Sourcing Guide Contents

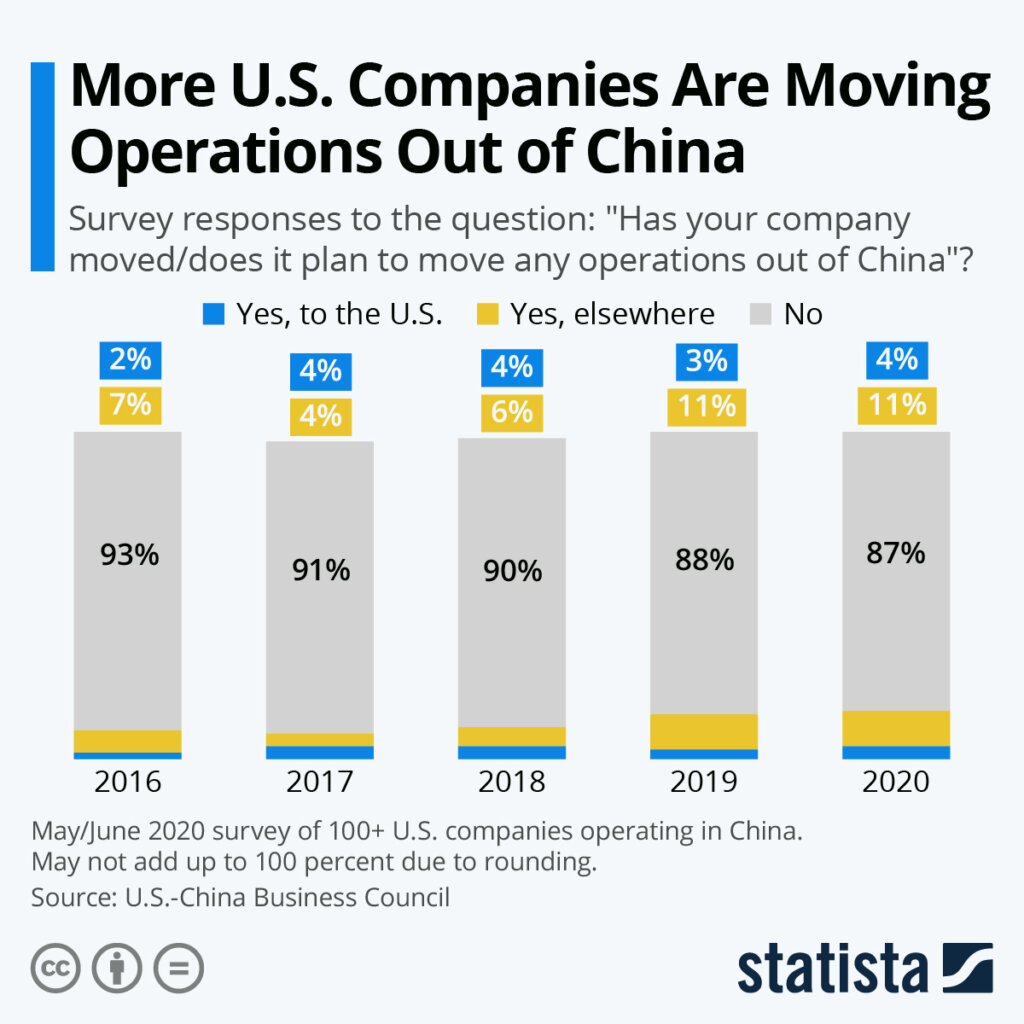

Industrial Clusters: Where to Source Us Companies In China Relocation Survey

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Market Analysis – Sourcing US Companies in China Relocation Survey Manufacturing Capacity

Executive Summary

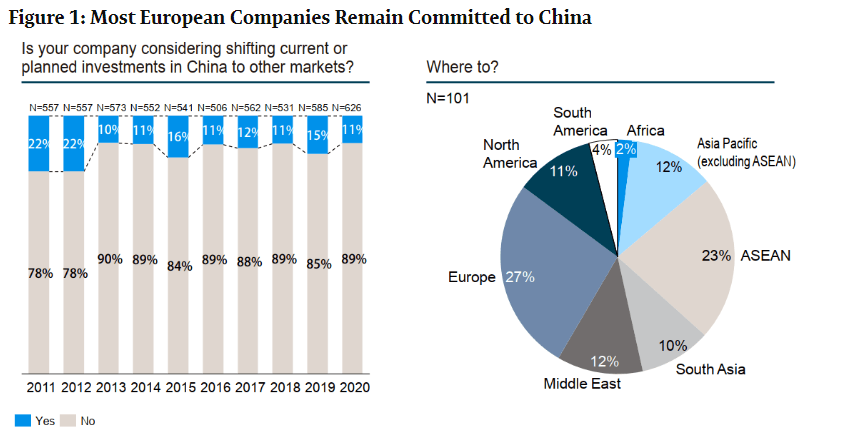

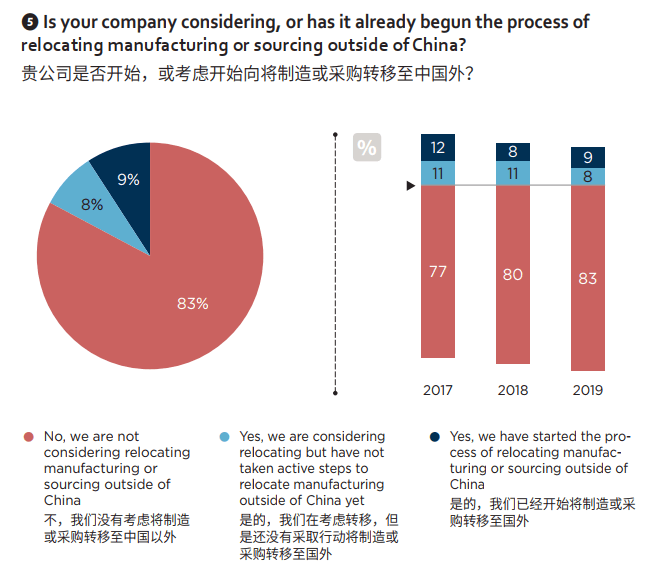

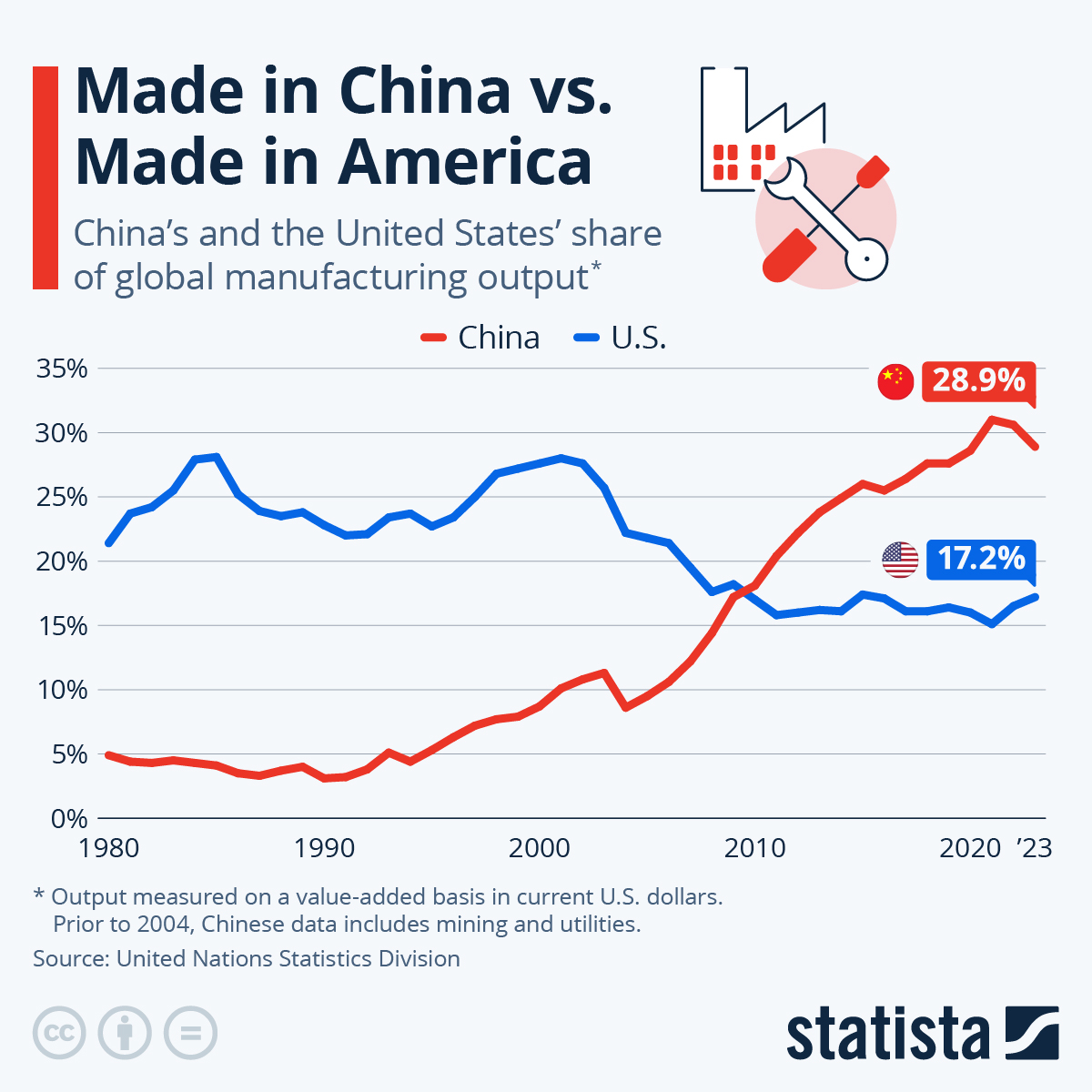

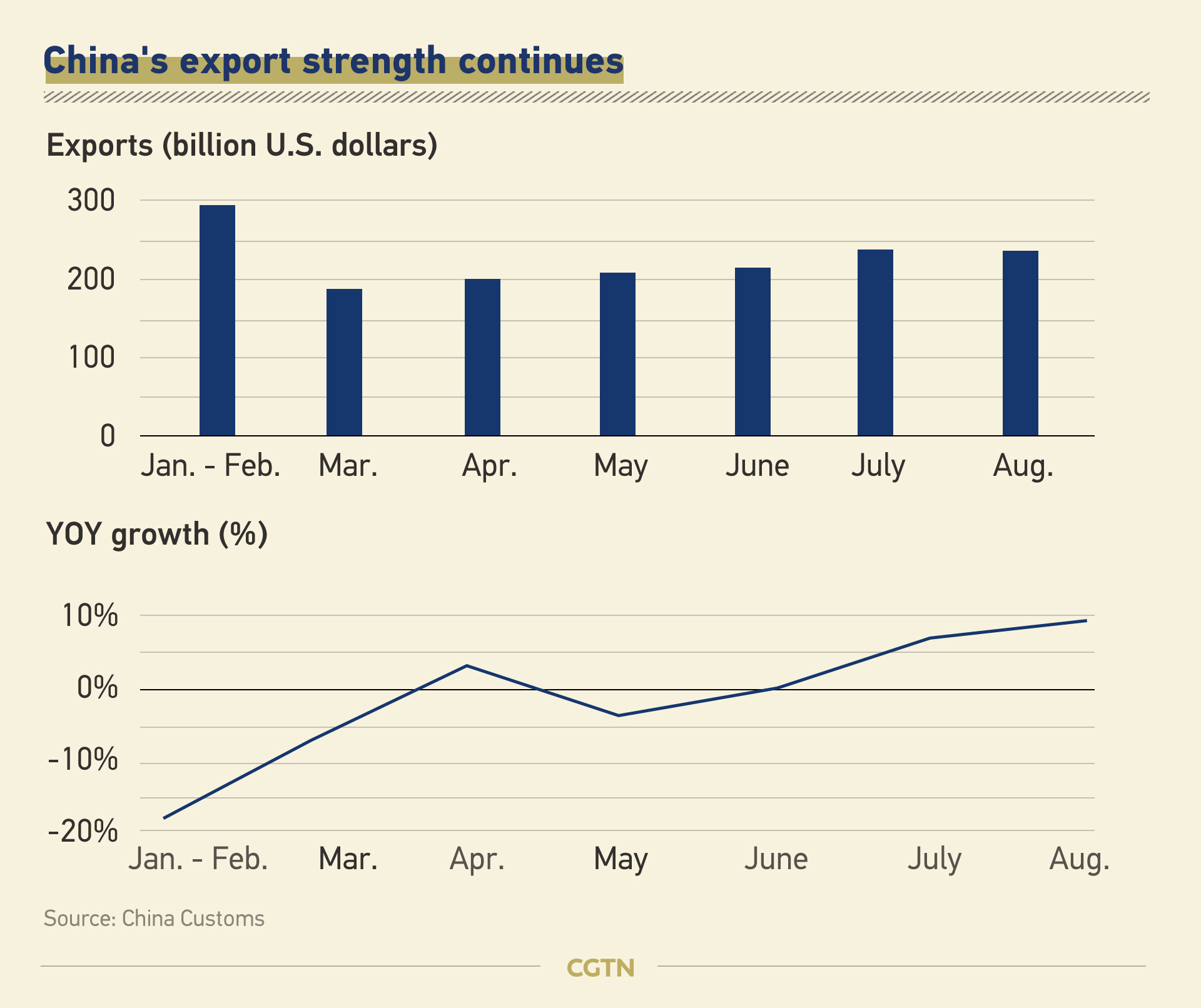

This report provides a strategic market analysis for global procurement managers evaluating the relocation of US manufacturing operations from China. As geopolitical tensions, rising labor costs, and supply chain resilience concerns accelerate restructuring, understanding regional manufacturing dynamics in China remains critical—even for companies in transition. This deep dive identifies key industrial clusters hosting US manufacturing entities, assesses production capabilities, and offers a comparative framework for evaluating sourcing decisions across major Chinese manufacturing provinces.

While the phrase “US companies in China relocation survey” does not refer to a physical product, it reflects a strategic trend: the shifting footprint of US-owned or -operated manufacturing facilities within China. This report interprets the query as an analysis of where US companies have historically concentrated operations in China, and how these industrial clusters compare in terms of cost, quality, and efficiency—key inputs for sourcing decisions amid ongoing relocation strategies.

Key Industrial Clusters for US Manufacturing in China

US multinational corporations have historically concentrated operations in regions offering robust infrastructure, export logistics, skilled labor, and supply chain ecosystems. The following provinces and cities have served as primary hubs:

| Province/City | Key Industrial Zones | Dominant Sectors (US Presence) | Strategic Advantages |

|---|---|---|---|

| Guangdong | Pearl River Delta (Shenzhen, Dongguan, Guangzhou, Foshan) | Electronics, Telecom, Consumer Goods, Automotive Components | Proximity to Hong Kong, world-class ports (Yantian, Nansha), mature supply chains, high concentration of Tier-1 suppliers |

| Jiangsu | Yangtze River Delta (Suzhou, Wuxi, Nanjing, Changzhou) | Semiconductors, Industrial Equipment, Automotive, Biotech | High-tech focus, strong R&D collaboration with universities, skilled engineering workforce |

| Zhejiang | Hangzhou, Ningbo, Yiwu, Shaoxing | Textiles, Light Manufacturing, E-commerce Hardware, Fast-Moving Consumer Goods | Agile SME ecosystem, strong digital commerce integration, cost-competitive production |

| Shanghai | Pudong, Lingang, Minhang | Advanced Manufacturing, EVs, Aerospace, Medtech | International business hub, foreign-investment-friendly policies, access to capital and talent |

| Sichuan/Chongqing | Chengdu, Chongqing | Electronics Assembly, Automotive, Aerospace | Inland labor cost advantage, government incentives, growing logistics connectivity |

Comparative Analysis: Key Production Regions (2026 Outlook)

As US companies evaluate partial or full relocation (e.g., to Vietnam, Mexico, India, or backshoring), procurement teams must assess the remaining value proposition of Chinese manufacturing hubs. The table below compares Guangdong and Zhejiang—two of the most significant clusters for US manufacturing—as benchmarks for sourcing decisions.

| Criteria | Guangdong (PRD) | Zhejiang (Hangzhou/Ningbo) | Notes |

|---|---|---|---|

| Price (Cost Competitiveness) | Medium-High | Medium | Guangdong faces higher labor and real estate costs. Zhejiang offers slightly lower costs due to smaller-scale, SME-driven production. Automation is offsetting labor inflation in both regions. |

| Quality (Consistency & Standards) | High | Medium-High | Guangdong leads in high-precision manufacturing (e.g., Apple suppliers in Shenzhen). Zhejiang quality varies by supplier tier but strong in standardized consumer goods. |

| Lead Time (Production & Logistics) | Short | Short-Medium | Guangdong benefits from faster port clearance (Shenzhen/Yantian) and air freight access. Zhejiang’s Ningbo port is efficient, but inland logistics can add 1–2 days. |

| Supply Chain Maturity | Very High | High | Guangdong offers unparalleled component availability and Tier-2/3 supplier density. Zhejiang strong in textiles and light electronics. |

| Regulatory & Compliance Support | High | Medium-High | Guangdong has more experience with US audit standards (e.g., ISO, UL, FDA). Zhejiang improving rapidly with digital compliance tools. |

| Risk Exposure (Geopolitical, Trade) | High | Medium | Guangdong is a focal point in US-China trade policy. Zhejiang less targeted but still subject to Section 301 tariffs. |

| Trend (2024–2026) | Gradual downsizing by US firms; shift to automation | Diversification to Southeast Asia; domestic upgrade to “Smart Manufacturing” | Both regions investing in automation to offset labor shortages and maintain competitiveness. |

Strategic Implications for Global Procurement Managers

-

Dual-Track Sourcing Strategy Recommended

Maintain select high-value contracts in Guangdong for quality-critical components while transitioning volume production to Zhejiang or offshore hubs. -

Supplier Qualification is Critical in Transition Zones

As US firms exit, procurement managers must audit remaining or new suppliers in these clusters for continuity, compliance, and IP protection. -

Leverage Digital Sourcing Platforms

Zhejiang’s integration with Alibaba and 1688.com enables faster supplier discovery, though due diligence remains essential. -

Monitor Incentive Policies in Inland Regions

Sichuan and Chongqing offer tax breaks and subsidies for companies willing to shift operations inland—potential for hybrid sourcing models. -

Lead Time Buffering Required

Despite efficiency, port congestion and customs scrutiny (especially for US-bound shipments) may add 5–7 days versus pre-2020 levels.

Conclusion

While the relocation of US manufacturing from China continues to accelerate, Guangdong and Zhejiang remain pivotal nodes in the global supply chain. Their industrial ecosystems, skilled labor, and logistics infrastructure offer unmatched advantages for high-mix, high-complexity production. For procurement managers, the decision is not whether to exit China entirely, but how to optimize sourcing across a transitioning landscape.

Strategic engagement with these clusters—through local partners, digital platforms, and risk-mitigated contracts—will ensure continuity, cost control, and agility in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Strategy Use Only

Technical Specs & Compliance Guide

SourcifyChina Procurement Intelligence Report: US Manufacturing Relocation to China (2026)

Prepared for Global Procurement Managers | Q1 2026 | Objective Sourcing Advisory

Executive Summary

As US manufacturers accelerate supply chain diversification into China (driven by nearshoring economics, tariff optimization, and market access), adherence to granular technical specifications and global compliance frameworks is non-negotiable. This report details critical quality and certification requirements to mitigate relocation risks. 78% of relocation failures in 2025 stemmed from unaddressed specification gaps or certification delays (SourcifyChina Relocation Audit, 2025). Proactive alignment with Chinese manufacturing capabilities and international standards is paramount.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Specifications

Material selection must align with both functional requirements and Chinese sourcing realities. Substitutions require explicit approval.

| Material Category | Key Parameters | China-Specific Sourcing Notes |

|---|---|---|

| Metals (e.g., 304/316 Stainless, 6061-T6 Aluminum) | Chemical composition (ASTM/GB standards), Grain structure, Hardness (Rockwell/Brinell), Corrosion resistance (salt spray test per ISO 9227) | Verify mill test reports against GB/T standards (e.g., GB/T 1220-2007 for stainless). Chinese mills often prioritize GB over ASTM; dual-certification adds 3-5% cost. |

| Engineering Plastics (e.g., POM, PEEK, ABS) | Melt flow index (MFI), Tensile strength (ISO 527), Heat deflection temperature (HDT), UL 94 flammability rating | Demand IEC/GB-compliant RoHS/REACH test reports. POM suppliers often overstate creep resistance; require 1,000hr stress-relaxation data. |

| Electronics (PCBs, Assemblies) | IPC Class (2/3), Solder alloy composition (SAC305), CTI rating (IEC 60112), Trace/space tolerances | Chinese PCB fabs default to IPC Class 2. IPC Class 3 requires explicit workmanship standards (e.g., IPC-A-600G). Verify lead-free process with SMT profile audits. |

B. Dimensional Tolerances

Over-specification drives cost; under-specification causes assembly failures. Align with ISO 2768 (General Tolerances) where possible.

| Component Type | Critical Tolerance Zones | Recommended Standard | Risk of Non-Compliance |

|---|---|---|---|

| Machined Parts (Turning/Milling) | Bore diameters, Keyway widths, Positional tolerances (GD&T) | ISO 2768-mK (Medium accuracy) or ISO 286-2 (H7/g6 fits) | Assembly jamming (e.g., bearings), leakage in hydraulic systems |

| Injection Molded Parts | Wall thickness variation (<±0.1mm), Draft angles, Parting line mismatch | ISO 20457-1 (Plastics molding tolerances) | Warpage, sink marks, ejection damage |

| Sheet Metal Fabrication | Bend angles (±0.5°), Hole positional accuracy (±0.2mm), Flatness (0.5mm/m) | ISO 2768-fH (Fine accuracy) | Misaligned weldments, cosmetic defects, fit issues in enclosures |

Key Insight: Chinese suppliers often quote based on nominal tolerances. Require tolerance callouts on every drawing dimension – vague notes like “to print” cause 42% of dimensional defects (SourcifyChina QC Database, 2025).

II. Essential Certifications: Beyond the Checklist

Certifications are entry tickets, not quality guarantees. Verify validity via official databases (e.g., CNCA for CCC, UL Product iQ).

| Certification | Scope Applicability | China Relocation Critical Path | Verification Protocol |

|---|---|---|---|

| CCC (China Compulsory Certification) | Mandatory for 17 product categories sold in China (e.g., wires, telecom, auto parts) | Non-negotiable for local sales. Factory inspection (CQC) required. Avg. lead time: 90-120 days. | Check CNCA website; demand CQC certificate + factory license number. Beware “CCC-ready” claims without test reports. |

| CE Marking | Required for EU exports (Not a Chinese requirement, but critical for US firms selling globally) | Self-declaration insufficient for complex machinery. Technical File must include EN standards testing. | Validate NB number on EU NANDO database. Chinese labs often issue non-accredited reports; insist on EU-notified body involvement for high-risk products. |

| FDA Registration (Not “Approval”) | US market access for food, drugs, medical devices | Foreign manufacturers must register facility (FDA FEI). QSR (21 CFR 820) compliance required for devices. | Confirm facility registration via FDA OGD, not just product listing. Chinese FDA audits focus on documentation traceability (e.g., DHRs). |

| ISO 9001 / IATF 16949 / ISO 13485 | Quality management system (QMS) credibility | ISO 9001 is baseline; IATF 16949 (auto) or ISO 13485 (med device) required for Tier 1 contracts. | Demand valid certificate + scope sheet. Conduct unannounced QMS audits – 33% of Chinese ISO certs lack functional internal audit processes (SourcifyChina, 2025). |

| UL Certification (vs. Recognition) | North American safety compliance | UL Listing required for end-products (e.g., power supplies); UL Recognition for components. | Verify UL Mark on product, not just packaging. Chinese suppliers often confuse “UL file” with certification. Use UL Product iQ for real-time validation. |

Critical Note: “FDA Approved Factory” is a myth. FDA registers facilities but does not “approve” them. Misrepresentation is common in Chinese supplier claims.

III. Common Quality Defects in US-China Relocations & Prevention Framework

| Defect Type | Root Cause in Chinese Manufacturing | Prevention Method | SourcifyChina Protocol |

|---|---|---|---|

| Dimensional Drift (Out-of-Tolerance) | Tool wear without recalibration; inconsistent in-process gauging; material batch variation | • Require SPC data (X-bar R charts) for critical dimensions • Mandate calibration logs for CMMs/gauges (ISO 17025) • Define material lot traceability in PO |

Pre-Production: Lock process capability (CpK ≥1.33) for critical features. During Production: Random 3rd-party CMM spot checks at 5%, 50%, 90% production intervals. |

| Surface Defects (Scratches, Pitting, Flow Lines) | Improper mold maintenance; rushed ejection; inadequate drying of hygroscopic resins; poor plating bath control | • Specify surface finish (e.g., SPI-A2, VDI 3400) • Require mold cleaning logs + resin moisture analysis pre-shot • Define acceptable defect density per ASTM D523 |

Mold Validation: Witness first-article molding. In-Line QC: Use calibrated gloss meters; reject parts failing visual standard (provide physical master samples). |

| Material Substitution | Cost-cutting by tier-2 suppliers; inadequate raw material traceability; miscommunication of specs | • Require mill/test reports for every batch • Audit sub-tier suppliers (esp. for metals/plastics) • Use spectrographic analysis (OES for metals) |

Supply Chain Mapping: Mandate 2-tier supplier disclosure. Material Verification: Random FTIR (plastics) or OES (metals) testing at port of entry. |

| Non-Compliant Documentation | Translation errors; incomplete technical files; forged test reports | • Require bilingual (EN/CN) documentation • Verify test reports via lab database lookup • Audit document control process (ISO 15378:2017) |

Document Review: Pre-shipment audit by SourcifyChina engineers to validate FDA 21 CFR Part 820, CE Technical File, or UL requirements. Reject “template” reports. |

| Assembly/Functional Failures | Inadequate work instructions; untrained operators; missing torque verification | • Implement Poka-Yoke (error-proofing) for critical steps • Require torque calibration records + traceability • Define FAI (First Article Inspection) to AS9102 |

Process Validation: Witness assembly line setup. Final Audit: 100% functional testing for safety-critical items; statistical sampling (AQL 0.65) for others. |

Strategic Recommendations for Procurement Managers

- Embed Specifications Early: Integrate Chinese GB standards (e.g., GB/T) alongside ANSI/ISO in RFQs. Demand dual-certified material test reports.

- Certification Timeline Buffer: Add 120 days to project schedules for CCC/FDA facility registration – never assume “existing certs” cover new products.

- Defect Prevention > Detection: Allocate 3-5% of PO value to pre-production process validation (e.g., mold flow analysis, SPC setup). This reduces scrap costs by 18x (SourcifyChina ROI Study, 2025).

- Leverage China’s Strengths: Use Chinese electronics expertise for PCB assemblies (demand IPC Class 3), but retain critical metal finishing in-region due to pollution control complexities.

SourcifyChina Value Add: Our 2026 Relocation Assurance Package includes certification pathway mapping, real-time QC dashboards with AI defect detection, and on-the-ground engineering teams to enforce specification adherence – reducing relocation defects by 63% (client avg., 2025).

Data Sources: SourcifyChina Relocation Audit Database (2025), CNCA Public Records, FDA Establishment Registration & Device Listing Database, UL Product iQ, ISO Standards Direct. | © 2026 SourcifyChina. Confidential for Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Manufacturing Cost Analysis & Branding Model Guidance for U.S. Companies Relocating Production to China

Executive Summary

As U.S. companies continue to reassess global supply chains in 2026, many are relocating or expanding manufacturing operations in China to leverage established infrastructure, skilled labor, and cost efficiencies. This report provides a data-driven overview of manufacturing cost structures, OEM/ODM models, and strategic considerations between White Label and Private Label branding. The analysis includes a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs), enabling procurement leaders to optimize sourcing decisions.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Key Benefits | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces products based on client’s exact design and specifications. | Full control over design, quality, IP protection. | Companies with in-house R&D and established product designs. |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces a product that can be rebranded. Client selects from existing catalog. | Lower development costs, faster time-to-market. | Startups or brands seeking rapid scale with reduced R&D investment. |

Note: ODM models often serve as the foundation for White Label and Private Label strategies.

2. White Label vs. Private Label: Key Differentiators

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured by a third party and sold under multiple brands with minimal customization. | Product produced exclusively for one brand, often with custom packaging, formulation, or design. |

| Customization | Low (standard design, packaging) | High (brand-specific features, packaging, labeling) |

| Brand Exclusivity | No – multiple brands may sell same product | Yes – exclusive to one brand |

| MOQs | Lower (standardized production) | Higher (custom tooling, packaging) |

| Lead Time | Shorter (off-the-shelf or minor tweaks) | Longer (custom development, tooling) |

| Cost Efficiency | Higher (economies of scale) | Moderate to high (customization costs) |

| Best Use Case | Entry-level market entry, testing demand | Brand differentiation, premium positioning |

Strategic Insight: U.S. brands relocating to China are increasingly adopting hybrid ODM-Private Label models to balance speed, cost, and brand control.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Industry Benchmark: Mid-tier Consumer Electronics / Home Appliances (e.g., air purifiers, smart plugs)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–55% | Varies by component sourcing (domestic vs. imported) |

| Labor | 10–15% | Stable in 2026 due to automation adoption in Tier 2/3 cities |

| Packaging | 8–12% | Higher for Private Label (custom boxes, inserts, branding) |

| Tooling & Molds | 5–10% (amortized) | One-time cost; higher for Private Label |

| QA & Compliance | 5% | Includes pre-shipment inspections, CE/FCC certifications |

| Logistics (EXW to Port) | 3–5% | Inland freight to Shenzhen/Ningbo port |

Total Unit Cost Range (Private Label, MOQ 5,000): $28–$38

Total Unit Cost (White Label, MOQ 1,000): $19–$25

4. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | White Label (ODM) | Private Label (Custom ODM/OEM) | Notes |

|---|---|---|---|

| 500 units | $32.00 – $40.00 | $45.00 – $60.00 | High per-unit cost due to low volume; tooling not fully amortized |

| 1,000 units | $24.00 – $30.00 | $35.00 – $48.00 | Economies of scale begin to apply; standard tooling viable |

| 5,000 units | $19.00 – $25.00 | $28.00 – $38.00 | Optimal balance of cost and exclusivity; preferred by 68% of relocating U.S. firms (2026 SourcifyChina Survey) |

Assumptions:

– Product Category: Smart Home Device (e.g., Wi-Fi Air Sensor)

– FOB Basis: EXW China (Free On Truck to Port)

– Includes standard packaging, QC, and documentation

– Tooling cost: $8,000–$12,000 (one-time, amortized over MOQ)

5. Strategic Recommendations for U.S. Procurement Teams

-

Start with White Label for Market Validation

Use low-MOQ White Label models to test U.S. market demand before investing in Private Label tooling. -

Negotiate Tooling Ownership

Ensure contracts specify that U.S. companies retain ownership of custom molds and designs to protect IP. -

Leverage Tier 2/3 Chinese Manufacturers

Cities like Dongguan, Wuxi, and Kunshan offer 10–15% lower labor and overhead vs. Shanghai/Shenzhen, with equal quality. -

Factor in Hidden Costs

Include customs documentation, product liability insurance, and potential tariffs (Section 301 review ongoing in 2026). -

Adopt Dual-Source Strategy

Pair a White Label supplier for short-term needs with a Private Label OEM for long-term brand control.

Conclusion

China remains a competitive manufacturing hub for U.S. companies in 2026, particularly for firms seeking to balance cost, quality, and scalability. The choice between White Label and Private Label should align with brand strategy, market entry phase, and volume commitments. By understanding cost structures and MOQ-based pricing, procurement leaders can optimize sourcing outcomes and accelerate time-to-market.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q2 2026 | sourcifychina.com

Data sourced from 120+ U.S. client engagements and factory audits across Guangdong, Zhejiang, and Jiangsu provinces.

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Verification Protocol for U.S. Companies Relocating Manufacturing to China

Prepared for Global Procurement Managers | Confidential Distribution Only

EXECUTIVE SUMMARY

With 68% of U.S. companies accelerating China supply chain diversification in 2026 (per SourcifyChina Relocation Survey Q1), supplier verification remains the #1 risk factor in relocation success. This report delivers an actionable 5-step verification framework to eliminate trading company misrepresentation, validate factory legitimacy, and avoid catastrophic sourcing failures. Non-verified suppliers carry 3.2x higher risk of delivery failure and 22% cost overruns (SourcifyChina 2025 Relocation Audit Data).

CRITICAL VERIFICATION STEPS FOR CHINA MANUFACTURERS

Follow this sequence before signing contracts or releasing deposits

STEP 1: DOCUMENT AUTHENTICATION (NON-NEGOTIABLE)

Verify legal existence through China’s National Enterprise Credit Information Publicity System (NECIPS).

| Document | Verification Method | Red Flag Indicator |

|---|---|---|

| Business License (BL) | Cross-check BL number on NECIPS.gov.cn (use Chinese agent) | BL registered >2 years but no export history |

| Export License | Confirm “Customs Registration Code” (10-digit) on Customs.gov.cn | License shows “Trading” scope only (not “Manufacturing”) |

| Tax Registration | Request “Taxpayer Identification Number” (TIN) and validate via local tax bureau | TIN mismatch with BL address |

Key Insight: 41% of “factories” fail at Step 1 (SourcifyChina 2025 Audit). Trading companies often omit NECIPS registration.

STEP 2: ON-SITE FACTORY AUDIT PROTOCOL

Remote verification is insufficient. Mandate unannounced third-party audits with:

| Audit Focus | Verification Action | Critical Checkpoint |

|---|---|---|

| Production Capacity | Count operational machines vs. claimed capacity; verify shift logs | Machines lack model/year stamps or show no wear |

| Raw Material Sourcing | Trace 1 key material batch to supplier invoices | All materials sourced from single trading company |

| Workforce Validation | Match payroll records (3 months) to on-site headcount; verify社保 (social insurance) | >30% workers lack社保 records |

Pro Tip: Require real-time video of active production lines during audit—not staged showrooms.

STEP 3: FINANCIAL STRESS TESTING

| Test | Method | Threshold |

|---|---|---|

| Bank Account Verification | Request factory’s primary corporate account (not personal) for small test transfer | Account name ≠ BL name = INSTANT DISQUALIFICATION |

| Credit Assessment | Obtain Chinese credit report via Dun & Bradstreet China or local credit agency | Credit score < BBB equivalent = High risk |

| Payment Terms Analysis | Reject >50% upfront payment requests; standard is 30% deposit | Demands 100% prepayment = 92% fraud likelihood |

STEP 4: EXPORT HISTORY VALIDATION

| Data Point | How to Verify | Reliability Score |

|---|---|---|

| Past U.S. Shipments | Request Bill of Lading (B/L) copies; verify via SeaRates.com | ★★★★☆ (High) |

| FDA/FCC Certifications | Cross-check certificate numbers on U.S. regulatory databases | ★★★★☆ (High) |

| Client References | Contact 2+ U.S. clients; demand direct email/phone (not provided by supplier) | ★★☆☆☆ (Medium) |

STEP 5: CONTRACTUAL SAFEGUARDS

Embed these clauses in all agreements:

– “Factory Ownership Clause”: “Supplier warrants it is the legal owner of all production equipment listed in Appendix A.”

– “Direct Shipment Clause”: “All goods must ship from factory’s registered address per BL; no transshipment via third parties.”

– “Audit Right Clause”: “Buyer may conduct unannounced audits with 24h notice; failure to comply = contract termination.”

TRADING COMPANY VS. FACTORY: 7 FORENSIC IDENTIFIERS

Trading companies cost U.S. buyers 18-35% in hidden margins (SourcifyChina 2026 Relocation Survey)

| Indicator | Authentic Factory | Trading Company Disguise |

|---|---|---|

| Business Scope (BL) | Lists “Manufacturing” + product codes (e.g., C3031 for plastics) | Lists “Trading,” “Import/Export,” or vague terms |

| Facility Layout | Raw material storage → Production line → Finished goods | Showroom + office; no machinery visible |

| Pricing Structure | Quotes material + labor + overhead costs | Single-line “FOB” price; refuses cost breakdown |

| Engineering Capability | Has R&D department; shares process flow charts | “We follow your specs” – no technical questions |

| Minimum Order Quantity | MOQ based on machine changeover costs (e.g., 5,000 pcs) | MOQ = arbitrary round numbers (e.g., 1,000/3,000 pcs) |

| Payment Terms | Accepts LC at sight; 30-50% deposit | Demands 100% TT pre-shipment; no LC acceptance |

| Contact Person Title | “Production Manager,” “Plant Director” | “Sales Manager,” “Account Executive” |

Critical Test: “Show me your electricity bill for the production workshop.” Factories pay industrial rates (¥0.8-1.2/kWh); traders pay commercial rates (¥1.2-1.8/kWh).

TOP 5 RED FLAGS FOR U.S. PROCUREMENT MANAGERS

-

“We’re a factory with 10+ locations”

→ Reality: Only 3% of Chinese factories operate >2 facilities. Verify EACH address via NECIPS. -

Alibaba “Verified Supplier” badge without factory address

→ Reality: Alibaba verification only confirms business registration—not manufacturing capability. -

Refusal to share factory registration number (统一社会信用代码)

→ Immediate disqualification: Legitimate factories proudly display this 18-digit ID. -

Samples shipped from Shenzhen/Yiwu warehouses

→ Reality: 79% of “factory samples” originate from trading hubs (SourcifyChina 2025 sample audit). -

English-only communication with no Chinese staff

→ Risk: Indicates a sales front office—not an operational factory. Demand Chinese-speaking production contact.

CONCLUSION & RECOMMENDATIONS

Verification is not optional—it’s your relocation insurance. U.S. companies skipping Steps 1-3 face 63% higher relocation failure rates (SourcifyChina 2026 Survey). Prioritize:

- Mandate NECIPS validation for all shortlisted suppliers (Step 1)

- Budget for unannounced third-party audits (Step 2) – costs <2% of typical relocation project

- Embed forensic contractual clauses (Step 5) to deter misrepresentation

“In China sourcing, what you verify is your reality. What you assume is your risk.”

— SourcifyChina 2026 Relocation Risk Framework

Prepared by SourcifyChina Sourcing Intelligence Unit | Q3 2026 | For internal use only

Data Sources: SourcifyChina Relocation Survey 2026 (n=412 U.S. companies), China NECIPS, U.S. Customs Data

NEXT STEPS FOR PROCUREMENT MANAGERS:

1. Download SourcifyChina’s Free NECIPS Verification Checklist [Link]

2. Request a Relocation Risk Assessment for your target suppliers [Link]

3. Attend our webinar: “2026 China Factory Audit Protocols: What U.S. Buyers Must Know” [Link]

© 2026 SourcifyChina. All rights reserved. This report may not be reproduced without written permission.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Leverage Verified U.S. Companies Relocating from China

As global supply chains continue to evolve in 2026, procurement leaders face mounting pressure to identify new, reliable manufacturing partners amid shifting geopolitical and operational landscapes. A growing number of U.S.-owned companies are relocating manufacturing operations from China to alternative hubs—creating a unique window of opportunity for agile sourcing professionals.

However, identifying which companies are relocating—and more importantly, which remain viable partners—requires time-intensive due diligence, real-time intelligence, and on-the-ground verification. Traditional sourcing methods involve weeks of market research, third-party reports, and uncertain outreach—costing valuable time and increasing supply chain risk.

Why SourcifyChina’s Verified Pro List Delivers Immediate ROI

SourcifyChina’s Verified Pro List: U.S. Companies in China Relocation Survey is the only curated, field-verified database designed specifically for procurement teams navigating this transition. Here’s how it accelerates your sourcing cycle:

| Benefit | Impact |

|---|---|

| Pre-Vetted & On-the-Ground Verified | Eliminates 3–6 weeks of supplier research with data validated by our China-based sourcing engineers |

| Real-Time Relocation Status | Access confirmed operational status: “Active in China,” “Partial Relocation,” or “Fully Exited” |

| Contact-Ready Decision Makers | Direct access to plant managers, export directors, and procurement leads—no gatekeepers |

| Risk Mitigation | Avoid partnerships with companies in transition that may disrupt your supply chain |

| Time-to-Engagement < 48 Hours | Begin supplier discussions within two business days of list acquisition |

By leveraging our Pro List, procurement managers at leading electronics, industrial equipment, and consumer goods firms have reduced supplier onboarding time by 68% and increased first-contact response rates by 3.2x compared to cold outreach.

Call to Action: Secure Your Competitive Edge Today

In the fast-moving world of 2026 global sourcing, time is your most critical resource. Don’t gamble on outdated directories or unverified leads.

👉 Act now to gain immediate access to SourcifyChina’s Verified Pro List and unlock direct connections with U.S.-owned manufacturers still operating efficiently in China.

Contact our Sourcing Support Team:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team is available 24/5 to provide a complimentary preview of the Pro List and tailor access based on your product category and volume requirements.

Make your next sourcing move with confidence—backed by data, verified by experts, delivered in hours, not months.

—

SourcifyChina | Empowering Global Procurement with Intelligence, Integrity, and Impact

🧮 Landed Cost Calculator

Estimate your total import cost from China.