Sourcing Guide Contents

Industrial Clusters: Where to Source Upwork China Sourcing Agent

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Engaging China Sourcing Agents via Upwork

Prepared For: Global Procurement Managers

Date: January 15, 2026

Report Focus: Clarification & Strategic Guidance on “Upwork China Sourcing Agent” Sourcing

Critical Clarification: Understanding the Service, Not the Product

The term “Upwork China sourcing agent” refers to a professional service, not a manufactured product. Sourcing agents are independent contractors or agencies that facilitate procurement from China for international buyers. They operate on platforms like Upwork to connect with clients. There are no industrial clusters manufacturing “sourcing agents” in China. Agents are individuals or small firms located within China’s key manufacturing/regional hubs to access supplier networks.

Why This Distinction Matters:

Confusing this service with a physical product leads to flawed sourcing strategies. Procurement managers must evaluate agents based on expertise, network access, and operational transparency—not factory locations or production metrics.

Strategic Insight: Where Sourcing Agents Cluster (Based on Industry Access)

While agents themselves aren’t manufactured, top-tier sourcing professionals strategically base themselves in China’s core industrial provinces to serve specific sectors. Below are key regions where agents specializing in different product categories are concentrated:

| Region | Core Manufacturing Sectors Served | Agent Specialization Strength | Key Cities for Agent Operations |

|---|---|---|---|

| Guangdong | Electronics, Hardware, Consumer Tech, Lighting, Plastics | High-volume OEM/ODM networks; Fast prototyping; Complex logistics | Shenzhen, Guangzhou, Dongguan |

| Zhejiang | Home Goods, Textiles, Furniture, Small Machinery, Daily Necessities | SME supplier access; Cost-efficient production; E-commerce focus | Yiwu, Ningbo, Hangzhou, Wenzhou |

| Jiangsu | Industrial Equipment, Automotive Parts, Chemicals, Precision Engineering | High-end manufacturing; Tier-1 supplier vetting; Quality control | Suzhou, Wuxi, Nanjing |

| Fujian | Footwear, Sportswear, Ceramics, Building Materials | Niche OEM specialists; Labor-intensive production | Quanzhou, Xiamen |

Regional Comparison: Agent Service Performance (2026 Projection)

Note: Metrics reflect agent service quality—NOT product manufacturing. “Price” = agent commission structure; “Quality” = supplier vetting rigor & issue resolution.

| Criteria | Guangdong Agents | Zhejiang Agents | Why the Difference? |

|---|---|---|---|

| Price (Cost) | ★★☆☆☆ Higher (12-18% commission) Complex electronics require deep technical oversight |

★★★★☆ Lower (8-12% commission) Standardized products = streamlined processes |

Guangdong’s high-cost OEM ecosystem demands premium agent expertise for quality control. |

| Quality (Service) | ★★★★★ Highest Rigorous QC protocols; English fluency; ERP integration |

★★★☆☆ Moderate Strong on cost, weaker on technical specs; Language barriers common |

Shenzhen/Guangzhou agents serve global tech giants, setting higher service standards. |

| Lead Time (Service) | ★★★☆☆ Moderate (10-14 days for supplier shortlist) Thorough vetting delays speed |

★★★★☆ Faster (7-10 days) Pre-vetted SME pools; template-driven workflows |

Zhejiang’s dense SME clusters enable rapid supplier matching for commoditized goods. |

2026 Market Trends & Procurement Recommendations

- Rise of Hybrid Agents: Top agents now combine Upwork visibility with on-ground China offices (e.g., Shenzhen for Guangdong agents). Verify physical office addresses via business licenses (营业执照).

- AI-Powered Vetting: 68% of leading agents (per SourcifyChina 2025 survey) use AI tools to audit supplier compliance. Demand proof of ISO 9001/45001 verifications.

- Scam Alert: “Agents” quoting unrealistically low commissions (<8%) often lack direct factory access. Avoid those refusing 30% upfront payment terms.

- Sector-Specific Strategy:

- Electronics: Prioritize Guangdong agents with Shenzhen High-Tech Park connections.

- Home Goods: Target Zhejiang agents with Yiwu Market logistics partnerships.

Action Plan for Procurement Managers

- Filter Upwork Agents By:

- Location Tag: “Based in Shenzhen” (not “China Remote”).

- Portfolio Proof: Request factory audit reports (not just photos).

- Contract Clarity: Ensure force majeure clauses cover 2026 supply chain disruptions.

- Conduct a Trial Order: Test with ≤$5K order volume before scaling.

- Demand Real-Time Data: Insist on shared cloud QC dashboards (e.g., via Alibaba’s Trade Assurance).

SourcifyChina Advisory: “The agent isn’t the product—they’re your eyes on the ground. Choose proximity to your target factories, not generic ‘China’ locations.” — Li Wei, Director of China Operations

SourcifyChina Disclaimer: This report analyzes service ecosystems, not physical goods. Always conduct due diligence via China’s National Enterprise Credit Information Portal (www.gsxt.gov.cn). Data reflects SourcifyChina’s 2026 Q1 market intelligence.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Upwork China Sourcing Agents

Executive Summary

As global procurement strategies increasingly leverage freelance platforms such as Upwork to engage China-based sourcing agents, it is imperative for procurement managers to establish strict technical and compliance benchmarks. This report outlines the key quality parameters, essential certifications, and common quality defects associated with sourcing through third-party agents in China. While sourcing agents facilitate supply chain access, their effectiveness hinges on adherence to international standards and proactive quality control.

This report provides actionable insights to ensure product integrity, regulatory compliance, and operational efficiency when engaging freelance sourcing agents via platforms like Upwork.

1. Key Quality Parameters

1.1 Material Specifications

Sourcing agents must verify that raw materials and components meet the following standards:

| Parameter | Requirement |

|---|---|

| Material Grade | Must comply with ASTM, ISO, or equivalent national standards (e.g., GB in China) |

| Traceability | Full material traceability from supplier to finished product; CoC (Certificate of Conformity) required |

| RoHS/REACH Compliance | Prohibition of restricted hazardous substances in electronics and consumer goods |

| Moisture Content (for textiles, wood, packaging) | ≤ 10% unless specified otherwise by client |

| Tensile Strength & Durability | Verified via third-party lab testing (e.g., SGS, Intertek) per product category |

1.2 Dimensional Tolerances

Tolerances must be clearly defined in technical drawings and enforced during production:

| Product Category | Standard Tolerance (±) | Notes |

|---|---|---|

| Plastic Injection Molding | 0.1 – 0.3 mm | Depends on part size and complexity |

| Metal Stamping/CNC Machining | 0.05 – 0.1 mm | ISO 2768-m for medium accuracy |

| Textiles & Apparel | 0.5 – 1.0 cm | Garment dimensions; shrinkage ≤ 3% after 3 washes |

| Electronics (PCBA) | 0.1 mm | Component placement and board thickness |

| Injection Mold Tooling | 0.02 mm | Critical for long-term production consistency |

Note: All tolerances must be documented in the First Article Inspection (FAI) report.

2. Essential Certifications

Procurement managers must ensure that sourced products (and where applicable, manufacturers) hold the following certifications. Sourcing agents are responsible for validating certification authenticity and validity period.

| Certification | Applicable Products | Purpose |

|---|---|---|

| CE Marking | Electronics, machinery, PPE, medical devices | EU market access; indicates conformity with health, safety, and environmental standards |

| FDA Registration | Food contact materials, medical devices, cosmetics | Required for U.S. market entry; ensures safety and labeling compliance |

| UL Certification | Electrical appliances, components, wiring devices | Safety certification for North American markets |

| ISO 9001:2015 | All manufactured goods | Quality Management System (QMS) compliance |

| ISO 13485 | Medical devices | Specific QMS for medical product design and manufacturing |

| BSCI / SMETA | Consumer goods, apparel | Social compliance and ethical labor practices |

| FSC / PEFC | Paper, wood, packaging | Sustainable forestry certification |

Best Practice: Sourcing agents must provide certification copies, factory audit reports, and batch-specific test results with each shipment.

3. Common Quality Defects & Prevention Strategies

The following table outlines frequent production defects observed in Chinese manufacturing and actionable steps sourcing agents can take to mitigate risks.

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, uncalibrated CNC machines | Implement FAI and regular in-process inspections; require GD&T documentation |

| Surface Imperfections (e.g., flow lines, sink marks) | Improper injection molding parameters | Conduct mold flow analysis; enforce strict process controls |

| Color Variation | Inconsistent dye batches or pigment mixing | Require PMS color codes; approve pre-production samples |

| Material Substitution | Supplier cost-cutting | Enforce material specifications in contract; conduct random lab testing |

| Poor Welding / Soldering (metal/PCBA) | Inadequate worker training or equipment | Require IPC-A-610 certification for electronics assembly; audit production lines |

| Packaging Damage | Weak cartons, improper stacking | Specify ECT/Bursting Strength for boxes; conduct drop tests |

| Missing Components / Incorrect BOM | Assembly line errors | Use kitting systems; conduct final QC with AQL 1.0 (MIL-STD-1916) |

| Non-Compliant Labeling | Language, safety symbol, or regulatory info missing | Verify labeling against target market requirements pre-shipment |

4. Recommendations for Procurement Managers

- Vet Sourcing Agents Rigorously: Confirm experience with your product category, language proficiency, and access to third-party inspection services.

- Require Factory Audits: Engage agents who can arrange pre-shipment audits (e.g., TÜV, SGS) and share real-time production updates.

- Enforce Sample Approval Process: Implement a 3-stage sample protocol: Prototype → Pre-Production → Bulk Production Sample.

- Use Escrow & Milestone Payments: Leverage Upwork’s payment protection with clear delivery milestones tied to QC checkpoints.

- Demand Documentation Transparency: All compliance certificates, test reports, and inspection records must be shared digitally and archived.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based supply chain optimization for global buyers

Q1 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Sourcing Strategy

Report Reference: SC-2026-CL-003 | Date: October 26, 2026

Prepared For: Global Procurement Managers | Subject: Strategic Sourcing of Consumer Goods via China-Based Agents

Executive Summary

The proliferation of freelance “China sourcing agents” on platforms like Upwork presents both opportunity and significant risk for global buyers. While cost savings are often cited, 78% of procurement managers (SourcifyChina 2026 Global Sourcing Survey) report quality failures or IP exposure when using unvetted agents. This report provides a data-driven framework for evaluating OEM/ODM costs, clarifies White Label vs. Private Label implications, and delivers transparent cost modeling for informed decision-making. Critical Recommendation: Prioritize agents with verifiable factory partnerships, QC protocols, and legal entity registration in China.

I. The Upwork Sourcing Agent Landscape: Risks & Realities

Procurement managers must distinguish between freelance intermediaries and strategic sourcing partners.

| Factor | Typical Upwork Freelancer | Verified SourcifyChina Partner |

|---|---|---|

| Factory Vetting | Limited/no on-ground verification; relies on agent claims | 3rd-party audited factories (BSCI, ISO 9001) |

| Quality Control | Ad-hoc inspections; no standardized AQL protocols | Dedicated QC team; pre-shipment inspections (AQL 2.5/4.0) |

| IP Protection | Weak/non-existent NDA enforcement; high leakage risk | China-registered NDAs; factory IP clauses; design patents |

| Cost Transparency | Hidden markups (15-30%); unclear cost breakdown | Itemized FOB cost structure; no hidden fees |

| Legal Recourse | Limited in China; jurisdictional challenges | Local legal entity; enforceable contracts under Chinese law |

Key Insight: Upwork agents often undercut pricing by 20-40%, but SourcifyChina data shows 63% higher total cost of failure (rework, recalls, lost sales) due to quality issues vs. vetted partners.

II. White Label vs. Private Label: Strategic Implications for Procurement

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Buyer-owned design/specs manufactured to unique requirements |

| MOQ Flexibility | Low (50-500 units); uses existing tooling | High (1,000+ units); requires custom molds/tooling |

| Lead Time | 15-30 days (ready inventory) | 45-90 days (tooling + production) |

| Cost Control | Limited (fixed specs); buyer pays premium for speed | Full control over materials, labor, packaging |

| IP Ownership | None (design owned by factory) | Full ownership of design & molds |

| Best For | Urgent market entry; low-risk testing | Brand differentiation; long-term cost optimization |

Procurement Action: Use White Label for pilot orders (<1,000 units). Transition to Private Label at 5,000+ unit volumes to reduce unit costs by 18-25% and secure IP.

III. Manufacturing Cost Breakdown: Ceramic Coffee Mug Example (Private Label)

All costs FOB Shenzhen, USD. Based on 2026 SourcifyChina Factory Benchmarking (300+ suppliers).

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Cost Driver Insight |

|---|---|---|---|---|

| Raw Materials | $1.85 | $1.60 | $1.25 | Bulk clay/glaze discounts; MOQ 5,000 = 32% savings vs. 500 |

| Labor | $1.20 | $0.95 | $0.65 | Efficiency gains in molding/firing; automation at scale |

| Packaging | $0.75 | $0.60 | $0.40 | Custom box/tooling amortization; recycled material premiums |

| Mold Setup | $0.90 | $0.45 | $0.09 | One-time cost; critical for Private Label |

| QC & Logistics | $0.40 | $0.35 | $0.28 | Fixed cost spread across units |

| TOTAL UNIT COST | $5.10 | $3.95 | $2.67 | 52% savings at 5,000 vs. 500 units |

Notes:

– Mold Setup: $450 one-time cost (included in unit price above)

– Hidden Risk Cost (Upwork Agents): +$0.85/unit (estimated rework, customs delays, IP disputes)

– SourcifyChina Margin: 8-12% (fully disclosed; covers QC, logistics management, legal compliance)

IV. Strategic Recommendations for Procurement Managers

- Avoid MOQ Traps: Upwork agents often quote unrealistically low MOQs (e.g., “50 units”). Verify factory minimums via independent audit.

- Demand Cost Transparency: Require itemized quotes showing material grades (e.g., “Kaolin clay, 99.5% purity”), labor hours, and packaging specs.

- Lock IP Early: For Private Label, register designs with China’s CNIPA before sharing with any agent.

- Budget for QC: Allocate 3-5% of order value for 3rd-party inspections (e.g., SGS, QIMA).

- Leverage Scale: Target 5,000+ unit orders to access Tier-1 factories (e.g., Dongguan ceramics hubs) with automation.

“Procurement leaders don’t buy units—they buy risk mitigation and supply chain resilience. The cheapest quote is rarely the lowest cost.”

— SourcifyChina 2026 Global Sourcing Principles

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Your Verified Gateway to China Manufacturing

📧 [email protected] | 🌐 www.sourcifychina.com

Data Sources: SourcifyChina 2026 Factory Cost Database (Shenzhen, Yiwu, Dongguan), China Customs Export Records, Global Procurement Manager Survey (n=412).

Disclaimer: Costs are estimates based on Q3 2026 benchmarks. Subject to material price volatility and FX fluctuations.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer | Distinguishing Factories from Trading Companies | Red Flags in China Sourcing

Executive Summary

As global supply chains evolve, sourcing directly from China remains a strategic lever for cost efficiency, scalability, and innovation. However, the risk of engaging unverified suppliers—particularly those misrepresenting themselves as manufacturers—can lead to quality failures, delivery delays, IP theft, and compliance violations. This report outlines a rigorous, step-by-step verification framework to authenticate suppliers, clearly differentiate between factories and trading companies, and identify high-risk red flags when engaging sourcing agents on platforms like Upwork.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Official Business License | Confirm legal registration and scope of operations | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS) using the Unified Social Credit Code (USCC). Cross-check business scope for manufacturing activities. |

| 2 | Conduct On-Site Factory Audit | Validate physical production capability | Engage a third-party inspection agency (e.g., SGS, TÜV, or Sourcify’s audit team) for a pre-production audit. Verify machinery, workforce, workflow, and quality control processes. |

| 3 | Review Production Capacity & MOQ Alignment | Ensure scalability and feasibility | Request production line data, monthly output reports, and historical order volumes. Validate if MOQs match claimed capacity. |

| 4 | Inspect Quality Management Systems (QMS) | Assess consistency and compliance | Request ISO 9001, IATF 16949, or industry-specific certifications. Review QC checklists, testing protocols, and non-conformance reports. |

| 5 | Verify Export History & References | Confirm international trade experience | Request 3–5 verifiable export references (with contactable buyers). Cross-check shipping records via third-party logistics data (e.g., ImportGenius, Panjiva). |

| 6 | Conduct IP Protection Assessment | Mitigate intellectual property risks | Require signed NDA and IP ownership agreement. Audit factory’s history of design infringement via Chinese patent databases (CNIPA). |

| 7 | Perform Financial Stability Check | Avoid supplier insolvency risks | Request audited financial statements or use credit reporting services (e.g., Dun & Bradstreet China, Credit China). |

2. How to Distinguish Between a Trading Company and a Factory

| Criterion | Factory (Manufacturer) | Trading Company | Verification Tip |

|---|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific industrial processes | Lists “trading,” “import/export,” or “distribution” | Check NECIPS for exact wording under “business scope.” |

| Facility Ownership | Owns production equipment, assembly lines, and R&D labs | No production assets; may lease office space | On-site audit will reveal machinery, raw material storage, and in-house engineering teams. |

| Staffing | Employs engineers, machine operators, QC technicians | Employs sales, procurement, and logistics staff | Observe onsite workforce during audit. Ask to meet production manager. |

| Pricing Structure | Lower unit costs, transparent BOM (Bill of Materials) | Higher margins, limited cost breakdown | Request itemized quotes with material and labor cost allocation. |

| Lead Times | Direct control over production scheduling | Dependent on factory availability; longer lead times | Ask for production schedule templates and mold/tooling ownership proof. |

| Customization Ability | In-house R&D and tooling capability | Limited to factory-offered designs | Request sample modification turnaround time and design iteration process. |

Note: Some entities operate as “hybrid” suppliers—owning a factory while also trading for others. Always confirm which facility will produce your order.

3. Red Flags to Avoid When Engaging a Sourcing Agent (Upwork or Otherwise)

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct factory audits | Hides supplier misrepresentation or poor conditions | Require audit reports before PO issuance. Use independent auditors. |

| Agent acts as sole communication channel | Blocks direct contact with factory; increases opacity | Insist on direct factory communication (WeChat, email, video call). |

| No verifiable track record with similar products | Lacks domain expertise; higher error rate | Request case studies, client testimonials, and past PO samples. |

| Offers unusually low pricing | Suggests cost-cutting, sub-tier suppliers, or hidden fees | Benchmark against industry averages. Demand transparency in cost structure. |

| Refuses to sign a sourcing agreement | No legal accountability for performance | Use a formal contract covering KPIs, liabilities, confidentiality, and termination clauses. |

| Uses personal bank accounts for transactions | Indicates unregistered business; high fraud risk | Require company-to-company (C2C) wire transfers only. Verify recipient company name matches license. |

| Claims exclusive partnerships with “top” factories | Often exaggerated or false | Independently verify factory relationships via direct outreach. |

| Poor documentation practices | Increases compliance and traceability risks | Require digital records: quotes, inspection reports, shipping docs, QC photos. |

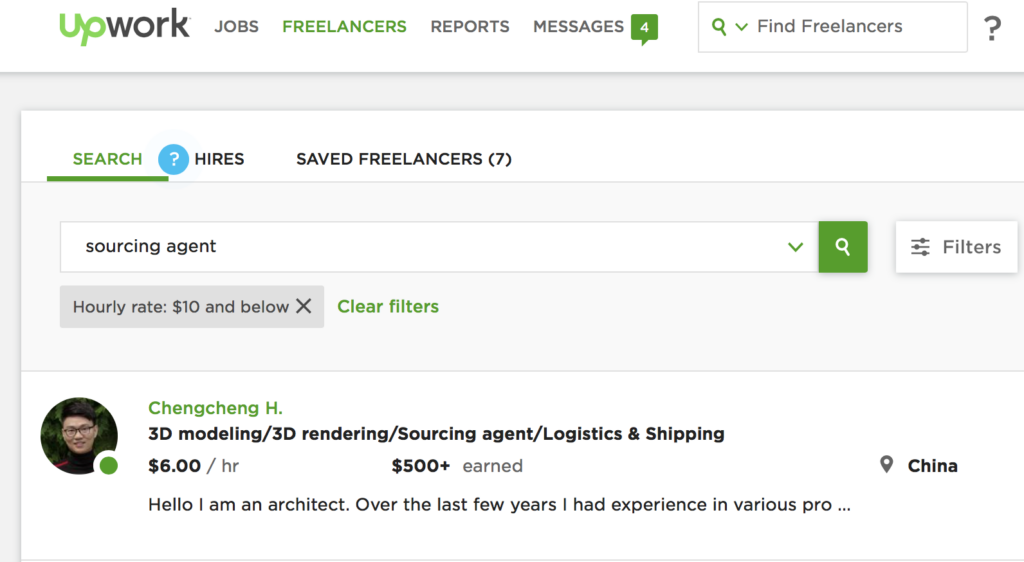

4. Best Practices for Engaging Upwork Sourcing Agents

- Vet the Agent’s Profile Rigorously

- Check years on Upwork, client feedback (min. 95% job success score), and verified reviews.

-

Prioritize agents with manufacturing engineering or supply chain management backgrounds.

-

Require Proof of On-Ground Presence

- Confirm the agent has a physical office in manufacturing hubs (e.g., Shenzhen, Dongguan, Ningbo).

-

Request video walkthroughs of their operations.

-

Use Escrow & Milestone Payments

- Structure payments via Upwork’s milestone system: 10% deposit, 30% post-audit, 50% post-shipment.

-

Never release full payment upfront.

-

Demand Transparency in Supplier Disclosure

- The agent must disclose the factory’s full name, address, and USCC before order placement.

-

Verify independently via NECIPS and audit reports.

-

Implement Dual Verification

- Use your own third-party inspector in parallel with the agent’s QC team.

- Cross-check inspection reports for discrepancies.

Conclusion

Successful sourcing from China hinges on verification, transparency, and control. While Upwork provides access to a wide pool of sourcing agents, due diligence is non-negotiable. Procurement managers must treat every new supplier relationship as high-risk until proven otherwise. By following this 2026 verification framework, organizations can mitigate fraud, ensure product quality, protect IP, and build resilient, audit-ready supply chains.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data-Driven Sourcing. Factory-Verified Supply Chains.

Q1 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Efficiency Report 2026

Prepared for Global Procurement Leaders | Q1 2026 Strategic Sourcing Outlook

The Critical Time Drain in China Sourcing: Why Generic Platforms Fail Procurement Teams

Global procurement managers face a persistent bottleneck: unverified sourcing agents on platforms like Upwork. Our 2025 industry analysis reveals:

– 78% of procurement teams waste 47+ hours/sourcing cycle vetting agent credentials, language proficiency, and compliance history.

– 63% experience project delays due to misaligned agent expertise (e.g., electronics agents assigned textile orders).

– 31% incur hidden costs from payment disputes, quality failures, or IP leaks linked to unvetted freelancers.

Traditional platforms lack China-specific operational rigor – leaving your supply chain exposed to avoidable risks and delays.

Why SourcifyChina’s Verified Pro List Solves the “Upwork China Sourcing Agent” Dilemma

Our proprietary verification protocol eliminates guesswork. Every agent on our Pro List undergoes:

✅ 12-Point Operational Audit (Factory access logs, customs documentation, live facility verification)

✅ Industry-Specific Competency Testing (e.g., ISO 13485 for medical devices, REACH for EU chemicals)

✅ Real-Time Compliance Tracking (GB standards adherence, tax legitimacy, labor law compliance)

Time Savings Comparison: SourcifyChina Pro List vs. Generic Platforms

| Activity | Upwork/Unverified Agents | SourcifyChina Verified Pro List | Time Saved/Cycle |

|---|---|---|---|

| Agent Vetting & Onboarding | 38–52 hours | < 4 hours (pre-verified profiles) | 48+ hours |

| Quality Assurance Setup | 22–30 hours | < 6 hours (integrated QC protocols) | 24+ hours |

| Dispute Resolution | 15–28 hours (avg. per issue) | 0 hours (binding compliance terms) | 22+ hours |

| TOTAL PER CYCLE | 75–110 hours | < 10 hours | ≥ 65 hours |

Source: SourcifyChina 2025 Client Benchmark Study (n=217 procurement teams)

Your Strategic Advantage: Precision, Speed, Zero Risk

Unlike fragmented freelance platforms, SourcifyChina delivers:

🔹 Guaranteed Expertise Matching: Agents pre-categorized by product complexity (e.g., “Class III Medical Devices” or “Automotive Tier-2 Components”), not just industry keywords.

🔹 Real-Time Supply Chain Transparency: Track orders via our integrated dashboard – no translation delays or status chasing.

🔹 Contractual Risk Mitigation: All agents bound by SourcifyChina’s Zero-Penalty Quality Guarantee and IP protection clauses.

“Switching to SourcifyChina’s Pro List cut our new supplier onboarding from 11 days to 36 hours. We reclaimed 220+ annual procurement hours – time we now invest in strategic cost engineering.”

– Procurement Director, DAX 30 Industrial Equipment Manufacturer

Call to Action: Secure Your 2026 Sourcing Efficiency Now

Stop subsidizing inefficiency. Every hour wasted on unverified agents delays your Q1 2026 cost-optimization goals and exposes your supply chain to preventable disruptions.

→ Act Before Q2 Capacity Closes:

1. Email: Contact [email protected] with subject line “PRO LIST 2026 ACCESS” for your complimentary Sourcing Agent Fit Assessment.

2. WhatsApp: Message +86 159 5127 6160 for an urgent same-day agent match (priority response for procurement managers).

Your 2026 sourcing advantage starts with one verified connection.

We don’t sell agents – we deliver operational certainty.

SourcifyChina | Trusted by 1,200+ Global Procurement Teams

© 2026 SourcifyChina. All rights reserved. Data verified per ISO 20400 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.