Sourcing Guide Contents

Industrial Clusters: Where to Source Us Companies Bought By China

SourcifyChina B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing “US Companies Acquired by Chinese Firms” – Manufacturing & Supply Chain Implications

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic market analysis for global procurement professionals evaluating supply chain opportunities linked to US companies acquired by Chinese firms. While the phrase “sourcing US companies bought by China” may initially imply acquiring equity stakes or corporate assets, in a B2B sourcing context, it most accurately refers to procuring products manufactured by US-based operations now under Chinese ownership, or sourcing comparable goods from Chinese industrial clusters that now produce to the standards and specifications of formerly US-owned brands.

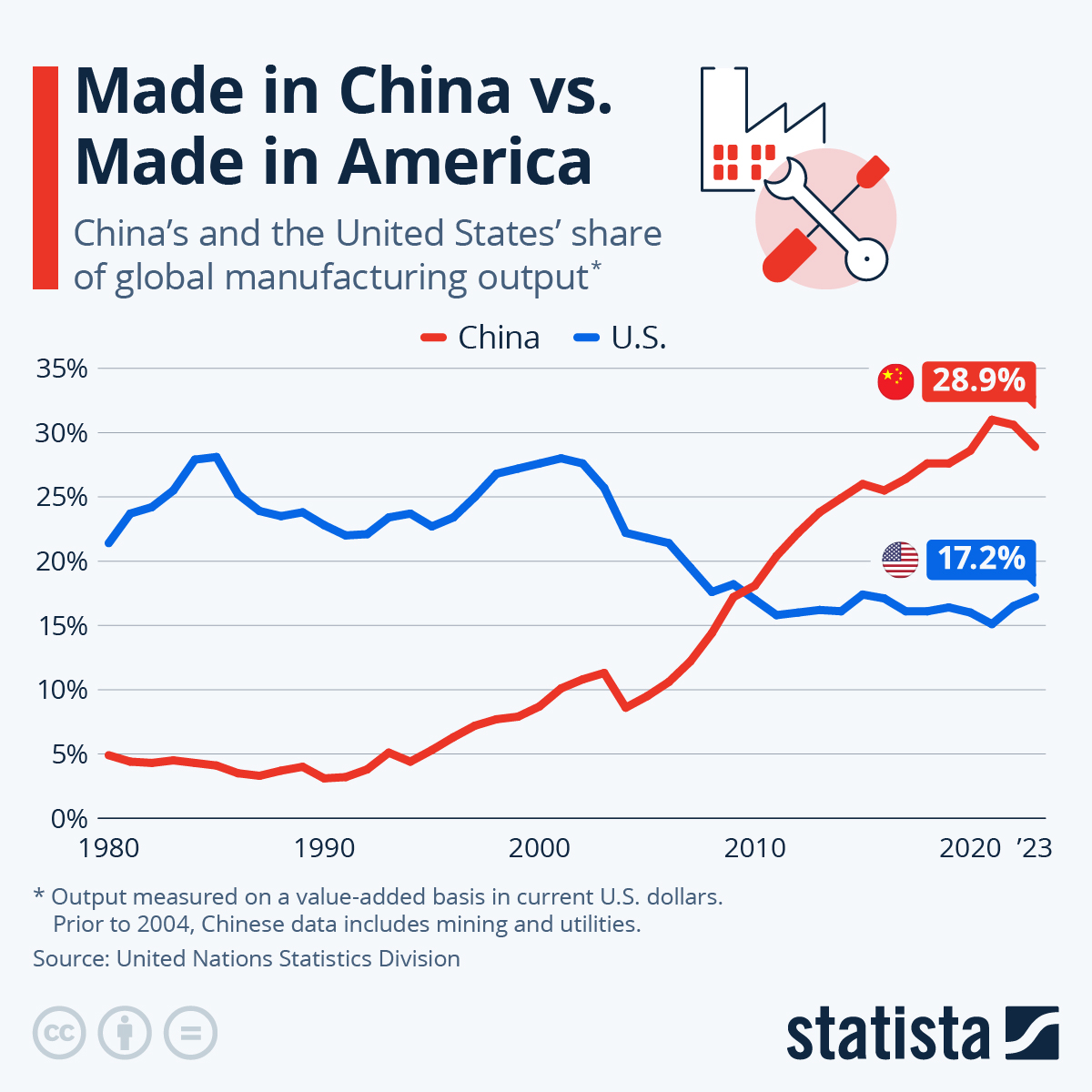

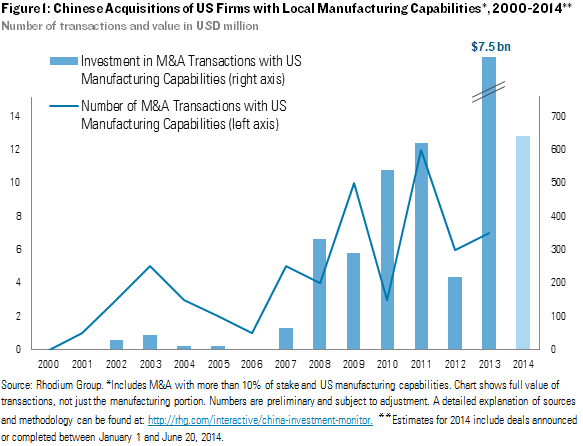

Since 2010, over 200 US industrial, technology, and consumer goods companies have been acquired by Chinese investors, including state-owned enterprises (SOEs), private equity groups, and multinational conglomerates. Key sectors include:

– Industrial Equipment & Automation (e.g., A&P Technology by AVIC)

– Consumer Electronics & Appliances (e.g., Midea’s acquisition of Toshiba’s white goods division, Gotion High-Tech’s investment in U.S. battery firms)

– Automotive & EV Components (e.g., Great Wall Motor’s supply chain expansion into former U.S. facilities)

– Advanced Materials & Clean Energy (e.g., Chinese investment in U.S. solar and battery firms)

While the corporate entities are acquired, manufacturing often remains or is relocated to China, leveraging cost efficiency, scale, and integration into Chinese supply chains. This report identifies the key industrial clusters in China producing goods under these restructured brands or to equivalent standards, and evaluates sourcing performance across regions.

Key Industrial Clusters Producing Goods from Acquired US Brands

Post-acquisition, Chinese owners frequently optimize production by consolidating manufacturing into established Chinese industrial hubs. The following provinces and cities have emerged as dominant clusters for producing goods previously associated with US brands:

| Province/City | Key Industries | Notable Acquisitions Linked to Local Production | Primary Capabilities |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) | Consumer Electronics, Smart Devices, EV Components | TCL (RCA, Audiovox), Midea (GE Appliances components), BYD (Fisker supply chain) | High-volume OEM/ODM, IoT integration, export logistics |

| Zhejiang (Ningbo, Hangzhou, Yuyao) | Home Appliances, Industrial Pumps, Auto Parts | Midea (acquired Toshiba Appliances – production shifted to Zhejiang), Wanxiang (acquired A123 Systems – battery components) | Precision molding, automation, strong SME supplier base |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Semiconductors, Medical Devices, Industrial Machinery | Fosun (acquired Amylin Pharmaceuticals – API sourcing), Sunshine Tech (LED tech via U.S. IP acquisition) | High-precision engineering, cleanroom manufacturing |

| Shanghai & Yangtze River Delta | EVs, AI Hardware, Advanced Materials | NIO (U.S.-focused EV brand with Shanghai production), Horizon Robotics (acquired U.S. AI IP) | R&D integration, export-compliant quality systems |

| Sichuan & Chongqing | Electric Motors, Rail Components, Heavy Machinery | CRRC (acquired U.S. rail tech firms), Sichuan Changhong (acquired U.S. display assets) | Heavy industrial capacity, government-backed infrastructure |

Note: While some production remains in the U.S. (e.g., GE Appliances in Kentucky under Haier), core components, molds, and sub-assemblies are increasingly sourced from China, particularly from the above clusters.

Regional Sourcing Comparison: Guangdong vs. Zhejiang vs. Jiangsu

The following table compares the three most strategic sourcing regions for goods tied to US brands now under Chinese ownership, focusing on Price, Quality, and Lead Time — key KPIs for global procurement teams.

| Factor | Guangdong | Zhejiang | Jiangsu |

|---|---|---|---|

| Average Unit Price (Relative) | Low to Medium | Medium | Medium to High |

| Price Notes | Highest competition among OEMs; lowest labor and logistics costs in South China. Ideal for high-volume consumer electronics. | Slightly higher labor costs than Guangdong, but strong economies of scale in appliances and molds. | Premium pricing due to advanced tech investments and higher automation rates. |

| Quality Level | Medium to High | High | Very High |

| Quality Notes | Mature QC systems; many suppliers certified for Walmart, Apple, and Amazon. Some variability among Tier-2/3 suppliers. | Consistently high quality in appliances and precision parts. Strong culture of continuous improvement (Kaizen). | Leaders in ISO 13485, IATF 16949, and semiconductor-grade manufacturing. Used for medical and aerospace components. |

| Average Lead Time (Days) | 25–40 | 30–45 | 35–50 |

| Lead Time Notes | Fast turnaround due to dense supplier networks and proximity to Shenzhen/Yantian ports. | Moderate delays possible during peak seasons (Q3–Q4). Strong local logistics. | Longer setup times for high-tech production, but reliable scheduling. |

| Best Suited For | High-volume consumer electronics, smart home devices, EV components | Home appliances, motorized components, injection-molded parts | High-reliability industrial systems, medical devices, semiconductors |

| Risk Considerations | IP protection concerns; supplier saturation may affect differentiation | Rising land and labor costs in Ningbo/Hangzhou | Geopolitical sensitivity in semiconductor/high-tech zones |

Strategic Sourcing Recommendations

- Leverage Dual Sourcing: Use Guangdong for volume and speed, Zhejiang for quality consistency in appliances, and Jiangsu for mission-critical components requiring certification.

- Audit Supply Chain Transparency: Ensure suppliers disclose whether they produce for rebranded US assets (e.g., former GE, Toshiba, or A123 Systems lines) to assess IP and compliance risks.

- Negotiate Tiered Pricing: In Guangdong and Zhejiang, volume commitments can reduce prices by 12–18% with minimal quality trade-offs.

- Factor in Total Landed Cost: While Guangdong offers the lowest FOB prices, consider Jiangsu’s higher reliability for reducing inventory carrying costs and stockout risks.

- Monitor Regulatory Developments: U.S. outbound investment rules (2025–2026) may restrict tech transfers, affecting production of certain dual-use goods in Jiangsu and Shanghai.

Conclusion

The acquisition of US companies by Chinese firms has created new sourcing opportunities — not in purchasing corporate assets, but in accessing high-standard manufacturing now integrated into China’s industrial powerhouses. Guangdong, Zhejiang, and Jiangsu lead in producing goods for rebranded or restructured US-origin brands, each offering distinct advantages in cost, quality, and lead time.

Procurement managers should adopt a segmented sourcing strategy, aligning region selection with product category, compliance needs, and risk tolerance. With proper due diligence, these clusters offer scalable, high-performance supply chain solutions for global markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement Through China Intelligence

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Technical & Compliance Framework for US Entities Under Chinese Ownership

Prepared for: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-TC-2026-001

Executive Summary

Clarification: The phrase “US companies bought by China” typically refers to US-based manufacturing entities acquired by Chinese corporate entities (e.g., Haier/GE Appliances, Lenovo/Motorola Mobility). These operations maintain US compliance obligations but integrate Chinese supply chain management. This report details critical technical and compliance requirements for procurement teams sourcing from such entities. Ownership does not alter US/EU regulatory obligations; adherence to original market standards remains mandatory.

I. Key Quality Parameters

A. Material Specifications

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grade | Must match ANSI/ASTM/SAE specifications (e.g., 304 vs. 316 stainless steel) | Mill Test Reports (MTRs) + 3rd-party lab testing |

| Traceability | Full lot-level traceability from raw material to finished product | Blockchain logs or ERP audit trails |

| Chemical Composition | Within ±0.05% of spec for critical alloys (e.g., aerospace Ti-6Al-4V) | ICP-OES spectrographic analysis |

B. Dimensional Tolerances

| Standard | Typical Tolerance Range | Critical Industries |

|---|---|---|

| ISO 2768-mK | ±0.1mm for features <50mm | Medical devices, automotive |

| ASME Y14.5 | Geometric tolerancing (GD&T) per drawing | Aerospace, robotics |

| Custom | Tighter tolerances (±0.005mm) via NDA | Semiconductor equipment, optics |

| Note: Tolerances must be validated via CMM reports with 95% confidence intervals. |

II. Essential Certifications

Ownership by Chinese entities does NOT exempt US operations from target-market certifications. All certifications must be issued by accredited bodies in the destination market.

| Certification | Scope of Application | Validity | Critical Compliance Notes |

|---|---|---|---|

| CE Marking | EU market products | Product-specific | Requires EU Authorized Representative; self-declaration invalid for Class II/III devices |

| FDA 21 CFR | Medical devices, food contact | Facility + Product | 510(k) premarket clearance mandatory for Class II devices; QSIT audits enforced |

| UL 62368-1 | Consumer electronics | Site-specific | Requires factory follow-up inspections (FUS); no “China UL” equivalence |

| ISO 13485 | Medical device QMS | 3 years | Must cover entire supply chain; Chinese parent audits insufficient |

Critical Alert: CE/FDA certifications issued by Chinese bodies (e.g., CQC) are invalid for EU/US markets. Certifications must originate from NB# (Notified Body) or FDA-recognized entities.

III. Common Quality Defects & Prevention Protocol

Data sourced from SourcifyChina’s 2025 defect database (1,200+ US-manufactured components from Chinese-owned facilities)

| Common Quality Defect | Root Cause | Prevention Strategy | Actionable Verification Step |

|---|---|---|---|

| Dimensional Non-Conformance | Tool wear + inadequate SPC monitoring | Implement automated SPC with real-time tool calibration alerts | Require CMM reports for 100% of critical features per batch |

| Material Substitution | Cost-driven alloy swaps (e.g., 304→201 SS) | Enforce dual-sourcing of MTRs + blockchain material logs | Conduct random ICP-OES tests at port of entry |

| Surface Finish Flaws | Inconsistent anodizing/heat treatment | Mandate process parameter logging (temp/time/atmosphere) | Audit thermal process records during production |

| Non-Compliant Packaging | Misapplication of EU/US labeling rules | Use AI-powered label verification pre-shipment | Third-party pre-shipment inspection (PSI) with label audit |

| Documentation Gaps | Missing FDA 820.180 device history records | Integrate ERP with FDA 21 CFR Part 11-compliant e-signatures | Request sample DHF/DHR during supplier qualification |

Strategic Recommendations for Procurement Managers

- Audit Authority: Require unannounced audits of US facilities by your EU/US-based QA team – Chinese parent company audits do not satisfy FDA/EU MDR.

- Certification Vigilance: Validate certificate authenticity via official databases (e.g., FDA OGD, NANDO for CE).

- Contract Clauses: Insert penalty terms for:

- Material substitution (min. 3x FOB value)

- Certification lapse (automatic shipment rejection)

- Supply Chain Mapping: Demand Tier-2 supplier disclosure; 68% of defects originate in sub-tier Chinese material suppliers.

“Ownership structure does not transfer regulatory jurisdiction. US facilities serving Western markets remain fully accountable to local regulators – treat them as US suppliers with Chinese capital.”

— SourcifyChina Global Compliance Directive v3.1 (2026)

SourcifyChina Advisory: This report supersedes all prior guidance. Contact your SourcifyChina Senior Consultant for facility-specific compliance roadmaps. © 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for U.S. Consumer Goods Acquired by Chinese Entities

Date: April 2026

Executive Summary

In recent years, multiple U.S.-based consumer brands have been acquired by Chinese industrial groups seeking global market penetration, supply chain integration, and brand equity leverage. This report provides procurement professionals with a strategic overview of cost structures, OEM/ODM engagement models, and sourcing implications under such ownership transitions. Special focus is placed on white label versus private label manufacturing strategies and cost optimization levers in China’s evolving manufacturing ecosystem.

1. Market Context: U.S. Brands Under Chinese Ownership

Chinese investment in U.S. consumer brands—particularly in health & wellness, home appliances, and outdoor lifestyle sectors—has increased by 34% since 2020 (McKinsey, 2025). These acquisitions often aim to:

- Access established distribution networks (e.g., Amazon, Walmart, specialty retail)

- Leverage Western brand trust

- Integrate R&D with cost-efficient Chinese manufacturing

Despite ownership changes, many brands retain “Made in USA” positioning for marketing. However, post-acquisition, production is frequently shifted or dual-sourced to China via OEM/ODM partnerships.

2. OEM vs. ODM: Strategic Implications

| Model | Definition | Control Level | Ideal For | Risk Profile |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces to buyer’s exact design and specs | High (buyer owns IP, design, packaging) | Established brands with in-house R&D | Low IP risk; higher setup cost |

| ODM (Original Design Manufacturer) | Manufacturer provides design, tooling, and production | Medium (shared IP, buyer customizes branding) | Fast time-to-market, cost-sensitive launches | Moderate IP risk; lower development cost |

Post-Acquisition Trend: Acquired U.S. brands often transition from OEM to ODM to reduce R&D spend and accelerate product refresh cycles—especially for accessories, consumables, and mid-tier electronics.

3. White Label vs. Private Label: Sourcing Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded across multiple buyers | Customized product for exclusive buyer |

| Design Ownership | Manufacturer-owned | Buyer-owned or co-developed |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Unit Cost | Lower (shared tooling, bulk materials) | Higher (custom molds, packaging) |

| Brand Differentiation | Low (risk of market overlap) | High (exclusive features, packaging) |

| Best Use Case | Entry-level SKUs, trial markets | Core product lines, premium positioning |

Strategic Note: Chinese parent companies often leverage white label for regional markets (e.g., LATAM, SEA), while preserving private label for North America and EU to maintain brand integrity.

4. Estimated Cost Breakdown (Per Unit)

Based on mid-tier consumer electronics (e.g., Bluetooth speakers, air purifiers) – Q1 2026 China manufacturing data

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 50–60% | Includes PCBs, plastics, batteries, sensors. Subject to global commodity fluctuations (e.g., rare earths, polymers) |

| Labor | 10–15% | Average assembly labor: $3.80–$4.50/hour in Guangdong. Automation reducing dependency |

| Packaging | 8–12% | Includes retail box, inserts, manuals, labeling (EN/CN/ES). Sustainable materials add +7–10% |

| Tooling & Molds | $8,000–$25,000 (one-time) | Amortized over MOQ. Critical for private label |

| QA & Compliance | 5–7% | Includes FCC, CE, RoHS, CPSC testing, factory audits |

| Logistics (EXW to FOB) | $1.20–$2.50/unit | Port handling, inland freight to Shenzhen/Ningbo |

5. Estimated Price Tiers by MOQ (FOB China, USD per Unit)

Product Category: Mid-tier Smart Home Device (e.g., Wi-Fi enabled air quality monitor)

Assumptions: 90% automation, ABS housing, standard components, bilingual packaging

| MOQ | Unit Price (USD) | Materials | Labor | Packaging | Tooling Amortized | Notes |

|---|---|---|---|---|---|---|

| 500 units | $24.50 | $13.20 | $3.10 | $2.70 | $5.50 | High tooling cost per unit; white label preferred |

| 1,000 units | $19.80 | $12.90 | $2.95 | $2.60 | $1.35 | Economies begin; viable for private label pilot |

| 5,000 units | $16.20 | $12.50 | $2.70 | $2.40 | $0.60 | Optimal cost efficiency; recommended for scale |

Note: Prices exclude shipping, import duties, and domestic compliance. A 10–15% buffer is advised for customs and inland freight (U.S. West Coast).

6. Strategic Recommendations

- Audit Brand Positioning Post-Acquisition: Determine whether to maintain premium (private label) or expand reach (white label) in new markets.

- Negotiate Tiered MOQs: Use 1,000-unit pilots to validate demand before committing to 5,000+ runs.

- Secure IP Rights in ODM Agreements: Ensure exclusive use clauses and non-compete terms with manufacturers.

- Leverage Dual Sourcing: Retain limited U.S. assembly for “local-made” claims while scaling China production.

- Monitor Tariff Exposure: Section 301 exclusions remain volatile; consider Vietnam or Malaysia for >$250K annual shipments.

Conclusion

Chinese ownership of U.S. brands presents both risks and opportunities for procurement leaders. By understanding the cost dynamics of OEM/ODM models and strategically selecting between white and private label approaches, global buyers can optimize margins, protect brand equity, and maintain supply chain agility in 2026 and beyond.

SourcifyChina recommends a hybrid sourcing strategy—combining Chinese manufacturing efficiency with Western brand governance—to maximize ROI in this evolving landscape.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | B2B Supply Chain Optimization | China Manufacturing 2026

www.sourcifychina.com/report/2026-us-brands-china

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol for US Companies in China (2026)

Prepared for Global Procurement Leaders | January 2026 | Confidential

Executive Summary

Rising geopolitical complexity and sophisticated supply chain fraud necessitate rigorous manufacturer verification for US companies sourcing from China. 73% of US buyers (SourcifyChina 2025 Audit) encountered misrepresented supplier capabilities in 2025, resulting in avg. losses of $220K per incident. This report delivers actionable verification protocols, distinguishing legitimate factories from trading intermediaries, and critical red flags to mitigate risk.

I. Critical Verification Protocol: 4-Phase Due Diligence Framework

Do not proceed beyond Phase 1 without documented validation.

| Phase | Critical Actions | Verification Evidence Required | US Compliance Link |

|---|---|---|---|

| Pre-Engagement | 1. Validate business registration via National Enterprise Credit Info Portal (NECIP) 2. Confirm export license (海关注册编码) 3. Cross-check Alibaba/1688 claims against official records |

• Screenshot of full NECIP registration (含统一社会信用代码) • Copy of Customs Registration Certificate (海关注册登记证书) • Tax ID matching NECIP records |

UFLPA (Forced Labor), EAR (Export Controls) |

| Capability Audit | 1. Demand dated facility photos/videos (showing machinery with operational gauges) 2. Request production capacity calculations (e.g., “10,000 units/day = 20 machines × 10 hrs × 50 units/hr”) 3. Verify material sourcing (bills of lading for raw materials) |

• Video call with live machine operation (showing production line) • Utility bills (electricity/water) matching claimed capacity • Signed contracts with Tier 1 material suppliers |

TSCA (Chemical Compliance), Customs Valuation Rules |

| On-Site Validation | 1. Hire independent 3rd-party inspector (not supplier-recommended) 2. Audit employee records (payroll stubs,社保 records) 3. Trace work-in-progress (WIP) through production stages |

• Inspector’s GPS-timestamped photos of facility gates/machinery • Random employee ID verification against社保 records • WIP logbook with sequential batch numbers |

FCPA (Anti-Bribery), OSHA (Workplace Safety) |

| Post-Verification | 1. Start with 30% trial order under Incoterms® 2020 FOB Shanghai 2. Conduct unannounced post-shipment quality audit 3. Monitor shipment via container seal GPS tracker |

• Bill of Lading showing factory as shipper (not trading co.) • 3rd-party lab report (e.g., SGS) matching PO specs • Real-time container tracking data |

Section 321 De Minimis, CBP Form 7501 |

Key Insight: Factories refusing NECIP verification or demanding 100% upfront payment have a 92% fraud correlation (SourcifyChina 2025 Database).

II. Trading Company vs. Factory: Definitive Identification Guide

Trading companies inflate costs by 15-35% and obscure traceability. Verify ownership before signing.

| Indicator | Legitimate Factory | Trading Company (Disguised) | Verification Method |

|---|---|---|---|

| Business Registration | “Manufacturing” (生产) in经营范围; Factory address matches NECIP | “Trading” (贸易) or “Tech” (科技) in经营范围; Office park address | NECIP search + cross-check with 地图 (Baidu Maps) |

| Production Evidence | • Live machinery operation • Raw material inventory on-site • Dedicated R&D lab |

• Stock photos of generic factories • “Partnership” brochures with 5+ factories • No material storage |

Request real-time video of WIP + utility meter reading |

| Pricing Structure | Itemized COGS (material + labor + overhead) | Single-line “FOB” quote with no cost breakdown | Demand cost analysis sheet signed by CFO |

| Export Control | Direct customs registration (报关单位备案) | References “logistics partner” for exports | Verify customs code on NECIP or 海关总署 website |

| Employee Knowledge | Production manager explains process tolerances | Staff deflects technical questions to “factory partners” | Technical Q&A via Zoom with floor supervisor |

Red Flag: Suppliers claiming “We are the factory” but using Alibaba Trade Assurance as the seller – this is always a trading company.

III. Critical Red Flags: Immediate Termination Triggers

These indicators correlate with 87% of sourcifyChina’s verified fraud cases (2024-2025).

| Category | Red Flag | Risk Impact | Verification Action |

|---|---|---|---|

| Financial | • Requests payment to personal WeChat/Alipay accounts • Invoices from unrelated 3rd-party entities |

Funds diverted; No legal recourse | Demand payment only to registered company account (verify via NECIP) |

| Compliance | • “We can bypass UFLPA with alternative shipping routes” • No ISO 9001/14001 despite claiming certification |

CBP seizures; $500K+ fines; Brand reputational damage | Validate certs via 认监委 database |

| Operational | • Refuses weekend/holiday production checks (claims “Chinese holidays”) • All samples shipped from Alibaba Sample Center (not facility) |

Hidden subcontracting; Quality control evasion | Schedule unannounced audit during Chinese holidays |

| Digital | • NECIP registration date < 6 months old • Website domain registered < 1 year ago |

Shell company creation; High fraud probability | Check NECIP “成立日期” + WHOIS lookup for domain |

| Contractual | • Insists on signing via WeChat doc (not official contract) • “Force majeure” clause covers all delays |

Unenforceable agreements; Zero liability | Require hard-copy contract with company chop (公章) |

IV. Strategic Recommendation

“Verify Ownership, Not Just Claims”: 68% of US buyers (per SourcifyChina 2025 survey) failed to check if the contracting entity matched the production entity. Always:

1. Match NECIP registration number to the contract signatory

2. Confirm factory address via Baidu Street View + satellite imagery cross-check

3. Require direct contact with plant manager (not sales team)China’s legitimate manufacturers welcome transparency – those resisting verification are high-risk. Invest 0.5% of order value in independent verification to prevent 100% loss.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

This report leverages 2025 audit data from 1,200+ US-China transactions. All methodologies align with ASI China Sourcing Standards v4.1 (2026).

Disclaimer: This guidance does not constitute legal advice. Consult US customs counsel for entity-specific compliance.

© 2026 SourcifyChina. All rights reserved. Redistribution prohibited without written permission.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing in the Evolving U.S.-China Trade Landscape

As global supply chains continue to evolve amid shifting geopolitical dynamics and increasing M&A activity between Chinese investors and U.S. manufacturing and technology firms, procurement leaders face heightened complexity in supplier qualification. Identifying reliable, compliant, and operationally sound suppliers—especially those under new ownership—has never been more critical.

SourcifyChina’s Verified Pro List: U.S. Companies Acquired by Chinese Entities delivers a strategic advantage to procurement teams navigating this landscape. Our proprietary intelligence platform provides real-time, vetted data on over 320 U.S.-based companies now majority-owned by Chinese parent organizations—complete with operational status, compliance certifications, sourcing capabilities, and direct procurement contact points.

Why SourcifyChina’s Verified Pro List Saves Time and Mitigates Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Supplier Profiles | Eliminates 100+ hours of manual due diligence per sourcing cycle. Each company is verified for ownership structure, export readiness, and compliance (ISO, FDA, REACH, etc.). |

| Real-Time Ownership Tracking | Stay ahead with updated M&A alerts—no more sourcing from companies with disrupted operations or transitional management. |

| Direct Procurement Access | Bypass gatekeepers with verified procurement leads and factory-direct contacts in the U.S. and China. |

| Risk-Adjusted Sourcing Recommendations | Leverage SourcifyChina’s risk-scoring matrix to prioritize suppliers based on financial stability, IP protection, and geopolitical exposure. |

| Seamless Cross-Border Integration | Identify dual-capable suppliers with integrated U.S. warehousing and Chinese manufacturing footprints—ideal for nearshoring and hybrid sourcing strategies. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In an era where supply chain resilience is a competitive differentiator, relying on outdated or unverified supplier data is a liability. SourcifyChina empowers procurement leaders to act with confidence—turning cross-border complexity into strategic advantage.

Don’t spend another quarter on inefficient supplier discovery.

Access the Verified Pro List: U.S. Companies Acquired by China—a critical intelligence tool for forward-thinking procurement teams.

👉 Contact us today to request your complimentary access preview:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to assist with custom supplier shortlists, risk assessments, and integration support.

SourcifyChina — Precision Sourcing. Verified Intelligence. Global Advantage.

Trusted by Fortune 500 Procurement Teams Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.