The global urethane wheels market is experiencing steady expansion, driven by rising demand across industrial, material handling, and transportation sectors. According to a 2023 report by Grand View Research, the global polyurethane market—of which urethane wheels are a key application segment—was valued at USD 73.8 billion and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. Mordor Intelligence further projects that increasing automation in manufacturing and logistics, coupled with the superior durability, load-bearing capacity, and noise reduction properties of polyurethane wheels, will continue to fuel market demand. With industries prioritizing efficiency and equipment longevity, urethane wheels have become a preferred choice over traditional rubber or plastic alternatives. This growing adoption has spurred innovation and competition among manufacturers, making it essential to identify the leading players shaping the market landscape.

Top 10 Urethane Wheels Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Polyurethane Wheels

Domain Est. 1996

Website: kastalon.com

Key Highlights: They are tough and durable. Constructed from the best materials with state-of-the-art production technology, Kastalon remolded wheels and tires are economical ……

#2 Custom Polyurethane Wheels and Polyurethane Rollers

Domain Est. 1996

Website: gallaghercorp.com

Key Highlights: Need something custom? We design and mass produce custom polyurethane wheels. Cast Molding | Injection Molding | 3D Printing. 1000s of OEMs have trusted us….

#3 Stellana Polyurethane Wheels and Tire Solutions

Domain Est. 1997

Website: stellana.com

Key Highlights: Stellana is the leading global manufacturer of polyurethane wheels and tires, natural rubber tires and caster wheels, and thermoplastic wheels….

#4 Uremet

Domain Est. 1998 | Founded: 1992

Website: uremet.com

Key Highlights: Uremet™ is a worldwide leading supplier of high quality, high performance solid polyurethane industrial wheels. Founded in 1992, Uremet ……

#5 Leading Urethane Wheel Manufacturers

Domain Est. 2001

Website: molded-urethane.com

Key Highlights: Weaver Industries offers urethane wheels, polyurethane molding, molded urethane, urethane sheets, & urethane/polyurethane manufacturing….

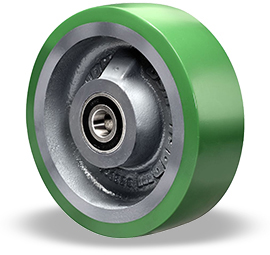

#6 Polyurethane Wheels

Domain Est. 1996

Website: hamiltoncaster.com

Key Highlights: Polyurethane wheels-the protective wheel that wears like steel-is Hamilton’s highest quality urethane, liquid cast to a thickness of approximately 1/2″….

#7 Custom Cast Polyurethane Wheels

Domain Est. 1997

Website: fallline.com

Key Highlights: High-quality custom polyurethane wheels designed for durability and performance. FallLine specializes in cast polyurethane wheels for various industries….

#8 Sunray, Inc: Polyurethane Wheels

Domain Est. 1997

Website: sunray-inc.com

Key Highlights: Sunray is capable of manufacturing many different styles of drive rollers and idler rollers, including: concave rollers, convex rollers, hubbed rollers, ……

#9 Custom Cast Urethane Wheels & Rollers

Domain Est. 1998

Website: urethaneusa.com

Key Highlights: Need custom cast urethane wheels & rollers? Urethane Innovators is your trusted USA partner. Call 800-545-2630 for expert urethane solutions….

#10 Maclan Corporation

Domain Est. 1999

Website: maclan.com

Key Highlights: Maclan is an industry leader in roller coaster wheels and parts! URETHANE WHEELS … Maclan is an official wheel vendor partner of Vekoma Rides Parts & Services ……

Expert Sourcing Insights for Urethane Wheels

H2: 2026 Market Trends for Urethane Wheels

The global urethane wheels market is poised for steady growth and significant transformation by 2026, driven by evolving industrial demands, technological advancements, and sustainability imperatives. Key trends shaping this market include:

1. Rising Demand from Material Handling & Logistics: The explosive growth of e-commerce and the need for efficient warehouse automation are fueling demand for durable, high-performance urethane wheels. Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), and electric forklifts increasingly rely on urethane wheels for their superior load-bearing capacity, floor protection (low marking), quiet operation, and resistance to oils and chemicals. This segment will be a primary growth engine through 2026.

2. Technological Innovation in Formulations: Manufacturers are investing heavily in R&D to develop advanced polyurethane formulations offering enhanced properties:

* Improved Abrasion & Cut Resistance: Critical for applications in harsh industrial environments (e.g., mining, heavy manufacturing).

* Higher Load Capacity & Resilience: Enabling lighter equipment designs and longer service life.

* Wider Temperature Range Performance: Expanding usability in extreme cold (cold storage) and hot environments.

* Enhanced Chemical & UV Resistance: Broadening applications in outdoor and corrosive settings.

* Tailored Properties: Development of specialized urethanes (e.g., high-rebound, low-rolling resistance, anti-static) for specific niche applications.

3. Sustainability and Environmental Focus: Environmental regulations and corporate sustainability goals are driving key trends:

* Bio-based Polyols: Increased R&D and adoption of polyols derived from renewable resources (e.g., castor oil, soy) to reduce reliance on fossil fuels and lower carbon footprint.

* Recyclability & Circular Economy: Growing emphasis on developing recyclable urethane formulations and exploring closed-loop recycling systems for end-of-life wheels, though technical challenges remain significant.

* Durability as Sustainability: The inherent long lifespan of high-quality urethane wheels reduces replacement frequency and waste, positioning them as a sustainable choice compared to shorter-lived alternatives.

4. Geographic Shifts and Regional Growth: While established markets (North America, Europe) remain significant, growth is accelerating in:

* Asia-Pacific (APAC): Driven by rapid industrialization, massive infrastructure development, booming e-commerce, and expanding manufacturing bases (especially in China, India, and Southeast Asia). APAC is expected to be the fastest-growing region.

* Emerging Economies: Increasing investment in logistics and manufacturing infrastructure in regions like Latin America and Africa will create new market opportunities.

5. Consolidation and Strategic Partnerships: The market may see increased consolidation as larger players acquire specialized niche manufacturers to broaden their product portfolios and geographic reach. Strategic partnerships between urethane producers, wheel manufacturers, and OEMs (Original Equipment Manufacturers) will be crucial for co-developing customized solutions and securing supply chains.

6. Focus on Customization and Value-Added Services: As applications diversify, there is a growing demand for highly customized wheel solutions (specific durometers, colors, cores, bearings). Suppliers offering value-added services like engineering support, rapid prototyping, and inventory management will gain a competitive edge.

Conclusion for 2026: By 2026, the urethane wheels market will be characterized by robust growth, particularly in automation and logistics. Success will depend on innovation in sustainable and high-performance materials, strategic focus on high-growth regions like APAC, and the ability to provide customized, value-added solutions. Suppliers who proactively address the dual demands of performance and environmental responsibility will be best positioned to capture market share.

Common Pitfalls Sourcing Urethane Wheels (Quality, IP)

Sourcing urethane wheels can present significant challenges, particularly concerning quality consistency and intellectual property (IP) protection. Being aware of these pitfalls is crucial for ensuring product performance, reliability, and legal compliance.

1. Inconsistent Material Quality and Formulation

One of the most frequent issues is variability in the urethane material itself. Different suppliers may use varying base polymers, additives, or curing processes, leading to inconsistent hardness (Shore A/D), load capacity, rebound, abrasion resistance, and chemical resistance. This inconsistency can result in premature wheel failure, poor performance, or incompatibility with your application—especially if precise rolling resistance or floor protection is required. Always demand material data sheets (MDS) and third-party test reports to verify specifications.

2. Lack of Traceability and Certification

Many lower-tier suppliers offer no batch traceability or quality certifications (e.g., ISO 9001). Without traceability, identifying the source of defects or performance issues becomes nearly impossible. Additionally, uncertified wheels may not meet industry-specific standards (e.g., food-grade FDA compliance, cleanroom suitability, or flame resistance), exposing your business to safety or regulatory risks.

3. Counterfeit or Reverse-Engineered Products

Urethane wheels, especially those designed for specialized applications (e.g., medical carts, robotics, or industrial automation), are often protected by design or utility patents. Sourcing from unauthorized manufacturers can lead to the procurement of counterfeit or reverse-engineered wheels that infringe on existing IP. This not only violates intellectual property rights but can also result in legal action, product recalls, and reputational damage.

4. Inadequate Tooling and Molding Precision

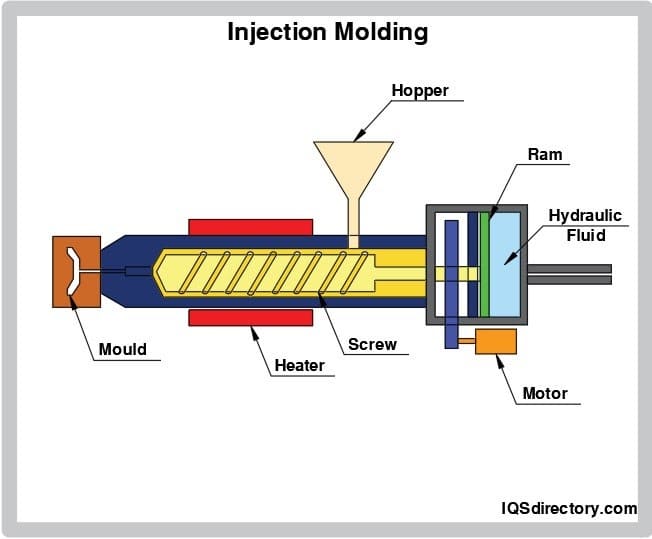

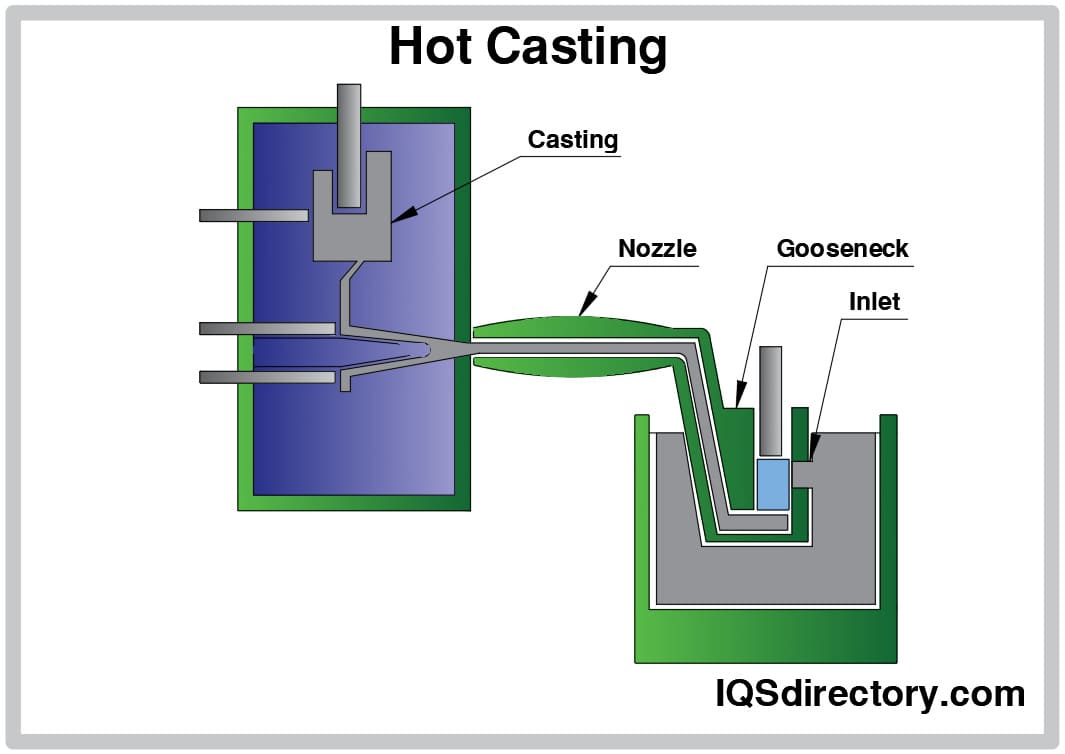

Precision in mold design and manufacturing is essential for uniform wheel dimensions, concentricity, and concentric runout. Poorly made molds or inconsistent injection processes can result in out-of-round wheels, uneven wear, vibration, and noise during operation. Suppliers with outdated equipment or lax process controls often fail to meet tight tolerances required in high-performance applications.

5. Hidden Costs from Poor Durability

Cheaper urethane wheels may appear cost-effective initially but often degrade quickly under load, UV exposure, or temperature fluctuations. This leads to higher total cost of ownership due to frequent replacements, downtime, and potential damage to equipment or facilities. Low-quality urethane may also “chunk” or delaminate, posing safety hazards.

6. Misrepresentation of Load and Environmental Ratings

Some suppliers exaggerate load capacity or environmental resistance (e.g., temperature range, UV stability, resistance to oils or cleaning agents). Without independent validation, relying on these claims can result in wheel failure under real-world conditions. Always verify performance claims with real-world testing or accredited laboratory data.

7. Weak or Absent IP Agreements with Suppliers

When sourcing custom-designed wheels, failing to secure proper IP assignment or licensing agreements can leave your designs unprotected. Suppliers may claim ownership of tooling or design improvements, or worse, sell identical wheels to your competitors. Ensure contracts explicitly state that all IP developed for your project belongs to you and include non-disclosure and non-compete clauses.

Mitigating these risks requires thorough supplier vetting, detailed specifications, contractual safeguards, and ongoing quality audits—ensuring your urethane wheels meet both performance standards and legal requirements.

Logistics & Compliance Guide for Urethane Wheels

Overview

Urethane wheels are widely used across industries including material handling, transportation, medical equipment, and consumer goods due to their durability, shock absorption, and quiet operation. However, shipping and handling these products require attention to specific logistics and regulatory compliance considerations. This guide outlines key aspects of transporting and managing urethane wheels in compliance with international and domestic regulations.

Material Composition & Classification

Urethane wheels are typically made from polyurethane, a synthetic polymer derived from isocyanates and polyols. Depending on the formulation, they may contain additives such as plasticizers or stabilizers. For customs and regulatory purposes, urethane wheels are generally classified under the Harmonized System (HS) code 3926.30 – “Other articles of plastics, of heading 3926: wheels, castors and roller wheels, of plastics.”

Accurate classification is essential for determining import duties, restrictions, and documentation requirements in destination countries.

Packaging & Handling

Proper packaging ensures product integrity during transit and reduces environmental and safety risks:

- Protection from Physical Damage: Use sturdy corrugated boxes or palletized packaging to prevent deformation or surface scratches.

- Moisture Resistance: Polyurethane can absorb moisture; use moisture-resistant wrapping or desiccants in humid environments.

- Stacking & Weight Limits: Follow manufacturer stacking guidelines to avoid compression damage. Use edge protectors and load bars when palletizing.

- Labeling: Clearly label packages with product details, weight, handling instructions (e.g., “Do Not Stack,” “Fragile”), and orientation arrows.

Transportation & Shipping

Urethane wheels are generally non-hazardous and can be shipped via air, sea, or land freight without special restrictions. Key considerations include:

- Non-Hazardous Classification: Polyurethane is not classified as a dangerous good under IATA, IMDG, or ADR regulations when in solid wheel form. No UN number is required.

- Temperature Sensitivity: Avoid prolonged exposure to extreme heat (>60°C/140°F) or cold (<-20°C/-4°F), which may affect material properties.

- Ventilation: Ensure adequate ventilation in enclosed containers to prevent condensation and odor buildup, especially in long sea shipments.

Regulatory Compliance

Ensure compliance with relevant international and local regulations:

- REACH (EU): Confirm that the polyurethane formulation does not contain Substances of Very High Concern (SVHC) above threshold levels (0.1% w/w). Provide a declaration of compliance if requested.

- RoHS (EU & China): Applicable if wheels are part of electrical/electronic equipment. Verify lead, cadmium, and other restricted substances.

- Proposition 65 (California, USA): Check if any components (e.g., certain plasticizers) are listed as carcinogens or reproductive toxins. Provide warning labels if required.

- TSCA (USA): Confirm compliance with the Toxic Substances Control Act, particularly for chemical substances used in polyurethane production.

Import & Export Requirements

When shipping internationally:

- Commercial Invoice & Packing List: Include detailed descriptions, HS codes, country of origin, and total value.

- Certificate of Origin: Required for preferential tariff treatment under trade agreements (e.g., USMCA, ASEAN).

- Customs Declarations: Accurately declare goods; misclassification can lead to delays, fines, or seizure.

- Destination-Specific Rules: Some countries may have additional standards (e.g., China Compulsory Certification – CCC) for wheels used in certain applications.

Environmental & Disposal Considerations

- Recyclability: Polyurethane is recyclable through specialized facilities. Provide end-of-life guidance to customers.

- Waste Disposal: Follow local regulations (e.g., EPA or EU Waste Framework Directive) for disposing of damaged or obsolete wheels. Avoid incineration without proper emission controls.

Quality & Documentation

Maintain documentation to support compliance and traceability:

- Material Safety Data Sheet (MSDS/SDS): Provide SDS under GHS standards, even if non-hazardous, for transparency.

- Test Reports: Include hardness (Shore A/D), load capacity, and abrasion resistance data as needed.

- Compliance Certificates: Issue RoHS, REACH, or other relevant compliance documentation upon request.

Summary

Urethane wheels are generally straightforward to transport and compliant with most logistics standards. However, attention to chemical compliance, proper packaging, and accurate customs documentation is critical for smooth international trade. Always verify requirements based on destination, application, and specific formulations used.

Conclusion for Sourcing Urethane Wheels

After a thorough evaluation of potential suppliers, product specifications, and performance requirements, sourcing urethane wheels presents a reliable and cost-effective solution for applications requiring durability, shock absorption, and resistance to wear and abrasion. Urethane wheels offer superior load-bearing capacity, noise reduction, and floor protection compared to alternatives like nylon or rubber, making them ideal for material handling, industrial equipment, and automation systems.

Key factors in selecting the right supplier include material quality, customization options (durometer, size, hub configuration), production consistency, and lead times. Establishing partnerships with reputable manufacturers who adhere to industry standards ensures long-term performance and reliability.

In conclusion, sourcing high-quality urethane wheels from trusted suppliers not only enhances equipment efficiency but also reduces maintenance costs and downtime. With careful vendor assessment and attention to technical specifications, urethane wheels represent a strategic investment in operational longevity and performance across diverse industrial environments.