The global urinal parts manufacturing industry is experiencing steady growth, driven by rising infrastructure development, increasing adoption of water-efficient plumbing solutions, and stringent regulations promoting hygiene in public and commercial spaces. According to Grand View Research, the global plumbing fixtures market—of which urinal systems are a key component—was valued at USD 57.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth trajectory is further supported by urbanization trends and the expansion of construction activities in emerging economies. As demand for reliable, durable, and sustainable urinal components such as flush valves, traps, sensors, and odor control mechanisms rises, manufacturers are focusing on innovation, material efficiency, and smart technology integration. In this competitive landscape, a select group of manufacturers has emerged as leaders, combining precision engineering, global supply capabilities, and compliance with international standards to meet evolving market needs. The following list highlights the top 10 urinal parts manufacturers shaping the industry through scale, innovation, and performance.

Top 10 Urinal Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Waterless/Water free Urinals System

Domain Est. 1996

Website: waterless.com

Key Highlights: Waterless Co. Inc. urinals are easy to install, cost-effective, come in different shapes and models, can be used in residential as well as commercial ……

#2 KOHLER Service & Replacement Parts

Domain Est. 1994

Website: kohler.com

Key Highlights: KOHLER® Genuine Service Parts. Parts are designed by Kohler engineers to maintain original product performance. Identify My Product ……

#3 Urinals

Domain Est. 1995

Website: zurn.com

Key Highlights: Zurn manufactures a full line of Urinals which adapt to multiple flow rates and have a standard footprint for new construction/retrofit urinal applications….

#4 Urinals

Domain Est. 1995

Website: laufen.com

Key Highlights: What type of product are you looking for? · Urinal (54) · Urinal divisions (6) · Covers for urinals (8) · Complements for urinals (4) · Urinal systems (6)….

#5 Briggs Plumbing

Domain Est. 1995

Website: briggsplumbing.com

Key Highlights: Briggs is a major supplier of plumbing products for residential, commercial, and hospitality applications in North American and Caribbean markets….

#6 Stainless Steel Urinals

Domain Est. 1996

Website: acorneng.com

Key Highlights: Acorn’s stainless steel urinals are made for durability, vandal-resistance, and longevity in commercial or institutional settings. Variations include trough ……

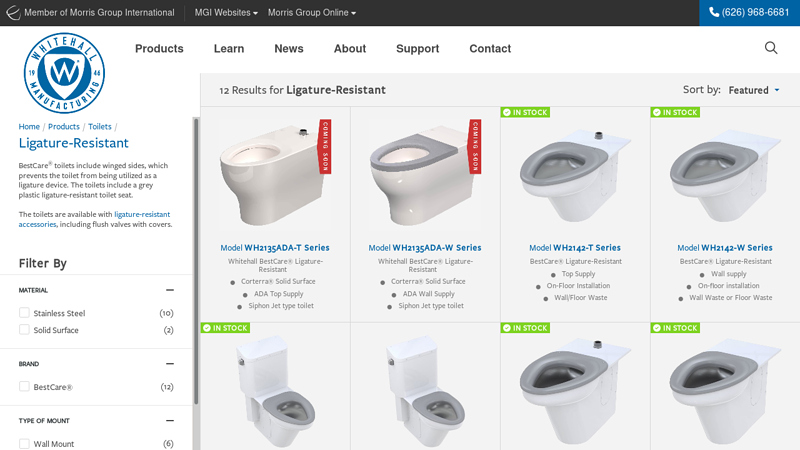

#7 Ligature

Domain Est. 1996

Website: whitehallmfg.com

Key Highlights: BestCare® toilets include winged sides, which prevents the toilet from being utilized as a ligature device….

#8 Flushing Urinals

Domain Est. 1997

Website: lookforwatersense.epa.gov

Key Highlights: Many flushing urinals are sold in two parts, with the urinal fixture and the flushing device sold separately. In order to ensure that the ……

#9 Flushometer Toilet

Domain Est. 1998

Website: sloan.com

Key Highlights: The Sloan Flushometer has set the standard in commercial restrooms. Explore our selection for manual, sensor, retrofit, & speciality flushometers….

#10 Urinal

Domain Est. 1998

Website: polyjohn.com

Key Highlights: Out of stockThe new PolyJohn Urinal has been completely redesigned. The new design has been proven to be the best shape and form to keep splash-back to a minimum….

Expert Sourcing Insights for Urinal Parts

H2: 2026 Market Trends for Urinal Parts

The global market for urinal parts is expected to undergo significant transformation by 2026, driven by technological innovation, sustainability demands, and evolving building standards. Below are key trends shaping the urinal parts sector in the coming years:

1. Growth in Water Conservation Technologies

With increasing global focus on water sustainability, demand for water-efficient urinal components—especially flush valves, sensors, and no-flush systems—is rising. By 2026, smart sensor-based flushing mechanisms and waterless urinal cartridges are projected to dominate the market, particularly in commercial and public infrastructure projects in North America, Europe, and parts of Asia-Pacific.

2. Expansion of Smart Restroom Solutions

The integration of IoT (Internet of Things) in restroom fixtures is accelerating. Urinal parts such as infrared sensors, automated cleaning nozzles, and connectivity-enabled monitoring systems will become standard in high-traffic facilities like airports, stadiums, and office complexes. This shift supports predictive maintenance and improves hygiene, contributing to a compound annual growth rate (CAGR) of approximately 6–8% for smart urinal components through 2026.

3. Rising Demand in Emerging Economies

Urbanization and infrastructure development in countries such as India, Brazil, and Indonesia are fueling demand for modern sanitation systems. Governments investing in public health initiatives are incentivizing the installation of hygienic, low-maintenance urinal systems, creating a robust market for durable and cost-effective urinal parts.

4. Material Innovation and Durability Focus

Manufacturers are shifting toward antimicrobial brass, recycled plastics, and ceramic composites to enhance longevity and reduce maintenance. These materials resist corrosion, lime buildup, and vandalism—key concerns in public installations—making them preferred choices in new construction and retrofit projects.

5. Regulatory Influence and Green Building Standards

Stricter plumbing codes and green certification programs (e.g., LEED, BREEAM) are pushing architects and contractors to adopt water-saving urinal systems. By 2026, compliance with regional water efficiency regulations will be a primary purchasing driver, especially in water-stressed regions.

6. Consolidation and Brand Differentiation

The urinal parts market is seeing increased consolidation among plumbing component manufacturers. Leading brands are differentiating through design, smart features, and service ecosystems (e.g., remote diagnostics and part replacement networks), enhancing customer retention and market share.

In conclusion, the 2026 urinal parts market will be defined by innovation in efficiency, connectivity, and sustainability. Stakeholders—from manufacturers to facility managers—must adapt to these trends to meet evolving consumer and regulatory expectations.

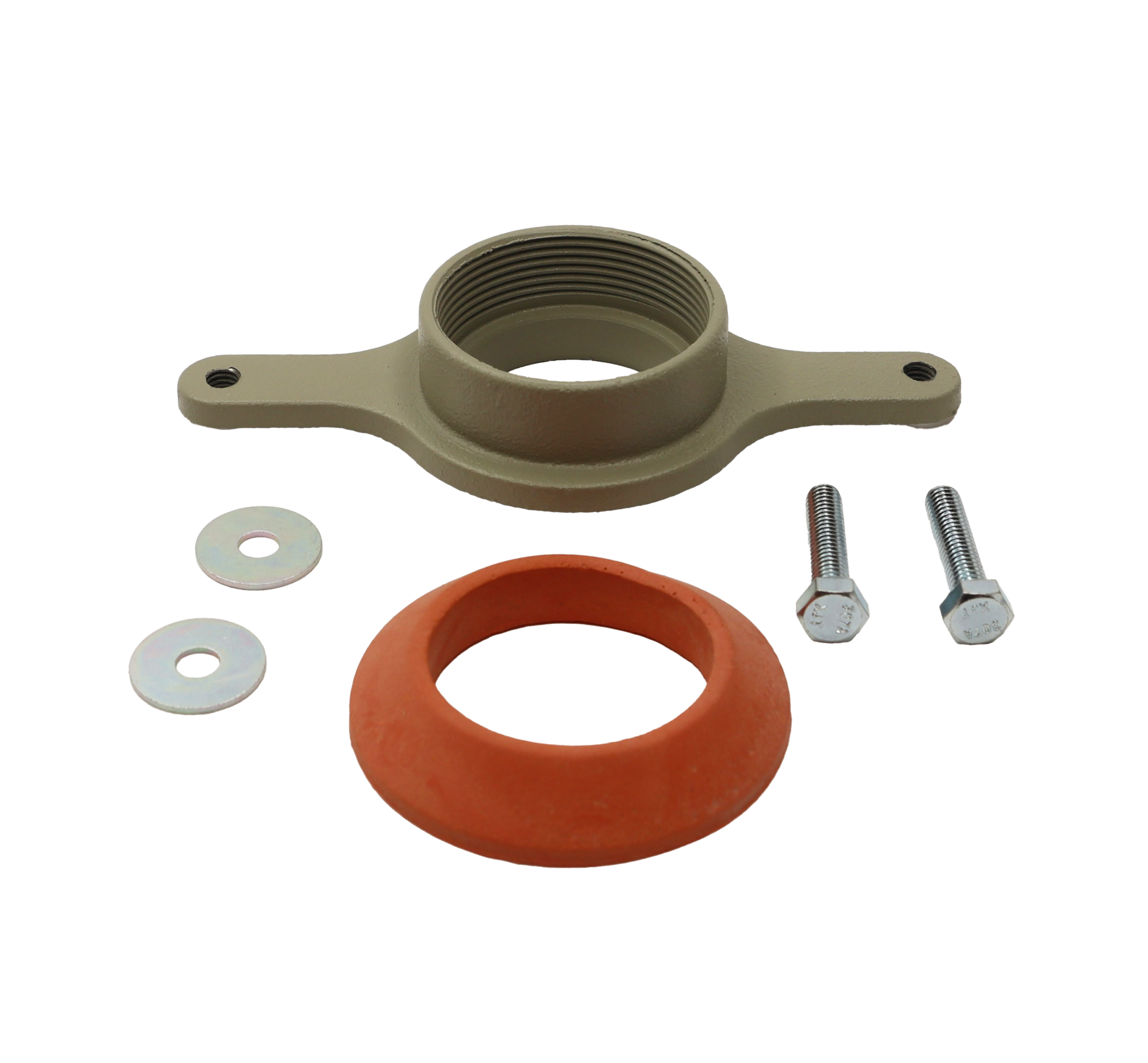

Common Pitfalls When Sourcing Urinal Parts: Quality and Intellectual Property Issues

Sourcing urinal parts—such as flush valves, sensors, traps, and mounting hardware—can be fraught with challenges, especially when balancing cost, quality, and legal compliance. Below are two major categories of pitfalls to watch for: quality concerns and intellectual property (IP) risks.

1. Quality-Related Pitfalls

- Substandard Materials: Many low-cost suppliers use inferior materials (e.g., low-grade plastics or non-corrosion-resistant metals), leading to premature failure, leaks, or malfunctions.

- Inconsistent Manufacturing Standards: Suppliers, particularly in unregulated markets, may lack ISO or plumbing industry certifications, resulting in inconsistent product quality and poor performance.

- Lack of Durability Testing: Some parts are not tested for high-traffic environments (e.g., public restrooms), causing frequent maintenance and higher lifecycle costs.

- Poor Compatibility: Sourced parts may not fit existing plumbing systems or brands, leading to installation issues and inefficiencies.

- Absence of Quality Documentation: Reliable suppliers provide test reports, material certifications, and compliance data. Their absence is a red flag for poor quality control.

2. Intellectual Property (IP) Risks

- Counterfeit or Clone Products: Some suppliers replicate branded urinal components (e.g., Sloan, TOTO, or Zurn parts) without authorization, infringing on patents or trademarks.

- Patented Design Infringement: Urinal mechanisms—especially sensor-based flush systems—often include patented technology. Sourcing unlicensed copies can expose buyers to legal liability.

- Lack of IP Due Diligence: Buyers may unknowingly source parts that violate IP rights, risking customs seizures, lawsuits, or damage to brand reputation.

- Misrepresented Certifications: Some suppliers falsely claim compliance with IP-protected standards or certifications (e.g., WaterSense, CE, or NSF), misleading buyers about legitimacy.

- No Legal Recourse: Purchasing infringing parts from offshore suppliers often limits legal recourse, especially if contracts lack IP indemnification clauses.

To mitigate these risks, conduct thorough supplier audits, request product certifications, verify IP ownership, and consider working with authorized distributors or OEMs.

Logistics & Compliance Guide for Urinal Parts

Product Classification & HS Codes

Correctly classifying urinal parts is essential for international shipping and customs clearance. Urinal components are typically categorized under plumbing fixtures or sanitary ware. Common Harmonized System (HS) codes include:

– HS 8481.80: Faucets, thermostatic mixers, and similar appliances for sinks, baths, or showers (may apply to flush valves or sensor units).

– HS 9032.89: Automatic controls for sanitary fixtures, including infrared sensors used in automatic urinals.

– HS 3926.10: Plastics parts of sanitary ware (e.g., plastic flush tanks, covers, or connectors).

– HS 7418.20: Copper or brass fittings and parts used in plumbing systems.

Always verify the HS code with local customs authorities, as classifications can vary by country and material composition.

Import/Export Regulations

Compliance with national and international regulations is mandatory:

– REACH & RoHS (EU): Ensure urinal parts containing metals or electronics comply with restrictions on hazardous substances like lead, cadmium, and phthalates.

– Water Efficiency Standards (e.g., EPA WaterSense in the U.S.): Parts affecting water flow (e.g., flush valves) may need certification for water conservation compliance.

– UKCA/CE Marking: Required for sale in the UK/EU to demonstrate conformity with health, safety, and environmental protection standards.

– Country-Specific Approvals: Some markets require third-party testing or certification (e.g., WRAS approval in the UK for water system components).

Packaging & Handling Requirements

Proper packaging ensures product integrity during transit:

– Use durable, moisture-resistant materials to protect against damage and corrosion.

– Clearly label packages with product details, HS codes, country of origin, and handling instructions (e.g., “Fragile” or “This Side Up”).

– Include compliance labels (e.g., CE, RoHS) on individual units or packaging where required.

Shipping & Transportation

Optimize logistics based on volume and destination:

– Air Freight: Suitable for small, high-value, or time-sensitive orders (e.g., sensor modules).

– Ocean Freight: Cost-effective for bulk shipments of heavy components like metal fixtures or ceramic parts.

– Incoterms: Clearly define responsibilities (e.g., FOB, CIF, DDP) to avoid disputes over shipping costs, insurance, and customs duties.

Customs Documentation

Ensure accurate and complete paperwork to prevent delays:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Test Reports or Certifications (e.g., RoHS, CE)

– Import License (if required by destination country)

Storage & Inventory Management

- Store parts in dry, temperature-controlled environments to prevent corrosion or material degradation.

- Segregate components by material type and compliance status (e.g., lead-free vs. standard brass).

- Maintain traceability through batch/lot tracking, especially for regulated components.

Disposal & Environmental Compliance

- Adhere to local e-waste regulations for electronic parts (e.g., sensor units or control boards).

- Recycle metal and plastic components in accordance with environmental directives (e.g., WEEE in the EU).

- Provide disposal guidelines to end-users or distributors.

Conclusion

Successful logistics and compliance for urinal parts require accurate classification, adherence to regional regulations, proper documentation, and careful handling. Partnering with experienced freight forwarders and staying updated on regulatory changes ensures smooth international trade operations.

In conclusion, sourcing urinal parts requires careful consideration of quality, compatibility, cost, and reliability of suppliers. Whether for commercial, residential, or public facility maintenance, selecting durable and water-efficient components contributes to long-term operational efficiency and sustainability. Establishing relationships with reputable suppliers, verifying product specifications, and staying informed about industry standards ensures that the sourced parts meet performance expectations and regulatory requirements. Ultimately, a strategic approach to sourcing not only minimizes downtime and repair costs but also supports efficient plumbing system functionality and user satisfaction.