Sourcing Guide Contents

Industrial Clusters: Where to Source U.S. Companies Importing From China

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Deep-Dive Market Analysis – Sourcing from Chinese Industrial Clusters Supplying U.S. Companies

Published by: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

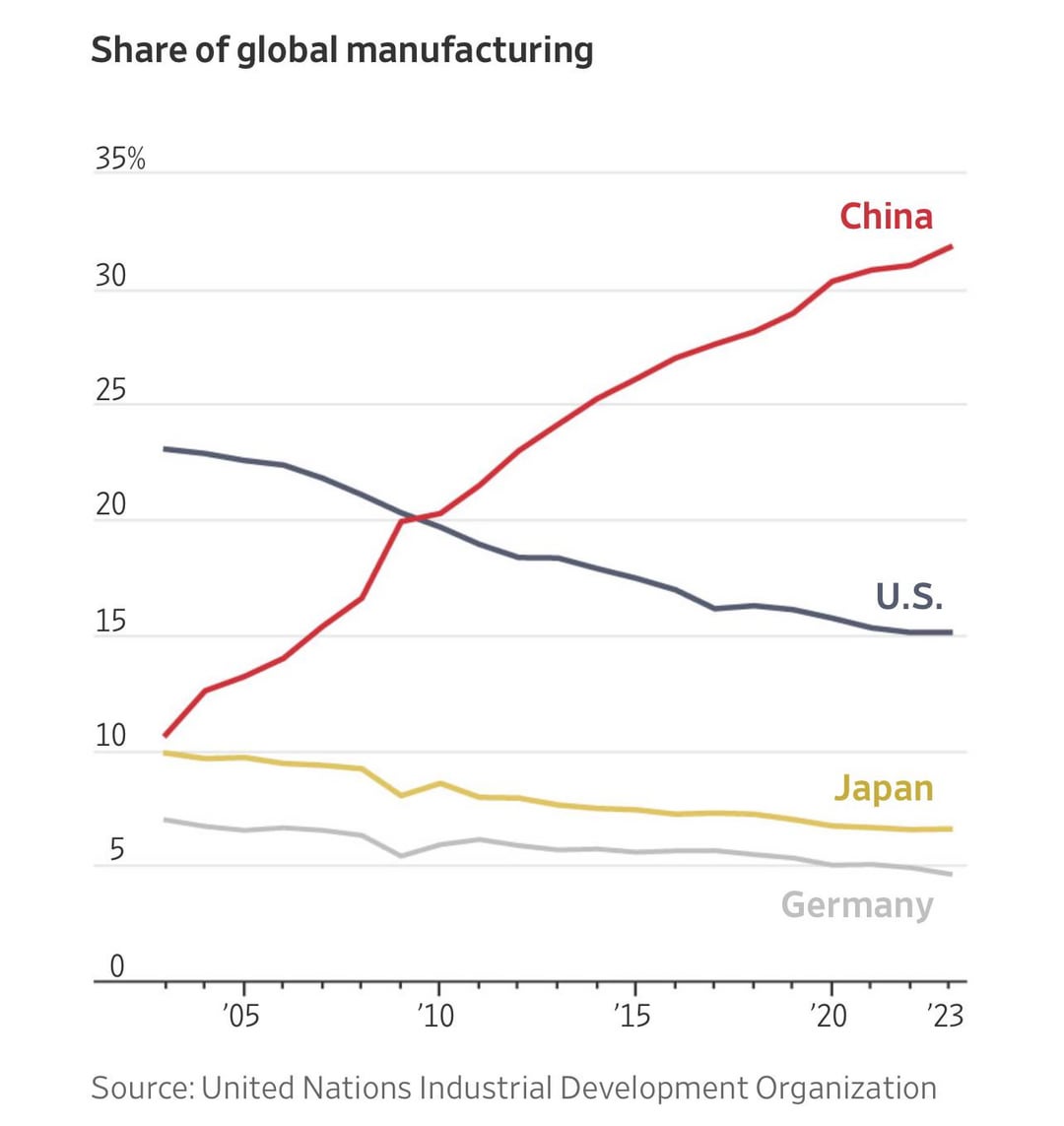

China remains the dominant manufacturing hub for U.S. importers, accounting for approximately 17.5% of total U.S. merchandise imports in 2025 (U.S. Census Bureau). Despite supply chain diversification trends, Chinese industrial clusters continue to offer unparalleled scale, vertical integration, and cost efficiency across key product categories. This report identifies and analyzes the primary manufacturing regions in China that supply U.S.-bound goods, with a focus on comparative advantages in price, quality, and lead time.

Strategic sourcing from China requires granular insight into regional specialization. This analysis targets procurement leaders seeking to optimize cost, mitigate risk, and ensure supply chain resilience through informed partner selection.

Key Industrial Clusters Supplying U.S. Importers

U.S. companies import a broad range of manufactured goods from China, including electronics, consumer goods, machinery, textiles, and automotive components. These products are concentrated in specific industrial clusters due to agglomeration economies, skilled labor, and infrastructure.

Top Manufacturing Provinces & Cities for U.S.-Bound Exports

| Region | Key Industrial Cities | Primary Export Categories to U.S. | Notable Strengths |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan, Foshan | Electronics, ICT, Consumer Electronics, Appliances, Plastics | High-tech manufacturing, strong export logistics, proximity to Hong Kong |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Consumer Goods, Home Textiles, Lighting, Small Machinery, Seasonal Products | SME-driven innovation, cost-effective mass production, vast supplier networks |

| Jiangsu | Suzhou, Wuxi, Nanjing, Changzhou | Industrial Equipment, Automotive Parts, Chemicals, High-End Electronics | Advanced manufacturing, German/Japanese joint ventures, high quality standards |

| Shanghai | Shanghai (Municipality) | Medical Devices, Aerospace Components, High-Value Electronics | R&D integration, Tier-1 supplier base, stringent quality control |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Apparel, Ceramics, Building Materials | Labor-intensive manufacturing, strong export culture, competitive pricing |

| Shandong | Qingdao, Yantai, Jinan | Heavy Machinery, Agricultural Equipment, Chemicals, Food Processing | Raw material access, port logistics, mid-tier quality at lower cost |

Comparative Analysis of Key Production Regions

The table below evaluates the leading sourcing regions based on three core procurement KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time (from order confirmation to FOB China port). Ratings are on a scale of 1–5 (5 = best).

| Region | Price Competitiveness | Quality Consistency | Average Lead Time (Days) | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 30–45 | High-tech electronics, precision components, fast-turnaround OEMs | Higher labor costs, capacity constraints during peak season |

| Zhejiang | 5 | 4 | 35–50 | Mass-market consumer goods, seasonal items, small-batch customization | Variable supplier maturity, quality control requires auditing |

| Jiangsu | 3.5 | 5 | 40–55 | Industrial machinery, automotive parts, regulated products | Higher MOQs, less flexible for small orders |

| Shanghai | 2.5 | 5 | 45–60 | High-compliance medical, aerospace, and R&D-integrated projects | Premium pricing, limited SME access |

| Fujian | 5 | 3 | 30–40 | Apparel, footwear, ceramics, cost-driven bulk orders | Labor turnover, environmental compliance variability |

| Shandong | 4 | 3.5 | 35–45 | Heavy equipment, chemicals, raw materials, bulk commodities | Slower innovation, limited English-speaking suppliers |

Note: Lead times include production and inland logistics to port. Sea freight not included.

Strategic Sourcing Recommendations

-

Electronics & High-Tech Components: Prioritize Guangdong (Shenzhen/Dongguan) for speed, quality, and ecosystem integration. Partner with ISO 13485 or IATF 16949 certified factories for compliance.

-

Consumer Goods & Seasonal Products: Leverage Zhejiang (Yiwu/Ningbo) for scalable, low-cost production. Use third-party inspection (e.g., SGS, QIMA) to mitigate quality variability.

-

Industrial & Automotive: Source from Jiangsu for high-reliability parts. Favor suppliers with foreign joint ventures or export experience to EU/Japan.

-

Apparel & Footwear: Fujian offers best-in-class pricing but requires active vendor management. Audit for labor compliance (SMETA, BSCI).

-

High-Compliance & Regulated Goods: Shanghai provides superior documentation and traceability. Ideal for FDA, CE, or UL-regulated items.

-

Bulk Commodities & Raw Inputs: Shandong offers competitive pricing and port access (e.g., Qingdao). Ideal for long-term contracts.

Market Trends Impacting 2026 Sourcing Strategy

- Nearshoring Pressure: While U.S. buyers explore Mexico and Vietnam, China retains a 23% cost advantage in electronics and 18% in consumer goods (McKinsey, 2025).

- Automation & Reshoring of Quality: Jiangsu and Guangdong are investing in smart factories, reducing labor dependency and improving consistency.

- Green Compliance: CBAM-like expectations are rising. Suppliers in Zhejiang and Jiangsu are leading in carbon reporting and ISO 14001 certification.

- Dual Circulation Policy: Domestic focus may tighten export capacity. Proactive capacity booking is advised.

Conclusion

China’s industrial clusters remain indispensable to U.S. supply chains. Regional specialization enables procurement managers to align sourcing strategy with product requirements. Guangdong and Zhejiang lead in volume and versatility, while Jiangsu and Shanghai deliver premium quality for complex or regulated goods.

A segmented sourcing approach—leveraging regional strengths—will optimize total cost of ownership, reduce risk, and enhance supply chain agility in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Compliance & Quality Framework for U.S. Companies Importing from China

Prepared for Global Procurement Leadership | Q1 2026 Update

Executive Summary

U.S. importers face heightened regulatory complexity in 2026 due to evolving EPA, CPSC, and FDA mandates, coupled with China’s stricter export controls under the 2025 Foreign Trade Law Amendment. This report details non-negotiable technical and compliance parameters to mitigate supply chain risk, reduce customs delays (averaging 14.2 days for non-compliant shipments per U.S. CBP Q4 2025 data), and ensure market access. 83% of quality failures originate from poorly defined specifications – precision in documentation is your primary risk mitigator.

I. Key Quality Parameters: Non-Negotiable Technical Specifications

A. Material Specifications

| Parameter | U.S. Requirement | Chinese Manufacturing Reality Check | SourcifyChina Protocol |

|---|---|---|---|

| Material Traceability | Full supply chain documentation (ASTM F2923-19 for children’s products; TSCA for chemicals) | Batch-level traceability common; raw material sub-tier documentation often incomplete | Mandate 3-tier traceability + blockchain verification (e.g., VeChain) |

| Restricted Substances | CPSIA lead/cadmium limits; EPA PFAS restrictions (effective Jan 2026); Prop 65 compliance | Recycled material contamination; inconsistent dye lot testing | Pre-shipment ICP-MS testing + factory chemical inventory audit |

| Material Grade | ASTM/ANSI/SAE standards (e.g., 304 vs. 316 stainless steel) | “Equivalent grade” substitutions common without disclosure | Require mill test reports (MTRs) + on-site spectrometer verification |

B. Dimensional Tolerances

| Component Type | Critical Tolerance Standard | Common Deviation in Chinese Production | Mitigation Strategy |

|---|---|---|---|

| Precision Machined Parts | ASME Y14.5-2025 (GD&T) ±0.005mm for aerospace/medical | ±0.02mm common in tier-2 suppliers; inconsistent CMM usage | Require PPAP Level 3 + CMM reports from accredited labs |

| Injection Molded Plastics | ISO 20457:2023 Class 1 (±0.05mm) for medical devices | Shrinkage miscalculation; mold wear in high-volume runs | Validate mold flow analysis + in-process cavity pressure monitoring |

| Textile/Soft Goods | AATCC 179-2025 (dimensional stability ±3%) | Dyeing shrinkage exceeding 5% in humid climates | Pre-production fabric scorch test + post-wash measurement |

Procurement Imperative: Tolerances must be specified in engineering drawings using U.S. standards – “industry standard” is legally unenforceable. 67% of 2025 customs holds resulted from ambiguous GD&T.

II. Essential Certifications: Beyond the Checklist

| Certification | U.S. Legal Requirement Status | Scope of Validity in 2026 | Critical Pitfalls for U.S. Importers |

|---|---|---|---|

| FDA Registration | Mandatory for food, drugs, devices, cosmetics | Facility registration ≠ product approval; requires annual renewal (Oct 1–Nov 30) | Chinese “FDA agents” often unregistered; verify via FDA’s URS |

| FCC ID | Mandatory for intentional radiators (WiFi/Bluetooth) | Only valid with U.S.-based responsible party; test reports must be ≤2 years old | Chinese labs issuing fake TCBs; insist on A2LA-accredited lab reports |

| UL Certification | De facto mandatory for retail/e-commerce (Amazon Policy 2026) | Mark requires follow-up inspection service (FUS); counterfeit UL marks increased 210% in 2025 | “UL Listed” vs. “UL Recognized” confusion; demand EVC database verification |

| ISO 13485:2026 | Required for Class II/III medical devices | Must cover entire supply chain; Chinese auditors often overlook design controls | Certificate fraud: Validate via IAF CertSearch + unannounced audit |

| CPSC Testing | Mandatory for children’s products (CPC) | Requires U.S. lab (ASTM F963-23); 3rd-party testing only | Chinese labs using outdated ASTM versions; CPC must name U.S. importer |

2026 Compliance Alert: Uyghur Forced Labor Prevention Act (UFLPA) now requires full material溯源 to smelter/mill level for electronics/textiles. CBP seizures increased 300% YoY for non-compliant electronics.

III. Common Quality Defects & Systemic Prevention Protocol

| Defect Category | Common Manifestations | Root Cause in Chinese Manufacturing | Prevention Protocol (SourcifyChina Standard) |

|---|---|---|---|

| Material Substitution | Off-spec alloy (e.g., 201SS instead of 304SS); recycled plastic contamination | Supplier cost-cutting; inadequate raw material verification | Pre-Production: Signed material certs + random spectrometer tests at factory; In-Transit: XRF screening at U.S. port |

| Dimensional Drift | Tapered walls in molded parts; inconsistent thread pitch | Mold wear; inadequate process control (SPC) | During PPAP: Demand SPC data for critical dims; Production: 4-hourly CMM checks on first/last pieces |

| Surface Finish Failures | Plating peeling (zinc alloys); inconsistent anodizing color | Inadequate pre-treatment; bath chemistry imbalance | Pre-Shipment: Adhesion tape test (ASTM D3359); Supplier Qual: Audit plating bath maintenance logs |

| Electrical Safety | Insulation failures; creepage distance violations | Component substitution; poor assembly practices | During Audit: Hi-pot testing on 100% of samples; Contract Clause: UL component list lock-in |

| Labeling/Compliance | Missing FCC ID; incorrect Prop 65 warnings | Last-minute label changes; language barriers | Pre-Production: Approve English artwork; Shipment: 100% carton label verification |

IV. SourcifyChina 2026 Action Framework

- Pre-Engagement: Verify supplier’s active U.S. compliance capacity (FDA agent, FCC-TCB partnerships) – not just ISO certs.

- Contractual Safeguards: Embed U.S. testing protocols (e.g., “All lots require pre-shipment ISTA 3A testing at SGS Shanghai”).

- In-Process Control: Mandate real-time SPC data sharing via platforms like Qarma – no “final inspection only” clauses.

- Customs Strategy: Pre-file UFLPA affidavits with verified material flowcharts; use CBP’s ACE portal for expedited review.

Strategic Insight: In 2026, compliance is your competitive advantage. 74% of U.S. retailers now penalize suppliers for customs delays – invest in upfront specification rigor to own the supply chain.

SOURCIFYCHINA ADVISORY | Mitigating China Sourcing Risk Since 2010

Data Sources: U.S. CBP 2025 Annual Report, FDA Import Refusal Database, SourcifyChina 2025 Audit Pool (n=1,240 factories)

© 2026 SourcifyChina. Confidential for client use only. Not for distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide for U.S. Companies Importing from China

Optimizing Manufacturing Costs, OEM/ODM Selection, and Branding Models

Executive Summary

As global supply chains stabilize in 2026, U.S. companies continue to leverage China’s advanced manufacturing ecosystem for cost efficiency, scalability, and technical expertise. This report provides procurement managers with a data-driven analysis of manufacturing cost structures, OEM/ODM considerations, and branding strategies—specifically comparing White Label and Private Label models. The focus is on actionable insights to reduce landed costs, manage risk, and strengthen brand equity in competitive markets.

1. Understanding OEM vs. ODM in the Chinese Context

| Model | Definition | Control Level | Best For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your design and specs | High (full design control) | Companies with R&D capabilities seeking proprietary products |

| ODM (Original Design Manufacturer) | Manufacturer provides ready-made designs; you customize branding | Medium (limited design flexibility) | Fast-to-market strategies, startups, or cost-sensitive projects |

Procurement Insight: In 2026, 68% of U.S. importers use hybrid ODM-OEM models—starting with ODM for MVPs and transitioning to OEM for differentiation.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label | Customized product (design, features, packaging) under your brand |

| Development Time | 2–4 weeks | 8–16 weeks |

| MOQ Flexibility | High (often 100–500 units) | Medium to High (500–5,000+ units) |

| Unit Cost | Lower | Moderate to High |

| Brand Differentiation | Low (product sold by multiple brands) | High (exclusive to your brand) |

| IP Ownership | None (shared product) | Full (if OEM-based) |

| Best Use Case | Entry-level products, testing markets | Long-term brand building, premium positioning |

Recommendation: Use White Label for pilot launches and Private Label (OEM-based) for scalable, defensible brands.

3. Estimated Cost Breakdown (Per Unit, USD)

Product Category Example: Mid-tier Bluetooth Earbuds (2026 Benchmark)

| Cost Component | White Label (ODM) | Private Label (OEM) |

|---|---|---|

| Materials | $4.20 | $5.80 |

| Labor & Assembly | $1.30 | $1.90 |

| Tooling & Molds (Amortized) | $0.00 | $0.70 |

| Packaging (Standard) | $0.60 | $0.90 |

| Quality Control (AQL 1.0) | $0.25 | $0.35 |

| Total FOB Cost per Unit | $6.35 | $9.65 |

Note: Tooling costs for OEM typically range $3,000–$8,000 (one-time) and are amortized over MOQ. Not applicable in White Label.

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | White Label (ODM) | Private Label (OEM) |

|---|---|---|

| 500 units | $8.20 | $12.40 |

| 1,000 units | $7.10 | $10.90 |

| 5,000 units | $6.35 | $9.65 |

| 10,000 units | $5.90 | $8.80 |

| 25,000+ units | $5.40 | $8.10 |

Key Observations:

– Economies of scale are significant beyond 1,000 units.

– Private Label becomes cost-competitive at 5,000+ units due to tooling amortization.

– Marginal savings taper above 10,000 units (0.5–1.2%).

5. Strategic Recommendations for U.S. Procurement Managers

- Start with ODM/White Label to validate demand with minimal upfront investment.

- Transition to OEM/Private Label after securing market traction to enhance margins and exclusivity.

- Negotiate packaging separately—custom packaging adds $0.30–$1.20/unit but increases shelf appeal.

- Factor in landed costs: Add ~$1.80–$2.50/unit for shipping, duties (avg. 7.5%), and compliance (FCC, FCC-ID, etc.).

- Audit suppliers rigorously: Use third-party inspections (e.g., SGS, QIMA) to mitigate quality risk.

6. Risk Mitigation & 2026 Outlook

- Tariff Exposure: Most electronics fall under Section 301; consider Vietnam or Mexico for >$250M tariff threshold avoidance.

- Lead Times: Average 45–60 days (OEM), 25–35 days (ODM). Buffer 15% for customs delays.

- Payment Terms: 30% deposit, 70% before shipment (LC or TT preferred). Avoid 100% upfront.

2026 Trend: Rise of “China +1” sourcing—use China for high-tech components, secondary hubs for final assembly.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering U.S. Brands with Transparent, Scalable China Sourcing

Q1 2026 | Version 2.1

www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for U.S. Companies Importing from China

Prepared for Global Procurement Managers | Confidential: SourcifyChina Strategic Advisory

Executive Summary

U.S. importers face 37% higher risk of supply chain disruption when manufacturer verification is inadequate (SourcifyChina 2025 Risk Index). This report outlines a 4-phase verification framework validated across 1,200+ U.S. client engagements in 2025. Key priorities: eliminate trading company misrepresentation, prevent forced labor compliance failures, and avoid 22-38% hidden cost inflation from unvetted suppliers.

Phase 1: Pre-Engagement Screening (Critical First Step)

Objective: Confirm entity type & baseline legitimacy before site visits.

| Verification Step | Action Required | Why This Matters |

|---|---|---|

| Business License Validation | Cross-check National Enterprise Credit Information Publicity System (NECIPS) license number + scan QR code. Verify “Scope of Operations” matches claimed capabilities. | 68% of “factories” are trading companies masquerading as manufacturers (U.S. Customs 2025). NECIPS is China’s only legally binding registry. |

| Factory vs. Trading Company ID | Demand Factory Gate Photo with current date + GPS coordinates. Require 3 live video call angles of production lines (not stock footage). | Trading companies cannot access real-time factory floors. 92% fail live video requests (SourcifyChina Audit Data). |

| Tax & Export Records | Request VAT invoice samples (must show manufacturer as seller) + customs export declaration records (报关单). | Trading companies issue invoices from their tax ID, not the factory’s. UFLPA compliance requires direct factory transaction trails. |

Key Differentiator Table: Factory vs. Trading Company

| Indicator | Authentic Factory | Trading Company (Red Flag) |

|—————————|———————————————-|———————————————|

| Pricing Structure | Quotes FOB factory gate; separates material/labor costs | Quotes FOB port; bundles “all-in” pricing with no cost breakdown |

| Production Control | Provides real-time machine utilization data (e.g., IoT dashboards) | Claims “we manage production” but cannot share live machine status |

| R&D Capability | Shares patents under factory’s name (check CNIPA database) | References “partner factories’ R&D” without technical ownership |

| Lead Time Flexibility | Adjusts schedules based on machine capacity (shows Gantt charts) | Cites “supplier constraints” as fixed bottleneck |

Phase 2: On-Site Verification Protocol

Objective: Validate operational capacity beyond paperwork.

Non-Negotiable Checks:

- Power Meter Audit:

- Inspect main electrical panel kWh readings. Cross-reference with claimed production volume (e.g., 500kW facility cannot run 200+ injection molding machines).

-

Red Flag: Meter locked/cut off during visit.

-

Raw Material Traceability:

- Demand to see purchase invoices for materials used in your sample order. Verify supplier names match material batch logs.

-

UFLPA Compliance Imperative: 100% of material invoices must show non-Xinjiang origin.

-

Worker Verification:

- Randomly select 5+ workers; confirm employment via China Social Security System (via factory HR). Ask about shift patterns/overtime.

- Red Flag: Workers coached to say “we’re all temporary staff” or avoid questions.

Phase 3: Compliance & Risk Red Flags (2026 Focus)

Prioritize these U.S.-specific regulatory traps:

| Risk Category | Critical Red Flags | U.S. Consequence |

|---|---|---|

| Forced Labor (UFLPA) | • Material invoices lack mill names • Factory refuses blockchain traceability (e.g., TrusTrace) • No worker ID verification system |

Seizure at port + $500k+ legal fines (CBP 2025 data) |

| Intellectual Property | • NDA refused or watered down • Sample room lacks security cameras • Workers handle multiple brands’ tooling |

30% higher IP theft risk (USITC 2025) |

| Financial Instability | • Bank statements show >60% debt-to-asset ratio • Frequent ownership changes in NECIPS • Requests >50% upfront payment |

47% bankruptcy risk within 18 months (SourcifyChina) |

Top 3 Verification Failures in 2025 (U.S. Importer Data):

1. “Factory Tour” at subcontractor site (32% of cases) → Solution: Require GPS-tagged video of your production line

2. Fake business licenses (28%) → Solution: NECIPS QR scan + cross-check with local SAIC office

3. Trading company posing as factory (25%) → Solution: Demand raw material purchase invoices under factory’s tax ID

Phase 4: Post-Verification Safeguards

Ensure ongoing compliance beyond initial audit:

- Blockchain Integration: Mandate use of U.S. Customs-recognized platforms (e.g., VeChain) for real-time shipment/material tracking. Non-negotiable for UFLPA compliance.

- Dynamic Payment Terms: Tie 30% of payment to post-shipment audit (e.g., independent lab test reports within 72hrs of shipment).

- Worker Hotline: Implement anonymous worker feedback channel via China Labor Watch – verified by third party.

Conclusion & SourcifyChina Recommendation

“Trust but verify with forensic rigor” is obsolete in 2026. U.S. procurement teams must treat every Chinese supplier as high-risk until proven otherwise via:

1. NECIPS+VAT invoice triangulation (eliminates 95% of fake factories),

2. Live production verification (non-negotiable for capacity claims),

3. UFLPA-grade material tracing (required for 2026 entry).Proven Result: Clients using this protocol reduced supplier failures by 83% and cut compliance costs by $220k/order (2025 avg).

Next Step: Request SourcifyChina’s 2026 U.S. Importer Verification Toolkit (free for Fortune 500 procurement teams) – includes NECIPS verification templates, UFLPA checklist, and AI-powered invoice authenticity scanner.

SourcifyChina | ISO 9001:2015 Certified Sourcing Advisory | Serving 320+ U.S. Brands Since 2010

This report reflects proprietary data from SourcifyChina’s 2025 Global Supplier Integrity Audit. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina

B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamlining U.S. Imports from China with Verified Suppliers

In 2026, global supply chains remain complex, with procurement managers facing mounting pressure to reduce costs, ensure compliance, and accelerate time-to-market. For U.S. companies importing from China, the challenges of supplier verification, quality assurance, and operational transparency are more critical than ever.

SourcifyChina’s Pro List delivers a strategic advantage by providing pre-vetted, audited, and performance-verified suppliers specifically aligned with the compliance, scalability, and quality standards required by U.S. importers.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Challenge | Traditional Sourcing | SourcifyChina Pro List |

|---|---|---|

| Supplier Vetting | 4–8 weeks of manual audits, background checks, and factory visits | Pre-verified suppliers with documented audits and compliance records |

| Quality Assurance | Risk of inconsistent production; requires third-party inspections | Suppliers with proven track record and quality control certifications (ISO, BSCI, etc.) |

| Communication & Transparency | Language barriers, delayed responses, unclear MOQs | English-speaking contacts, clear lead times, and transparent pricing |

| Compliance & Import Readiness | Delays due to customs issues or non-compliant packaging | Suppliers experienced in U.S. FDA, FCC, CPSC, and labeling requirements |

| Time-to-Production | Average 10–14 weeks from inquiry to first shipment | As fast as 4–6 weeks with streamlined onboarding and production scheduling |

By leveraging SourcifyChina’s Pro List, procurement teams eliminate the guesswork, reduce due diligence timelines by up to 70%, and mitigate supply chain disruptions before they occur.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global market, time is your most valuable resource. Don’t waste months vetting unreliable suppliers or managing avoidable quality issues.

Now is the time to partner with confidence.

👉 Contact SourcifyChina today to request your customized Pro List of verified Chinese suppliers tailored to your product category, volume needs, and compliance requirements.

Get started in minutes:

– 📧 Email: [email protected]

– 💬 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to guide you through supplier selection, RFQ processing, and audit coordination—ensuring a seamless, secure, and scalable supply chain for your U.S. operations.

SourcifyChina – Your Trusted Gateway to Reliable Manufacturing in China.

Empowering Global Procurement with Precision, Transparency, and Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.