The global urea market continues to expand, driven by rising demand for nitrogen fertilizers to support food production amid a growing population. According to a 2023 report by Mordor Intelligence, the urea market was valued at USD 67.2 billion in 2022 and is projected to grow at a CAGR of over 4.1% from 2023 to 2028. This growth is fueled by increasing agricultural activities, particularly in Asia-Pacific and Latin America, where crop yields rely heavily on nitrogen-rich fertilizers like urea crystals. Additionally, industrial applications—such as in the automotive sector for AdBlue (diesel exhaust fluid)—are contributing to steady demand. As the market evolves, a handful of manufacturers have emerged as key players, combining scale, technological advancement, and geographic reach to dominate urea crystal production. The following list highlights the top eight manufacturers shaping the global urea landscape.

Top 8 Urea Crystals Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Urea Crystal

Domain Est. 2017

Website: choline-betaine.com

Key Highlights: Pengbo Biotechnology Co., Ltd. is the reliable urea supplier manufacturer and exporter in China. We may offer you the urea crystal Pharma Grade (assay:≥ 99%) ……

#2 Urea-Crystal-Reagent-ACS

Domain Est. 1995

Website: spectrumchemical.com

Key Highlights: 15-day returnsUrea, Crystal, Reagent, ACS is an odorless and colorless solid that is an important nitrogen-containing substance found in mammal urine….

#3 Urea

Domain Est. 1996

Website: thechemco.com

Key Highlights: Urea is a raw material used in the manufacture of many chemicals, such as various plastics, urea-formaldehyde resins and adhesives….

#4 Innovating Science®

Domain Est. 1997

Website: aldon-chem.com

Key Highlights: Urea Crystals, Lab Grade, 500g an Innovating Science® product from Aldon Corporation….

#5 UREA CRYSTALLINE POWDER USP

Domain Est. 1999

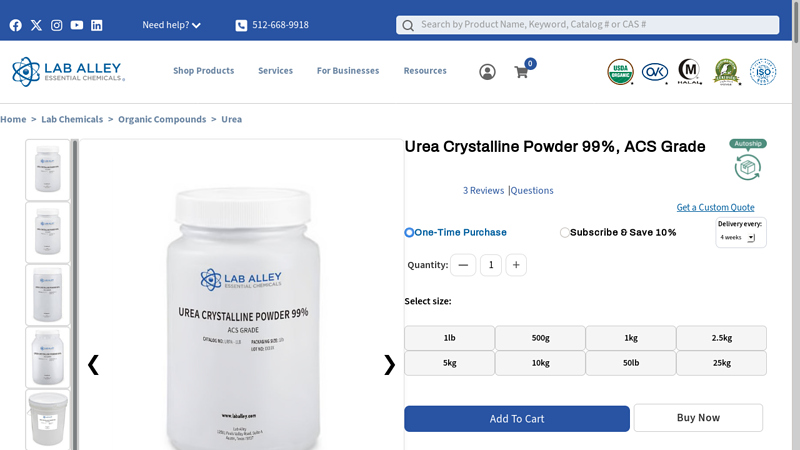

#6 Urea Crystalline Powder 99%, ACS Grade

Domain Est. 2011

Website: laballey.com

Key Highlights: In stock Rating 5.0 (3) Jan 13, 2025 · Urea Crystal 99% ACS Grade from Lab Alley has 99% of purity. White or almost white, crystalline powder or transparent crystals, slightly hy…

#7 Urea Crystal Lab Grade 500G Uu0030

Domain Est. 2018

Website: congeriem.com

Key Highlights: In stock Rating 4.8 (775) Urea Crystal Lab Grade 500G Uu0030-500G ; CAS#: 57-13-6 ; Chemical Formula: NH2CONH2 ; Molecular Weight: 60.055….

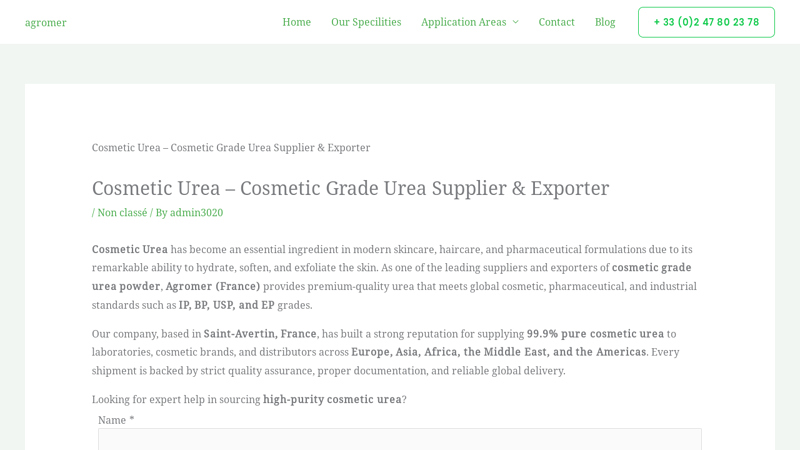

#8 Cosmetic Grade Urea Supplier & Exporter

Domain Est. 2019

Website: agromer.org

Key Highlights: Rating 4.9 (72,800) Looking for cosmetic urea in bulk, we are leading cosmetic grade urea supplier and exporter. Learn its uses in skincare, benefits, purity levels, ……

Expert Sourcing Insights for Urea Crystals

H2: Projected Market Trends for Urea Crystals in 2026

The global urea crystals market is poised for significant transformation by 2026, driven by a confluence of agricultural demand, industrial applications, environmental regulations, and macroeconomic factors. As a key nitrogen-rich compound, urea remains indispensable in fertilizer production, accounting for the majority of its consumption. However, emerging trends across supply chains, sustainability initiatives, and technological innovation are reshaping the market landscape.

-

Agricultural Demand and Food Security

Population growth and the intensification of farming practices, especially in Asia-Pacific and sub-Saharan Africa, are expected to sustain strong demand for urea crystals. With global food security remaining a priority, governments are investing in agricultural productivity, boosting urea-based fertilizer use. India, China, and Brazil are anticipated to remain top importers, relying on both domestic production and international supply. -

Supply Chain Dynamics and Geopolitical Factors

The 2026 urea market will continue to be influenced by geopolitical tensions, energy prices, and trade policies. Natural gas, the primary feedstock for urea production, remains a cost-determining factor—regions with low gas prices (e.g., the Middle East and the U.S.) maintain a production advantage. However, disruptions from regional conflicts or export restrictions (e.g., from Russia or North Africa) could create supply volatility, leading to price fluctuations. -

Environmental Regulations and Green Urea

Environmental concerns over nitrogen runoff and greenhouse gas emissions are pushing the industry toward sustainable alternatives. Regulatory pressure in the EU and North America is likely to promote the adoption of enhanced-efficiency fertilizers (EEFs) and slow-release urea formulations. By 2026, “green urea” produced using renewable energy or carbon capture technologies may gain traction, especially as carbon pricing mechanisms expand. -

Industrial Applications Expansion

Beyond agriculture, urea crystals are increasingly used in industrial sectors such as automotive (in Selective Catalytic Reduction systems for diesel engines), adhesives, and animal feed. The global push for cleaner emissions standards will sustain demand for diesel exhaust fluid (DEF), a urea-water solution. Growth in the automotive sector in emerging markets could thus support urea consumption even if agricultural demand plateaus. -

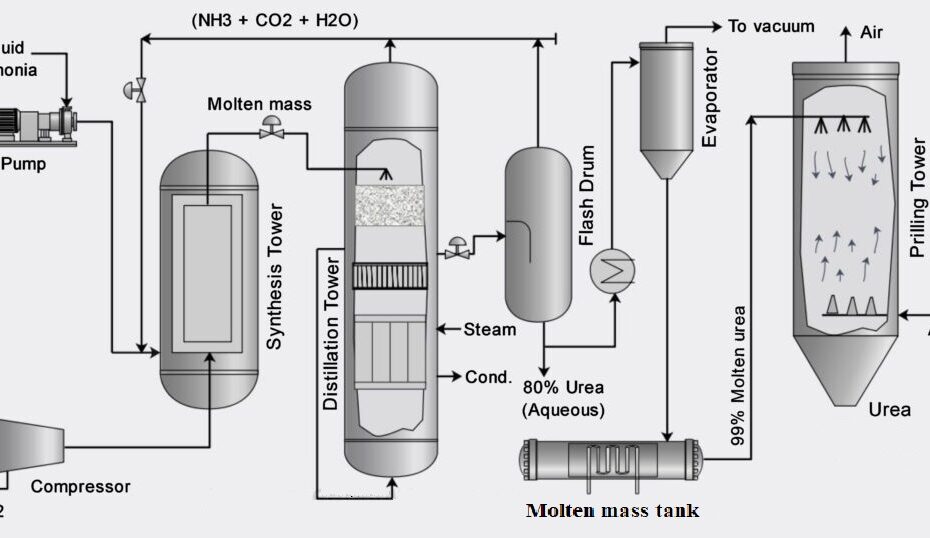

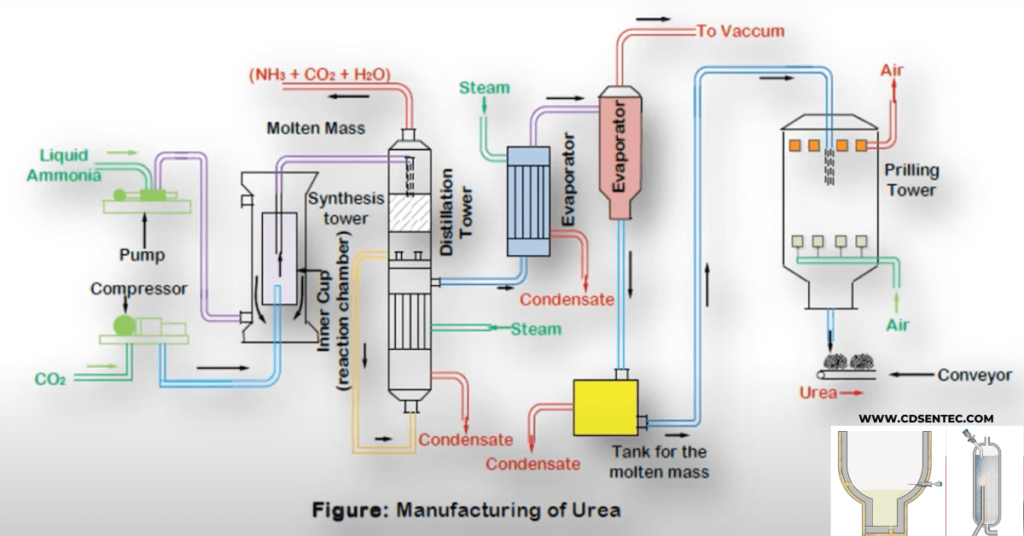

Technological Advancements and Production Efficiency

Manufacturers are investing in process optimization and energy-efficient technologies to reduce costs and carbon footprints. By 2026, smart manufacturing, digital monitoring, and AI-driven predictive maintenance are expected to enhance operational efficiency in urea plants. Additionally, modular and small-scale urea production units may emerge, particularly in remote agricultural regions, reducing logistics costs. -

Market Consolidation and Strategic Alliances

The urea market is likely to see increased consolidation, with major players forming joint ventures or acquiring smaller producers to secure supply chains and expand market reach. Vertical integration—from gas supply to fertilizer distribution—will become a competitive advantage, particularly for state-owned enterprises in resource-rich countries. -

Price Volatility and Market Speculation

Urea prices are expected to remain volatile in 2026 due to fluctuating energy costs, currency exchange rates, and inventory cycles. The rise of digital commodity trading platforms may increase market transparency but could also amplify speculative behavior, affecting price stability for end-users.

In conclusion, the 2026 urea crystals market will be shaped by the balance between persistent agricultural needs and evolving environmental and technological paradigms. Stakeholders must navigate a complex ecosystem of regulatory requirements, energy dynamics, and innovation to maintain competitiveness. Sustainable practices and diversification into high-value applications will be critical for long-term growth.

H2: Common Pitfalls in Sourcing Urea Crystals – Quality and Intellectual Property Considerations

Sourcing urea crystals for industrial, agricultural, or specialty chemical applications involves several critical challenges, particularly concerning product quality and intellectual property (IP) risks. Understanding these pitfalls is essential to ensure regulatory compliance, process efficiency, and protection against legal exposure.

1. Quality-Related Pitfalls

a) Inconsistent Purity and Contaminants

One of the most common issues is receiving urea crystals with substandard purity. Urea intended for industrial use (e.g., in AdBlue/DEF—Diesel Exhaust Fluid) must meet strict specifications (e.g., ISO 22241). Contaminants such as biuret, ammonia, moisture, or heavy metals can degrade performance, especially in automotive SCR (Selective Catalytic Reduction) systems, leading to catalyst poisoning or system failure.

Pitfall: Suppliers may offer technical-grade urea instead of automotive-grade, resulting in non-compliance and potential equipment damage.

b) Improper Crystallization and Particle Size

Urea crystal morphology—particle size, shape, and bulk density—affects solubility, handling, and downstream processing. Poorly controlled crystallization can yield fines or agglomerated crystals, leading to bridging in silos or inconsistent dissolution rates.

Pitfall: Off-spec particle size distribution can disrupt automated blending processes or reduce formulation efficacy.

c) Moisture Content and Caking

Urea is hygroscopic and prone to caking during storage and transport if not properly dried or packaged. High moisture content promotes degradation into ammonia and isocyanic acid, reducing shelf life and effectiveness.

Pitfall: Inadequate packaging (e.g., non-laminated PP bags) or poor storage conditions can compromise product integrity before end-use.

d) Lack of Certification and Traceability

Reputable suppliers should provide COA (Certificate of Analysis) and adhere to international standards. Sourcing from uncertified or unverified manufacturers increases the risk of adulterated or mislabeled products.

Pitfall: Absence of traceability makes it difficult to address quality issues or recall batches in regulated industries.

2. Intellectual Property (IP) Risks

a) Proprietary Formulations and Processes

In specialty applications (e.g., cosmetics, pharmaceuticals, or high-efficiency fertilizers), urea may be part of patented formulations or manufactured via proprietary processes (e.g., prilling vs. granulation, coating technologies).

Pitfall: Sourcing urea produced using patented methods without licensing could expose the buyer to contributory infringement claims, especially if the end-product incorporates protected technology.

b) Gray Market and IP-Infringing Suppliers

Some suppliers, particularly in regions with weak IP enforcement, may produce or distribute urea that infringes on process patents or brand rights (e.g., mimicking branded DEF-grade urea). Using such materials in commercial products may taint the buyer’s IP position.

Pitfall: Incorporating infringing materials—even unknowingly—can lead to legal liability, supply chain disruption, or reputational damage.

c) Technology Transfer and Reverse Engineering Risks

When sourcing from contract manufacturers, especially overseas, there is a risk of IP leakage if urea production involves customized processing parameters or additives. Inadequate contractual safeguards may allow unauthorized replication or resale of proprietary methods.

Pitfall: Poorly drafted supply agreements may fail to protect trade secrets or assign IP ownership clearly.

Recommendations to Mitigate Risks:

– Require third-party testing and certification (e.g., ISO, REACH, FDA-compliance where applicable).

– Audit suppliers for quality management systems (e.g., ISO 9001) and production controls.

– Include IP indemnification clauses in procurement contracts.

– Avoid suppliers offering unusually low prices, which may indicate substandard quality or IP violations.

– Engage legal counsel to assess freedom-to-operate when sourcing for patented applications.

By proactively addressing quality and IP concerns, organizations can ensure reliable supply, regulatory compliance, and protection of their innovation and market position.

H2: Logistics & Compliance Guide for Urea Crystals

Urea crystals (chemical formula: CO(NH₂)₂), also known as carbamide, are widely used in agriculture as a nitrogen-rich fertilizer, as well as in industrial applications such as automotive emissions control (AdBlue/DEF), plastics, and pharmaceuticals. Due to their chemical properties and classification under certain regulatory frameworks, the logistics and compliance handling of urea crystals must follow specific guidelines to ensure safety, regulatory adherence, and efficient transportation.

1. Classification & Regulatory Overview

- UN Number: Not regulated as hazardous for transport under normal conditions (UN3263 applies only if urea is in solution with methanol; solid urea crystals are typically non-hazardous).

- IATA/ICAO: Not classified as a dangerous good when transported in solid form.

- IMDG Code (Maritime): Not classified as dangerous under normal conditions (Class 9 may apply in specific circumstances, but urea is generally exempt).

- 49 CFR (US DOT): Not regulated as a hazardous material in solid form.

- GHS Classification:

- Not classified for physical hazards.

- May cause irritation upon prolonged contact (Eye Irritation Category 2).

- Not classified for environmental hazards under standard conditions.

✅ Note: Always verify the specific formulation—urea solutions (e.g., 32.5% aqueous urea in AdBlue) are subject to different regulations.

2. Packaging Requirements

- Primary Packaging: Use moisture-resistant, sealed polyethylene bags (e.g., 25 kg or 50 kg multi-wall paper bags with PE liner).

- Bulk Packaging: For large shipments, use FIBCs (Flexible Intermediate Bulk Containers) with UV protection and moisture barriers.

- Containers:

- Dry bulk trucks or ISO flexitanks for large volumes.

- Standard 20′ or 40′ dry containers for bagged urea.

- Labeling:

- Product name: “Urea Crystals” or “Urea Fertilizer”

- Net weight

- Manufacturer/importer details

- GHS-compliant label if required (usually not mandatory for solid urea)

3. Storage Guidelines

- Environment: Store in a cool, dry, and well-ventilated area.

- Conditions:

- Temperature: Below 40°C (104°F) to prevent caking or decomposition.

- Humidity: Keep relative humidity below 70% to avoid moisture absorption and caking.

- Segregation: Store away from strong oxidizers, acids, and reactive chemicals.

- Shelf Life: Typically 2–3 years if stored properly.

4. Transportation

- Modes:

- Road: Use covered, dry trucks or containers. Avoid exposure to rain.

- Rail: Standard hopper cars or covered gondolas.

- Sea: Use dry, ventilated containers. Avoid refrigerated (reefer) units unless climate demands.

- Air: Permitted without restrictions as non-hazardous cargo.

- Documentation:

- Commercial invoice

- Packing list

- Bill of Lading (B/L)

- Certificate of Analysis (CoA) if required

- SDS (Safety Data Sheet) – readily available

5. Safety & Handling

- PPE Requirements:

- Gloves (nitrile or latex)

- Safety goggles

- Dust mask (if handling in bulk or dusty environments)

- Handling Precautions:

- Avoid generating dust.

- Use mechanical handling (e.g., conveyors, forklifts) to minimize manual labor.

- Prevent contamination of waterways—urea can contribute to eutrophication.

- Spill Management:

- Sweep or vacuum spilled crystals.

- Avoid washing into drains or water sources.

6. Regulatory Compliance by Region

| Region | Key Regulations |

|——-|—————–|

| USA | EPA (Clean Water Act), OSHA (handling exposure limits), FDA (if used in food/feed applications) |

| EU | REACH (registration not required for urea), CLP Regulation (labeling), Fertilising Products Regulation (EU) 2019/1009 |

| Canada | CFIA (fertilizer regulations), WHMIS 2015 (hazard communication) |

| Australia | APVMA (for agricultural use), Safe Work Australia (handling standards) |

| China | GB 2440-2017 (standard for urea fertilizer), MIIT regulations |

⚠️ Export Note: Verify import requirements—some countries require pre-shipment inspection, SPS (Sanitary and Phytosanitary) certificates, or registration of fertilizer products.

7. Environmental & Sustainability Considerations

- Emissions Risk: Urea can hydrolyze to ammonia in moist soil, contributing to air/water pollution.

- Sustainable Practices:

- Use closed-loop packaging systems.

- Optimize transport routes to reduce carbon footprint.

- Encourage end-user best practices (e.g., precision agriculture).

8. Required Documentation Checklist

- Safety Data Sheet (SDS) – GHS-compliant

- Certificate of Analysis (CoA)

- Bill of Lading / Air Waybill

- Commercial Invoice & Packing List

- Fertilizer Registration Certificate (if applicable)

- Phytosanitary Certificate (for agricultural use, if required by destination)

9. Key Compliance Tips

- Confirm urea is in solid crystal form (not solution) to avoid hazardous classification.

- Ensure packaging is moisture-resistant—urea is hygroscopic.

- Train warehouse and logistics staff on safe handling procedures.

- Monitor regulatory updates, especially for agricultural chemical regulations.

Conclusion

Urea crystals are generally non-hazardous and straightforward to transport, but compliance with packaging, storage, and regional regulations is essential. Proper documentation, moisture control, and safe handling practices ensure smooth logistics and regulatory approval across global supply chains.

📌 Always consult the latest SDS and local regulatory authority guidelines before shipping.

Conclusion for Sourcing Urea Crystals:

In conclusion, sourcing urea crystals requires a strategic approach that balances quality, cost, reliability, and compliance with regulatory standards. As a widely used chemical in industries ranging from agriculture and animal feed to pharmaceuticals and emissions control (e.g., diesel exhaust fluid), ensuring a consistent supply of high-purity urea crystals is critical. Successful sourcing involves evaluating suppliers based on their manufacturing capabilities, quality control processes, certifications (such as ISO or REACH), and logistical efficiency. Additionally, considerations such as market price volatility, regional availability, and sustainability practices are increasingly important in making informed procurement decisions. By establishing strong supplier relationships and conducting ongoing market analysis, organizations can secure a reliable and cost-effective supply of urea crystals to meet their operational needs while maintaining product integrity and regulatory compliance.