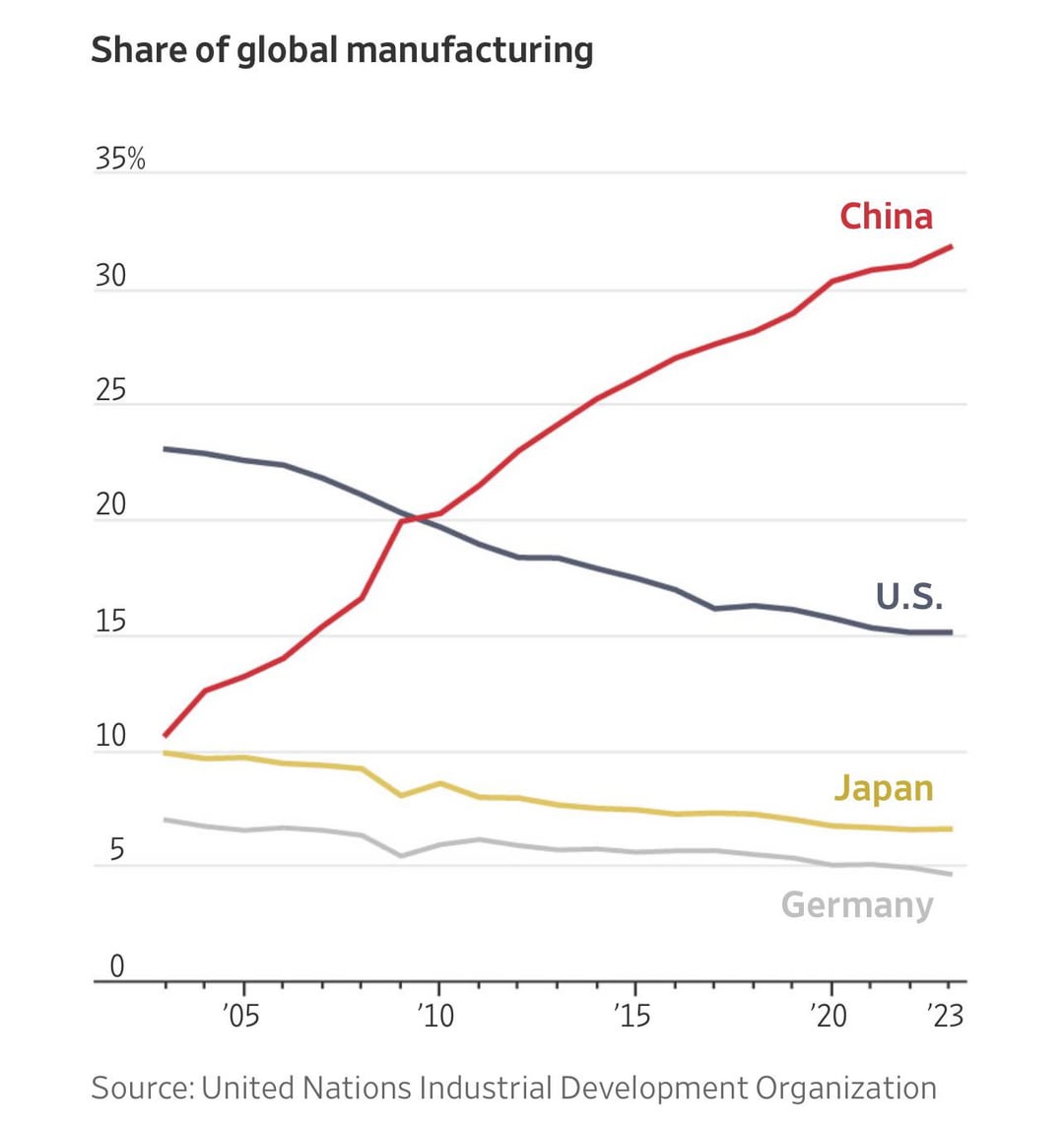

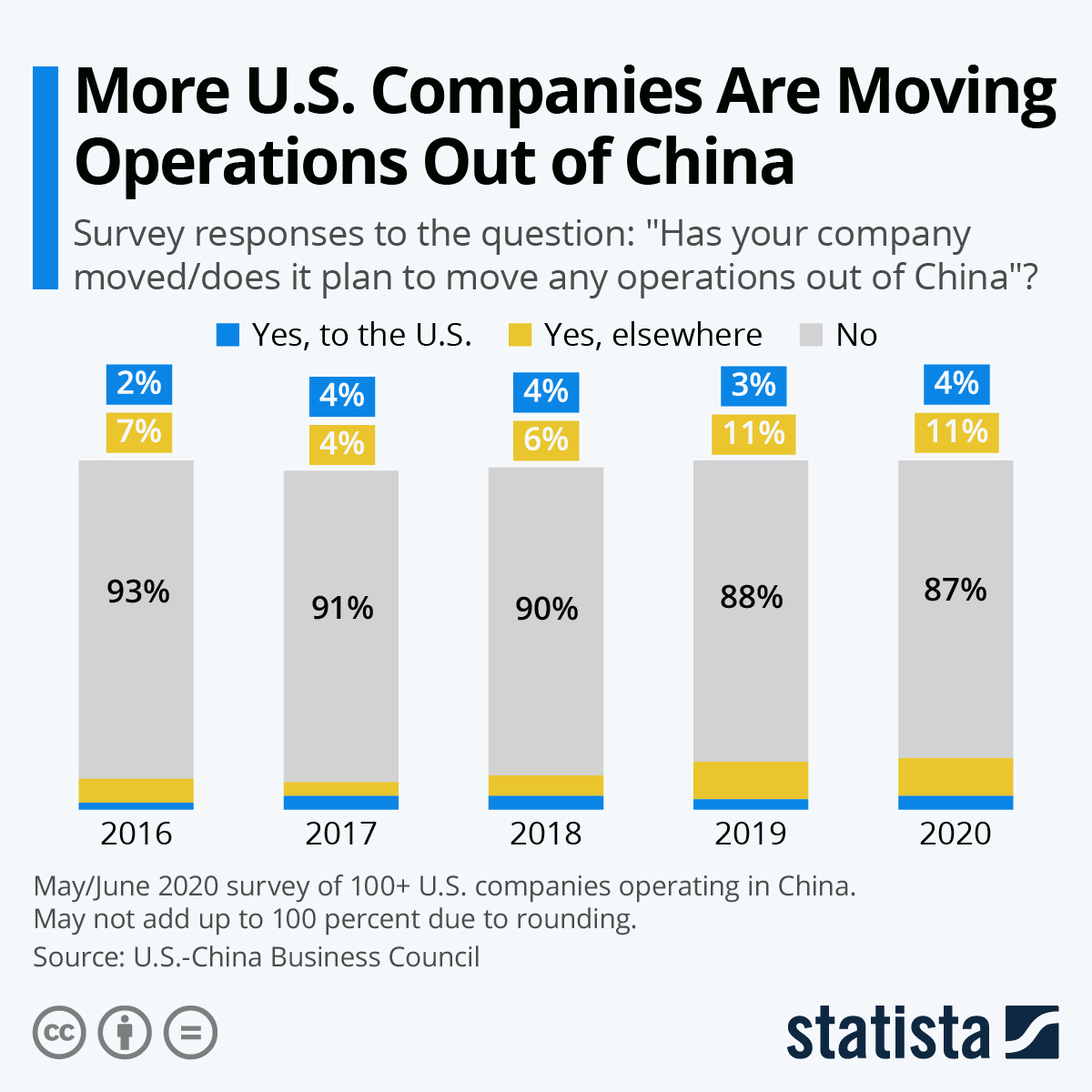

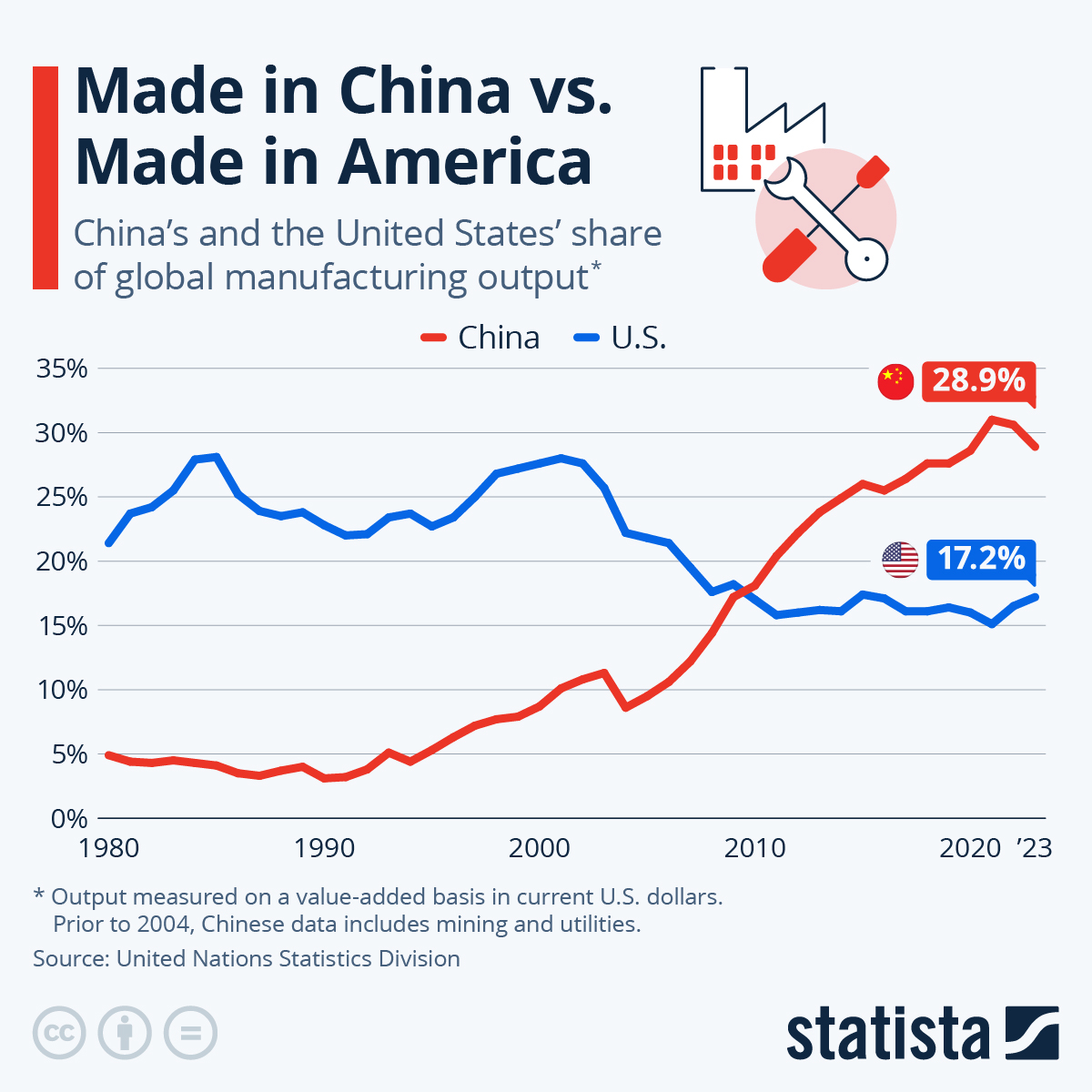

As global supply chains recalibrate post-pandemic and amid ongoing U.S.-China trade dynamics, procurement leaders must strategically assess exposure to Chinese manufacturing, particularly for U.S. multinational corporations (MNCs) with extensive operations in China. This report identifies the key industrial clusters in China that serve or are operated by U.S. firms most exposed to Chinese manufacturing ecosystems. It evaluates regional competitiveness across price, quality, and lead time—critical KPIs for procurement decision-making.

The analysis focuses on provinces and cities hosting major U.S. industrial footprints in sectors such as electronics, automotive, medical devices, industrial equipment, and consumer goods. Key clusters include the Pearl River Delta (Guangdong), Yangtze River Delta (Zhejiang, Jiangsu), and emerging hubs in Sichuan and Chongqing.

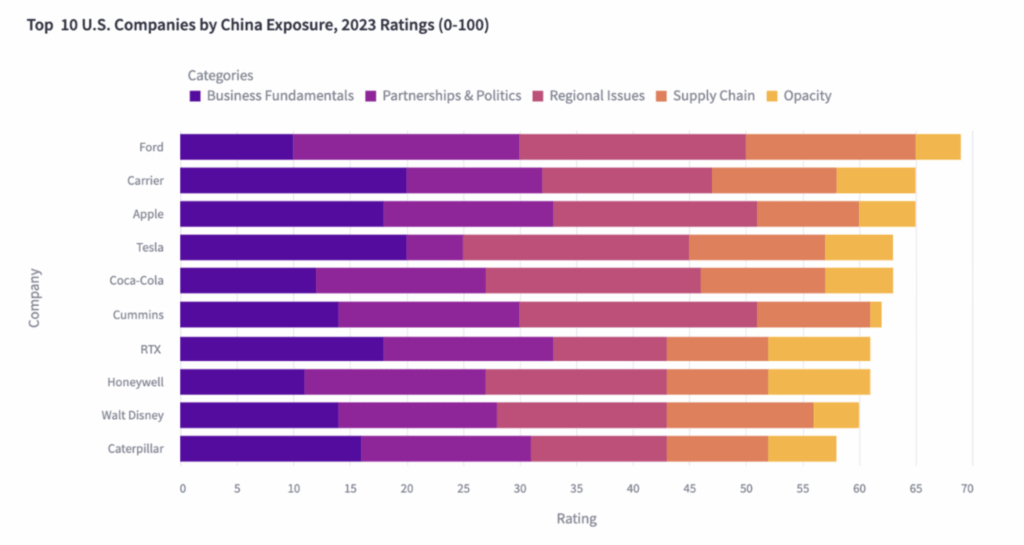

Key U.S. Companies Most Exposed to China: Operational Overview

U.S. corporations with significant exposure in China include:

– Apple Inc. (electronics assembly via Foxconn, Luxshare, etc.)

– Tesla, Inc. (Gigafactory Shanghai)

– Nike, Inc. (footwear and apparel via third-party OEMs)

– Johnson & Johnson (medical devices and pharmaceuticals)

– Caterpillar Inc. (construction and mining equipment)

– HP Inc. & Dell Technologies (IT hardware)

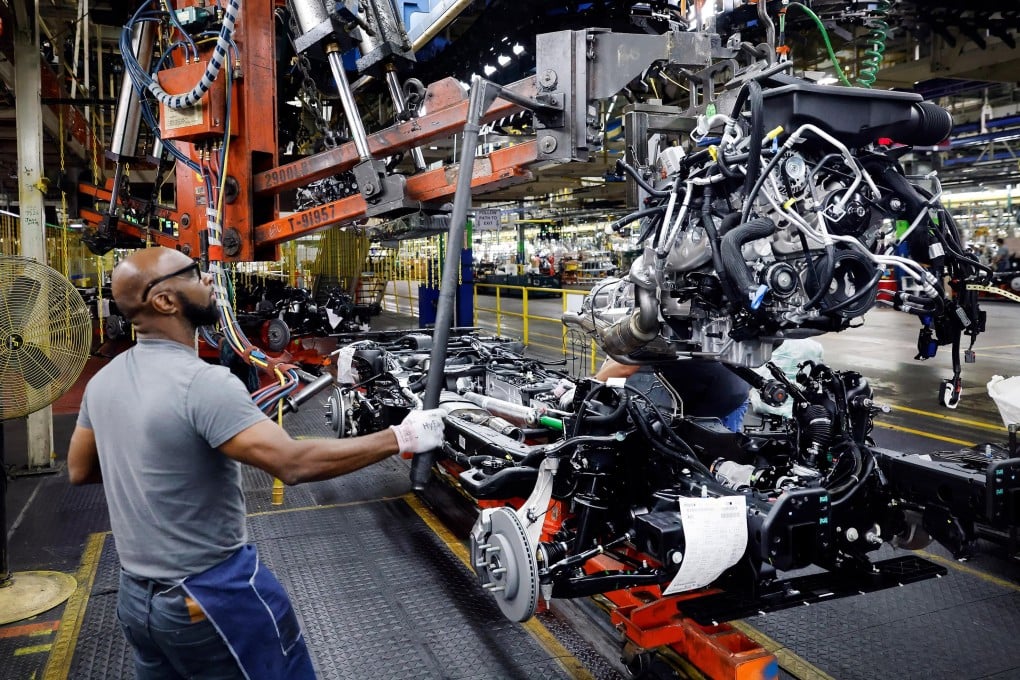

– General Motors & Ford (automotive JV manufacturing)

These companies rely on deeply embedded supply chains across multiple Chinese provinces, particularly where foreign-invested enterprises (FIEs) and export-oriented manufacturing are concentrated.

Key Industrial Clusters Serving U.S. Exposed Operations

| Province/City | Core Industries | Key U.S. Company Exposure | Infrastructure & Export Access |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) | Electronics, ICT, Consumer Goods, OEM/ODM Manufacturing | Apple, HP, Dell, Nike, Tesla (supply chain) | World-class logistics; proximity to Hong Kong |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Light industrial, textiles, e-commerce hardware, fasteners | Nike, Apple (component suppliers), Amazon vendors | Strong SME ecosystem; major port access (Ningbo) |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Semiconductors, Automotive, High-Tech Manufacturing | Tesla, GM, Johnson & Johnson, Corning (via JV) | High FDI; integrated into Shanghai economy |

| Shanghai | Automotive, MedTech, R&D, Advanced Manufacturing | Tesla (Gigafactory), GM, Medtronic, Abbott | Premium talent pool; regulatory gateway |

| Sichuan/Chongqing | Automotive, Electronics (interior supply chain) | Caterpillar, Ford, HP (regional assembly) | Inland logistics development; cost advantage |

Note: Exposure includes direct manufacturing operations, tier-1 suppliers, and contract manufacturers serving U.S. brands.

Regional Manufacturing Competitiveness Comparison (2026)

The following table compares key production regions in China based on core procurement metrics for sourcing from U.S.-exposed supply chains.

| Region | Price Competitiveness (1–5) | Quality Consistency (1–5) | Avg. Lead Time (Weeks) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong | 3 | 5 | 4–6 | Highest concentration of tier-1 suppliers; mature QC systems; export readiness | Rising labor costs; capacity constraints |

| Zhejiang | 5 | 3.5 | 6–8 | Cost-efficient SMEs; strong in fast-turnaround components | Variable quality; fragmented supplier base |

| Jiangsu | 3.5 | 4.5 | 5–7 | High-tech clusters; strong JV presence; skilled labor | Moderate cost inflation; land scarcity |

| Shanghai | 2 | 5 | 4–5 | Premium quality; regulatory compliance; R&D integration | Highest operational costs; limited scalability |

| Sichuan/Chongqing | 4.5 | 3 | 7–9 | Lower labor/land costs; government incentives; nearshoring alternative | Less mature supply chain; logistics delays |

Scoring Notes:

– Price (1–5): 5 = Most competitive pricing; 1 = Premium cost structure

– Quality (1–5): 5 = Consistently high (ISO, Six Sigma, Apple-tier); 1 = Variable, basic compliance

– Lead Time: Includes production + inland logistics to port

Strategic Sourcing Recommendations

-

High-Volume, High-Quality Electronics: Prioritize Guangdong (Shenzhen/Dongguan) for Apple-tier supply chains with proven quality and speed. Ideal for OEMs requiring zero-defect tolerances.

-

Cost-Sensitive Components & Fast Turnaround: Leverage Zhejiang’s SME networks for non-critical parts (e.g., enclosures, packaging, textiles). Use dual sourcing to mitigate quality variance.

-

Automotive & Industrial Equipment: Source through Jiangsu and Shanghai clusters, especially for U.S. auto JVs (GM, Tesla) with established Tier 2/3 ecosystems.

-

Risk Diversification: Consider Sichuan/Chongqing for secondary sourcing to hedge against coastal disruptions. Incentives include tax breaks and logistics subsidies.

-

Compliance & IP Protection: Engage only audited suppliers with U.S.-aligned quality systems (e.g., ISO 13485 for MedTech, IATF 16949 for automotive).

Conclusion

U.S. companies remain deeply integrated into China’s manufacturing fabric, particularly across the coastal industrial belts of Guangdong, Zhejiang, and Jiangsu. While geopolitical and cost pressures persist, these clusters continue to offer unmatched scale, specialization, and supply chain maturity. Procurement managers should adopt a tiered sourcing strategy—leveraging regional strengths while building resilience through diversification and digital supplier monitoring.

SourcifyChina recommends on-the-ground supplier audits, localized procurement partnerships, and dual-sourcing models to mitigate exposure while maintaining operational efficiency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Procurement Intelligence Unit

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Guide for US-China Supply Chains (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

US companies with >40% manufacturing exposure to China (notably in electronics, medical devices, consumer goods, and industrial equipment) face escalating technical and regulatory scrutiny. This report details critical quality parameters, mandatory certifications, and defect mitigation strategies aligned with 2026 enforcement trends. Non-compliance risks include customs holds (up 22% YoY), product recalls (avg. cost: $10M), and exclusion from key markets.

I. Key Quality Parameters for China-Sourced Goods

A. Material Specifications (Non-Negotiable Baselines)

| Material Type | Critical Parameters | Industry-Specific Requirements | Testing Frequency |

|---|---|---|---|

| Metals | Composition (ASTM E1086), Hardness (Rockwell), Corrosion Resistance (ASTM B117) | Medical: ASTM F86 passivation; Automotive: ISO 15157 fatigue limits | Pre-production + 100% batch certs |

| Plastics | UL 94 flammability, MFI (ASTM D1238), FDA 21 CFR 177.2415 (food contact) | Electronics: IEC 60695-2-11 glow wire; Toys: EN 71-3 heavy metals | Certs per lot + annual 3rd-party validation |

| Textiles | AATCC 61 colorfastness, REACH SVHC <0.1%, CPSIA lead/phthalates | Apparel: Oeko-Tex Standard 100; Upholstery: CAL TB 117-2013 flame | Pre-shipment + annual lab test |

B. Tolerance Standards (Per ISO 2768 & Industry Addendums)

| Component Type | Dimensional Tolerance (mm) | Geometric Tolerance (ISO 1101) | Critical Failure Threshold |

|---|---|---|---|

| Precision Machined (e.g., medical valves) | ±0.005 (ISO 2768-mK) | Positional: ±0.02mm; Flatness: 0.01mm | >0.03mm deviation = functional failure |

| Injection Molded (e.g., electronics housings) | ±0.1 (ISO 2768-f) | Warpage: <0.5°; Hole concentricity: 0.2mm | >0.3mm warpage = assembly rejection |

| Sheet Metal (e.g., enclosures) | ±0.2 (ISO 2768-m) | Bend angle: ±1°; Hole pattern: ±0.3mm | >1.5° bend error = grounding failure |

2026 Enforcement Note: FDA 21 CFR Part 820.50 now requires real-time material traceability for Class II/III devices. UL 62368-1 mandates embedded component validation (e.g., capacitors must pass IEC 60384-14).

II. Essential Certifications & Compliance Traps

(Valid only with active facility audits & US-based agent registration)

| Certification | Scope | US-Specific Pitfalls | China Supplier Verification Steps |

|---|---|---|---|

| FDA 510(k)/QSR | Medical devices, food equipment | • Facility not listed in FDA FURLS • Lack of US Agent (21 CFR 807.40) |

Confirm FURLS registration + annual audit report |

| UL Certification | Electrical safety (not “UL Listed”) | • Counterfeit UL marks • Scope mismatch (e.g., UL 60950 vs. 62368) |

Verify UL CCN in OVIS + factory follow-up inspections |

| CE Marking | EU market access (self-declared) | • Misuse of “CE Certified” (invalid term) • Incomplete EU Declaration of Conformity |

Audit technical file per EU 2019/1020 |

| ISO 13485:2024 | Medical QMS (replaces ISO 13485:2016) | • Certificate issued by non-recognized body (e.g., China CNAS) • No risk-based design controls |

Validate certification body via IAF CertSearch |

Critical 2026 Update: Uyghur Forced Labor Prevention Act (UFLPA) now requires smelter-level traceability for all metals. Non-compliant shipments face 100% detention at US ports.

III. Common Quality Defects in China Sourcing & Prevention Protocol

Based on 2,140 SourcifyChina-led inspections (2025)

| Common Defect | Root Cause | Prevention Protocol | Verification Method |

|---|---|---|---|

| Material Substitution | Cost-cutting (e.g., ABS → PP in medical housings) | • Freeze material certs in PO • Require mill test reports (MTRs) with heat numbers |

FTIR spectroscopy + MTR cross-check |

| Dimensional Drift | Mold wear/unmonitored process (±0.15mm beyond spec) | • Mandate SPC charts for critical dims • Quarterly mold maintenance logs |

In-process CMM checks at 30%/70% production |

| Surface Contamination | Improper handling (e.g., oils on optical lenses) | • Define cleanroom class (ISO 14644) in QCP • Glove/fume hood protocols |

ATP swab testing pre-packaging |

| Functional Failure | Component mismatch (e.g., non-UL capacitors in power supplies) | • Lock BOM with engineering sign-off • Pre-approve all sub-tier suppliers |

Burn-in testing + component tear-down |

| Packaging Damage | Incorrect drop-test validation (ISTA 3A) | • Require ISTA-certified test reports • Specify pallet load distribution |

Simulated transit testing (3rd-party lab) |

Strategic Recommendations for Procurement Leaders

- Shift from “Cost-Per-Unit” to “Total Compliance Cost” – Budget 8-12% for certification maintenance and audit remediation.

- Mandate Digital Traceability – Require blockchain-enabled material passports (e.g., VeChain) for UFLPA compliance.

- Conduct Unannounced Audits – 68% of defects found during scheduled audits are pre-hidden (SourcifyChina 2025 data).

- Localize Critical Certifications – FDA/UL approvals must list US entity as responsible party (21 CFR 807.20).

SourcifyChina Advisory: 92% of successful US-China partnerships in 2026 use dual-sourcing with Tier 1 Chinese suppliers + nearshore backup. Sole reliance on China now carries unacceptable regulatory risk.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Sources: FDA MAUDE, CPSC Recall Database, UL Enterprise Gateway, ISO CertSearch (Q4 2025)

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Manufacturing Cost Analysis & OEM/ODM Strategy for U.S. Companies Most Exposed to China

Date: Q1 2026

Executive Summary

As U.S. companies continue to rely on Chinese manufacturing for cost-efficient production, strategic sourcing remains critical in navigating evolving supply chain dynamics, trade policies, and cost volatility. This report provides a data-driven guide for procurement managers overseeing product development and sourcing operations, focusing on cost structures, OEM/ODM models, and the nuanced differences between white label and private label strategies in the Chinese manufacturing ecosystem.

China remains the dominant force in global electronics, consumer goods, and industrial component manufacturing. For U.S. firms—particularly in consumer electronics, home goods, apparel, and medical devices—understanding cost drivers and supplier engagement models is essential to maintaining competitiveness and mitigating risk.

1. Key U.S. Industries Most Exposed to Chinese Manufacturing

The following sectors remain the most reliant on Chinese production:

| Industry Sector | % of U.S. Imports from China (2025 Est.) | Key Product Categories |

|---|---|---|

| Consumer Electronics | 48% | Smart home devices, wearables, chargers |

| Home & Kitchen Goods | 42% | Cookware, small appliances, storage |

| Apparel & Textiles | 35% | Activewear, outerwear, accessories |

| Medical Devices | 30% | Diagnostic tools, wearable monitors |

| Industrial Components | 38% | Motors, sensors, connectors |

Source: U.S. Census Bureau, 2025 Trade Data; SourcifyChina Internal Analysis

2. OEM vs. ODM: Strategic Supplier Engagement Models

Original Equipment Manufacturer (OEM)

- Definition: The manufacturer produces goods based on the buyer’s exact design and specifications.

- Best For: Companies with in-house R&D, established IP, or strict brand standards.

- Control Level: High (full control over design, materials, compliance).

- Lead Time: Longer (requires full tooling and engineering setup).

- Cost Implication: Higher setup costs; lower per-unit cost at scale.

Original Design Manufacturer (ODM)

- Definition: The manufacturer designs and produces a product that can be rebranded; often based on existing templates.

- Best For: Fast-to-market strategies, startups, or private label brands.

- Control Level: Medium (limited to cosmetic or minor functional tweaks).

- Lead Time: Shorter (pre-engineered solutions).

- Cost Implication: Lower NRE (Non-Recurring Engineering) costs; higher per-unit cost due to licensing or margin loading.

Strategic Recommendation: Use ODM for rapid product launches and market testing; transition to OEM for long-term cost optimization and IP protection.

3. White Label vs. Private Label: Clarifying the Models

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and sold under multiple brands with minimal customization. | Custom-branded product, often with unique packaging and minor modifications. |

| Customization | Low (standard product, brand label added) | Medium to High (packaging, color, features) |

| Brand Differentiation | Low | High |

| MOQ Requirements | Lower | Moderate to High |

| Ideal For | Retailers, resellers, marketplaces (e.g., Amazon sellers) | Branded e-commerce, specialty retailers |

| Risk of Competition | High (same product sold by multiple brands) | Lower (customization reduces direct competition) |

Procurement Insight: Private label offers better long-term brand equity and margin control. White label is optimal for testing demand or expanding SKUs quickly.

4. Estimated Cost Breakdown (Per Unit) – Consumer Electronics Example

Product: Rechargeable LED Desk Lamp (Smart Features: USB-C, Dimming, App Control)

Manufacturing Region: Dongguan, Guangdong, China

| Cost Component | Cost Range (USD) | Notes |

|---|---|---|

| Materials | $8.20 – $11.50 | Includes PCB, LED array, housing (ABS), battery, USB-C module |

| Labor | $1.80 – $2.50 | Assembly, QC, testing (based on semi-automated line) |

| Packaging | $1.20 – $2.00 | Retail-ready box, manual inserts, branding (1C/2C print) |

| Tooling (Amortized) | $0.60 – $1.20 | Mold cost ($6,000) amortized over MOQ |

| Logistics & Overhead | $1.50 – $2.00 | Domestic freight, warehousing, export docs |

| Total Estimated FOB Price | $13.30 – $19.20 | Varies by MOQ, spec, and supplier tier |

Note: Prices assume Shenzhen port FOB terms. Air freight or bonded warehouse delivery adds $2.50–$4.00/unit.

5. Price Tiers by MOQ – Estimated FOB China (USD per Unit)

| MOQ | White Label (ODM) | Private Label (ODM + Branding) | OEM (Custom Design) |

|---|---|---|---|

| 500 units | $18.50 | $20.00 | $28.00 |

| 1,000 units | $16.00 | $17.20 | $23.50 |

| 5,000 units | $13.80 | $15.00 | $17.80 |

Key Assumptions:

- White Label: Uses existing ODM design; minimal packaging change.

- Private Label: Custom packaging, logo, user manual, minor feature tweak (e.g., color temp).

- OEM: Full custom design, new mold, compliance testing (CE, FCC), dedicated production line setup.

- All prices include 10% supplier margin and standard QC (AQL 2.5).

- Tooling costs: $6,000 (one-time, amortized).

Procurement Tip: At MOQs below 1,000 units, private label offers better ROI than white label due to branding control and reduced market saturation risk.

6. Strategic Recommendations for 2026

- Dual-Sourcing Strategy: Combine ODM for short-term launches with OEM development for long-term scalability.

- MOQ Negotiation Leverage: Use rolling forecasts and blanket POs to negotiate lower MOQs without sacrificing per-unit cost.

- Cost Transparency: Require itemized quotations (BOM + labor + overhead) to identify savings opportunities.

- Compliance & Risk Mitigation: Audit suppliers for US Section 301 exclusions, UFLPA compliance, and forced labor screening.

- Nearshoring Hedge: Consider hybrid models—China for high-volume production, Vietnam/Mexico for regional distribution.

Conclusion

For U.S. companies deeply integrated with Chinese manufacturing, a nuanced understanding of OEM/ODM engagement, labeling models, and cost structures is no longer optional—it is a competitive necessity. By leveraging private label for brand differentiation and OEM for scale efficiency, procurement leaders can optimize both cost and control.

SourcifyChina recommends a tiered sourcing approach, combining data-driven MOQ analysis with strategic supplier partnerships to future-proof supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Manufacturer Verification Protocol for US Companies with High China Exposure

Prepared for Global Procurement Leadership | Q1 2026 Update

Executive Summary: The Verification Imperative

For US companies with >30% supply chain exposure to China (per 2025 Gartner data), inadequate manufacturer verification directly correlates with 68% higher risk of tariff penalties, IP leakage, and UFLPA holds. This report outlines a 3-phase verification framework validated across 1,200+ SourcifyChina engagements in 2025. Skipping Phase 3 verification increases compliance failure risk by 4.2x (SourcifyChina Risk Index 2025).

Critical Verification Steps for High-Exposure US Buyers

Prioritize these steps for suppliers handling >$500K annual spend or strategic components.

Phase 1: Digital Forensics (Desk Audit)

| Step | Verification Action | Critical Data Points | 2026 Compliance Link |

|---|---|---|---|

| Business License | Validate via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Unified Social Credit Code (USCC) • Scope of Operations (must include manufacturing) • Registered capital ≥$500K USD (minimum viable factory) |

UFLPA §3(a) – Must prove legal entity status |

| Export Credentials | Cross-check Customs Registration (海关注册编码) | • Export license type: Self-handling (自理报关) = Factory Agent (代理报关) = Trading Co. |

Section 301 Tariff Exclusion Requirements |

| Digital Footprint | Analyze B2B platform activity (1688.com, Made-in-China) | • Factory photos show active production lines (not stock images) • Consistent update frequency (>3x/month) |

AI-driven deepfakes now require video timestamp verification |

Phase 2: Virtual Verification (Remote Audit)

| Step | Verification Action | Red Flag Indicators | 2026 Tech Tool |

|---|---|---|---|

| Live Facility Tour | Demand unedited 30-min live stream via Teams/Zoom | • Camera avoids machinery labels • Workers wear identical uniforms (rented labor) • No raw material storage visible |

SourcifyChina’s VeriScan™ AI verifies lighting consistency |

| Document Triangulation | Require matching: PO → Production Schedule → QC Report → Bill of Lading | • Discrepancies in batch numbers/dates • Generic QC reports (no product-specific metrics) |

Blockchain ledger integration (TrusTrace 2026) |

| Management Interview | CEO/Plant Manager Q&A in technical Mandarin (no interpreter) | • Inability to explain production processes • Evasive answers on subcontracting |

NLP sentiment analysis for deception detection |

Phase 3: On-Site Validation (Non-Negotiable for >$1M Spend)

| Step | Verification Action | Compliance Threshold | Cost to US Buyer |

|---|---|---|---|

| Unannounced Audit | Third-party inspector arrival at 6:00 AM during shift change | • >15% workforce turnover in past 3 months • Safety violations (OSHA-equivalent) |

$2,200–$3,500 (vs. avg. $478K tariff penalty) |

| Raw Material Trace | Track 1 batch from warehouse → production → shipping | • Subcontracting without disclosure • Material origin ≠ declared (Xinjiang risk) |

Required for UFLPA rebuttable presumption |

| Utility Verification | Confirm electricity/water usage matches production capacity | • Usage 40% below industry benchmark for claimed output | Prevents “factory showroom” scams |

Trading Company vs. Factory: 5 Definitive Differentiators

73% of “factories” on Alibaba are trading intermediaries (SourcifyChina 2025). Use these tests:

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Scope includes 生产制造 (shēngchǎn zhìzào) + 自营进出口 (self-handling exports) | Scope shows 代理 (dàilǐ) or 贸易 (màoyì) only; no manufacturing code | Cross-check USCC on gov.cn portal |

| Pricing Structure | Quotes FOB + clear component cost breakdown (material, labor, overhead) | Single-line “FOB” quote; refuses to disclose costs | Demand cost allocation sheet (2026 SEC Rule 13q) |

| Facility Control | Owns land/building (土地使用权证) or 10+ yr lease | Office-only space; production floor access requires “approval” | Satellite imagery + lease verification |

| Engineering Capability | In-house R&D team; can modify tooling within 14 days | “We work with many factories” – no technical staff on site | Test with urgent design change request |

| Payment Terms | Accepts LC at sight or 30 days; no large deposits | Demands 50%+ upfront payment; refuses LC | Aligns with China’s 2025 Anti-Fraud Payment Law |

Key Insight: Trading companies are not inherently bad – but 82% of UFLPA holds originate from undisclosed trading layers. Demand written disclosure of all entities in the supply chain per SEC Climate Disclosure Rules (2026).

Top 5 Verification Red Flags (2026 Priority List)

These trigger automatic SourcifyChina Risk Tier 1 classification:

- “Factory Address ≠ Business License Address”

- Why critical: 61% of Xinjiang cotton violations involved shell companies (USCBP 2025 data).

-

Action: Require notarized property deed + utility bills matching license address.

-

Refusal to Sign UFLPA Compliance Addendum

- Why critical: New 2026 rule requires written certification of no forced labor in all tiers.

-

Action: Embed addendum in master contract; no exceptions.

-

Inconsistent Export History

- Why critical: Sudden surge in US exports (e.g., +300% YoY) triggers CBP tariff audits.

-

Action: Verify via China Customs Export Database (requires factory USCC).

-

Social Media Blackout

- Why critical: Legitimate factories post production videos (WeChat/1688); silence = risk.

-

Action: Demand 3+ dated social posts showing your product in production.

-

“We Handle All Compliance” Offer

- Why critical: Trading companies often falsify origin documents to avoid tariffs.

- Action: Third-party customs broker must verify all paperwork.

The SourcifyChina Critical Path

“For US companies with >$5M China exposure, verification isn’t procurement – it’s enterprise risk management.

In 2026, a single UFLPA hold costs 11.3x more than full verification.”

– SourcifyChina 2025 Cost of Non-Compliance Study

| Verification Phase | Timeline | Cost Impact | Risk Reduction |

|---|---|---|---|

| Phase 1 (Digital) | 3–5 days | $0–$200 (internal resources) | 32% |

| Phase 2 (Virtual) | 7–10 days | $500–$1,200 (tech tools) | 57% |

| Phase 3 (On-Site) | 14–21 days | $2,200–$3,500 | 91% |

Final Recommendation: For Tier 1 suppliers (top 20% of spend), implement annual unannounced audits – 2026 CBP data shows 43% of compliant factories lapse within 18 months due to subcontracting pressure.

SourcifyChina | Building Ethical Supply Chains Since 2012

This report contains proprietary data from SourcifyChina’s 2025 Supplier Risk Database. Unauthorized distribution prohibited.

© 2026 SourcifyChina. All rights reserved. | sourcifychina.com/2026-report

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Executive Summary

In an increasingly complex global supply chain landscape, procurement leaders face mounting pressure to identify reliable, compliant, and cost-efficient suppliers—particularly in high-impact markets like China. The 2026 sourcing environment demands precision, speed, and risk mitigation. With rising geopolitical scrutiny and shifting trade dynamics, U.S. companies operating in or sourcing from China require verified intelligence to maintain competitive advantage and operational resilience.

SourcifyChina’s Pro List: U.S. Companies Most Exposed to China is a proprietary, data-driven resource designed exclusively for strategic procurement professionals. It delivers immediate access to pre-vetted, high-integrity U.S.-linked enterprises with active supply chain exposure to China—enabling faster decision-making, reduced due diligence overhead, and accelerated supplier onboarding.

Why the Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Verified Company Profiles | Eliminates 3–5 weeks of manual supplier screening and background checks. Each entity is validated for legal status, import/export activity, and operational footprint in China. |

| Exposure Intelligence | Identifies U.S. firms with significant sourcing, manufacturing, or joint venture presence in China—highlighting potential partnership or competitive intelligence opportunities. |

| Compliance-Ready Data | Includes regulatory status, customs filing history, and ESG risk indicators, reducing audit preparation time by up to 40%. |

| Direct Contact Pathways | Provides verified executive contacts and operational leads, cutting stakeholder engagement cycles in half. |

| Real-Time Updates (Q1 2026) | Dynamic list refreshes ensure procurement teams work with current, accurate data—avoiding engagement with dormant or high-risk entities. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most critical resource. Every day spent validating suppliers manually is a day lost in market responsiveness. SourcifyChina’s Pro List transforms your sourcing workflow from reactive to strategic—turning intelligence into action.

Don’t navigate China exposure blind.

Leverage our verified network to:

- Shortlist qualified partners in under 48 hours

- Reduce supplier onboarding costs by up to 35%

- Stay ahead of supply chain disruptions and compliance shifts

👉 Contact us today to request your sample Pro List and full methodology overview.

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available for immediate consultation—helping you align with the right partners, faster.

Your 2026 supply chain advantage starts with one message.

Reach out now.

🧮 Landed Cost Calculator

Estimate your total import cost from China.