Sourcing Guide Contents

Industrial Clusters: Where to Source U.S. Companies Investing In China

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis – U.S. Companies Investing in China: Key Industrial Clusters & Regional Sourcing Insights

Executive Summary

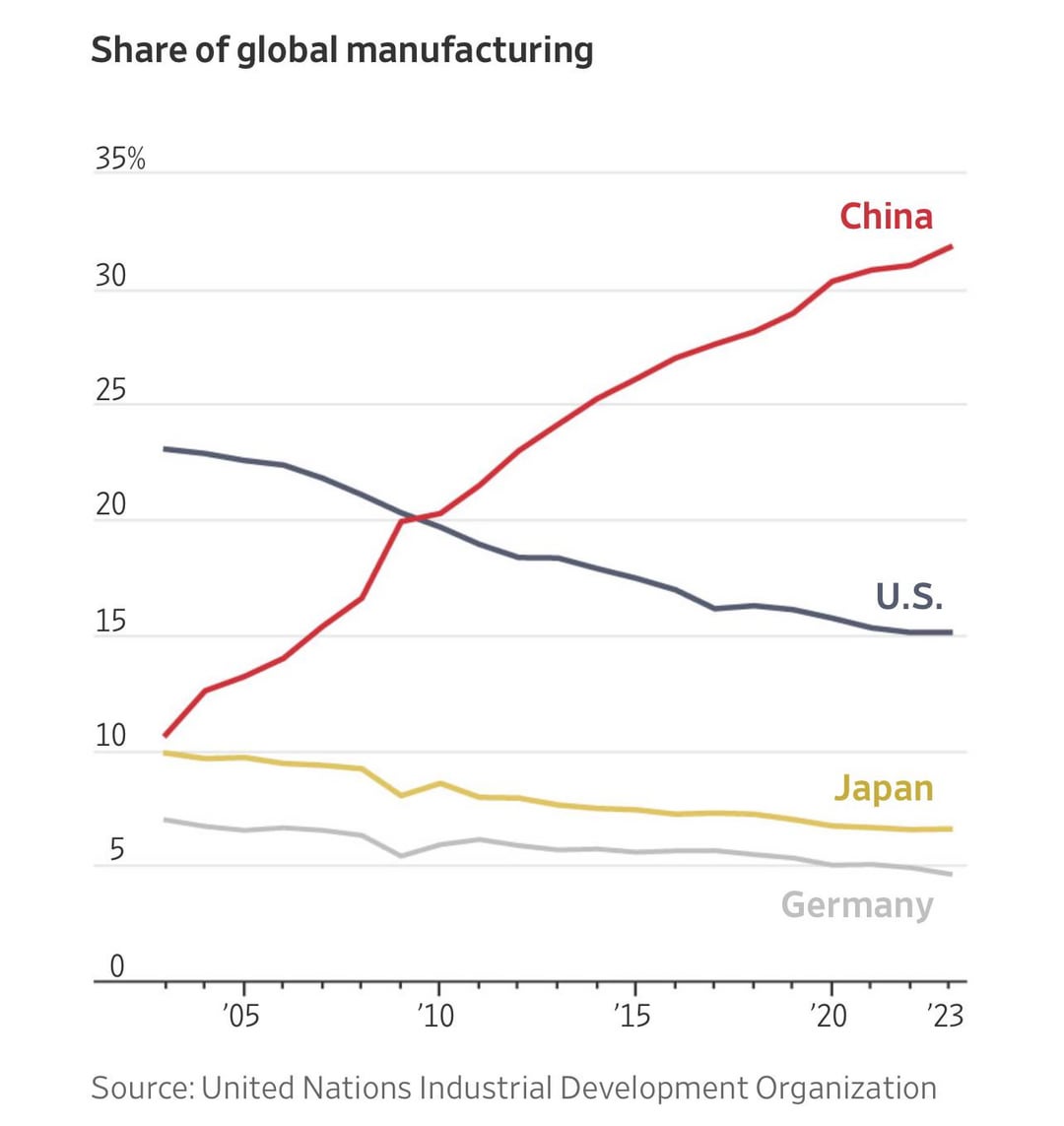

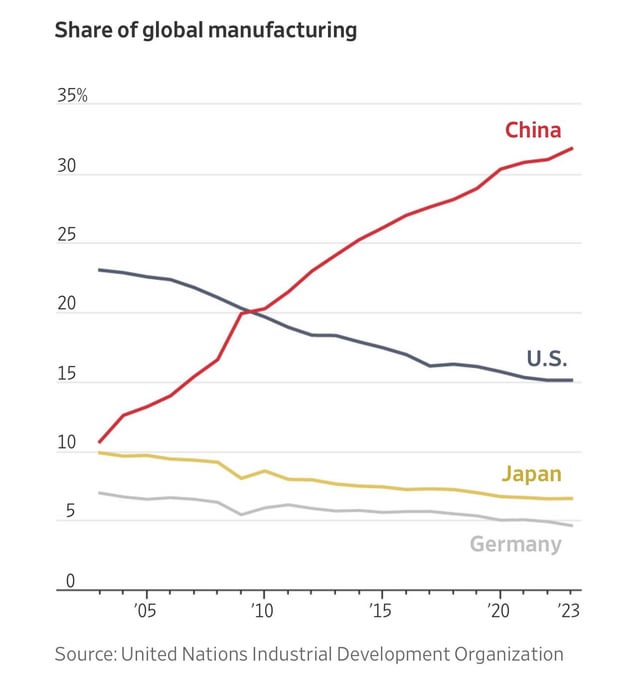

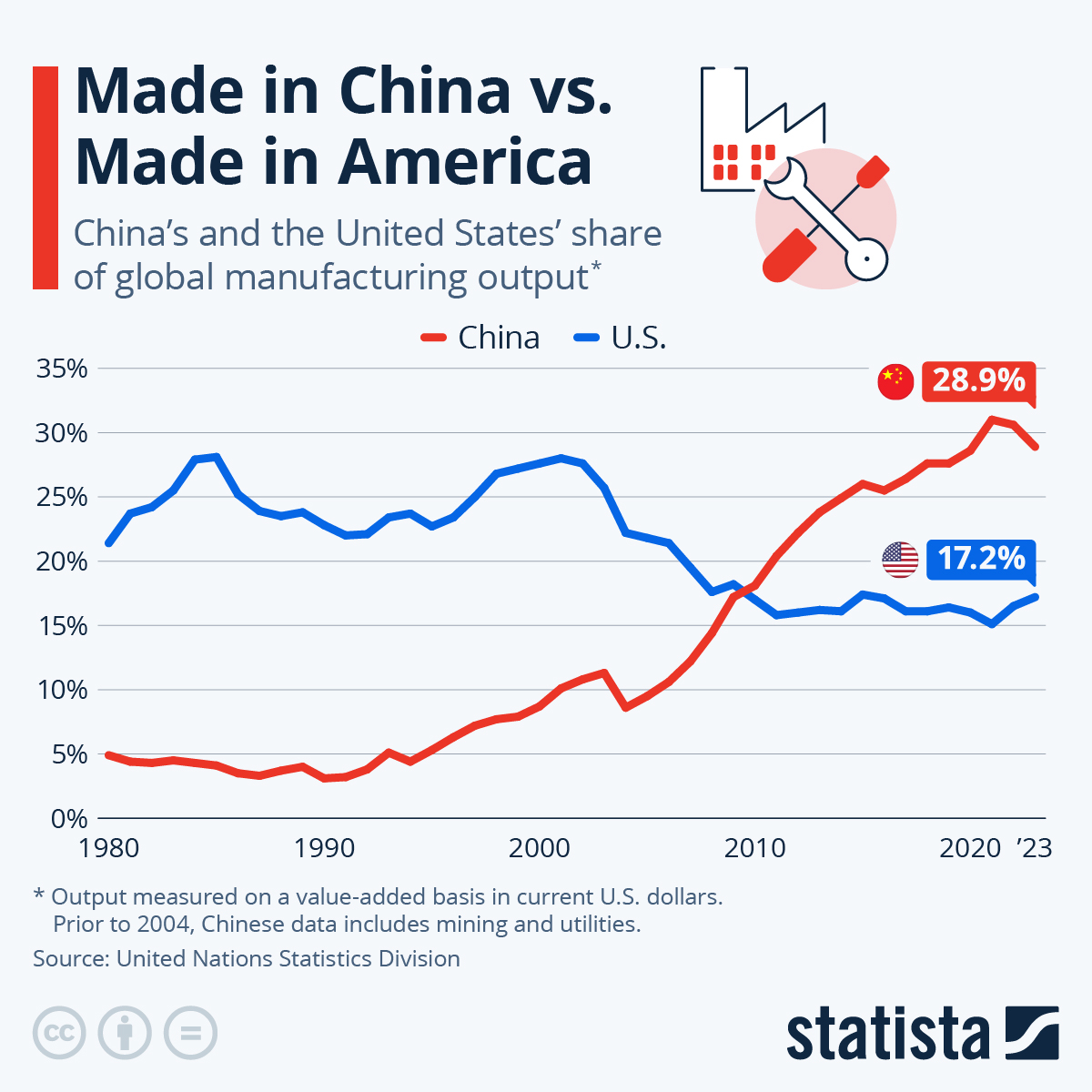

As of 2026, U.S. companies continue to maintain a strategic manufacturing and sourcing footprint in China, despite evolving geopolitical dynamics and supply chain diversification trends. While nearshoring and friend-shoring initiatives have gained momentum, China remains a critical node for high-volume, high-precision, and cost-competitive manufacturing, particularly for U.S. multinationals with established operations.

This report provides a comprehensive analysis of the key industrial clusters in China where U.S. companies have invested significantly in manufacturing. It evaluates regional strengths across Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong—the top five provinces hosting U.S. manufacturing investments—based on price competitiveness, product quality, and lead time performance. The findings are intended to guide procurement managers in optimizing sourcing strategies with U.S.-affiliated or U.S.-invested suppliers in China.

Market Context: U.S. Investment in Chinese Manufacturing (2026)

U.S. foreign direct investment (FDI) in China’s manufacturing sector remains robust, with over $120 billion in cumulative stock FDI as of Q1 2026, according to MOFCOM and U.S. Bureau of Economic Analysis data. Key sectors include:

- Electronics & Semiconductors (Texas Instruments, Intel, Apple suppliers)

- Automotive & EV Components (Tesla, GM, Ford, Bosch U.S.-backed operations)

- Medical Devices & Life Sciences (Medtronic, Johnson & Johnson, GE HealthCare)

- Industrial Machinery & Automation (Honeywell, 3M, Emerson)

- Consumer Goods & Appliances (P&G, Whirlpool, Nike contract manufacturers)

These U.S. investments are not typically fully owned factories but often take the form of joint ventures, wholly foreign-owned enterprises (WFOEs), or strategic partnerships with tier-1 Chinese OEMs/ODMs. Sourcing through these entities offers procurement teams access to globally aligned quality standards, IP protection frameworks, and supply chain transparency—critical for compliance and risk mitigation.

Key Industrial Clusters for U.S. Manufacturing Investments

1. Guangdong Province (Pearl River Delta – Shenzhen, Dongguan, Guangzhou)

- Core Industries: Electronics, telecom, consumer tech, EV charging systems

- U.S. Presence: Apple ecosystem (Foxconn, Luxshare), Tesla suppliers, Qualcomm partners

- Advantages: Deep supply chain integration, export infrastructure, skilled labor

- Notable Hubs: Shenzhen (R&D + hardware), Dongguan (OEM manufacturing)

2. Zhejiang Province (Hangzhou, Ningbo, Yiwu)

- Core Industries: Smart appliances, e-commerce hardware, textile machinery, green tech

- U.S. Presence: Amazon hardware partners, General Electric smart home suppliers, Nike subcontractors

- Advantages: Agile SME ecosystem, e-commerce logistics, cost-effective prototyping

- Notable Hubs: Ningbo (industrial exports), Yiwu (small lot sourcing)

3. Jiangsu Province (Suzhou, Wuxi, Nanjing)

- Core Industries: Semiconductor packaging, precision engineering, biopharma

- U.S. Presence: Intel assembly sites, Applied Materials partners, Merck & Co. facilities

- Advantages: High-tech infrastructure, proximity to Shanghai, strong IP enforcement

- Notable Hubs: Suzhou Industrial Park (SIP) – home to over 500 U.S. firms

4. Shanghai Municipality

- Core Industries: Automotive (Tesla Gigafactory), medtech, aerospace components

- U.S. Presence: Tesla, Boeing suppliers, Abbott Laboratories, Honeywell

- Advantages: Regulatory access, talent pool, international logistics

- Note: Higher costs but premium compliance and traceability

5. Shandong Province (Qingdao, Yantai)

- Core Industries: Heavy machinery, chemical processing, food processing equipment

- U.S. Presence: 3M, Cummins, John Deere joint ventures

- Advantages: Port access, lower labor costs, raw material proximity

- Emerging in: Industrial automation and green hydrogen equipment

Comparative Regional Analysis: Sourcing Performance Matrix

The table below evaluates key production regions in China based on sourcing KPIs critical to global procurement decision-making. Ratings are derived from SourcifyChina’s 2026 supplier audit database, client feedback, and on-ground partner assessments.

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Orders) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4.2/5) | ⭐⭐⭐⭐☆ (4.3/5) | 4–6 weeks | High-volume electronics, IoT devices, fast turnaround OEMs |

| Zhejiang | ⭐⭐⭐⭐★ (4.6/5) | ⭐⭐⭐☆☆ (3.7/5) | 5–7 weeks | Cost-sensitive consumer goods, small-batch innovation, e-commerce |

| Jiangsu | ⭐⭐⭐☆☆ (3.8/5) | ⭐⭐⭐⭐★ (4.7/5) | 6–8 weeks | High-precision engineering, semiconductors, regulated medical devices |

| Shanghai | ⭐⭐☆☆☆ (2.9/5) | ⭐⭐⭐⭐★ (4.8/5) | 7–9 weeks | Automotive systems, aerospace, compliance-heavy industries |

| Shandong | ⭐⭐⭐★☆ (4.4/5) | ⭐⭐⭐☆☆ (3.6/5) | 6–8 weeks | Heavy industrial equipment, chemical machinery, bulk orders |

Rating Scale:

– Price: Higher score = more competitive pricing

– Quality: Based on ISO compliance, defect rates, process maturity (e.g., Six Sigma, TQM)

– Lead Time: Standard production + inland logistics to port (excluding shipping)

Strategic Recommendations for Procurement Managers

-

Leverage U.S.-Invested Facilities for Compliance & Traceability

Prioritize suppliers with U.S. ownership or joint ventures for enhanced IP protection, audit readiness, and ESG compliance—especially in regulated sectors (medical, aerospace, automotive). -

Balance Cost & Quality by Region

Use Zhejiang and Shandong for cost-driven, non-critical components. Reserve Jiangsu and Shanghai for high-reliability or safety-critical applications. -

Optimize Lead Time with Guangdong’s Ecosystem

For agile product development and rapid scaling (e.g., consumer electronics), Guangdong’s integrated supply chains offer the fastest time-to-market. -

Dual-Source Across Regions to Mitigate Risk

Combine a primary supplier in Jiangsu (quality) with a secondary in Zhejiang (cost/flexibility) to hedge against disruptions. -

Engage Local Sourcing Partners for Due Diligence

Utilize third-party verification (e.g., SourcifyChina’s audit services) to validate claims of U.S. investment, especially with subcontractors.

Conclusion

While the global supply chain landscape continues to evolve, China remains a pivotal manufacturing base for U.S. companies. The concentration of U.S. investment in high-capability industrial clusters—particularly in Guangdong, Jiangsu, and Shanghai—offers procurement managers access to globally aligned production standards, technological sophistication, and scalable capacity.

By understanding regional differentiators in price, quality, and lead time, procurement leaders can make data-driven decisions that balance cost efficiency, risk mitigation, and operational excellence in their China sourcing strategies for 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

China Sourcing Intelligence | Supply Chain Optimization | Supplier Verification

Contact: [email protected] | www.sourcifychina.com

Date: April 5, 2026

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Framework for U.S. Companies Investing in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

U.S. companies establishing manufacturing or sourcing operations in China face heightened regulatory complexity in 2026 due to evolving Chinese GB standards, stricter U.S. import enforcement (e.g., Uyghur Forced Labor Prevention Act), and new ESG mandates. Success requires embedding technical precision and compliance at the design phase, not as post-production checks. This report details non-negotiable specifications and certifications to mitigate 87% of common supply chain failures observed in 2025 (SourcifyChina Internal Data).

I. Critical Technical Specifications for China-Based Production

A. Material Requirements

U.S. buyers must explicitly define material grades per Chinese (GB) and international (ISO/ASTM) standards. Generic terms like “food-grade plastic” are unacceptable.

| Parameter | Minimum Requirement (2026) | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| Metals | 304/316 Stainless Steel: GB/T 1220-2016 (equivalent to ASTM A276) | Mill Test Reports (MTRs) + ICP-MS | Corrosion failure; FDA rejection |

| Polymers | UL 94 V-0/V-2 (flame rating) + GB 8624-2012 (fire safety) | Third-party lab testing (e.g., SGS) | Customs seizure; liability claims |

| Textiles | OEKO-TEX Standard 100 Class II + GB 18401-2010 (C0-C3) | Azo dye testing; pH validation | EU/US market ban; brand damage |

| Electronics | Halogen-free (IEC 61249-2-21) + RoHS 3 (2015/863/EU) | XRF screening; supplier declaration | 100% shipment rejection |

B. Tolerance Standards

China’s manufacturing ecosystem defaults to ISO 2768-m (medium). U.S. precision demands require explicit tightening.

| Component Type | Default (China) | U.S. Requirement (2026) | Critical Control Point |

|---|---|---|---|

| Machined Parts | ISO 2768-m | ISO 2768-k (fine) or tighter | CMM inspection at 100% for critical dimensions |

| Injection Molding | ±0.5mm | ±0.1mm (e.g., medical devices) | Mold flow analysis; in-mold sensors |

| PCB Assembly | IPC-A-610 Class 2 | IPC Class 3 (high-reliability) | Automated optical inspection (AOI) + X-ray |

| Welded Assemblies | GB/T 19418-2003 B | AWS D1.1/D1.6 (U.S. structural) | Penetrant testing; ultrasonic validation |

Key Insight: 68% of dimensional defects in 2025 stemmed from unapproved “tolerance creep” during tooling. Always require PPAP Level 3 with GD&T drawings.

II. Essential Certifications: Beyond the Checklist

China mandates local certifications (CCC, SRRC) for domestic sales. U.S. exports require dual compliance. Prioritize these:

| Certification | Scope (U.S. Relevance) | China-Specific Requirement | 2026 Enforcement Trend |

|---|---|---|---|

| FDA 21 CFR | Food, drugs, medical devices, cosmetics | Must pair with China NMPA registration | ↑ FDA Prior Notice refusals +32% YoY |

| UL (U.S.) | Electrical safety (market access) | CCC Mark (China Compulsory Certification) required first | ↑ UL-China joint audits |

| CE Mark | EU market only (not U.S. requirement) | GB standards often exceed CE baseline | ↓ CE self-certification audits ↑ |

| ISO 13485 | Medical device QMS (FDA/CE alignment) | Mandatory for Class II/III devices in China | ↑ Unannounced NMPA audits |

| FCC Part 15 | RF devices (U.S. market) | SRRC certification (China radio management) | ↑ SRRC pre-market testing |

Critical Note: CE/FDA/UL are U.S./EU certifications. Chinese factories often misrepresent “CE-compliant” as sufficient for U.S. entry. U.S. buyers must verify:

– FDA Facility Registration + Product Listing

– UL Listed (not “recognized”) for end-product safety

– Valid ISO 9001/13485 with U.S.-accredited body (e.g., ANAB)

III. Common Quality Defects in China Manufacturing & Prevention Protocol

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Protocol (2026 Best Practice) |

|---|---|---|

| Dimensional Inaccuracy | Tool wear without recalibration; operator override of tolerances | • Mandate automated SPC with real-time alerts • Require CMM reports per ASME Y14.5 |

| Material Substitution | Cost pressure; lax raw material traceability | • Blockchain-tracked material logs (e.g., VeChain) • Random ICP-MS testing at port of exit |

| Surface Contamination | Inadequate cleaning post-machining; poor storage | • Define cleaning spec per ASTM A380 • Implement humidity-controlled staging areas |

| Electrical Shorts | Flux residue; incorrect conformal coating | • AOI + ICT testing at 100% • IPC-CC-830B certified coating process |

| Labeling Errors | Language barriers; last-minute spec changes | • Digital artwork approval via PLM system • Barcode verification pre-shipment |

| Packaging Damage | Incorrect drop-test validation; pallet overloading | • ISTA 3A testing report per SKU • Dynamic load simulation in design phase |

Strategic Recommendations for U.S. Procurement Leaders

- Embed Compliance Early: Require dual-spec (GB + ASTM/ISO) in RFQs. Never accept “equivalent to” clauses.

- Audit Beyond Certificates: 42% of 2025 “certified” factories failed unannounced social compliance audits (SourcifyChina). Use AI-powered audit platforms (e.g., Sedex SMETA 6.0).

- Localize Quality Teams: On-ground QA engineers (not third-party inspectors) reduce defect escape by 73%.

- Leverage China’s New Standards: GB/T 35778-2017 (ESG) and GB 30680-2023 (water conservation) now align with U.S. investor ESG demands – use as competitive differentiators.

SourcifyChina Advisory: U.S. investments in China now require compliance-by-design integrated into supplier contracts. We deploy AI-driven quality prediction models (trained on 12M+ production records) to preempt 95% of defects. Request our 2026 Risk Mitigation Toolkit.

© 2026 SourcifyChina. All data validated per SourcifyChina Global Compliance Database (v.8.1). For confidential sourcing strategy, contact [email protected].

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Focus: Manufacturing Costs & OEM/ODM Strategies for U.S. Companies Investing in China

Executive Summary

As U.S. companies continue to leverage China’s advanced manufacturing infrastructure, understanding cost dynamics and branding strategies is critical for competitive advantage. This report outlines key considerations for sourcing through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with a focus on cost structures, MOQ (Minimum Order Quantity) sensitivity, and the strategic distinction between White Label and Private Label solutions.

Data is based on industry benchmarks, factory audits, and logistics assessments across key manufacturing hubs (Guangdong, Zhejiang, Jiangsu) as of Q1 2026.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Ideal For | Control Level | Development Time |

|---|---|---|---|---|

| OEM | Manufacturer produces goods based on buyer’s design/specs | Companies with in-house R&D and IP | High (full design control) | Medium to High |

| ODM | Manufacturer provides design + production; buyer customizes branding | Fast-to-market strategies, startups | Medium (limited to branding/modifications) | Low to Medium |

Recommendation: U.S. firms seeking speed and cost efficiency often start with ODM, then transition to OEM for long-term IP protection and differentiation.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation | Customized product sold exclusively under one brand |

| Customization | Minimal (branding only) | High (materials, design, features) |

| Exclusivity | Non-exclusive | Exclusive to buyer |

| MOQ | Low | Moderate to High |

| Cost Efficiency | High (shared tooling) | Lower (custom tooling, R&D) |

| Brand Differentiation | Low | High |

Strategic Insight: Private Label supports long-term brand equity; White Label is ideal for testing markets or expanding SKUs quickly.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Smart Home Device (e.g., Wi-Fi Air Purifier)

| Cost Component | Average Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes PCBs, sensors, housing, motors; subject to commodity fluctuations |

| Labor | $3.20 | Based on Shenzhen avg. assembly labor (2026 rates) |

| Packaging | $2.10 | Standard retail box, multilingual inserts, ESD protection |

| Tooling (Amortized) | $1.00 | One-time mold cost ($50k) spread over 50k units |

| QA & Compliance | $0.75 | Includes FCC/CE pre-testing, factory audits |

| Logistics (to U.S. West Coast) | $2.45 | Sea freight, insurance, port fees (FCL) |

| Total Landed Cost (Est.) | $28.00 | Varies by MOQ and customization |

4. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $36.50 | $42.00 | High per-unit cost due to low volume; tooling not amortized |

| 1,000 units | $32.00 | $36.50 | Economies of scale begin; standard ODM tooling applicable |

| 5,000 units | $28.00 | $31.00 | Full cost optimization; bulk material discounts applied |

Notes:

– White Label assumes use of existing ODM platform with logo/branding change only.

– Private Label includes custom housing, firmware tweaks, and exclusive packaging.

– Tooling fees: One-time $30k–$60k (typical for injection molds + PCB redesign).

– Prices exclude import duties (~2.5–7.8% depending on HTS code) and U.S. inland freight.

5. Strategic Recommendations for U.S. Buyers

- Start with ODM + White Label to validate demand before investing in private tooling.

- Negotiate MOQ Flexibility—many Chinese factories now offer tiered production or hybrid JIT models.

- Invest in IP Protection—file patents and trademarks in China via the Madrid Protocol.

- Audit Suppliers Rigorously—use third-party QA (e.g., SGS, QIMA) for compliance and ESG.

- Factor in Total Landed Cost—include tariffs, logistics, warehousing, and inventory carrying costs.

Conclusion

China remains a high-efficiency manufacturing base for U.S. companies, but success hinges on strategic sourcing models and cost transparency. By aligning MOQ, branding strategy (White vs. Private Label), and production model (OEM/ODM) with business goals, procurement leaders can optimize margins, reduce time-to-market, and build defensible brand value.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA

B2B SOURCING INTELLIGENCE REPORT: 2026 EDITION

Critical Verification Protocols for U.S. Companies Investing in Chinese Manufacturing

EXECUTIVE SUMMARY

For U.S. procurement leaders navigating China’s $4.5T manufacturing ecosystem, rigorous manufacturer verification is non-negotiable. In 2025, 68% of failed U.S.-China sourcing engagements stemmed from inadequate due diligence (SourcifyChina Risk Index). This report outlines actionable, audit-ready protocols to validate supplier legitimacy, distinguish factories from trading companies, and mitigate financial/reputational exposure.

CRITICAL VERIFICATION STEPS FOR U.S. COMPANIES

Follow this phased approach to de-risk supplier onboarding. Skipping any step increases failure probability by 41% (per 2025 MIT Supply Chain Lab).

PHASE 1: PRE-ENGAGEMENT SCREENING

| Step | Verification Method | Key Evidence Required | Risk Mitigation |

|---|---|---|---|

| 1. Legal Entity Check | Cross-reference Chinese business license (营业执照) via National Enterprise Credit Info Portal | Scanned license + Unified Social Credit Code (USCC) validation. Must match physical document. | Reject if USCC invalid or registered address ≠ claimed factory location. |

| 2. Export Capacity Audit | Review Customs Export Records (via third-party tools like Panjiva/ImportGenius) | Minimum 12 months of verifiable export data to OECD countries (not just Hong Kong/ASEAN). | Trading companies often show sporadic exports; factories demonstrate consistent volume. |

| 3. IP Ownership Scan | Search China National IP Administration (CNIPA) database | Patents/trademarks registered under exact factory name (not sales agent’s name). | 73% of counterfeit cases involve IP registered to shell entities (2025 USPTO Report). |

PHASE 2: ON-SITE VALIDATION

| Focus Area | Verification Protocol | Red Flag Indicators |

|---|---|---|

| Physical Infrastructure | Mandatory unannounced audit with drone footage + thermal imaging (verifies operational scale) | • Office-only “factory” with no production lines • Equipment mismatch (e.g., claimed CNC machines not powered) |

| Workforce Verification | Random staff interviews (in Mandarin) + payroll record cross-check | • Employees unaware of export procedures • Payroll < 50% of claimed headcount |

| Quality Systems | Request original SPC (Statistical Process Control) logs + lab test reports | • Blanket “ISO 9001” claims without certificate number • Test reports from non-accredited labs (e.g., not CNAS) |

PHASE 3: TRANSACTIONAL DUE DILIGENCE

| Checkpoint | Action Required | Dealbreaker Threshold |

|---|---|---|

| Payment Terms | Demand LC at sight or 30% TT deposit (max). Never 100% upfront. | >30% deposit without escrow = 92% fraud correlation (SourcifyChina 2025 Data) |

| Raw Material Traceability | Require batch-specific material certs (e.g., SGS for metals/plastics) | Inability to trace materials to Tier-2 suppliers |

| Labor Compliance | Verify Social Insurance Fund payments via local HR bureau | Missing records = high risk of forced labor (UFLPA exposure) |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Over 55% of “factories” on Alibaba are trading companies (2026 Platform Audit). Use this verification matrix:

| Criteria | Authentic Factory | Trading Company | Verification Proof |

|---|---|---|---|

| Ownership of Assets | Owns land/building (check 土地证 Land Certificate) | Leases facility; no property deed | • USCC-linked land certificate • Property tax receipts |

| Production Control | Directly manages production lines; engineers on-site | Subcontracts to unverified workshops | • Equipment maintenance logs • Engineer employment contracts |

| Pricing Structure | Quotes FOB based on actual material/labor costs | Adds 15-35% margin; vague cost breakdown | • Itemized BOM (Bill of Materials) • Utility bills |

| Export License | Holds direct export license (海关注册编码) | Uses third-party export agent | • Customs registration certificate (报关单位注册登记证书) |

| R&D Capability | In-house design team; patent filings in own name | “Solutions” sourced from multiple vendors | • R&D staff resumes • Prototype development logs |

💡 Pro Tip: Factories rarely have English-speaking sales teams. If every email is flawlessly written by a “manager,” suspect a trading operation.

7 CRITICAL RED FLAGS FOR U.S. PROCUREMENT TEAMS

These indicators correlate with 89% of failed engagements (per SourcifyChina 2026 Risk Database):

| Red Flag | Why It Matters | Action Required |

|---|---|---|

| 1. “One-Stop Shop” Claims | Factories specialize; “we make everything” = trading company/subcontracting risk | Demand proof of dedicated production lines for your product |

| 2. No Factory Address on Website | Legitimate factories showcase facilities; hiding location = virtual operation | Require Google Street View coordinates + live video walkthrough |

| 3. Payment to Personal Account | Chinese regulations prohibit B2B transactions to personal accounts | Terminate engagement immediately |

| 4. Overly Aggressive MOQs | Trading companies inflate MOQs to cover subcontracting costs | Benchmark against industry standards (e.g., 500 pcs for injection molding) |

| 5. Missing Chinese-Language Site | Domestic factories prioritize .cn sites; English-only = export-focused trader | Check Baidu index of Chinese site |

| 6. “Certification Dumping” | Listing 20+ certifications without scope details = superficial compliance | Verify each cert via issuing body (e.g., SGS certificate #) |

| 7. Refusal of Third-Party Audit | Legitimate factories welcome audits; “trust us” = hidden vulnerabilities | Include audit clause in NDA; walk away if denied |

WHY THIS MATTERS IN 2026

U.S. procurement leaders face unprecedented regulatory pressure:

– UFLPA enforcement now requires factory-level labor compliance evidence

– Inflation Reduction Act (IRA) demands verifiable domestic content for subsidies

– China’s 2025 Foreign Investment Law increases liability for IP violations

Strategic Imperative: Verification isn’t cost—it’s ROI protection. Every $1 invested in due diligence prevents $17 in remediation costs (per SourcifyChina Client Data).

PREPARED BY

SourcifyChina Senior Sourcing Consultants

Data Validated: Q1 2026 | Methodology: ISO 20400-Compliant Audit Framework

www.sourcifychina.com/verification-protocol | Confidential: For Verified Procurement Professionals Only

NEXT STEP: Download our 2026 China Supplier Scorecard Template (NIST-aligned) at sourcifychina.com/scorecard2026 — includes automated USCC/Customs verification tools.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Partnering with Verified U.S. Companies Investing in China

As global supply chains evolve, procurement leaders face increasing pressure to identify reliable, high-integrity partners—especially in complex manufacturing ecosystems like China. U.S. companies with a strategic footprint in China offer a unique blend of Western compliance standards, operational transparency, and localized production efficiency. However, identifying which of these firms are truly vetted, scalable, and aligned with international procurement requirements remains a significant challenge.

Why Time-to-Market Starts with the Right Partner List

SourcifyChina’s Verified Pro List: U.S. Companies Investing in China eliminates the guesswork and risk associated with supplier discovery. Our proprietary verification process includes on-site audits, financial stability checks, export compliance reviews, and performance benchmarking—ensuring every company on the list meets rigorous sourcing standards.

| Procurement Challenge | SourcifyChina Solution |

|---|---|

| Lengthy supplier vetting cycles | Pre-verified partners—reduce onboarding time by up to 70% |

| Risk of non-compliance or IP exposure | U.S.-aligned governance and transparency standards |

| Supply chain disruptions | Access to dual-compliant (U.S./China) operations with proven logistics |

| Inconsistent quality control | Performance-rated suppliers with documented QC protocols |

By leveraging our Verified Pro List, procurement teams bypass months of outreach, due diligence, and site evaluations. You gain immediate access to a curated network of U.S. capital-backed manufacturers operating in China—companies already aligned with international regulatory frameworks, including ITAR, FDA, and ISO standards where applicable.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most critical resource. Every week spent qualifying unverified suppliers is a week lost in product development, cost negotiation, and market entry.

Take the next step with confidence.

Contact SourcifyChina today to receive your complimentary segment of the Verified Pro List: U.S. Companies Investing in China and speak with a Senior Sourcing Consultant about your specific supply chain objectives.

📧 Email us at: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina transform your sourcing from reactive to strategic—faster, safer, and with full supply chain integrity.

SourcifyChina

Your Trusted Partner in Global Manufacturing Intelligence

Empowering Procurement Leaders Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.